Alico, Inc. (“Alico”, the “Company”, “we”, “us” or “our”) (Nasdaq:

ALCO) today announced financial results for the third quarter of

fiscal year 2024 and the nine months ended June 30, 2024, the

highlights of which are as follows:

- The

Company previously announced that it entered a new three-year

agreement to sell oranges to Tropicana at prices that are

approximately 33% to 50% higher, over the life of the contract,

than the average price for all the citrus fruit sold to Tropicana

last season.

- The

Company has now treated substantially all of its

producing trees with Oxytetracycline (“OTC”) and anticipates that

these 4.5 million trees will support meaningful production growth

in the 2024-25 harvest season.

- The

Company previously announced that it has continued to commit to its

real estate activities by hiring Mitch Hutchcraft, who joined Alico

as Executive Vice President of Real Estate in May

2024.

- The

Company's Board of Directors is announcing, as part of its

succession plan, the anticipated appointment of a current Director,

Adam Putnam, as the next Chairman of the Board when the current

Chairman, George Brokaw, completes his term as Chairman in February

2025. Mr. Brokaw will continue to serve as a Director of

Alico.

- The

Company sold 798 acres of citrus

land for approximately $7.2 million

($9,000 per acre) and the buyer has an

option within the next nine months to purchase the remaining 680

acres on that grove at the same price per acre.

- The

Company maintains a strong balance sheet, with

approximately $94.8 million

available under lines of credit, a Working Capital Ratio

of 2.67 to 1.00 and a Debt to

Total Assets ratio of 0.20 to

1.00 at June 30, 2024, with

no significant maturities until 2029.

Results of Operations

| (in thousands,

except for per share amounts and percentages) |

| |

(Unaudited) |

|

(Unaudited) |

| |

Three Months Ended June 30, |

|

Nine Months Ended June 30, |

| |

|

2024 |

|

|

|

2023 |

|

|

% Change |

|

|

2024 |

|

|

|

2023 |

|

|

% Change |

|

Revenue |

$ |

13,610 |

|

|

$ |

7,284 |

|

|

|

86.8 |

% |

|

$ |

45,708 |

|

|

$ |

39,166 |

|

|

16.7 |

% |

| Net

(loss) income attributable to Alico, Inc. common stockholders |

$ |

(2,044 |

) |

|

$ |

11,832 |

|

|

(117.3 |

)% |

|

$ |

25,097 |

|

|

$ |

895 |

|

|

NM |

|

| (Loss)

earnings per diluted common share |

$ |

(0.27 |

) |

|

$ |

1.56 |

|

|

(117.3 |

)% |

|

$ |

3.29 |

|

|

$ |

0.12 |

|

|

NM |

|

| EBITDA

(1) |

$ |

1,343 |

|

|

$ |

18,789 |

|

|

(92.9 |

)% |

|

$ |

48,686 |

|

|

$ |

16,504 |

|

|

195.0 |

% |

| Adjusted

EBITDA (1) |

$ |

(3,390 |

) |

|

$ |

(1,286 |

) |

|

(163.6 |

)% |

|

$ |

(4,415 |

) |

|

$ |

(12,523 |

) |

|

64.7 |

% |

| Net cash

provided by (used in) operating activities |

$ |

1,021 |

|

|

$ |

6,492 |

|

|

(84.3 |

)% |

|

$ |

(18,720 |

) |

|

$ |

(618 |

) |

|

NM |

|

| |

|

|

|

|

|

|

|

|

|

|

|

| |

June 30,2024 |

|

September 30,2023 |

|

$ Change |

|

|

|

June 30,2024 |

|

September 30,2023 |

| |

(Unaudited) |

|

|

|

|

|

|

|

(Unaudited) |

|

(Unaudited) |

| Balance Sheet

Items |

|

|

|

|

|

|

|

|

|

|

|

| Cash and cash equivalents |

$ |

9,106 |

|

|

$ |

1,062 |

|

|

$ |

8,044 |

|

|

Working Capital

Ratio |

|

2.67 to 1 |

|

3.90 to 1 |

| Current

portion of long-term debt |

$ |

1,410 |

|

|

$ |

2,566 |

|

|

$ |

(1,156 |

) |

|

Debt to equity

ratio |

|

0.20 to 1 |

|

0.30 to 1 |

|

Long-term debt, net |

$ |

82,642 |

|

|

$ |

101,410 |

|

|

$ |

(18,768 |

) |

|

Net Debt (1) |

|

$ |

74,946 |

|

127,636 |

| Lines of

credit |

$ |

— |

|

|

$ |

24,722 |

|

|

$ |

(24,722 |

) |

|

|

|

|

|

|

| Total Alico stockholders’

equity |

$ |

269,489 |

|

|

$ |

244,991 |

|

|

$ |

24,498 |

|

|

|

|

|

|

|

| |

|

|

|

|

|

|

|

|

|

|

|

|

(1) “EBITDA,” “Adjusted EBITDA” and “Net Debt” are non-GAAP

financial measures. See “Non-GAAP Financial Measures” at the end of

this earnings release for details regarding these measures,

including reconciliations of the Non-GAAP Financial Measures to

their most directly comparable GAAP measures. |

| NM =

Not meaningful |

For the three and nine months ended

June 30, 2024, the Company reported a net (loss) income

attributable to Alico common stockholders of $(2.0) million and

$25.1 million, respectively, compared to net income attributable to

Alico common stockholders of $11.8 million and $0.9 million for the

three and nine months ended June 30, 2023, respectively. The

decrease in our net income attributable to Alico common

stockholders for the three months ended June 30, 2024 was

driven by Hurricane Ian insurance proceeds of $17.5 million

received during the three months ended June 30, 2023 (the

“Insurance Proceeds”), which were recorded as a reduction of

operating expenses, partially offset by a gain of $4.4 million from

the sale of citrus land in the three months ended June 30,

2024. The increase in our net income attributable to Alico common

stockholders for the nine months ended June 30, 2024 compared

to the nine months ended June 30, 2023, was driven by a gain

of $74.9 million on the sale of the remaining 17,229 acres of the

Alico Ranch on December 21, 2023 and a gain of $4.4 million from

the sale of citrus land on June 28, 2024, partially offset by

inventory adjustments recorded at September 30, 2022 on the ending

inventory balance, as a result of the impact of Hurricane Ian,

which effectively lowered the inventory to be expensed in fiscal

year 2023, $21.4 million of Insurance Proceeds, and a

$9.4 million increase in the tax provision for the nine months

ended June 30, 2024. For the three and nine months ended

June 30, 2024, the Company had a (loss) earnings of $(0.27)

and $3.29 per diluted common share, respectively, compared to

earnings of $1.56 and $0.12 per diluted common share for the three

and nine months ended June 30, 2023, respectively.

For the three and nine months ended

June 30, 2024, the Company had EBITDA of $1.3 million and

$48.7 million, respectively, compared to $18.8 million and $16.5

million for the three and nine months ended June 30, 2023,

respectively. Adjusted EBITDA (loss) for the three and nine months

ended June 30, 2024 and 2023 was approximately $(3.4) million

and $(4.4) million, respectively, and $(1.3) million and $(12.5)

million, respectively.

These quarterly financial results also reflect

the seasonal nature of the Company’s business. The majority of the

Company’s citrus crop is typically harvested in the second and

third quarters of the fiscal year; consequently, most of the

Company’s gross profit and cash flows from operating activities are

recognized in those quarters. However, due to the timing of the

current year harvest, more of the citrus crop was harvested in the

first and second quarters of this fiscal year. Furthermore, the

Company’s working capital requirements are typically greater in the

first and fourth quarters of the fiscal year.

Alico Citrus Division

Results

Citrus production for the three and nine months

ended June 30, 2024 and 2023 is summarized in the following

table.

| (in thousands,

except per box and per pound solids data) |

| |

Three Months EndedJune 30, |

|

Change |

|

Nine Months EndedJune 30, |

|

Change |

| |

|

2024 |

|

|

2023 |

|

Unit |

|

% |

|

|

2024 |

|

|

2023 |

|

Unit |

|

% |

| Boxes

Harvested: |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

Early and Mid-Season |

|

— |

|

|

— |

|

|

— |

|

|

— |

|

|

|

1,194 |

|

|

979 |

|

|

215 |

|

|

22.0 |

% |

|

Valencias |

|

843 |

|

|

415 |

|

|

428 |

|

|

103.1 |

% |

|

|

1,855 |

|

|

1,669 |

|

|

186 |

|

|

11.1 |

% |

|

Total Processed |

|

843 |

|

|

415 |

|

|

428 |

|

|

103.1 |

% |

|

|

3,049 |

|

|

2,648 |

|

|

401 |

|

|

15.1 |

% |

|

Fresh Fruit |

|

— |

|

|

1 |

|

|

(1 |

) |

|

(100.0 |

)% |

|

|

35 |

|

|

41 |

|

|

(6 |

) |

|

(14.6 |

)% |

|

Total |

|

843 |

|

|

416 |

|

|

427 |

|

|

102.6 |

% |

|

|

3,084 |

|

|

2,689 |

|

|

395 |

|

|

14.7 |

% |

| Pound Solids

Produced: |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

Early and Mid-Season |

|

— |

|

|

— |

|

|

— |

|

|

— |

|

|

|

5,364 |

|

|

4,586 |

|

|

778 |

|

|

17.0 |

% |

|

Valencias |

|

4,294 |

|

|

2,142 |

|

|

2,152 |

|

|

100.5 |

% |

|

|

9,365 |

|

|

8,702 |

|

|

663 |

|

|

7.6 |

% |

|

Total |

|

4,294 |

|

|

2,142 |

|

|

2,152 |

|

|

100.5 |

% |

|

|

14,729 |

|

|

13,288 |

|

|

1,441 |

|

|

10.8 |

% |

| Pound Solids per

Box: |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

Early and Mid-Season |

|

— |

|

|

— |

|

|

— |

|

|

— |

|

|

|

4.49 |

|

|

4.68 |

|

|

(0.19 |

) |

|

(4.0 |

)% |

|

Valencias |

|

5.09 |

|

|

5.16 |

|

|

(0.07 |

) |

|

(1.3 |

)% |

|

|

5.05 |

|

|

5.21 |

|

|

(0.16 |

) |

|

(3.1 |

)% |

| Price per Pound

Solids: |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

Early and Mid-Season |

$ |

— |

|

$ |

— |

|

$ |

— |

|

|

— |

|

|

$ |

2.71 |

|

$ |

2.61 |

|

$ |

0.10 |

|

|

3.8 |

% |

|

Valencias |

$ |

2.84 |

|

$ |

2.83 |

|

$ |

0.01 |

|

|

0.3 |

% |

|

$ |

2.87 |

|

$ |

2.76 |

|

$ |

0.11 |

|

|

4.1 |

% |

For the three and nine months ended

June 30, 2024, Alico Citrus harvested approximately 0.8

million and 3.1 million boxes of fruit, respectively, compared to

0.4 million and 2.7 million boxes of fruit in the same periods of

the prior fiscal year. The increase in boxes harvested was driven

by the timing of the harvest for the three months ended

June 30, 2024 and as a result of our production beginning to

recover to pre-hurricane levels during the nine months ended

June 30, 2024.

The Early and Mid-Season and Valencia harvests

are complete and for the nine months ended June 30, 2024 pound

solids produced were up 17.0% and 7.6%, respectively, while pound

solids per box were down 4.0% and 3.1%, respectively. Additionally,

we realized an increase in the price per pound solids of 3.8% and

4.1%, respectively, in the nine months ended June 30, 2024,

compared to the same period in the prior year, as a result of more

favorable pricing in one of our contracts with Tropicana.

Our average realized/blended price per pound

solids for the nine months ended June 30, 2024 increased 3.9%,

as compared to the same period of the prior year. As a result of

our signing of the new contract with Tropicana, the Company expects

that our prices per pound solid will increase more significantly

next year.

We expect it may take another season, or more,

for the groves to fully recover to pre-Hurricane Ian production

levels.

Land Management and Other Operations

Division Results

Land Management and Other Operations includes

lease income from grazing rights leases, hunting leases, a farm

lease, a lease to a third party of an aggregate mine, leases of oil

extraction rights to third parties, and other miscellaneous

income.

Land Management and Other Operations revenue for

the three and nine months ended June 30, 2024 decreased 34.8%

and 10.6%, respectively, as compared to the same period in the

prior year principally due to a decrease in hunting lease revenue

as a result of the sale of the ranch land.

The 19.2% decrease in operating expenses from

Land Management and Other Operations for the three months ended

June 30, 2024, as compared to the three months ended

June 30, 2023, was primarily due to a decrease in property

taxes related to land sales. The 15.3% increase in operating

expenses from Land Management and Other Operations for the nine

months ended June 30, 2024, as compared to the nine months

ended June 30, 2023, was primarily due to an increase in

mining permitting costs.

Management Comment

John Kiernan, President and Chief Executive

Officer, commented:

I wanted to thank our investors who checked in

over the weekend as Hurricane Debby approached the Florida

coastline. Alico, and my fellow employees, had a wet weekend, and

we expect rain to continue each day for the rest of the week, but

we did not sustain any damage from Debby. Our thoughts are with all

of our fellow Floridians who were impacted by this storm yesterday.

Alico had been through dozens of storms over the past century, and

we take every one seriously. Thank you again for your concern.

During the past quarter, Alico finished

harvesting the last fruit in our 2023-24 season. Fruit quality was

poor at the beginning of both our Early-Mid and Valencia crop

harvests but improved; however, the rate of fruit drop accelerated

during both harvests. Lower levels of production for the Early and

Mid-Season and Valencia harvests this season resulted in lower

levels of pounds solid being sold, which has led to a total

inventory write-down of $28.5 million in fiscal year 2024. We

believe that the Early and Mid-Season and Valencia box production

was affected by the continued impacts of Hurricane Ian. We managed

our costs aggressively over the past year, but the lower revenue

base was out of our control for the second year in a row.

We have several reasons to be more optimistic

about our production next season. First, since 2017 Alico has

planted 2.2 million trees, and nearly all of them are now producing

fruit. Second, Alico began treating its citrus trees in January

2023 with an OTC product via trunk injection as a citrus greening

therapy. In 2023, we were able to treat over 35% of our producing

trees with OTC and in 2024, we treated approximately 4.5 million

producing trees. Alico received $1.8 million of grant money from

the Florida Citrus Research and Field Trial Foundation in January

2024 that covered substantially all of the costs of the 2023-24

harvest season OTC applications, and $1.1 million was received in

June that will cover approximately 34% of the 2024-25 harvest

season OTC applications. Although the small crop harvested this

past season was not impressive, we believe that the continued

recovery from Hurricane Ian was the most significant factor

impacting fruit production and quality. We remain cautiously

optimistic that being another year removed from the hurricane,

along with the combination of a second round of injections for

previously treated trees and a first round of injections for trees

that were not treated in 2023, will show more significant

improvements, not just in yield, but also in reduced fruit drop. In

fact, in July it was reported that the Florida Department of

Agriculture and Consumer Services approved a label change for the

OTC product to remove the restriction that the product cannot be

applied more than two years in a row. This change will enable us to

apply the OTC treatment in calendar year 2025 to the trees that we

started treating in 2023, which would be a relief to Alico and the

Florida citrus industry overall. Third, as Alico’s production

recovers next season, we will sell our fruit at higher prices. As

we previously announced, the Company and Tropicana have extended

our relationship for another 3 years. With our new contract to

supply Tropicana with fruit, Alico will realize significantly

higher prices per pound solid, which better reflect current market

pricing, with price increases in the second and third years. This

new contract covers production on approximately 65% of our acres.

The remainder of our acres are covered by a contract with

Tropicana, which expires at the end of the 2024-25 season but which

also has higher pricing than the expiring contracts.

As the Atlantic hurricane season becomes more

active over the next few months, Alico is prepared and focused on

managing its world-class citrus operations, just as it has for more

than 125 years. One of our greatest competitive advantages, as we

face potential weather uncertainties, is our balance sheet

liquidity. Our relationships with our lenders remain strong and we

have approximately $94.8 million of undrawn capacity under a

combination of a revolving line of credit, which matures in

November 2029, and a working capital line of credit, which matures

in November 2025, to provide ample liquidity as our trees continue

to recover from Hurricane Ian. Our $70 million of term debt does

not amortize, and is not due for repayment until 2029. We have

steady access to workers and contractors, and our employee base is

stable.

Outside of our citrus operations, Alico

continues to invest resources as it evaluates the long-term highest

and best use of our real estate assets. To be clear, Alico will

continue to conduct our regular citrus operations at nearly all of

our groves for years to come. We will continue evaluating all of

our properties to explore creative solutions to enhance and extract

value. We seek to provide our investors with the benefits and

stability of a conventional agriculture investment, with the

optionality that comes with active land management. Last year,

after evaluating the direct hit it took from Hurricane Ian in 2022,

we made a difficult decision to transition our TRB grove in

Charlotte County from proprietary citrus operations to a mix of

third-party mining, vegetable and fruit crop leasing activities.

This year, we evaluated another grove and have decided to also move

beyond citrus there to realize its highest and best use. In 2022,

Alico entered into a Purchase Option Agreement (“Option Agreement”)

with a third party, E.R. Jahna Industries, Inc. (“Jahna”) for the

sale of approximately 899 acres of land at a price of approximately

$11,500 per acre on our 2x6 grove located in Hendry County,

Florida, which expires in January 2025. It is expected that this

Option Agreement will be exercised by the end of December 2024. It

is understood that Jahna plans to conduct sand mining operations on

the land once regulatory approval has been obtained, and Alico will

have the right to lease back most of these acres, including 340 net

citrus acres, for de minimis lease payments. In April 2024, we

entered into an agreement to sell another approximately 798 acres

of land at the 2x6 grove to a third party for approximately $7.2

million ($9,000 per acre), that includes an option to purchase

another 680 acres within ten months from the closing date of the

sale, at the same price per acre and Alico will continue to grow

citrus on those 680 acres for the next harvest season. This

previously announced transaction, which closed at the end of June

2024, illustrates our strategy of monetizing citrus groves on a

case by case basis to redeploy capital to generate better returns

for our shareholders.

In addition to our citrus operations, Alico has

been pursuing a diversified real estate strategy since early 2022,

which began with a comprehensive analysis of our land holdings

portfolio. That process encouraged us to begin the entitlement

process for our 4,500 acre grove in Collier County. In May, we

recruited Mitch Hutchcraft to lead our Real Estate activities to

accelerate the entitlement activities at Corkscrew, as well as

develop a comprehensive analysis of highest and best use for

remaining properties and create a roadmap to execute these

strategic initiatives. Alico is continuing to evaluate every acre

for its highest and best use, against its near-term potential for

continued cash flow generation from our existing agricultural

operations.

I am also pleased to announce that, as part of

our succession planning process, current board member Adam Putnam

has been selected to be appointed Chairman of the Board of Alico

following our next Annual General Meeting to be held in 2025. Adam

will succeed George Brokaw, who has served as Chairman since

February 2022 and as a Director since November 2013. George will

continue to serve Alico as a Director of the Company.

Adam has served on the Alico Board of Directors

since August 2020 and has extensive knowledge and experience in the

areas of agriculture, sustainability, government affairs, supply

chain, business leadership and finance. Adam has served as the

Chief Executive Officer of Ducks Unlimited, a U.S. nonprofit

organization dedicated to the conservation of wetlands and

associated upland habitats for waterfowl, other wildlife, and

people since April 2019. Prior to joining Ducks Unlimited, he

served as Florida’s Commissioner of Agriculture from 2011 until

2019, where he focused on fostering the growth of Florida

agriculture and protecting the state’s water supply, among other

issues, and was a U.S. Congressman for five terms, from 2001 until

2011, where he engaged on issues such as agriculture, water and

energy. He also was the House Republican Conference Chair from 2007

until 2009. With his public policy and public service experience,

Adam brings to the board expertise in understanding and navigating

the physical and transition risks and opportunities of climate

change, together with his knowledge of sustainability, water

supply, and agricultural operations within Florida’s regulatory

environment.

Other Corporate Financial

Information

General and administrative expense decreased

$0.5 million for the three months ended June 30, 2024,

compared to the three months ended June 30, 2023. The decrease

was primarily due to lower employee costs (as a result of lower

bonus accruals), lower depreciation, lower legal costs (as a result

of the voluntary dismissal of the shareholder lawsuit in the prior

year), and lower accounting and insurance costs.

General and administrative expense decreased

$0.1 million for the nine months ended June 30, 2024, compared

to the nine months ended June 30, 2023, primarily due to lower

depreciation, legal and insurance costs, partially offset by

increased employee costs.

Other Expense, net for the three months ended

June 30, 2024 increased $2.5 million, compared to the three

months ended June 30, 2023, driven by gains of $4.4 million on

the sale of 798 acres of citrus land during the quarter ended

June 30, 2024 compared to gains of $2.6 million on the sale of

548 acres of the Alico Ranch during the quarter ended June 30,

2023.

Other Expense, net for the nine months ended

June 30, 2024 increased $75.2 million, compared to the nine

months ended June 30, 2023, primarily due to the sale of

17,229 acres of the Alico Ranch to the State of Florida and the

sale of 798 acres of citrus land during the nine months ended

June 30, 2024. By comparison, for the nine months ended

June 30, 2023 we recognized gains on sale of property and

equipment of approximately $7.4 million relating to the sale of

1,436 acres, in the aggregate, from the Alico Ranch to several

third parties.

Dividend

On July 12, 2024, the Company paid a third

quarter cash dividend of $0.05 per share on its outstanding common

stock to stockholders of record as of June 28, 2024.

Balance Sheet and Liquidity

The Company continues to demonstrate financial

strength within its balance sheet, as highlighted below:

- The Company’s

working capital was $34.0 million at June 30, 2024,

representing a 2.67 to 1:00 ratio.

- The Company

maintains a solid debt to total assets ratio. At June 30, 2024

and September 30, 2023, the ratios were 0.20 to 1.00 and 0.30

to 1.00, respectively.

- Total debt was

$84.1 million and net debt was $74.9 million at June 30, 2024,

compared to $128.7 million and $127.6 million, respectively, at

September 30, 2023.

- Available

borrowings under the Company’s lines of credit were approximately

$94.8 million at June 30, 2024.

About Alico

Alico, Inc. primarily operates two divisions:

Alico Citrus, one of the nation’s largest citrus producers, and

Land Management and Other Operations, which includes land leasing

and related support operations. Learn more about Alico (Nasdaq:

“ALCO”) at www.alicoinc.com.

Forward-Looking Statements

This press release contains forward-looking

statements within the meaning of Section 27A of the Securities Act

of 1933, as amended, and Section 21E of the Securities Exchange Act

of 1934, as amended. Forward-looking statements include, but are

not limited to, statements regarding our expectations regarding

prices in the 2024/2025 harvest season; the impact of Hurricane Ian

on our results; expectations regarding the closing of certain

agreements to sell land; expectations regarding entry into future

contracts; the impact of the OTC injections; expectations related

to our succession plans; expectations regarding our liquidity,

business strategy, plans and objectives of management for future

operations or any other statements relating to our future

activities or other future events or conditions. These statements

are based on our current expectations, estimates and projections

about our business based, in part, on assumptions made by our

management and can be identified by terms such as “will,” “should,”

“expects,” “plans,” ,”hopes,” “anticipates,” “could,” “intends,”

“targets,” “projects,” “contemplates,” “believes,” “estimates,”

“forecasts,” “predicts,” “potential” or “continue” or the negative

of these terms or other similar expressions.

These forward-looking statements are not

guarantees of future performance and involve risks, uncertainties

and assumptions that are difficult to predict. Therefore, actual

outcomes and results may differ materially from what is expressed

or forecasted in the forward-looking statements due to numerous

factors, including, but not limited to: adverse weather conditions,

natural disasters and other natural conditions, including the

effects of climate change and hurricanes and tropical storms,

particularly because our citrus groves are geographically

concentrated in Florida; damage and loss from disease including,

but not limited to, citrus greening and citrus canker; any adverse

event affecting our citrus business; our ability to effectively

perform grove management services, or to effectively manage an

expanded portfolio of groves; our dependency on our relationship

with Tropicana and Tropicana’s relationship with certain third

parties for a significant portion of our business; our ability to

execute our strategic growth initiatives and whether they

adequately address the challenges or opportunities we face; product

contamination and product liability claims; water use regulations

restricting our access to water; changes in immigration laws; harm

to our reputation; tax risks associated with a Section 1031

Exchange; risks associated with the undertaking of one or more

significant corporate transactions; the seasonality of our citrus

business; fluctuations in our earnings due to market supply and

prices and demand for our products; climate change, or legal,

regulatory, or market measures to address climate change; ESG

issues, including those related to climate change and

sustainability; increases in labor, personnel and benefits costs;

increases in commodity or raw product costs, such as fuel and

chemical costs; transportation risks; any change or the

classification or valuation methods employed by county property

appraisers related to our real estate taxes; liability for the use

of fertilizers, pesticides, herbicides and other potentially

hazardous substances; compliance with applicable environmental

laws; loss of key employees; material weaknesses and other control

deficiencies relating to our internal control over financial

reporting ; macroeconomic conditions, such as rising inflation and

the deadly conflicts in Ukraine and Israel; system security risks,

data protection breaches, cyber-attacks and systems integration

issues; our indebtedness and ability to generate sufficient cash

flow to service our debt obligations; higher interest expenses as a

result of variable rates of interest for our debt; our ability to

continue to pay cash dividends; and the other factors described

under the sections "Risk Factors" and "Management's Discussion and

Analysis of Financial Condition and Results of Operations" in our

Annual Report on Form 10-K for the fiscal year ended September 30,

2023 filed with the Securities and Exchange Commission (the “SEC”)

on December 6, 2023, and in our Quarterly Reports on Form 10-Q

filed with the SEC. Except as required by law, we do not undertake

an obligation to publicly update or revise any forward-looking

statement, whether as a result of new information, future

developments, or otherwise.

This press release also contains financial

projections that are necessarily based upon a variety of estimates

and assumptions which may not be realized and are inherently

subject, in addition to the risks identified in the forward-looking

statement disclaimer, to business, economic, competitive, industry,

regulatory, market and financial uncertainties, many of which are

beyond the Company’s control. There can be no assurance that the

assumptions made in preparing the financial projections will prove

accurate. Accordingly, actual results may differ materially from

the financial projections.

Investor Contact:Investor Relations(239)

226-2060InvestorRelations@alicoinc.com

Brad HeineChief Financial Officer(239)

226-2000bheine@alicoinc.com

|

ALICO, INC.CONDENSED CONSOLIDATED BALANCE

SHEETS(in thousands, except share

amounts) |

| |

| |

June 30,2024 |

|

September 30,2023 |

| |

(Unaudited) |

|

|

|

ASSETS |

|

|

|

| Current

assets: |

|

|

|

|

Cash and cash equivalents |

$ |

9,106 |

|

|

$ |

1,062 |

|

|

Accounts receivable, net |

|

4,512 |

|

|

|

712 |

|

|

Inventories |

|

35,998 |

|

|

|

52,481 |

|

|

Income tax receivable |

|

— |

|

|

|

1,200 |

|

|

Assets held for sale |

|

3,106 |

|

|

|

1,632 |

|

|

Prepaid expenses and other current assets |

|

1,642 |

|

|

|

1,718 |

|

|

Total current assets |

|

54,364 |

|

|

|

58,805 |

|

| Restricted cash |

|

— |

|

|

|

2,630 |

|

| Property and equipment,

net |

|

355,255 |

|

|

|

361,849 |

|

| Goodwill |

|

2,246 |

|

|

|

2,246 |

|

| Other non-current assets |

|

2,737 |

|

|

|

2,823 |

|

|

Total assets |

$ |

414,602 |

|

|

$ |

428,353 |

|

| |

|

|

|

|

LIABILITIES AND STOCKHOLDERS’ EQUITY |

|

|

|

| Current

liabilities: |

|

|

|

|

Accounts payable |

$ |

6,632 |

|

|

$ |

6,311 |

|

|

Accrued liabilities |

|

4,618 |

|

|

|

5,363 |

|

|

Current portion of long-term debt |

|

1,410 |

|

|

|

2,566 |

|

|

Income tax payable |

|

7,171 |

|

|

|

— |

|

|

Other current liabilities |

|

527 |

|

|

|

825 |

|

|

Total current liabilities |

|

20,358 |

|

|

|

15,065 |

|

| Long-term debt, net |

|

82,642 |

|

|

|

101,410 |

|

| Lines of credit |

|

— |

|

|

|

24,722 |

|

| Deferred income tax

liabilities, net |

|

36,868 |

|

|

|

36,410 |

|

| Other liabilities |

|

442 |

|

|

|

369 |

|

|

Total liabilities |

|

140,310 |

|

|

|

177,976 |

|

| |

|

|

|

| Stockholders’

equity: |

|

|

|

|

Preferred stock, no par value, 1,000,000 shares authorized; none

issued |

|

— |

|

|

|

— |

|

|

Common stock, $1.00 par value, 15,000,000 shares authorized;

8,416,145 shares issued and 7,624,185 and 7,610,551 shares

outstanding at June 30, 2024 and September 30, 2023,

respectively |

|

8,416 |

|

|

|

8,416 |

|

|

Additional paid in capital |

|

20,153 |

|

|

|

20,045 |

|

|

Treasury stock, at cost, 791,960 and 806,341 shares held at

June 30, 2024 and September 30, 2023, respectively |

|

(26,838 |

) |

|

|

(27,274 |

) |

|

Retained earnings |

|

267,758 |

|

|

|

243,804 |

|

|

Total Alico stockholders’ equity |

|

269,489 |

|

|

|

244,991 |

|

|

Noncontrolling interest |

|

4,803 |

|

|

|

5,386 |

|

|

Total stockholders’ equity |

|

274,292 |

|

|

|

250,377 |

|

|

Total liabilities and stockholders’ equity |

$ |

414,602 |

|

|

$ |

428,353 |

|

|

ALICO, INC.CONDENSED CONSOLIDATED

STATEMENTS OF OPERATIONS (UNAUDITED)(in thousands,

except per share amounts) |

| |

| |

Three Months EndedJune 30, |

|

Nine Months EndedJune 30, |

|

|

|

2024 |

|

|

|

2023 |

|

|

|

2024 |

|

|

|

2023 |

|

| Operating

revenues: |

|

|

|

|

|

|

|

|

Alico Citrus |

$ |

13,237 |

|

|

$ |

6,712 |

|

|

$ |

44,591 |

|

|

$ |

37,917 |

|

|

Land Management and Other Operations |

|

373 |

|

|

|

572 |

|

|

|

1,117 |

|

|

|

1,249 |

|

|

Total operating revenues |

|

13,610 |

|

|

|

7,284 |

|

|

|

45,708 |

|

|

|

39,166 |

|

| Operating

expenses: |

|

|

|

|

|

|

|

|

Alico Citrus |

|

17,813 |

|

|

|

(8,322 |

) |

|

|

82,062 |

|

|

|

33,493 |

|

|

Land Management and Other Operations |

|

84 |

|

|

|

104 |

|

|

|

346 |

|

|

|

300 |

|

|

Total operating expenses |

|

17,897 |

|

|

|

(8,218 |

) |

|

|

82,408 |

|

|

|

33,793 |

|

| Gross (loss)

profit |

|

(4,287 |

) |

|

|

15,502 |

|

|

|

(36,700 |

) |

|

|

5,373 |

|

| General and administrative

expenses |

|

2,441 |

|

|

|

2,930 |

|

|

|

8,034 |

|

|

|

8,106 |

|

| (Loss) income from

operations |

|

(6,728 |

) |

|

|

12,572 |

|

|

|

(44,734 |

) |

|

|

(2,733 |

) |

| Other expense,

net: |

|

|

|

|

|

|

|

|

Interest income |

|

95 |

|

|

|

— |

|

|

|

345 |

|

|

|

— |

|

|

Interest expense |

|

(628 |

) |

|

|

(1,196 |

) |

|

|

(2,896 |

) |

|

|

(3,618 |

) |

|

Gain on property and equipment |

|

4,491 |

|

|

|

2,605 |

|

|

|

81,520 |

|

|

|

7,368 |

|

|

Other income, net |

|

— |

|

|

|

14 |

|

|

|

— |

|

|

|

44 |

|

| Total other expense, net |

|

3,958 |

|

|

|

1,423 |

|

|

|

78,969 |

|

|

|

3,794 |

|

| (Loss) income before income

taxes |

|

(2,770 |

) |

|

|

13,995 |

|

|

|

34,235 |

|

|

|

1,061 |

|

| Income tax (benefit)

provision |

|

(861 |

) |

|

|

1,923 |

|

|

|

9,721 |

|

|

|

306 |

|

| Net (loss)

income |

|

(1,909 |

) |

|

|

12,072 |

|

|

|

24,514 |

|

|

|

755 |

|

| Net (loss) income attributable to

noncontrolling interests |

|

(135 |

) |

|

|

(240 |

) |

|

|

583 |

|

|

|

140 |

|

| Net (loss) income attributable to

Alico, Inc. common stockholders |

$ |

(2,044 |

) |

|

$ |

11,832 |

|

|

$ |

25,097 |

|

|

$ |

895 |

|

| Per share information

attributable to Alico, Inc. common stockholders: |

|

|

|

|

|

|

|

| Earnings per common

share: |

|

|

|

|

|

|

|

|

Basic |

$ |

(0.27 |

) |

|

$ |

1.56 |

|

|

$ |

3.29 |

|

|

$ |

0.12 |

|

|

Diluted |

$ |

(0.27 |

) |

|

$ |

1.56 |

|

|

$ |

3.29 |

|

|

$ |

0.12 |

|

| Weighted-average number

of common shares outstanding: |

|

|

|

|

|

|

|

|

Basic |

|

7,624 |

|

|

|

7,605 |

|

|

|

7,620 |

|

|

|

7,599 |

|

|

Diluted |

|

7,624 |

|

|

|

7,605 |

|

|

|

7,620 |

|

|

|

7,599 |

|

| |

|

|

|

|

|

|

|

| Cash dividends declared

per common share |

$ |

0.05 |

|

|

$ |

0.05 |

|

|

$ |

0.15 |

|

|

$ |

0.15 |

|

|

ALICO, INC.CONDENSED CONSOLIDATED

STATEMENTS OF CASH FLOWS (UNAUDITED)(in

thousands) |

| |

| |

Nine Months EndedJune 30, |

|

|

|

2024 |

|

|

|

2023 |

|

| Net cash (used in)

operating activities |

|

|

|

|

Net income |

$ |

24,514 |

|

|

$ |

755 |

|

|

Adjustments to reconcile net income to net cash used in operating

activities: |

|

|

|

|

Depreciation, depletion and amortization |

|

11,317 |

|

|

|

11,685 |

|

|

Amortization of debt issue costs |

|

176 |

|

|

|

106 |

|

|

Gain on sale of property and equipment |

|

(81,520 |

) |

|

|

(7,368 |

) |

|

Loss on disposal of long-lived assets |

|

6,213 |

|

|

|

5,535 |

|

|

Inventory net realizable value adjustment |

|

28,549 |

|

|

|

1,616 |

|

|

Deferred income tax provision |

|

458 |

|

|

|

166 |

|

|

Stock-based compensation expense |

|

544 |

|

|

|

731 |

|

|

Other |

|

55 |

|

|

|

(4 |

) |

|

Changes in operating assets and liabilities: |

|

|

|

|

Accounts receivable |

|

(3,800 |

) |

|

|

(4,039 |

) |

|

Inventories |

|

(12,624 |

) |

|

|

(12,767 |

) |

|

Prepaid expenses |

|

76 |

|

|

|

(307 |

) |

|

Income tax receivable |

|

1,200 |

|

|

|

70 |

|

|

Other assets |

|

(46 |

) |

|

|

315 |

|

|

Accounts payable and accrued liabilities |

|

(843 |

) |

|

|

3,355 |

|

|

Income taxes payable |

|

7,171 |

|

|

|

— |

|

|

Other liabilities |

|

(160 |

) |

|

|

(467 |

) |

|

Net cash (used in) operating activities |

|

(18,720 |

) |

|

|

(618 |

) |

| |

|

|

|

| Cash flows from investing

activities: |

|

|

|

|

Purchases of property and equipment |

|

(15,931 |

) |

|

|

(12,923 |

) |

|

Acquisition of citrus groves |

|

— |

|

|

|

(77 |

) |

|

Net proceeds from sale of property and equipment |

|

86,394 |

|

|

|

7,583 |

|

|

Notes receivable |

|

— |

|

|

|

(570 |

) |

|

Change in deposits on purchase of citrus trees |

|

(375 |

) |

|

|

269 |

|

|

Net cash provided by (used in) investing activities |

|

70,088 |

|

|

|

(5,718 |

) |

| |

|

|

|

| Cash flows from financing

activities: |

|

|

|

|

Repayments on revolving lines of credit |

|

(44,032 |

) |

|

|

(51,953 |

) |

|

Borrowings on revolving lines of credit |

|

19,310 |

|

|

|

64,935 |

|

|

Principal payments on term loans |

|

(20,089 |

) |

|

|

(1,807 |

) |

|

Capital contribution received from noncontrolling interest |

|

— |

|

|

|

441 |

|

|

Dividends paid |

|

(1,143 |

) |

|

|

(4,553 |

) |

|

Net cash (used in) provided by financing activities |

|

(45,954 |

) |

|

|

7,063 |

|

| |

|

|

|

| Net increase in cash and

restricted cash |

|

5,414 |

|

|

|

727 |

|

| Cash and cash equivalents and

restricted cash at beginning of the period |

|

3,692 |

|

|

|

865 |

|

| |

|

|

|

|

Cash and cash equivalents at end of the

period |

$ |

9,106 |

|

|

$ |

1,592 |

|

| |

|

|

|

| Non-cash investing

activities: |

|

|

|

|

Assets received in exchange for services |

$ |

85 |

|

|

$ |

— |

|

|

Trees delivered in exchange for prior tree deposits |

$ |

377 |

|

|

$ |

— |

|

Non-GAAP Financial Measures

In addition to the measurements prepared in

accordance with accounting principles generally accepted in the

United States (“U.S. GAAP”), Alico utilizes EBITDA, Adjusted

EBITDA, and Net Debt, which are non-GAAP financial measures within

the meaning of Regulation G and Item 10(e) of Regulation S-K, to

evaluate the performance of its business. Due to significant

depreciable assets associated with the nature of our operations

and, to a lesser extent, interest costs associated with our capital

structure, management believes that EBITDA, Adjusted EBITDA, and

Net Debt are important measures to evaluate our results of

operations between periods on a more comparable basis and to help

investors analyze underlying trends in our business, evaluate the

performance of our business both on an absolute basis and relative

to our peers and the broader market, provide useful information to

both management and investors by excluding certain items that may

not be indicative of our core operating results and operational

strength of our business and help investors evaluate our ability to

service our debt. Such measurements are not prepared in accordance

with U.S. GAAP and should not be construed as an alternative to

reported results determined in accordance with U.S. GAAP. The

non-GAAP information provided is unique to Alico and may not be

consistent with methodologies used by other companies. EBITDA is

defined as net income before interest expense, provision for income

taxes, depreciation, depletion and amortization. Adjusted EBITDA is

defined as net income before interest expense, provision for income

taxes, depreciation, depletion and amortization and adjustments for

non-recurring transactions or transactions that are not indicative

of our core operating results, such as gains or losses on sales of

real estate, property and equipment and assets held for sale. Net

Debt is defined as Current portion of long-term debt, Long-term

debt, net and Lines of credit, less cash. The Company is not able

to provide a quantitative reconciliation of its full-year 2024

guidance as to Net Debt to Current portion of long-term debt, the

most directly comparable GAAP measure, and has not provided

forward-looking guidance for Current portion of long-term debt

because of the uncertainty around certain items that may impact

Current portion of long-term debt that are not within our control

or cannot be reasonably predicted without unreasonable effort.

EBITDA and Adjusted EBITDA

| (in

thousands) |

(Unaudited) |

|

(Unaudited) |

| |

Three Months EndedJune 30, |

|

Nine Months EndedJune 30, |

|

|

|

2024 |

|

|

|

2023 |

|

|

|

2024 |

|

|

|

2023 |

|

| Net (loss) income attributable

to Alico, Inc. common stockholders |

$ |

(2,044 |

) |

|

$ |

11,832 |

|

|

$ |

25,097 |

|

|

$ |

895 |

|

|

Interest expense, net |

|

533 |

|

|

|

1,196 |

|

|

|

2,551 |

|

|

|

3,618 |

|

|

Income tax (benefit) provision |

|

(861 |

) |

|

|

1,923 |

|

|

|

9,721 |

|

|

|

306 |

|

|

Depreciation, depletion and amortization |

|

3,715 |

|

|

|

3,838 |

|

|

|

11,317 |

|

|

|

11,685 |

|

| EBITDA |

|

1,343 |

|

|

|

18,789 |

|

|

|

48,686 |

|

|

|

16,504 |

|

| Non-GAAP Adjustments: |

|

|

|

|

|

|

|

|

Inventory net realizable value adjustment |

|

— |

|

|

|

— |

|

|

|

28,549 |

|

|

|

1,616 |

|

|

Employee stock compensation expense (1) |

|

57 |

|

|

|

61 |

|

|

|

169 |

|

|

|

281 |

|

|

Federal relief - Hurricane Irma |

|

— |

|

|

|

(49 |

) |

|

|

— |

|

|

|

(1,315 |

) |

|

Insurance proceeds - Hurricane Ian |

|

(299 |

) |

|

|

(17,482 |

) |

|

|

(299 |

) |

|

|

(22,241 |

) |

|

Gain on sale of property and equipment |

|

(4,491 |

) |

|

|

(2,605 |

) |

|

|

(81,520 |

) |

|

|

(7,368 |

) |

| Adjusted EBITDA |

$ |

(3,390 |

) |

|

$ |

(1,286 |

) |

|

$ |

(4,415 |

) |

|

$ |

(12,523 |

) |

| |

|

|

|

|

|

|

|

| (1) Includes stock

compensation expense for current executives, senior management and

other employees. |

Net Debt

| (in thousands) |

(Unaudited) |

|

(Unaudited) |

| |

June 30,2024 |

|

September 30,2023 |

|

Current portion of long-term debt |

$ |

1,410 |

|

|

$ |

2,566 |

|

| Long-term debt, net |

|

82,642 |

|

|

|

101,410 |

|

| Lines of credit |

|

— |

|

|

|

24,722 |

|

| Total Debt |

|

84,052 |

|

|

|

128,698 |

|

| Less: Cash |

|

(9,106 |

) |

|

|

(1,062 |

) |

| Net Debt |

$ |

74,946 |

|

|

$ |

127,636 |

|

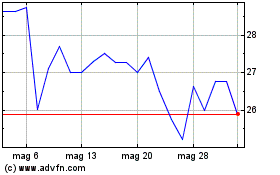

Grafico Azioni Alico (NASDAQ:ALCO)

Storico

Da Gen 2025 a Feb 2025

Grafico Azioni Alico (NASDAQ:ALCO)

Storico

Da Feb 2024 a Feb 2025