Form SC 13G/A - Statement of acquisition of beneficial ownership by individuals: [Amend]

18 Gennaio 2024 - 6:03PM

Edgar (US Regulatory)

UNITED STATES

SECURITIES AND EXCHANGE

COMMISSION

Washington, D.C. 20549

SCHEDULE 13G

Under the Securities

Exchange Act of 1934

(Amendment No. 2)*

Coca-Cola Consolidated,

Inc.

(Name of Issuer)

Common Stock

(Title of Class of Securities)

191098102

(CUSIP Number)

12/31/2023

(Date of Event Which Requires Filing of this Statement)

Check

the appropriate box to designate the rule pursuant to which this Schedule is filed:

x Rule

13d-1(b)

¨ Rule 13d-1(c)

¨ Rule

13d-1(d)

*The remainder of this cover page shall be filled out for a reporting

person’s initial filing on this form with respect to the subject class of securities, and for any subsequent amendment containing

information which would alter the disclosures provided in a prior cover page.

The information required in the remainder of this cover page

shall not be deemed to be “filed” for the purpose of Section 18 of the Securities Exchange Act of 1934 (“Act”)

or otherwise subject to the liabilities of that section of the Act but shall be subject to all other provisions of the Act (however, see

the Notes).

Persons who respond to the

collection of information contained in this form are not

required to respond unless the form displays a currently valid OMB control

number.

13G

| CUSIP No. 191098102 |

|

Page

2 of 5 |

| 1. |

Names

of Reporting Persons.

Deborah S. Harrison (Deborah H. Everhart)* |

| 2. |

Check the Appropriate Box if a Member of a Group

(a) ¨

(b) ¨ |

| 3. |

SEC

Use Only

|

| 4. |

Citizenship or Place of Organization

USA |

Number of Shares

Beneficially

Owned by

Each Reporting

Person With: |

5. |

Sole Voting Power

323,079 |

| 6. |

Shared Voting Power

|

| 7. |

Sole Dispositive Power

323,079 |

| 8. |

Shared Dispositive Power

|

| 9. |

Aggregate Amount Beneficially Owned by Each Reporting Person

323,079 |

| 10. |

Check

if the Aggregate Amount in Row (9) Excludes Certain Shares ¨ |

| 11. |

Percent of Class Represented by Amount in Row (9)

3.4% |

| 12. |

Type of Reporting Person

Individual |

* Deborah S. Harrison is the maiden name of Deborah H. Everhart

13G

CUSIP No.

ITEM 1.

| (a) | Name of Issuer: Coca-Cola Consolidated, Inc. |

| (b) | Address of Issuer's Principal Executive Offices: 4100 Coca-Cola Plz, Charlotte, NC 28211 |

| ITEM 2. |

|

| |

(a) |

Name of Person Filing: |

Deborah S. Harrison |

| (b) | Address

of Principal Business Office, or if None, Residence: c/o Miller & Martin PLLC, 832 Georgia Avenue Suite 1200,

Chattanooga, TN 37402 |

| (d) | Title of Class of Securities: Common

Stock |

| (e) | CUSIP Number: 191098102 |

ITEM 3. IF THIS STATEMENT IS FILED PURSUANT TO SS.240.13d-1(b) OR

240.13d-2(b) OR (c), CHECK WHETHER THE PERSON FILING IS A:

| (a) |

¨ | Broker or dealer registered under Section 15 of the Act (15 U.S.C. 78o). |

| (b) |

¨ | Bank as defined in Section 3(a)(6) of the Act (15 U.S.C. 78c). |

| (c) |

¨ | Insurance company as defined in Section 3(a)(19) of the Act (15 U.S.C. 78c). |

| (d) |

¨ | Investment company registered under Section 8 of the Investment Company Act of 1940 (15 U.S.C. 80a-8). |

| (e) |

¨ | An investment adviser in accordance with ss.240.13d-1(b)(1)(ii)(E); |

| (f) |

¨ | An employee benefit plan or endowment fund in accordance with ss.240.13d-1(b)(1)(ii)(F); |

| (g) |

¨ | A parent holding company or control person in accordance with ss.240.13d-1(b)(1)(ii)(G); |

| (h) |

¨ | A savings associations as defined in Section 3(b) of the Federal Deposit Insurance Act (12 U.S.C.

1813); |

| (i) |

¨ | A church plan that is excluded from the definition of an investment company under section 3(c)(14)

of the Investment Company Act of 1940 (15 U.S.C. 80a-3); |

| (j) |

¨ | Group, in accordance with ss.240.13d-1(b)(1)(ii)(J). |

ITEM 4. OWNERSHIP.

Provide the following information regarding the aggregate number and

percentage of the class of securities of the issuer identified in Item 1.

| (a) Amount beneficially owned: 323,079 |

| |

| (b) Percent of class: 3.4% |

| |

| (c) Number of shares as to which such person has: |

| |

| (i) Sole power to vote

or to direct the vote 323,079 |

| |

| (ii) Shared power to vote or to direct the vote |

| |

| (iii) Sole power to dispose

or to direct the disposition of 323,079 |

| |

| (iv) Shared power to

dispose or to direct the disposition of |

| |

INSTRUCTION. For computations regarding securities which

represent a right to acquire an underlying security SEE ss.240.13d3(d)(1).

ITEM 5. OWNERSHIP OF FIVE PERCENT OR LESS OF A CLASS.

If this statement is being

filed to report the fact that as of the date hereof the reporting person has ceased to be the beneficial owner of more than five percent

of the class of securities, check the following x.

INSTRUCTION: Dissolution of a group requires a response to this item.

ITEM 6. OWNERSHIP OF MORE THAN FIVE PERCENT ON BEHALF OF ANOTHER

PERSON.

If any other person is known to have the right

to receive or the power to direct the receipt of dividends from, or the proceeds from the sale of, such securities, a statement to that

effect should be included in response to this item and, if such interest relates to more than five percent of the class, such person should

be identified. A listing of the shareholders of an investment company registered under the Investment Company Act of 1940 or the beneficiaries

of employee benefit plan, pension fund or endowment fund is not required.

ITEM 7. IDENTIFICATION AND CLASSIFICATION OF

THE SUBSIDIARY WHICH ACQUIRED THE SECURITY BEING REPORTED ON BY THE PARENT HOLDING COMPANY.

If a parent holding company or Control person

has filed this schedule, pursuant to Rule 13d-1(b)(1)(ii)(G), so indicate under Item 3(g) and attach an exhibit stating the identity and

the Item 3 classification of the relevant subsidiary. If a parent holding company or control person has filed this schedule pursuant to

Rule 13d-1(c) or Rule 13d-1(d), attach an exhibit stating the identification of the relevant subsidiary.

ITEM 8. IDENTIFICATION AND CLASSIFICATION OF MEMBERS OF THE GROUP.

If a group has filed this schedule pursuant to

ss.240.13d-1(b)(1)(ii)(J), so indicate under Item 3(j) and attach an exhibit stating the identity and Item 3 classification of each member

of the group. If a group has filed this schedule pursuant to ss.240.13d-1(c) or ss.240.13d-1(d), attach an exhibit stating the identity

of each member of the group.

ITEM 9. NOTICE OF DISSOLUTION OF GROUP.

Notice of dissolution of a group may be furnished

as an exhibit stating the date of the dissolution and that all further filings with respect to transactions in the security reported on

will be filed, if required, by members of the group, in their individual capacity. See Item 5.

ITEM 10. CERTIFICATIONS.

| (a) | The following certification shall be included if the statement

is filed pursuant to Rule 13d-1(b): |

"By signing below I certify that,

to the best of my knowledge and belief, the securities referred to above were acquired and are held in the ordinary course of business

and were not acquired and not held for the purpose of or with the effect of changing or influencing the control of the issuer of the securities

and were not acquired and are not held in connection with or as a participant in any transaction having such purpose or effect."

| (b) | The following certification shall be included if the statement

is filed pursuant to Rule 13d-1(c): |

"By signing below I certify that,

to the best of my knowledge and belief, the securities referred to above were not acquired and are not held for the purpose of or with

the effect of changing or influencing the control of the issuer of the securities and were not acquired and are not held in connection

with or as a participant in any transaction having such purpose or effect."

SIGNATURE

After reasonable inquiry and to the best of my

knowledge and belief, I certify that the information set forth in this statement is true, complete and correct.

| |

1/18/2024 |

|

| |

(Date) |

|

| |

|

|

| |

/s/ Deborah S. Harrison |

|

| |

Deborah S. Harrison |

|

The original statement shall be signed by each

person on whose behalf the statement is filed or his authorized representative. If the statement is signed on behalf of a person by his

authorized representative other than an executive officer or general partner of the filing person, evidence of the representative's authority

to sign on behalf of such person shall be filed with the statement, provided, however, that a power of attorney for this purpose which

is already on file with the Commission may be incorporated by reference. The name and any title of each person who signs the statement

shall be typed or printed beneath his signature.

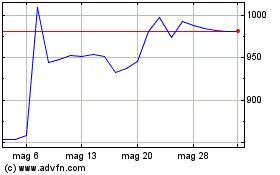

Grafico Azioni Coca Cola Consolidated (NASDAQ:COKE)

Storico

Da Dic 2024 a Gen 2025

Grafico Azioni Coca Cola Consolidated (NASDAQ:COKE)

Storico

Da Gen 2024 a Gen 2025