DocuSign Shows Strong Demand as Shares Jump 35% -- Update

27 Aprile 2018 - 7:02PM

Dow Jones News

By Austen Hufford

Electronic-signature technology company DocuSign Inc. jumped 30%

in the first minutes of its market debut Friday.

DocuSign's share price after early trading values it at about

$5.76 billion. The company, founded in 2003, was valued at $3

billion in April 2015.

The company's stock was recently up 35% to $39.08, above its

already raised $29 initial-public-offering price.

Founded in 2003, DocuSign was valued at $3 billion in April

2015.

DocuSign is the latest so-called unicorn, or private companies

valued at $1 billion or more, to make its market debut this year,

joining others such as Spotify Technology SA and Dropbox Inc.

Another technology company, Smartsheet Inc., also had its market

start on Friday. Its shares were up 23% to $18.50 in recent

trading.

Still, many highly-valued, venture-backed companies remain

private and flush with cash. They may eventually choose to tap

public markets to allow employees and investors to cash out.

San Francisco-based DocuSign is trading under the symbol DOCU on

Nasdaq. The company sold 16.1 million shares for $29 while other

shareholders sold 5.6 million.

DocuSign, which competes with the likes of Adobe Systems Inc.

and has yet to turn profitable, offers cloud-based technology that

makes signing contracts on a computer simpler and more

user-friendly.

The company started as a provider of electronic signatures

serving the U.S. real-estate industry and has expanded to track,

authenticate and archive all types of digital documents for

insurance, consumer goods, enterprise sales, financial,

pharmaceuticals and other sectors. Customers include Salesforce.com

Inc., T-Mobile US Inc. and Comcast Corp., according to the

filing.

DocuSign reported $518.5 million in revenue in the year ended

Jan. 31. The company, which generates the bulk of its revenue from

subscriptions, said about 17% of its revenue came from customers

outside the U.S.

The company also reported a net loss of $52.3 million, compared

with a loss of $115.4 million the prior year.

DocuSign hired former Responsys Inc. chief executive Daniel

Springer as CEO in January 2017, more than a year after Keith Krach

said he would step down as CEO and remain chairman.

--Maureen Farrell contributed to this article

Write to Austen Hufford at austen.hufford@wsj.com

(END) Dow Jones Newswires

April 27, 2018 12:47 ET (16:47 GMT)

Copyright (c) 2018 Dow Jones & Company, Inc.

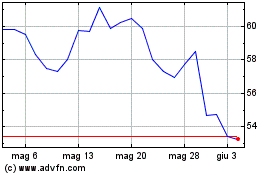

Grafico Azioni DocuSign (NASDAQ:DOCU)

Storico

Da Giu 2024 a Lug 2024

Grafico Azioni DocuSign (NASDAQ:DOCU)

Storico

Da Lug 2023 a Lug 2024