0001261333FALSE00012613332024-06-062024-06-06

UNITED STATES

SECURITIES AND EXCHANGE COMMISSION

WASHINGTON, D.C. 20549

______________________________________

FORM 8-K

______________________________________

CURRENT REPORT

Pursuant to Section 13 or 15(d) of the Securities Exchange Act of 1934

Date of Report (Date of earliest event reported): June 6, 2024

Commission File Number: 001-38465

______________________________________

DOCUSIGN, INC.

(Exact name of registrant as specified in its charter)

______________________________________

| | | | | | | | | | | | | | |

| Delaware | | 91-2183967 |

| (State or Other Jurisdiction of Incorporation) | | (I.R.S. Employer Identification Number) |

| | | | |

| 221 Main St. | Suite 1550 | San Francisco | California | 94105 |

| (Address of Principal Executive Offices) (Zip Code) |

(415) 489-4940

(Registrant’s Telephone Number, Including Area Code)

Check the appropriate box below if the Form 8-K filing is intended to simultaneously satisfy the filing obligation of the registrant under any of the following provisions (see General Instructions A.2. below): | | | | | |

| ¨ | Written communications pursuant to Rule 425 under the Securities Act (17 CFR 230.425) |

| |

| ¨ | Soliciting material pursuant to Rule 14a-12 under the Exchange Act (17 CFR 240.14a-12) |

| |

| ¨ | Pre-commencement communications pursuant to Rule 14d-2(b) under the Exchange Act (17 CFR 240.14d-2(b)) |

| |

| ¨ | Pre-commencement communications pursuant to Rule 13e-4(c) under the Exchange Act (17 CFR 240.13e-4(c)) |

Securities registered pursuant to Section 12(b) of the Act: | | | | | | | | |

| Title of each class | Trading Symbol | Name of each exchange on which registered |

| Common Stock, par value $0.0001 per share | DOCU | The Nasdaq Global Select Market |

Indicate by check mark whether the registrant is an emerging growth company as defined in Rule 405 of the Securities Act of 1933 (§230.405 of this chapter) or Rule 12b-2 of the Securities Exchange Act of 1934 (§240.12b-2 of this chapter).

Emerging growth company ¨

If an emerging growth company, indicate by check mark if the registrant has elected not to use the extended transition period for complying with any new or revised financial accounting standards provided pursuant to Section 13(a) of the Exchange Act. ¨

Item 2.02 Results of Operations and Financial Condition.

On June 6, 2024, Docusign, Inc. (the “Company”) reported financial results for the three months ended April 30, 2024. A copy of the press release is furnished as Exhibit 99.1 to this Current Report on Form 8-K.

The press release is being furnished and shall not be deemed to be “filed” for purposes of Section 18 of the Securities Exchange Act of 1934, as amended, or otherwise subject to the liabilities of that section or Sections 11 and 12(a)(2) of the Securities Act of 1933, as amended. The information in this Item 2.02 and in the accompanying Exhibit 99.1 shall not be deemed incorporated by reference into any registration statement or other filing with the Securities and Exchange Commission made by the Company, whether made before or after the date of this Current Report, regardless of any general incorporation language in such filing, except as shall be expressly set forth by specific references in such filing.

Item 9.01 Financial Statements and Exhibits.

(d) Exhibits:

| | | | | |

| Exhibit No. | Description |

| 99.1 | |

| 104 | Cover Page Interactive Data File (embedded within the Inline XBRL document) |

SIGNATURES

Pursuant to the requirements of the Securities Exchange Act of 1934, the registrant has duly caused this report to be signed on its behalf by the undersigned thereunto duly authorized.

Date: June 6, 2024 | | | | | | | | |

| DOCUSIGN, INC. |

| | |

| By: | /s/ Blake Grayson |

| | Blake Grayson |

| | Chief Financial Officer |

| | (Principal Accounting and Financial Officer) |

Exhibit 99.1

Docusign Announces First Quarter Fiscal 2025 Financial Results;

Announces $1.0 Billion Increase to Share Repurchase Program

San Francisco – June 6, 2024 – Docusign, Inc. (NASDAQ: DOCU) today announced results for its fiscal quarter ended April 30, 2024. Prepared remarks and the news release with the financial results will be accessible on Docusign’s website at investor.docusign.com prior to its webcast.

“Docusign is off to a strong start in fiscal 2025. We launched a significant expansion to our company strategy with our announcement of the Docusign Intelligent Agreement Management platform,” said Allan Thygesen, CEO of Docusign. “In Q1, we continued to stabilize the business and improve profitability, allowing Docusign to continue investing for long term growth.”

First Quarter Financial Highlights

▪Total revenue was $709.6 million, an increase of 7% year-over-year. Subscription revenue was $691.5 million, an increase of 8% year-over-year. Professional services and other revenue was $18.2 million, a decrease of 18% year-over-year.

▪Billings were $709.5 million, an increase of 5% year-over-year.

▪GAAP gross margin was 78.9% compared to 79.4% in the same period last year. Non-GAAP gross margin was 82.0% compared to 82.6% in the same period last year.

▪GAAP net income per basic share was $0.16 on 206 million shares outstanding compared to $0.00 on 203 million shares outstanding in the same period last year.

▪GAAP net income per diluted share was $0.16 on 210 million shares outstanding compared to $0.00 on 208 million shares outstanding in the same period last year.

▪Non-GAAP net income per diluted share was $0.82 on 210 million shares outstanding compared to $0.72 on 208 million shares outstanding in the same period last year.

▪Net cash provided by operating activities was $254.8 million compared to $233.6 million in the same period last year.

▪Free cash flow was $232.1 million compared to $214.6 million in the same period last year.

▪Cash, cash equivalents, restricted cash and investments were $1.2 billion at the end of the quarter.

A reconciliation of GAAP to non-GAAP financial measures has been provided in the tables included in this press release. An explanation of these measures is also included below under the heading “Non-GAAP Financial Measures and Other Key Metrics.”

Operational and Other Financial Highlights:

Launches Docusign IAM (“Intelligent Agreement Management”): Docusign announced a significant expansion of its company strategy at its Momentum24 NYC conference. Docusign IAM is a platform with services that transforms how customers create, commit, and manage agreements. Services include:

▪Docusign Maestro: Automate and accelerate agreement creation and processes through flexible, customizable workflows without using code. Maestro integrates Docusign products, including eSignature, ID verification, and data verification, with third-party applications.

▪Docusign Navigator: A smart repository that enables organizations to centrally store, manage, and analyze agreements from any source. Powered by Docusign AI, Navigator transforms unstructured agreements into structured data, making it easy for users to find agreements, access vital information, and gain valuable insights from agreements.

▪Docusign App Center: Customers can discover, install, and connect third-party applications to integrate their existing systems with IAM. At launch, App Center will feature an initial set of commonly used apps, including HubSpot, ServiceNow, Stripe, and document-sharing services like Google Drive, Microsoft OneDrive, and Microsoft Sharepoint.

▪IAM application suites: The IAM platform will be offered through purpose-built applications for specific functions within organizations. With the initial Q2 IAM launch, Docusign will offer IAM for Sales, IAM for Customer Experience, and IAM Core. Future application suites will include IAM for Legal, IAM for Procurement, IAM for Human Resources, and other solutions for functions and industry verticals.

Subsequent to the end of Q1, Docusign announced in late May the general availability of IAM for an initial set of customers. From that point, IAM will gradually roll out across customer segments and geographies.

AI Innovation Leadership:

▪Lexion Acquisition: After Q1, Docusign closed its acquisition of DocuSmart, Inc. d/b/a Lexion (“Lexion”). Lexion is a leader in AI-based agreement technology with solutions designed to automate workflows and extract vital information from contracts. Founded in 2019, Lexion accelerates Docusign’s AI-powered IAM roadmap and brings industry leaders into its technology teams.

▪AI Momentum24 Announcements: Docusign announced the launch of AI-powered Agreement Summarization in Docusign CLM, enabling the creation of concise summaries of large amounts of agreement text. Docusign is also one of the first integrations with Microsoft Copilot for Sales, giving sellers using Microsoft Dynamics or Salesforce Sales Cloud the power to surface and instantly access agreement data relevant to a CRM record.

Increase to Stock Repurchase Program

▪Docusign’s board of directors has authorized an increase to its existing stock repurchase program for an additional amount of up to $1.0 billion of Docusign’s outstanding common stock. The program has no minimum purchase commitment and no mandated end date. The repurchase is expected to be executed, subject to general business and market conditions and other investment opportunities, through open market purchases, and other transactions in accordance with applicable securities laws. The timing and the amount of any repurchased common stock will be determined by Docusign’s management based on its evaluation of market conditions and other factors. The repurchase program does not obligate Docusign to acquire any particular amount of common stock and the repurchase program may be suspended or discontinued at any time at Docusign’s discretion without prior notice.

Guidance

The company currently expects the following guidance:

▪Quarter ending July 31, 2024 (in millions, except percentages): | | | | | | | | | | | |

| Total revenue | $725 | to | $729 |

| Subscription revenue | $705 | to | $709 |

| Billings | $715 | to | $725 |

| Non-GAAP gross margin | 80.5% | to | 81.5% |

| Non-GAAP operating margin | 27.0% | to | 28.0% |

| Non-GAAP diluted weighted-average shares outstanding | 208 | to | 213 |

▪Fiscal Year ending January 31, 2025 (in millions, except percentages): | | | | | | | | | | | |

| Total revenue | $2,920 | to | $2,932 |

| Subscription revenue | $2,844 | to | $2,856 |

| Billings | $2,980 | to | $3,030 |

| Non-GAAP gross margin | 81.0% | to | 82.0% |

| Non-GAAP operating margin | 26.5% | to | 28.0% |

| Non-GAAP diluted weighted-average shares outstanding | 208 | to | 213 |

A reconciliation of non-GAAP guidance measures to corresponding GAAP guidance measures is not available on a forward-looking basis without unreasonable effort due to the uncertainty regarding, and the potential variability of, expenses that may be incurred in the future. Stock-based compensation-related charges, including employer payroll tax-related items on employee stock transactions, are impacted by many factors, including the timing of employee stock transactions, the future fair market value of our common stock, and our future hiring and retention needs, all of which are difficult to predict and subject to constant change. We have provided a reconciliation of GAAP to non-GAAP financial measures in the financial statement tables for our historical non-GAAP financial results included in this release.

Webcast Conference Call Information

The company will host a conference call on June 6, 2024 at 2:00 p.m. PT (5:00 p.m. ET) to discuss its financial results. A live webcast of the event will be available on the Docusign Investor Relations website at investor.docusign.com. Prepared remarks and the news release with the financial results will also be accessible on Docusign’s website prior to the webcast. A live dial-in will be available domestically at 877-407-0784 or internationally at 201-689-8560. A replay will be available domestically at 844-512-2921 or internationally at 412-317-6671 until midnight (EST) June 20, 2024 using the passcode 13746695.

About Docusign

Docusign brings agreements to life. Over 1.5 million customers and more than a billion people in over 180 countries use Docusign solutions to accelerate the process of doing business and simplify people's lives. With intelligent agreement management, Docusign unleashes business critical data that is trapped inside of documents. Until now, these were disconnected from business systems of record, costing businesses time, money, and opportunity. Using Docusign IAM, companies can create, commit, and manage agreements with solutions created by the #1 company in e-signature and contract lifecycle management (CLM). Learn more at www.docusign.com.

Copyright 2024. Docusign, Inc. is the owner of DOCUSIGN® and all its other marks (www.docusign.com/IP).

Investor Relations:

Docusign Investor Relations

investors@docusign.com

Media Relations:

Docusign Corporate Communications

media@docusign.com

Forward-Looking Statements

This press release contains “forward-looking” statements within the meaning of Section 27A of the Securities Act of 1933, as amended, and Section 21E of the Securities Exchange Act of 1934, as amended, that are based on our management’s beliefs and assumptions and on information currently available to management, and which statements involve substantial risk and uncertainties. All statements contained in this press release other than statements of historical fact, including statements regarding our future operating results and financial position, our business strategy and plans, market growth and trends, objectives for future operations, and the impact of such assumptions on our financial condition and results of operations are forward-looking statements. Forward-looking statements in this press release also include, among other things, statements under “Guidance” above and any other statements about expected financial metrics, such as revenue, billings, non-GAAP gross margin, non-GAAP operating margin, non-GAAP diluted weighted-average shares outstanding, and non-financial metrics, as well as statements related to our expectations regarding the benefits of the Docusign IAM platform and Docusign's utilization of its stock repurchase program, including the expected timing, duration, volume and nature of share repurchase under such program. Forward-looking statements generally relate to future events or our future financial or operating performance. In some cases, you can identify forward-looking statements because they contain words such as “may,” “will,” “should,” “expects,” “plans,” “anticipates,” “could,” “intends,” “target,” “projects,” “contemplates,” “believes,” “estimates,” “predicts,” “potential,” or “continue” or the negative of these words or other similar terms or expressions that concern our expectations, strategy, plans or intentions.

Forward-looking statements contained in this press release include, but are not limited to, statements about: our expectations regarding global macro-economic conditions, including the effects of inflation, volatile interest rates, instability in the global banking sector, and market volatility on the global economy; our ability to estimate the size and growth of our total addressable market; our ability to compete effectively in an evolving and competitive market; the impact of any data breaches, cyberattacks or other malicious activity on our technology systems; our ability to effectively sustain and manage our growth and future expenses and achieve and maintain future profitability; our ability to attract new customers and maintain and expand our existing customer base; our ability to effectively implement and execute our restructuring plans; our ability to scale and update our platform to respond to customers’ needs and rapid technological change, including our ability to successfully incorporate generative artificial intelligence into our existing and future products; our ability to successfully execute our go-to-market and sales strategy for our IAM platform; our ability to expand use cases within existing customers and vertical solutions; our ability to expand our operations and increase adoption of our platform internationally; our ability to strengthen and foster our relationships with developers; our ability to retain our direct sales force, customer success team and strategic partnerships around the world; our ability to identify targets for and execute potential acquisitions and to successfully integrate and realize the anticipated benefits of such acquisitions; our ability to maintain, protect and enhance our brand; the sufficiency of our cash, cash equivalents and capital resources to satisfy our liquidity needs; limitations on us due to obligations we have under our credit facility or other indebtedness; our ability to realize the anticipated benefits of our stock repurchase program; our failure or the failure of our software to comply with applicable industry standards, laws and regulations; our ability to maintain, protect and enhance our intellectual property; our ability to successfully defend litigation against us; our ability to attract large organizations as users; our ability to maintain our corporate culture; our ability to offer high-quality customer support; our ability to hire, retain and motivate qualified personnel, including executive level management; our ability to successfully manage and integrate executive management transitions; uncertainties regarding the impact of general economic and market conditions, including as a result of regional and global conflicts; our ability to successfully implement and maintain new and existing information technology systems, including our ERP system; and our ability to maintain proper and effective internal controls.

Additional risks and uncertainties that could affect our financial results are included in the sections titled “Risk Factors” and “Management’s Discussion and Analysis of Financial Condition and Results of Operations” in our annual report on Form 10-K for the fiscal year ended January 31, 2024 filed on March 21, 2024, our quarterly report on Form 10-Q for the quarter ended April 30, 2024, which we expect to file on June 7, 2024 with the Securities and Exchange Commission (the “SEC”), and other filings that we make from time to time with the SEC. The forward-looking statements made in this press release relate only to events as of the date on which such statements are made. We undertake no obligation to update any forward-looking statements after the date of this press release or to conform such statements to actual results or revised expectations, except as required by law.

Non-GAAP Financial Measures and Other Key Metrics

To supplement our consolidated financial statements, which are prepared and presented in accordance with GAAP, we use certain non-GAAP financial measures, as described below, to understand and evaluate our core operating performance. These non-GAAP financial measures, which may be different than similarly-titled measures used by other companies, are presented to enhance investors’ overall understanding of our financial performance and should not be considered a substitute for, or superior to, the financial information prepared and presented in accordance with GAAP.

We believe that these non-GAAP financial measures provide useful information about our financial performance, enhance the overall understanding of our past performance and future prospects, and allow for greater transparency with respect to important metrics used by our management for financial and operational decision-making. We present

these non-GAAP measures to assist investors in seeing our financial performance using a management view, and because we believe that these measures provide an additional tool for investors to use in comparing our core financial performance over multiple periods with other companies in our industry. However, these non-GAAP measures are not intended to be considered in isolation from, a substitute for, or superior to our GAAP results.

Non-GAAP gross profit, non-GAAP gross margin, non-GAAP operating expenses, non-GAAP income from operations, non-GAAP operating margin, non-GAAP net income and non-GAAP net income per share: We define these non-GAAP financial measures as the respective GAAP measures, excluding expenses related to stock-based compensation, employer payroll tax on employee stock transactions, amortization of acquisition-related intangibles, amortization of debt discount and issuance costs, fair value adjustments to strategic investments, acquisition-related expenses, lease-related impairment and lease-related charges, restructuring and other related charges, as these costs are not reflective of ongoing operations and, as applicable, other special items. The amount of employer payroll tax-related items on employee stock transactions is dependent on our stock price and other factors that are beyond our control and do not correlate to the operation of the business. When evaluating the performance of our business and making operating plans, we do not consider these items (for example, when considering the impact of equity award grants, we place a greater emphasis on overall stockholder dilution rather than the accounting charges associated with such grants). We believe it is useful to exclude these expenses in order to better understand the long-term performance of our core business and to facilitate comparison of our results to those of peer companies and over multiple periods. In addition to these exclusions, we subtract an assumed provision for income taxes to calculate non-GAAP net income. We utilize a fixed long-term projected tax rate in our computation of the non-GAAP income tax provision to provide better consistency across the reporting periods. For fiscal 2024 and fiscal 2025, we have determined the projected non-GAAP tax rate to be 20%.

Free cash flow: We define free cash flow as net cash provided by operating activities less purchases of property and equipment. We believe free cash flow is an important liquidity measure of the cash that is available (if any), after purchases of property and equipment, for operational expenses, investment in our business, and to make acquisitions. Free cash flow is useful to investors as a liquidity measure because it measures our ability to generate or use cash in excess of our capital investments in property and equipment. Once our business needs and obligations are met, cash can be used to maintain a strong balance sheet and invest in future growth.

Billings: We define billings as total revenues plus the change in our contract liabilities and refund liability less contract assets and unbilled accounts receivable in a given period. Billings reflects sales to new customers plus subscription renewals and additional sales to existing customers. Only amounts invoiced to a customer in a given period are included in billings. We believe billings can be used to measure our periodic performance, when taking into consideration the timing aspects of customer renewals, which represents a large component of our business. Given that most of our customers pay in annual installments one year in advance, but we typically recognize a majority of the related revenue ratably over time, we use billings to measure and monitor our ability to provide our business with the working capital generated by upfront payments from our customers.

For a reconciliation of these non-GAAP financial measures to the most directly comparable GAAP financial measure, please see “Reconciliation of GAAP to Non-GAAP Financial Measures” below.

CONDENSED CONSOLIDATED STATEMENTS OF OPERATIONS

(Unaudited) | | | | | | | | | | | | | | | |

| | | Three Months Ended April 30, |

| (in thousands, except per share data) | | | | | 2024 | | 2023 |

| Revenue: | | | | | | | |

| Subscription | | | | | $ | 691,483 | | | $ | 639,307 | |

| Professional services and other | | | | | 18,157 | | | 22,081 | |

| Total revenue | | | | | 709,640 | | | 661,388 | |

| Cost of revenue: | | | | | | | |

| Subscription | | | | | 126,602 | | | 108,942 | |

| Professional services and other | | | | | 22,844 | | | 27,545 | |

| Total cost of revenue | | | | | 149,446 | | | 136,487 | |

| Gross profit | | | | | 560,194 | | | 524,901 | |

| Operating expenses: | | | | | | | |

| Sales and marketing | | | | | 281,644 | | | 280,605 | |

| Research and development | | | | | 134,320 | | | 115,364 | |

| General and administrative | | | | | 92,478 | | | 104,811 | |

| Restructuring and other related charges | | | | | 29,124 | | | 28,772 | |

| Total operating expenses | | | | | 537,566 | | | 529,552 | |

| Income (loss) from operations | | | | | 22,628 | | | (4,651) | |

| Interest expense | | | | | (144) | | | (1,966) | |

| Interest income and other income, net | | | | | 14,109 | | | 12,245 | |

| Income before provision for income taxes | | | | | 36,593 | | | 5,628 | |

| Provision for income taxes | | | | | 2,833 | | | 5,089 | |

| Net income | | | | | $ | 33,760 | | | $ | 539 | |

| Net income per share attributable to common stockholders: | | | | |

| Basic | | | | | $ | 0.16 | | | $0.00 |

| Diluted | | | | | $ | 0.16 | | | $0.00 |

| Weighted-average shares used in computing net income per share: | | | | |

| Basic | | | | | 205,870 | | | 202,631 | |

| Diluted | | | | | 209,896 | | | 208,071 | |

| | | | | | | |

| Stock-based compensation expense included in costs and expenses: | | | | |

| Cost of revenue—subscription | | | | | $ | 14,181 | | | $ | 11,357 | |

| Cost of revenue—professional services and other | | | | | 4,702 | | | 6,730 | |

| Sales and marketing | | | | | 46,271 | | | 45,326 | |

| Research and development | | | | | 44,202 | | | 35,997 | |

| General and administrative | | | | | 28,520 | | | 40,342 | |

| Restructuring and other related charges | | | | | 4,628 | | | 4,954 | |

CONDENSED CONSOLIDATED BALANCE SHEETS

(Unaudited) | | | | | | | | | | | |

| (in thousands) | April 30, 2024 | | January 31, 2024 |

| Assets | | | |

| Current assets | | | |

| Cash and cash equivalents | $ | 817,388 | | | $ | 797,060 | |

| Investments—current | 269,400 | | | 248,402 | |

| Accounts receivable, net | 306,152 | | | 439,299 | |

| Contract assets—current | 12,319 | | | 15,922 | |

| Prepaid expenses and other current assets | 84,540 | | | 66,984 | |

| Total current assets | 1,489,799 | | | 1,567,667 | |

| Investments—noncurrent | 139,108 | | | 121,977 | |

| Property and equipment, net | 255,736 | | | 245,173 | |

| Operating lease right-of-use assets | 119,997 | | | 123,188 | |

| Goodwill | 352,450 | | | 353,138 | |

| Intangible assets, net | 46,206 | | | 50,905 | |

| Deferred contract acquisition costs—noncurrent | 415,739 | | | 409,627 | |

| Other assets—noncurrent | 107,654 | | | 99,615 | |

| Total assets | $ | 2,926,689 | | | $ | 2,971,290 | |

| Liabilities and Equity | | | |

| Current liabilities | | | |

| Accounts payable | $ | 17,700 | | | $ | 19,029 | |

| Accrued expenses and other current liabilities | 99,177 | | | 104,037 | |

| Accrued compensation | 153,932 | | | 195,266 | |

| | | |

| Contract liabilities—current | 1,313,227 | | | 1,320,059 | |

| Operating lease liabilities—current | 20,925 | | | 22,230 | |

| Total current liabilities | 1,604,961 | | | 1,660,621 | |

| | | |

| Contract liabilities—noncurrent | 23,840 | | | 21,980 | |

| Operating lease liabilities—noncurrent | 117,444 | | | 120,823 | |

| Deferred tax liability—noncurrent | 18,037 | | | 16,795 | |

| Other liabilities—noncurrent | 25,407 | | | 21,332 | |

| Total liabilities | 1,789,689 | | | 1,841,551 | |

| | | |

| Stockholders’ equity | | | |

| Common stock | 20 | | | 21 | |

| Treasury stock | (2,670) | | | (2,164) | |

| Additional paid-in capital | 2,950,081 | | | 2,821,461 | |

| Accumulated other comprehensive loss | (24,910) | | | (19,360) | |

| Accumulated deficit | (1,785,521) | | | (1,670,219) | |

Total stockholders’ equity | 1,137,000 | | | 1,129,739 | |

| Total liabilities and equity | $ | 2,926,689 | | | $ | 2,971,290 | |

CONDENSED CONSOLIDATED STATEMENTS OF CASH FLOWS

(Unaudited) | | | | | | | | | | | | | | | |

| | | Three Months Ended April 30, |

| (in thousands) | | | | | 2024 | | 2023 |

| Cash flows from operating activities: | | | | | | | |

| Net income | | | | | $ | 33,760 | | | $ | 539 | |

Adjustments to reconcile net income to net cash provided by operating activities: | | | | | | | |

| Depreciation and amortization | | | | | 24,506 | | | 22,867 | |

| Amortization of deferred contract acquisition and fulfillment costs | | | | | 54,212 | | | 48,230 | |

| Amortization of debt discount and transaction costs | | | | | 138 | | | 1,246 | |

| Non-cash operating lease costs | | | | | 4,878 | | | 5,980 | |

| Stock-based compensation expense | | | | | 142,504 | | | 144,706 | |

| Deferred income taxes | | | | | 1,477 | | | 1,623 | |

| Other | | | | | 1,472 | | | (831) | |

| Changes in operating assets and liabilities: | | | | | | | |

| Accounts receivable | | | | | 130,639 | | | 108,281 | |

| | | | | | | |

| Prepaid expenses and other current assets | | | | | (17,061) | | | (16,803) | |

| Deferred contract acquisition and fulfillment costs | | | | | (63,072) | | | (56,526) | |

| Other assets | | | | | 1,917 | | | (7,661) | |

| Accounts payable | | | | | (1,163) | | | (9,021) | |

| Accrued expenses and other liabilities | | | | | (3,480) | | | 1,095 | |

| Accrued compensation | | | | | (45,048) | | | (21,582) | |

| Contract liabilities | | | | | (4,973) | | | 18,287 | |

| Operating lease liabilities | | | | | (5,880) | | | (6,795) | |

| Net cash provided by operating activities | | | | | 254,826 | | | 233,635 | |

| Cash flows from investing activities: | | | | | | | |

| | | | | | | |

| Purchases of marketable securities | | | | | (119,638) | | | (53,830) | |

| | | | | | | |

| Maturities of marketable securities | | | | | 82,114 | | | 80,699 | |

| Purchases of strategic and other investments | | | | | (500) | | | — | |

| Purchases of property and equipment | | | | | (22,753) | | | (19,057) | |

| Net cash provided by (used in) investing activities | | | | | (60,777) | | | 7,812 | |

| Cash flows from financing activities: | | | | | | | |

| | | | | | | |

| Repurchases of common stock | | | | | (149,062) | | | (40,472) | |

| Settlement of capped calls, net of related costs | | | | | — | | | 23,688 | |

| Payment of tax withholding obligation on net RSU settlement and ESPP purchase | | | | | (41,637) | | | (22,637) | |

| Proceeds from exercise of stock options | | | | | 635 | | | 127 | |

| Proceeds from employee stock purchase plan | | | | | 20,190 | | | 18,390 | |

| Net cash used in financing activities | | | | | (169,874) | | | (20,904) | |

| Effect of foreign exchange on cash, cash equivalents and restricted cash | | | | | (2,915) | | | 1,011 | |

| Net increase in cash, cash equivalents and restricted cash | | | | | 21,260 | | | 221,554 | |

Cash, cash equivalents and restricted cash at beginning of period (1) | | | | | 801,499 | | | 723,201 | |

Cash, cash equivalents and restricted cash at end of period (1) | | | | | $ | 822,759 | | | $ | 944,755 | |

(1) Cash, cash equivalents and restricted cash included restricted cash of $5.4 million and $4.4 million at April 30, 2024 and January 31, 2024.

RECONCILIATION OF GAAP TO NON-GAAP FINANCIAL MEASURES

(Unaudited)

Reconciliation of gross profit (loss) and gross margin: | | | | | | | | | | | | | | | |

| | | Three Months Ended April 30, |

| (in thousands) | | | | | 2024 | | 2023 |

| GAAP gross profit | | | | | $ | 560,194 | | $ | 524,901 |

| Add: Stock-based compensation | | | | | 18,883 | | 18,087 |

| Add: Amortization of acquisition-related intangibles | | | | | 2,070 | | 2,403 |

| | | | | | | |

| Add: Employer payroll tax on employee stock transactions | | | | | 1,023 | | 675 |

| Add: Lease-related impairment and lease-related charges | | | | | — | | 429 |

| Non-GAAP gross profit | | | | | $ | 582,170 | | $ | 546,495 |

| GAAP gross margin | | | | | 78.9 | % | | 79.4 | % |

| Non-GAAP adjustments | | | | | 3.1 | % | | 3.2 | % |

| Non-GAAP gross margin | | | | | 82.0 | % | | 82.6 | % |

| | | | | | | |

| GAAP subscription gross profit | | | | | $ | 564,881 | | $ | 530,365 |

| Add: Stock-based compensation | | | | | 14,181 | | 11,357 |

| Add: Amortization of acquisition-related intangibles | | | | | 2,070 | | 2,403 |

| | | | | | | |

| Add: Employer payroll tax on employee stock transactions | | | | | 792 | | 466 |

| Add: Lease-related impairment and lease-related charges | | | | | — | | 299 |

| Non-GAAP subscription gross profit | | | | | $ | 581,924 | | $ | 544,890 |

| GAAP subscription gross margin | | | | | 81.7 | % | | 83.0 | % |

| Non-GAAP adjustments | | | | | 2.5 | % | | 2.2 | % |

| Non-GAAP subscription gross margin | | | | | 84.2 | % | | 85.2 | % |

| | | | | | | |

| GAAP professional services and other gross loss | | | | | $ | (4,687) | | $ | (5,464) |

| Add: Stock-based compensation | | | | | 4,702 | | 6,730 |

| | | | | | | |

| Add: Employer payroll tax on employee stock transactions | | | | | 231 | | 209 |

| Add: Lease-related impairment and lease-related charges | | | | | — | | 130 |

| Non-GAAP professional services and other gross profit | | | | | $ | 246 | | $ | 1,605 |

| GAAP professional services and other gross margin | | | | | (25.8) | % | | (24.7) | % |

| Non-GAAP adjustments | | | | | 27.2 | % | | 32.0 | % |

| Non-GAAP professional services and other gross margin | | | | | 1.4 | % | | 7.3 | % |

Reconciliation of operating expenses: | | | | | | | | | | | | | | | |

| | | Three Months Ended April 30, |

| (in thousands) | | | | | 2024 | | 2023 |

| GAAP sales and marketing | | | | | $ | 281,644 | | | $ | 280,605 | |

| Less: Stock-based compensation | | | | | (46,271) | | | (45,326) | |

| Less: Amortization of acquisition-related intangibles | | | | | (2,629) | | | (2,629) | |

| Less: Employer payroll tax on employee stock transactions | | | | | (2,138) | | | (1,670) | |

| Less: Lease-related impairment and lease-related charges | | | | | — | | | (1,356) | |

| | | | | | | |

| Non-GAAP sales and marketing | | | | | $ | 230,606 | | | $ | 229,624 | |

| GAAP sales and marketing as a percentage of revenue | | | | | 39.7 | % | | 42.4 | % |

| Non-GAAP sales and marketing as a percentage of revenue | | | | | 32.5 | % | | 34.7 | % |

| | | | | | | |

| GAAP research and development | | | | | $ | 134,320 | | | $ | 115,364 | |

| Less: Stock-based compensation | | | | | (44,202) | | | (35,997) | |

| | | | | | | |

| Less: Employer payroll tax on employee stock transactions | | | | | (2,565) | | | (1,408) | |

| Less: Lease-related impairment and lease-related charges | | | | | — | | | (492) | |

| Non-GAAP research and development | | | | | $ | 87,553 | | | $ | 77,467 | |

| GAAP research and development as a percentage of revenue | | | | | 18.9 | % | | 17.4 | % |

| Non-GAAP research and development as a percentage of revenue | | | | | 12.3 | % | | 11.7 | % |

| | | | | | | |

| GAAP general and administrative | | | | | $ | 92,478 | | | $ | 104,811 | |

| Less: Stock-based compensation | | | | | (28,520) | | | (40,342) | |

| Less: Employer payroll tax on employee stock transactions | | | | | (678) | | | (431) | |

| Less: Acquisition-related expenses | | | | | (1,358) | | | — | |

| | | | | | | |

| Less: Lease-related impairment and lease-related charges | | | | | — | | | (399) | |

| Non-GAAP general and administrative | | | | | $ | 61,922 | | | $ | 63,639 | |

| GAAP general and administrative as a percentage of revenue | | | | | 13.0 | % | | 15.8 | % |

| Non-GAAP general and administrative as a percentage of revenue | | | | | 8.7 | % | | 9.6 | % |

Reconciliation of income (loss) from operations and operating margin: | | | | | | | | | | | | | | | |

| | | Three Months Ended April 30, |

| (in thousands) | | | | | 2024 | | 2023 |

| GAAP income (loss) from operations | | | | | $ | 22,628 | | | $ | (4,651) | |

| Add: Stock-based compensation | | | | | 137,876 | | | 139,752 | |

| Add: Amortization of acquisition-related intangibles | | | | | 4,699 | | | 5,032 | |

| Add: Employer payroll tax on employee stock transactions | | | | | 6,404 | | | 4,184 | |

| Add: Acquisition-related expenses | | | | | 1,358 | | | — | |

| Add: Restructuring and other related charges | | | | | 29,124 | | | 28,772 | |

| | | | | | | |

| Add: Lease-related impairment and lease-related charges | | | | | — | | | 2,676 | |

| Non-GAAP income from operations | | | | | $ | 202,089 | | | $ | 175,765 | |

| GAAP operating margin | | | | | 3.2 | % | | (0.7) | % |

| Non-GAAP adjustments | | | | | 25.3 | % | | 27.3 | % |

| Non-GAAP operating margin | | | | | 28.5 | % | | 26.6 | % |

Reconciliation of net income and net income per share, basic and diluted: | | | | | | | | | | | | | | | |

| | | Three Months Ended April 30, |

| (in thousands, except per share data) | | | | | 2024 | | 2023 |

| GAAP net income | | | | | $ | 33,760 | | | $ | 539 | |

| Add: Stock-based compensation | | | | | 137,876 | | | 139,752 | |

| Add: Amortization of acquisition-related intangibles | | | | | 4,699 | | | 5,032 | |

| Add: Employer payroll tax on employee stock transactions | | | | | 6,404 | | | 4,184 | |

| Add: Acquisition-related expenses | | | | | 1,358 | | | — | |

| Add: Restructuring and other related charges | | | | | 29,124 | | | 28,772 | |

| | | | | | | |

| Add: Amortization of debt discount and issuance costs | | | | | — | | | 1,604 | |

| Add: Fair value adjustments to strategic investments | | | | | — | | | 119 | |

| Add: Lease-related impairment and lease-related charges | | | | | — | | | 2,676 | |

| Add: Income tax effect of non-GAAP adjustments | | | | | (40,378) | | | (32,464) | |

| Non-GAAP net income | | | | | $ | 172,843 | | | $ | 150,214 | |

| | | | | | | |

| Numerator: | | | | | | | |

| Non-GAAP net income | | | | | $ | 172,843 | | | $ | 150,214 | |

| Add: Interest expense on convertible senior notes | | | | | — | | | 357 | |

| Non-GAAP net income attributable to common stockholders, diluted | | | | | $ | 172,843 | | | $ | 150,571 | |

| | | | | | | |

| Denominator: | | | | | | | |

| Weighted-average common shares outstanding, basic | | | | | 205,870 | | | 202,631 | |

| Effect of dilutive securities | | | | | 4,026 | | | 5,440 | |

| Non-GAAP weighted-average common shares outstanding, diluted | | | | | 209,896 | | | 208,071 | |

| | | | | | | |

| GAAP net income per share, basic | | | | | $ | 0.16 | | | $ | 0.00 | |

| GAAP net income per share, diluted | | | | | $ | 0.16 | | | $ | 0.00 | |

| Non-GAAP net income per share, basic | | | | | $ | 0.84 | | | $ | 0.74 | |

| Non-GAAP net income per share, diluted | | | | | $ | 0.82 | | | $ | 0.72 | |

Computation of free cash flow: | | | | | | | | | | | | | | | |

| | | Three Months Ended April 30, |

| (in thousands) | | | | | 2024 | | 2023 |

| Net cash provided by operating activities | | | | | $ | 254,826 | | | $ | 233,635 | |

| Less: Purchases of property and equipment | | | | | (22,753) | | | (19,057) | |

| Non-GAAP free cash flow | | | | | $ | 232,073 | | | $ | 214,578 | |

| Net cash provided by (used in) investing activities | | | | | $ | (60,777) | | | $ | 7,812 | |

| Net cash used in financing activities | | | | | $ | (169,874) | | | $ | (20,904) | |

Computation of billings: | | | | | | | | | | | | | | | |

| | | Three Months Ended April 30, |

| (in thousands) | | | | | 2024 | | 2023 |

| Revenue | | | | | $ | 709,640 | | | $ | 661,388 | |

| Add: Contract liabilities and refund liability, end of period | | | | | 1,340,680 | | | 1,210,965 | |

| Less: Contract liabilities and refund liability, beginning of period | | | | | (1,343,792) | | | (1,191,269) | |

| Add: Contract assets and unbilled accounts receivable, beginning of period | | | | | 20,189 | | | 16,615 | |

| Less: Contract assets and unbilled accounts receivable, end of period | | | | | (17,179) | | | (22,936) | |

| | | | | | | |

| | | | | | | |

| Non-GAAP billings | | | | | $ | 709,538 | | | $ | 674,763 | |

v3.24.1.1.u2

Cover

|

Jun. 06, 2024 |

| Cover [Abstract] |

|

| Document Type |

8-K

|

| Document Period End Date |

Jun. 06, 2024

|

| Entity Registrant Name |

DOCUSIGN, INC.

|

| Entity Central Index Key |

0001261333

|

| Amendment Flag |

false

|

| Entity Incorporation, State or Country Code |

DE

|

| Entity File Number |

001-38465

|

| Entity Tax Identification Number |

91-2183967

|

| Entity Address, Address Line One |

221 Main St.

|

| Entity Address, Address Line Two |

Suite 1550

|

| Entity Address, City or Town |

San Francisco

|

| Entity Address, State or Province |

CA

|

| Entity Address, Postal Zip Code |

94105

|

| City Area Code |

415

|

| Local Phone Number |

489-4940

|

| Written Communications |

false

|

| Soliciting Material |

false

|

| Pre-commencement Tender Offer |

false

|

| Pre-commencement Issuer Tender Offer |

false

|

| Title of 12(b) Security |

Common Stock, par value $0.0001 per share

|

| Security Exchange Name |

NASDAQ

|

| Entity Emerging Growth Company |

false

|

| Trading Symbol |

DOCU

|

| X |

- DefinitionBoolean flag that is true when the XBRL content amends previously-filed or accepted submission.

| Name: |

dei_AmendmentFlag |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:booleanItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionFor the EDGAR submission types of Form 8-K: the date of the report, the date of the earliest event reported; for the EDGAR submission types of Form N-1A: the filing date; for all other submission types: the end of the reporting or transition period. The format of the date is YYYY-MM-DD.

| Name: |

dei_DocumentPeriodEndDate |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:dateItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionThe type of document being provided (such as 10-K, 10-Q, 485BPOS, etc). The document type is limited to the same value as the supporting SEC submission type, or the word 'Other'.

| Name: |

dei_DocumentType |

| Namespace Prefix: |

dei_ |

| Data Type: |

dei:submissionTypeItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionAddress Line 1 such as Attn, Building Name, Street Name

| Name: |

dei_EntityAddressAddressLine1 |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:normalizedStringItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionAddress Line 2 such as Street or Suite number

| Name: |

dei_EntityAddressAddressLine2 |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:normalizedStringItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- Definition

+ References

+ Details

| Name: |

dei_EntityAddressCityOrTown |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:normalizedStringItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionCode for the postal or zip code

| Name: |

dei_EntityAddressPostalZipCode |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:normalizedStringItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionName of the state or province.

| Name: |

dei_EntityAddressStateOrProvince |

| Namespace Prefix: |

dei_ |

| Data Type: |

dei:stateOrProvinceItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionA unique 10-digit SEC-issued value to identify entities that have filed disclosures with the SEC. It is commonly abbreviated as CIK. Reference 1: http://www.xbrl.org/2003/role/presentationRef

-Publisher SEC

-Name Exchange Act

-Number 240

-Section 12

-Subsection b-2

| Name: |

dei_EntityCentralIndexKey |

| Namespace Prefix: |

dei_ |

| Data Type: |

dei:centralIndexKeyItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionIndicate if registrant meets the emerging growth company criteria. Reference 1: http://www.xbrl.org/2003/role/presentationRef

-Publisher SEC

-Name Exchange Act

-Number 240

-Section 12

-Subsection b-2

| Name: |

dei_EntityEmergingGrowthCompany |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:booleanItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionCommission file number. The field allows up to 17 characters. The prefix may contain 1-3 digits, the sequence number may contain 1-8 digits, the optional suffix may contain 1-4 characters, and the fields are separated with a hyphen.

| Name: |

dei_EntityFileNumber |

| Namespace Prefix: |

dei_ |

| Data Type: |

dei:fileNumberItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionTwo-character EDGAR code representing the state or country of incorporation.

| Name: |

dei_EntityIncorporationStateCountryCode |

| Namespace Prefix: |

dei_ |

| Data Type: |

dei:edgarStateCountryItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionThe exact name of the entity filing the report as specified in its charter, which is required by forms filed with the SEC. Reference 1: http://www.xbrl.org/2003/role/presentationRef

-Publisher SEC

-Name Exchange Act

-Number 240

-Section 12

-Subsection b-2

| Name: |

dei_EntityRegistrantName |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:normalizedStringItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionThe Tax Identification Number (TIN), also known as an Employer Identification Number (EIN), is a unique 9-digit value assigned by the IRS. Reference 1: http://www.xbrl.org/2003/role/presentationRef

-Publisher SEC

-Name Exchange Act

-Number 240

-Section 12

-Subsection b-2

| Name: |

dei_EntityTaxIdentificationNumber |

| Namespace Prefix: |

dei_ |

| Data Type: |

dei:employerIdItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionLocal phone number for entity.

| Name: |

dei_LocalPhoneNumber |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:normalizedStringItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionBoolean flag that is true when the Form 8-K filing is intended to satisfy the filing obligation of the registrant as pre-commencement communications pursuant to Rule 13e-4(c) under the Exchange Act. Reference 1: http://www.xbrl.org/2003/role/presentationRef

-Publisher SEC

-Name Exchange Act

-Number 240

-Section 13e

-Subsection 4c

| Name: |

dei_PreCommencementIssuerTenderOffer |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:booleanItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionBoolean flag that is true when the Form 8-K filing is intended to satisfy the filing obligation of the registrant as pre-commencement communications pursuant to Rule 14d-2(b) under the Exchange Act. Reference 1: http://www.xbrl.org/2003/role/presentationRef

-Publisher SEC

-Name Exchange Act

-Number 240

-Section 14d

-Subsection 2b

| Name: |

dei_PreCommencementTenderOffer |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:booleanItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionTitle of a 12(b) registered security. Reference 1: http://www.xbrl.org/2003/role/presentationRef

-Publisher SEC

-Name Exchange Act

-Number 240

-Section 12

-Subsection b

| Name: |

dei_Security12bTitle |

| Namespace Prefix: |

dei_ |

| Data Type: |

dei:securityTitleItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionName of the Exchange on which a security is registered. Reference 1: http://www.xbrl.org/2003/role/presentationRef

-Publisher SEC

-Name Exchange Act

-Number 240

-Section 12

-Subsection d1-1

| Name: |

dei_SecurityExchangeName |

| Namespace Prefix: |

dei_ |

| Data Type: |

dei:edgarExchangeCodeItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionBoolean flag that is true when the Form 8-K filing is intended to satisfy the filing obligation of the registrant as soliciting material pursuant to Rule 14a-12 under the Exchange Act. Reference 1: http://www.xbrl.org/2003/role/presentationRef

-Publisher SEC

-Name Exchange Act

-Section 14a

-Number 240

-Subsection 12

| Name: |

dei_SolicitingMaterial |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:booleanItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionTrading symbol of an instrument as listed on an exchange.

| Name: |

dei_TradingSymbol |

| Namespace Prefix: |

dei_ |

| Data Type: |

dei:tradingSymbolItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionBoolean flag that is true when the Form 8-K filing is intended to satisfy the filing obligation of the registrant as written communications pursuant to Rule 425 under the Securities Act. Reference 1: http://www.xbrl.org/2003/role/presentationRef

-Publisher SEC

-Name Securities Act

-Number 230

-Section 425

| Name: |

dei_WrittenCommunications |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:booleanItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

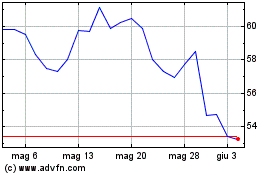

Grafico Azioni DocuSign (NASDAQ:DOCU)

Storico

Da Mag 2024 a Giu 2024

Grafico Azioni DocuSign (NASDAQ:DOCU)

Storico

Da Giu 2023 a Giu 2024