TIDMPFP

RNS Number : 5674A

Pathfinder Minerals Plc

25 May 2023

25 May 2023

Pathfinder Minerals Plc

("Pathfinder" the "Company")

Final Results for the Year Ended 31 December 2022

Pathfinder reports its audited financial results for the year

ended 31 December 2022. The full annual report including, all notes

to the accounts, will be posted to shareholders on 26 May 2023, and

is available on the Company's website at www.pathfinderminerals.com

.

Dennis Edmonds, Chairman, commented:

"Following the completion of the disposal of IM Minerals

Limited, which the Company expects imminently, Acumen Advisory

Group LLC will have a binding agreement with the Company to

progress the claim against the Government of Mozambique. If the

claim is successful, Pathfinder stands to receive a substantial

contingent payment. While that process is underway, assuming

completion of the disposal, Pathfinder will be well funded to

pursue other opportunities to achieve value creation for

shareholders."

Enquiries:

Pathfinder Minerals Plc

Peter Taylor, Chief Executive Officer

Tel. +44 (0)20 3143 6748

Strand Hanson Limited (Nominated & Financial Adviser and

Broker)

James Spinney / Ritchie Balmer / Abigail Wennington

Tel. +44 (0)20 7409 3494

Vigo Consulting (Public Relations)

Ben Simons / Kate Kilgallen

Tel. +44 (0)20 7390 0234

Email pathfinderminerals@vigoconsulting.com

The information contained within this announcement is deemed by

the Company to constitute inside information as stipulated under

the Market Abuse Regulations (EU) No. 596/2014 ("MAR").

Chairman's Statement

for the Year Ended 31 December 2022

Introduction and principal activities

The Group's activities during 2022 continued to focus on

preparing the Company to bring a claim against the Government of

Mozambique, under the Mozambique-United Kingdom Bilateral

Investment Treaty (2004) (the "Treaty"), for its role in

facilitating the expropriation of Mining Concession 4623C (the

"Licence") from the Company in 2011 through a transfer which the

Board believes was unlawful (the "Claim"). This culminated in the

signing in September 2022 of an option agreement for the sale of IM

Minerals Limited ("IMM"), a wholly owned subsidiary of Pathfinder,

and, with it, the rights to bring the Claim.

Alongside this, the Board has continued to review additional

commercial opportunities across several minerals and geographies

which, if pursued, would offer shareholders multiple avenues for

potential value creation.

Preparations to bring or monetise a claim

Since the receipt in December 2020 of a legal opinion that,

subject to the interpretation of the facts and applicable laws as

they are currently known to the Board and Counsel, there is a 55-60

percent prospect of establishing liability on the part of the

Government of Mozambique in a BIT claim under Article 2(2) and 2(3)

of the Treaty, the Board had set about undertaking the various

workstreams to prepare to bring or monetise the Claim.

As part of the Company's preparatory procedures, the Board

commissioned, during 2021, Versant Partners LLC ("Versant") to

undertake an analysis of the valuation of Pathfinder's potential

claim. Whilst the detail behind the valuation remains legally

privileged, the Versant analysis assesses a range of successful

scenarios with valuation ranges from a minimum of US$110m for an

ex-ante damages award through to US$1,500m for an ex-post damages

award. The Versant valuation supports the US$621.3m of estimated

losses, detailed in the Company's 12 April 2021 announcement, that

has been notified to the government of Mozambique.

In September 2022, the Company entered into an option agreement

with Acumen Advisory Group LLC ("Acumen" or "AAG"), an asset

recovery specialist incorporated in Delaware, USA, with a track

record of international claim enforcement, under which the Company

granted Acumen an exclusive option to acquire IMM and therefore the

rights to bring the Claim.

Following the end of the financial year, on 1 February 2023,

Pathfinder announced that Acumen had sought to exercise its rights

under the Option and, at a general meeting of shareholders of the

Company held on 11 May 2023, shareholders voted to proceed with the

disposal of IMM and therefore the Claim (the "Disposal"). Under the

terms of the Sale and Purchase Agreement (the "SPA") entered into

with Acumen, the Company expects to receive imminently, an initial

cash payment of GBP2 million and subsequently a further payment

being the greater of US$24 million or 20% of the aggregate amount

(including deferred or conditional payments) subject to, and

payable on, settlement or determination of the Claim, less

expenses. Further details on the Disposal, including the payment

mechanism, and associated risk factors, are detailed in the

circular posted to shareholders on 21 April 2023.

Company strategy

Following the completion of the Disposal, the Company will cease

to own, control, or conduct all, or substantially all, of its

existing business activities or assets. Accordingly, upon

completion of the Disposal, the Company will be classified as an

AIM Rule 15 cash shell and, as such, will be required to make an

acquisition or acquisitions which constitute a reverse takeover

under AIM Rule 14 (or seek re-admission as an investing company (as

defined under the AIM Rules)), on or before the date falling six

months from completion of the Disposal, failing which the Company's

Ordinary Shares would be suspended from trading on AIM pursuant to

AIM Rule 40. Admission of the Company's Ordinary Shares to trading

on AIM would be cancelled six months from the date of suspension

should the Company not complete such a transaction during this

time.

Until such time as the GBP2 million has been received by the

Company, the Disposal will not complete and the Company will not be

classified as an AIM Rule 15 cash shell.

The Board is continuing to evaluate opportunities in the sectors

it considers appropriate, seeking to identify one or more projects

or assets suitable for acquisition from which the Board believes it

can unlock unrealised value for shareholders in the near-term.

Any reverse takeover transaction will require the publication of

an AIM Rules compliant admission document and will be subject to

shareholder approval at a further general meeting of the Company to

be convened at the appropriate time.

Financial results and current financial position

The audited financial statements of the Pathfinder Group for the

year ended 31 December 2022 follow later in this report.

The Income Statement for the period ended 31 December 2022

reflects a loss of GBP376k (period ended 31 December 2021:

GBP367k). The Group's Statement of Financial Position shows total

assets at 31 December 2022 of GBP59k (31 December 2021: GBP384k);

the assets were held largely in the form of cash deposits of GBP46k

(31 December 2021: GBP365k).

Board changes

Jonathan Summers retired as a non-executive director of the

Company on 30 June 2022. The Board is grateful to Mr Summers for

his contribution to the Company.

Outlook

Following the completion of the Disposal, which the Company

expects imminently, Acumen will have a binding agreement with the

Company to progress the Claim. If the Claim is successful, the

Company stands to receive a substantial contingent payment. While

that process is underway, assuming completion of the Disposal,

Pathfinder will be well funded and able to pursue other

opportunities which offer shareholders multiple avenues for value

creation.

Dennis Edmonds

Chair

25 May 2023

Consolidated Statement of Comprehensive Income

for the Year E nded 31 December 2022

Year ended Year ended

31 December 31 December

Note 2022 2021

GBP'000 GBP'000

CONTINUI NG OP ERATIONS

Re v e nue - -

Ad ministrati ve exp e ns es 3, 4 (376) (367)

OPE R ATING LOSS (376) (367)

-------------------------------------------- ---- ------------ --------------

LOSS B EFORE INCOME TAX (376) (367)

Income tax 5 - -

LOSS FOR THE Y EAR (376) (367)

-------------------------------------------- ---- ------------ --------------

Total comprehensive lo ss for the year

attributable to equity holders of the

parent (376) (367)

Loss p er s hare from continuing operations

in p e nce p er s hare: 7

Basic and diluted (0.07) (0.07)

Consolidated Statement of Financial Position

for the Year E nded 31 December 2022

Year ended Year ended

31 December 31 December

Note 2022 2021

GBP'000 GBP'000

NON-CURRENT ASSETS

Investments 8 - -

CURRENT ASSETS

Trade and other receivables 9 13 19

Cash and cash equivalents 10 46 365

TOTAL ASSETS 59 384

-------------------------------------- ----- ------------- -------------

EQUITY AND LIABILITIES

Capital and reserves attributable to

equity holders of the Company:

Share capital 11 18,717 18,716

Share premium 11 14,239 14,234

Share based payment reserve 162 199

Warrant reserve 104 255

Accumulated deficit (33,357) (33,169)

-------------------------------------- ----- ------------- -------------

TOTAL EQUITY (135) 235

CURRENT LIABILITIES

Trade and other payables 12 114 149

Borrowings 13 80 -

-------------------------------------- ----- ------------- -------------

TOTAL LIABILITIES 194 149

TOTAL EQUITY AND LIABILITIES 59 384

-------------------------------------- ----- ------------- -------------

T h e financial statem e nts we re appro ved for issue by the

Board of Directors on 25 May 2023 and w ere signed on its b e half

by:

Dennis Edmonds

Director

Consolidated Statement of Changes in Equity

for the Year E nded 31 December 2022

Share

Called based

up share Share payment Warrant Accumulated Total

capital premium reserve reserve deficit equity

GBP'000 GBP'000 GBP'000 GBP'000 GBP'000 GBP'000

Balance at 1 January

2021 as previously

stated 18,584 13,685 184 253 (32,831) (125)

Prior year adjustment - - - - - -

Balance at 1 January

2021 as restated 18,584 13,685 184 253 (32,831) (125)

------------------------ ---------- --------- --------- --------- ------------ --------

Loss for the year - - - - (367) (367)

------------------------ ---------- --------- --------- --------- ------------ --------

Total comprehensive

loss for the year - - - - (367) (367)

------------------------ ---------- --------- --------- --------- ------------ --------

Issue of share capital 132 599 - - - 731

Cost of share issue - (41) - - - (41)

Share based payments - (9) 15 2 29 37

------------------------ ---------- --------- --------- --------- ------------ --------

Balance at 31 December

2021 18,716 14,234 199 255 (33,169) 235

------------------------ ---------- --------- --------- --------- ------------ --------

Loss for the year - - - - (376) (376)

Total comprehensive

loss for the year - - - - (376) (376)

------------------------ ---------- --------- --------- --------- ------------ --------

Issue of share capital 1 5 - - - 6

Cost of share issue - - - - - -

Share based payments - - (37) (151) 188 -

Balance at 31 December

2022 18,717 14,239 162 104 (33,357) (135)

------------------------ ---------- --------- --------- --------- ------------ --------

Consolidated Statement o f Cash Fl ows

for the Year E nded 31 December 2022

Note Year ended Year ended

31 December 31 December

2022 2021

GBP'000 GBP'000

Cash flows from operating activities

Loss before tax (376) (367)

Adjustments for:

Share-based payments - 35

PAYE/NI provision written back - (140)

-------------------------------------------- ----- ------------- -------------

Net cash flow from operating activities

before changes in working capital (376) (472)

Changes in working capital:

Decrease in trade and other receivables 9 6 15

Decrease in trade and other payables 12 (35) (61)

-------------------------------------------- ----- ------------- -------------

Net cash flow used in operating activities (405) (518)

Cash flow from financing activities

Proceeds arising as a result of the

issue of ordinary shares 6 720

Costs related to issue of ordinary

share capital - (28)

Proceeds of borrowings 13 80 -

-------------------------------------------- ----- ------------- -------------

Net cash flow from financing activities 86 692

Net increase in cash and cash equivalents

in the year (319) 174

Cash and cash equivalents at beginning

of the year 365 191

-------------------------------------------- ----- ------------- -------------

Cash and cash equivalents at end of

the year 46 365

-------------------------------------------- ----- ------------- -------------

Details of material non-cash transactions are set out in note 17

.

Company Statement of Financial Position

for the Year E nded 31 December 2022

Year ended Year ended

31 December 31 December

Note 2022 2021

GBP'000 GBP'000

NON-CURRENT ASSETS

Investments 8 - -

CURRENT ASSETS

Trade and other receivables 9 13 19

Cash and cash equivalents 10 46 365

TOTAL ASSETS 59 384

-------------------------------------- ----- ------------- -------------

EQUITY AND LIABILITIES

Capital and reserves attributable to

equity holders of the Company:

Share capital 11 18,717 18,716

Share premium 11 14,239 14,234

Share based payment reserve 162 199

Warrant reserve 104 252

Accumulated deficit (33,357) (33,169)

-------------------------------------- ----- ------------- -------------

TOTAL EQUITY (135) 235

CURRENT LIABILITIES

Trade and other payables 12 114 149

Borrowings 13 80 -

-------------------------------------- ----- ------------- -------------

TOTAL LIABILITIES 194 149

TOTAL EQUITY AND LIABILITIES 59 384

-------------------------------------- ----- ------------- -------------

The Company has taken exemptions allowed under section 408 of

the Companies Act 2006 and has not presented its own profit and

loss account in these financial statements. The loss after tax of

the parent Company for the year was GBP376k (2021: GBP367k).

The financial statements were approved and authorised for issue

by the Board of Directors on 25 May 2023 and were signed on its

behalf by:

Dennis Edmonds

Director

Company Statement of Changes in Equity

for the Year E nded 31 December 2022

Share

Called based

up share Share payment Warrant Accumulated Total

capital premium reserve reserve deficit equity

GBP'000 GBP'000 GBP'000 GBP'000 GBP'000 GBP'000

Balance at 1 January

2021 as previously

stated 18,584 13,685 184 253 (32,831) (125)

------------------------ ---------- --------- --------- --------- ------------ --------

Prior year adjustment - - - - - -

Balance at 1 January

2021 as restated 18,584 13,685 184 253 (32,831) (125)

Loss for the year - - - - (367) (367)

Total comprehensive

loss for the year - - - - (367) (367)

------------------------ ---------- --------- --------- --------- ------------ --------

Issue of share capital 132 599 - - - 731

Cost of share issue - (41) - - - (41)

Share based payments - (9) 15 2 29 37

------------------------ ---------- --------- --------- --------- ------------ --------

Balance at 31 December

2021 18,716 14,234 199 255 (33,169) 235

------------------------ ---------- --------- --------- --------- ------------ --------

Loss for the year - - - - (376) (376)

------------------------ ---------- --------- --------- --------- ------------ --------

Total comprehensive

loss for the year (376) (376)

------------------------ ---------- --------- --------- --------- ------------ --------

Issue of share capital 1 5 - - - 6

Share based payments - - (37) (151) 188 -

Balance at 31 December

2022 18,717 14,239 162 104 (33,357) (135)

------------------------ ---------- --------- --------- --------- ------------ --------

Company Statement of Cash Flows

for the Year E nded 31 December 2022

Note Year ended Year ended

31 December 31 December

2022 2021

GBP'000 GBP'000

Cash flows from operating activities

Loss before tax (376) (367)

Adjustments for:

Share-based payments - 35

PAYE/NI provision written back - (140)

-------------------------------------------- ----- ------------- -------------

Net cash flow from operating activities

before changes in working capital (376) (472)

Changes in working capital:

Decrease in trade and other receivables 9 6 15

Decrease in trade and other payables 12 (35) (61)

-------------------------------------------- ----- ------------- -------------

Net cash flow used in operating activities (405) (518)

Cash flow from financing activities

Proceeds arising as a result of the

issue of ordinary shares 6 720

Costs related to issue of ordinary

share capital - (28)

Proceeds of borrowings 13 80 -

-------------------------------------------- ----- ------------- -------------

Net cash flow from financing activities 86 692

Net increase in cash and cash equivalents

in the year (319) 174

Cash and cash equivalents at beginning

of the year 365 191

-------------------------------------------- ----- ------------- -------------

Cash and cash equivalents at end of

the year 46 365

-------------------------------------------- ----- ------------- -------------

Details of material non-cash transactions are set out in note 17

.

No tes to the C onsoli dated Fi nanc ial Statements

for the Year E nded 31 December 2022

1. ACCOU N TING P O LICIES

General information

Pathfinder Minerals Plc is a public limited company, quoted on

AIM and is incorporated, registered and domiciled in England.

The Company's registered office is 35 Berkeley Square, London,

England, W1J 5BF.

B asis of preparation

These financial statements have been prepared in accordance with

UK-adopted International Accounting Standards as issued by the

International Accounting Standards Board (IASB) and Interpretations

(collectively IASs) and with those parts of the Companies Act 2006

applicable to companies reporting under IASs. The financial

statements have been prepared under the historical cost convention.

The functional and presentational currency of the Company is Pound

Sterling.

New standards, amendments and interpretations adopted by the

Company

At the date of authorisation of these financial statements, the

following standards and interpretations relevant to the Company and

which have not been applied in these financial statements, were in

issue but were not yet effective.

Standard Effective date,

annual period

beginning on

or after

IAS 1 - Presentation of Financial Statements 1 January 2023

----------------

IFRS 17 - Insurance Contracts 1 January 2023

----------------

IAS 8 amendments - Definition of accounting 1 January 2023

estimates

----------------

Amendments to IAS 12 - Deferred Tax related 1 January 2023

to Assets and Liabilities arising from a

Single Transaction

----------------

Classification of Liabilities as Current 1 January 2023

or Non-Current: Amendments to IAS 1

----------------

The adoption of these standards is not expected to have any

material impact on the financial statements of the Company.

Going concern

The Directors maintain cash flow forecasts looking ahead for

periods not less than 12 months. As at the reporting date, the

Company's cash balance was GBP46k (2021: GBP365k).

As at the date of approval of the financial statements, the cash

flow forecast indicates that the Company has sufficient financial

resources for at least the next 12 months, however, this is

predicated on the receipt of GBP2 million consideration from AAG in

respect of the disposal of the Company's 100%-owned subsidiary, IM

Minerals Limited. The Board therefore considers that this is a

material uncertainty which may cast significant doubt about the

Group's and the Company's ability to continue as a going

concern.

Taking into consideration the Board's expectation that these

funds will be received imminently, the Group's merits and the

Board's track record in raising additional funding, the Board, has

a reasonable expectation that the Group will be able to continue in

operation and meet its liabilities as they fall due over the next

12 months. Based on the Group's current expenditure plans, in the

absence of receipt of the GBP2 million consideration from AAG, and

without further funding being raised, the Group is funded up to

October 2023.

The Board considers this period of assessment to be appropriate

because it contextualises the Company's financial position,

business model and strategy.

Notwithstanding the above, the directors consider the Group and

the Company to be a going concern and therefore have prepared these

financial statements on a going concern basis.

Basis of consolidation

Although the Company's direct subsidiary as at 31 December 2022,

IM Minerals Limited holds 99.9% of the issued share capital of

Companhia Mineira de Naburi SARL, which in turn holds 99.8% of the

issued share capital of Sociedade Geral de Mineracao de Moçambique

SARL, events in 2011 indicated that the Company does not control

either of these Moçambique-domiciled companies group companies;

neither has it been possible to obtain the statutory registers or

audited accounts for them; accordingly, these financial statements

consolidate the financial statements of IM Minerals Limited only.

IM Minerals Limited is a dormant intermediate holding company

registered in England & Wales.

Foreign currencies

Assets and liabilities in foreign currencies are translated into

sterling at the rates of exchange ruling at the statement of

financial position date. Transactions in foreign currencies are

translated into sterling at the rate of exchange ruling at the date

of transaction. Exchange differences are considered in arriving at

the operating result.

Employee benefit costs

The Group makes available a defined contribution pension scheme

to eligible employees. Any contributions paid to the Group's

pension scheme are charged to the income statement in the period to

which they relate.

Equity instruments and reserves description

An equity instrument is any contract that evidences a residual

interest in the assets of the Company after deducting all of its

liabilities. Equity instruments issued by the Company are recorded

at the proceeds received net of direct issue costs.

Ordinary shares are classified as equity.

Deferred shares are classified as equity but have restricted

rights such that they have no economic value.

Share capital account represents the nominal value of the

ordinary and deferred shares issued.

The share premium account represents premiums received on the

initial issuing of the share capital. Any transaction costs

associated with the issuing of shares are deducted from share

premium, net of any related income tax benefits.

Share based payment reserve represents equity-settled

share-based employee remuneration until such share options are

exercised.

Warrant reserve represents equity-settled share-based payments

until such share warrants are exercised.

Share-based payments

Where equity settled share options or warrants are awarded, the

fair value of the options at the date of grant is charged to the

statement of comprehensive income over the vesting period.

Non-market vesting conditions are considered by adjusting the

number of equity instruments expected to vest at each balance sheet

date so that, ultimately, the cumulative amount recognised over the

vesting period is based on the number of options that eventually

vest.

Financial instruments

Trade and other receivables

Trade receivables are measured at initial recognition at fair

value and are subsequently measured at amortised cost using the

effective interest rate method. Trade and other receivables are

accounted for at original invoice amount less any provisions for

doubtful debts. Provisions are made where there is evidence of a

risk of non-payment, considering the age of the debt, historical

experience and general economic conditions. If a trade debt is

determined to be uncollectable, it is written off, firstly against

any provisions already held and then to the statement of

comprehensive income. Subsequent recoveries of amounts previously

provided for are credited to the statement of comprehensive

income.

Appropriate allowances for estimated irrecoverable amounts are

recognised in profit or loss in accordance with the expected credit

loss model under IFRS 9. For trade and other receivables which do

not contain a significant financing component, the Company applies

the simplified approach. This approach requires the allowance for

expected credit losses to be recognised at an amount equal to

lifetime expected credit losses. For other debt financial assets,

the Company applies the general approach to providing for expected

credit losses as prescribed by IFRS 9, which permits for the

recognition of an allowance for the estimated expected loss

resulting from default in the subsequent 12-month period. Exposure

to credit loss is monitored on a continual basis and, where

material, the allowance for expected credit losses is adjusted to

reflect the risk of default during the lifetime of the financial

asset should a significant change in credit risk be identified.

The majority of the Company's financial assets are expected to

have a low risk of default. A review of the historical occurrence

of credit losses indicates that credit losses are insignificant due

to the size of the Company's clients and the nature of its

activities. The outlook for the natural resources industry is not

expected to result in a significant change in the Company's

exposure to credit losses. As lifetime expected credit losses are

not expected to be significant the Company has opted not to adopt

the practical expedient available under IFRS 9 to utilise a

provision matrix for the recognition of lifetime expected credit

losses on trade receivables. Allowances are calculated on a

case-by-case basis based on the credit risk applicable to

individual counterparties.

Trade and other payables

Trade and other payables are held at amortised cost which

equates to nominal value.

Cash and cash equivalents

Cash and cash equivalents comprise cash in hand, current

balances with banks and similar institutions and liquid investments

generally with maturities of 3 months or less. They are readily

convertible into known amounts of cash and have an insignificant

risk of changes in values.

Taxation

The tax expense represents the sum of the tax currently payable

and deferred tax.

The tax currently payable is based on taxable profit for the

period. Taxable profit differs from the net profit as reported in

the income statement because it excludes items of income or expense

that are taxable or deductible in other periods and it further

excludes items that are never taxable or deductible. The Company's

liability for current tax is calculated using tax rates that have

been enacted or substantively enacted by the balance sheet

date.

Provisions

Provisions are recognised when the Company has a present

obligation as a result of a past event, it is probable that the

Company will be required to settle that obligation and a reliable

estimate can be made of the amount of the obligation. The amount

recognised as a provision is the best estimate of the consideration

required to settle the present obligation at the balance sheet

date, taking into account the risks and uncertainties surrounding

the obligation.

Critical accounting estimates and judgements

The preparation of financial information in accordance with

generally accepted accounting practice, in the case of the Group

using IFRSs, requires the directors to make estimates and

judgements that affect the reported amount of assets, liabilities,

income and expenditure and the disclosures made in the financial

statements. Such estimates and judgements must be continually

evaluated based on historical experience and other factors,

including expectations of future events.

Details of accounting estimates and judgements that have the

most significant effect on the amounts recognised in the financial

statements have been disclosed under the relevant note or

accounting policy for each area where disclosure is required.

Valuation of share-based payments to employees

The Company estimates the expected value of share-based payments

to employees and this is charged through the income statement over

the vesting period. The fair value is estimated using the Black

Scholes valuation model which requires a number of assumptions to

be made such as level of share vesting, time of exercise, expected

length of service and employee turnover and share price volatility.

This method of estimating the value of share-based payments is

intended to ensure that the actual value transferred to employees

is provided for by the time such payments are made.

2. SEG M E N T A L R EPORTING

The Group has one activity only. The whole of the value of the

Group's and the Company's net assets in their respective financial

statements at 31 December 2022 and 2021 was attributable to UK

assets and liabilities.

3. OPER A TING LOSS

Group and Company

2022 2021

GBP'000 GBP'000

Lo ss from operations has been arrived at after

charging:

Directors' Remuneration 124 102

Share based payment charge - 36

Legal Fees 4 38

Nomad Fees 50 83

Fees payable to the Company's auditor for the

audit of the Group and Company's financial statements 22 27

4. E M PLOY E ES A N D DIRECTORS

The average number of persons employed by the Company in the

financial year (including directors that receive remuneration) was

5 (2021: 5).

The highest paid director during the year received GBP62,000

(2021: 57,000).

T h e follo wing tables s et out and analy se the rem un eration

of directors for the y ears e nd ed 31 December 2022 and 2021.

For the year ended 31 December 2022:

Contribution Share

Total to Pension Based

Salary Fees emoluments schemes Payments Total remuneration

------------------ -------- -------- ------------ ------------- ----------- -------------------

GBP'000 GBP'000 GBP'000 GBP'000 GBP'000 GBP'000

Dennis Edmonds 30 - 30 - - 30

Peter Taylor 60 - 60 2 - 62

Mark Gasson - 25 25 - - 25

Jonathan Summers 7 - 7 - - 7

97 25 122 2 - 124

------------------ -------- -------- ------------ ------------- ----------- -------------------

For the year ended 31 December 2021:

Contribution Share

to Pension Based

Salary Fees Total emoluments schemes Payments Total remuneration

------------------ -------- -------- ----------------- ------------- ----------- -------------------

GBP'000 GBP'000 GBP'000 GBP'000 GBP'000 GBP'000

John Taylor 6 - 6 - - 6

Dennis Edmonds 30 - 30 - - 30

Peter Taylor 51 - 51 1 5 57

Mark Gasson - 15 15 - 8 23

Jonathan Summers - - - - 11 11

87 15 102 1 24 127

------------------ -------- -------- ----------------- ------------- ----------- -------------------

No share options were exercised by the directors, and no shares

were received or receivable by any director in respect of

qualifying services under a long-term incentive scheme.

5. INCO M E T AX

The charge for the year is made up as follows:

2022 2021

GBP'000 GBP'000

Current tax - -

------------------------ -------- --------

Tax charge for the year - -

------------------------ -------- --------

A n al ysis of tax expense

N o liability to UK corporation tax arose for the y ear e nd ed

31 December 2022 nor for the y ear e nd ed 31 December 2021. No

deferred tax asset has been recorded on tax losses carried

forward.

Factors affecting the tax expense

T h e tax ass es sed for the y ear is higher than the standard

rate of corporation tax in t he UK. T he dif f ere n ce is explain

ed b elow:

2022 2021

GBP'000 GBP'000

Loss on ordinary activities before tax (376) (367)

Loss on ordinary activities multiplied

by the standard rate of corporation tax

in the UK of 19% (2021: 19%) (71) (70)

Effects of:

Non-deductible expenses - -

Income not chargeable to tax - -

Unrelieved tax losses carried forward 71 70

Tax expense - -

--------------------------------------------- -------- --------

6. LOSS OF PARE N T CO M PA N Y

As permitted by Section 408 of the Companies Act 2006, the

income statement of the parent company is not presented as part of

these financial statements. The parent company's loss for the

financial year was GBP376k (2021: GBP367k).

7. LOSS P E R SHA R E

Basic lo ss p er s hare is calculat e d, as set out in the

tables b elow, by dividing the loss attributable to ordinary s hare

hold e rs by the weight ed a verage nu m b er of ordinary s hares

outstanding during the p eriod.

In accordance with IAS 33, as the Group is reporting a loss for

both this and the preceding year the share options and warrants are

not considered dilutive because the exercise of these would have

the effect of reducing the loss per share.

As at 31 December 2022:

Loss Weighted average Per-share

GBP'000 number of shares amount, pence

--------- ------------------ ---------------

Basic loss attributable to

the ordinary shareholders 376 532,094,193 0.07p

As at 31 December 2021:

Loss Weighted average Per-share

GBP'000 number of shares amount, pence

--------- ------------------ ---------------

Basic loss attributable to

the ordinary shareholders 367 494,687,905 0.07p

8. INVESTMENTS

Parent company Shares in group

undertakings

GBP'000

COST

At 31 December 2021 and 31 December

2022 34,806

PROVISION FOR IMPAIRMENT

At 31 December 2021 and 31 December

2022 (34,806)

NET BOOK VALUE

At 31 December 2021 and 31 December -

2022

S ub si d iar ies

Pathfinder Battery Commodities Ltd

Regi ster ed o ffic e: 35 Berkeley Square, London, W1J 5BF, U nit ed Kin g dom

N ature of bu sin e s s: Holding com pany

Class of sha r es: Ordinary

Holding: 100.00%

I M M i nerals Li m ited

Regi ster ed o ffic e: 35 Berkeley Square, London, W1J 5BF, U nit ed Kin g dom

N ature of bu sin e s s: Holding com pany

Class of sha r es: Ordinary

Holding: 100.00%

Companh ia M i nei ra de Nab uri SARL

Regi ster ed o ffic e: Moza m bique

N ature of bu sin e s s: Mining

Nature of business: Non-trading

Class of sha r es: Ordinary

Ordinary 99.9%

S oc i edade Geral de M i nerac ao de Moçam b i que SARL

Regi ster ed o ffic e: Moza m bique

N ature of bu sin e s s: Non-trading

Class of sha r es: Ordinary

Ordinary 99.8%

IM Min erals Li mited h eld the s hares in Co m panhia Min eira

de Naburi SARL ("CMdN ") w hich h eld titanium dioxide mining conce

s sions in the R e public of Moza m biqu e. In Novem b er 2011, the

original v e ndors of IM Min erals' s ub sidiary, CMdN, ad vis ed

the Com pany that th ey had procured the cancellation of IM Min

erals Ltd's s har es in CMdN and the tran sfer of its ass ets (the

mining lice nce s) to another company controlled by th em. Whil st

the Co m pany is ta king l egal and oth er action in ord er to r

eco ver the s hares and the lic e nce s, the Com pany, in the

interest of accounting prud e nce, made f ull pro vision in the

2011 financial statem e nts again st the co st of its inv es t m e

nt in IM Min erals Ltd. As a consequence of the situation regarding

the Company's legal claims, the Company has been unable to verify

the current registered office addresses for the

Mozambique-domiciled companies, CMdN and Sociedade Geral de

Mineracao de Moçambique SARL. Furthermore, whilst the Company

believes these companies to be non-trading, the Company has been

unable to verify their trading statuses.

9. TRADE AND OTHER RECEIVABLES

Group Parent Company

2022 2021 2022 2021

GBP'000 GBP'000 GBP'000 GBP'000

Other debtors 8 8 8 8

VAT 5 4 5 4

Prepayments and accrued income - 7 - 7

-------- -------- -------- --------

13 19 13 19

-------- -------- -------- --------

10. CA S H AND C ASH EQUIVALE N TS

Group Parent Company

2022 2021 2022 2021

GBP'000 GBP'000 GBP'000 GBP'000

Bank accounts 46 365 46 365

-------- -------- -------- --------

11. SHA R E CA PITAL

a) Called up, allotted, issued and fully paid share capital

No. Ordinary Deferred Allotment Share Share Premium

shares shares price Capital GBP'000

of 0.1p of 9.9p (GBPs) GBP'000

each each

Total as at 31 December

2021 531,328,168 183,688,116 18,716 14,234

------------------------- ------------- ------------ ---------- --------- --------------

6 May 2022 1,166,666 - 0.005 1 5

Total as at 31 December

2022 532,494,834 183,688,116 18,717 14,239

------------------------- ------------- ------------ ---------- --------- --------------

b) Share options & warrants in issue

Share options

Exercise Grant Date Expiry Date At 1 January Issued At 31 December

Price 2022 / (lapsed) 2022

2.50p 10 April 2019 9 April 2022 7,500,000 (7,500,000) -

1.25p(1) 11 May 2020 11 May 2022 19,000,000 (9,000,000) 10,000,000

1.25p(1) 4 August 2020 31 May 2023 6,000,000 - 6,000,000

21 September 20 September

1.75p 2018 2023 18,750,000 - 18,750,000

0.55p 17 March 2021 16 March 2023 6,000,000 - 6,000,000

1.25p 1 April 2021 31 March 2023 6,000,000 - 6,000,000

1.25p 9 June 2021 8 June 2023 6,000,000 - 6,000,000

1.25p 23 June 2021 22 June 2023 3,000,000 - 3,000,000

1.25p 4 October 2021 3 October 2023 5,000,000 - 5,000,000

77,250,000 (16,500,000) 60,750,000

--------- --------------- --------------- ------------- ------------- ---------------

(1) On 6 May 2022, the following amendments were made to certain of the above share options:

-- 10,000,000 of the 19,000,000 1.25p options that were

otherwise due to expire on 11 May 2022 were extended so as to lapse

on 11 May 2023

-- 6,000,000 options with an exercise price of 1.25p and an

expiry date of 11 May 2022, were extended so as to expire on 31 May

2023.

Share warrants

Exercise Expiry Date At 1 January Issued/(lapsed) At 31 December

Price 2022 2022

0.50p(1) 11 May 2022 1,166,666 (1,166,666) -

3.50p 17 June 2022 10,703,018 (10,703,018) -

1.50p 11 May 2022 38,769,230 (38,769,230) -

2 November

1.25p 2022 2,500,000 (2,500,000) -

0.50p(2)

(3) 31 May 2023 11,666,668 - 11,666,668

1.50p(3) 31 May 2023 3,076,923 - 3,076,923

0.60p 29 April 2024 3,500,000 - 3,500,000

--------- -------------- ------------- ---------------- ---------------

71,382,505 (53,138,914) 18,243,591

--------- -------------- ------------- ---------------- ---------------

(1) On 6 May 2022, 1,166,666 warrants over Ordinary shares were

exercised at a price of 0.5p per share.

(2) On 19 February 2021, in accordance with the terms of the 11

May 2020 warrant instrument, the warrants subsisting thereunder

were repriced from 0.60p to 0.50p each.

(3) On 6 May 2022, 11,666,668 warrants with an exercise price of

0.50p and 3,076,923 warrants with an exercise price of 1.50p, all

with an expiry date of 11 May 2022, were extended so as to expire

on 31 May 2023.

12. TRADE AND OTHER PAYABLES

Group Parent Company

2022 2021 2022 2021

GBP'000 GBP'000 GBP'000 GBP'000

Trade creditors 4 - 4 -

Social security and other

taxes 43 86 43 86

Other creditors 42 42 42 42

Accruals and deferred

income 25 21 25 21

-------- -------- -------- --------

114 149 113 149

-------- -------- -------- --------

13. BORROWINGS

On 29 September 2022 and 28 December 2022, the Company announced

it has entered into a loan agreement whereby an FCA authorised

financial institution has arranged for the provision to the Company

by an individual, of an unsecured loan facility of up to GBP120,000

(the "Loan") for working capital purposes. The Loan carried a

simple fixed interest of 5.0 percent on any amounts drawn down and

had issue costs of GBP5,000. The Loan was designed to provide the

Company with access to additional working capital, should it be

required. As at 31 December 2022 GBP80,000 had been drawn down.

The Loan was repaid in full together with accrued interest and

the issue costs on 1 February 2023.

14. CONTINGENT LIABILITIES

As part of the agreement for the purchase of the shares in its

subsidiary, Companhia Mineira de Naburi SARL (CMdN), the Company's

subsidiary, IM Minerals Limited, agreed to pay the vendors a

further sum of US$9,900,000 if, following further exploration and

appraisal, an agreement is reached for the construction of a

facility for the processing of ore extracted from the Naburi

mineral sands deposit. This sum has since been reduced by advances

of GBP90,083, made by IM Minerals Limited, and GBP75,933, made by

the Company, to one of the vendors, Mr Diogo Cavaco.

Similarly, as part of its agr e e me nt for the purchase of the

w hole of the i ss u ed s hare capital of Soci e dade Geral de Min

eracao de Moçambiq ue SARL, CMdN has agreed to pay the ve ndors,

BHP Billiton, a f urth er s um of US$9,500,000 if, following f urth

er exploration and appraisal, an agree me nt is reach ed for the

con struction of a facility for the processing of ore extracted

from the Mo e base min eral sands d e posit. T his obligation is

guaranteed by IM Min erals L i mited.

In July 2021, the Company engaged Travers Smith LLP to act for

the Company in connection with its ongoing work to secure the

return of Mining Licence 4623C (the "Licence"), or compensation in

relation thereto. The fees payable to Travers Smith LLP are payable

on a contingent basis subject to a minimum pre-claim amount; in

February 2022, the cap was increased from GBP100,000 to GBP200,000;

in November 2022, the cap was further increased to GBP250,000.

Following the year-end, the Company and Travers Smith LLP agreed a

pre-claim fee of approximately GBP226k, including disbursements, in

respect of the ongoing work to secure the return of Mining Licence

4623C or compensation in relation thereto.

15. REL A T E D PARTY DISCLOSUR E S

Details of directo r s' re m un eration are given in note 4

above.

16. SHARE BASED PAYMENTS

The fair values of the share options and warrants at the date of

grant have been measured using the Black- Scholes pricing model,

which takes into account factors such as the option life, share

price volatility and the risk-free rate.

Each share option and warrant vested and was exercisable

immediately upon grant. The share-based expense relating to each

share option and share warrant was recognised in full on the date

of grant.

Share options

Risk Expected Fair

Share Exercise Free life Expected Expected value

Date of grant price price Rate(1) of options yield volatility(2) per option

21 September

2018 1.45p 1.75p 0.70% 5 years 0% 55% GBP0.00609

10 April 2019 1.35p 2.50p 0.71% 3 years 0% 55% GBP0.00264

11 May 2020 0.93p 1.25p(3) 0.07% 2 years 0% 55% GBP0.00190

4 August 2020 0.43p 1.25p(3) 0.06% 2 years 0% 55% GBP0.00022

17 March 2021 0.53p 0.55p 0.05% 2 years 0% 55% GBP0.00151

1 April 2021 0.53p 1.25p 0.05% 2 years 0% 55% GBP0.00040

9 June 2021 0.79p 1.25p(3) 0.05% 2 years 0% 55% GBP0.00127

23 June 2021 0.75p 1.25p(3) 0.05% 2 years 0% 55% GBP0.00111

4 October

2021 0.73p 1.25p(3) 0.05% 2 years 0% 55% GBP0.00101

(1) Daily sterling overnight index average (SONIA) rate at the

date of grant was adopted as the effective risk - free rate.

(2) Expected volatility is based on management's estimate of the

expected volatility

(3) Repriced to 0.75p following the year-end, on 27 April

2023.

Share warrants

Risk Expected Fair

Share Exercise Free life Expected Expected value

Date of grant price price Rate of warrants yield volatility per option

4 June 2019 2.75p 3.50p 0.71% 3 years 0% 55% GBP0.00827

11 May 2020(1) 0.93p 0.60p 0.07% 2 years 0% 55% GBP0.00426

11 May 2020 0.93p 1.50p 0.07% 2 years 0% 55% GBP0.00144

2 November

2020 0.68p 1.25p 0.05% 2 years 0% 55% GBP0.00083

21 May 2021 0.68p 0.6p 0.05% 2.9 years 0% 55% GBP0.00271

(1) On 19 February 2021, in accordance with the terms of the

relevant warrant instrument, the warrants subsisting thereunder

were repriced from 0.60p to 0.50p each.

On 6 May 2022, the Company extended the expiry date of certain

directors' share options and share warrants issued to a related

party. The details are as follows:

Director Date of No. Options Exercise Original Expiry New Expiry

Grant Price Date Date

--------------- ----------- ------------ ---------- ---------------- -----------

Dennis Edmonds 11/05/2020 10,000,000 GBP0.0125 11/05/2022 11/05/2023

Peter Taylor 04/08/2020 6,000,000 GBP0.0125 30/08/2022 30/08/2023

--------------- ----------- ------------ ---------- ---------------- -----------

Warrant Holder Date of No. Warrants Exercise Original Expiry New Expiry

Grant Price Date Date

----------------- ----------- ------------- --------- ---------------- -----------

Richard Jennings 11/05/2020 11,666,668 GBP0.005 11/05/2022 11/05/2023

Richard Jennings 11/05/2020 3,076,923 GBP0.015 11/05/2022 11/05/2023

----------------- ----------- ------------- --------- ---------------- -----------

The extension of share options and warrants did not result in a

change to the fair value that was determined on initial

recognition.

In addition, following the year-end, the exercise price and

expiry date of the aforementioned options was changed. See note

19.

The directors' interests in the share options and warrants of

the Company as at 31 December 2022 are as follows:

Director Number Number Exercise Latest exercise

of options of warrants price per date

share

D. Edmonds 10,000,000 - 1.25p 11 May 2023

P. Taylor 6,000,000 - 1.25p 30 August 2023

P. Taylor 5,000,000 - 1.25p 3 October 2023

M Gasson 6,000,000 - 1.25p 8 June 2023

The total share-based payment expense in the year for the

Company was GBPnil in relation to options (2021: GBP27k) and GBPnil

in relation to warrants (2021: GBP8.5k).

17. NON-CASH TRANSACTIONS

2022 2021

GBP'000 GBP'000

Settlement of broker commissions - 11

---------------------------------- ---------- ---------

- 11

--------------------------------------------- ---------

18. FINANCIAL INSTRUMENTS

The Company's principal financial instruments comprise cash and

cash equivalents and other receivables/payables. The Company's

accounting policies and method adopted, including the criteria for

recognition, the basis on which income and expenses are recognised

in respect of each class of financial assets, financial liability

and equity instrument are set out in note 1. The Company does not

use financial instruments for speculative purposes.

The principal financial instruments used by the Company, from

which financial instrument risk arises, are as follows:

Group Parent Company

2022 2021 2022 2021

Financial assets at amortised GBP'000 GBP'000 GBP'000 GBP'000

cost

Cash and cash equivalents 46 365 46 365

Prepayments and accrued income - 7 - 7

Financial liabilities at

amortised cost

Trade payables and accruals 114 149 114 149

a) Financial risk management objectives and policies

The Company's major financial instruments include bank balances

and amounts payable to suppliers. The risks associated with these

financial instruments and the policies on how to mitigate these

risks are set out below. The Directors manage and monitor these

exposures to ensure appropriate measures are implemented on a

timely and effective manner.

b) Liquidity risk

Liquidity risk arises from the Company's management of working

capital.

The Company regularly reviews its major funding positions to

ensure that it has adequate financial resources in meeting its

financial obligations. The Directors have considered the liquidity

risk as part of their going concern assessment (see note 1).

Controls over expenditure are carefully managed in order to

maintain its cash reserves whilst it targets a suitable

transaction. Financial liabilities are all due within one year.

c) Credit risk

The Company's credit risk is wholly attributable to its cash

balance. The credit risk from its cash and cash equivalents is

limited because the counterparties are banks with high credit

ratings and have not experienced any losses in such accounts.

d) Interest risk

The Company's exposure to interest rate risk is the interest

received on the cash held, which is immaterial.

e) Capital risk management

The Company's objectives when managing capital are to safeguard

the Company's ability to continue as a going concern, in order to

provide returns for shareholders and benefits for other

stakeholders and to maintain an optimal capital structure. The

Company has no borrowings. In order to maintain or adjust the

capital structure, the Company may adjust the amount of dividends

paid to shareholders, return capital to shareholders, or issue new

shares.

f) Fair value of financial assets and liabilities

There are no material differences between the fair value of the

Company's financial assets and liabilities and their carrying

values in the financial information.

19. E V E N TS A F T ER T H E RE PORT I N G P E RI O D

On 1 February 2023, the Company announced the issue and

allotment of 100,000,000 new ordinary shares of 0.1 pence per share

to raise GBP0.5m before expenses.

On 28 April 2023, the expiry date and exercise price of share

options which were granted to certain Directors and an employee

were amended as set out below. The revised exercise price

represents a premium of approximately 50 percent to the closing

share price on 27 April 2023.

Original Original Revised Revised

Exercise Date of Expiry Exercise Expiry

Name Position No. Options Price Grant Date Price Date

--------------- --------- ------------ ---------- ----------- ----------- ---------- -----------

Dennis Edmonds Director 10,000,000 GBP0.0125 11/05/2020 11/05/2023 GBP0.0075 30/06/2025

Peter Taylor Director 6,000,000 GBP0.0125 04/08/2020 30/08/2023 GBP0.0075 30/06/2025

5,000,000 GBP0.0125 04/10/2021 03/10/2023 GBP0.0075 30/06/2025

Mark Gasson Director 6,000,000 GBP0.0125 09/06/2021 08/06/2023 GBP0.0075 30/06/2025

Employee Employee 3,000,000 GBP0.0125 23/06/2021 22/06/2023 GBP0.0075 30/06/2025

--------------- --------- ------------ ---------- ----------- ----------- ---------- -----------

On 11 May 2023, shareholders voted to approve the disposal of

the Company's wholly-owned subsidiary, IM Minerals Limited as

explained further, in the Chairman's Statement on page 2 .

20. ULTIMATE CONTROLLING PARTY

The directors believe there is no ultimate controlling

party.

This information is provided by RNS, the news service of the

London Stock Exchange. RNS is approved by the Financial Conduct

Authority to act as a Primary Information Provider in the United

Kingdom. Terms and conditions relating to the use and distribution

of this information may apply. For further information, please

contact rns@lseg.com or visit www.rns.com.

RNS may use your IP address to confirm compliance with the terms

and conditions, to analyse how you engage with the information

contained in this communication, and to share such analysis on an

anonymised basis with others as part of our commercial services.

For further information about how RNS and the London Stock Exchange

use the personal data you provide us, please see our Privacy

Policy.

END

FR NKQBPABKDNPB

(END) Dow Jones Newswires

May 25, 2023 02:00 ET (06:00 GMT)

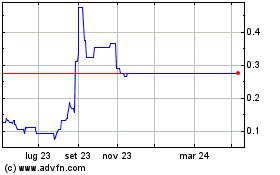

Grafico Azioni Pathfinder Minerals (LSE:PFP)

Storico

Da Apr 2024 a Mag 2024

Grafico Azioni Pathfinder Minerals (LSE:PFP)

Storico

Da Mag 2023 a Mag 2024