TIDMTEM

RNS Number : 0826W

Templeton Emerging Markets IT PLC

07 December 2023

Templeton Emerging Markets Investment Trust PLC ("TEMIT" or "the

Company")

Half Yearly Report to 30 September 2023

Legal Entity Identifier 5493002NMTB70RZBXO96

Company Overview

Launched in June 1989, Templeton Emerging Markets Investment

Trust plc ("TEMIT" or the "Company") is an investment trust that

invests principally in emerging markets companies with the aim of

delivering capital growth to shareholders over the long term. While

the majority of the Company's shareholders are based in the UK,

shares are traded on both the London and New Zealand stock

exchanges.

TEMIT has a diversified portfolio of around 80 high quality

companies, actively selected for their long-term growth potential

and sustainable earnings, and with due regard to Environmental,

Social and Governance ("ESG") attributes. TEMIT's research-driven

investment approach and strong long-term performance has helped it

to grow to be the largest emerging markets investment trust in the

UK, with net assets of GBP1.9 billion as at 30 September 2023. From

its launch to 30 September 2023, TEMIT's net asset value ("NAV")

total return was +3,832.7% compared to the benchmark total return

of +1,698.1%.

The Company is governed by a Board of Directors who are

committed to ensuring that shareholders' best interests,

considering the wider community of stakeholders, are at the

forefront of all decisions. Under the guidance of the Chairman, the

Board of Directors is responsible for the overall strategy of the

Company and monitoring its performance.

TEMIT at a glance

For the six months to 30 September 2023

Net asset value total Share price total return(a) MSCI Emerging Markets Interim dividend for

return -1.6% Index total return(a)(b) the financial year 2024

(cum-income)(a) (2022: -8.5%) -0.5% 2.00p

-0.3% (2022: -7.4%) (Interim dividend for the

(2022: -8.3%) financial year 2023: 2.00p)

--------------------------- --------------------------- ------------------------- ---------------------------

(a) A glossary of alternative performance measures is included

in the full Half Yearly Report.

(b) Source: MSCI. The Company's benchmark is the MSCI Emerging

Markets Index, with net dividends reinvested.

Chairman's Statement

Market overview and investment performance

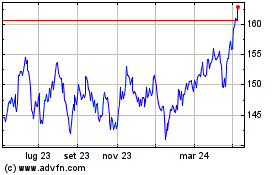

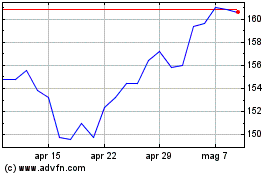

Over the six months to 30 September 2023, TEMIT produced a small

negative total return of -0.3%(a) which was marginally better than

the benchmark index's return of -0.5%(a) . In aggregate, emerging

markets as measured by the index have been less volatile than they

were in our last financial year but have not shown any meaningful

progress, moving ahead for short periods only to fall back again,

particularly towards the end of the six-month period.

(a) A glossary of alternative performance measures is included

in the full Half Yearly Report.

Revenue and dividend

Net revenue earnings for the six months to 30 September 2023

amounted to 3.34 pence per share. It is too early to predict

earnings for the full financial year but, noting that TEMIT usually

earns the majority of its revenue in the first six months of its

financial year, an unchanged interim dividend of 2.00 pence per

share will be paid on 26 January 2024.

Share rating

The Board continues to encourage and support our managers in

their active programme of promoting TEMIT's shares to existing and

potential investors via a variety of traditional and online

channels. We have long held the view that marketing and promotion

is an area to which a company should commit over the long term. The

Board was therefore very pleased to be the inaugural recipient of

the AIC's Consistent Communications Award. The award panel

recognised that TEMIT "has delivered a comprehensive strategy

including advertising, PR and social media to win over current and

potential shareholders."

The discount remained under pressure during the period under

review and we were regularly active in buying back shares. A total

of 23.9 million shares were bought back at an average discount of

13.9%. This increased the NAV per share by 0.3% for continuing

shareholders.

The Board

We recently announced that Angus Macpherson had joined the Board

as a non-executive Director of the Company, with effect from 6

October 2023. Angus is chief executive of Noble and Company (UK)

Limited, an independent boutique Scottish corporate finance

business. He was based in Singapore and Hong Kong between 1995 and

2004, latterly as head of capital markets and financing for Merrill

Lynch in Asia. He is currently Chairman of Pacific Horizon

Investment Trust, Henderson Diversified Income and a director of

Schroder Japan Trust and Hampden & Co. As a consequence of his

appointment he intends to step down from the Chair of Pacific

Horizon as soon as a suitable successor can be appointed.

The Board's intention is that Angus will take on the role of

Chairman of the Company on 1 January 2024. In the meantime, I will

work closely with him to ensure an effective handover of the role.

As this will be my last formal report, I would like to thank

shareholders for their support and particularly those shareholders

who I have spoken to for their invaluable insights. I would also

like to thank the team at Franklin Templeton and all of the

suppliers to TEMIT for their considerable efforts over the last

eight and a half years.

Annual General Meeting

The Board was pleased to welcome shareholders to the AGM in

July. All resolutions at the AGM were duly carried by a large

majority and I would like to thank shareholders for their

continuing support. I recognise that some shareholders are unable

to attend meetings in person and if you have any questions, please

send these by email to temitcosec@franklintempleton.com or via

www.temit.co.uk./investor/contact-us.

Continuation vote and the Conditional Tender Offer

At next year's AGM, TEMIT will hold its five yearly continuation

vote. The 31 March 2024 financial year-end will also be the end of

the five-year measurement period for our Conditional Tender Offer,

under which the Board has undertaken to arrange a tender offer for

up to 25% of the Company's shares if the NAV total return

underperforms that of the benchmark index over the five-year

period. For the four years and six months to the end of September,

the NAV total return was +14.0%, some 4.2 percentage points higher

than that of the comparator benchmark.

Outlook

The geopolitical and macroeconomic outlook remains difficult and

investors are clearly facing a number of headwinds. Managing

investments for the long term relies on an ability to see beyond

the issues posed by wars in Ukraine and Gaza, along with high

inflation, and to focus on the long-term trends. Notwithstanding

the immediate challenges, with their extensive resources on the

ground and around the world, our managers are well equipped to deal

with this environment as they continue to focus on some of the

world's most interesting and dynamic companies.

The prospects for emerging markets remain compelling, with

relatively high levels of economic growth, young populations and

increasing wealth. As I step down from the Board I look to the

future with optimism and I know that I leave the Company in very

capable hands.

Paul Manduca

Chairman

7 December 2023

Interim Management Report

Principal risks

The Company invests predominantly in the stock markets of

emerging markets. The principal categories of risks facing the

Company, determined by the Board and described in detail in the

Strategic Report within the Annual Report and Audited Accounts,

are:

-- Market;

-- Geopolitical;

-- Technology;

-- Portfolio concentration;

-- Sustainability and climate change;

-- Foreign currency;

-- Discount;

-- Operational and custody;

-- Key personnel; and

-- Regulatory.

The Board has provided the Investment Manager with guidelines

and limits for the management of principal risks. The Board and

Investment Manager are aware that the economic challenges continue

to be the key issue affecting investment markets around the world,

as well as the tensions between the United States and China over

trade and the Taiwan Strait. The ongoing Israel-Hamas conflict also

adds to existing geopolitical uncertainties, as do the continuing

ramifications of the Russian invasion of Ukraine. While pandemic

risk is no longer considered a top risk the Board remains mindful

of the possibility of a future pandemic and its potential impacts

on the Company. There have been no further changes to the principal

and emerging risks reported in the Annual Report and, in the

Board's view, these risks are equally applicable to the remaining

six months of the financial year as they were to the six months

under review.

Related party transactions

There were no transactions with related parties during the

period other than the fees paid to the Directors and the AIFM.

Going concern

The Company's assets consist of equity shares in companies

listed on recognised stock exchanges and in most circumstances are

realisable within a short timescale. Having made suitable

enquiries, including consideration of the Company's objective, the

nature of the portfolio, net current assets, expenditure forecasts,

the principal and emerging risks and uncertainties described within

the Annual Report, the Directors are satisfied that, assuming that

there will be a successful continuation vote at the 2024 AGM, the

Company has adequate resources to continue to operate as a going

concern for the period to 31 March 2025, which is at least 12

months from the date of approval of these Financial Statements, and

are satisfied that the going concern basis is appropriate in

preparing the Financial Statements.

Statement of Directors' Responsibilities

The Disclosure Guidance and Transparency Rules of the UK Listing

Authority require the Directors to confirm their responsibilities

in relation to the preparation and publication of the Interim

Management Report and Financial Statements.

Each of the Directors, who are listed in the full Half Yearly

Report, confirms that to the best of their knowledge:

(a) the condensed set of Financial Statements, for the period

ended 30 September 2023, have been prepared in accordance with the

UK adopted International Accounting Standard (IAS) 34 "Interim

Financial Reporting"; and

(b) the Half Yearly Report includes a true and fair view of the

assets, liabilities, financial position and profit or loss of the

Company and a fair review of the information required by:

(i) DTR 4.2.7R of the Disclosure Guidance and Transparency

Rules, being an indication of important events that have occurred

during the first six months of the financial year and their impact

on the condensed set of Financial Statements, and a description of

the principal risks and uncertainties for the remaining six months

of the year; and

(ii) DTR 4.2.8R of the Disclosure Guidance and Transparency

Rules, being related party transactions that have taken place in

the first six months of the current financial year and that have

materially affected the financial position or performance of the

entity during that period, and any changes in the related party

transactions described in the last Annual Report that could do

so.

The Half Yearly Report was approved by the Board on 7 December

2023 and the above Statement of Directors' Responsibilities was

signed on its behalf by

Paul Manduca

Chairman

7 December 2023

Investment Manager's Report

Review of performance

Emerging markets declined over the six months under review. The

period started positively, expectations of a turnaround for the

technology sector and signs of receding inflation in several

countries were optimistic developments, but this was somewhat

affected by China's slow demand recovery and uncertainty over US

interest rates. A risk-off environment sparked by the US Federal

Reserve's forecast of higher-for-longer interest rate policy

through 2024 affected market sentiment towards the end of the

period. The MSCI Emerging Markets Index returned -0.5% in the

6--month period under review, whilst TEMIT delivered a net asset

value total return of -0.3% (all figures are total return measured

in sterling). Full details of TEMIT's performance can be found in

the full Half Yearly Report.

By region, Latin America saw an improvement in its general

macroeconomic environment. Equities in the EMEA region also rose.

Volatility in energy prices drove a mixed result for Middle Eastern

equities, which were also weighed down by a higher-for-longer

interest rate environment in the US. Emerging Asia declined. Stocks

in China were amongst detractors as a slower-than-expected recovery

weighed. The technology-heavy countries of South Korea and Taiwan

grappled with slumping exports due to a slower recovery of the

semiconductor industry than investors had expected. However, an

improving long-term outlook for semiconductor stocks helped to

limit losses for both countries. India logged gains on improving

macroeconomic indicators and robust corporate earnings.

China was TEMIT's largest market exposure, although the

portfolio remained underweight relative to the benchmark. Chinese

equities fell by more than 10% in sterling terms over the six-month

period. Concerns about the country's slow consumption recovery and

geopolitical tensions between China and the West impacted investor

sentiment. Its property sector woes, plagued by liquidity worries

and lack of demand, also continued into the reporting period, with

the weakness spreading to consumption-related stocks over worries

about the impact of weak property prices on consumer sentiment.

These overshadowed early signals of China's recovery from the

release of better-than-expected inflationary, credit and

manufacturing data after some stimulus packages. We do still see

some upside in China; in particular the internet sector, to which

the portfolio has sizeable exposure, has adjusted to the new

operating environment as China eased its regulatory crackdown on

the sector.

TEMIT's second-largest market position was in South Korea, where

the portfolio was overweight versus the benchmark. South Korean

equities declined by more than 1% during the reporting period, as

the technology-heavy market continued to struggle throughout the

year on weakening demand for technology products, including

consumer electronics. However, an improving outlook for

semiconductor stocks, partially from increasing interest and

ensuing optimism around artificial intelligence ("AI") limited

losses. South Korea is less exposed to geopolitical risks as

compared to China, and the country is home to several companies

which are expected to benefit from the secular trends of

digitalisation and decarbonisation, such as technology-related

companies, and firms in the value chain of electric vehicle ("EV")

production.

The Taiwanese market also fell marginally, ending the reporting

period with a loss of more than 1%. The technology-heavy and

export-oriented country experienced a lower demand for its

technology exports, which we view to be a cyclical occurrence, but

a demand uplift from AI benefitted Taiwanese equities. TEMIT's

allocation is slightly lower than the benchmark, with the

portfolio's exposure to the country largely attributable to the

island's semiconductor industry and TEMIT's largest portfolio

holding which is Taiwan Semiconductor Manufacturing Company

("TSMC"). Besides being an essential component of electronic

devices used in various industries spanning health care, military

systems and clean energy, the emergence of AI will drive further

demand for TSMC's advanced chips. We maintain a positive long-term

view on Taiwan's semiconductor industry.

India was TEMIT's fourth largest exposure at the end of

September 2023. Indian equities rose by 17% over the six-month

period, benefitting from a moderating inflationary environment,

improving macroeconomic indicators and strong corporate earnings.

India has two growth drivers: strong domestic consumption and

infrastructure investments. Whilst higher energy prices remain a

risk to India's near-term outlook, the diversification of its power

sources should eventually ease pressure from imported energy and

inflation in the long term. We also believe that there are still

pockets of reasonable and compelling valuations, and there is still

room for Indian equities to post further gains based on improving

earnings.

Equities in Brazil experienced some volatility in the beginning

of the period, but recovered strongly and ended the reporting

period with double-digit gains. Brazilian equities reacted

favourably to improvements in its macroeconomic environment,

inflation reached a new 12-month low whilst a

stronger-than-expected GDP gave rise to an upward forecast of its

full-year GDP. The approval of its new fiscal framework and the

subsequent commencement of its rate-easing cycle overcame some

negativity from concerns on changes to its taxation regulations,

which could potentially impact corporate earnings.

Investment strategy, portfolio changes and performance

attribution

The following sections show how different investment factors

(stocks, sectors, and geographies) accounted for the Company's

performance over the period. We continue to emphasise that our

investment process selects companies based on their individual

attributes and ability to generate risk-adjusted returns for

investors, rather than taking a high-level view of sectors,

countries, or geographic regions to determine our investment

allocations.

Our investment style is centred on finding companies with

long-term earnings power and whose shares trade at a discount

relative to our estimates of their intrinsic worth and to other

investment opportunities in the market. We also pay close attention

to risks.

We continue to utilise our research-based, active approach to

help us to find companies which have high standards of corporate

governance, respect their shareholder base, and understand the

local intricacies that may determine consumer trends and habits.

Utilising our large team of analysts, we aim to maintain close

contact with the board and senior management of existing and

potential investments and believe in engaging constructively with

our investee companies.

All of these factors require us to conduct detailed analyses of

potential returns versus risks with a time horizon of typically

five years or more.

Our well-resourced, locally based teams remain a key competitive

advantage and it has certainly been helpful being on the ground in

the benchmark heavyweights of China and India. This local presence

allows us to understand business models, competitive dynamics, and

supply chain issues. We have also managed to get insights into

regulatory conversations and management capabilities which are

factored into our analysis. We view our locally based teams, which

are armed with vast knowledge of a country's macroeconomic issues

and views on-the-ground, as vital sources of input into the

investment process.

In the portfolio, we remain positioned in long-term themes

including consumption premiumisation, digitalisation, health care

and technology. We focus on companies reflecting our philosophy of

owning good quality businesses, with long-term repeatable earnings

power and share prices at a discount to intrinsic worth. We see

high levels of leverage as a risk and continue to avoid companies

with weak balance sheets. We continue to embed governance and

sustainability factors into our fundamental bottom-up research and

remain active owners across our holdings. This involves integrating

Environmental, Social and Governance ("ESG") factors into our stock

thesis, engaging with investee companies on material ESG issues and

actively voting on behalf of our investors.

Performance attribution analysis %

Six months to 30 September 2023 2022 2021 2020 2019

---------------------------------- ----- ------ ------ ---- -----

Net asset value total return(a) (0.3) (8.3) (7.5) 31.3 6.3

---------------------------------- ----- ------ ------ ---- -----

Expenses incurred(b) 0.5 0.5 0.5 0.5 0.5

---------------------------------- ----- ------ ------ ---- -----

Gross total return(a) 0.2 (7.8) (7.0) 31.8 6.8

---------------------------------- ----- ------ ------ ---- -----

Benchmark total return(a) (0.5) (7.4) (1.0) 24.4 2.2

---------------------------------- ----- ------ ------ ---- -----

Excess return(a) 0.7 (0.4) (6.0) 7.4 4.6

---------------------------------- ----- ------ ------ ---- -----

Stock selection 0.1 2.9 (4.3) 2.5 2.6

---------------------------------- ----- ------ ------ ---- -----

Sector allocation 0.4 (2.2) (1.4) 4.0 1.6

---------------------------------- ----- ------ ------ ---- -----

Currency (0.1) (1.1) (0.5) 0.5 0.4

---------------------------------- ----- ------ ------ ---- -----

Share buyback impact 0.3 0.1 0.0 0.3 0.2

---------------------------------- ----- ------ ------ ---- -----

Residual return(a) 0.0 (0.1) 0.2 0.1 (0.2)

---------------------------------- ----- ------ ------ ---- -----

Total contribution 0.7 (0.4 ) (6.0 ) 7.4 4.6

---------------------------------- ----- ------ ------ ---- -----

Source: FactSet and Franklin Templeton.

(a) A glossary of alternative performance measures is included

in the full Half Yearly Report.

(b) Represents expenses incurred for the six months to 30

September 2023. Details of the annualised ongoing charges ratio are

included in the glossary of alternative performance measures in the

full Half Yearly Report.

Top 10 contributors to relative performance by security

(%)(a)

Contribution to

portfolio relative

Share price to MSCI Emerging

Top contributors Country Sector total return Markets Index

---------------------------- ---------------- ----------------------- ------------- -------------------

Petroleo Brasileiro Brazil Energy 86.2 1.1

----------------------------- ----------------- ---------------------- ------------- -------------------

POSCO(b) South Korea Materials 66.5 0.6

----------------------------- ----------------- ---------------------- ------------- -------------------

Brilliance China

Automotive(c) China/Hong Kong Consumer Discretionary 50.3 0.5

----------------------------- ----------------- ---------------------- ------------- -------------------

Zomato India Consumer Discretionary 99.1 0.5

----------------------------- ----------------- ---------------------- ------------- -------------------

ICICI Bank India Financials 9.5 0.5

----------------------------- ----------------- ---------------------- ------------- -------------------

Yandex(b)(c) Russia Communication Services - 0.4

----------------------------- ----------------- ---------------------- ------------- -------------------

Itaú Unibanco Brazil Financials 13.5 0.2

----------------------------- ----------------- ---------------------- ------------- -------------------

One 97 Communications(c) India Financials 34.8 0.2

----------------------------- ----------------- ---------------------- ------------- -------------------

Samsung Life Insurance South Korea Financials 9.4 0.2

----------------------------- ----------------- ---------------------- ------------- -------------------

Cognizant Technology

Solutions(c)(d) United States Information Technology 13.4 0.2

----------------------------- ----------------- ---------------------- ------------- -------------------

(a) For the period 31 March 2023 to 30 September 2023.

(b) Security not held by TEMIT as at 30 September 2023.

(c) Security not included in the MSCI Emerging Markets Index as

at 30 September 2023.

(d) This security, listed on a stock exchange in a developed

market, has significant exposure to operations from emerging

markets.

Finishing higher over the six-month period were shares of

Petroleo Brasileiro ("Petrobras"), a Brazilian energy company

engaged in the exploration, production, and distribution of oil and

gas which was a strong contributor. Its share price remained

resilient throughout the period. The company announced a new

shareholder return policy and raised gasoline and diesel prices,

which alleviated some concerns regarding capital allocation and

pricing policy. An increase in oil prices towards the end of the

quarter also supported its share price.

POSCO, a South Korea-based steel product manufacturer with a

diversified line of steel products (including cold and hot rolled

products) was also a strong contributor. Its shares rallied in the

later part of the period on optimism around its battery materials

business, where the company has materially raised its longer-term

targets. Whilst POSCO is one of the most efficient and cost

competitive steel makers globally, we observed that POSCO's strong

stock performance rose to a level above our assessment of its

intrinsic value and therefore sold our remaining holding in the

period.

Brilliance China Automotive is a Chinese automotive manufacturer

noted for its association with German luxury car maker BMW. The

company announced a special dividend in the second quarter of 2023,

which was a key driver of returns.

Top 10 detractors to relative performance by security (%)(a)

Contribution

to portfolio

relative

to MSCI

Share price Emerging

Top detractors Country Sector total return Markets Index

--------------------------------- ---------------- ----------------------- ------------- --------------

Guangzhou Tinci Materials

Technology China/Hong Kong Materials (37.9) (0.8)

---------------------------------- ----------------- ---------------------- ------------- --------------

Prosus(b) China/Hong Kong Consumer Discretionary (16.6) (0.5)

---------------------------------- ----------------- ---------------------- ------------- --------------

Alibaba China/Hong Kong Consumer Discretionary (13.6) (0.4)

---------------------------------- ----------------- ---------------------- ------------- --------------

Samsung SDI South Korea Information Technology (32.0) (0.4)

---------------------------------- ----------------- ---------------------- ------------- --------------

Daqo New Energy China/Hong Kong Information Technology (34.7) (0.3)

---------------------------------- ----------------- ---------------------- ------------- --------------

China Resources Cement China/Hong Kong Materials (45.9) (0.3)

---------------------------------- ----------------- ---------------------- ------------- --------------

Genpact(b)(c) United States Industrials (20.2) (0.3)

---------------------------------- ----------------- ---------------------- ------------- --------------

Uni-President China China/Hong Kong Consumer Staples (25.7) (0.3)

---------------------------------- ----------------- ---------------------- ------------- --------------

TSMC Taiwan Information Technology (5.1) (0.2)

---------------------------------- ----------------- ---------------------- ------------- --------------

Quanta Computer(d) Taiwan Information Technology 175.7 (0.2)

---------------------------------- ----------------- ---------------------- ------------- --------------

(a) For the period 31 March 2023 to 30 September 2023.

(b) Security not included in the MSCI Emerging Markets Index as

at 30 September 2023.

(c) This security, listed on a stock exchange in a developed

market, has significant exposure to operations from emerging

markets.

(d) Security not held by TEMIT as at 30 September 2023.

Guangzhou Tinci Materials Technology is a China-based producer

of electrolytes for EV batteries. Slower growth in EV demand as

well as higher competition driven by an increase in industry

capacity for electrolytes and declining lithium prices have

impacted the company's near-term performance. We remain positive

about the company's prospects as the robust demand for batteries

needed for EVs and energy storage-two of the fastest growing parts

of the global economy-should allow it to deliver strong earnings

over the medium term. The company is vertically integrated, and we

believe it is cost competitive.

An off-benchmark holding in Prosus, a leading global investment

company and the largest shareholder of Tencent, a Chinese

technology company, was a key detractor. Its share price tracked

Tencent's, which declined in the period alongside broader Chinese

equities despite reporting resilient results. Concerns over China's

weak economic recovery also weighed on Tencent. However, an

announcement that Prosus will remove the cross-holding structure

with technology company Naspers (not a portfolio holding) managed

to limit losses.

Another portfolio holding that detracted was Alibaba, a Chinese

e-commerce company providing brands and merchants the

infrastructure to acquire and sell to customers online. Its share

price had been volatile over the period, erasing gains from March

from its organisational revamp. Its share price ended lower on

concerns of slower demand recovery, China's weak economic recovery

and uncertainty around the potential impact of a complete spin-off

of its cloud business. However, there were several uplifts to the

stock price within the period from better-than-expected quarterly

results and policy support from the Chinese government. We remain

positive on the strength of its e-commerce ecosystem and its

ability to generate strong cash flows. The business has adjusted to

the new environment in China, and we expect the e-commerce

businesses of Alibaba to deliver steady growth.

Top contributors and detractors to relative performance by

sector (%)(a)

Contribution Contribution

MSCI to portfolio MSCI to portfolio

Emerging relative Emerging relative

Markets Index to MSCI Markets Index to MSCI

sector total Emerging sector total Emerging

Top contributors return Markets Index Top detractors return Markets Index

--------------------- -------------- -------------- -------------------- -------------- --------------

Information

Communication Services (11.0) 0.8 Technology (0.5) (0.8)

---------------------- -------------- -------------- -------------------- -------------- --------------

Financials 5.6 0.5 Consumer Staples (3.1) (0.2)

---------------------- -------------- -------------- -------------------- -------------- --------------

Energy 21.3 0.5 Industrials (0.1) (0.2)

---------------------- -------------- -------------- -------------------- -------------- --------------

Consumer

Health Care (2.0) 0.3 Discretionary (4.4) (0.2)

---------------------- -------------- -------------- -------------------- -------------- --------------

Materials (6.4) (0.2)

--------------------- -------------- -------------- -------------------- -------------- --------------

(a) For the period 31 March 2023 to 30 September 2023.

Favourable stock selection in the communication services,

financials and energy sectors added to TEMIT's performance relative

to the benchmark index in the period under review. Within the

communication services sector, an underweight allocation to

Tencent, and an overweight allocation to NetEase, one of the

largest online games companies in China, helped to support returns.

The strong performance in the financials sector was led by an

overweight holding in India-based ICICI Bank, and Brazil-based Itaú

Unibanco (a Brazilian retail-focused bank providing a broad range

of services such as cards, loans and insurance). Our off-benchmark

holding in One 97 Communications, a payment solutions and financial

services provider in India, also supported results within the

financials sector. Petrobras was a key contributor in the energy

sector.

In contrast, stock selection in the information technology,

consumer staples and industrials sectors detracted relatively.

Within the information technology sector, the portfolio's positions

in Samsung SDI (a South Korea-based leading manufacturer of

lithium-ion batteries), Daqo New Energy (a China-based polysilicon

manufacturer) and TSMC weighed on performance. The detraction in

the consumer staples sector was led by China-based instant noodle

and beverage manufacturer Uni-President China. In the industrials

sector, Genpact, a US-listed technology services company with

significant exposure to India, pressured returns.

Top contributors and detractors to relative performance by

country (%)(a)

Contribution Contribution

MSCI to portfolio MSCI to portfolio

Emerging relative Emerging relative

Markets Index to MSCI Markets Index to MSCI

country total Emerging country total Emerging

Top contributors return Markets Index Top detractors return Markets Index

----------------- -------------- -------------- --------------- -------------- --------------

Brazil 18.1 1.1 China/Hong Kong (10.2) (0.6)

------------------ -------------- -------------- --------------- -------------- --------------

South Korea (1.1) 0.7 India 17.1 (0.5)

------------------ -------------- -------------- --------------- -------------- --------------

Russia(b)(c) - 0.4 Taiwan (1.1) (0.4)

------------------ -------------- -------------- --------------- -------------- --------------

South Africa (6.8) 0.1 Turkey(d) 20.3 (0.1)

------------------ -------------- -------------- --------------- -------------- --------------

Chile (4.7) 0.1 Saudi Arabia(d) 3.0 (0.1)

------------------ -------------- -------------- --------------- -------------- --------------

(a) For the period 31 March 2023 to 30 September 2023.

(b) All companies held by TEMIT in this country are fair valued

at zero as at 30 September 2023.

(c) No companies included in the MSCI Emerging Markets Index in

this country as at 30 September 2023.

(d) No companies held by TEMIT in this country as at 30

September 2023.

By markets, Brazil, South Korea, and South Africa were amongst

contributors. Besides Petrobras, several holdings in Brazil such as

Itaú Unibanco and Banco Bradesco helped relative returns. Brazilian

equities benefitted from a broad recovery, partially from positive

sentiment from its new fiscal framework. South Korea's contribution

was led by POSCO, whilst South Africa's performance was due to an

underweight allocation.

Russia also contributed to relative returns. All Russian

securities have been valued at zero since 4 March 2022. However,

during the first six months of the financial year, an opportunity

arose to dispose of TEMIT's holding in Yandex (Russia's largest

search engine, which also offers a wide range of other online

services in areas such as e-commerce) via an over-the-counter

trade, which led to Russia being a top contributor to relative

performance. The two remaining Russian securities, LUKOIL and

Sberbank of Russia, continue to be fair valued at zero at the

period end.

Due to stock selection, China was the top detractor at a country

level. Several holdings in China such as Guangzhou Tinci Materials

Technology and Daqo New Energy pressured relative returns. India

was the second-largest detractor, as both stock selection and an

underweight allocation to the country dragged returns. Taiwan also

detracted, largely due to stock selection-TSMC led detractions in

Taiwan.

Largest holdings

The largest portfolio holding is TSMC. The share price suffered

in the last few quarters due to demand weakness of some of its end

customers. Better-than-expected sales from AI-induced demand

propped the share price up at the beginning of the third quarter of

2023, but momentum declined after the release of second-quarter

results. A downward revision to its revenue forecast for 2023 and a

cautious near-term outlook weighed on the stock. News that TSMC

asked its major suppliers to delay high-end chipmaking equipment

deliveries also pressured the share price. Driven by structural

growth in demand for computing and its technology leadership, we

remain confident in the resilience of the TSMC business model.

The second largest portfolio holding is ICICI Bank, which rose

on the back of positive results for several quarters. The bank

delivered strong profit growth driven by loan growth, expansion in

net interest income and continued low credit costs. An uptick in

the broader Indian equity market also helped. The bank remains well

positioned with its healthy capital adequacy ratios and strong

franchise.

Global semiconductor manufacturer Samsung Electronics was the

third-largest holding in the portfolio. Samsung Electronics also

manufactures a wide range of consumer and industrial electronics

and equipment. Its share price has seen some recovery after

declining in 2022 on optimism around bottoming of the memory cycle

supported by supply cuts. An improvement in the outlook for

semiconductor stocks due to robust AI-driven demand for advanced

chips also fuelled the upward momentum of the stock.

Portfolio changes by sector

Total return in sterling

30 September MSCI

31 March 2023 Market 2023 market Emerging

market value Purchases Sales movement value TEMIT Markets Index

Sector GBPm GBPm GBPm GBPm GBPm % %

----------------- ------------- --------- ----- --------- ------------ -------- ----------------

Information

Technology(a) 517 70 (65) (28) 494 (3.7) (0.5)

------------------ ------------- --------- ----- --------- ------------ -------- ----------------

Financials(a) 484 92 (116) 25 485 7.3 5.6

------------------ ------------- --------- ----- --------- ------------ -------- ----------------

Consumer

Discretionary(a) 272 17 (23) (24) 242 (5.5) (4.4)

------------------ ------------- --------- ----- --------- ------------ -------- ----------------

Communication

Services 198 7 (12) (10) 183 (4.5) (11.0)

------------------ ------------- --------- ----- --------- ------------ -------- ----------------

Industrials(a) 153 42 (24) (5) 166 (2.4) (0.1)

------------------ ------------- --------- ----- --------- ------------ -------- ----------------

Materials 169 20 (58) (13) 118 (10.0) (6.4)

------------------ ------------- --------- ----- --------- ------------ -------- ----------------

Health Care 60 18 - 2 80 5.4 (2.0)

------------------ ------------- --------- ----- --------- ------------ -------- ----------------

Energy 49 - - 20 69 67.4 21.3

------------------ ------------- --------- ----- --------- ------------ -------- ----------------

Consumer Staples 73 2 (7) (12) 56 (12.2) (3.1)

------------------ ------------- --------- ----- --------- ------------ -------- ----------------

Utilities 9 - (1) 2 10 13.8 3.0

------------------ ------------- --------- ----- --------- ------------ -------- ----------------

Real Estate 9 - - (2) 7 (15.8) (4.1)

------------------ ------------- --------- ----- --------- ------------ -------- ----------------

Total investments 1,993 268 (306) (45 ) 1,910

------------------ ------------- --------- ----- --------- ------------ -------- ----------------

(a) One 97 Communications and Genpact were previously included

within Information Technology but have been reallocated to

Financials and Industrials, respectively. Astra International was

previously included within Consumer Discretionary and has been

reallocated to Industrials. The reallocations have been performed

as a result of a change in the Global Industry Classification

Standard ("GICS") structure.

Portfolio changes by country

Total return in sterling

30 September MSCI

31 March 2023 Market 2023 market Emerging

market value Purchases Sales movement value TEMIT Markets Index

Country GBPm GBPm GBPm GBPm GBPm % %

------------------ ------------- --------- ------ --------- ------------ -------- ----------------

China/Hong Kong 616 89 (68) (93) 544 (12.7) (10.2)

------------------- ------------- --------- ------ --------- ------------ -------- ----------------

South Korea 398 46 (71) 10 383 2.4 (1.1)

------------------- ------------- --------- ------ --------- ------------ -------- ----------------

Taiwan 316 17 (37) (20) 276 (3.7) (1.1)

------------------- ------------- --------- ------ --------- ------------ -------- ----------------

India 226 45 (50) 33 254 15.6 17.1

------------------- ------------- --------- ------ --------- ------------ -------- ----------------

Brazil 155 6 (17) 26 170 27.1 18.1

------------------- ------------- --------- ------ --------- ------------ -------- ----------------

Other 282 65 (63) (1) 283 - -

------------------- ------------- --------- ------ --------- ------------ -------- ----------------

Total investments 1,993 268 (306 ) (45 ) 1,910

------------------- ------------- --------- ------ --------- ------------ -------- ----------------

Portfolio investments by fair value

As at 30 September 2023

Fair value % of net

Holding Country Sector Trading(a) GBP'000 assets

---------------------- --------------------- ---------------------- ----------- ---------- --------

TSMC Taiwan Information Technology PS 197,753 10.2

----------------------- ---------------------- ----------------------- --------- ---------- --------

ICICI Bank India Financials PS 107,486 5.6

----------------------- ---------------------- ----------------------- --------- ---------- --------

Samsung Electronics South Korea Information Technology PS 107,078 5.5

----------------------- ---------------------- ----------------------- --------- ---------- --------

Alibaba(b) China/Hong Kong Consumer Discretionary NT 98,656 5.1

----------------------- ---------------------- ----------------------- --------- ---------- --------

NAVER South Korea Communication Services IH 62,957 3.3

----------------------- ---------------------- ----------------------- --------- ---------- --------

Petrobras(c) Brazil Energy NT 62,039 3.2

----------------------- ---------------------- ----------------------- --------- ---------- --------

Tencent China/Hong Kong Communication Services NT 59,544 3.1

----------------------- ---------------------- ----------------------- --------- ---------- --------

Prosus(d) China/Hong Kong Consumer Discretionary IH 52,341 2.7

----------------------- ---------------------- ----------------------- --------- ---------- --------

LG South Korea Industrials PS 50,828 2.6

----------------------- ---------------------- ----------------------- --------- ---------- --------

Samsung Life Insurance South Korea Financials IH 50,688 2.6

----------------------- ---------------------- ----------------------- --------- ---------- --------

TOP 10 LARGEST INVESTMENTS 849,370 43.9

-------------------------------------------------------------------------------------- ---------- --------

MediaTek Taiwan Information Technology PS 45,006 2.3

----------------------- ---------------------- ----------------------- --------- ---------- --------

Itaú

Unibanco(c)(e) Brazil Financials PS 37,731 1.9

----------------------- ---------------------- ----------------------- --------- ---------- --------

HDFC Bank India Financials IH 36,554 1.9

----------------------- ---------------------- ----------------------- --------- ---------- --------

Techtronic Industries China/Hong Kong Industrials IH 34,581 1.8

----------------------- ---------------------- ----------------------- --------- ---------- --------

Grupo Financiero

Banorte Mexico Financials NH 34,537 1.8

----------------------- ---------------------- ----------------------- --------- ---------- --------

Banco Bradesco(c)(e) Brazil Financials PS 34,445 1.8

----------------------- ---------------------- ----------------------- --------- ---------- --------

China Merchants Bank China/Hong Kong Financials PS 33,752 1.7

----------------------- ---------------------- ----------------------- --------- ---------- --------

Genpact(f) United States Industrials IH 33,597 1.7

----------------------- ---------------------- ----------------------- --------- ---------- --------

Baidu China/Hong Kong Communication Services IH 32,941 1.7

----------------------- ---------------------- ----------------------- --------- ---------- --------

WuXi Biologics China/Hong Kong Health Care IH 32,110 1.7

----------------------- ---------------------- ----------------------- --------- ---------- --------

TOP 20 LARGEST INVESTMENTS 1,204,624 62.2

-------------------------------------------------------------------------------------- ---------- --------

Samsung SDI South Korea Information Technology IH 31,470 1.6

----------------------- ---------------------- ----------------------- --------- ---------- --------

Cognizant Technology

Solutions(f) United States Information Technology PS 30,367 1.6

----------------------- ---------------------- ----------------------- --------- ---------- --------

Vale Brazil Materials NT 29,662 1.5

----------------------- ---------------------- ----------------------- --------- ---------- --------

Infosys Technologies India Information Technology IH 25,853 1.3

----------------------- ---------------------- ----------------------- --------- ---------- --------

Guangzhou Tinci

Materials Technology China/Hong Kong Materials PS 25,730 1.3

----------------------- ---------------------- ----------------------- --------- ---------- --------

Kasikornbank Thailand Financials IH 24,573 1.3

----------------------- ---------------------- ----------------------- --------- ---------- --------

Unilever(f) United Kingdom Consumer Staples PS 23,828 1.2

----------------------- ---------------------- ----------------------- --------- ---------- --------

Gedeon Richter Hungary Health Care IH 22,864 1.2

----------------------- ---------------------- ----------------------- --------- ---------- --------

Soulbrain South Korea Materials PS 22,832 1.2

----------------------- ---------------------- ----------------------- --------- ---------- --------

Brilliance China

Automotive China/Hong Kong Consumer Discretionary PS 22,370 1.2

----------------------- ---------------------- ----------------------- --------- ---------- --------

TOP 30 LARGEST INVESTMENTS 1,464,173 75.6

-------------------------------------------------------------------------------------- ---------- --------

Ping An Insurance China/Hong Kong Financials NT 22,207 1.1

----------------------- ---------------------- ----------------------- --------- ---------- --------

NetEase China/Hong Kong Communication Services PS 19,738 1.0

----------------------- ---------------------- ----------------------- --------- ---------- --------

Hon Hai Precision

Industry Taiwan Information Technology IH 19,517 1.0

----------------------- ---------------------- ----------------------- --------- ---------- --------

Doosan Bobcat South Korea Industrials PS 17,874 0.9

----------------------- ---------------------- ----------------------- --------- ---------- --------

Banco Santander

Chile(e) Chile Financials NT 17,319 0.9

----------------------- ---------------------- ----------------------- --------- ---------- --------

One 97 Communications India Financials NT 16,859 0.9

----------------------- ---------------------- ----------------------- --------- ---------- --------

Meituan China/Hong Kong Consumer Discretionary NT 15,362 0.8

----------------------- ---------------------- ----------------------- --------- ---------- --------

Bajaj Holdings &

Investments India Financials PS 15,192 0.8

----------------------- ---------------------- ----------------------- --------- ---------- --------

Federal Bank India Financials NH 15,010 0.8

----------------------- ---------------------- ----------------------- --------- ---------- --------

Uni-President China China/Hong Kong Consumer Staples NT 14,877 0.8

----------------------- ---------------------- ----------------------- --------- ---------- --------

TOP 40 LARGEST INVESTMENTS 1,638,128 84.6

-------------------------------------------------------------------------------------- ---------- --------

Astra International Indonesia Industrials PS 14,513 0.7

----------------------- ---------------------- ----------------------- --------- ---------- --------

Netcare South Africa Health Care IH 13,906 0.7

----------------------- ---------------------- ----------------------- --------- ---------- --------

Yageo Taiwan Information Technology IH 13,380 0.7

----------------------- ---------------------- ----------------------- --------- ---------- --------

Daqo New Energy(e) China/Hong Kong Information Technology NT 13,332 0.7

----------------------- ---------------------- ----------------------- --------- ---------- --------

Zomato India Consumer Discretionary PS 13,226 0.7

----------------------- ---------------------- ----------------------- --------- ---------- --------

ACC India Materials NH 12,635 0.7

----------------------- ---------------------- ----------------------- --------- ---------- --------

Fila South Korea Consumer Discretionary PS 12,497 0.7

----------------------- ---------------------- ----------------------- --------- ---------- --------

LegoChem Biosciences South Korea Health Care IH 11,350 0.6

----------------------- ---------------------- ----------------------- --------- ---------- --------

Emirates Central

Cooling Systems United Arab Emirates Utilities NT 10,116 0.5

----------------------- ---------------------- ----------------------- --------- ---------- --------

Intercorp Financial

Services Peru Financials NT 9,515 0.5

----------------------- ---------------------- ----------------------- --------- ---------- --------

TOP 50 LARGEST INVESTMENTS 1,762,598 91.1

-------------------------------------------------------------------------------------- ---------- --------

Thai Beverage Thailand Consumer Staples IH 9,015 0.5

----------------------- ---------------------- ----------------------- --------- ---------- --------

Ping An Bank China/Hong Kong Financials NT 9,004 0.5

----------------------- ---------------------- ----------------------- --------- ---------- --------

Wizz Air Holdings Hungary Industrials NH 8,984 0.5

----------------------- ---------------------- ----------------------- --------- ---------- --------

BDO Unibank Philippines Financials NT 8,534 0.4

----------------------- ---------------------- ----------------------- --------- ---------- --------

Haier Smart Home China/Hong Kong Consumer Discretionary NH 7,919 0.4

----------------------- ---------------------- ----------------------- --------- ---------- --------

H&H Group China/Hong Kong Consumer Staples IH 7,905 0.4

----------------------- ---------------------- ----------------------- --------- ---------- --------

Beijing Oriental Yuhong

Waterproof Technology China/Hong Kong Materials NT 7,780 0.4

----------------------- ---------------------- ----------------------- --------- ---------- --------

Kiatnakin Phatra Bank Thailand Financials NT 6,833 0.4

----------------------- ---------------------- ----------------------- --------- ---------- --------

Star Petroleum Refining Thailand Energy NT 6,593 0.3

----------------------- ---------------------- ----------------------- --------- ---------- --------

Hindalco Industries India Materials NH 6,496 0.3

----------------------- ---------------------- ----------------------- --------- ---------- --------

TOP 60 LARGEST INVESTMENTS 1,841,661 95.2

-------------------------------------------------------------------------------------- ---------- --------

Tencent Music

Entertainment(e) China/Hong Kong Communication Services NT 6,324 0.3

----------------------- ---------------------- ----------------------- --------- ---------- --------

China Resources Cement China/Hong Kong Materials NT 6,276 0.3

----------------------- ---------------------- ----------------------- --------- ---------- --------

LG Chem South Korea Materials NT 6,139 0.3

----------------------- ---------------------- ----------------------- --------- ---------- --------

TOTVS Brazil Information Technology IH 6,073 0.3

----------------------- ---------------------- ----------------------- --------- ---------- --------

COSCO SHIPPING Ports China/Hong Kong Industrials PS 5,521 0.3

----------------------- ---------------------- ----------------------- --------- ---------- --------

PB Fintech India Financials PS 4,745 0.2

----------------------- ---------------------- ----------------------- --------- ---------- --------

China Resources Land China/Hong Kong Real Estate NT 4,439 0.2

----------------------- ---------------------- ----------------------- --------- ---------- --------

NagaCorp Cambodia Consumer Discretionary IH 4,309 0.2

----------------------- ---------------------- ----------------------- --------- ---------- --------

L&F South Korea Information Technology NH 3,739 0.2

----------------------- ---------------------- ----------------------- --------- ---------- --------

Hankook Tire South Korea Consumer Discretionary NT 3,659 0.2

----------------------- ---------------------- ----------------------- --------- ---------- --------

TOP 70 LARGEST INVESTMENTS 1,892,885 97.7

-------------------------------------------------------------------------------------- ---------- --------

Nemak Mexico Consumer Discretionary NT 3,545 0.2

----------------------- ---------------------- ----------------------- --------- ---------- --------

Chervon Holdings China/Hong Kong Consumer Discretionary IH 3,139 0.2

----------------------- ---------------------- ----------------------- --------- ---------- --------

Greentown Service Group China/Hong Kong Real Estate NT 2,928 0.2

----------------------- ---------------------- ----------------------- --------- ---------- --------

BAIC Motor China/Hong Kong Consumer Discretionary NT 2,371 0.1

----------------------- ---------------------- ----------------------- --------- ---------- --------

Weifu High-Technology China/Hong Kong Consumer Discretionary NT 1,634 0.1

----------------------- ---------------------- ----------------------- --------- ---------- --------

KT Skylife South Korea Communication Services NT 1,584 0.1

----------------------- ---------------------- ----------------------- --------- ---------- --------

JD.com China/Hong Kong Consumer Discretionary NT 1,384 0.1

----------------------- ---------------------- ----------------------- --------- ---------- --------

East African Breweries Kenya Consumer Staples NT 552 0.0

----------------------- ---------------------- ----------------------- --------- ---------- --------

LUKOIL(g) Russia Energy NT 0.0 0.0

----------------------- ---------------------- ----------------------- --------- ---------- --------

Sberbank of Russia(g) Russia Financials NT 0.0 0.0

----------------------- ---------------------- ----------------------- --------- ---------- --------

TOP 80 LARGEST INVESTMENTS 1,910,022 98.7

-------------------------------------------------------------------------------------- ---------- --------

TOTAL INVESTMENTS 1,910,022 98.7

-------------------------------------------------------------------------------------- ---------- --------

NET ASSETS 25,544 1.3

-------------------------------------------------------------------------------------- ---------- --------

TOTAL NET ASSETS 1,935,566 100.0

-------------------------------------------------------------------------------------- ---------- --------

(a) Trading activity during the year: (NH) New Holding, (IH)

Increased Holding, (PS) Partial Sale and (NT) No Trading.

(b) TEMIT holds in this company shares listed on the Hong Kong

stock exchange and American Depository Receipts listed on the New

York stock exchange.

(c) Preferred shareholders are entitled to dividends before

ordinary shareholders.

(d) This company is listed in the Netherlands. The

classification of China/Hong Kong is due to most of its revenue

coming from its holding in Tencent.

(e) US listed American Depository Receipt.

(f) This company, listed on a stock exchange in a developed

market, has significant exposure to operations from emerging

markets.

(g) This company is fair valued at zero as a result of its

trading being suspended on international stock exchanges.

Portfolio summary

As at 30 September 2023

All figures are a % of the net assets

30

September 31

March

Communication Consumer Consumer Health Information Real Total Net 2023 2023

Services Discretionary Staples Energy Financials Care Industrials Technology Materials Estate Utilities Equities assets(a) Total Total

------------ ------------- ------------- -------- ------ ---------- ------ ----------- ----------- --------- ------ --------- -------- --------- --------- -----

Brazil - - - 3.2 3.7 - - 0.3 1.5 - - 8.7 - 8.7 7.6

------------- ------------- ------------- -------- ------ ---------- ------ ----------- ----------- --------- ------ --------- -------- --------- --------- -----

Cambodia - 0.2 - - - - - - - - - 0.2 - 0.2 0.3

------------- ------------- ------------- -------- ------ ---------- ------ ----------- ----------- --------- ------ --------- -------- --------- --------- -----

Chile - - - - 0.9 - - - - - - 0.9 - 0.9 0.8

------------- ------------- ------------- -------- ------ ---------- ------ ----------- ----------- --------- ------ --------- -------- --------- --------- -----

China/Hong

Kong 6.1 10.7 1.2 - 3.3 1.7 2.1 0.7 2.0 0.4 - 28.2 - 28.2 30.3

------------- ------------- ------------- -------- ------ ---------- ------ ----------- ----------- --------- ------ --------- -------- --------- --------- -----

Hungary - - - - - 1.2 0.5 - - - - 1.7 - 1.7 1.0

------------- ------------- ------------- -------- ------ ---------- ------ ----------- ----------- --------- ------ --------- -------- --------- --------- -----

India - 0.7 - - 10.2 - - 1.3 1.0 - - 13.2 - 13.2 11.2

------------- ------------- ------------- -------- ------ ---------- ------ ----------- ----------- --------- ------ --------- -------- --------- --------- -----

Indonesia - - - - - - 0.7 - - - - 0.7 - 0.7 0.9

------------- ------------- ------------- -------- ------ ---------- ------ ----------- ----------- --------- ------ --------- -------- --------- --------- -----

Kenya - - 0.0 - - - - - - - - 0.0 - 0.0 0.1

------------- ------------- ------------- -------- ------ ---------- ------ ----------- ----------- --------- ------ --------- -------- --------- --------- -----

Mexico - 0.2 - - 1.8 - - - - - - 2.0 - 2.0 1.5

------------- ------------- ------------- -------- ------ ---------- ------ ----------- ----------- --------- ------ --------- -------- --------- --------- -----

Pakistan - - - - - - - - - - - - - - 0.1

------------- ------------- ------------- -------- ------ ---------- ------ ----------- ----------- --------- ------ --------- -------- --------- --------- -----

Peru - - - - 0.5 - - - - - - 0.5 - 0.5 0.5

------------- ------------- ------------- -------- ------ ---------- ------ ----------- ----------- --------- ------ --------- -------- --------- --------- -----

Philippines - - - - 0.4 - - - - - - 0.4 - 0.4 0.4

------------- ------------- ------------- -------- ------ ---------- ------ ----------- ----------- --------- ------ --------- -------- --------- --------- -----

Russia(b) - - - 0.0 0.0 - - - - - - 0.0 - 0.0 0.0

------------- ------------- ------------- -------- ------ ---------- ------ ----------- ----------- --------- ------ --------- -------- --------- --------- -----

South Africa - - - - - 0.7 - - - - - 0.7 - 0.7 0.6

------------- ------------- ------------- -------- ------ ---------- ------ ----------- ----------- --------- ------ --------- -------- --------- --------- -----

South Korea 3.4 0.9 - - 2.6 0.6 3.5 7.3 1.5 - - 19.8 - 19.8 19.8

------------- ------------- ------------- -------- ------ ---------- ------ ----------- ----------- --------- ------ --------- -------- --------- --------- -----

Taiwan - - - - - - - 14.2 - - - 14.2 - 14.2 15.8

------------- ------------- ------------- -------- ------ ---------- ------ ----------- ----------- --------- ------ --------- -------- --------- --------- -----

Thailand - - 0.5 0.3 1.7 - - - - - - 2.5 - 2.5 2.4

------------- ------------- ------------- -------- ------ ---------- ------ ----------- ----------- --------- ------ --------- -------- --------- --------- -----

United Arab

Emirates - - - - - - - - - - 0.5 0.5 - 0.5 0.5

------------- ------------- ------------- -------- ------ ---------- ------ ----------- ----------- --------- ------ --------- -------- --------- --------- -----

United

Kingdom - - 1.2 - - - - - - - - 1.2 - 1.2 1.6

------------- ------------- ------------- -------- ------ ---------- ------ ----------- ----------- --------- ------ --------- -------- --------- --------- -----

United States - - - - - - 1.7 1.6 - - - 3.3 - 3.3 3.4

------------- ------------- ------------- -------- ------ ---------- ------ ----------- ----------- --------- ------ --------- -------- --------- --------- -----

Net assets(a) - - - - - - - - - - - - 1.3 1.3 1.2

------------- ------------- ------------- -------- ------ ---------- ------ ----------- ----------- --------- ------ --------- -------- --------- --------- -----

30 September

2023 Total 9.5 12.7 2.9 3.5 25.1 4.2 8.5 25.4 6.0 0.4 0.5 98.7 1.3 100.0 -

------------- ------------- ------------- -------- ------ ---------- ------ ----------- ----------- --------- ------ --------- -------- --------- --------- -----

31 March 2023

Total(c) 9.8 13.3 3.6 2.4 23.8 3.0 7.7 25.8 8.5 0.4 0.5 98.8 1.2 - 100.0

------------- ------------- ------------- -------- ------ ---------- ------ ----------- ----------- --------- ------ --------- -------- --------- --------- -----

(a) The Company's net assets are the total of net current assets

plus non-current liabilities per the Statement of Financial

Position in the full Half Yearly Report.

(b) All companies held by TEMIT in this country are fair valued at zero.

(c) One 97 Communications and Genpact were previously included

within Information Technology but have been reallocated to

Financials and Industrials, respectively. Astra International was

previously included within Consumer Discretionary and has been

reallocated to Industrials. The reallocations have been performed

as a result of a change in the GICS structure.

Less than GBP1.5bn to GBP5bn to Greater than

Market capitalisation breakdown (%) GBP1.5bn GBP5bn GBP25bn GBP25bn Net assets(a)

------------------------------------ --------- ----------- --------- ------------ -------------

30 September 2023 5.2 9.3 29.5 54.7 1.3

------------------------------------- --------- ----------- --------- ------------ -------------

31 March 2023 5.1 11.2 22.9 59.6 1.2

------------------------------------- --------- ----------- --------- ------------ -------------

30 September 31 March

Split between markets(b) (%) 2023 2023

------------------------------------ --------- ----------- --------- ------------ -------------

Emerging markets 94.0 93.3

------------------------------------- --------- ----------- --------- ------------ -------------

Developed markets(c) 4.5 5.0

------------------------------------- --------- ----------- --------- ------------ -------------

Frontier markets 0.2 0.5

------------------------------------- --------- ----------- --------- ------------ -------------

Net assets(a) 1.3 1.2

------------------------------------- --------- ----------- --------- ------------ -------------

Source: FactSet Research System, Inc.

(a) The Company's net assets are the total of net current assets

plus non-current liabilities per the Statement of Financial

Position in the full Half Yearly Report.

(b) Geographic split between "Emerging markets", "Frontier

markets", "Developed markets" are as per MSCI index

classifications.

(c) Developed market exposure represented by companies listed in

United Kingdom and United States which have significant exposure to

operations from emerging markets.

Environmental, Social and Governance

We continue to embed governance and sustainability factors into

our fundamental bottom-up research and remain active owners across

our holdings. This involves integrating ESG factors into our stock

thesis, engaging with investee companies on material ESG issues and

actively voting on behalf of our investors. In addition, we monitor

the potential ESG characteristics that may be exhibited by our

investee companies, including TEMIT's portfolio carbon footprint

where our portfolio managers seek to understand the carbon risk

profile. We provide below a short summary of our process over the

six-month period under review.

Integrating ESG factors

A case study example of integrating ESG factors is Federal Bank,

whose shares were purchased during the six months under review.

Federal Bank is a mid-sized regional private sector bank in India.

The company has amongst the strongest liability franchises within

mid-sized banks due to its strong presence in Kerala and aided by

traction amongst the non-resident Kerala population working in the

Middle East. Looking at the ESG practices of the company, we first

highlight that despite it being a mid-sized bank, the company is

board driven, and has a management team that is well respected. We

noted no material past controversies and business practices focused

on risk management and disciplined capital management. The company

has board approved environment and social management systems

("ESMS") in place to incorporate environmental and social risk

considerations into financing activities as part of its credit risk

governance. Finally, the company has a stated framework around

cybersecurity, compliant with external certifications/standards

(e.g., ISO 27001 certificate for critical IT areas) and no reported

instances of cybersecurity breaches over the past few years. We

believe the company is well positioned to manage its exposure to

material operational ESG issues.

Climate change

Note we prefer to commentate around the WACI metric as it

provides a measurement of the carbon intensity of businesses,

normalises for company size and allows us to compare companies

against each other, helping to determine the portfolio's exposure

to potential carbon related risks.

The TEMIT Portfolio Carbon Emissions are 30% lower (31 March

2023: 23% lower) than the MSCI Emerging Markets benchmark, Carbon

Intensity is 20% lower (31 March 2023: 10% lower) and Weighted

Average Carbon Intensity is 31% lower (31 March 2023: 38% lower).

The portfolio carbon exposure is concentrated amongst a small

number of companies, with the top five companies in terms of carbon

intensity representing 2.7% of the portfolio by value and

accounting for 62.4% of the total portfolio WACI.

Over the six-month period, the portfolio's carbon footprint

remained stable with some changes in both positioning as well as

updates in emissions data for a few companies contributing to this.

The purchase of ACC, an update by MSCI to estimated emissions data

(previously not covered) for Emirates Central Cooling Systems and a

change from estimated to reported emissions data for Daqo New

Energy by MSCI, added to the portfolio WACI. The reduction in

ending weight for China Resources Cement, and sale of POSCO helped

offset some of the impact on the portfolio WACI.

As at 30 September 2023, China Resources Cement is the company

with the largest carbon intensity, contributing 16.7% to the total

portfolio WACI. We believe that the company is managing its

emissions profile well and, looking forward, the company is seeking

to improve its carbon emissions management further through the use

of solar, carbon capture, usage and storage ("CCUS"), and

alternative fuels. They have also set 2025 targets around their

absolute carbon emissions and carbon intensity, with the long-term

aim to achieve carbon neutrality by 2060. We are willing to invest

in companies in carbon-intensive sectors, such as cement, steel and

extractive industries. Our engagement with these companies focuses

on their intention to decarbonise and any incremental improvements

they are making to reach these goals. These views are integrated

into our investment views.

Active ownership

As investors with a significant presence in emerging markets,

our investment team's active ownership efforts are a key part of

the overall approach to stewardship. Over the six-month period, we

have engaged with select investee companies on material governance

and sustainability issues, as well as executing on our proxy voting

policy on behalf of our shareholders. For example, in April 2023,

we spoke to the CEO of Gedeon Richter regarding their capital

allocation activities, new board structure, and how they expect to

improve disclosure on specific areas within their remuneration

policy such as key KPIs. The CEO was very transparent regarding the

higher capital return in 2023, rationale behind first ever share

buyback and their intentions. The company is in contact with key

shareholders on best practice and we believe the company's

intentions to improve corporate governance are promising.

We also voted against a proposal to approve the remuneration

report at Unilever. We voted against this proposal as the incoming

CEO's salary has been set higher than his predecessor's and is

significantly higher than his current salary and those at UK market

peers. The company has not provided a compelling justification for

this remuneration package. We continue to use our voting power as a

signal to management on important issues raised through voting

ballots. We believe that our engagement and proxy voting efforts

are key in understanding our companies better and improving

outcomes for shareholders as well as stakeholders more broadly.

We will be sharing a more detailed account of our stewardship

practices in the next Annual Report and dedicated Stewardship

Report.

Outlook for emerging markets

Emerging markets have been volatile due to fears of higher

interest rates lasting for longer. Long-term yields have now

started to come off, which should be positive for the emerging

markets asset class. A few emerging markets economics, such as

Brazil, have already started to cut their interest rates. The onset

of an easing cycle in selected countries tilts the balancing act of

tackling inflation yet pursuing economic growth. The impact of a

rate cut is positive for overall consumption as well as for

financing costs for companies which should also spur

investments.

Besides rate cuts, other long-term opportunities abound in

emerging markets. The increasingly popular China+1 strategy, where

global manufacturers establish an additional overseas production

base in China plus one other country, stands to benefit India,

Mexico and several other Association of Southeast Asian Nations

("ASEAN") economies.

Another longstanding theme is the transition to a greener

future. Asia is home to well-run companies in the electric vehicle

and solar equipment segment. The structural theme of electrical

vehicles has seen a short-term slowdown impacted by slower growth

and concerns of oversupply. We believe that the long-term

structural growth opportunities for these sectors remain intact

supported by national commitments underpinning energy transition to

a cleaner environment.

The recovery of demand in China has been tepid and low birth

rates and difficulties in the property sector pose further

long-term challenges to its growth trajectory. Whilst government

policy has become more supportive, we are cognisant that more

substantive policies and a rebound in consumer activity is a

prerequisite for a recovery in Chinese equities. We remain watchful

for such developments. China's internet sector, which forms a large

part of the index, has already adjusted to the new policy and

demand environment. We expect future returns for the sector to be

driven more by steady cash flow generation and corporate

actions.

The semiconductor cycle has remained weak due to slower demand.

With the emerging popularity of AI, there has been a demand uplift

that primarily benefits companies within the value chain. In the

portfolio, our holdings in TSMC and Samsung Electronics are direct

beneficiaries of AI-driven demand. In India, information technology

services have been impacted by a slowdown in discretionary

spending. Nevertheless, cost takeout deals-deals aimed at saving

costs-have been strong.

Amidst an uncertain macroeconomic environment, we continue to

retain a bottom-up focus on research. We believe that the long-term

fundamentals for emerging markets remain attractive despite near

term headwinds, and that equities offer good potential for

investors. We believe that breadth of opportunities, growth,

innovation and stronger institutional resilience together create an

attractive future for emerging markets.

Chetan Sehgal

Lead Portfolio Manager

7 December 2023

Independent Review Report

to the members of Templeton Emerging Markets Investment Trust

plc

Conclusion

We have been engaged by Templeton Emerging Markets Investment

Trust plc ('the Company') to review the condensed set of Financial

Statements in the Half Yearly Report for the six months ended 30

September 2023 which comprises the Statement of Comprehensive

Income, Statement of Financial Position, Statement of Changes in

Equity, Statement of Cash Flows, and related notes 1-9. We have

read the other information contained in the Half Yearly Report and

considered whether it contains any apparent misstatements or

material inconsistencies with the information in the condensed set

of Financial Statements.