Beasley Broadcast Group, Inc. (Nasdaq: BBGI) (“Beasley” or the

“Company”), a multi-platform media company, today announced

operating results for the three-month period ended September 30,

2023. For further information, the Company has posted a

presentation to its website regarding the third quarter highlights

and accomplishments that management will review on today’s

conference call.

Summary of Third Quarter and Nine Months

Results

|

In millions, except per share data |

Three Months EndedSeptember

30, |

Nine Months EndedSeptember

30, |

|

|

2023 |

2022 |

2023 |

2022 |

|

Net revenue |

$60.1 |

$63.8 |

$181.4 |

$184.4 |

|

Operating income (loss) 1 |

(85.5) |

4.7 |

(89.6) |

(2.6) |

|

Net income (loss) 1 |

(67.5) |

0.5 |

(81.5) |

(17.6) |

|

Net income (loss) per diluted share 1 |

(2.25) |

0.02 |

(2.73) |

(0.60) |

|

Adjusted EBITDA (non-GAAP) |

$5.5 |

$7.2 |

$15.9 |

$15.3 |

| 1Operating loss, net loss and net loss per diluted share in the

three and nine months ended September 30, 2023 reflect $88.8

million and $98.8 million, respectively, of non-cash impairment

losses. Operating loss, net loss and net loss per diluted share in

the nine months ended September 30, 2022 includes $10.5 million of

non-cash impairment losses. Excluding the third quarter 2023

impairment losses of $88.8 million, Beasley would have reported

operating income of $3.3 million in the third quarter of 2023

compared to operating income of $4.7 million in the third quarter

of 2022. |

| |

Net revenue during the three months ended

September 30, 2023 reflects a year-over-year decrease in cyclical

political advertising and commercial advertising, related to

continued softness in the agency business, partially offset by

growth in digital advertising and other revenue.

Despite the year-over-year decrease in operating

expenses and corporate expenses of 2.7% and 12.5%, respectively,

Beasley reported a 2023 third quarter operating loss of $85.5

million compared to operating income of $4.7 million in the third

quarter of 2022. The third quarter 2023 operating loss largely

reflects the impact of $88.8 million of non-cash impairment losses,

primarily due to an increase in the discount rate due to certain

risks associated with the U.S. economy and a decrease in the

projected revenues used in the discounted cash flow analyses to

estimate the fair value of FCC licenses and goodwill. Excluding the

third quarter 2023 impairment losses of $88.8 million, Beasley’s

operating income was $3.3 million compared to operating income of

$4.7 million in the third quarter of 2022.

Beasley reported a net loss of $67.5 million, or

$2.25 per diluted share, in the three months ended September 30,

2023, compared to net income of $0.5 million, or $0.02 per diluted

share, in the three months ended September 30, 2022. The 2023 third

quarter net loss was primarily due to the aforementioned non-cash

impairment losses.

Adjusted EBITDA (a non-GAAP financial measure)

was $5.5 million in the third quarter of 2023 compared to $7.2

million in the third quarter of 2022. The year-over-year decrease

is primarily attributable to lower net revenue compared to the

prior year period.

Please refer to the “Calculation of Adjusted

EBITDA” and “Reconciliation of Net Income (Loss) to Adjusted

EBITDA” tables at the end of this release.

Commenting on the financial results, Caroline

Beasley, Chief Executive Officer, said, “Beasley’s third quarter

financial results reflect the well-publicized economic challenges

and continued advertising market softness which we outlined in the

prior quarters. While we saw sequential month-over-month

improvement in our advertising revenue performance from August to

September, our net revenues for the 2023 third quarter decreased

5.8% year-over-year, or 3.2% when excluding the year-over-year

decrease in political advertising revenue of $1.9 million.

Importantly, Beasley’s ongoing expense management, revenue

diversification and new business initiatives resulted in lower

operating expenses and healthy growth across our digital, network

and other revenue sources, and we generated third quarter adjusted

EBITDA of $5.5 million.

“Similar to recent quarters, Beasley delivered

strong digital revenue growth of 9.1% year-over-year, with digital

revenue representing 18.6% of total third quarter revenue. Our

continued strong digital revenue growth has moved us to within a

few basis points of reaching the bottom end of our goal of digital

revenue accounting for 20% to 30% of total revenue, and we remain

laser focused on this initiative as a means to diversify our

revenue in a cash flow positive manner. Our dedicated sales teams

continue to leverage the tremendous audience reach and engagement

of our local multi-platform content to attract new advertisers,

resulting in a 22% increase in new local business revenue growth

for the third quarter. Additionally, the actions we have taken to

reduce our cost structure resulted in third quarter operating and

corporate expenses decreases of 2.7% and 12.5%, respectively.

“In addition to our expense reduction and

revenue diversification initiatives, Beasley also remained

committed to enhancing financial flexibility and cash flows through

debt reduction. Subsequent to quarter end, we completed the sale of

substantially all of the assets used in the operations of WJBR-FM

in Wilmington for $5.0 million and used 100% of the sale proceeds,

along with cash on hand, to repurchase another $10 million of our

senior secured notes at a discount. We have reduced debt by $13.0

million year-to-date, strengthening our balance sheet and

lowering quarterly interest expense. We remain focused on enhancing

our cash flows and expect to generate positive cash flow in the

2023 fourth quarter.

“In summary, we believe our third quarter

financial performance demonstrates that our digital transformation

and revenue diversification strategies continue to gain momentum

and our initiatives focused on lowering operating expenses and

reducing debt are positioning Beasley to generate increased and

more diversified cash flows in future periods. Looking ahead, as

has always been the case for non-election years, we expect fourth

quarter revenues to be somewhat impacted by the absence of cyclical

political advertising. While we plan to offset some of this

expected softness through continued growth in digital and new

business, we are hopeful that the overall advertising environment

will improve in the fourth quarter and continue to closely monitor

the economy.”

Conference Call and Webcast Information

The Company will host a conference call and

webcast today, November 1, 2023, at 11:00 a.m. ET to discuss its

financial results and operations. To access the conference call,

interested parties may dial 877-407-4018 or 201-689-8471,

conference ID 13742084 (domestic and international callers).

Participants can also listen to a live webcast of the call at the

Company’s website at www.bbgi.com. Please allow 15 minutes to

register and download and install any necessary software. Following

its completion, a replay of the webcast can be accessed for five

days on the Company’s website, www.bbgi.com.

Questions from analysts, institutional investors

and debt holders may be e-mailed to ir@bbgi.com at any time up

until 9:00 a.m. ET on Wednesday, November 1, 2023. Management will

answer as many questions as possible during the conference call and

webcast (provided the questions are not addressed in their prepared

remarks).

About Beasley Broadcast

GroupBeasley Broadcast Group, Inc. (www.bbgi.com) was

founded in 1961 by George G. Beasley and owns 59 AM and FM stations

in 13 large- and mid-size markets in the United States. Beasley

radio stations reach over 30 million unique consumers weekly

over-the-air, online and on smartphones and tablets, and millions

regularly engage with the Company’s brands and personalities

through digital platforms such as Facebook, Twitter, text, apps and

email. For more information, please visit www.bbgi.com.

For further information, or to receive future

Beasley Broadcast Group news announcements via e-mail, please

contact Beasley Broadcast Group, at 239-263-5000 or email@bbgi.com,

or Joseph Jaffoni, JCIR, at 212-835-8500 or bbgi@jcir.com.

DefinitionsEBITDA is defined as

net income (loss) before interest income or expense, income tax

expense or benefit, depreciation, and amortization.

Adjusted EBITDA is defined as EBITDA further

adjusted to exclude certain, non-operating or other items that we

believe are not indicative of the performance of our ongoing

operations, such as impairment losses, other income or expense, or

equity in earnings of unconsolidated affiliates. See

“Reconciliation of Net Income (Loss) to Adjusted

EBITDA” for additional information.

Adjusted EBITDA can also be calculated as net

revenue less operating and corporate expenses. We define operating

expenses as cost of services and selling, general and

administrative expenses. Corporate expenses include general and

administrative expenses and certain other income and expense items

not allocated to the operating segments.

Adjusted EBITDA is a measure widely used in the

media industry. The Company recognizes that because Adjusted EBITDA

is not calculated in accordance with GAAP, it is not necessarily

comparable to similarly titled measures employed by other

companies. However, management believes that Adjusted EBITDA

provides meaningful information to investors because it is an

important measure of how effectively we operate our business and

assists investors in comparing our operating performance with that

of other media companies.

Note Regarding Forward-Looking

StatementsStatements in this release that are

“forward-looking statements” are based upon current expectations

and assumptions, and involve certain risks and uncertainties within

the meaning of the U.S. Private Securities Litigation Reform Act of

1995. Words or expressions such as “looking ahead,” “intends,”

“believes,” “expects,” “seek,” “will,” “should” or variations of

such words and similar expressions are intended to identify such

forward-looking statements. Forward-looking statements by their

nature address matters that are, to different degrees, uncertain.

Key risks are described in the Company’s reports filed with the

Securities and Exchange Commission (“SEC”) including its annual

report on Form 10-K and quarterly reports on Form 10-Q. Readers

should note that forward-looking statements are subject to change

and to inherent risks and uncertainties and may be impacted by

several factors, including:

- external economic forces and

conditions that could have a material adverse impact on our

advertising revenues and results of operations;

- the ability of our stations to

compete effectively in their respective markets for advertising

revenues;

- our ability to develop compelling

and differentiated digital content, products and services;

- audience acceptance of our content,

particularly our audio programs;

- our ability to respond to changes

in technology, standards and services that affect the audio

industry;

- our dependence on federally issued

licenses subject to extensive federal regulation;

- actions by the FCC or new

legislation affecting the audio industry;

- increases to royalties we pay to

copyright owners or the adoption of legislation requiring royalties

to be paid to record labels and recording artists;

- our dependence on selected market

clusters of stations for a material portion of our net

revenue;

- credit risk on our accounts

receivable;

- the risk that our FCC licenses

and/or goodwill could become impaired;

- our substantial debt levels and the

potential effect of restrictive debt covenants on our operational

flexibility and ability to pay dividends;

- the potential effects of hurricanes

on our corporate offices and stations;

- the failure or destruction of the

internet, satellite systems and transmitter facilities that we

depend upon to distribute our programming;

- disruptions or security breaches of

our information technology infrastructure and information

systems;

- the loss of key personnel;

- our ability to integrate acquired

businesses and achieve fully the strategic and financial objectives

related thereto and their impact on our financial condition and

results of operations;

- the fact that our Company is

controlled by the Beasley family, which creates difficulties for

any attempt to gain control of our Company;

- the Company’s ability to comply

with the continued listing standards of the Nasdaq Global Market;

and

- other economic, business,

competitive, and regulatory factors affecting our businesses,

including those set forth in our filings with the SEC.

Our actual performance and results could differ materially

because of these factors and other factors discussed in our SEC

filings, including but not limited to our annual reports on Form

10-K or quarterly reports on Form 10-Q, copies of which can be

obtained from the SEC, www.sec.gov, or our website, www.bbgi.com.

All information in this release is as of November 1, 2023 and we

undertake no obligation to update the information contained herein

to actual results or changes to our expectations.

|

|

|

|

|

|

|

Three months ended |

|

Nine months ended |

|

|

September 30, |

|

September 30, |

|

|

|

2023 |

|

|

2022 |

|

|

2023 |

|

|

2022 |

| Net revenue |

$ |

60,119,757 |

|

$ |

63,823,288 |

|

$ |

181,360,600 |

|

$ |

184,354,006 |

| Operating expenses: |

|

|

|

|

|

|

|

|

|

|

|

|

Operating expenses (including stock-based compensation and

excluding depreciation and amortization shown separately

below) |

|

50,117,044 |

|

|

51,511,699 |

|

|

152,098,261 |

|

|

155,147,840 |

|

Corporate expenses (including stock-based compensation) |

|

4,493,277 |

|

|

5,132,362 |

|

|

13,381,403 |

|

|

13,933,292 |

|

Depreciation and amortization |

|

2,201,664 |

|

|

2,456,646 |

|

|

6,626,974 |

|

|

7,423,648 |

|

FCC licenses impairment losses |

|

78,204,065 |

|

|

- |

|

|

88,245,065 |

|

|

4,619,772 |

|

Goodwill impairment losses |

|

10,582,360 |

|

|

- |

|

|

10,582,360 |

|

|

5,856,551 |

|

Total operating expenses |

|

145,598,410 |

|

|

59,100,707 |

|

|

270,934,063 |

|

|

186,981,103 |

|

Operating income (loss) |

|

(85,478,653) |

|

|

4,722,581 |

|

|

(89,573,463) |

|

|

(2,627,097) |

| Non-operating income

(expense): |

|

|

|

|

|

|

|

|

|

|

|

|

Interest expense |

|

(6,445,746) |

|

|

(6,621,540) |

|

|

(19,764,067) |

|

|

(20,293,794) |

|

Other income, net |

|

1,106,918 |

|

|

1,166,430 |

|

|

1,684,168 |

|

|

1,357,512 |

|

Loss before income taxes |

|

(90,817,481) |

|

|

(732,529) |

|

|

(107,653,362) |

|

|

(21,563,379) |

| Income tax benefit |

|

(23,299,388) |

|

|

(1,252,669) |

|

|

(26,285,207) |

|

|

(3,874,646) |

|

Income (loss) before equity in earnings of unconsolidated

affiliates |

|

(67,518,093) |

|

|

520,140 |

|

|

(81,368,155) |

|

|

(17,688,733) |

| Equity in earnings of

unconsolidated affiliates, net of tax |

|

(18,744) |

|

|

(22,072) |

|

|

(135,877) |

|

|

141,154 |

|

Net income (loss) |

$ |

(67,536,837) |

|

$ |

498,068 |

|

$ |

(81,504,032) |

|

$ |

(17,547,579) |

| |

|

|

|

|

|

|

|

|

|

|

|

| Basic and diluted net income

(loss) per share |

$ |

(2.25) |

|

$ |

0.02 |

|

$ |

(2.73) |

|

$ |

(0.60) |

| Basic common shares

outstanding |

|

29,962,613 |

|

|

29,546,324 |

|

|

29,867,820 |

|

|

29,445,998 |

| Diluted common shares

outstanding |

|

29,962,613 |

|

|

29,715,361 |

|

|

29,867,820 |

|

|

29,445,998 |

|

|

|

Selected Balance Sheet Data - Unaudited(in

thousands) |

|

|

|

|

September 30, |

|

December 31, |

|

|

2023 |

|

2022 |

|

Cash and cash equivalents |

$ |

29,665 |

|

$ |

39,535 |

| Working capital |

|

42,973 |

|

|

48,966 |

| Total assets |

|

594,381 |

|

|

714,943 |

| Long-term debt, net of

unamortized debt issuance costs |

|

283,612 |

|

|

285,473 |

| Stockholders' equity |

$ |

142,448 |

|

$ |

223,489 |

| |

|

Selected Statement of Cash Flows Data –

Unaudited |

| |

| |

Nine months ended |

| |

September 30, |

| |

2023 |

|

2022 |

|

Net cash provided by (used in) operating activities |

$ |

(5,004,885) |

|

$ |

6,751,546 |

|

Net cash used in investing activities |

|

(2,810,716) |

|

|

(7,301,590) |

|

Net cash used in financing activities |

|

(2,053,588) |

|

|

(4,910,152) |

|

Net decrease in cash and cash equivalents |

$ |

(9,869,189) |

|

$ |

(5,460,196) |

| |

|

Calculation of Adjusted EBITDA |

| |

| |

Three months ended |

|

Nine months ended |

| |

September 30, |

|

September 30, |

|

|

|

2023 |

|

|

2022 |

|

|

2023 |

|

|

2022 |

| Net revenue |

$ |

60,119,757 |

|

$ |

63,823,288 |

|

$ |

181,360,600 |

|

$ |

184,354,006 |

| Operating expenses |

|

(50,117,044) |

|

|

(51,511,699) |

|

|

(152,098,261) |

|

|

(155,147,840) |

| Corporate expenses |

|

(4,493,277) |

|

|

(5,132,362) |

|

|

(13,381,403) |

|

|

(13,933,292) |

|

Adjusted EBITDA |

$ |

5,509,436 |

|

$ |

7,179,227 |

|

$ |

15,880,936 |

|

$ |

15,272,874 |

| |

|

Reconciliation of Net Income (Loss) to Adjusted

EBITDA |

| |

| |

Three months ended |

|

Nine months ended |

| |

September 30, |

|

September 30, |

| |

|

2023 |

|

|

2022 |

|

|

2023 |

|

|

2022 |

| Net income (loss) |

$ |

(67,536,837) |

|

$ |

498,068 |

|

$ |

(81,504,032) |

|

$ |

(17,547,579) |

| Interest expense |

|

6,445,746 |

|

|

6,621,540 |

|

|

19,764,067 |

|

|

20,293,794 |

| Income tax benefit |

|

(23,299,388) |

|

|

(1,252,669) |

|

|

(26,285,207) |

|

|

(3,874,646) |

| Depreciation and

amortization |

|

2,201,664 |

|

|

2,456,646 |

|

|

6,626,974 |

|

|

7,423,648 |

|

EBITDA |

|

(82,188,815) |

|

|

8,323,585 |

|

|

(81,398,198) |

|

|

6,295,217 |

| FCC licenses impairment

losses |

|

78,204,065 |

|

|

- |

|

|

88,245,065 |

|

|

4,619,772 |

| Goodwill impairment

losses |

|

10,582,360 |

|

|

- |

|

|

10,582,360 |

|

|

5,856,551 |

| Other income, net |

|

(1,106,918) |

|

|

(1,166,430) |

|

|

(1,684,168) |

|

|

(1,357,512) |

| Equity in earnings of

unconsolidated affiliates, net of tax |

|

18,744 |

|

|

22,072 |

|

|

135,877 |

|

|

(141,154) |

|

Adjusted EBITDA |

$ |

5,509,436 |

|

$ |

7,179,227 |

|

$ |

15,880,936 |

|

$ |

15,272,874 |

| |

|

| CONTACT: |

|

| B. Caroline Beasley |

Joseph Jaffoni, Jennifer Neuman |

| Chief Executive Officer |

JCIR |

| Beasley Broadcast Group, Inc. |

212/835-8500 or bbgi@jcir.com |

| 239/263-5000 or ir@bbgi.com |

|

| |

|

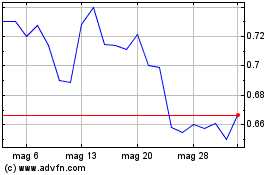

Grafico Azioni Beasley Broadcast (NASDAQ:BBGI)

Storico

Da Gen 2025 a Feb 2025

Grafico Azioni Beasley Broadcast (NASDAQ:BBGI)

Storico

Da Feb 2024 a Feb 2025