Digital Brands Group Reports First Quarter 2024 Financial Results

20 Maggio 2024 - 3:30PM

Digital Brands Group, Inc. (“DBG”) (NASDAQ: DBGI), a curated

collection of luxury lifestyle, digital-first brands, today

reported financial results for its first quarter ended March 31,

2024.

“Despite a timing shift in our wholesale

shipments, which shifted revenue from the first quarter to the

second quarter, we experienced significant operating expense

leverage. We expect this operating leverage to continue throughout

the year. In fact, this operating leverage coupled with higher

revenues will result in higher flow through to our operating and

net income,” said Hil Davis, CEO of Digital Brands Group.

Results for the First Quarter

- Net revenues were $3.6 million compared to $4.4 million a year

ago

o Net revenues were negatively impacted by

wholesale shipments that slipped from the end of March to the first

half of April

o This wholesale revenue shift will benefit our

second quarter revenue

- Gross profit margins increased to 48.1% compared to 45.5% a

year ago

o Gross profit was $1.7 million compared to $2.0

million a year ago

- G&A expenses decreased to $1.0 million compared to $4.5

million a year ago

o G&A expense ratio was 27.2% compared to

100.5% a year ago

- Sales & Marketing expenses were $700,000 compared to $1.0

million a year ago

o Sales and marketing expenses ratio was 19.8%

compared to 22.0% a year ago

- Net operating loss was $225,000 compared to a loss of $3.7

million a year ago

- Net loss was $684,000, or a loss of $0.46 per diluted share,

compared to a loss of $6.1 million, or a loss of $27.48 per diluted

share, a year ago

Conference Call and Webcast Details

Updated

Management will host a conference call on

Monday, May 20, 2024 at 10:30 a.m. ET to discuss the results. The

live conference call can be accessed by dialing 888-506-0062 from

the U.S. or internationally. The conference I.D. code is 817721 or

referencing Digital Brands or via the web by using the following

link: https://www.webcaster4.com/Webcast/Page/3044/50662.

Forward-looking Statements

Certain statements included in this release are

"forward-looking statements" within the meaning of the federal

securities laws. Forward-looking statements are made based on our

expectations and beliefs concerning future events impacting DBG and

therefore involve several risks and uncertainties. You can identify

these statements by the fact that they use words such as “will,”

“anticipate,” “estimate,” “expect,” “should,” and “may” and other

words and terms of similar meaning or use of future dates, however,

the absence of these words or similar expressions does not mean

that a statement is not forward-looking. All statements regarding

DBG’s plans, objectives, projections and expectations relating to

DBG’s operations or financial performance, and assumptions related

thereto are forward-looking statements. We caution that

forward-looking statements are not guarantees and that actual

results could differ materially from those expressed or implied in

the forward-looking statements. DBG undertakes no obligation to

publicly update or revise any forward-looking statements, whether

as a result of new information, future events or otherwise, except

as required by law. Potential risks and uncertainties that could

cause the actual results of operations or financial condition of

DBG to differ materially from those expressed or implied by

forward-looking statements include, but are not limited to: risks

arising from the widespread outbreak of an illness or any other

communicable disease, or any other public health crisis, including

the coronavirus (COVID-19) global pandemic; the level of consumer

demand for apparel and accessories; disruption to DBGs distribution

system; the financial strength of DBG’s customers; fluctuations in

the price, availability and quality of raw materials and contracted

products; disruption and volatility in the global capital and

credit markets; DBG’s response to changing fashion trends, evolving

consumer preferences and changing patterns of consumer behavior;

intense competition from online retailers; manufacturing and

product innovation; increasing pressure on margins; DBG’s ability

to implement its business strategy; DBG’s ability to grow its

wholesale and direct-to-consumer businesses; retail industry

changes and challenges; DBG’s and its vendors’ ability to maintain

the strength and security of information technology systems; the

risk that DBG’s facilities and systems and those of our third-party

service providers may be vulnerable to and unable to anticipate or

detect data security breaches and data or financial loss; DBG’s

ability to properly collect, use, manage and secure consumer and

employee data; stability of DBG’s manufacturing facilities and

foreign suppliers; continued use by DBG’s suppliers of ethical

business practices; DBG’s ability to accurately forecast demand for

products; continuity of members of DBG’s management; DBG’s ability

to protect trademarks and other intellectual property rights;

possible goodwill and other asset impairment; DBG’s ability to

execute and integrate acquisitions; changes in tax laws and

liabilities; legal, regulatory, political and economic risks;

adverse or unexpected weather conditions; DBG's indebtedness and

its ability to obtain financing on favorable terms, if needed,

could prevent DBG from fulfilling its financial obligations; and

climate change and increased focus on sustainability issues. More

information on potential factors that could affect DBG’s financial

results is included from time to time in DBG’s public reports filed

with the SEC, including DBG’s Annual Report on Form 10-K, and

Quarterly Reports on Form 10-Q, and Forms 8-K filed or furnished

with the SEC.

DIGITAL BRANDS GROUP,

INCSTATEMENT OF OPERATIONS

| |

|

Three Months Ended |

|

| |

|

March, 31 |

|

| |

|

2024 |

|

|

2023 |

|

| Net revenues |

|

$ |

3,576,587 |

|

|

$ |

4,439,508 |

|

| Cost of net revenues |

|

|

1,855,851 |

|

|

|

2,420,194 |

|

| Gross profit |

|

|

1,720,736 |

|

|

|

2,019,314 |

|

| |

|

|

|

|

|

|

|

|

| Operating expenses: |

|

|

|

|

|

|

|

|

| General and

administrative |

|

|

971,732 |

|

|

|

4,460,462 |

|

| Sales and marketing |

|

|

708,150 |

|

|

|

977,154 |

|

| Distribution |

|

|

265,499 |

|

|

|

270,185 |

|

| Total operating expenses |

|

|

1,945,381 |

|

|

|

5,707,802 |

|

| |

|

|

|

|

|

|

|

|

| Loss from operations |

|

|

(224,645 |

) |

|

|

(3,688,487 |

) |

| |

|

|

|

|

|

|

|

|

| Other income (expense): |

|

|

|

|

|

|

|

|

| Interest expense |

|

|

(504,991 |

) |

|

|

(1,864,598 |

) |

| Other non-operating income

(expenses) |

|

|

45,901 |

|

|

|

(678,989 |

) |

| Total other income (expense),

net |

|

|

(459,090 |

) |

|

|

(2,543,587 |

) |

| |

|

|

|

|

|

|

|

|

| Income tax benefit

(provision) |

|

|

- |

|

|

|

- |

|

| Net loss from continuing

operations |

|

|

(683,735 |

) |

|

|

(6,232,075 |

) |

| Income from discontinued

operations, net of tax |

|

|

- |

|

|

|

95,726 |

|

| Net loss |

|

$ |

(683,735 |

) |

|

$ |

(6,136,349 |

) |

| |

|

|

|

|

|

|

|

|

| Weighted average common shares

outstanding - |

|

|

|

|

|

|

|

|

| basic and diluted |

|

|

1,485,210 |

|

|

|

226,814 |

|

| Net loss per common share -

basic and diluted |

|

$ |

(0.46 |

) |

|

$ |

(27.48 |

) |

The accompanying notes are an integral part of

these financial statements.

DIGITAL BRANDS GROUP, INC

STATEMENTS OF CASH FLOW

| |

|

Three Months Ended |

|

| |

|

March 31, |

|

| |

|

2024 |

|

|

2023 |

|

| Cash flows from

operating activities: |

|

|

|

|

|

|

|

|

| Net loss |

|

$ |

(683,735 |

) |

|

$ |

(6,136,349 |

) |

| Adjustments to reconcile net

loss to net cash used in operating activities: |

|

|

|

|

|

|

|

|

| Depreciation and

amortization |

|

|

1,117,240 |

|

|

|

959,207 |

|

| Amortization of loan discount

and fees |

|

|

492,858 |

|

|

|

1,412,425 |

|

| Loss on extinguishment of

debt |

|

|

- |

|

|

|

689,100 |

|

| Stock-based compensation |

|

|

100,299 |

|

|

|

105,594 |

|

| Shares issued for

services |

|

|

224,265 |

|

|

|

499,338 |

|

| Change in credit reserve |

|

|

(151,611 |

) |

|

|

109,298 |

|

| Changes in operating assets

and liabilities: |

|

|

|

|

|

|

|

|

| Accounts receivable, net |

|

|

(207,071 |

) |

|

|

282,947 |

|

| Due from factor, net |

|

|

(297,951 |

) |

|

|

(77,776 |

) |

| Inventory |

|

|

201,127 |

|

|

|

299,188 |

|

| Prepaid expenses and other

current assets |

|

|

(24,545 |

) |

|

|

(218,286 |

) |

| Accounts payable |

|

|

(1,409,514 |

) |

|

|

(416,093 |

) |

| Accrued expenses and other

liabilities |

|

|

(440,775 |

) |

|

|

464,855 |

|

| Deferred revenue |

|

|

- |

|

|

|

115,292 |

|

| Accrued interest |

|

|

(161,130 |

) |

|

|

218,740 |

|

| Net cash used in operating

activities |

|

|

(1,240,541 |

) |

|

|

(1,692,520 |

) |

| Cash flows from

investing activities: |

|

|

|

|

|

|

|

|

| Purchase of property,

equipment and software |

|

|

(13,785 |

) |

|

|

- |

|

| Deposits |

|

|

- |

|

|

|

87,379 |

|

| Net cash provided by (used in)

investing activities |

|

|

(13,785 |

) |

|

|

87,379 |

|

| Cash flows from

financing activities: |

|

|

|

|

|

|

|

|

| Repayments from related party

advances |

|

|

(1,233 |

) |

|

|

(104,170 |

) |

| Advances from factor |

|

|

27,936 |

|

|

|

217,625 |

|

| Issuance of loans and note

payable |

|

|

- |

|

|

|

3,542,199 |

|

| Repayments of convertible

notes and loan payable |

|

|

(518,026 |

) |

|

|

(5,677,621 |

) |

| Issuance of common stock for

cash |

|

|

1,736,206 |

|

|

|

5,000,003 |

|

| Offering costs |

|

|

- |

|

|

|

(686,927 |

) |

| Net cash provided by financing

activities |

|

|

1,244,882 |

|

|

|

2,291,109 |

|

| Net chane in cash and

cash equivalents |

|

|

(9,443 |

) |

|

|

685,968 |

|

| Cash and cash equivalents at

beginning of period |

|

|

20,773 |

|

|

|

1,283,282 |

|

| Cash and cash equivalents at

end of period |

|

$ |

11,330 |

|

|

$ |

1,969,250 |

|

| |

|

|

|

|

|

|

|

|

| Supplemental

disclosure of cash flow information: |

|

|

|

|

|

|

|

|

| Cash paid for income

taxes |

|

$ |

- |

|

|

$ |

- |

|

| Cash paid for interest |

|

$ |

- |

|

|

$ |

60,465 |

|

| |

|

|

|

|

|

|

|

|

| Supplemental

disclosure of non-cash investing and financing

activities: |

|

|

|

|

|

|

|

|

| Right of use asset |

|

$ |

- |

|

|

$ |

467,738 |

|

The accompanying notes are an integral part of

these financial statements.

DIGITAL BRANDS GROUP,

INCSTATEMENT OF BALANCE SHEETS

| |

|

March 31, |

|

|

December 31, |

|

| |

|

2024 |

|

|

2023 |

|

| ASSETS |

|

|

|

|

|

|

|

|

| Current assets: |

|

|

|

|

|

|

|

|

| Cash and cash equivalents |

|

$ |

11,330 |

|

|

$ |

20,773 |

|

| Accounts receivable, net |

|

|

281,904 |

|

|

|

74,833 |

|

| Due from factor, net |

|

|

759,437 |

|

|

|

337,811 |

|

| Inventory |

|

|

4,648,473 |

|

|

|

4,849,600 |

|

| Prepaid expenses and other

current assets |

|

|

301,215 |

|

|

|

276,670 |

|

| Total current assets |

|

|

6,002,359 |

|

|

|

5,559,687 |

|

| Property, equipment and

software, net |

|

|

69,294 |

|

|

|

55,509 |

|

| Goodwill |

|

|

8,973,501 |

|

|

|

8,973,501 |

|

| Intangible assets, net |

|

|

9,262,670 |

|

|

|

9,982,217 |

|

| Deposits |

|

|

75,431 |

|

|

|

75,431 |

|

| Right of use asset |

|

|

465,069 |

|

|

|

689,688 |

|

| Total assets |

|

$ |

24,848,324 |

|

|

$ |

25,336,033 |

|

| |

|

|

|

|

|

|

|

|

| LIABILITIES AND

STOCKHOLDERS' EQUITY |

|

|

|

|

|

|

|

|

| Current liabilities: |

|

|

|

|

|

|

|

|

| Accounts payable |

|

$ |

6,266,814 |

|

|

$ |

7,538,902 |

|

| Accrued expenses and other

liabilities |

|

|

4,317,717 |

|

|

|

4,758,492 |

|

| Due to related parties |

|

|

398,779 |

|

|

|

400,012 |

|

| Convertible note payable,

net |

|

|

100,000 |

|

|

|

100,000 |

|

| Accrued interest payable |

|

|

1,835,623 |

|

|

|

1,996,753 |

|

| Loan payable, current |

|

|

2,300,674 |

|

|

|

2,325,842 |

|

| Promissory note payable,

net |

|

|

5,057,666 |

|

|

|

4,884,592 |

|

| Right of use liability,

current portion |

|

|

1,073,389 |

|

|

|

1,210,814 |

|

| Total current liabilities |

|

|

21,350,662 |

|

|

|

23,215,407 |

|

| Loan payable |

|

|

150,000 |

|

|

|

150,000 |

|

| Deferred tax liability |

|

|

368,034 |

|

|

|

368,034 |

|

| Total liabilities |

|

|

21,868,696 |

|

|

|

23,733,441 |

|

| |

|

|

|

|

|

|

|

|

| Commitments and

contingencies |

|

|

|

|

|

|

|

|

| |

|

|

|

|

|

|

|

|

| Stockholders' equity: |

|

|

|

|

|

|

|

|

| Undesignated preferred stock,

$0.0001 par, 10,000,000 shares authorized, 0 shares |

|

|

|

|

|

|

|

|

| issued and outstanding

as of both March 31, 2024 and December 31, 2023 |

|

|

- |

|

|

|

- |

|

| Series A convertible preferred

stock, $0.0001 par, 6,300 shares designated, 6,300 shares issued

and |

|

|

|

|

|

|

|

|

| outstanding as of both March

31, 2024 and December 31, 2023 |

|

|

1 |

|

|

|

1 |

|

| Series C convertible preferred

stock, $0.0001 par, 3,239 and 4,786 shares issued and |

|

|

|

|

|

|

|

|

| outstanding as of March 31,

2024 and December 31, 2023, respectively |

|

|

1 |

|

|

|

1 |

|

| Common stock, $0.0001 par,

1,000,000,000 shares authorized, 1,714,157 and 1,114,359

shares |

|

|

|

|

|

|

|

|

| issued and outstanding as of

March 31, 2024 and December 31, 2023, respectively |

|

|

169 |

|

|

|

110 |

|

| Additional paid-in

capital |

|

|

117,657,641 |

|

|

|

115,596,929 |

|

| Accumulated deficit |

|

|

(114,678,184 |

) |

|

|

(113,994,449 |

) |

| Total stockholders'

equity |

|

|

2,979,628 |

|

|

|

1,602,592 |

|

| Total liabilities and

stockholders' equity |

|

$ |

24,848,324 |

|

|

$ |

25,336,033 |

|

The accompanying notes are an integral part of

these financial statements.

About Digital Brands Group

We offer a wide variety of apparel through

numerous brands on a both direct-to-consumer and wholesale basis.

We have created a business model derived from our founding as a

digitally native-first vertical brand. We focus on owning the

customer's "closet share" by leveraging their data and purchase

history to create personalized targeted content and looks for that

specific customer cohort.

Digital Brands Group, Inc. Company Contact

Hil Davis, CEOEmail:

invest@digitalbrandsgroup.coPhone: (800) 593-1047

SOURCE Digital Brands Group, Inc.

Related Links

https://www.digitalbrandsgroup.co

https://ir.digitalbrandsgroup.co

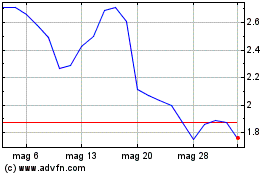

Grafico Azioni Digital Brands (NASDAQ:DBGI)

Storico

Da Dic 2024 a Gen 2025

Grafico Azioni Digital Brands (NASDAQ:DBGI)

Storico

Da Gen 2024 a Gen 2025