Affinity Bancshares, Inc. (NASDAQ:“AFBI”) (the

“Company”), the holding company for Affinity Bank (the “Bank”),

today announced net income of $1.0 million for the three months

ended June 30, 2024, as compared to $1.6 million for the three

months ended June 30, 2023.

This press release features multimedia. View

the full release here:

https://www.businesswire.com/news/home/20240726813331/en/

At or for the three months

ended,

Performance Ratios:

June 30, 2024

March 31, 2024

December 31, 2023

September 30, 2023

June 30, 2023

Net income (in thousands)

$

1,031

$

1,335

$

1,514

$

1,623

$

1,590

Diluted earnings per share

0.16

0.20

0.23

0.25

0.24

Common book value per share

19.49

19.21

18.94

18.50

18.34

Tangible book value per share (1)

16.64

16.36

16.08

15.63

15.47

Total assets (in thousands)

872,558

869,547

843,258

855,431

876,905

Return on average assets

0.48

%

0.63

%

0.70

%

0.74

%

0.71

%

Return on average equity

3.33

%

4.38

%

5.03

%

5.42

%

5.37

%

Equity to assets

14.33

%

14.18

%

14.41

%

13.85

%

13.45

%

Tangible equity to tangible assets (1)

12.50

%

12.33

%

12.50

%

11.95

%

11.59

%

Net interest margin

3.71

%

3.38

%

3.32

%

3.36

%

3.17

%

Efficiency ratio

78.74

%

75.96

%

74.30

%

71.78

%

71.68

%

(1) Non-GAAP measure - see “Explanation of

Certain Unaudited Non-GAAP Financial Measures” for more information

and reconciliation to GAAP.

Net Income

- Net income was $1.0 million for three months ended June 30,

2024 as compared to $1.6 million for the three months ended June

30, 2023, as a result of an increase in other noninterest expense

partially offset by a net increase in interest income.

Results of Operations

- Net interest income was $7.6 million for the three months ended

June 30, 2024 compared to $6.7 million for the three months ended

June 30, 2023. The increase was due to an increase in interest

income on loans and investment securities, partially offset by a

rise in deposit and borrowing costs and a decrease in interest

income on interest-earning deposits.

- Net interest margin for the three months ended June 30, 2024

increased to 3.71% from 3.17% for the three months ended June 30,

2023. The increases in the margin relate to increases in our yield

on earning assets exceeding our increases in our deposits and

borrowing costs.

- Provision for credit losses, which is related to provision on

unfunded commitments was $213,000 for the three months ended June

30, 2024 compared to zero provision for the three months ended June

30, 2023.

- Noninterest income increased $28,000 to $706,000 for the three

months ended June 30, 2024.

- Non-interest expense increased $1.4 million to $6.7 million for

the three months ended June 30, 2024 compared to the respective

period in 2023, due to increases in professional fees related to

our recently announced merger with Atlanta Postal Credit Union and

increases in salaries and employee benefits.

- Net interest income was $14.3 million for the six months ended

June 30, 2024 compared to $13.6 million for the six months ended

June 30, 2023. The increase was due to an increase in interest

income on loans and investment securities, partially offset by a

rise in deposit and borrowing costs and a decrease in interest

income on interest-earning deposits.

- Net interest margin for the six months ended June 30, 2024

increased to 3.55% from 3.37% for the six months ended June 30,

2023. The increase in the margin relates to increases in our yield

on earning assets exceeding our increases in our deposits and

borrowing costs.

- Noninterest income increased $60,000 to $1.3 million for the

six months ended June 30, 2024.

- Non-interest expense increased $1.8 million to $12.3 million

for the six months ended June 30, 2024 compared to the respective

period in 2023, due to increases in professional fees related to

our recently announced merger with Atlanta Postal Credit Union and

increases in salaries and employee benefits.

Financial Condition

- Total assets increased $29.3 million to $872.6 million at June

30, 2024 from $843.3 million at December 31, 2023, as we

experienced loan growth.

- Total gross loans increased $32.7 million to $692.6 million at

June 30, 2024 from $659.9 million at December 31, 2023. The

increase was due to steady loan demand in construction and

commercial non-owner occupied properties.

- Non-owner occupied office loans totaled $29.4 million at June

30, 2024; the average LTV on these loans is 46.0%, including

- $15.0 million medical/dental tenants and

- $14.4 million to other various tenants.

- Investment securities held-to-maturity unrealized losses were

$294,000, net of tax. Investment securities available-for-sale

unrealized losses were $6.0 million, net of tax.

- Cash and cash equivalents remained stable at $50.4 million at

June 30, 2024 from $50.0 million at December 31, 2023.

- Deposits increased by $15.3 million to $689.7 million at June

30, 2024 compared to $674.4 million at December 31, 2023, with an

$18.4 million increase in demand deposits partially offset by $2.5

million decrease in certificates of deposits.

- Uninsured deposits were approximately $106.3 million at June

30, 2024 and represented 15.4% of total deposits.

- Borrowings increased by $11.8 million to $51.8 million at June

30, 2024 compared to $40.0 million at December 31, 2023 as we

continue to evaluate borrowing needs related to enhancing bank

liquidity.

Asset Quality

- Non-performing loans decreased to $3.0 million at June 30, 2024

from $7.4 million at December 31, 2023.

- The allowance for credit losses as a percentage of

non-performing loans was 282.0% at June 30, 2024, as compared to

120.1% at December 31, 2023.

- Allowance for credit losses to total loans decreased to 1.22%

at June 30, 2024 from 1.35% at December 31, 2023.

- Net loan charge-offs were $460,000 for the six months ended

June 30, 2024, as compared to net loan charge-offs of $72,000 for

the six months ended June 30, 2023.

About Affinity Bancshares,

Inc.

The Company is a Maryland corporation based in Covington,

Georgia. The Company’s banking subsidiary, Affinity Bank, opened in

1928 and currently operates a full-service office in Atlanta,

Georgia, two full-service offices in Covington, Georgia, and a loan

production office serving the Alpharetta and Cumming, Georgia

markets.

Forward-Looking

Statements

In addition to historical information, this release may contain

forward-looking statements within the meaning of the Private

Securities Litigation Reform Act of 1995, which describe the future

plans, strategies and expectations of the Company. Forward-looking

statements can be identified by the use of words such as

“estimate,” “project,” “believe,” “intend,” “anticipate,” “assume,”

“plan,” “seek,” “expect,” “will,” “may,” “should,” “indicate,”

“would,” “contemplate,” “continue,” “target” and words of similar

meaning. Forward-looking statements are based on our current

beliefs and expectations and are inherently subject to significant

business, economic and competitive uncertainties and contingencies,

many of which are beyond our control. In addition, these

forward-looking statements are subject to assumptions with respect

to future business strategies and decisions that are subject to

change. Accordingly, you should not place undue reliance on such

statements. We are under no duty to and do not take any obligation

to update any forward-looking statements after the date of this

report. Factors which could have a material adverse effect on the

operations of the Company and its subsidiaries include, but are not

limited to, changes in general economic conditions, interest rates

and inflation; changes in asset quality; our ability to access

cost-effective funding; fluctuations in real estate values; changes

in laws or regulations; changes in liquidity, including the size

and composition of our deposit portfolio and the percentage of

uninsured deposits in the portfolio; changes in technology;

failures or breaches of our IT security systems; our ability to

introduce new products and services and capitalize on growth

opportunities; changes in the value of our goodwill and other

intangible assets; our ability to successfully integrate acquired

operations or assets; changes in accounting policies and practices;

our ability to retain key employees; and the effects of natural

disasters and geopolitical events, including terrorism, conflict

and acts of war. These risks and other uncertainties are further

discussed in the reports that the Company files with the Securities

and Exchange Commission.

Average Balance Sheets

The following tables set forth average balance sheets, average

annualized yields and costs, and certain other information for the

periods indicated. No tax-equivalent yield adjustments have been

made, as the effects would be immaterial. All average balances are

monthly average balances. Non-accrual loans were included in the

computation of average balances. The yields set forth below include

the effect of deferred fees, discounts, and premiums that are

amortized or accreted to interest income or interest expense.

For the Six Months Ended June

30,

2024

2023

Average Outstanding

Balance

Interest

Average Yield/Rate

Average Outstanding

Balance

Interest

Average Yield/Rate

(Dollars in thousands)

Interest-earning assets:

Loans

$

673,282

$

19,978

5.97

%

$

658,887

$

17,018

5.21

%

Investment securities held-to-maturity

34,225

1,056

6.20

%

33,518

1,025

6.17

%

Investment securities

available-for-sale

47,875

942

3.96

%

49,806

838

3.39

%

Interest-earning deposits and federal

funds

50,527

1,296

5.16

%

69,568

1,638

4.75

%

Other investments

5,467

171

6.29

%

2,403

72

6.07

%

Total interest-earning assets

811,376

23,443

5.81

%

814,182

20,591

5.10

%

Non-interest-earning assets

51,633

51,524

Total assets

$

863,009

$

865,706

Interest-bearing liabilities:

Interest-bearing checking accounts

$

88,584

$

217

0.49

%

$

93,596

$

100

0.22

%

Money market accounts

143,243

2,258

3.17

%

138,394

1,486

2.17

%

Savings accounts

74,093

1,054

2.86

%

92,003

1,110

2.43

%

Certificates of deposit

219,315

4,571

4.19

%

195,260

3,403

3.51

%

Total interest-bearing deposits

525,235

8,100

3.10

%

519,253

6,099

2.37

%

FHLB advances and other borrowings

58,145

1,025

3.55

%

41,078

901

4.42

%

Total interest-bearing liabilities

583,380

9,125

3.15

%

560,331

7,000

2.52

%

Non-interest-bearing liabilities

156,177

186,874

Total liabilities

739,557

747,205

Total stockholders' equity

123,452

118,501

Total liabilities and stockholders'

equity

$

863,009

$

865,706

Net interest rate spread

2.66

%

2.58

%

Net interest income

$

14,318

$

13,591

Net interest margin

3.55

%

3.37

%

For the Three Months Ended

June 30,

2024

2023

Average Outstanding

Balance

Interest

Average Yield/Rate

Average Outstanding

Balance

Interest

Average Yield/Rate

(Dollars in thousands)

Interest-earning assets:

Loans

$

681,903

$

10,479

6.18

%

$

665,921

$

8,727

5.26

%

Investment securities held-to-maturity

34,237

529

6.21

%

34,131

521

6.13

%

Investment securities

available-for-sale

47,581

479

4.05

%

50,758

428

3.38

%

Interest-earning deposits and federal

funds

50,973

648

5.11

%

93,116

1,150

4.95

%

Other investments

5,487

87

6.38

%

2,167

37

6.90

%

Total interest-earning assets

820,181

12,222

5.99

%

846,093

10,863

5.15

%

Non-interest-earning assets

51,122

52,023

Total assets

$

871,303

$

898,116

Interest-bearing liabilities:

Interest-bearing checking accounts

$

89,110

$

115

0.52

%

$

95,317

$

56

0.23

%

Money market accounts

145,886

1,173

3.23

%

137,306

825

2.41

%

Savings accounts

73,775

526

2.87

%

88,152

558

2.54

%

Certificates of deposit

218,824

2,285

4.20

%

240,954

2,346

3.91

%

Total interest-bearing deposits

527,595

4,099

3.12

%

561,729

3,785

2.70

%

FHLB advances and other borrowings

63,674

555

3.51

%

35,495

385

4.35

%

Total interest-bearing liabilities

591,269

4,654

3.17

%

597,224

4,170

2.80

%

Non-interest-bearing liabilities

155,659

182,140

Total liabilities

746,928

779,364

Total stockholders' equity

124,375

118,752

Total liabilities and stockholders'

equity

$

871,303

$

898,116

Net interest rate spread

2.82

%

2.35

%

Net interest income

$

7,568

$

6,693

Net interest margin

3.71

%

3.17

%

AFFINITY BANCSHARES,

INC.

Consolidated Balance

Sheets

(unaudited)

June 30, 2024

December 31, 2023

(Dollars in thousands except

per share amounts)

Assets

Cash and due from banks

$

6,158

$

6,030

Interest-earning deposits in other

depository institutions

44,239

43,995

Cash and cash equivalents

50,397

50,025

Investment securities

available-for-sale

47,266

48,561

Investment securities held-to-maturity

(estimated fair value of $33,901, net of allowance for credit

losses of $45 at June 30, 2024 and estimated fair value of $33,835,

net of allowance for credit losses of $45 at December 31, 2023)

34,248

34,206

Other investments

5,491

5,434

Loans

692,591

659,876

Allowance for credit loss on loans

(8,461

)

(8,921

)

Net loans

684,130

650,955

Other real estate owned

—

2,850

Premises and equipment, net

3,569

3,797

Bank owned life insurance

16,283

16,086

Intangible assets

18,271

18,366

Other assets

12,903

12,978

Total assets

$

872,558

$

843,258

Liabilities and Stockholders' Equity

Liabilities:

Non-interest-bearing checking

$

161,156

$

154,689

Interest-bearing checking

88,742

85,362

Money market accounts

147,250

138,673

Savings accounts

74,077

74,768

Certificates of deposit

218,487

220,951

Total deposits

689,712

674,443

Federal Home Loan Bank advances and other

borrowings

51,837

40,000

Accrued interest payable and other

liabilities

5,944

7,299

Total liabilities

747,493

721,742

Stockholders' equity:

Common stock (par value $0.01 per share,

40,000,000 shares authorized; 6,416,628 issued and outstanding at

June 30, 2024 and December 31, 2023)

64

64

Preferred stock (10,000,000 shares

authorized, no shares outstanding)

—

—

Additional paid in capital

61,773

61,026

Unearned ESOP shares

(4,482

)

(4,587

)

Retained earnings

73,711

71,345

Accumulated other comprehensive loss

(6,001

)

(6,332

)

Total stockholders' equity

125,065

121,516

Total liabilities and stockholders'

equity

$

872,558

$

843,258

AFFINITY BANCSHARES,

INC.

Consolidated Statements of

Income

(unaudited)

Three Months Ended June

30,

Six Months Ended June

30,

2024

2023

2024

2023

(Dollars in thousands except

per share amounts)

Interest income:

Loans, including fees

$

10,479

$

8,727

$

19,978

$

17,018

Investment securities

1,095

986

2,169

1,935

Interest-earning deposits

648

1,150

1,296

1,638

Total interest income

12,222

10,863

23,443

20,591

Interest expense:

Deposits

4,099

3,785

8,100

6,099

FHLB advances and other borrowings

555

385

1,025

901

Total interest expense

4,654

4,170

9,125

7,000

Net interest income before provision for

credit losses

7,568

6,693

14,318

13,591

Provision for credit losses

213

—

213

7

Net interest income after provision for

credit losses

7,355

6,693

14,105

13,584

Noninterest income:

Service charges on deposit accounts

391

405

786

796

Net gain on sale of other real estate

owned

135

—

135

—

Other

180

273

369

434

Total noninterest income

706

678

1,290

1,230

Noninterest expenses:

Salaries and employee benefits

3,417

3,036

6,596

6,040

Occupancy

615

638

1,233

1,282

Data processing

508

487

1,019

980

Professional fees

1,118

177

1,381

315

Other

1,061

946

2,061

1,861

Total noninterest expenses

6,719

5,284

12,290

10,478

Income before income taxes

1,342

2,087

3,105

4,336

Income tax expense

311

497

739

1,024

Net income

$

1,031

$

1,590

$

2,366

$

3,312

Weighted average common shares

outstanding

Basic

6,416,628

6,486,260

6,416,628

6,542,653

Diluted

6,544,450

6,546,382

6,534,751

6,616,294

Basic earnings per share

$

0.16

$

0.25

$

0.37

$

0.51

Diluted earnings per share

$

0.16

$

0.24

$

0.36

$

0.50

Explanation of Certain Unaudited

Non-GAAP Financial Measures

Reported amounts are presented in accordance with GAAP.

Additionally, the Company believes the following information is

utilized by regulators and market analysts to evaluate a company’s

financial condition and, therefore, such information is useful to

investors. These disclosures should not be viewed as a substitute

for financial results in accordance with GAAP, nor are they

necessarily comparable to non-GAAP performance measures which may

be presented by other companies. Refer to the Non-GAAP

Reconciliation tables below for details on the earnings impact of

these items.

For the Three Months

Ended

Non-GAAP Reconciliation

June 30, 2024

March 31, 2024

December 31, 2023

September 30, 2023

June 30, 2023

Tangible book value per common share

reconciliation

Book Value per common share (GAAP)

$

19.49

$

19.21

$

18.94

$

18.50

$

18.34

Effect of goodwill and other

intangibles

(2.85

)

(2.85

)

(2.86

)

(2.87

)

(2.87

)

Tangible book value per common share

$

16.64

$

16.36

$

16.08

$

15.63

$

15.47

Tangible equity to tangible assets

reconciliation

Equity to assets (GAAP)

14.33

%

14.18

%

14.41

%

13.85

%

13.45

%

Effect of goodwill and other

intangibles

(1.83

)%

(1.85

)%

(1.91

)%

(1.90

)%

(1.86

)%

Tangible equity to tangible assets (1)

12.50

%

12.33

%

12.50

%

11.95

%

11.59

%

(1) Tangible assets is total assets less

intangible assets. Tangible equity is total equity less intangible

assets.

View source

version on businesswire.com: https://www.businesswire.com/news/home/20240726813331/en/

Edward J. Cooney Chief Executive Officer (678) 742-9990

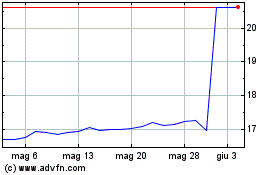

Grafico Azioni Affinity Bancshares (NASDAQ:AFBI)

Storico

Da Dic 2024 a Gen 2025

Grafico Azioni Affinity Bancshares (NASDAQ:AFBI)

Storico

Da Gen 2024 a Gen 2025