TIDMRMII TIDMTTM

RNS Number : 1315V

RM Infrastructure Income PLC

30 November 2023

THIS ANNOUNCEMENT AND THE INFORMATION CONTAINED HEREIN IS NOT

FOR RELEASE, PUBLICATION OR DISTRIBUTION, IN WHOLE OR IN PART,

DIRECTLY OR INDIRECTLY, IN OR INTO THE UNITED STATES, AUSTRALIA,

CANADA, THE REPUBLIC OF SOUTH AFRICA, JAPAN, ANY MEMBER STATE OF

THE EUROPEAN ECONOMIC AREA OR ANY JURISDICTION IN WHICH IT WOULD BE

UNLAWFUL TO DO SO

30 November 2023

RM Infrastructure Income plc

(the "Company")

Proposed change of investment objective and policy to facilitate

a managed wind-down of the Company

and

Notice of General Meeting

As announced by the Company on 6 September 2023, the board of

directors (the "Board") has decided to put forward details to

Shareholders for the implementation of a managed wind-down of the

Company (the "Managed Wind-down").

A circular (the "Circular") to convene a General Meeting ("GM")

containing details of the proposals in respect of the Managed

Wind-down is expected to be published today and a copy of will be

submitted to the National Storage Mechanism and will shortly be

available for inspection at

https://data.fca.org.uk/#/nsm/nationalstoragemechanism . The

Circular will also be available on the Company's website

https://rm-funds.co.uk/rm-infrastructure-income/ .

Background to the Managed Wind-down

Although the Company has demonstrated strong NAV total return

performance over the longer term (4.97 per cent. and 31.72 per

cent. over one year and five years, respectively, to 31 October

2023) and generated a high net interest income in excess of the

annual dividend target of 6.5 pence per share [1] , the discount to

NAV per Share at which the Shares trade has been both wide and

persistent despite measures taken by the Board to seek to address

this through the use of buybacks and the provision of a periodic

realisation opportunity. This, coupled with the small scale of the

Company and the low levels of liquidity in the Company's shares has

restricted the Company's ability to grow.

As set out in the Company's announcement on 23 May 2023, in

April 2023 the Board received a non-binding indicative proposal

which involved a combination of all the Company's assets with

another investment company managed by Gravis Capital Partners (as

disclosed on 11 August 2023 ). The combination was proposed to be

structured under section 110 of the Insolvency Act 1986 with no

option, partial or otherwise, for you as a shareholder to elect to

receive cash.

The proposal was considered alongside a wide array of potential

options under a broader review of the Company's future strategy: a

potential continuation of the Company's existing investment policy

and strategy, a full or partial exit opportunity, a combination of

the Company's assets with another suitable investment company or

fund and a managed wind-down. The Board consulted with Shareholders

on these options and concluded that a partial exit opportunity

would only exacerbate the challenges the Company faces, as it would

further reduce the size of the Company.

Following the receipt of the first proposal, the Board received

two additional business combination proposals, as described in the

Company's announcement on 10 July 2023.

Having considered the various proposals in detail, the Board

concluded that no better option existed which was likely to receive

the required Shareholder consent, and on 6 September 2023, the

Board announced its decision to put forward a proposal for a

managed wind-down of the Company.

The Investment Manager provided a run-off profile of the

portfolio to Shareholders during the Shareholder consultation in

the third quarter of 2023. This showed an expected maturity profile

of the Company's Loans and a forecasted weighted average remaining

life of circa 1.7 years (as of 31 October 2023) with liquidation of

the Company occurring in the second half of 2027. The Investment

Manager has since then discussed with the Board an incentive

structure to accelerate capital repayments to Shareholders via

management initiatives and developed a capital acceleration

incentive proposal, details of which are set out in section 3 of

the Circular. The Investment Manager believes that the maturity

profile of the run-off portfolio could be reduced with proactive

management and as a result the weighted average remaining life

reduced to less than one year (as of 31 October 2023). Shareholders

would benefit from such acceleration as follows:

-- circa GBP72 million of Loans returned quicker or circa 70 per

cent. of total portfolio Loans;

-- potential shorter maturity to December 2026;

-- a significant amount of capital returned during 2024;

-- a Net Present Value to Shareholders versus the Shareholder

consulta ti on por tf olio repayment profile of circa GBP7.5

million assuming a discount rate of 9 per cent.; and

-- a reduc ti on of forecasted management fees of circa GBP0.77 million.

In order to implement the Proposal, Shareholders are requested

to approve revisions to the investment objective and policy of the

Company to restate the policy to facilitate the Company's assets

being realised in an orderly manner in order to maximise

shareholder value.

The Board believes that a carefully managed process of divesting

assets and periodically returning capital is in Shareholders' best

interests. In the Board's view, there is insufficient Shareholder

support for an alternative as evidenced during the Shareholder

consultation.

Amendments to Investment Objective and Policy

In order for the Company to follow the Managed Wind-down

process, it would be necessary to amend the Company's Investment

Objective and Policy. Therefore, t he Company proposes to amend its

investment objective and is proposing that the Company's investment

objective be restated as follows: "The Company aims to conduct an

orderly realisation of the assets of the Company, to be effected in

a manner that seeks to achieve a balance between returning cash to

Shareholders promptly and maximising value.". The full text of the

proposed Investment Objective and Policy is in the Circular

published today.

Amendment to the Investment Management Agreement

The Company proposes to amend the Investment Management

Agreement, once the Proposal has been approved, so that the

management fee will continue to be calculated at the rate of 0.875

per cent. of NAV per annum (payable monthly in arrears), but

subject to a minimum fee of GBP33,300 payable monthly in arrears,

subject to renegotiation with the Board, until the earlier of (i)

the Company's liquidation; (ii) the value of the Company's

portfolio (excluding cash and other liquid assets) being less than

or equal to GBP35 million; or (iii) 31 December 2026. Further

details on the proposed amendments to the Investment Management

Agreement are set out in the Circular.

The proposed amendment to the Investment Management Agreement

constitutes a related party transaction to which the modified

requirements for smaller related party transactions in the Listing

Rules apply (LR11.1.10R). Under the smaller related party

transaction rules, there is no requirement for Shareholders to vote

on the amendment. However, as a matter of good corporate

governance, the Company has consulted with its major Shareholders

on the terms of the proposed amendment as to the best interests of

Shareholders. The Company has also received written confirmation

from a sponsor that the terms of the proposed amendment are fair

and reasonable as far as the Shareholders are concerned.

Shareholder returns

The Board will keep Shareholders informed of its intentions

concerning returns of capital, mechanisms for which may include

tender offers, other schemes for the return of capital and/or the

buying back of Shares as the portfolio is realised. Throughout the

managed wind-down, the Board will follow the principle of seeking

to balance the optimum scale and accompanying costs to the Company

of the relevant method of return with the desire to accomplish that

return as quickly as practicable, without eroding the value to be

distributed.

Amounts becoming available for return will come from contractual

repayments of Loans by borrowers to the Company and from the

disposal of portfolio assets, potentially after the repayment and

cancellation of some or all of the Company's bank facilities.

The Board also expects to continue paying dividends at the

current rate of 6.5 pence per share [2] until the commencement of

the managed wind-down. Thereafter, the Company expects not to be

able to keep paying dividends at the current rate. The Company will

instead pay dividends only as required to maintain investment trust

status. As the Company's portfolio reduces in size its fixed costs

will become a greater proportion of its income.

The Company intends to maintain its investment trust status and

listing during this managed realisation process prior to the

Company's eventual liquidation. Maintaining the listing would allow

Shareholders to continue to trade Shares during the managed

wind-down of the Company.

Unless there are other proposals which it considers to be in the

Company's best interests at the relevant time, the Board also

expects to propose that the Company enters into members' voluntary

liquidation at a point when the realisations and returns of capital

have caused the Company to become too small to justify the costs of

retaining a listing for its Shares or otherwise at a point when the

Board considers the Company's remaining portfolio would be likely

to cease, in the near term future, to continue to provide a spread

of investment risk that is reasonable in the prevailing

circumstances. Any such proposed liquidation process would require

separate Shareholder approval.

General Meeting

The Proposal is conditional on the approval by Shareholders of

the Resolution to be proposed at the General Meeting which has been

convened for 10 a.m. on 20 December 2023.

The Resolution will be proposed as an ordinary resolution. An

ordinary resolution requires a majority of members entitled to vote

and present in person or by proxy to vote in favour in order for it

to be passed.

The formal notice convening the General Meeting, to be held at

the offices of Travers Smith LLP, 10 Snow Hill, London EC1A 2AL on

20 December 2023 at 10 a.m., is set out in the Circular.

Consequences of the Proposal not being approved

The Board regards the orderly realisation of the Company's

assets as the best strategic option for Shareholders. However,

should Shareholders reject the proposed amendment to the investment

policy to facilitate a managed wind-down of the Company, the Board

and the Investment Manager will continue to fulfil the existing

investment objective and policy and work to identify alternative

options for the future of the Company.

Recommendation

The Board considers that the Proposal is in the best interests

of the Company and its Shareholders as a whole. In the opinion of

the Board the proposed amendments to the Investment Management

Agreement are fair and reasonable as far as Shareholders are

concerned.

Accordingly, the Board unanimously recommends that Shareholders

vote in favour of the Resolution to be proposed at the General

Meeting.

The Directors intend to vote in favour, or procure the vote in

favour, of the Resolution at the General Meeting in respect of

their own beneficial holdings of Shares which, in aggregate, amount

to 69,982 Shares representing approximately 0.06 per cent. of the

Company's issued share capital (excluding Shares held in

treasury).

Expected timetable of events

The anticipated dates and sequence of events relating to the

implementation of the Proposals are set out below:

Latest time and date for receipt of

Forms

of Proxy or CREST electronic proxy 10 a.m. on 18 December

appointments for the General Meeting 2023

General Meeting 10 a.m. on 20 December

2023

Adoption of amended and restated investment 20 December 2023

objective and policy (if the Resolution

is passed)

Publication of the results of the 20 December 2023

General Meeting

Capitalised terms used but not defined in this announcement will

have the same meaning as set out in the Circular.

For further information, please contact:

RM Funds - Investment Manager

James Robson

Pietro Nicholls

Thomas Le Grix De La Salle 0131 603 7060

Singer Capital Markets - Financial Adviser and

Broker

James Maxwell

Asha Chotai 020 7496 3000

Apex Listed Funds Services (UK) Limited - Administrator

and Company Secretary

Jenny Thompson 020 3327 9720

About RM Infrastructure Income PLC

The Company aims to generate attractive and regular dividends

and positive social impact by lending to assets at the forefront of

providing essential services to society.

Its diversified portfolio of loans sourced or originated by the

Investment Manager with a degree of inflation protection through

index-linked returns where appropriate. Loans in which the Company

invests are predominantly secured against assets such as real

estate or plant and machinery and/or income streams such as account

receivables.

For more information, please contact James Robson at RM

Funds.

About RM Funds

RM Funds is an alternative asset manager. Founded in 2010, with

offices in Edinburgh, and London, the firm manages capital on

behalf of institutional investors, multi-asset allocators, wealth

managers and retail investors. RM Funds focuses on real asset

investing across liquid alternatives and private markets.

RM Funds is a delivery partner to the British Business Bank in

connection with the Coronavirus Business Interruption Loan Scheme.

RM Funds is a trading name of RM Capital Markets Limited.

RM Funds is a signatory to the Principles of Responsible

Investment.

Disclaimer

Neither the content of the Company's website, nor the content on

any website accessible from hyperlinks on its website for any other

website, is incorporated into, or forms part of, this announcement

nor, unless previously published by means of a recognised

information service, should any such content be relied upon in

reaching a decision as to whether or not to acquire, continue to

hold, or dispose of, securities in the Company.

[1] The dividend target is a target only and not a profit

forecast. There can be no assurance that this target will be met,

or that the Company will make any distributions at all and it

should not be taken as an indication of the Company's expected

future results. The Company's actual returns will depend upon a

number of factors, including but not limited to the Company's net

income and level of ongoing charges.

[2] The dividend target is a target only and not a profit

forecast. There can be no assurance that this target will be met,

or that the Company will make any distributions at all and it

should not be taken as an indication of the Company's expected

future results. The Company's actual returns will depend upon a

number of factors, including but not limited to the Company's net

income and level of ongoing charges.

This information is provided by RNS, the news service of the

London Stock Exchange. RNS is approved by the Financial Conduct

Authority to act as a Primary Information Provider in the United

Kingdom. Terms and conditions relating to the use and distribution

of this information may apply. For further information, please

contact rns@lseg.com or visit www.rns.com.

RNS may use your IP address to confirm compliance with the terms

and conditions, to analyse how you engage with the information

contained in this communication, and to share such analysis on an

anonymised basis with others as part of our commercial services.

For further information about how RNS and the London Stock Exchange

use the personal data you provide us, please see our Privacy

Policy.

END

UPDFLFSTLILAFIV

(END) Dow Jones Newswires

November 30, 2023 02:00 ET (07:00 GMT)

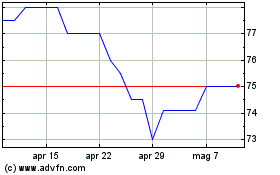

Grafico Azioni Rm Infrastructure Income (LSE:RMII)

Storico

Da Dic 2024 a Gen 2025

Grafico Azioni Rm Infrastructure Income (LSE:RMII)

Storico

Da Gen 2024 a Gen 2025