TIDMRTC

RNS Number : 2191U

RTC Group PLC

27 March 2023

27 March 2023

Certain information contained within this Announcement is deemed

by the Company to constitute inside information as stipulated under

the Market Abuse Regulation (EU) No. 596/2014 ("MAR") as applied in

the United Kingdom. Upon publication of this Announcement, this

information is now considered to be in the public domain.

RTC Group Plc

("RTC", "the Company" or "the Group")

Final results for the year ended 31 December 2021

RTC Group Plc (AIM: RTC.L) is pleased to announce its audited

results for the year ended 31 December 2022.

Highlights

-- Group revenue from continuing operations GBP71.9m (2021: GBP77.7m).

-- EBITDA GBP0.6m (2021: GBP1.1m).

-- Improvement in cash generation from operating activities of GBP2.35m versus 2021.

-- Net assets GBP6.2m (2021: GBP6.6m).

-- Basic loss per share 2.45p (2021: earnings per share 0.04p).

-- No final dividend is proposed. Total dividend in respect of

the year to 31 December 2022: Nil (2021: Nil).

Commenting on the results Andy Pendlebury, CEO said:

" 2022 was a year of two very contrasting halves for RTC Group.

Like many other companies, the early part of the year continued to

be impacted by the effects of covid. Additionally, the new

maintenance and renewals contract with Network Rail which saw

Ganymede Rail successfully awarded another long-term programme of

work, was heavily biased towards upfront cost and investment

activities. Whilst the combined effect of these two events impacted

our first half profitability, the fundamental capabilities

underpinning all our trading entities remained robust. The second

half of the year saw much improved trading across the Group. With

the exception of Ganymede Rail, all of our businesses enjoyed

second half run rates last seen prior to the onset of covid in

2020.

Our overall financial position sees the Group with no long-term

debt, a working capital facility with significant headroom for

growth, and strong cash and treasury management supporting

predominately blue chip and government backed clients. RTC Group

has a strong balance sheet which hasn't necessitated any form of

recapitalisation which befell many larger players in the sector and

a very strong and lengthy order book with many leading clients

across a number of our sectors. I believe we are well positioned to

capitalise on growth opportunities as they emerge."

Enquiries:

RTC Group Plc Tel: 0133 286 1842

Bill Douie, Chairman

Andy Pendlebury, Chief Executive

SPARK Advisory Partners Limited (Nominated Tel: 0203 368 3550

Adviser)

Matt Davis / Mark Brady

www.Sparkadvisorypartners.com

Panmure Gordon (Broker) Tel: 020 7886 2500

Hugh Rich

www.panmure.com

About RTC

RTC Group Plc is an AIM listed recruitment business that focuses

on white and blue-collar recruitment, providing temporary and

permanent labour to a broad range of industries and customers in

both domestic and international markets through its geographically

defined operating divisions.

UK division

Through its Ganymede and ATA Recruitment brands the Group

provides a wide range of recruitment services in the UK.

Ganymede specialise in recruiting the best technical and

engineering talent and providing complete workforce solutions to

help build and maintain infrastructure and transportation for a

wide range of UK and international clients. Ganymede is a market

leader in providing a diverse range of people solutions to the

rail, energy, construction, highways and transportation sectors.

With offices strategically located across the country, Ganymede

provides its clients with the benefit of a national network of

skilled personnel combined with local expertise.

ATA Recruitment provide high-quality technical recruitment

solutions to the manufacturing, engineering and technology sectors.

Working as an engineering recruitment partner supporting businesses

across the UK. ATA Recruitment has a strong track record of

attracting and recruiting the best engineering talent for our

clients. ATA's regional offices which are strategically located in

Leicester and Leeds each have dedicated market-experts to ensure

ATA delivers excellence to both our clients and candidates.

The Group headquarters are located at the Derby Conference

Centre which also provides office accommodation for its operating

divisions in addition to generating rental and conferencing income

from space not utilised by the Group.

International division

Through its GSS brand the Group works with customers across the

globe that are focused on delivering projects in a variety of

engineering sectors. GSS has a track record of delivery in some of

the world's most hostile locations. Working closely with its

customers GSS provides contract and permanent staffing solutions on

an international basis, providing key personnel into new projects

and supporting ongoing large-scale project staffing needs. GSS

typically recruit across a range of disciplines and skills from

operators and supervisors, through to senior management level.

www.rtcgroupplc.co.uk

Chairman's statement

For the year ended 31 December 2022

I am pleased to present the final report for the year.

Group

The Group overall delivered revenues of GBP71.9m (2021:

GBP77.7m) and overall gross profit was GBP11.8m (2021:

GBP11.8m).

Ganymede Energy markedly increased volumes, our branch general

manufacturing and engineering recruitment performance was buoyant,

led by increased permanent placement volumes and our UK technical

and engineering operations produced a much-improved contribution.

Our international business continued to make steady progress from

an already sound base and achieved results comparable to the final

year of our service in Afghanistan despite reduced volumes. The

difficult trading conditions experienced in the rail business in

2021 continued through 2022, exacerbated by ongoing industrial

action, although the year ended with most of the challenges being

addressed. Within Central services the Derby Conference Centre

recovered strongly to generate a trading profit on markedly better

business levels in both the conferencing area and the hotel and

events activities.

Dividends

In the conditions which have unfolded this year it remains

prudent not to pay a dividend in respect of 2022 and to concentrate

future efforts on balance sheet improvement in preparation for the

expected need to invest in business changes and developments in the

future. It is unlikely that we will be recommending a return to

dividend payments in the near future.

Our people

I should like to thank all our people for their loyalty, hard

work, and enthusiasm during the course of the year.

Outlook

It is more than usually difficult to assess the likely economic

backdrop which will provide the stage for business management and

performance in 2023. Continuing high levels of inflation, albeit

varying throughout the world, coupled with the war between Russia

and Ukraine and alarming increases in tension between China and the

West do not augur well for stability. Although any slide into

recession in the UK could adversely affect general permanent

recruitment, other elements of our portfolio of activities are in

areas not so directly affected by economic factors and should offer

a more stable investment environment. Although it is possible that

inflation will continue to abate and remain lower, history casts

some doubt on the likelihood of that being the case. Nonetheless

the RTC Group has a strong balance sheet and management in depth

and your directors are cautiously optimistic of a continuing

improvement in our financial performance.

W J C Douie 26 March 2023

Chairman

Chief Executive's operational and strategic review

For the year ended 31 December 2022

Overview

2022 was a year of two very contrasting halves for RTC Group.

Like many other companies, the early part of the year continued to

be impacted by the effects of covid and the health, safety, and

well-being of both our permanent and contract workforce remained

our highest priority as we cautiously transitioned to a more

normalised trading environment. Additionally, the new maintenance

and renewals contract with Network Rail which saw Ganymede Rail

successfully awarded another long-term programme of work, albeit on

new operating routes, was heavily biased towards upfront cost and

investment activities. Whilst the combined effect of these two

events impacted our first half profitability resulting in only a

marginal EBITDA for the period, the fundamental capabilities

underpinning all our trading entities remained robust. This was

evidenced in the second half of the year which saw much improved

trading across the Group. With the exception of Ganymede Rail, all

of our businesses enjoyed second half run rates last seen prior to

the onset of covid in 2020. Furthermore, and whilst we are early in

the new financial year with much global and domestic uncertainty

clouding the visibility businesses and investors desire, I am

optimistic that these run-rates can maintain momentum and continue

in a positive direction.

Whilst 2022 full year sales of GBP71.9m were down around 7.5%

from 2021 reflecting the difficult start to the year, our gross

profit held constant at GBP11.8m with the margin gaining some

ground to 16% reflecting changes to our sales mix and operational

changes to our international contracts with fewer low margin

administration activities performed on behalf of our client.

Additionally, and of significance to the financial performance of

our Ganymede Rail business and the Group, it should be noted that

having endured elevated operating costs in the early part of the

year to comply with the tail end of covid, constantly escalating

fuel prices and wage-based inflation due to supply shortages, the

business was further heavily impacted in the second half of the

year by industrial action across the whole of the rail network.

This was naturally hugely disappointing and costly to our rail

business having invested significantly in the preparation of

personnel and new route management/deployment activities in the

early part of the year. To give some financial context, the

business, with minimal ability to offset operational cost, lost

around 75,000 billable hours in the second half of the year due to

the disruption which in turn equated to missed revenue of around

GBP2m along with the associated gross margin and profit

contribution. A significant sum which if recognised would have had

a positive impact on the outcome of the Group's results.

Furthermore, and taking account of our medium to long-term view

of growth across the industries and sectors we operate in, we have

continued throughout the year to invest in and increase the number

of recruitment consultants employed across the Group and alongside

this have committed to investing in a new front end, cloud based

CRM recruitment system which will provide a unified platform across

the Group and integrate with all financial, payroll and accounting

systems. Also, as we cooperate and integrate more closely alongside

and within our clients' businesses our technology platform will

enable us to seamlessly enhance and grow the value of key client

relationships. Naturally, the nature of these investments,

especially the costs attached to finding, training, and developing

new consultants, are forward loaded with delayed revenue streams

and we expect a positive return on these investments from 2023

onwards.

Taking all of this into account and considering our overall

financial position which sees the Group with no long term debt, a

working capital facility with significant headroom for growth,

strong cash and treasury management supporting predominately

blue-chip and government backed clients, a strong balance sheet

which hasn't necessitated any form of recapitalisation, which

befell many larger players in the sector and a very strong and

lengthy order book with many leading clients across a number of our

sectors, I believe we are well positioned to capitalise on growth

opportunities as they emerge.

Our strategy is very clear and will continue to centre around

our business model of growing industry leading, independent

subsidiary businesses capable of competing in each of their

respective sectors and offering clients significant opportunities

for greater value add and high-level cost savings through working

collaboratively across all RTC Group companies.

Finally, I believe our commitment to the highest levels of

corporate, commercial, and operational governance has been a

significant distinguishing factor in building the strong and

long-term relationships we have with our client base. This coupled

with the financial health of the Group, our ability to attract

strong management teams in each of our businesses and a Group board

with the necessary experience and proven track record to steer the

business through what has been an unprecedented few years for the

sector with significant companies having to seek additional

shareholder funds to survive, is evidence that the Group is in very

solid and strong position for its shareholders.

Business review

UK Division

2022 was a year of recovery for our UK recruitment business with

very strong demand returning for both permanent and temporary

recruitment pushing vacancy levels to post pandemic highs. However,

whilst client requirements for permanent staff were running at

all-time highs, a shortage of candidates due to skill availability,

candidate reluctance to change employer during the prevailing

economic uncertainties and counter offers by employers to retain

'hard-to-replace' employees, created a challenging recruitment

environment. Despite this our white-collar recruitment teams in

Ganymede and ATA enjoyed a 25% increase in permanent fees for the

period. The growth was driven by a combination of increased fees as

salary levels rose to attract key hires and an overall increase in

volume in line with market growth. The focus we have achieved

through combining our white-collar rail and infrastructure

recruitment business alongside our Ganymede Rail business has

continued to provide opportunities across the sector with many

clients choosing to leverage the combined capability. Having been

awarded several preferred supplier status contracts we have been

able to secure additional revenue and reduce external recruitment

costs for many rail and infrastructure clients. Also, during the

year, following encouragement from a number of rail specific

clients, a rail signalling business was established, and this is

now delivering a new and profitable business stream with growing

demand as we enter the new year.

Whilst candidate caution due to economic and political

uncertainty dominated the permanent marketplace, the temporary

sector excluding rail had an extremely buoyant year. Ganymede and

ATA's white collar recruitment teams saw revenue from temporary

activity increase significantly across both businesses resulting in

increased gross profit of 38%. This is a hugely impressive

performance, especially for the ATA business which lost over 90% of

temporary workers out on assignment during the height of covid.

ATA's current run-rate is now tracking back at pre-covid levels and

demand as we enter the new year is showing positive signs of

encouragement.

During 2022 Ganymede Energy finally began to fulfil its full

potential following successive years of setbacks. Over 5 years ago

the business established itself as a partner to major utility

companies to provide personnel to support the Government's smart

meter roll out strategy. Having recruited, trained, and begun to

deploy smart meter installers it quickly became apparent that

issues with the technology would have to halt the programme pending

technology improvements. This was followed by delays caused through

client redundancy programmes and then a complete suspension of

activity as covid restrictions prohibited workers from attending

private residences. This was still the case in quarter one 2022 but

once all restrictions were finally lifted activity recommenced. I

am delighted to report that during the rest of the year demand for

our smart meter installers has hit record highs with the year

ending with over 200 Ganymede personnel out on daily assignment and

this is expected to rise during 2023. Outside of the 6 major

utility companies our energy business is now one of the largest

providers of smart meter installers in the country. A remarkable

achievement given the multiple hurdles the business has faced

during its growth journey. The Government is currently legislating

to extend its powers in relation to the smart meter roll-out until

November 2028. Based on data published at the end of September 2022

there are some 24 million smart meters awaiting fitment. Given

current installation rates across the industry it is estimated that

it will take between 6-8 years (excluding enhancements to existing

meters) to replace the remaining traditional meters. We are

confident that given our current performance and dominant

positioning our energy business has a significant and sustainable

revenue potential revenue for the foreseeable future. In addition,

in collaboration with our conference business, the Derby Conference

Centre, our energy partners are using our inhouse facility to

induct direct personnel alongside the Ganymede smart meter

installers which is generating broader revenue for the Group.

Towards the second half of 2022 our projects business which had

traditionally focused on rail projects began exploring the

opportunity to enter the social housing market given the scale of

property refurbishment which was forecast across many district

councils. Following a pilot scheme which saw some upfront

investment to gain skills, capability and experience the team began

working as a secondary provider of labour to a prime contractor.

Over the past 6 months and following successful inclusion as a

direct provider our projects business has now refurbished in excess

of 100 council properties. Whilst it is early days, we believe the

scale of properties requiring renovation or upgrade as part of the

Government's heating and building strategy to decarbonise homes,

offers another long-term opportunity for two RTC business units to

combine capabilities and offer a single point solution to a

significant and growth dominated sector. In preparation and

readiness for this the Group is funding the establishment of a

training and assessment centre within our energy business

premises.

As has been alluded to Ganymede Rail experienced a very

challenging year in 2022 mainly due to the tail end of covid,

disruption to its operational route management through significant

industrial action, escalating fixed and variable costs through

excessive fuel prices and high wage inflation, and the impact of

route changes which resulted in reduced revenue and additional set

up costs for the newly awarded long term Network Rail contract.

Whilst this has proved an extremely difficult period for the

business, its management, and its permanent and contract workforce,

I cannot emphasise enough the strategic value and importance that

the Group board place on this business. The business has a long

term, multimillion-pound order book with a minimum 4-year tenure

which will see Ganymede continue as one of Network Rail's largest

and historically best performing maintenance and renewals labour

suppliers. In addition to its long-term direct relationship with

Network Rail Ganymede Rail is partner with numerous blue-chip prime

contractors and has a first-class track record in safety management

in the sector and is one of the largest apprentice training funders

across labour supply companies. We remain extremely confident in

the business's ability deliver an extremely high value service on

one of the country's most important and strategic assets and we

look forward to seeing it rebound in 2023.

Central services

The Derby Conference Centre which forms part of the central

services division had a much-improved year culminating in a

significant increase in volume for all its service offerings.

Following a long period of closure to comply with government

restrictions in 2020 and 2021 the business like many in the

hospitality sector was plagued with uncertainty at the beginning of

2022. However, its performance due to its strong reputation in the

East Midlands quicky regained momentum and December delivered one

of its best festive results. Furthermore, as we enter 2023 the

business achieved its best January result and the whole team is

encouraged about its long-term future in the sector.

International

Whilst GSS no longer provides personnel to Afghanistan following

the demobilisation of all international personnel, the business

remains very active in supporting overseas clients and territories

and has secured new clients providing exciting new opportunities

for the business. We still provide a wide-ranging workforce to many

other overseas locations including, Dubai, Bahrain, Iraq,

Mogadishu, and Poland. During 2022 the business secured a

significant new contract with its largest client to provide large

volumes of permanent personnel to British Overseas Territories. The

team are also currently working with several NATO supply partners

in support of emerging mobilisation contracts in various

locations.

Outlook

Following a vastly improved performance in the second half of

the year and early signs of a continuation of this trajectory into

the early part of this year, I remain cautiously optimistic about

our future revenue and profit generation. Whilst naturally there is

considerable and justified concern about both international and

domestic events which serve to destabilise both market and customer

demand, I believe the services being provided by many of our

domestic clients, especially our utility and transportation clients

where maintenance and enhancement programmes to key infrastructure

assets have work programmes spanning many years offering

significant growth potential to add to our already well established

orderbook. In addition to this, the broad generalist capability

being offered by our permanent and temporary recruitment business

serving the UK's growing manufacturing, industrial and engineering

companies, and our expanding geographic presence through our

international business will ensure that we are well placed to take

capture new business opportunities across all our Group recruitment

businesses.

Our people

The energy and enthusiasm showed by our people across the RTC

Group is, as always, exceptional. Given how tough the last few

years have been on our people and their families it is has been

humbling to see their resilience, ambition, and desire to see RTC

continue to differentiate itself in highly populated markets.

The Board of directors could not be prouder of the collective

team effort and would like to thank everybody across the Group.

A M Pendlebury

CEO 26 March 2023

Finance Director's report

For the year ended 31 December 2022

Financial highlights

The Group overall delivered revenues of GBP71.9m (2021:

GBP77.7m) and overall gross profit was GBP11.8m (2021: GBP11.8m).

The loss from operations of GBP0.2m (2021: profit of GBP0.3m)

reflects a mixed year that saw good performance across all areas of

the Group other than rail which experienced a perfect storm of

increased costs to supply and lower than anticipated volumes (see

more detail in the UK Recruitment section below).

UK Recruitment

The division's white collar recruitment divisions, serviced by

our ATA and Ganymede recruitment brands both performed well

throughout the year, despite the well-publicised candidate

shortages, with strong client demand across both permanent and

contract recruitment. In 2022 these divisions delivered a combined

25% growth in permanent fees and 38% growth in contract GP compared

to 2021.

Ganymede Energy continued its growth trajectory, supporting the

Government's smart meter roll out programme, delivering 50% growth

at GP level compared to 2021. Additionally, 2022 saw the

development of training and assessment facilities at the Ganymede

Energy premises in Milton Keynes to support workforce

upskilling.

Ganymede Rail had a challenging year, severely impacted by

ongoing industrial action, escalating fuel prices and wage

inflation fuelled by candidate shortages. Year on year volumes

reduced by 35% in comparison to 2021 reflecting the changes in

geographical regions of supply to Network Rail under the revised

contract which commenced in Q4 of 2021, combined with the lost

revenue impact of the rail strikes between June and December.

Additionally, the company continued to grow its minor projects

capability; developed a signalling labour supply business and

delivered ongoing improvement in safety performance throughout the

year.

Overall, UK Recruitment delivered slightly reduced revenues of

GBP64.8m (2021: GBP66.8m) which were converted to profit from

operations of GBP1.5m (2021: GBP2.7m). The reduction in profit from

operations reflecting strike action and the increased cost of

supply, particularly fuel prices in the Rail division and increased

administrative expenses largely due to higher commissions on very

strong performances in energy and recruitment.

International

Whilst revenue reduced significantly to GBP5.2m (2021: GBP9.6m)

following the withdrawal of NATO from Afghanistan, gross profit

reduced only slightly to GBP0.8m (2021: GBP0.9m) with gross margin

increasing to 15% (2021: 10%) as much of the revenue relating to

Afghanistan related to services (e.g., contractor travel) that were

provided at cost. The division has been successful in securing work

under new framework agreements in addition to existing arrangements

delivering profit from operations of GBP0.5m (2021: GBP0.5m) on a

par with 2021 despite the withdrawal from Afghanistan.

Central Services

Within Central Services, the Derby Conference Centre has seen

good levels of activity relating to conferences, events and bedroom

sales for the majority of 2022 with a particularly strong finish on

festive activities. Revenue generated by the segment was GBP2.0m

(2021: GBP1.3m) and gross profit increased to GBP1.1m (2021:

GBP0.7m).

Taxation

The tax credit for the year was GBP0.1m (2021: charge of

GBP0.1m). The variance between this and the expected charge if a

19% corporation tax rate was applied to the result for the year is

explained in note 9.

Dividends

No dividends were paid during the year (2021: Nil). No final

dividend for the year ended 31 December 2022 has been proposed

(2021: Nil).

Own shares held

The cost of the Group's own shares purchased through the

Employee Benefit Trust (EBT) is shown as a deduction from equity.

No options were exercised during the year. The balance of

GBP235,918 (2021: GBP235,918) in the own shares held reserve within

equity reflects 337,027 (2021: 337,027) shares remaining in the EBT

that will be used to satisfy future exercises.

Statement of financial position and cash flows

The Group's net working capital reduced slightly to GBP4.6m

(2021: GBP5.0m). The ratio of current assets to current liabilities

was slightly reduced at 1.4 (2021: 1.5). The Group's gearing ratio,

which is calculated as total borrowings over net assets, increased

to 0.5 (2021: 0.4).

The Group generated GBP2.4m more cash in 2022 compared to. This

improvement versus 2021 reflects increased activity across the

majority of the business.

The Group has no term debt and is financed using its invoice

discounting and overdraft facilities with HSBC. At 31 December 2022

the Group's had available funds to draw down of GBP5.1m (2021:

GBP4.3m)

Financing and going concern

The Group's current bank facilities include a net overdraft

facility across the Group of GBP50,000 and an invoice discounting

facility with HSBC providing of up to GBP12.0m, based on a

percentage of good book debts, at a margin of 1.6% above base. The

Board closely monitors the level of facility utilisation and

availability to ensure there is enough headroom to manage current

operations and support the growth of the business.

Given the uncertainty and mixed opinion about short and

medium-term prospects for the UK economy influenced by the

cost-of-living crisis, widespread strike action, the looming threat

of a recession and other geo-political events, in addition to the

established budgeting and forecasting processes, which considers a

range of plausible events and circumstances, a reverse stress test

has been undertaken. This shows that, assuming a continuation of

the current facilities, the Group has access to sufficient cash and

facilities to withstand a 20% reduction against the 2022 revenues

without any significant restructuring or other cost reduction

measures.

In assessing the risks related to the continued availability of

the current facilities, the Board have taken into consideration the

existing relationship with HSBC and the strength of the security

provided, also taking into account the quality of the Group's

customer base. Based on their enquiries, the Board have concluded

that sufficient facilities will continue to remain available to the

Group and therefore the going concern basis of preparation remains

appropriate and no material uncertainty exists.

Liquidity risk

The Group seeks to mitigate liquidity risk by effective cash

management. The Group's policy, throughout the year, has been to

ensure the continuity of funding through a net overdraft facility

of GBP50,000 and an invoicing discounting facility, providing up to

GBP12m based on a percentage of good book debts. The invoice

discounting facility, which is the Group's core funding line is

classed as evergreen in that it has no fixed expiry date (although

it is reviewed annually).

The strategic report was approved by the Board on 26 March 2023

and signed on its behalf by:

S L Dye 26 March 2023

Consolidated statement of comprehensive income

For the year ended 31 December 2022

2022 2021

Notes GBP'000 GBP'000

---------------------------------------------- ------- ---------- ----------

Revenue 2 71,907 77,715

Cost of sales (60,132) (65,928)

---------------------------------------------- ------- ---------- ----------

Gross profit 11,775 11,787

Other operating income 6 351

Administrative expenses (12,024) (11,864)

---------------------------------------------- ------- ---------- ----------

(Loss)/profit from operations (243) 274

Finance expense (212) (160)

---------------------------------------------- ------- ---------- ----------

(Loss)/profit before tax (455) 114

Tax expense 3 104 (109)

---------------------------------------------- ------- ---------- ----------

Total (loss)/profit and other comprehensive

(expense)/income for the year attributable

to owners of the Parent (351) 5

---------------------------------------------- ------- ---------- ----------

Earnings per ordinary share

Basic (2.45p) 0.04p

---------------------------------------------- ------- ---------- ----------

Fully diluted (2.45p) 0.03p

---------------------------------------------- ------- ---------- ----------

Consolidated statement of changes in equity

For the year ended 31 December 2022

Share Share Own Capital Share Retained Total

capital premium shares redemption based earnings equity

held reserve payment

reserve

GBP'000 GBP'000 GBP'000 GBP'000 GBP'000 GBP'000 GBP'000

---------- ---------- --------- ------------- ---------- ----------- ---------

Balance

at 1 January

2022 146 120 (236) 50 146 6,320 6,546

---------------------- ---------- ---------- --------- ------------- ---------- ----------- ---------

Total comprehensive

expense for

the year - - - - - (351) (351)

---------------------- ---------- ---------- --------- ------------- ---------- ----------- ---------

Transactions

with owners:

Share options

cancelled - - - - (24) 24 -

Share based

payment charge

---------------------- ---------- ---------- --------- ------------- ---------- ----------- ---------

Total transactions

with owners - - - - (24) 24 -

---------------------- ---------- ---------- --------- ------------- ---------- ----------- ---------

At 31 December

2022 146 120 (236) 50 122 5,993 6,195

---------------------- ---------- ---------- --------- ------------- ---------- ----------- ---------

The consolidated statement of changes in equity for the prior

year was as follows:

Share Share Own Capital Share Retained Total

capital premium shares redemption based earnings equity

held reserve payment

reserve

GBP'000 GBP'000 GBP'000 GBP'000 GBP'000 GBP'000 GBP'000

---------- ---------- --------- ------------- ---------- ----------- ---------

Balance at

1 January

2021 146 120 (236) 50 718 6,278 7,076

---------------------- ---------- ---------- --------- ------------- ---------- ----------- ---------

Total comprehensive

income for

the year - - - - - 5 5

---------------------- ---------- ---------- --------- ------------- ---------- ----------- ---------

Transactions

with owners:

Share options

cancelled - - - - (782) 37 (745)

Share based

payment charge - - - - 210 - 210

---------------------- ---------- ---------- --------- ------------- ---------- ----------- ---------

Total transactions

with owners - - - - (572) 37 (535)

---------------------- ---------- ---------- --------- ------------- ---------- ----------- ---------

At 31 December

2021 146 120 (236) 50 146 6,320 6,546

---------------------- ---------- ---------- --------- ------------- ---------- ----------- ---------

Consolidated statement of financial position

As at 31 December 2022

2022 2021

Note GBP'000 GBP'000

--------------------------------- ------- ---------- ----------

Assets

Non-current

Goodwill 132 132

Other intangible assets 28 74

Property, plant, and equipment 1,544 1,554

Right-of-use assets 2,491 2,779

Deferred tax asset 210 40

------------------------------------------ ---------- ----------

4,405 4,579

Current

Inventories 15 21

Trade and other receivables 15,388 13,481

Cash and cash equivalents 467 946

------------------------------------------ ---------- ----------

15,870 14,448

Total assets 20,275 19,027

------------------------------------------ ---------- ----------

Liabilities

Current

Trade and other payables (7,875) (6,430)

Lease liabilities (303) (294)

Current borrowings (3,132) (2,828)

(11,310) (9,552)

Non-current liabilities

Lease liabilities (2,576) (2,801)

Deferred tax liabilities (194) (128)

------------------------------------------ ---------- ----------

Total liabilities (14,080) (12,481)

------------------------------------------ ---------- ----------

Net assets 6,195 6,546

------------------------------------------ ---------- ----------

Equity

Share capital 146 146

Share premium 120 120

Own shares held (236) (236)

Capital redemption reserve 50 50

Share based payment reserve 122 146

Retained earnings 5,993 6,320

Total equity 6,195 6,546

------------------------------------------ ---------- ----------

Consolidated statement of cash flows

For the year ended 31 December 2022

2022 2021

GBP'000 GBP'000

Cash flows from operating activities

(Loss)/profit before tax (455) 114

Adjustments for:

Depreciation, loss on disposal and

amortisation 857 816

Finance expense 212 160

Employee equity settled share options

charge - 210

Change in inventories 6 (14)

Change in trade and other receivables (1,907) (77)

Change in trade and other payables 1,445 (3,271)

---------------------------------------------- --------- ---------

Cash inflow/(outflow) from operations 158 (2,062)

Income tax paid - (217)

Interest paid (212) (160)

Net cash outflow from operating activities (54) (2,439)

---------------------------------------------- --------- ---------

Cash flows from investing activities

Purchase of property, plant and equipment

and intangibles (417) (279)

Net cash outflow from investing activities (417) (279)

Cash flows from financing activities

Movement on invoice discounting facility 872 2,231

Movement on perpetual bank overdrafts (568) (370)

Amounts paid to cancel share options - (745)

Payment of lease liabilities (312) (279)

Net cash (outflow)/inflow from financing

activities (8) 837

---------------------------------------------- --------- ---------

Net decrease in cash and cash equivalents (479) (1,881)

---------------------------------------------- --------- ---------

Cash and cash equivalents at beginning

of year 946 2,827

---------------------------------------------- --------- ---------

Cash and cash equivalents at end of

year 467 946

---------------------------------------------- --------- ---------

1. Corporate information and basis of preparation

RTC Group Plc is a public limited company incorporated and

domiciled in England whose shares are publicly traded.

The announcement of results of the Group for the year ended 31

December 2022 was authorised for issue in accordance with a

resolution of the directors on 26 March 2023.

The financial information included in this announcement has been

prepared under the historical cost convention, as modified by

measurement of share-based payments at fair value at date of grant

, and in accordance with UK adopted international accounting

standards ("IFRS") and with those parts of the Companies Act 2006

applicable to companies reporting under IFRS. This announcement

does not itself however contain sufficient information to comply

with IFRS.

The accounting policies adopted are consistent with those

described in the annual financial statements for the year ended 31

December 2021. There have been no significant changes in the basis

upon which estimates have been determined, compared to those

applied at 31 December 2021 and no change in estimate has had a

material effect on the current period.

2. Segment analysis

The business is split into three operating segments, with

recruitment being split by geographical area. This reflects the

integrated approach to the Group's recruitment business in the UK

and independent delivery of overseas business. Three operating

segments have therefore been agreed, based on the geography of the

business unit: United Kingdom, International and Central

Services.

This is consistent with the reporting for management purposes,

with the Group organised into two reportable segments, Recruitment

and Central Services, which are strategic business units that offer

different products and services. They are managed separately

because each segment has a different purpose within the Group and

requires different technologies and marketing strategies.

Segment operating profit is the profit earned by each operating

segment defined above and is the measure reported to the Group's

Board, the Group's Chief Operating Decision Maker, for performance

management and resource allocation purposes. The Group manages the

trading performance of each segment by monitoring operating

contribution and centrally manages working capital, financing, and

equity.

Revenues within the recruitment operating segment have similar

economic characteristics and share a majority of the aggregation

criteria set out in IFRS 8:12 in particular the nature of the

products and services, the type or class of customers, the country

in which the service is delivered, and the processes utilised to

deliver the services and the regulatory environment for the

services.

The purpose of the Central Services segment is to provide all

central services for the Group including the Group's head office

facilities in Derby. It also generates income from the Derby site

including rental of excess space and hotel and conferencing

facilities.

Revenue, gross profit, and operating profit delivery by

geography:

2022 2021

UK UK Inter-national Total UK UK Inter-national Total

Recruitment Central Recruitment Group Recruitment Central Recruitment Group

Services Services

GBP'000 GBP'000 GBP'000 GBP'000 GBP'000 GBP'000 GBP'000 GBP'000

----------------- ------------- ---------- ---------------- ---------- ------------- ---------- ---------------- ----------

Revenue 64,764 1,979 5,164 71,907 66,842 1,279 9,594 77,715

Cost of

sales (54,878) (912) (4,342) (60,132) (56,703) (622) (8,603) (65,928)

----------------- ------------- ---------- ---------------- ---------- ------------- ---------- ---------------- ----------

Gross profit 9,886 1,067 822 11,775 10,139 657 991 11,787

Other operating

income* - 6 - 6 213 138 - 351

Administrative

expenses (7,948) (2,883) (341) (11,172) (7,240) (3,293) (519) (11,052)

Amortisation

of intangibles (46) - - (46) (100) - - (100)

Depreciation

of

right-of-use

assets (144) (240) - (384) (129) (239) - (368)

Depreciation (261) (157) (4) (422) (175) (165) (4) (344)

----------------- ------------- ---------- ---------------- ---------- ------------- ---------- ---------------- ----------

Total

administrative

expenses (8,399) (3,280) (345) (12,024) (7,644) (3,697) (523) (11,864)

----------------- ------------- ---------- ---------------- ---------- ------------- ---------- ---------------- ----------

Profit

from

operations 1,487 (2,207) 477 (243) 2,708 (2,902) 468 274

----------------- ------------- ---------- ---------------- ---------- ------------- ---------- ---------------- ----------

*Other operating income represents Government Grants in respect

of the Coronavirus Job Retention Scheme and a Local Government

Business Support Grant (none of which are required to be

repaid).

The revenue reported above is generated from continuing

operations with external customers. There were no sales between

segments in the year (2021: Nil). For segment reporting purposes in

this note, revenue is analysed by the geographical location in

which the services are delivered.

The accounting policies of the operating segments are the same

as the Group's accounting policies described in notes 1 above.

Segment profit represents the profit earned by each segment,

without allocation of Group administration costs or finance

costs.

During 2022, one customer in the UK segment contributed 10% or

more of total revenue being GBP18.0m (2021: GBP28.0m) and one

customer in the International segment also contributed 10% or more

of total revenue being GBP5.1m (2021: GBP9.1m).

Recruitment revenues are generated from permanent and temporary

recruitment and long-term agreements for labour supply. Within

Central Services revenues are generated from the rental of excess

space and hotel and conference facilities at the Derby site,

described as Other below.

Revenue and gross profit by service classification for

management purposes:

Revenue Gross profit

2022 2021 2022 2021

GBP'000 GBP'000 GBP'000 GBP'000

----------------------- --------- --------- --------- ---------

Permanent placements 2,706 2,098 2,706 2,098

Temporary placements 67,222 74,338 8,002 9,032

Others 1,979 1,279 1,067 657

----------------------- --------- --------- --------- ---------

71,907 77,715 11,775 11,787

----------------------- --------- --------- --------- ---------

All operations are continuing. All assets and liabilities are in

the UK.

3. Tax expense

2022 2021

Continuing operations GBP'000 GBP'000

---------------------------------------------------- --------- ---------

Current tax

UK corporation tax - (6)

Deferred tax

Origination and reversal of temporary differences (104) 115

Tax (104) 109

---------------------------------------------------- --------- ---------

Factors affecting the tax expense

The tax credit assessed for the year is lower than (2021: charge

higher than) would be expected by multiplying the loss by the

standard rate of corporation tax in the UK of 19% (2021: 19%). The

differences are explained below:

2022 2021

Factors affecting tax expense GBP'000 GBP'000

--------------------------------------------------- --------- ---------

Result for the year before tax (455) 114

--------------------------------------------------- --------- ---------

(Loss)/profit multiplied by standard rate of tax

of 19% (2021: 19%) (86) 22

Non-deductible expenses 50 68

Tax charge on exercise of options - 28

Effect of change in deferred tax rate 13 (9)

Adjustment in respect of previous periods (81) -

--------------------------------------------------- --------- ---------

(104) 109

--------------------------------------------------- --------- ---------

4. Dividends

No final dividend for the year ended 31 December 2022 has been

proposed (2021: Nil). This represents a payment of Nil (2021: Nil)

per share.

5. Report and accounts

The above financial information does not constitute the

Company's statutory accounts for the years ended 31 December 2022

or 2021 but is derived from those accounts. The auditor has

reported on these accounts; their report was unqualified, did not

draw attention to any matters by way of emphasis without qualifying

their report and did not contain statements under s498 (2) or (3)

Companies Act 2006 or equivalent preceding legislation. The

statutory accounts for 2020 have been filed with the Registrar of

Companies.

Full audited accounts of RTC Group Plc for the year ended 31

December 2022 will be made available on the Company's website at

www.rtcgroupplc.co.uk later today and will be dispatched to

shareholders on 25 April 2023 and then be available from the

Company's registered office - The Derby Conference Centre, London

Road, Derby, DE24 8UX.

The Company's Annual General meeting will be held at 12.30pm on

31 May 2023 at the Derby Conference Centre, London Road, Derby,

DE24 8UX.

This information is provided by RNS, the news service of the

London Stock Exchange. RNS is approved by the Financial Conduct

Authority to act as a Primary Information Provider in the United

Kingdom. Terms and conditions relating to the use and distribution

of this information may apply. For further information, please

contact rns@lseg.com or visit www.rns.com.

RNS may use your IP address to confirm compliance with the terms

and conditions, to analyse how you engage with the information

contained in this communication, and to share such analysis on an

anonymised basis with others as part of our commercial services.

For further information about how RNS and the London Stock Exchange

use the personal data you provide us, please see our Privacy

Policy.

END

FR EAXDLALEDEFA

(END) Dow Jones Newswires

March 27, 2023 02:00 ET (06:00 GMT)

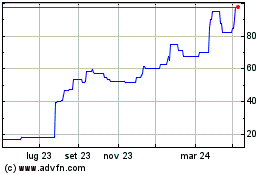

Grafico Azioni Rtc (LSE:RTC)

Storico

Da Nov 2024 a Dic 2024

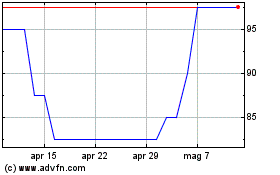

Grafico Azioni Rtc (LSE:RTC)

Storico

Da Dic 2023 a Dic 2024