Ruffer Investment Company Limited Monthly Investment Report - November 2023 (5590W)

13 Dicembre 2023 - 8:00AM

UK Regulatory

TIDMRICA

RNS Number : 5590W

Ruffer Investment Company Limited

13 December 2023

RUFFER INVESTMENT COMPANY LIMITED

(a closed-ended investment company incorporated in Guernsey with

registration number 41996)

LEI 21380068AHZKY7MKNO47

Attached is a link to the Monthly Investment Report for November

2023.

http://www.rns-pdf.londonstockexchange.com/rns/5590W_1-2023-12-12.pdf

November proved to be a positive month for asset owners, as both

bonds and equities rallied sharply. The catalyst was a growing hope

that falling inflation will not be accompanied by slowing economic

growth. This is an ideal outcome since it would allow policymakers

to gently ease interest rates, helping to sustain high equity

valuations without dampening earnings. Policymakers have also

changed their tone, leaving investors less concerned about further

monetary policy tightening.

The market moves were significant, with global bonds

experiencing their best monthly return since 2008 and US equities

recording their best monthly return this year. We added to the

Company's bond duration in recent months to take advantage of

compelling valuations (eg US ten year real yields reaching 2.5%),

and with the belief that yields were reaching levels beyond which

they would begin to cause acute pain to the financial system. The

increased exposure enabled the Company to further benefit from

November's rally in fixed income, which was the largest contributor

to returns over the month. Likewise in equities, we had tactically

added to the Company's exposure as risk assets struggled with

rising yields in prior months. These increases to both bonds and

equities enabled the portfolio to deliver a positive return and

outweighed the headwinds from our protective assets. From a stock

picking perspective, holdings in Ryanair, Coty and Jackson

Financial were large positive contributors, alongside exposure to

US banks Citi and EastWest.

On the negative side of the ledger, protective positions to

guard against pain in the corporate bond market naturally suffered

in the buoyant environment as credit spreads narrowed sharply.

Elsewhere, exposure to energy was a headwind, partly as the

perceived risk of wider military conflict across the Middle East

has faded. Within our growth seeking assets, the exposure to

Chinese equities continued to stutter. Whilst we deem the visit of

Xi Jinping to San Francisco as a positive step in easing the

tensions between the World's two largest powers, investor sentiment

remains weak. We acknowledge there are good reasons for the high

risk premium applied to Chinese equities, but it does stand out for

both depressed valuations and, in our view, the increasing

likelihood of further policy stimulus to come.

Given the speed of the rally across bonds and equities, we felt

it was prudent to reduce the Company's exposures towards the end of

the month. Bond markets are now pricing in over 1% of interest rate

cuts in 2024 from the Federal Reserve. High equity valuations,

tight credit spreads and low volatility suggest complacency may

have returned to financial markets. There is a path for

policymakers to pull off the magic trick of raising interest rates

aggressively without derailing the economy, but we see an obvious

vulnerability should events deviate from this narrow route. Policy

changes feed through with a lag and the initial signs of a possible

soft landing are eerily similar to those pre-empting something more

severe. The Company's portfolio is designed to deliver positive

returns in both benign conditions such as we saw this month, but

also in those which are likely to be more challenging ahead.

Enquiries:

Sanne Fund Services (Guernsey) Limited

Jamie Dodd

Email: RIC@apexfs.group

This information is provided by RNS, the news service of the

London Stock Exchange. RNS is approved by the Financial Conduct

Authority to act as a Primary Information Provider in the United

Kingdom. Terms and conditions relating to the use and distribution

of this information may apply. For further information, please

contact rns@lseg.com or visit www.rns.com.

RNS may use your IP address to confirm compliance with the terms

and conditions, to analyse how you engage with the information

contained in this communication, and to share such analysis on an

anonymised basis with others as part of our commercial services.

For further information about how RNS and the London Stock Exchange

use the personal data you provide us, please see our Privacy

Policy.

END

DOCNKBBDKBDBQBD

(END) Dow Jones Newswires

December 13, 2023 02:00 ET (07:00 GMT)

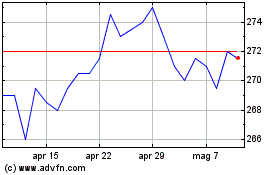

Grafico Azioni Ruffer Investment (LSE:RICA)

Storico

Da Apr 2024 a Mag 2024

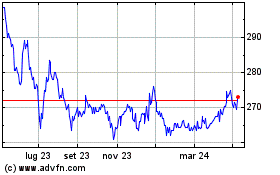

Grafico Azioni Ruffer Investment (LSE:RICA)

Storico

Da Mag 2023 a Mag 2024