Artesian Resources Corporation (Nasdaq: ARTNA), a leading provider

of water and wastewater services, and related services, on the

Delmarva Peninsula, today announced earnings results for the fourth

quarter and year ended December 31, 2023.

Year End Results

Net income was $16.7 million, a $1.3 million, or

7.2%, decrease compared to net income recorded during the twelve

months ended December 31, 2022. Diluted net income per share

decreased to $1.67, compared to $1.90 for the same period in

2022.

Revenues totaled $98.9 million for both the year

ended December 31, 2023 and December 31, 2022, respectively:

Water sales revenue

increased $1.7 million, or 2.2%, primarily related to a temporary

net rate increase of 7.50% of gross water sales placed into effect

on November 28, 2023, as permitted under Delaware law, until

permanent rates are determined by the Delaware Public Service

Commission, or DEPSC, and an increase in overall water consumption.

In addition, fixed fee revenue increased as a result of additional

customers.

Other utility

operating revenue increased approximately $0.7 million, or 6.0%.

This increase is primarily due to an increase in wastewater revenue

associated with customer growth and an increase in fee revenue

related to inspection, service and finance charges.

Non-utility operating

revenue decreased approximately $2.4 million, or 26.9%. This

decrease is primarily due to a decrease in contract service revenue

related to a contract for the design and construction of wastewater

infrastructure now nearing completion, partially offset by an

increase in Service Line Protection Plan, or SLP Plan, revenue.

Operating expenses, excluding depreciation and

amortization and income taxes, increased $0.2 million, or 0.4%.

Utility operating

expenses increased $2.4 million, or 5.6%, primarily the result of

increases in employee benefits and payroll costs, computer system

maintenance costs, and supply and treatment costs for our water and

wastewater systems. These increases are partially

offset by a decrease in purchased water under a new contract,

effective January 2022, in which the minimum amount of water

required to be purchased was reduced.

Non-utility operating

expenses decreased $2.4 million, or 35.4%, primarily due to a

decrease in costs associated with a wastewater infrastructure

design and construction contract.

Property and other

taxes increased $0.2 million, or 3.9%, primarily due to an increase

in utility plant subject to taxation and an increase in payroll

taxes, related to increased payroll related expenses. Property

taxes are assessed on land, buildings and certain utility plant,

which include the footage and size of pipe, hydrants and wells.

Depreciation and amortization expense increased

$0.7 million, or 5.7%, primarily due to continued investment in

utility plant providing supply, treatment, storage and distribution

of water to customers and service to our wastewater customers.

Federal and state income tax expense increased

$0.5 million, or 8.0%, primarily due to adjustments related to the

application of state net operating loss valuation allowances and

stock options exercised in 2022, partially offset by lower pre-tax

income in 2023 compared to 2022.

Other income increased $0.8 million, primarily

due to a $0.7 million increase in allowance for funds used during

construction, or AFUDC, as a result of higher long-term

construction activity subject to AFUDC. Miscellaneous income

increased $0.1 million primarily related to an increase in the

annual patronage refund from CoBank, ACB. The primary refund

calculation for both 2023 and 2022 was based on the average loan

balance outstanding.

Long-term debt interest increased $0.5 million,

primarily related to an increase in long-term debt interest

associated with the Series W First Mortgage Bond issued on April

29, 2022. Short-term debt interest increased $0.1 million,

primarily related to higher interest rates.

“In April 2023 we filed a request for an

increase in water rates in our Delaware operations. We requested a

$16.7 million increase in annual revenue, which is necessary to

recover increased operating costs and significant investments made

to ensure water quality and resiliency, including upgrades of our

treatment equipment and facilities, new elevated water storage,

replacement of aging water mains, and investments in information

technology. We began charging temporary rates on November 28, 2023,

as permitted by the Delaware Public Service Commission, while the

full request is under examination. We are now beginning to see

recovery of some of these investments and increased expenses,” said

Dian C. Taylor, CEO.

Fourth Quarter Results

Net income was $3.5 million for the three months

ended December 31, 2023, a $1.2 million, or 49.7%, increase

compared to net income recorded during the three months ended

December 31, 2022. Diluted net income per share increased to $0.34

compared to $0.24 for the same period in 2022.

Revenues totaled $24.5 million, a decrease of

$0.6 million, or 2.3%, compared to revenues recorded for the same

period in 2022.

Water sales revenue

increased $1.0 million, or 5.3%, primarily related to a temporary

net rate increase of 7.50% of gross water sales placed into effect

on November 28, 2023, as permitted under Delaware law, until

permanent rates are determined by the DEPSC, and an increase in

overall water consumption. In addition, fixed fee revenue increased

as a result of additional customers.

Other utility

operating revenue decreased approximately $0.1 million, or 3.5%,

primarily due to decreased operating subsidies from developers and

the timing of industrial wastewater revenue, partially offset by an

increase in wastewater revenue associated with additional customers

served.

Non-utility operating

revenue decreased approximately $1.5 million, or 46.1%, primarily

due to a decrease in contract service revenue related to a contract

for the design and construction of wastewater infrastructure now

nearing completion, partially offset by an increase in SLP Plan

revenue.

Operating expenses, excluding depreciation and

amortization and income taxes, decreased $2.3 million, or

13.9%.

Utility operating

expenses decreased $1.1 million, or 8.3%, primarily the result of

an overall decrease in payroll and employee benefits costs and

water treatment costs.

Non-utility operating

expenses decreased $1.3 million, or 54.8%, primarily due to a

decrease in costs associated with a wastewater infrastructure

design and construction contract.

Property and other

taxes increased $0.1 million, or 4.6%, primarily due to an increase

in utility plant subject to taxation and an increase in payroll

taxes, related to increased payroll related expenses. Property

taxes are assessed on land, buildings and certain utility plant,

which include the footage and size of pipe, hydrants and wells.

Depreciation and amortization expense increased

$0.2 million, or 5.6%, primarily due to continued investment in

utility plant providing supply, treatment, storage and distribution

of water customers and service to our wastewater customers.

Federal and state income tax expense increased

$0.3 million, or 32.4%, primarily due to higher pre-tax income in

2023 compared to 2022.

Other income decreased $0.2 million, primarily

due to a $0.1 million decrease in AFUDC, as a result of lower

long-term construction activity subject to AFUDC.

Capital Expenditures

As part of Artesian’s ongoing effort to ensure

high-quality reliable service to customers, $62.2 million was

invested in water and wastewater infrastructure projects during

2023 compared to $48.5 million for the same period in 2022. We

invested in our rehabilitation program for transmission and

distribution facilities by replacing aging or deteriorating mains,

installation of new mains, enhancing or improving existing

treatment facilities, construction of new water storage tanks, and

replacing aging wells and pumping equipment to better serve our

customers. We also continue to invest in wastewater treatment and

distribution facilities.

“In 2023 we invested over $62 million in capital

improvements. These investments in utility plant not only ensure

that we provide high quality and reliable water and wastewater

services to our customers, but allow us to meet growth demands in

our expanding franchise area. Additionally, we continue

to make investments proactively to treat for PFAS in drinking water

in anticipation of the EPA’s release of a more stringent

regulation, staying ahead of the upcoming equipment supply needs of

other utilities,” said Nicki Taylor, President of Artesian Water

Company.

About Artesian

ResourcesArtesian Resources Corporation operates as a

holding company of wholly-owned subsidiaries offering water and

wastewater services, and a number of other related core business

services, on the Delmarva Peninsula. Artesian Water Company, the

principal subsidiary, is the oldest and largest regulated water

utility on the Delmarva Peninsula and has been providing water

service since 1905. Artesian Water Company supplies 8.7 billion

gallons of water per year through 1,470 miles of main to over a

third of Delawareans.

Forward Looking StatementsThis

release contains forward looking statements within the meaning of

the Private Securities Litigation Reform Act of 1995 regarding,

among other things, recovery of investments in water utility plant

and increased operating costs in rates charged to customers as

presented in our current filing before the Delaware Public Service

Commission, expectations regarding the cost, timing and recovery in

customer rates of infrastructure investments and increased

operational costs, our expectations in 2024, our ability to

continue to provide high-quality and reliable water and wastewater

service to customers and meet increased demands, and our growth

strategy and continued growth in our business and the number of

customers served. These statements involve risks and uncertainties

that could cause actual results to differ materially from those

expressed or implied by such forward-looking statements including:

changes in weather, changes in our contractual obligations, changes

in government policies, the timing and results of our rate

requests, failure to receive regulatory approval, changes in

economic and market conditions generally and other matters

discussed in our filings with the Securities and Exchange

Commission. While the Company may elect to update forward-looking

statements, we specifically disclaim any obligation to do so and

you should not rely on any forward-looking statement as

representation of the Company’s views as of any date subsequent to

the date of this release.

Contact:Nicki TaylorInvestor

Relations(302) 453-6900ntaylor@artesianwater.com

| Artesian Resources

Corporation |

|

| Condensed

Consolidated Statement of Operations |

|

| (In thousands,

except per share amounts) |

|

| (Unaudited) |

|

| |

|

|

|

|

|

|

|

|

|

|

|

|

| |

Three months

ended |

|

Twelve months

ended |

|

| |

December 31, |

|

December 31, |

|

| |

2023 |

|

2022 |

|

2023 |

|

2022 |

|

|

Operating Revenues |

|

|

|

|

|

|

|

|

|

|

|

|

|

Water sales |

$ |

19,739 |

|

|

$ |

18,751 |

|

|

$ |

80,033 |

|

$ |

78,318 |

|

|

Other utility operating revenue |

|

3,112 |

|

|

|

3,226 |

|

|

|

12,195 |

|

|

11,506 |

|

|

Non-utility operating revenue |

|

1,694 |

|

|

|

3,140 |

|

|

|

6,633 |

|

|

9,073 |

|

| |

|

24,545 |

|

|

|

25,117 |

|

|

|

98,861 |

|

|

98,897 |

|

| |

|

|

|

|

|

|

|

|

|

|

|

|

|

Operating Expenses |

|

|

|

|

|

|

|

|

|

|

|

|

|

Utility operating expenses |

|

11,717 |

|

|

|

12,778 |

|

|

|

46,205 |

|

|

43,772 |

|

|

Non-utility operating expenses |

|

1,099 |

|

|

|

2,432 |

|

|

|

4,428 |

|

|

6,850 |

|

|

Depreciation and amortization |

|

3,453 |

|

|

|

3,270 |

|

|

|

13,335 |

|

|

12,620 |

|

|

State and federal income taxes |

|

1,192 |

|

|

|

900 |

|

|

|

6,348 |

|

|

5,878 |

|

|

Property and other taxes |

|

1,570 |

|

|

|

1,499 |

|

|

|

6,099 |

|

|

5,871 |

|

| |

|

19,031 |

|

|

|

20,879 |

|

|

|

76,415 |

|

|

74,991 |

|

| |

|

|

|

|

|

|

|

|

|

|

|

|

|

Operating Income |

|

5,514 |

|

|

|

4,238 |

|

|

|

22,446 |

|

|

23,906 |

|

| |

|

|

|

|

|

|

|

|

|

|

|

|

|

Allowance for funds used during construction |

|

309 |

|

|

|

431 |

|

|

|

2,002 |

|

|

1,329 |

|

|

Miscellaneous |

|

(148 |

) |

|

|

(47 |

) |

|

|

1,407 |

|

|

1,265 |

|

| |

|

|

|

|

|

|

|

|

|

|

|

|

|

Income Before Interest Charges |

|

5,675 |

|

|

|

4,622 |

|

|

|

25,855 |

|

|

26,500 |

|

| |

|

|

|

|

|

|

|

|

|

|

|

|

|

Interest Charges |

|

2,195 |

|

|

|

2,297 |

|

|

|

9,156 |

|

|

8,502 |

|

| |

|

|

|

|

|

|

|

|

|

|

|

|

| Net

Income |

$ |

3,480 |

|

|

$ |

2,325 |

|

|

$ |

16,699 |

|

$ |

17,998 |

|

| |

|

|

|

|

|

|

|

|

|

|

|

|

|

Weighted Average Common Shares Outstanding - Basic |

|

10,281 |

|

|

|

9,497 |

|

|

|

10,018 |

|

|

9,462 |

|

|

Net Income per Common Share - Basic |

$ |

0.34 |

|

|

$ |

0.24 |

|

|

$ |

1.67 |

|

$ |

1.90 |

|

| |

|

|

|

|

|

|

|

|

|

|

|

|

|

Weighted Average Common Shares Outstanding - Diluted |

|

10,284 |

|

|

|

9,505 |

|

|

|

10,022 |

|

|

9,481 |

|

|

Net Income per Common Share - Diluted |

$ |

0.34 |

|

|

$ |

0.24 |

|

|

$ |

1.67 |

|

$ |

1.90 |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

Artesian Resources Corporation |

|

| Condensed

Consolidated Balance Sheets |

|

| (In thousands) |

|

| (Unaudited) |

|

| |

|

|

|

|

|

|

|

|

|

|

|

|

| |

December 31, |

|

December 31, |

|

|

|

|

|

|

|

| |

2023 |

|

2022 |

|

|

|

|

|

|

|

|

Assets |

|

|

|

|

|

|

|

|

|

|

|

|

|

Utility Plant, at original cost less |

|

|

|

|

|

|

|

|

|

|

|

|

|

accumulated depreciation |

$ |

714,284 |

|

|

$ |

668,031 |

|

|

|

|

|

|

|

|

|

Current Assets |

|

30,617 |

|

|

|

27,804 |

|

|

|

|

|

|

|

|

|

Regulatory and Other Assets |

|

21,931 |

|

|

|

23,956 |

|

|

|

|

|

|

|

|

| |

$ |

766,832 |

|

|

$ |

719,791 |

|

|

|

|

|

|

|

|

| |

|

|

|

|

|

|

|

|

|

|

|

|

|

Capitalization and Liabilities |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

Stockholders' Equity |

$ |

230,397 |

|

|

$ |

187,930 |

|

|

|

|

|

|

|

|

|

Long Term Debt, Net of Current Portion |

|

178,307 |

|

|

|

175,619 |

|

|

|

|

|

|

|

|

|

Current Liabilities |

|

22,414 |

|

|

|

44,070 |

|

|

|

|

|

|

|

|

|

Net Advances for Construction |

|

2,797 |

|

|

|

3,686 |

|

|

|

|

|

|

|

|

|

Contributions in Aid of Construction |

|

247,934 |

|

|

|

224,308 |

|

|

|

|

|

|

|

|

|

Other Liabilities |

|

84,983 |

|

|

|

84,178 |

|

|

|

|

|

|

|

|

| |

$ |

766,832 |

|

|

$ |

719,791 |

|

|

|

|

|

|

|

|

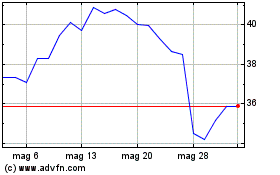

Grafico Azioni Artesian Resources (NASDAQ:ARTNA)

Storico

Da Dic 2024 a Gen 2025

Grafico Azioni Artesian Resources (NASDAQ:ARTNA)

Storico

Da Gen 2024 a Gen 2025