HOD HASHARON, Israel, May 9 /PRNewswire-FirstCall/ -- Allot

Communications Ltd. (NASDAQ:ALLT), a leader in IP service

optimization solutions based on deep packet inspection (DPI)

technology, today announced financial results for the first quarter

ended March 31, 2007. Revenues for the first quarter of 2007

totaled $8.3 million, a 9% increase from the $7.6 million of

revenues reported in the first quarter of 2006. On a GAAP basis,

net loss for the first quarter of 2007 was $434 thousand, or $0.02

per share, as compared with net income of $5 thousand, or $0.00 per

share, in the first quarter of 2006. Included in the GAAP net

income is the impact of share-based compensation expense. On a

pro-forma, non-GAAP basis, excluding the impact of share-based

compensation expense in both periods, non-GAAP net loss for the

first quarter of 2007 totaled $112 thousand, or $0.00 per share, as

compared with a non-GAAP net profit of $87 thousand, or $0.01 per

diluted share, for the first quarter of 2006. These non-GAAP

measures should be considered in addition to, and not as a

substitute for, comparable GAAP measures. A full reconciliation

between GAAP and non-GAAP measures is provided in the accompanying

Table 3. "As we previously reported, revenues for the first quarter

were below our expectation," stated Rami Hadar, Allot

Communications' President and Chief Executive Officer. "This

weakness was due primarily to a slowdown in sales through some of

our distribution channels, principally in the Americas, which are

focused on sales to enterprise, education and smaller ISPs.

However, we were pleased with the success Allot had during the

quarter in terms of securing larger scale DPI projects within a

variety of customer verticals and geographic regions. We are

encouraged by our continued progress in the Tier 1 and Tier 2

service provider accounts worldwide, which is our strategic

objective. Our larger customers this quarter included 5 large

service providers in Asia, EMEA and Latin America, two mobile

operators and one incumbent telecom operator in Asia, and several

government accounts in EMEA and Latin America. "Our high-end

carrier class NetEnforcer products continue to address the needs of

service providers looking to introduce intelligent IP service

optimization solutions to improve their network efficiency,

minimize operating costs and increase levels of customer

satisfaction. In addition, our next generation 20 GB/s platform,

which is tailored to meet the scalability and multi-Gigabit

throughput needs of the Tier 1 carrier market, remains on track,"

concluded Mr. Hadar. As of March 31, 2007, Allot's cash and cash

equivalents, including short and long-term deposits and investments

in marketable securities, totaled $80.5 million. Financial Guidance

The Company reaffirms its previous guidance for the year 2007, and

anticipates that net revenues will total approximately $40 million.

Conference Call & Webcast The Company's management team plans

to host a live conference call and webcast today at 8:30 AM EDT to

discuss the financial results as well as management's outlook for

the business. To access the conference call, please dial one of the

following numbers: US: 1-866-966-9446, International:

+44-1452-567-098, Israel: 1-809-213-849. A replay of the conference

call will be available from 12:01 am EDT on May 10, 2007 through

May 16, 2007, at 11:59 pm EDT. To access the replay, please dial:

US: 1-866-247-4222, International: +44- 1452-55-0000. Access code

for both: 6819658#. A live webcast of the conference call can be

accessed on the Allot Communications website at

http://www.allot.com/. The webcast will also be archived on our

website following the conference call. About Allot Communications

Allot Communications Ltd. (NASDAQ:ALLT) is a leading provider of

intelligent IP service optimization solutions. Designed for

carriers, service providers and enterprises, Allot solutions apply

deep packet inspection (DPI) technology to transform broadband

pipes into smart networks. This creates the visibility and control

vital to manage applications, services and subscribers, guarantee

quality of service (QoS), contain operating costs and maximize

revenue. Allot believes in listening to customers and provides them

access to its global network of visionaries, innovators and support

engineers. For more information, please visit

http://www.allot.com/. Safe Harbor Statement Information provided

in this press release contains statements relating to current

expectations, estimates, forecasts and projections about future

financial performance, timing of product introductions and events

that are "forward-looking statements" as defined in the Private

Securities Litigation Reform Act of 1995. These forward-looking

statements generally relate to our plans, objectives and

expectations for future operations and are based upon management's

current estimates and projections of future results or trends.

Actual future results may differ materially from those which may be

expressed or implied by the forward-looking statements that we make

as a result of certain risks and uncertainties, including, among

others, changes in general economic and business conditions and

specifically, a decline in demand for our products, our inability

to timely develop and introduce new technologies, products and

applications and loss of market. These factors include, but are not

limited to, our inability to successfully defend ourselves against

certain complaints filed against us and certain of our directors

and officers in the United States District Court for the Southern

District of New York, as well as risks discussed under the heading

"Risk Factors" in our final prospectus for our IPO filed with the

Securities and Exchange Commission on November 16, 2006 and other

filings with the Securities and Exchange Commission. These

forward-looking statements are made only as of the date hereof, and

we undertake no obligation to update or revise the forward-looking

statements, whether as a result of new information, future events

or otherwise. This press release also is available at our Web site.

TABLE - 1 ALLOT COMMUNICATIONS LTD. AND ITS SUBSIDIARIES

CONSOLIDATED STATEMENTS OF OPERATIONS (U.S. dollars in thousands,

except share and per share data) Three Months Ended March 31, 2007

2006 (unaudited) Revenues $8,276 $7,571 Cost of revenues 1,974

1,700 Gross profit 6,302 5,871 Operating expenses: Research and

development costs, net 2,453 1,882 Sales and marketing 4,194 3,493

General and administrative 1,043 609 Total operating expenses 7,690

5,984 Operating loss (1,388) (113) Financial and other income, net

957 121 Income (loss) before income tax expenses (431) 8 Income tax

expenses 3 3 Net income (loss) (434) 5 Basic net earnings (loss)

per share $(0.02) $0.00 Diluted net earnings (loss) per share

$(0.02) $0.00 Weighted average number of shares used in computing

basic net earnings (loss) per share 21,009,705 12,783,114 Weighted

average number of shares used in computing diluted net earnings

(loss) per share 23,467,686 14,298,882 TABLE - 2 ALLOT

COMMUNICATIONS LTD. AND ITS SUBSIDIARIES CONSOLIDATED BALANCE

SHEETS (U.S. dollars in thousands) March 31, December 31, 2007 2006

(unaudited) ASSETS CURRENT ASSETS: Cash and cash equivalents $9,081

$7,117 Marketable securities and short term deposit 67,404 70,423

Trade receivables 6,409 5,856 Other receivables and prepaid

expenses 2,800 1,961 Inventories 4,058 3,337 Total current assets

81,754 88,694 LONG-TERM ASSETS: Marketable securities 4,001 5,750

Severance pay fund 2,851 2,648 Other assets 1,017 1,054 Total

long-term assets 15,867 9,452 PROPERTY AND EQUIPMENT, NET 3,681

2,939 GOODWILL 125 99 Total assets $101,427 $101,184 LIABILITIES

AND SHAREHOLDERS' EQUITY CURRENT LIABILITIES: Short-term bank

credit and current maturities, net $0 $6 Trade payables 4,219 4,415

Deferred revenues 4,303 3,788 Other payables and accrued expenses

4,405 4,833 Total current liabilities 12,927 13,042 LONG-TERM

LIABILITIES: Deferred revenues 1,671 1,578 Accrued severance pay

2,719 2,377 Total long-term liabilities 4,390 3,955 SHAREHOLDERS'

EQUITY 84,110 84,187 Total liabilities and shareholders' equity

$101,427 $101,184 TABLE - 3 ALLOT COMMUNICATIONS LTD. AND ITS

SUBSIDIARIES RECONCILIATION OF GAAP AND NON-GAAP CONSOLIDATED

STATEMENTS OF OPERATIONS (U.S. dollars in thousands, except per

share data) Three months ended Three months ended March 31, 2007

March 31, 2006 GAAP Adjust- GAAP Adjust- Reported ments* Non-GAAP

Reported ments* Non-GAAP Gross profit 6,302 (11) 6,313 5,871 -

5,871 Total operating expenses 7,690 (311) 7,379 5,984 (82) 5,902

Operating income (loss) (1,388) 322 (1,066) (113) 82 (31) Income

(loss) before income tax expenses (benefit) (431) 322 (109) 8 8 Net

income (434) 322 (112) 5 82 87 Basic net earnings (loss) per share

$(0.02) $0.02 $0.00 $0.00 $0.01 $0.01 Diluted net earnings (loss)

per share $(0.02) $0.02 $0.00 $0.00 $0.01 $0.01 (*) Adjustment

excludes the expenses recorded for stock-based compensation of

which: $11,000, $50,000, $119,000 and $142,000 resulted from cost

of revenue, research and development expenses, sales and marketing

expenses and general and administrative expenses, respectively.

DATASOURCE: Allot Communications Ltd. CONTACT: Jay Kalish,

Executive Director Investor Relations of Allot Communications Ltd.,

International access code +972-9-761-9365, Web site:

http://www.allot.com/

Copyright

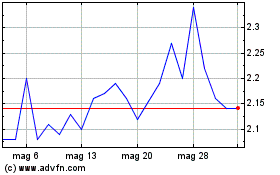

Grafico Azioni Allot (NASDAQ:ALLT)

Storico

Da Giu 2024 a Lug 2024

Grafico Azioni Allot (NASDAQ:ALLT)

Storico

Da Lug 2023 a Lug 2024