false

0001668010

0001668010

2024-01-16

2024-01-16

0001668010

us-gaap:CommonStockMember

2024-01-16

2024-01-16

0001668010

DBGI:WarrantsEachExercisableToPurchaseOneShareOfCommonStockMember

2024-01-16

2024-01-16

iso4217:USD

xbrli:shares

iso4217:USD

xbrli:shares

UNITED

STATES

SECURITIES AND EXCHANGE COMMISSION

Washington,

D.C. 20549

FORM 8-K

CURRENT

REPORT

Pursuant

to Section 13 OR 15(d)

of The Securities Exchange Act of 1934

Date

of Report (Date of earliest event reported)

January 16, 2024

DIGITAL

BRANDS GROUP, INC.

(Exact

name of registrant as specified in its charter)

| Delaware |

|

001-40400 |

|

46-1942864 |

(State

or other jurisdiction

of incorporation) |

|

(Commission

File Number) |

|

(IRS

Employer

Identification No.) |

1400

Lavaca Street

Austin, TX |

|

78701 |

| (Address

of principal executive offices) |

|

(Zip

Code) |

Registrant’s

telephone number, including area code (209) 651-0172

(Former name or former address, if changed since last report.)

Check

the appropriate box below if the Form 8-K filing is intended to simultaneously satisfy the filing obligation of the registrant under

any of the following provisions (see General Instruction A.2. below):

¨ Written

communications pursuant to Rule 425 under the Securities Act (17 CFR 230.425)

¨ Soliciting

material pursuant to Rule 14a-12 under the Exchange Act (17 CFR 240.14a-12)

¨ Pre-commencement

communications pursuant to Rule 14d-2(b) under the Exchange Act (17 CFR 240.14d-2(b))

¨ Pre-commencement

communications pursuant to Rule 13e-4(c) under the Exchange Act (17 CFR 240.13e-4(c))

Securities

registered pursuant to Section 12(b) of the Act:

| Title

of each class |

Trading

Symbol(s) |

Name

of each exchange on which registered |

| Common

Stock, par value $0.0001 |

DBGI |

The

Nasdaq Stock Market LLC |

| Warrants,

each exercisable pursuant to purchase one share of Common Stock |

DBGIW |

The

Nasdaq Stock Market LLC |

Indicate by check mark whether the registrant is an emerging growth company as defined in Rule 405 of the Securities Act of 1933 (§230.405

of this chapter) or Rule 12b-2 of the Securities Exchange Act of 1934 (§240.12b-2 of this chapter).

Emerging

growth company ¨

If

an emerging growth company, indicate by check mark if the registrant has elected not to use the extended transition period for complying

with any new or revised financial accounting standards provided pursuant to Section 13(a) of the Exchange Act. ¨

Item 7.01. Regulation FD Disclosure.

On January 16, 2024,

Digital Brands Group, Inc. (the “Company”) issued a press release announcing that it has entered into a Letter of Intent

to open its first retail store in March, 2024.

The press release is

attached hereto as Exhibit 99.1 and incorporated herein by reference. The information included in this Current Report on Form 8-K, including

Exhibit 99.1, shall not be deemed to be "filed" for purposes of Section 18 of the Securities Exchange Act of 1934, as amended

(the "Exchange Act"), or otherwise subject to the liabilities of that section, nor shall such information be deemed incorporated

by reference in any filing under the Securities Act of 1933, as amended, or the Exchange Act, except as shall be expressly set forth by

specific reference in such a filing. The information set forth under this Item 7.01 shall not be deemed an admission as to the materiality

of any information in this Current Report on Form 8-K that is required to be disclosed solely to satisfy the requirements of Regulation

FD.

Item

9.01 Financial Statements and Exhibits

(d) Exhibits

SIGNATURES

Pursuant to the requirements

of the Securities Exchange Act of 1934, the registrant has duly caused this report to be signed on its behalf by the undersigned thereunto

duly authorized.

| Date: January 16, 2024 |

DIGITAL BRANDS GROUP, INC. |

| |

|

|

| |

By: |

/s/ John Hilburn Davis IV |

| |

Name: |

John Hilburn Davis IV |

| |

Title: |

President and Chief Executive Officer |

Exhibit 99.1

Digital Brands Group Signs Letter of Intent to Open First Retail Store in March

DBG forecasts the store to generate over $1.5

million in annual revenue and $500,000 in annual cash flow

Austin, TX-- Digital Brands Group, Inc. (“DBG”) (NASDAQ:

DBGI), a curated collection of luxury lifestyle, digital-first brands, today announces that is has signed a Letter of Intent to open

its first retail store in March. The Company forecasts the store to generate over $1.5 million in annual revenue and over $500,000 in

annual cash flow based on the historical metrics and performance of this store, and excess Sundry inventory prior to the acquisition.

DBG will use this store to clear excess inventory at a meaningfully

higher margin than selling into the off-price channel. Importantly, DBG received a significant amount of excess inventory with its Sundry

acquisition. Therefore, there will be no additional costs to make these excess units, as they have already been paid for and are at our

warehouse. Given this, we expect this store to generate significant annual cash flow of over $500,000 a year.

“We are

excited to begin the retail store phase of growth strategy. We believe the best performing retail brands will have three legs to their

growth story: (1) wholesale, (2) e-commerce and (3) retail stores. We started with an outlet location due to the finished goods inventory

that are already paid for and sitting at our warehouse, as well as the historical metrics and performance of this store,”

said Hil Davis, Chief Executive Officer of Digital Brands Group.

Forward-looking Statements

Certain statements included in this release are

"forward-looking statements" within the meaning of the federal securities laws. Forward-looking statements are made based

on our expectations and beliefs concerning future events impacting DBG and therefore involve several risks and uncertainties. You

can identify these statements by the fact that they use words such as “will,” “anticipate,”

“estimate,” “expect,” “should,” and “may” and other words and terms of similar

meaning or use of future dates, however, the absence of these words or similar expressions does not mean that a statement is not

forward-looking. All statements regarding DBG’s plans, objectives, projections and expectations relating to DBG’s

operations or financial performance, and assumptions related thereto are forward-looking statements. We caution that forward-looking

statements are not guarantees and that actual results could differ materially from those expressed or implied in the forward-looking

statements. DBG undertakes no obligation to publicly update or revise any forward-looking statements, whether as a result of new

information, future events or otherwise, except as required by law. Potential risks and uncertainties that could cause the actual

results of operations or financial condition of DBG to differ materially from those expressed or implied by forward-looking

statements include, but are not limited to: risks arising from the widespread outbreak of an illness or any other communicable

disease, or any other public health crisis, including the coronavirus (COVID-19) global pandemic; the level of consumer demand for

apparel and accessories; disruption to DBGs distribution system; the financial strength of DBG’s customers; fluctuations in

the price, availability and quality of raw materials and contracted products; disruption and volatility in the global capital and

credit markets; DBG’s response to changing fashion trends, evolving consumer preferences and changing patterns of consumer

behavior; intense competition from online retailers; manufacturing and product innovation; increasing pressure on margins;

DBG’s ability to implement its business strategy; DBG’s ability to grow its wholesale and direct-to-consumer businesses;

retail industry changes and challenges; DBG’s and its vendors’ ability to maintain the strength and security of

information technology systems; the risk that DBG’s facilities and systems and those of our third-party service providers may

be vulnerable to and unable to anticipate or detect data security breaches and data or financial loss; DBG’s ability to

properly collect, use, manage and secure consumer and employee data; stability of DBG’s manufacturing facilities and foreign

suppliers; continued use by DBG’s suppliers of ethical business practices; DBG’s ability to accurately forecast demand

for products; continuity of members of DBG’s management; DBG’s ability to protect trademarks and other intellectual

property rights; possible goodwill and other asset impairment; DBG’s ability to execute and integrate acquisitions; changes in

tax laws and liabilities; legal, regulatory, political and economic risks; adverse or unexpected weather conditions; DBG's

indebtedness and its ability to obtain financing on favorable terms, if needed, could prevent DBG from fulfilling its financial

obligations; and climate change and increased focus on sustainability issues. More information on potential factors that could

affect DBG’s financial results is included from time to time in DBG’s public reports filed with the SEC, including

DBG’s Annual Report on Form 10-K, and Quarterly Reports on Form 10-Q, and Forms 8-K filed or furnished with the SEC.

About Digital Brands Group

We offer a wide variety of apparel through numerous brands on a both direct-to-consumer and wholesale basis. We have created a business

model derived from our founding as a digitally native-first vertical brand. We focus on owning the customer's "closet share"

by leveraging their data and purchase history to create personalized targeted content and looks for that specific customer cohort.

Digital Brands Group, Inc. Company Contact

Hil Davis, CEO

Email: invest@digitalbrandsgroup.co

Phone: (800) 593-1047

SOURCE Digital Brands Group, Inc.

Related Links

https://ir.digitalbrandsgroup.co

v3.23.4

Cover

|

Jan. 16, 2024 |

| Document Information [Line Items] |

|

| Document Type |

8-K

|

| Amendment Flag |

false

|

| Document Period End Date |

Jan. 16, 2024

|

| Entity File Number |

001-40400

|

| Entity Registrant Name |

DIGITAL

BRANDS GROUP, INC.

|

| Entity Central Index Key |

0001668010

|

| Entity Tax Identification Number |

46-1942864

|

| Entity Incorporation, State or Country Code |

DE

|

| Entity Address, Address Line One |

1400

Lavaca Street

|

| Entity Address, City or Town |

Austin

|

| Entity Address, State or Province |

TX

|

| Entity Address, Postal Zip Code |

78701

|

| City Area Code |

209

|

| Local Phone Number |

651-0172

|

| Written Communications |

false

|

| Soliciting Material |

false

|

| Pre-commencement Tender Offer |

false

|

| Pre-commencement Issuer Tender Offer |

false

|

| Entity Emerging Growth Company |

false

|

| Common Stock [Member] |

|

| Document Information [Line Items] |

|

| Title of 12(b) Security |

Common

Stock, par value $0.0001

|

| Trading Symbol |

DBGI

|

| Security Exchange Name |

NASDAQ

|

| Warrants, each exercisable to purchase one share of Common Stock [Member] |

|

| Document Information [Line Items] |

|

| Title of 12(b) Security |

Warrants,

each exercisable pursuant to purchase one share of Common Stock

|

| Trading Symbol |

DBGIW

|

| Security Exchange Name |

NASDAQ

|

| X |

- DefinitionBoolean flag that is true when the XBRL content amends previously-filed or accepted submission.

| Name: |

dei_AmendmentFlag |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:booleanItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionFor the EDGAR submission types of Form 8-K: the date of the report, the date of the earliest event reported; for the EDGAR submission types of Form N-1A: the filing date; for all other submission types: the end of the reporting or transition period. The format of the date is YYYY-MM-DD.

| Name: |

dei_DocumentPeriodEndDate |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:dateItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionThe type of document being provided (such as 10-K, 10-Q, 485BPOS, etc). The document type is limited to the same value as the supporting SEC submission type, or the word 'Other'.

| Name: |

dei_DocumentType |

| Namespace Prefix: |

dei_ |

| Data Type: |

dei:submissionTypeItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionAddress Line 1 such as Attn, Building Name, Street Name

| Name: |

dei_EntityAddressAddressLine1 |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:normalizedStringItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- Definition

+ References

+ Details

| Name: |

dei_EntityAddressCityOrTown |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:normalizedStringItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionCode for the postal or zip code

| Name: |

dei_EntityAddressPostalZipCode |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:normalizedStringItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionName of the state or province.

| Name: |

dei_EntityAddressStateOrProvince |

| Namespace Prefix: |

dei_ |

| Data Type: |

dei:stateOrProvinceItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionA unique 10-digit SEC-issued value to identify entities that have filed disclosures with the SEC. It is commonly abbreviated as CIK. Reference 1: http://www.xbrl.org/2003/role/presentationRef

-Publisher SEC

-Name Exchange Act

-Number 240

-Section 12

-Subsection b-2

| Name: |

dei_EntityCentralIndexKey |

| Namespace Prefix: |

dei_ |

| Data Type: |

dei:centralIndexKeyItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionIndicate if registrant meets the emerging growth company criteria. Reference 1: http://www.xbrl.org/2003/role/presentationRef

-Publisher SEC

-Name Exchange Act

-Number 240

-Section 12

-Subsection b-2

| Name: |

dei_EntityEmergingGrowthCompany |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:booleanItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionCommission file number. The field allows up to 17 characters. The prefix may contain 1-3 digits, the sequence number may contain 1-8 digits, the optional suffix may contain 1-4 characters, and the fields are separated with a hyphen.

| Name: |

dei_EntityFileNumber |

| Namespace Prefix: |

dei_ |

| Data Type: |

dei:fileNumberItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionTwo-character EDGAR code representing the state or country of incorporation.

| Name: |

dei_EntityIncorporationStateCountryCode |

| Namespace Prefix: |

dei_ |

| Data Type: |

dei:edgarStateCountryItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionThe exact name of the entity filing the report as specified in its charter, which is required by forms filed with the SEC. Reference 1: http://www.xbrl.org/2003/role/presentationRef

-Publisher SEC

-Name Exchange Act

-Number 240

-Section 12

-Subsection b-2

| Name: |

dei_EntityRegistrantName |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:normalizedStringItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionThe Tax Identification Number (TIN), also known as an Employer Identification Number (EIN), is a unique 9-digit value assigned by the IRS. Reference 1: http://www.xbrl.org/2003/role/presentationRef

-Publisher SEC

-Name Exchange Act

-Number 240

-Section 12

-Subsection b-2

| Name: |

dei_EntityTaxIdentificationNumber |

| Namespace Prefix: |

dei_ |

| Data Type: |

dei:employerIdItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionLocal phone number for entity.

| Name: |

dei_LocalPhoneNumber |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:normalizedStringItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionBoolean flag that is true when the Form 8-K filing is intended to satisfy the filing obligation of the registrant as pre-commencement communications pursuant to Rule 13e-4(c) under the Exchange Act. Reference 1: http://www.xbrl.org/2003/role/presentationRef

-Publisher SEC

-Name Exchange Act

-Number 240

-Section 13e

-Subsection 4c

| Name: |

dei_PreCommencementIssuerTenderOffer |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:booleanItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionBoolean flag that is true when the Form 8-K filing is intended to satisfy the filing obligation of the registrant as pre-commencement communications pursuant to Rule 14d-2(b) under the Exchange Act. Reference 1: http://www.xbrl.org/2003/role/presentationRef

-Publisher SEC

-Name Exchange Act

-Number 240

-Section 14d

-Subsection 2b

| Name: |

dei_PreCommencementTenderOffer |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:booleanItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionTitle of a 12(b) registered security. Reference 1: http://www.xbrl.org/2003/role/presentationRef

-Publisher SEC

-Name Exchange Act

-Number 240

-Section 12

-Subsection b

| Name: |

dei_Security12bTitle |

| Namespace Prefix: |

dei_ |

| Data Type: |

dei:securityTitleItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionName of the Exchange on which a security is registered. Reference 1: http://www.xbrl.org/2003/role/presentationRef

-Publisher SEC

-Name Exchange Act

-Number 240

-Section 12

-Subsection d1-1

| Name: |

dei_SecurityExchangeName |

| Namespace Prefix: |

dei_ |

| Data Type: |

dei:edgarExchangeCodeItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionBoolean flag that is true when the Form 8-K filing is intended to satisfy the filing obligation of the registrant as soliciting material pursuant to Rule 14a-12 under the Exchange Act. Reference 1: http://www.xbrl.org/2003/role/presentationRef

-Publisher SEC

-Name Exchange Act

-Section 14a

-Number 240

-Subsection 12

| Name: |

dei_SolicitingMaterial |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:booleanItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionTrading symbol of an instrument as listed on an exchange.

| Name: |

dei_TradingSymbol |

| Namespace Prefix: |

dei_ |

| Data Type: |

dei:tradingSymbolItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionBoolean flag that is true when the Form 8-K filing is intended to satisfy the filing obligation of the registrant as written communications pursuant to Rule 425 under the Securities Act. Reference 1: http://www.xbrl.org/2003/role/presentationRef

-Publisher SEC

-Name Securities Act

-Number 230

-Section 425

| Name: |

dei_WrittenCommunications |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:booleanItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- Details

| Name: |

us-gaap_StatementClassOfStockAxis=us-gaap_CommonStockMember |

| Namespace Prefix: |

|

| Data Type: |

na |

| Balance Type: |

|

| Period Type: |

|

|

| X |

- Details

| Name: |

us-gaap_StatementClassOfStockAxis=DBGI_WarrantsEachExercisableToPurchaseOneShareOfCommonStockMember |

| Namespace Prefix: |

|

| Data Type: |

na |

| Balance Type: |

|

| Period Type: |

|

|

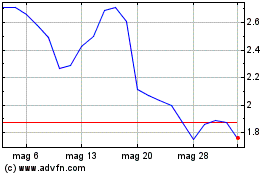

Grafico Azioni Digital Brands (NASDAQ:DBGI)

Storico

Da Dic 2024 a Gen 2025

Grafico Azioni Digital Brands (NASDAQ:DBGI)

Storico

Da Gen 2024 a Gen 2025