Eos Energy Enterprises, Inc. (NASDAQ: EOSE) (“Eos” or the

“Company”), America’s leading innovator in designing,

manufacturing, and providing zinc-based long duration energy

storage (LDES) systems sourced and manufactured in the United

States, today announced its financial results for the fourth

quarter and full-year ended December 31, 2024.

Fourth Quarter Highlights

- Revenue totaled $7.3 million, a 10%

increase compared to the prior year and 749% increase compared to

last quarter.

- Gross loss of $23.5 million,

consistent with prior year, on lower Z3 material costs offset by

higher project execution costs related to commissioning and field

operations.

- Operating expenses totaled $28.2

million, a 52% increase compared to prior year, with 45% of the

total representing non-cash items. Cash operating expenses remained

relatively flat, with $8.5 million (or 88% of the increase over

prior year) driven by non-cash items such as PP&E write offs

and stock-based compensation expense as a result of a significant

stock price increase.

- Net loss attributable to

shareholders of $268.1 million, largely driven by non-cash change

in fair value tied to mark-to-market adjustments related to the

Company’s increased December 31, 2024, stock price. Adjusted EBITDA

loss of $44.6 million, a 20% increase compared to the prior year,

driven by an increase in Gen 2.3 PP&E write offs and Cerberus

debt issuance costs.

- Total cash of $103.4 million,

including restricted cash, as of December 31, 2024.

- $14.4 billion commercial

opportunity pipeline, a 9% increase from prior year, with a $682

million orders backlog, an increase of 16% compared to prior

quarter and 28% compared to December 31, 2023.

- Achieved SOX compliance by

strengthening the Company’s internal controls, eliminating

previously disclosed material weakness.

Full-Year 2024 Highlights

- Revenue totaled $15.6 million in

line with the Company’s revised 2024 revenue guidance.

- Gross loss of $83.3 million, a 13%

increase compared to the prior year; lower Z3 material costs were

more than offset by labor and overhead inefficiencies related to

manual sub assembly and increased project execution.

- Operating expenses totaled $91.9

million, a 16% increase compared to the prior year, with 29% of the

total representing non-cash items. The year over year increase

included $7.7 million in cash expenses which was primarily driven

by strategic investments in sales, sourcing, software engineering,

and controllership to position the Company for scaled growth.

- Net loss attributable to

shareholders of $685.9 million, largely driven by non-cash change

in fair value tied to mark-to market adjustments stemming from the

increase in stock price as of December 31, 2024. Adjusted EBITDA

loss of $156.6 million.

"Over the past 12 months the team delivered

significant results. The organization brought the first

state-of-the-art manufacturing line into full operation, reduced Z3

costs, increased commercial opportunity pipeline and orders backlog

and secured two major financing investments with Cerberus and the

Department of Energy," said Joe Mastrangelo, Eos Chief Executive

Officer. "These two critical proof points strongly validate our

long-term strategy and capabilities, positioning the Company to

scale with the growing demand for long-duration energy storage.

With the announcement of Factory 2 Works and plans to order three

additional manufacturing lines, Eos is now hyper-scaling its

capacity expansion to secure larger orders and deliver for

customers and shareholders.”

2025 Outlook

- For the full-year 2025, Eos expects

to achieve revenue between $150 million and $190 million. This

projected growth is expected to be driven by increased production

volume on the Company’s first state-of-the-art manufacturing line

as staged sub-assembly automation comes online.

Recent Business Highlights

Cerberus Strategic InvestmentAs

announced in January, Eos successfully achieved the third tranche

of performance milestones previously agreed upon between Eos and an

affiliate of Cerberus Capital Management LP (“Cerberus”) as part of

their strategic investment in the Company. Meeting these

performance milestones allowed the Company to access the final

$40.5 million of the Delayed Draw Term Loan (DDTL), fueling ongoing

operations and U.S. production expansion. The $210.5 million DDTL

announced in June 2024 is now fully funded, driven by the Company

consistently achieving key operational milestones related to the

Company’s state-of-the-art manufacturing line, raw materials

cost-out, Z3 technology performance improvement and customer cash

conversion. The Company surpassed its January raw materials

cost-out target by 6% while delivering manufacturing cycle times

below 10 seconds and maintaining 98% first pass yield to further

demonstrate continued operational efficiency and progress towards

profitable growth.

Commercial Growth &

BankabilityIn the fourth quarter, the Company secured

several key standalone storage orders including contracts with a

municipal cooperative in Springfield Missouri, the U.S. Marine

Corps Base at Camp Pendleton in San Diego and most recently the

Naval Base of San Diego. Eos deployment of American-made energy

storage systems is becoming increasingly vital, not only for

enhancing military resilience but also for strengthening the U.S.

against global energy disruptions and securing America’s energy

independence.

To drive further growth, the Company launched a

comprehensive insurance program in partnership with Ariel Green, a

division of Ariel Re, to enhance the bankability of the Company’s

technology. These products include investment tax credit (ITC) and

ITC recapture protections, along with contractual warranty and

performance guarantee backstop coverage. Most recently, the Company

also updated its standard warranty to a 3-year term with the option

to extend to 5 or 10 years. These customer-focused solutions,

combined with extensive third-party validations and a more robust

Company balance sheet, provide greater risk mitigation, enhanced

operational stability and increased economic certainty.

Operational Capacity Expansion

Demand for safe, multi-cycle, American-made energy storage has

reached a level that requires significant capacity expansion. As

announced in December 2024, the Company launched its search for

Factory 2 Works, submitting Requests for Proposals (RFPs) to eight

states, with multiple sites now shortlisted. In parallel, Eos is

progressing with plans to procure three additional manufacturing

lines, including sub-assemblies, battery manufacturing, and cube

assembly to support 6 GWh of additional annualized manufacturing

capacity. This expansion is a crucial step in scaling operations to

meet the growing demand for reliable, high performance energy

storage.

The Company is expanding its first manufacturing line from 1.25

GWh to 2 GWh annualized capacity and continues to progress through

Factory Acceptance Testing with its staged sub-assembly automation

implementation. The Company expects full implementation to occur in

the second and early third quarter, which is essential for

increasing throughput and reducing labor and overhead costs.

Earnings Conference Call and

WebcastEos will host a conference call to discuss its

fourth quarter and full-year 2024 results on March 5, 2025, at 8:30

a.m. ET. The live webcast of the earnings call will be available on

the “Investor Relations” page of the Company’s website at Eos

Investors or may be accessed using this link (registration link).

To avoid delays, we encourage participants to join the conference

call fifteen minutes ahead of the scheduled start time.

The conference call replay will be available via

webcast through Eos’ investor relations website for twelve months

following the live presentation. The webcast replay will be

available from approximately 11:30 a.m. ET on March 5, 2025, and

can be accessed by visiting Eos Investors.

About Eos Energy

Enterprises

Eos Energy Enterprises, Inc. is accelerating the

shift to American energy independence with positively ingenious

solutions that transform how the world stores power. Our

breakthrough Znyth™ aqueous zinc battery was designed to overcome

the limitations of conventional lithium-ion technology. It is safe,

scalable, efficient, sustainable, manufactured in the U.S., and the

core of our innovative systems that today provides utility,

industrial, and commercial customers with a proven, reliable energy

storage alternative for 3 to 12-hour applications. Eos was founded

in 2008 and is headquartered in Edison, New Jersey. For more

information about Eos (NASDAQ: EOSE), visit eose.com.

|

|

|

| Contacts |

|

| Investors: |

ir@eose.com |

| Media: |

media@eose.com |

| |

|

Forward Looking Statements

Except for the historical information contained

herein, the matters set forth in this press release are

forward-looking statements within the meaning of the "safe harbor"

provisions of the Private Securities Litigation Reform Act of 1995.

Forward-looking statements include, but are not limited to,

statements regarding our expected revenue, for the fiscal years

December 31, 2025, our path to profitability and strategic outlook,

statements regarding orders backlog and opportunity pipeline,

statements regarding our expectation that we can continue to

increase product volume on our state-of-the-art manufacturing line,

statements regarding our future expansion and its impact on our

ability to scale up operations, statements regarding our

expectation that we can continue to strengthen our overall supply

chain, statements regarding our expectation that our new

comprehensive insurance program will provide increased operational

and economic certainty, statements that refer to the delayed draw

term loan with Cerberus, milestones thereunder and the anticipated

use of proceeds, statements that refer to outlook, projections,

forecasts or other characterizations of future events or

circumstances, including any underlying assumptions. The words

"anticipate," "believe," "continue," "could," "estimate," "expect,"

"intends," "may," "might," "plan," "possible," "potential,"

"predict," "project," "should," "would" and similar expressions may

identify forward-looking statements, but the absence of these words

does not mean that a statement is not forward-looking.

Forward-looking statements are based on our management’s beliefs,

as well as assumptions made by, and information currently available

to, them. Because such statements are based on expectations as to

future financial and operating results and are not statements of

fact, actual results may differ materially from those

projected.

Factors which may cause actual results to differ

materially from current expectations include, but are not limited

to: changes adversely affecting the business in which we are

engaged; our ability to forecast trends accurately; our ability to

generate cash, service indebtedness and incur additional

indebtedness; our ability to achieve the operational milestones on

the delayed draw term loan; our ability to raise financing in the

future; risks associated with the credit agreement with Cerberus,

including risks of default, dilution of outstanding Common Stock,

consequences for failure to meet milestones and contractual lockup

of shares; our customers’ ability to secure project financing; the

amount of final tax credits available to our customers or to Eos

pursuant to the Inflation Reduction Act; the timing and

availability of future funding under the Department of Energy Loan

Facility; our ability to continue to develop efficient

manufacturing processes to scale and to forecast related costs and

efficiencies accurately; fluctuations in our revenue and operating

results; competition from existing or new competitors; our ability

to convert firm order backlog and pipeline to revenue; risks

associated with security breaches in our information technology

systems; risks related to legal proceedings or claims; risks

associated with evolving energy policies in the United States and

other countries and the potential costs of regulatory compliance;

risks associated with changes to the U.S. trade environment; our

ability to maintain the listing of our shares of common stock on

NASDAQ; our ability to grow our business and manage growth

profitably, maintain relationships with customers and suppliers and

retain our management and key employees; risks related to the

adverse changes in general economic conditions, including

inflationary pressures and increased interest rates; risk from

supply chain disruptions and other impacts of geopolitical

conflict; changes in applicable laws or regulations; the

possibility that Eos may be adversely affected by other economic,

business, and/or competitive factors; other factors beyond our

control; risks related to adverse changes in general economic

conditions; and other risks and uncertainties.

The forward-looking statements contained in this

press release are also subject to additional risks, uncertainties,

and factors, including those more fully described in the Company’s

most recent filings with the Securities and Exchange Commission,

including the Company’s most recent Annual Report on Form 10-K and

subsequent reports on Forms 10-Q and 8-K. Further information on

potential risks that could affect actual results will be included

in the subsequent periodic and current reports and other filings

that the Company makes with the Securities and Exchange Commission

from time to time. Moreover, the Company operates in a very

competitive and rapidly changing environment, and new risks and

uncertainties may emerge that could have an impact on the

forward-looking statements contained in this press release.

Forward-looking statements speak only as of the

date they are made. Readers are cautioned not to put undue reliance

on forward-looking statements, and, except as required by law, the

Company assumes no obligation and does not intend to update or

revise these forward-looking statements, whether as a result of new

information, future events, or otherwise.

Key Metrics

Backlog. Our backlog represents

the amount of revenue that we expect to realize from existing

agreements with our customers for the sale of our battery energy

storage systems and performance of services. The backlog is

calculated by adding new orders in the current fiscal period to the

backlog as of the end of the prior fiscal period and then

subtracting the shipments in the current fiscal period. If the

amount of an order is modified or cancelled, we adjust orders in

the current period and our backlog accordingly, but do not

retroactively adjust previously published backlogs. There is no

comparable US-GAAP financial measure for backlog. We believe that

the backlog is a useful indicator regarding the future revenue of

our Company.

Pipeline. Our pipeline

represents projects for which we have submitted technical proposals

or non-binding quotes plus letters of intent (“LOI”) or firm

commitments from customers. Pipeline does not include lead

generation projects.

Booked Orders. Booked orders

are orders where we have legally binding agreements with a Purchase

Order (“PO”), or Master Supply Agreement (“MSA”) executed by both

parties.

Non-GAAP Financial Measures

To provide investors with additional information

regarding our financial results, we have disclosed in this earnings

release non-GAAP financial measures, including adjusted EBITDA and

adjusted EPS, which are non-GAAP financial measures as defined

under the rules of the SEC. These non-GAAP financial measures

should be considered supplemental to, not a substitute for, or

superior to, the financial measures of the Company’s calculated in

accordance with U.S. generally accepted accounting principles

(“GAAP”). The Company believes adjusted EBITDA, and adjusted EPS

are useful measures in evaluating its financial and operational

performance distinct and apart from financing costs, certain

non-cash expenses and non-operational expenses.

We believe that non-GAAP financial information,

when taken collectively may be helpful to our investors in

assessing its operating performance. There are a number of

limitations related to the use of these non-GAAP financial measures

and their nearest GAAP equivalents. For example, the Company’s

definitions of non-GAAP financial measures may differ from non-GAAP

financial measures used by other companies. Below is a description

of the non-GAAP financial information included herein as well as

reconciliations to the most directly comparable GAAP measure. You

should review the reconciliations below but not rely on any single

financial measure to evaluate our business.

Adjusted EBITDA is defined as earnings (net

loss) attributable to Eos adjusted for interest expense, income

tax, depreciation and amortization, non-cash stock-based

compensation expense, change in fair value of debt and derivatives,

debt extinguishment, and other non-cash or non-recurring items as

determined by management which it does not believe to be indicative

of its underlying business trends. Adjusted EPS is defined as GAAP

net loss per common share as adjusted for non-cash stock-based

compensation expense change in fair value of debt and derivatives

and debt extinguishment per common share.

|

EOS ENERGY ENTERPRISES, INC.CONSOLIDATED STATEMENTS OF

OPERATIONS AND COMPREHENSIVE LOSS(In thousands, except

share and per share amounts) |

| |

For the Years Ended December 31, |

|

|

|

2024 |

|

|

|

2023 |

|

| Revenue |

$ |

15,606 |

|

|

$ |

16,378 |

|

| Cost of goods sold |

|

98,867 |

|

|

|

89,798 |

|

| Gross profit

(loss) |

|

(83,261 |

) |

|

|

(73,420 |

) |

| Operating

expenses |

|

|

|

|

Research and development expenses |

|

22,758 |

|

|

|

18,708 |

|

|

Selling, general and administrative expenses |

|

60,047 |

|

|

|

53,650 |

|

|

Loss from write-down of property, plant and equipment |

|

9,133 |

|

|

|

7,159 |

|

|

Total operating expenses |

|

91,938 |

|

|

|

79,517 |

|

| Operating

loss |

|

(175,199 |

) |

|

|

(152,937 |

) |

| Other (expense)

income |

|

|

|

|

Interest expense, net |

|

(8,718 |

) |

|

|

(18,770 |

) |

|

Interest expense – related parties |

|

(19,499 |

) |

|

|

(37,466 |

) |

|

Change in fair value of debt - related party |

|

33,823 |

|

|

|

— |

|

|

Change in fair value of warrants |

|

(171,226 |

) |

|

|

(24,980 |

) |

|

Change in fair value of derivatives - related parties |

|

(405,388 |

) |

|

|

9,983 |

|

| Gain (loss) on debt

extinguishment |

|

68,478 |

|

|

|

(3,510 |

) |

| Other expense |

|

(8,120 |

) |

|

|

(1,795 |

) |

| Loss before income

taxes |

$ |

(685,849 |

) |

|

$ |

(229,475 |

) |

| Income tax expense |

|

21 |

|

|

|

31 |

|

| Net loss attributable

to shareholders |

$ |

(685,870 |

) |

|

$ |

(229,506 |

) |

|

Accretion of Preferred Stock - related party |

|

(278,330 |

) |

|

|

— |

|

| Net loss attributable

to common shareholders |

$ |

(964,200 |

) |

|

$ |

(229,506 |

) |

| Other comprehensive

(loss) income attributable to common shareholders |

|

|

|

|

Change in fair value of debt - credit risk - related party |

|

(43,490 |

) |

|

|

— |

|

|

Foreign currency translation adjustment |

|

(13 |

) |

|

|

1 |

|

| Comprehensive loss

attributable to common shareholders |

$ |

(1,007,703 |

) |

|

$ |

(229,505 |

) |

| Basic and diluted loss

per share attributable to common shareholders |

|

|

|

| Basic |

$ |

(4.55 |

) |

|

$ |

(1.81 |

) |

| Diluted |

$ |

(4.55 |

) |

|

$ |

(1.81 |

) |

| Weighted average

shares of common stock |

|

|

|

| Basic |

|

212,039,775 |

|

|

|

126,967,756 |

|

| Diluted |

|

212,039,775 |

|

|

|

126,967,756 |

|

| |

|

|

|

|

|

|

|

|

EOS ENERGY ENTERPRISES, INC.CONSOLIDATED BALANCE

SHEET(In thousands) |

| |

December 31, |

|

|

|

2024 |

|

|

|

2023 |

|

| Balance sheet

data |

|

|

|

| Cash and cash

equivalents |

$ |

74,292 |

|

|

$ |

69,473 |

|

| Other current

assets |

|

105,620 |

|

|

|

52,858 |

|

| Property, plant and

equipment, net |

|

45,660 |

|

|

|

37,855 |

|

| Other

assets |

|

34,746 |

|

|

|

26,306 |

|

| Total

assets |

|

260,318 |

|

|

|

186,492 |

|

| Total

liabilities |

|

842,085 |

|

|

|

297,292 |

|

| Mezzanine equity -

preferred stock |

|

488,696 |

|

|

|

— |

|

| Total

deficit |

|

(1,070,463 |

) |

|

|

(110,800 |

) |

| |

|

|

|

|

|

|

|

|

EOS ENERGY ENTERPRISES, INC.CONSOLIDATED STATEMENT OF

CASHFLOWS(In thousands) |

| |

December 31, |

|

|

|

2024 |

|

|

|

2023 |

|

| Cash used in operating

activities |

$ |

(153,936 |

) |

|

$ |

(145,018 |

) |

| Cash used in investing

activities |

|

(33,186 |

) |

|

|

(29,461 |

) |

| Cash provided by

financing activities |

|

205,834 |

|

|

|

227,918 |

|

| Effect of foreign

exchange on cash, cash equivalents and restricted

cash |

|

(17 |

) |

|

|

5 |

|

| Net increase in cash,

cash equivalents and restricted cash |

|

18,695 |

|

|

|

53,444 |

|

| Cash, cash equivalents

and restricted cash, beginning of year |

|

84,667 |

|

|

|

31,223 |

|

| Cash, cash equivalents

and restricted cash, end of year |

$ |

103,362 |

|

|

$ |

84,667 |

|

|

EOS ENERGY ENTERPRISES, INC.RECONCILIATION OF NET LOSS TO

EBITDA AND ADJUSTED EBITDA(In thousands) |

| |

|

For the three months ended December 31, |

|

For the twelve months ended December 31, |

| |

|

|

2024 |

|

|

|

2023 |

|

|

|

2024 |

|

|

|

2023 |

|

| Net loss |

|

$ |

(268,124 |

) |

|

$ |

(41,208 |

) |

|

$ |

(685,870 |

) |

|

$ |

(229,506 |

) |

|

add: Interest expense |

|

|

5,248 |

|

|

|

8,565 |

|

|

|

28,217 |

|

|

|

56,236 |

|

|

add: Income tax expense |

|

|

4 |

|

|

|

6 |

|

|

|

21 |

|

|

|

31 |

|

|

add: Depreciation and amortization |

|

|

2,640 |

|

|

|

2,435 |

|

|

|

7,899 |

|

|

|

9,751 |

|

| EBITDA

loss |

|

|

(260,232 |

) |

|

|

(30,202 |

) |

|

|

(649,733 |

) |

|

|

(163,488 |

) |

|

add: Stock based compensation |

|

|

7,840 |

|

|

|

3,934 |

|

|

|

18,780 |

|

|

|

14,057 |

|

|

add (deduct): Change in fair value of derivatives |

|

|

244,877 |

|

|

|

(10,922 |

) |

|

|

576,614 |

|

|

|

14,997 |

|

|

deduct: Change in fair value of debt |

|

|

(37,099 |

) |

|

|

— |

|

|

|

(33,823 |

) |

|

|

— |

|

|

(deduct) add: (Gain) loss on debt extinguishment |

|

|

— |

|

|

|

— |

|

|

|

(68,478 |

) |

|

|

3,510 |

|

| Adjusted EBITDA

loss |

|

$ |

(44,614 |

) |

|

$ |

(37,190 |

) |

|

$ |

(156,640 |

) |

|

$ |

(130,924 |

) |

| |

|

EOS ENERGY ENTERPRISES, INC.RECONCILIATION OF NET (LOSS)

INCOMETO ADJUSTED NET (LOSS) INCOME PER SHARE(In

thousands, except share and per share data) |

| |

For the three months ended December 31, |

|

For the twelve months ended December 31, |

| |

|

2024 |

|

|

|

2023 |

|

|

|

2024 |

|

|

|

2023 |

|

| Net loss attributable

to common shareholders |

$ |

(481,516 |

) |

|

$ |

(41,208 |

) |

|

$ |

(964,200 |

) |

|

$ |

(229,506 |

) |

|

add: Stock based compensation |

|

7,840 |

|

|

|

3,934 |

|

|

|

18,780 |

|

|

|

14,057 |

|

|

add (deduct): Change in fair value of derivatives |

|

244,877 |

|

|

|

(10,922 |

) |

|

|

576,614 |

|

|

|

14,997 |

|

|

deduct: Change in fair value of debt |

|

(37,099 |

) |

|

|

— |

|

|

|

(33,823 |

) |

|

|

— |

|

|

(deduct) add: (Gain) loss on debt extinguishment |

|

— |

|

|

|

— |

|

|

|

(68,478 |

) |

|

|

3,510 |

|

|

Adjusted net loss attributable to common shareholders |

|

(265,898 |

) |

|

|

(48,196 |

) |

|

|

(471,107 |

) |

|

|

(196,942 |

) |

| |

|

|

|

|

|

|

|

| Basic and

diluted loss per share attributable to common

shareholders |

|

Basic |

$ |

(2.20 |

) |

|

$ |

(0.25 |

) |

|

$ |

(4.55 |

) |

|

$ |

(1.81 |

) |

|

Diluted |

$ |

(2.20 |

) |

|

$ |

(0.25 |

) |

|

$ |

(4.55 |

) |

|

$ |

(1.81 |

) |

| |

|

|

|

|

|

|

|

| Basic and

diluted adjusted loss per share attributable to common

shareholders |

|

Basic |

$ |

(1.22 |

) |

|

$ |

(0.29 |

) |

|

$ |

(2.22 |

) |

|

$ |

(1.55 |

) |

|

Diluted |

$ |

(1.22 |

) |

|

$ |

(0.29 |

) |

|

$ |

(2.22 |

) |

|

$ |

(1.55 |

) |

| |

|

|

|

|

|

|

|

| Weighted average

shares of common stock |

|

|

|

|

|

|

|

|

Basic |

|

218,640,092 |

|

|

|

164,780,351 |

|

|

|

212,039,775 |

|

|

|

126,967,756 |

|

|

Diluted |

|

218,640,092 |

|

|

|

164,780,351 |

|

|

|

212,039,775 |

|

|

|

126,967,756 |

|

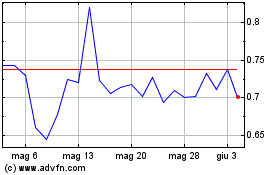

Grafico Azioni Eos Energy Enterprises (NASDAQ:EOSE)

Storico

Da Feb 2025 a Mar 2025

Grafico Azioni Eos Energy Enterprises (NASDAQ:EOSE)

Storico

Da Mar 2024 a Mar 2025