Enact Holdings, Inc. Prices $750 Million of Senior Notes

23 Maggio 2024 - 12:35AM

Enact Holdings, Inc. (Nasdaq: ACT) (Enact), today

announced that it has priced a registered public offering of $750

million of its 6.25% Senior Notes due 2029 (the “2029 Notes”). The

expected settlement date for the offering is May 28, 2024, subject

to the satisfaction of customary closing conditions.

The 2029 Notes will pay interest semi-annually on May 28 and

November 28, beginning November 28, 2024, at a rate of 6.250% per

year, maturing May 28, 2029.

Enact intends to use the net proceeds of the offering, together

with other legally available funds, to redeem its 6.500% Senior

Notes due August 2025 (the “2025 Notes”) in accordance with the

terms of the related indenture. This press release does not

constitute a notice of redemption with respect to, or an offer to

purchase, any securities.

J.P. Morgan Securities LLC, Citigroup Global Markets Inc. and

Goldman Sachs & Co. LLC are acting as joint book-running

managers for the offering.

This press release is neither an offer to sell nor a

solicitation of an offer to buy any of the 2025 Notes or 2029 Notes

and shall not constitute an offer, solicitation or sale in any

jurisdiction in which such offer, solicitation or sale is

unlawful.

The 2029 Notes are being offered pursuant to an automatic shelf

registration statement relating to the 2029 Notes that was

previously filed with the Securities and Exchange Commission (the

“SEC”) and became effective upon filing. Before you invest, you

should read the prospectus in the registration statement and other

documents Enact has filed with the SEC for more complete

information about Enact and the offering. A copy of the prospectus

and prospectus supplement relating to the offering may be obtained

on the SEC website at www.sec.gov.

About Enact Holdings,

Inc.Enact (Nasdaq: ACT), operating

principally through its wholly-owned subsidiary Enact Mortgage

Insurance Corporation since 1981, is a leading U.S. private

mortgage insurance provider committed to helping more people

achieve the dream of homeownership. Building on a deep

understanding of lenders' businesses and a legacy of financial

strength, we partner with lenders to bring best-in class service,

leading underwriting expertise, and extensive risk and capital

management to the mortgage process, helping to put more people in

homes and keep them there. By empowering customers and their

borrowers, Enact seeks to positively impact the lives of those in

the communities in which it serves in a sustainable way. Enact is

headquartered in Raleigh, North Carolina.

Safe Harbor StatementThis communication

contains “forward-looking statements” within the meaning of the

Private Securities Litigation Reform Act. These forward-looking

statements may address, among other things, our expected financial

and operational results, the related assumptions underlying our

expected results, expectation as to the closing and settlement date

for the 2029 Notes and the quotations of management. These

forward-looking statements are distinguished by use of words such

as “will,” “may,” “would,” “anticipate,” “expect,” “believe,”

“designed,” “plan,” “predict,” “project,” “target,” “could,”

“should,” or “intend,” the negative of these terms, and similar

references to future periods. These views involve risks and

uncertainties that are difficult to predict and, accordingly, our

actual results may differ materially from the results discussed in

our forward-looking statements. Our forward-looking statements

contained herein speak only as of the date of this press release.

Factors or events that we cannot predict, including risks related

to an economic downturn or recession in the United States and in

other countries around the world; changes in political, business,

regulatory, and economic conditions; changes in or to Fannie Mae

and Freddie Mac (the “GSEs”), whether through Federal legislation,

restructurings or a shift in business practices; failure to

continue to meet the mortgage insurer eligibility requirements of

the GSEs; competition for customers; lenders or investors seeking

alternatives to private mortgage insurance; an increase in the

number of loans insured through Federal government mortgage

insurance programs, including those offered by the Federal Housing

Administration; and other factors described in the risk factors

contained in our 2023 Annual Report on Form 10-K and other filings

with the SEC, may cause our actual results to differ from those

expressed in forward-looking statements. Although Enact believes

the expectations reflected in such forward-looking statements are

based on reasonable assumptions, Enact can give no assurance that

its expectations will be achieved and it undertakes no obligation

to update publicly any forward-looking statements as a result of

new information, future events, or otherwise, except as required by

applicable law.

Investor Contact

Daniel Kohl

EnactIR@enactmi.com

Media Contact

Sarah Wentz

Sarah.Wentz@enactmi.com

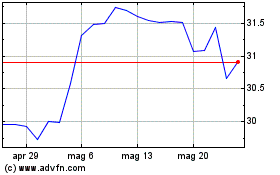

Grafico Azioni Enact (NASDAQ:ACT)

Storico

Da Gen 2025 a Feb 2025

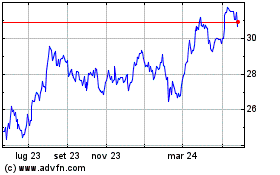

Grafico Azioni Enact (NASDAQ:ACT)

Storico

Da Feb 2024 a Feb 2025