Results Exceeded all Guided Metrics

Subscription Portion of Annual Recurring

Revenue (ARR) Grew 46% Year-Over-Year to $735 million

Total ARR Grew 31% Year-Over-Year to $926

million

Subscription Revenue Grew 43% Year-Over-Year to

$175.6 million

Total Revenue Grew 26% Year-Over-Year Reaching

a Record of $240.1 million

Net Cash Provided by Operating Activities for

the Nine Months Ended September 30, 2024 of $167.2 million

Company Raises Full Year Guidance Across all

Metrics

CyberArk (NASDAQ: CYBR), the global leader in identity security,

today announced strong financial results for the third quarter

ended September 30, 2024.

“CyberArk reported strong results and outperformed guidance

across all metrics. Our best-in-class execution and industry

leadership in identity security is helping us deliver strong net

new ARR, record revenue and increased profitability and cash flow,”

said Matt Cohen, CyberArk’s Chief Executive Officer. “The security

first approach is at the core of CyberArk’s DNA and differentiating

us from competitors. We continue to deliver on our vision of

securing every identity – human and machine – with the right level

of privilege controls. Demand for our solutions remains strong as

customers continue to embrace our industry leading solutions across

workforce, IT, developer and machine identities. Given the

tremendous market opportunity, the mission critical nature of

securing all identities, and durable demand drivers, we are

confidently raising our guidance for the full year 2024 across all

metrics.

“We are thrilled to have closed the acquisition of Venafi on

October 1, extending our platform leadership and setting a new

standard for end-to-end machine identity security. Feedback from

both customers and partners has further validated our excitement.

Machine identities are the fastest growing and most complex

identities today, and Venafi’s cloud native, modern machine

identity management solution is the leader in a market that is

ready for an inflection,” concluded Cohen.

Financial Summary for the Third Quarter Ended September 30,

2024

The financial results for the third quarter of 2024 did not

include any financial contribution from the acquisition of Venafi,

which closed on October 1, 2024.

- Subscription revenue was $175.6 million in the third quarter of

2024, an increase of 43 percent from $122.9 million in the third

quarter of 2023.

- Maintenance and professional services revenue was $61.6 million

in the third quarter of 2024, compared to $64.3 million in the

third quarter of 2023.

- Perpetual license revenue was $2.9 million in the third quarter

of 2024, compared to $4.1 million in the third quarter of

2023.

- Total revenue was $240.1 million in the third quarter of 2024,

up 26 percent from $191.2 million in the third quarter of

2023.

- GAAP operating loss was $(11.1) million compared to GAAP

operating loss of $(25.7) million in the same period last year.

Non-GAAP operating income was $35.4 million compared to non-GAAP

operating income of $16.9 million, in the same period last

year.

- GAAP net income was $11.1 million, or $0.24 per diluted share,

compared to GAAP net loss of $(14.6) million, or $(0.35) per basic

and diluted share, in the same period last year. Non-GAAP net

income was $45.1 million, or $0.94 per diluted share, compared to

non-GAAP net income of $19.6 million, or $0.42 per diluted share,

in the same period last year.

Balance Sheet and Net Cash Provided by Operating

Activities

- As of September 30, 2024, cash, cash equivalents, short-term

deposits, and marketable securities were $1.5 billion.

- During the nine months ended September 30, 2024, net cash

provided by operating activities was $167.2 million, compared to

$9.3 million in the nine months ended September 30, 2023.

Key Business Highlights

- Annual Recurring Revenue (ARR) was $926 million, an increase of

31 percent from $705 million at September 30, 2023.

- The Subscription portion of ARR was $735 million, or 79 percent

of total ARR at September 30, 2024. This represents an increase of

46 percent from $504 million, or 72 percent of total ARR, at

September 30, 2023.

- The Maintenance portion of ARR was $191 million at September

30, 2024, compared to $200 million at September 30, 2023.

- Recurring revenue in the third quarter was $224.2 million, an

increase of 29 percent from $174.4 million for the third quarter of

2023.

CyberArk Announces Chief Financial Officer Transition

CyberArk today announced that Josh Siegel, CyberArk’s Chief

Financial Officer, is stepping down from his role as Chief

Financial Officer effective January 1, 2025. As part of a planned

succession, Erica Smith, CyberArk's Deputy Chief Financial Officer,

will become Chief Financial Officer and join the executive team at

that time. The details of the announcement can be accessed

here.

Recent Developments

- CyberArk Closed the Acquisition of Machine Identity Management

Leader Venafi, setting a new paradigm for end-to-end machine

identity security.

- CyberArk Celebrated the 10 Year Anniversary of its Initial

Public Offering (IPO) by ringing the Opening Bell at the NASDAQ

Stock Exchange.

- CyberArk announced a strategic partnership with leading cloud

security provider Wiz, working together to enable organizations to

build faster and safer in the cloud.

- CyberArk Named a Leader in the 2024 Gartner® Magic Quadrant™

for Privileged Access Management. CyberArk is positioned as a

Leader for the sixth consecutive time and is positioned furthest in

Completeness of Vision. (1)

- CyberArk Named a Overall Leader in the 2024 Leadership Compass

on Privileged Access Management(2) by KuppingerCole Analysts AG.

The report examined three separate leadership categories: Product,

Innovation and Market Leadership. CyberArk is placed in the top

quadrant and scores highest in all of them.

- CyberArk Named Trusted Cloud Provider by Cloud Security

Alliance.

(1)Gartner® Magic Quadrant™ for Privileged Access Management, by

Abhyuday Data, Michael Kelley, Nayara Sangiorgio, Felix Gaehtgens,

Paul Mezzera, 9 September 2024

(2)KuppingerCole Analysts AG “Leadership Compass: Privileged

Access Management,” October 7, 2024 by Paul Fisher.

Business Outlook

Based on information available as of November 13, 2024, CyberArk

is issuing guidance for the fourth quarter and full year 2024 as

indicated below.

The guidance for the fourth quarter and full year 2024 includes

the expected contribution from the acquisition of Venafi, which

closed on October 1, 2024.

Fourth Quarter 2024:

- Total revenue is expected to be in the range of $297.0 million

and $303.0 million, representing growth of 33 percent to 36 percent

compared to the fourth quarter of 2023.

- Non-GAAP operating income is expected to be in the range of

$43.5 million to $48.5 million.

- Non-GAAP net income per share is expected to be in the range of

$0.65 to $0.75 per diluted share.

- Assumes 51.2 million weighted average diluted shares.

Full Year 2024:

- Total revenue is expected to be in the range of $983.0 million

to $989.0 million, representing growth of 31 percent to 32 percent

compared to the full year 2023.

- Non-GAAP operating income is expected to be in the range of

$135.0 million to $140.0 million.

- Non-GAAP net income per share is expected to be in the range of

$2.85 to $2.96 per diluted share.

- Assumes 49.0 million weighted average diluted shares.

- ARR as of December 31, 2024 is expected to be in the range of

$1.153 billion to $1.163 billion, representing growth of 49 percent

to 50 percent from December 31, 2023.

- Non-GAAP free cash flow is expected to be in the range of

$203.0 million to $213.0 million for the full year 2024.

Conference Call Information

In conjunction with this announcement, CyberArk will host a

conference call on Wednesday, November 13, 2024 at 8:30 a.m.

Eastern Time (ET) to discuss the Company’s third quarter financial

results and its business outlook. To access this call, dial +1

(888) 330-2455 (U.S.) or +1 (240) 789-2717 (international). The

conference ID is 6515982. Additionally, a live webcast of the

conference call will be available via the “Investor Relations”

section of the company’s website at www.cyberark.com.

Following the conference call, a replay will be available for

one week at +1 (800) 770-2030 (U.S.) or +1 (609) 800-9909

(international). The replay pass code is 6515982. An archived

webcast of the conference call will also be available in the

“Investor Relations” section of the company’s website at

www.cyberark.com.

Gartner Disclaimers

GARTNER is a registered trademarks and service mark, and MAGIC

QUADRANT is a registered trademark of Gartner, Inc. ("Gartner"),

and/or its affiliates in the U.S. and internationally and are used

herein with permission. All rights reserved.

Gartner does not endorse any vendor, product or service depicted

in its research publications, and does not advise technology users

to select only those vendors with the highest ratings or other

designation. Gartner research publications consist of the opinions

of Gartner’s research organization and should not be construed as

statements of fact. Gartner disclaims all warranties, expressed or

implied, with respect to this research, including any warranties of

merchantability or fitness for a particular purpose.

The Gartner content described herein (the “Gartner Content”)

represents research opinion or viewpoints published, as part of a

syndicated subscription service, by Gartner, Inc. and is not a

representation of fact. Gartner Content speaks as of its original

publication date (and not as of the date of this press release),

and the opinions expressed in the Gartner Content are subject to

change without notice.

About CyberArk

CyberArk (NASDAQ: CYBR) is the global leader in identity

security. Centered on Intelligent Privilege Controls™, CyberArk

provides the most comprehensive security offering for any identity

– human or machine – across business applications, distributed

workforces, hybrid cloud environments and throughout the DevOps

lifecycle. The world’s leading organizations trust CyberArk to help

secure their most critical assets. To learn more about CyberArk,

visit cyberark.com, read the CyberArk blogs or follow on LinkedIn,

X, Facebook or YouTube.

Copyright © 2024 CyberArk Software. All Rights Reserved. All

other brand names, product names, or trademarks belong to their

respective holders.

Key Performance Indicators and Non-GAAP Financial

Measures

Recurring Revenue

- Recurring Revenue is defined as revenue derived from SaaS and

self-hosted subscription contracts, and maintenance contracts

related to perpetual licenses during the reported period.

Annual Recurring Revenue (ARR)

- ARR is defined as the annualized value of active SaaS,

self-hosted subscriptions and their associated maintenance and

support services, and maintenance contracts related to the

perpetual licenses in effect at the end of the reported

period.

Subscription Portion of Annual Recurring Revenue

- Subscription portion of ARR is defined as the annualized value

of active SaaS and self-hosted subscription contracts in effect at

the end of the reported period. The subscription portion of ARR

excludes maintenance contracts related to perpetual licenses.

Maintenance Portion of Annual Recurring Revenue

- Maintenance portion of ARR is defined as the annualized value

of active maintenance contracts related to perpetual licenses. The

Maintenance portion of ARR excludes SaaS and self-hosted

subscription contracts in effect at the end of the reported

period.

Net New ARR

- Net new ARR refers to the difference between ARR as of

September 30, 2024 and ARR as of June 30, 2024.

Annual Recurring Revenue (ARR), Subscription portion of ARR and

Maintenance portion of ARR are performance indicators that provide

more visibility into the growth of our recurring business in the

upcoming year. This visibility allows us to make informed decisions

about our capital allocation and level of investment. Each of these

measures should be viewed independently of revenues and total

deferred revenue as each is an operating measure and is not

intended to be combined with or to replace either of those

measures. ARR, Subscription portion of ARR and Maintenance portion

of ARR are not forecasts of future revenues and can be impacted by

contract start and end dates and renewal rates.

Non-GAAP Financial Measures

CyberArk believes that the use of non-GAAP gross profit,

non-GAAP operating expense, non-GAAP operating income (loss),

non-GAAP net income and free cash flow is helpful to our investors.

These financial measures are not measures of the Company’s

financial performance under U.S. GAAP and should not be considered

as alternatives to gross profit, operating loss, net income (loss)

or net cash provided by operating activities or any other

performance measures derived in accordance with GAAP.

- Non-GAAP gross profit is calculated as GAAP gross profit

excluding share-based compensation expense, amortization of

intangible assets related to acquisitions, and impairment of

capitalized software development costs.

- Non-GAAP operating expense is calculated as GAAP operating

expenses excluding share-based compensation expense, acquisition

related expenses, and amortization of intangible assets related to

acquisitions.

- Non-GAAP operating income (loss) is calculated as GAAP

operating loss excluding share-based compensation expense,

acquisition related expenses, amortization of intangible assets

related to acquisitions, and impairment of capitalized software

development costs.

- Non-GAAP net income is calculated as GAAP net (loss) excluding

share-based compensation expense, acquisition related expenses,

amortization of intangible assets related to acquisitions,

amortization of debt discount and issuance costs, change in fair

value of derivative assets, gain from investment in privately held

companies, impairment of capitalized software development costs,

and the tax effect of non-GAAP adjustments.

- Free cash flow is calculated as net cash provided by operating

activities less purchase of property and equipment.

The Company believes that providing non-GAAP financial measures

that are adjusted by, as applicable, share-based compensation

expense, acquisition related expenses, amortization of intangible

assets related to acquisitions, non-cash interest expense related

to the amortization of debt discount and issuance cost, change in

fair value of derivative assets, and the tax effect of the non-GAAP

adjustments and purchase of property and equipment allows for more

meaningful comparisons of its period to period operating results.

Share-based compensation expense has been, and will continue to be

for the foreseeable future, a significant recurring expense in the

Company’s business and an important part of the compensation

provided to its employees. Share based compensation expense has

varying available valuation methodologies, subjective assumptions

and a variety of equity instruments that can impact a company’s

non-cash expense. The Company believes that expenses related to its

acquisitions, amortization of intangible assets related to

acquisitions, change in fair value of derivative assets, and

non-cash interest expense related to the amortization of debt

discount and issuance costs do not reflect the performance of its

core business and impact period-to-period comparability. The

Company believes free cash flow is a liquidity measure that, after

the purchase of property and equipment, provides useful information

about the amount of cash generated by the business.

Non-GAAP financial measures may not provide information that is

directly comparable to that provided by other companies in the

Company’s industry, as other companies in the industry may

calculate non-GAAP financial results differently, particularly

related to non-recurring, unusual items. In addition, there are

limitations in using non-GAAP financial measures as they exclude

expenses that may have a material impact on the Company’s reported

financial results. The presentation of non-GAAP financial

information is not meant to be considered in isolation or as a

substitute for the directly comparable financial measures prepared

in accordance with U.S. GAAP. CyberArk urges investors to review

the reconciliation of its non-GAAP financial measures to the

comparable U.S. GAAP financial measures included below, and not to

rely on any single financial measure to evaluate its business.

Guidance for non-GAAP financial measures excludes, as

applicable, share-based compensation expense, acquisition related

expenses, amortization of intangible assets related to

acquisitions, non-cash interest expense related to the amortization

of debt discount and issuance costs, non-cash change in fair value

of derivative assets, the tax effect of the non-GAAP adjustments,

and purchase of property and equipment. A reconciliation of the

non-GAAP financial measures guidance to the corresponding GAAP

measures is not available on a forward-looking basis due to the

uncertainty regarding, and the potential variability and

significance of, the amounts of share-based compensation expense,

amortization of intangible assets related to acquisitions, and the

non-recurring expenses that are excluded from the guidance, as well

as changes in interest rates and foreign exchange rates, which

impact other GAAP performance metrics. Accordingly, a

reconciliation of the non-GAAP financial measures guidance to the

corresponding GAAP measures for future periods is not available

without unreasonable effort.

Cautionary Language Concerning Forward-Looking

Statements

This release contains forward-looking statements, which express

the current beliefs and expectations of CyberArk’s (the “Company”)

management. In some cases, forward-looking statements may be

identified by terminology such as “believe,” “may,” “estimate,”

“continue,” “anticipate,” “intend,” “should,” “plan,” “expect,”

“predict,” “potential” or the negative of these terms or other

similar expressions. Such statements involve a number of known and

unknown risks and uncertainties that could cause the Company’s

future results, levels of activity, performance or achievements to

differ materially from the results, levels of activity, performance

or achievements expressed or implied by such forward-looking

statements. Important factors that could cause or contribute to

such differences include risks relating, but not limited to: risks

related to the Company’s acquisition of Venafi Holdings, Inc.

(“Venafi”), including impacts of the acquisition on the Company’s

or Venafi’s operating results and business generally; the ability

of the Company or Venafi to retain and hire key personnel and

maintain relationships with customers, suppliers and others with

whom the Company or Venafi do business; risks that Venafi’s

business will not be integrated successfully into the Company’s

operations; risks relating to the Company’s ability to realize

anticipated benefits of the combined operations after the Venafi

acquisition; changes to the drivers of the Company’s growth and the

Company’s ability to adapt its solutions to the information

security market changes and demands, including artificial

intelligence (“AI”); the Company’s ability to acquire new customers

and maintain and expand the Company’s revenues from existing

customers; intense competition within the information security

market; real or perceived security vulnerabilities, gaps, or

cybersecurity breaches of the Company, or the Company’s customers’

or partners’ systems, solutions or services; risks related to the

Company’s compliance with privacy, data protection and AI laws and

regulations; the Company’s ability to successfully operate its

business as a subscription company and fluctuation in the quarterly

results of operations; the Company’s reliance on third-party cloud

providers for its operations and software-as-a-service (“SaaS”)

solutions; the Company’s ability to hire, train, retain and

motivate qualified personnel; the Company’s ability to effectively

execute its sales and marketing strategies; the Company’s ability

to find, complete, fully integrate or achieve the expected benefits

of additional strategic acquisitions; the Company’s ability to

maintain successful relationships with channel partners, or if the

Company’s channel partners fail to perform; risks related to sales

made to government entities; prolonged economic uncertainties or

downturns; the Company’s history of incurring net losses, the

Company’s ability to generate sufficient revenue to achieve and

sustain profitability and the Company’s ability to generate cash

flow from operating activities; regulatory and geopolitical risks

associated with the Company’s global sales and operations; risks

related to intellectual property claims; fluctuations in currency

exchange rates; the ability of the Company’s products to help

customers achieve and maintain compliance with government

regulations or industry standards; the Company’s ability to protect

its proprietary technology and intellectual property rights; risks

related to using third-party software, such as open-source

software; risks related to stock price volatility or activist

shareholders; any failure to retain the Company’s “foreign private

issuer” status or the risk that the Company may be classified, for

U.S. federal income tax purposes, as a “passive foreign investment

company”; risks related to the Company’s Convertible Senior Notes

due 2024 (the “Convertible Notes”), including the potential

dilution to existing shareholders and the Company’s ability to

raise the funds necessary to repurchase the Convertible Notes;

changes in tax laws; the Company’s expectation to not pay dividends

on the Company’s ordinary shares for the foreseeable future; risks

related to the Company’s incorporation and location in Israel,

including the ongoing war between Israel and Hamas and conflict in

the region; and other factors discussed under the heading “Risk

Factors” in the Company’s most recent annual report on Form 20-F

filed with the Securities and Exchange Commission. Forward-looking

statements in this release are made pursuant to the safe harbor

provisions contained in the U.S. Private Securities Litigation

Reform Act of 1995. These forward-looking statements are made only

as of the date hereof, and the Company undertakes no obligation to

update or revise the forward-looking statements, whether as a

result of new information, future events or otherwise, except as

required by applicable law.

CYBERARK SOFTWARE LTD. Consolidated Statements of

Operations U.S. dollars in thousands (except per share

data) (Unaudited) Three Months Ended

Nine Months Ended September 30, September 30,

2023

2024

2023

2024

Revenues: Subscription

$

122,879

$

175,577

$

321,766

$

490,230

Perpetual license

4,056

2,896

13,028

9,484

Maintenance and professional services

64,301

61,629

193,990

186,644

Total revenues

191,236

240,102

528,784

686,358

Cost of revenues: Subscription

21,281

24,569

54,859

68,132

Perpetual license

642

466

1,173

1,248

Maintenance and professional services

19,816

22,150

60,446

65,231

Total cost of revenues

41,739

47,185

116,478

134,611

Gross profit

149,497

192,917

412,306

551,747

Operating expenses: Research and development

51,733

59,306

157,653

169,776

Sales and marketing

98,859

113,690

299,376

333,993

General and administrative

24,642

31,011

67,038

89,422

Total operating expenses

175,234

204,007

524,067

593,191

Operating loss

(25,737

)

(11,090

)

(111,761

)

(41,444

)

Financial income, net

12,424

23,442

33,912

50,841

Income (loss) before taxes on income

(13,313

)

12,352

(77,849

)

9,397

Tax benefit (taxes on income)

(1,296

)

(1,242

)

2,434

(5,740

)

Net income (loss)

$

(14,609

)

$

11,110

$

(75,415

)

$

3,657

Basic income (loss) per ordinary share

$

(0.35

)

$

0.26

$

(1.82

)

$

0.09

Diluted income (loss) per ordinary share

$

(0.35

)

$

0.24

$

(1.82

)

$

0.12

Shares used in computing net income (loss) per ordinary

shares, basic

41,899,371

43,310,397

41,539,052

42,879,017

Shares used in computing net income (loss) per ordinary shares,

diluted

41,899,371

48,260,869

41,539,052

47,926,888

CYBERARK SOFTWARE LTD.

Consolidated Balance

Sheets

U.S. dollars in

thousands

(Unaudited)

December 31, September 30,

2023

2024

ASSETS CURRENT ASSETS: Cash and cash

equivalents

$

355,933

$

1,238,472

Short-term bank deposits

354,472

199,128

Marketable securities

283,016

37,707

Trade receivables

186,472

166,157

Prepaid expenses and other current assets

31,550

300,766

Total current assets

1,211,443

1,942,230

LONG-TERM ASSETS: Marketable securities

324,548

19,311

Property and equipment, net

16,494

17,470

Intangible assets, net

20,202

14,974

Goodwill

153,241

153,241

Other long-term assets

214,816

232,207

Deferred tax asset

81,464

82,382

Total long-term assets

810,765

519,585

TOTAL ASSETS

$

2,022,208

$

2,461,815

LIABILITIES AND SHAREHOLDERS' EQUITY CURRENT

LIABILITIES: Trade payables

$

10,971

$

5,346

Employees and payroll accruals

95,538

86,779

Accrued expenses and other current liabilities

36,562

47,524

Convertible senior notes, net

572,340

535,378

Deferred revenues

409,219

447,757

Total current liabilities

1,124,630

1,122,784

LONG-TERM LIABILITIES: Deferred revenues

71,413

78,052

Other long-term liabilities

33,839

30,452

Total long-term liabilities

105,252

108,504

TOTAL LIABILITIES

1,229,882

1,231,288

SHAREHOLDERS' EQUITY: Ordinary shares of NIS 0.01 par value

111

114

Additional paid-in capital

827,260

1,259,840

Accumulated other comprehensive income (loss)

(1,849

)

112

Accumulated deficit

(33,196

)

(29,539

)

Total shareholders' equity

792,326

1,230,527

TOTAL LIABILITIES AND SHAREHOLDERS’ EQUITY

$

2,022,208

$

2,461,815

CYBERARK SOFTWARE LTD.

Consolidated Statements of

Cash Flows

U.S. dollars in

thousands

(Unaudited)

Nine Months Ended September 30,

2023

2024

Cash flows from operating activities: Net income

(loss)

$

(75,415

)

$

3,657

Adjustments to reconcile net income (loss) to net cash provided by

operating activities: Depreciation and amortization

15,097

11,983

Amortization of premium and accretion of discount on marketable

securities, net and other

(2,724

)

(3,591

)

Share-based compensation

102,566

121,421

Deferred income taxes, net

(10,763

)

2,764

Decrease in trade receivables

1,834

20,315

Amortization of debt discount and issuance costs

2,245

2,257

Change in fair value of derivative assets

-

(2,591

)

Increase in prepaid expenses, other current and long-term assets

and others

(22,565

)

(31,778

)

Changes in operating lease right-of-use assets

5,495

5,947

Decrease in trade payables

(980

)

(6,078

)

Increase in short-term and long-term deferred revenues

14,613

45,177

Decrease in employees and payroll accruals

(13,579

)

(6,195

)

Increase in accrued expenses and other current and long-term

liabilities

669

10,216

Changes in operating lease liabilities

(7,187

)

(6,353

)

Net cash provided by operating activities

9,306

167,151

Cash flows from investing activities: Investment in

short and long term deposits

(204,461

)

(221,898

)

Proceeds from short and long term deposits

243,630

374,707

Investment in marketable securities and other

(322,049

)

(129,481

)

Proceeds from sales and maturities of marketable securities and

other

285,445

688,060

Purchase of property and equipment

(4,253

)

(7,090

)

Net cash provided by (used in) investing activities

(1,688

)

704,298

Cash flows from financing activities: Proceeds from

(payment of) withholding tax related to employee stock plans

3,210

(7,661

)

Proceeds from exercise of stock options

4,209

5,245

Proceeds in connection with employees stock purchase plan

11,776

14,867

Net cash provided by financing activities

19,195

12,451

Increase in cash and cash equivalents

26,813

883,900

Effect of exchange rate differences on cash and cash

equivalents

(1,955

)

(1,361

)

Cash and cash equivalents at the beginning of the period

347,338

355,933

Cash and cash equivalents at the end of the period

$

372,196

$

1,238,472

CYBERARK SOFTWARE LTD.

Reconciliation of GAAP

Measures to Non-GAAP Measures

U.S. dollars in thousands

(except per share data)

(Unaudited)

Reconciliation of Net cash provided by

operating activities to Free cash flow:

Three Months Ended

Nine Months Ended

September 30,

September 30,

2023

2024

2023

2024

Net cash provided by operating

activities

$

14,353

$

54,173

$

9,306

$

167,151

Less:

Purchase of property and equipment

(731

)

(2,605

)

(4,253

)

(7,090

)

Free cash flow

$

13,622

$

51,568

$

5,053

$

160,061

GAAP net cash provided by (used in)

investing activities

(42,788

)

534,926

(1,688

)

704,298

GAAP net cash provided by financing

activities

5,510

6,196

19,195

12,451

Reconciliation of Gross Profit to

Non-GAAP Gross Profit:

Three Months Ended

Nine Months Ended

September 30,

September 30,

2023

2024

2023

2024

Gross profit

$

149,497

$

192,917

$

412,306

$

551,747

Plus:

Share-based compensation (1)

4,780

5,624

13,112

15,857

Amortization of share-based compensation

capitalized in software development costs (3)

103

81

309

234

Amortization of intangible assets (2)

1,704

1,704

5,113

5,113

Impairment of capitalized software

development costs

2,067

-

2,067

-

Non-GAAP gross profit

$

158,151

$

200,326

$

432,907

$

572,951

Reconciliation of Operating Expenses to

Non-GAAP Operating Expenses:

Three Months Ended

Nine Months Ended

September 30,

September 30,

2023

2024

2023

2024

Operating expenses

$

175,234

$

204,007

$

524,067

$

593,191

Less:

Share-based compensation (1)

33,821

37,767

89,454

105,564

Amortization of intangible assets (2)

139

126

410

376

Acquisition related expenses

-

1,144

-

6,425

Non-GAAP operating expenses

$

141,274

$

164,970

$

434,203

$

480,826

Reconciliation of Operating Loss to

Non-GAAP Operating Income (Loss):

Three Months Ended

Nine Months Ended

September 30,

September 30,

2023

2024

2023

2024

Operating loss

$

(25,737

)

$

(11,090

)

$

(111,761

)

(41,444

)

Plus:

Share-based compensation (1)

38,601

43,391

102,566

121,421

Amortization of share-based compensation

capitalized in software development costs (3)

103

81

309

234

Amortization of intangible assets (2)

1,843

1,830

5,523

5,489

Acquisition related expenses

-

1,144

-

6,425

Impairment of capitalized software

development costs

2,067

-

2,067

-

Non-GAAP operating income (loss)

$

16,877

$

35,356

$

(1,296

)

$

92,125

Reconciliation of Net Income (Loss) to

Non-GAAP Net Income:

Three Months Ended

Nine Months Ended

September 30,

September 30,

2023

2024

2023

2024

Net income (loss)

$

(14,609

)

$

11,110

$

(75,415

)

$

3,657

Plus:

Share-based compensation (1)

38,601

43,391

102,566

121,421

Amortization of share-based compensation

capitalized in software development costs (3)

103

81

309

234

Amortization of intangible assets (2)

1,843

1,830

5,523

5,489

Acquisition related expenses

-

1,144

-

6,425

Amortization of debt discount and issuance

costs

748

753

2,244

2,257

Change in fair value of derivative

assets

-

(2,591

)

-

(2,591

)

Gain from investment in privately held

companies

(250

)

-

(544

)

-

Impairment of capitalized software

development costs

2,067

-

2,067

-

Taxes on income related to non-GAAP

adjustments

(8,894

)

(10,578

)

(22,808

)

(29,787

)

Non-GAAP net income

$

19,609

$

45,140

$

13,942

$

107,105

Non-GAAP net income per share

Basic

$

0.47

$

1.04

$

0.34

$

2.50

Diluted

$

0.42

$

0.94

$

0.30

$

2.23

Weighted average number of shares

Basic

41,899,371

43,310,397

41,539,052

42,879,017

Diluted

46,641,527

48,260,869

46,134,041

47,926,888

(1) Share-based Compensation :

Three Months Ended

Nine Months Ended

September 30,

September 30,

2023

2024

2023

2024

Cost of revenues - Subscription

$

1,149

$

1,702

$

2,959

$

4,731

Cost of revenues - Perpetual license

11

5

30

17

Cost of revenues - Maintenance and

Professional services

3,620

3,917

10,123

11,109

Research and development

7,867

8,541

21,797

24,258

Sales and marketing

15,800

17,486

43,990

49,277

General and administrative

10,154

11,740

23,667

32,029

Total share-based compensation

$

38,601

$

43,391

$

102,566

$

121,421

(2) Amortization of intangible assets

:

Three Months Ended

Nine Months Ended

September 30,

September 30,

2023

2024

2023

2024

Cost of revenues - Subscription

$

1,704

$

1,704

$

5,113

$

5,113

Sales and marketing

139

126

410

376

Total amortization of intangible

assets

$

1,843

$

1,830

$

5,523

$

5,489

(3) Classified as Cost of revenues

- Subscription.

View source

version on businesswire.com: https://www.businesswire.com/news/home/20241113416461/en/

Investor Relations: Srinivas Anantha, CFA CyberArk

617-558-2132 ir@cyberark.com

Media: Nick Bowman CyberArk +44 (0) 7841 673378

press@cyberark.com

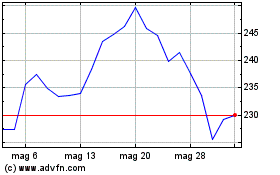

Grafico Azioni CyberArk Software (NASDAQ:CYBR)

Storico

Da Dic 2024 a Gen 2025

Grafico Azioni CyberArk Software (NASDAQ:CYBR)

Storico

Da Gen 2024 a Gen 2025