0001762239

false

0001762239

2023-08-03

2023-08-03

iso4217:USD

xbrli:shares

iso4217:USD

xbrli:shares

UNITED

STATES

SECURITIES

AND EXCHANGE COMMISSION

WASHINGTON,

D.C. 20549

FORM

8-K

CURRENT REPORT

PURSUANT TO SECTION 13 OR 15(D) OF THE SECURITIES

EXCHANGE ACT OF 1934

Date of Report (Date of earliest event reported):

August 3, 2023 (August 1, 2023)

Kaival

Brands Innovations Group, Inc.

(Exact name of registrant as specified

in its charter)

| Delaware |

000-56016 |

83-3492907 |

(State or other jurisdiction

of incorporation) |

(Commission File Number) |

(I.R.S. Employer

Identification No.) |

4460 Old Dixie Highway

Grant-Valkaria , Florida 32949

(Address of principal executive office, including

zip code)

Telephone: (833) 452-4825

(Registrant’s telephone number,

including area code)

Securities registered pursuant to Section

12(b) of the Act:

| Title

of each class |

Trading

Symbol(s) |

Name

of each exchange on which registered |

| Common

Stock, par value $0.001 per share |

KAVL |

The

Nasdaq Stock Market, LLC |

Check the appropriate box below if the Form

8-K filing is intended to simultaneously satisfy the filing obligation of the registrant under any of the following provisions:

☐

Written communications pursuant to Rule 425 under the Securities Act (17 CFR 230.425)

☐

Soliciting material pursuant to Rule 14a-12 under the Exchange Act (17 CFR 240.14a-12)

☐

Pre-commencement communications pursuant to Rule 14d-2(b) under the Exchange Act (17 CFR 240.14d-2(b))

☐

Pre-commencement communications pursuant to Rule 13e-4(c) under the Exchange Act (17 CFR 240.13e-4(c))

Indicate

by check mark whether the registrant is an emerging growth company as defined in Rule 405 of the Securities Act of 1933 (§230.405

of this chapter) or Rule 12b-2 of the Securities Exchange Act of 1934 (§240.12b-2 of this chapter).

Emerging

growth company ☒

If

an emerging growth company, indicate by check mark if the registrant has elected not to use the extended transition period for

complying with any new or revised financial accounting standards provided pursuant to Section 13(a) of the Exchange Act.

Item 1.01 Entry into a Material Definitive

Agreement.

Item 5.02 Departure of Directors or Principal

Officers; Election of Directors; Appointment of Principal Officers; Compensatory Arrangements of Certain Officers.

Appointment of Thomas Metzler as Chief Financial Officer, Treasurer

and Secretary of the Company

Effective as of August 1, 2023, the Board of Directors

(the “Board”) of Kaival Brands Innovations Group, Inc. (the “Company”) appointed Thomas Metzler

as the Company’s Chief Financial Officer, Treasurer and Secretary. As Chief Financial Officer, Mr. Metzler replaces Mark Thoenes,

who has served as the Company’s Interim Chief Financial Officer since June 2021. Pursuant to his appointment, Mr. Metzler entered

into an employment agreement with the Company effective as of August 1, 2023 (the “Metzler Employment Agreement”).

Mr. Metzler, 46, brings over 20 years of finance and

operational experience in the vaping and consumer products sector to the Company. Since June 2019, he has worked as an accounting and

operational consultant. From April 2013 to June 2019, Mr. Metzler served as Managing Director of a Division of Turning Point Brands (NYSE:

TPB), a manufacturer, marketer and distributor of branded alternative smoking accessories and consumables with active ingredients. At

Turning Point Brands, Mr. Metzler led a team to transform the process of financial management efficiencies, which improved cost controls,

managed inventory turn, developed strategic product promotions to accelerate product distribution, and built strategic alliances with

suppliers. Mr. Metzler also developed & monitored key performance indicators (“KPIs”) which generated record growth with

retail and wholesale distributors. He also provided post-acquisition assistance to integrate newly acquired entities into Turning Point

Brands and advocated for the vapor industry by meeting with the White House’s OMB/OIRA office, and various congressional and senatorial

offices. Mr. Metzler was a significant contributor as a Standard Technical Panel member in developing UL 8139- Electrical Systems of Electronic

Cigarettes and Vaping Devices, a safety standard that evaluates the electrical and battery systems of vaping devices and electronic cigarettes.

Mr. Metzler was a licensed CPA for over 20 years, during which time he provided accounting and related consulting services to many companies.

He began his career working with public and private companies in the assurance practice at PricewaterhouseCoopers LLP in Boston. Mr. Metzler

earned a B.S. in Accounting from Canisius College.

The Company believes Mr. Metzler is qualified to be

Chief Financial Officer because of his extensive experience in accounting and mergers and acquisitions, and because of his deep knowledge

of business operations in our industry.

There is no arrangement or understanding between Mr.

Metzler and any other person pursuant to which he was selected as Chief Financial Officer. Mr. Metzler has no family relationships with

any of our directors or executive officers, and has no direct or indirect material interest in any transaction required to be disclosed

pursuant to Item 404(a) of Regulation S-K.

Pursuant to the Metzler Employment Agreement, the

Company shall pay to Mr. Metzler a base salary of $240,000. The Company may, in its sole discretion, grant to Mr. Metzler a bonus for

the calendar year 2023. Beginning in the 2024 calendar year, the Company may, in its sole discretion, grant to Mr. Metzler an annual incentive

bonus based upon targets set by the Board and its Compensation Committee. Beginning in 2024 and thereafter, Mr. Metzler’s bonus

target shall be up to 30% of his base salary.

Pursuant to the Metzler Employment Agreement, the

Company has also granted to Mr. Metzler, effective August 1, 2023, an option to purchase 253,916 shares of the Company’s common

stock with an exercise price of $0.591 per share (which option was valued under the Black-Scholes pricing model at $150,000) (the “Metzler

Option”). The Metzler Option shall vest over four years. One-quarter of the Metzler Option shall vest on the first anniversary

of the grant date and shall vest afterward monthly at the rate of 1/36 per month until fully vested. The Metzler Option and its vesting

shall be subject to, and governed by, the terms and conditions of the Company’s 2020 Stock and Incentive Compensation Plan (the

“Incentive Plan”) as amended from time to time, and the award agreement issued by the Incentive Plan.

Mr. Metzler’s employment agreement contains

customary clawback language, which states that any incentive-based compensation granted to Mr. Metzler, including any annual incentive

bonus and the Metzler Option, that is subject to recovery under any law, government rule or regulation, or stock exchange listing requirement

(“Clawback Rules”), will be subject to such deductions and clawback as may be required to be made pursuant to such

Clawback Rules or any policy adopted by the Company pursuant to any such Clawback Rules.

Mr. Metzler’s employment is at will, meaning

that either he or the Company may terminate the employment at any time for any reason or no reason. The employment agreement also allows

for termination by the Company for “Cause” or by Mr. Metzler without “Good Reason,” as defined in the agreement.

If the Company terminates Mr. Metzler’s employment for Cause, or if he terminates without Good Reason, Mr. Metzler will be entitled

to receive the following: (i) any unpaid base salary accrued up to the termination date, (ii) reimbursement for business expenses, and

(iii) employee benefits and equity compensation under the Company’s benefit plans as of the termination date, without any additional

severance or termination payments. If the Company terminates Mr. Metzler without Cause, or if he terminates for Good Reason, Mr. Metzler

will be entitled to receive: (i) the previously mentioned accrued amounts, (ii) severance pay equal to two (2) months of his base salary,

increasing to six (6) months after one (1) year of employment, and (iii) any rights to option or equity grants as defined in the Incentive

Plan.

The Metzler Employment Agreement also contains customary

provisions for confidentiality and matters related to intellectual property and Company property.

The foregoing description of the Metzler Employment

Agreement contained herein does not purport to be complete and is qualified in its entirety by reference thereto, which is attached to

this Report as Exhibit 10.1 and is incorporated herein by reference.

Appointment of Eric Mosser as Chief Executive Officer

and President

Effective as of August 1, 2023, the Board promoted

Mr. Eric Mosser, the Company’s President and Chief Operating Officer, as the Company’s Chief Executive Officer and President.

In connection with his promotion, Mr. Mosser has entered into an employment agreement with the Company (the “Mosser Employment

Agreement”) effective as of August 1, 2023.

Aside from agreements with Mr. Mosser that have previously

been disclosed by the Company in its filings with the Securities and Exchange Commission, Mr. Mosser has not been involved in any transaction

with the Company that would require disclosure under Item 404(a) of Regulation S-K. There are no family relationships between Mr. Mosser

and any other director, executive officer, or person nominated or chosen by the Company to become a director or executive officer of the

Company and there are no arrangements or understandings between him and any other persons pursuant to which he was or is to be selected

as an officer.

Pursuant to the Mosser Employment Agreement, the Company

agrees to pay to Mr. Mosser a base salary of $300,000. The Company may, in its sole discretion, grant to Mr. Mosser a bonus for the calendar

year 2023. Beginning in the 2024 calendar year, the Company may, in its sole discretion, grant to Mr. Mosser an annual incentive bonus

based upon targets set by the Board and its Compensation Committee. Beginning in 2024 and thereafter, Mr. Mosser’s bonus target

shall be up to 40% of his base salary.

Pursuant to the Mosser Employment Agreement, the Company

has also granted to Mr. Mosser, effective August 1, 2023, an option to purchase 567,080 shares of the Company’s common stock with

an exercise price of $0.591 per share (which option was valued under the Black-Scholes pricing model at $335,000) (the “Mosser

Option”). The Mosser Option shall vest over four years. One-quarter of the Mosser Option shall vest on the first anniversary

of the grant date and shall vest afterward monthly at the rate of 1/36 per month until fully vested. The Mosser Option and its vesting

shall be subject to, and governed by, the terms and conditions of the Company’s Incentive Plan as amended from time to time, and

the award agreement issued by the Incentive Plan.

Mr. Mosser’s employment agreement contains customary

clawback language, which states that any incentive-based compensation granted to Mr. Mosser, including any annual incentive bonus and

the Mosser Option, that is subject to recovery under the Clawback Rules, will be subject to such deductions and clawback as may be required

to be made pursuant to such Clawback Rules or any policy adopted by the Company pursuant to any such Clawback Rules.

The Mosser Employment agreement includes clauses related

to non-competition and non-solicitation. During the term of the agreement and for six (6) months thereafter, Mr. Mosser agrees not to

contribute in certain “Prohibited Activity” as defined in the agreement. Such activity includes but is not limited to contributing

to entities engaged in the same or similar business as the Company, including those engaged in the business of developing, manufacturing,

marketing, distributing, or selling, vaping products. Mr. Mosser also agrees not to solicit Company employees and customers for twelve

(12) months after the termination of his employment.

Mr. Mosser’s employment is at will, meaning

that either he or the Company may terminate the employment at any time for any reason or no reason. The employment agreement also allows

for termination by the Company for “Cause” or by Mr. Mosser without “Good Reason,” as defined in the agreement.

If the Company terminates Mr. Mosser’s employment for Cause, or if he terminates without Good Reason, Mr. Mosser will be entitled

to receive the following: (i) any unpaid base salary accrued up to the termination date, (ii) reimbursement for business expenses, and

(iii) employee benefits and equity compensation under the Company’s benefit plans as of the termination date, without any additional

severance or termination payments. If the Company terminates Mr. Mosser without Cause or if he terminates for Good Reason, Mr. Mosser

will be entitled to receive: (i) the previously mentioned accrued amounts, (ii) severance pay equal to two (2) months of his base salary,

increasing to six (6) months after one (1) year of employment, and (iii) any rights to option or equity grants as defined in the Incentive

Plan.

The Mosser Employment Agreement also contains customary

provisions for confidentiality and matters related to intellectual property and Company property.

The foregoing description of the Mosser Employment

Agreement contained herein does not purport to be complete and is qualified in its entirety by reference thereto, which is attached to

this Report as Exhibit 10.2 and is incorporated herein by reference.

On August 3, 2023, the Company issued a press release

announcing the appointment of Mr. Metzler and Mr. Mosser as the Company’s new Chief Financial Officer and Chief Executive Officer,

respectively. The full text of the press release is furnished as Exhibit 99.1 to this Current Report on Form 8-K and is incorporated herein

by reference.

Item 3.01 Notice of Delisting or Failure

to Satisfy a Continued Listing Rule or Standard; Transfer of Listing.

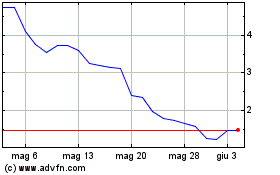

As previously reported, on January 30, 2023,

the Company received a letter from The Nasdaq Stock Market (“Nasdaq”) notifying the Company that because the

closing bid price for the Company’s common stock had fallen below $1.00 per share for 30 consecutive business days (December

14, 2022 through January 17, 2023), the Company no longer complied with the minimum bid price requirement for continued listing

on the Nasdaq Capital Market under Rule 5550(a)(2) of the Nasdaq Listing Rules (the “Bid Price Rule”). The notice

indicated that we would have 180 calendar days, or until July 31, 2023, to regain compliance with the Bid Price Rule.

On August 1, 2023, Nasdaq notified the Company

that its has received a 180-day extension to comply with the Bid Price Rule until January 29, 2024, by which date the Company must

evidence compliance with the Bid Price Rule for at least ten (10) consecutive business days. If compliance cannot be demonstrated

by January 29, 2024, Nasdaq will provide written notification to the Company that its common stock will be delisted. In the event

of such a notification, the Company may appeal Nasdaq’s determination. There can be no assurance Nasdaq would grant any such

request for continued listing.

The Company is presently evaluating various

courses of action to regain compliance with the Bid Price Rule. However, there can be no assurance that the Company will be able

to regain compliance. This notification has no immediate effect on the Company’s listing on the Nasdaq Capital Market nor

on the trading of the Company’s common stock.

The Company issued a press release on August

2, 2023 stating that it received this letter from Nasdaq. A copy of this please release is filed as Exhibit 99.2 to this Current

Report on Form 8-K and is incorporated herein by reference.

| Exhibit No. |

Description |

| 10.1 |

Employment Agreement by and between the Company and Thomas Metzler, dated August 1, 2023 |

| 10.2 |

Employment Agreement by and between the Company and Eric Mosser, dated August 1, 2023 |

| 99.1 |

Press release of the Company, dated August 3, 2023, announcing the appointment of the Company’s new Chief Executive Officer and Chief Financial Officer |

| 99.2 |

Press release of the Company, dated August 2, 2023, announcing the 180-day extension granted to the Company by Nasdaq for compliance with Nasdaq’s minimum bid price rule |

| 104 |

Cover Page Interactive Data File (embedded within the Inline XBRL document) |

SIGNATURES

Pursuant to the requirements

of the Securities Exchange Act of 1934, the registrant has duly caused this report to be signed on its behalf by the undersigned

thereunto duly authorized.

| |

Kaival Brands Innovations Group, Inc. |

| |

|

|

| Dated: August 3, 2023 |

By: |

/s/ Eric Mosser |

| |

|

Eric Mosser |

| |

|

Chief Executive Officer and President |

Exhibit 10.1

EXECUTIVE EMPLOYMENT AGREEMENT

THIS EXECUTIVE EMPLOYMENT

AGREEMENT (this “Agreement”) is made and entered into by and between Kaival Brands Innovations Group, Inc.

(the “Company”) located at 4460 Old Dixie Highway, Grant-Valkaria, Florida 32949, and Mr. Thomas Metzler (“Executive”)

(each a “Party” and collectively the “Parties”) on this 1st day of August 2023 (“Effective

Date”).

WHEREAS, the Company

wishes to employ Executive on the terms set forth in this Agreement; and

WHEREAS, Executive

wishes to become employed on the terms set forth herein;

NOW, THEREFORE,

in consideration of the mutual promises contained herein and other good and valuable consideration, the receipt and sufficiency

of which are acknowledged, the Parties agree as follows:

Employment Term. Executive’s

employment is at will, meaning that either party may terminate the employment at any time for any reason or no reason. Nothing

in this Agreement is intended to create a promise or representation of continued employment or employment for a fixed period of

time. The period of time between the Effective Date and the termination of the Executive’s employment shall be referred as

the “Term.”

Position and Duties.

a) Title.

The Company hereby agrees to employ the Executive to serve as Chief Financial Officer, Treasurer and Secretary of the Company.

b) Duties.

Executive shall report to the Company’s Chief Executive Officer (“CEO”). Executive shall perform all duties

and have all powers incident to the office he holds. Executive shall have overall responsibility for the Company’s financial

operations, including accurate accounting and financial reporting, payment of the Company’s obligations, cash and investment

management, analysis, and negotiation, of financing agreements, and management of subordinates working in the Company’s finance

function. Executive shall also be required to certify to the United States Securities & Exchange Commission (“SEC”)

that the Company’s filings with the SEC fairly present in all material

respects the Company’s financial condition. During the Term, the Executive shall be employed by the Company on a full-time

basis and shall perform such duties and responsibilities on behalf of the Company and all persons and entities directly or indirectly

controlling, controlled by, or under common control with, the Company. Executive shall perform such other duties and may exercise

such other powers as may be assigned by the CEO from time to time that are consistent with his title and status.

c) Board Service.

The Company may nominate Executive to serve as a board member of Company affiliates or subsidiaries. Executive agrees, for no additional

compensation, to serve on such boards. Upon the end of the Term for any reason, Executive shall resign from any such board positions

Executive holds with any Company subsidiary or affiliate.

d) Full-Time Commitment/Policies.

Throughout the Executive’s employment, the Executive shall devote substantially all of his professional time to the performance

of his duties of employment with the Company (except as otherwise provided herein) and shall faithfully and industriously perform

such duties. The Executive will be required to comply with all Company policies

as may exist and be in effect from time to time.

e) Executive

Representations. The Executive represents and warrants to the Company that he is under

no obligation or commitments, whether contractual or otherwise, that are inconsistent with his obligations under this Agreement.

The Executive represents and warrants that he will not use or disclose, in connection with his employment by the Company, any trade

secrets or proprietary information or intellectual property in which any other person or entity has any right, title or interest

and that his employment by the Company as contemplated by this Agreement will not infringe or violate the rights of any other person.

Compensation and Benefits.

a) Base

Salary. In consideration for his work under the terms of this Agreement, the Executive shall earn a base salary in the

gross amount of $240,000 (Two Hundred Forty Thousand Dollars) per year (“Base Salary”). Executive’s Base

Salary shall be paid in equal semi-monthly installments, in accordance with the regular payroll practices of the Company.

b) Annual

Bonus. For the calendar year 2023, the Company may, in its sole discretion, grant Executive an annual incentive bonus.

Beginning in calendar year 2024, Executive shall be eligible for an annual incentive bonus based upon targets set by the Board

of Directors and its Compensation Committee in their sole and absolute discretion in an executive bonus plan, by January 30, 2024

and January 30 of each succeeding year. Beginning in 2024, and thereafter, Executive’s bonus target shall be up to 30% (thirty

percent) of Executive’s Base Salary.

c) Option

Grants. On the Effective Date, the Company shall grant Executive an option, valued by the Company’s Black-Scholes

analysis at $150,000.00 (One Hundred Fifty Thousand Dollars) to purchase common shares of the Company (the “Option”).

The Option shall vest over four years. One-quarter of the Option shall vest on the first anniversary of the grant date and afterward

shall vest monthly at the rate of 1/36 per month until fully vested. The Option and its vesting shall be subject to, and governed

by, the terms and conditions of the Company’s 2020 Stock and Incentive Compensation Plan as amended from time to time (the

“Incentive Plan”), and the award agreement issued by the Incentive Plan.

d) Clawback

Rules. Notwithstanding any other provisions in this Agreement to the contrary, any incentive-based compensation, including

any annual incentive bonus and the Option, paid to the Executive under this Agreement, the Incentive Plan, or any other agreement

or arrangement with the Company, which is subject to recovery under any law, government rule or regulation, or stock exchange listing

requirement (“Clawback Rules”), will be subject to such deductions and clawback as may be required to be made

pursuant to such Clawback Rules or any policy adopted by the Company pursuant to any such Clawback Rules. The Company shall decide,

in its sole and absolute discretion, what policies it must adopt in order to comply with such Clawback Rules.

e) Benefits

and Perquisites. Executive shall be eligible for any fringe benefits offered by the Company on the same terms and conditions

as other executives. Such benefits may include group health benefits and a 401k retirement plan. The Company reserves the right,

in its sole discretion, to amend or terminate any employee benefit plan in accordance with applicable law.

f) Paid

Time Off. Executive will be entitled to 20 (twenty) paid vacation days per calendar year, pro-rated for partial years.

Vacation days shall accrue at the rate of 1/24 per pay period. Executive shall be entitled to an additional vacation day each succeeding

year up to a maximum accrual rate of 30 vacation days per year. The maximum vacation accrual shall be 1.75 times Executive’s

annual vacation allotment, at which point Executive shall not accrue any additional vacation days until Executive’s accrual

balance is reduced below that amount. Executive shall also be entitled to five paid sick days and those paid holidays recognized

by the Company. All paid time off shall be governed by the Company’s policies which the Company may, in its sole and absolute

discretion, change from time to time.

g) Taxes-Withholdings.

All compensation paid or provided under this Agreement shall be subject to such deductions and withholdings for taxes and such

other amounts as are required by law or elected by the Executive.

Business Expenses. The Company

will reimburse or advance all reasonable business expenses that Executive incurs in connection with the performance of his duties

under this Agreement, including travel expenses, in accordance with the Company’s policies as established from time to time.

Termination of Employment. The

Executive’s employment hereunder may be terminated by either the Company or the Executive at any time and for any reason.

On termination of the Executive’s employment, the Executive shall be entitled to the compensation and benefits described

in this Section 5 and shall have no further rights to any compensation or any other benefits from the Company or any of its affiliates.

a) For

Cause, or Without Good Reason. The Executive’s employment hereunder may be terminated by the Company for Cause,

or by the Executive without Good Reason. If the Executive’s employment is terminated by the Company for Cause, or by the

Executive without Good Reason, the Executive shall be entitled to receive:

any accrued but

unpaid Base Salary which shall be paid on the pay date immediately following the Termination Date (as defined below) in accordance

with the Company’s customary payroll procedures;

reimbursement for

unreimbursed business expenses properly incurred by the Executive, which shall be subject to and paid in accordance with the Company’s

expense reimbursement policy; and

such employee benefits

(including equity compensation), if any, to which the Executive may be entitled under the Company’s employee benefit plans

as of the Termination Date; provided that, in no event shall the Executive be entitled to any payments in the nature of

severance or termination payments except as specifically provided herein.

Items 5.1(a)(i) through 5.1(a)(iii)

are referred to herein collectively as the “Accrued Amounts”.

b) Cause. For purposes

of this Agreement, but not for purposes of the Incentive Plan, “Cause” shall mean the Executive:

| |

(i) |

intentionally or negligently fails to perform his duties under this Agreement; |

| |

|

|

| |

(ii) |

refuses to comply with a lawful order of the Chief Executive Officer; |

| |

|

|

| |

(iii) |

materially breaches a material term of this Agreement; |

| |

|

|

| |

(iv) |

willfully and materially violates a written Company policy; |

| |

|

|

| |

(v) |

is indicted for, convicted of, or pleads guilty or no contest to, a felony or crime involving moral turpitude; |

| |

|

|

| |

(vi) |

engages in conduct that constitutes gross negligence or willful misconduct in carrying out his duties; |

| |

|

|

| |

(vii) |

materially violates a federal or state law that the Board reasonably determines has had, or is reasonably likely to have, a material detrimental effect on the Company’s reputation or business; or |

commits an act

of fraud or dishonesty in the performance of his job duties;

provided, however, that in the case of (i) - (iv),

if curable, the Executive shall have fifteen (15) days from the delivery of written notice by the Company within which to cure

any acts or omissions constituting Cause.

c) Good Reason. For

purposes of this Agreement, “Good Reason” shall mean the occurrence of any of the following, in each case during

the Term without the Executive’s written consent:

(i) a reduction

in the Executive’s Base Salary, other than a general reduction in Base Salary of no more than ten percent (10%) that affects

all similarly situated executives in substantially the same proportions;

(ii) a relocation

of the Executive’s principal place of employment by more than 50 (fifty) miles;

(iii) any

material breach by the Company of any material provision of this Agreement, including failure to provide any material payment or

benefit required to be provided to Executive under this Agreement; or

(iv) a material,

adverse change in the Executive’s authority, duties, or responsibilities (other than temporarily while the Executive is physically

or mentally incapacitated or as required by applicable law);

Executive cannot terminate employment

for Good Reason unless Executive has provided written notice to the Company of the existence of the circumstances providing grounds

for termination for Good Reason within thirty (30) days after the initial existence of such grounds and the Company has had thirty

(30) days from the date on which such notice is provided to cure such circumstances. If Executive does not terminate his employment

for Good Reason within sixty-five (65) days after Executive learns of the first occurrence of the applicable grounds, then Executive

will be deemed to have waived the right to terminate for Good Reason with respect to such grounds.

d) Termination

Without Cause or Resignation for Good Reason. If Executive’s employment

is terminated by the Company without Cause, or by the Executive for Good Reason, the Executive shall be entitled to receive:

(i) The

Accrued Amounts;

(ii) Severance

pay in an amount equal to two months of Executive’s then-applicable Base Salary (the “Severance Pay”).

On the first anniversary of the Effective Date, Executive’s Severance Pay amount will increase to six months of Executive’s

then-applicable Base Salary. The Severance Pay will be paid to Executive in a lump sum within fourteen (14) days after the Release

(defined below) becomes effective; and

(iii)

Whatever rights with respect to any option or equity grants that are afforded to Executive under the Incentive Plan, including

the Incentive Plan’s definition of “Cause” for termination of employment.

e) Release.

The Company’s obligation to pay Severance Pay, is expressly conditioned upon Executive’s execution of and delivery

to the Company (and non-revocation) of a release (as drafted by the Company at the time of Executive’s termination of employment)

which will include an unconditional release of all rights to any claims, charges, complaints, grievances, arising from or relating

to Executive’s employment or its termination plus any other potential claims, known or unknown to Executive, against the

Company, its affiliates or assigns, or any of their officers, directors, employees and agents, through to the date of Executive’s

termination from employment (the “Release”). The Release shall not be mutual but may contain mutual confidentiality

and non-disparagement provisions and requirements that certain features of this Agreement remain in effect. The Release shall not

require Executive to waive or release any rights to vested or earned compensation of any kind or to waive any rights as a shareholder,

option holder, unitholder, or as a participant in the Company’s Incentive Plan.

f) Notice

of Termination. Any termination of the Executive’s employment hereunder by the Company or by Executive during

the Term (other than termination on account of Executive’s death) shall be communicated by written notice of termination

(“Notice of Termination”) to the other party hereto. The Notice of Termination shall specify:

(i) The

termination provision of this Agreement relied upon;

(ii) To

the extent applicable, the facts and circumstances claimed to provide a basis for termination of the Executive’s employment

under the provision so indicated; and

(iii) The

applicable Termination Date.

g) Termination Date.

The Executive’s “Termination Date” shall be:

(i) If

Executive’s employment hereunder terminates on account of Executive’s death, the date of the Executive’s death;

(ii) If

the Company terminates Executive’s employment hereunder for any reason, the date the Notice of Termination is delivered to

the Executive;

(iii)

If Executive terminates his employment hereunder with or without Good Reason, the date specified in the Executive’s Notice

of Termination.

Confidentiality.

Confidential Information.

The Executive acknowledges that the Executive will occupy a position of trust and confidence. The Company, from time to time,

may disclose to the Executive, and the Executive will require access to and may generate confidential and proprietary information

(no matter how created or stored) concerning the business practices, products, services, and operations of the Company which is

not known to its competitors or within its industry generally and which is of great competitive value to it, including, but not

limited to: (i) Trade Secrets (as defined herein), inventions, mask works, ideas, concepts, drawings, materials, documentation,

procedures, diagrams, specifications, models, processes, formulae, source and object codes, data, software, programs, other works

of authorship, know-how, improvements, discoveries, developments, designs and techniques; (ii) information regarding research,

development, products, marketing plans, market research and forecasts, bids, proposals, quotes, business plans, budgets, financial

information and projections, overhead costs, profit margins, pricing policies and practices, accounts, processes, planned collaborations

or alliances, licenses, suppliers and customers; (iii) operational information including deployment plans, means and methods of

performing services, operational needs information, and operational policies and practices; and (iv) any information obtained by

the Company from any third party that the Company treats or agrees to treat as confidential or proprietary information of the third

party (collectively, “Confidential Information”). The Executive acknowledges and agrees that Confidential Information

includes Confidential Information disclosed to the Executive prior to entering into this Agreement.

Trade Secrets.

“Trade Secrets” means any information, including any data, plan, drawing, specification, pattern, procedure,

method, computer data, system, program or design, device, list, tool, or compilation, that relates to the present or planned business

of the Company and which: (i) derives economic value, actual or potential, from not being generally known to, and not readily ascertainable

by proper means to, other persons who can obtain economic value from their disclosure or use; and (ii) is the subject of efforts

that are reasonable under the circumstances to maintain their secrecy. To the extent that the foregoing definition is inconsistent

with a definition of “trade secret” under applicable law, the latter definition shall control.

Restrictions On Use

and Disclosure of Confidential Information. The Executive agrees during his employment and after his employment ends, the

Executive will hold the Confidential Information in strict confidence and will neither use the information nor disclose it to anyone,

except to the extent necessary to carry out the Executive’s responsibilities as an employee of the Company or as specifically

authorized in writing by a duly authorized officer of the Company. Nothing in this Agreement shall be deemed to prohibit the Executive

from disclosing any concerns about suspected unlawful conduct to any proper government authority subject to proper jurisdiction.

This provision shall survive the termination of the Executive’s employment for so long as the Company maintains the secrecy

of the Confidential Information and the Confidential Information has competitive value; and to the extent such information is otherwise

protected by statute for a longer period, for example and not by way of limitation, the Defend Trade Secrets Act of 2016 (“DTSA”),

then until such information ceases to have statutory protection.

Defend Trade Secrets

Act. Misappropriation of a Trade Secret of the Company in breach of this Agreement may subject the Executive to liability

under the DTSA, entitle the Company to injunctive relief, and require the Executive to pay compensatory damages, double damages,

and attorneys’ fees to the Company. Notwithstanding any other provision of this Agreement, Executive hereby is notified in

accordance with the DTSA that Executive will not be held criminally or civilly liable under a federal or state law for the disclosure

of a trade secret that is made in confidence to a federal, state or local government official, either directly or indirectly, or

to an attorney, and solely for the purpose of reporting or investigating a suspected violation of law; or is made in a complaint

or other document filed in a lawsuit or other proceeding, if such filing is made under seal. If the Executive files a lawsuit for

retaliation by the Company for reporting a suspected violation of law, the Executive may disclose the trade secret to the Executive’s

attorney and use the trade secret information in the court proceeding, provided that the Executive must file any document containing

the trade secret under seal, and must not disclose the trade secret, except pursuant to court order.

Inventions and Proprietary Information.

Definitions.

(i) “Intellectual

Property Rights” means all rights in and to United States and foreign (A) patents, patent disclosures, and inventions

(whether patentable or not), (B) trademarks, service marks, trade dress, trade names, logos, corporate names, and domain names,

and other similar designations of source or origin, together with the goodwill symbolized by any of the foregoing, (C) copyrights

and works of authorship (whether copyrightable or not), including computer programs, mask works, and rights in data and databases,

(D) trade secrets, know-how, and other confidential information, (E) all other intellectual property rights, in each case whether

registered or unregistered, and including all rights of priority in and all rights to apply to register for such rights, all registrations

and applications for, and renewals or extensions of, such rights, and all similar or equivalent rights or forms of protection in

any part of the world, (F) any and all royalties, fees, income, payments, and other proceeds with respect to any and all of the

foregoing, and (G) any and all claims and causes of action with respect to any of the foregoing, including all rights to recover

for infringement, misappropriation, or dilution of the foregoing, and all rights corresponding thereto throughout the world.

(ii) “Work

Product” means, without limitation, any and all ideas, concepts, information, materials, processes, methods, data, programs,

know-how, technology, improvements, discoveries, developments, works of authorship, designs, artwork, formulae, other copyrightable

works, and techniques and all Intellectual Property Rights that presently exist or may come to exist in the future in any of the

items listed above.

Work Product.

(iii) All

right, title, and interest in and to all Work Product as well as any and all Intellectual Property Rights therein and all improvements

thereto shall be the sole and exclusive property of the Company.

(iv) The

Company shall have the unrestricted right (but not any obligation), in its sole and absolute discretion, to (A) use, commercialize,

or otherwise exploit any Work Product or (B) file an application for patent, copyright registration, or registration of any other

Intellectual Property Rights, and prosecute or abandon such application prior to issuance or registration. No royalty or other

consideration shall be due or owing to the Executive now or in the future as a result of such activities.

(v) The

Work Product is and shall at all times remain the Confidential Information of the Company.

Work Made

for Hire; Assignment; Limitations.

(vi) The

Executive acknowledges that, by reason of being employed by the Company at the relevant times, to the extent permitted by law,

all Work Product consisting of copyrightable subject matter is “work made for hire” as defined in the Copyright Act

of 1976 (17 U.S.C. § 101), and such copyrights are therefore owned by the Company. To the extent that the foregoing does not

apply, the Executive hereby irrevocably assigns to the Company, and its successors and assigns, for no additional consideration,

the Executive’s entire right, title, and interest, in and to all Work Product and Intellectual Property Rights therein, including

without limitation the right to sue, counterclaim, and recover for all past, present, and future infringement, misappropriation,

or dilution thereof, and all rights corresponding thereto throughout the world. Nothing contained in this Agreement shall be construed

to reduce or limit the Company’s right, title, or interest in any Work Product or Intellectual Property Rights so as to be

less in any respect than the Company would have had in the absence of this Agreement.

(vii) To

the extent that the Executive has not separately assigned any Prior Inventions, the Executive hereby irrevocably assigns to the

Company, and its successors and assigns, for no additional consideration, the Executive’s entire right, title, and interest

in and to all Prior Inventions, including without limitation the right to sue, counterclaim, and recover for all past, present,

and future infringement, misappropriation, or dilution thereof, and all rights corresponding thereto throughout the world. Nothing

contained in this Agreement shall be construed to reduce or limit the Company’s right, title, or interest in any Prior Inventions

so as to be less in any respect than the Company would have had in the absence of this Agreement.

(viii) The

provisions of this Agreement related to assignment of Intellectual Property Rights does not apply to inventions which qualify fully

for protection under Section 2870 of the California Labor Code, a copy of which is annexed hereto as Appendix “A.”

Moreover, for the avoidance of doubt, the Company expressly acknowledges that Executive retains sole and exclusive ownership of

any internet domain names that Executive owned prior to the Effective Date and that the Company has no ownership of such internet

domain names.

Survival of Provisions. The respective

rights and obligations of the parties hereunder shall survive any termination of this Agreement hereunder for any reason to the

extent necessary to the intended provision of such rights and the intended performance of such obligations.

Return of Property/Post-Employment Representations.

On the date of the Executive’s termination of employment with the Company for any reason (or at any time prior thereto

at the Company’s request), the Executive shall return all property and documents belonging to the Company and not retain

any copies, including, but not limited to, any keys, access cards, badges, laptops, computers, cell phones, wireless electronic

mail devices, USB drives, other equipment, documents, reports, files, and other property provided by or belonging to the Company.

Executive shall provide all usernames and passwords to all electronic devices, documents, and accounts, including any social media

accounts Executive used in connection with his duties. Upon request, the Executive shall return all Company-related documents and

data on personal devices and delete such documents and data upon the request of the Company. The Executive shall give written acknowledgment

of the return and/or deletion of Company-related documents and data upon request of the Company. On and after the Termination Date,

Executive shall no longer represent to anyone that he remains employed by the Company and shall take affirmative action to amend

any statements to the contrary on any social media sites, including but not limited to Linked-in and Facebook.

Notices. For the purposes of

this Agreement, notices, demands and all other communications provided for in the Agreement shall be in writing and shall be deemed

to have been given when delivered by email with return receipt requested, upon the obtaining of a valid return receipt from the

recipient, by hand, or mailed by nationally recognized overnight delivery service, addressed to the Parties’ addresses specified

below or to such other address as any Party may have furnished to the other in writing in accordance herewith, except that notices

of change of address shall be effective only upon receipt:

| To the Company: |

To the Executive: |

| |

|

| Kaival Brands Innovations Group, Inc. |

Mr. Thomas Metzler |

| Attn: Eric Mosser |

P.O. Box 131115 |

| Chief Executive Officer |

Carlsbad, California 92013 |

| 4460 Old Dixie Highway |

Email: legal@thomasjmetzler.com |

| Grant-Valkaria, Florida 32949 |

|

| Email: eric@kaivalbrands.com |

|

| |

|

| With a copy that will not constitute notice to: |

|

| |

|

| Lawrence A. Rosenbloom, Esq. |

|

| Ellenoff Grossman & Schole LLP |

|

| 1345 Avenue of the Americas, 11th Floor |

|

| New York, New York 10105 |

|

| Email: lrosenbloom@egsllp.com |

|

Tax Matters. The Company may

withhold from any and all amounts payable under this Agreement or otherwise such federal, state and local taxes as may be required

to be withheld pursuant to any applicable law or regulation.

Assignment. The Executive may

not assign any part of the Executive’s rights or obligations under this Agreement. The Executive agrees and hereby consents

that the Company may assign this Agreement to a third party that acquires or succeeds to the Company’s business, that the

provisions hereof are enforceable against the Executive by such assignee or successor in interest, and that this Agreement shall

become an obligation of, inure to the benefit of, and be assigned to, any legal successor or successors to the Company.

Headings. Titles or captions

of sections or paragraphs contained in this Agreement are intended solely for the convenience of reference, and shall not serve

to define, limit, extend, modify, or describe the scope of this Agreement or the meaning of any provision hereof. The language

used in this Agreement is deemed to be the language chosen by the Parties to express their mutual intent, and no rule of strict

construction will be applied against any person.

Severability. The provisions

of this Agreement are severable. The unenforceability or invalidity of any provision or portion of this Agreement in any jurisdiction

shall not affect the validity, legality, or enforceability of the remainder of this Agreement, it being intended that all rights

and obligations of the Parties hereunder shall be enforceable to the full extent permitted by applicable law.

Waiver; Modification. No provision

of this Agreement may be modified, waived, or discharged unless such waiver, modification or discharge is agreed to in writing

and signed by the Executive and a duly authorized officer of the Company. No waiver by either Party hereto at any time of any breach

by the other Party hereto of, or compliance with, any condition or provision of this Agreement to be performed by such other Party

shall be deemed a waiver of similar or dissimilar provisions or conditions at the same or at any prior or subsequent time.

Recitals; Entire Agreement. The

Recitals are hereby incorporated into this Agreement. This Agreement sets forth the entire agreement of the Parties with respect

to the subject matter contained herein and supersedes any and all prior agreements or understandings between the Executive and

the Company with respect to the subject matter hereof. No agreements, inducements, or representations, oral or otherwise, express,

or implied, with respect to the subject matter hereof have been made by either Party which are not expressly set forth in this

Agreement.

Counterparts. This

Agreement may be executed in counterparts, and each executed counterpart shall have the efficacy of a signed original and may be

transmitted by facsimile or email. Each copy, facsimile copy, or emailed copy of any such signed counterpart may be used in lieu

of the original for any purpose.

IN WITNESS WHEREOF, the

Parties hereto have executed this Executive Employment Agreement effective as of the date first written above.

KAIVAL BRANDS INNOVATIONS GROUP, INC.

| By: |

/s/ Eric Mosser |

|

| |

Eric Mosser |

|

| |

Chief Executive Officer and President |

|

| |

|

| EXECUTIVE |

|

| |

|

| /s/ Thomas Metzler |

|

| Thomas Metzler |

|

APPENDIX “A”

California Labor Code Section 2870

(a) Any provision

in an employment agreement which provides that an employee shall assign, or offer to assign, any of his or her rights in an invention

to his or her employer shall not apply to an invention that the employee developed entirely on his or her own time without using

the employer’s equipment, supplies, facilities, or trade secret information except for those inventions that either:

(1) Relate

at the time of conception or reduction to practice of the invention to the employer’s business, or actual or demonstrably

anticipated research or development of the employer; or

(2) Result

from any work performed by the employee for the employer.

(b) To the

extent a provision in an employment agreement purports to require an employee to assign an invention otherwise excluded from being

required to be assigned under subdivision (a), the provision is against the public policy of this state and is unenforceable.

Exhibit 10.2

EXECUTIVE EMPLOYMENT AGREEMENT

THIS EXECUTIVE EMPLOYMENT

AGREEMENT (this “Agreement”) is made and entered into by and between Kaival Brands Innovations Group, Inc.

(the “Company”) located at 4460 Old Dixie Highway, Grant-Valkaria, Florida 32949, and Mr. Eric Mosser (“Executive”)

(each a “Party” and collectively the “Parties”) on this 1st day of August 2023 (“Effective

Date”).

WHEREAS, the Company

wishes to employ Executive on the terms set forth in this Agreement; and

WHEREAS, Executive

wishes to become employed on the terms set forth herein;

NOW, THEREFORE,

in consideration of the mutual promises contained herein and other good and valuable consideration, the receipt and sufficiency

of which are acknowledged, the Parties agree as follows:

Employment Term/Prior Agreements.

a) Employment

Term. Executive’s employment is at will, meaning that either party may terminate the employment at any time for any

reason or no reason. Nothing in this Agreement is intended to create a promise or representation of continued employment or employment

for a fixed period of time. The period of time between the Effective Date and the termination of the Executive’s employment

shall be referred as the “Term.”

b) Prior

Agreements. Any and all prior agreements under which Executive performed work for, or provided services to, the Company,

its parent company, or any affiliate, shall terminate, and be of no further force or effect as of the Effective Date. Nothing herein

shall, however, be considered a waiver of any vested compensation Executive earned under any prior agreement.

Position and Duties.

f) Title.

The Company hereby agrees to employ the Executive to serve as Chief Executive Officer and President of the Company.

g) Duties.

Executive shall report to the Company’s Board of Directors (the “Board”). Executive shall perform all

duties and have all powers incident to the office he holds. Executive shall have overall responsibility for the Company’s

operations, including supervision of all subordinate officers and employees. Executive shall also be required to certify to the

United States Securities & Exchange Commission (“SEC”) that the Company’s filings with the SEC fairly

present in all material respects the Company’s financial condition. During the Term, the Executive shall be employed

by the Company on a full-time basis and shall perform such duties and responsibilities on behalf of the Company and all persons

and entities directly or indirectly controlling, controlled by, or under common control with, the Company. Executive shall perform

such other duties and may exercise such other powers as may be assigned by the Board from time to time that are consistent with

his title and status.

h) Board Service.

The Company may nominate Executive to serve as a Board member. Executive agrees, for no additional compensation, to serve on the

Board and any committees of the Board. Upon the end of the Term for any reason, Executive shall resign from the Board and from

any other offices he holds with the Company or its parent company or affiliates.

i) Full-Time Commitment/Policies.

Throughout the Executive’s employment, the Executive shall devote substantially all of his professional time to the performance

of his duties of employment with the Company (except as otherwise provided herein) and shall faithfully and industriously perform

such duties. The Executive will be required to comply with all Company policies

as may exist and be in effect from time to time.

j) Executive

Representations. The Executive represents and warrants to the Company that he is under

no obligation or commitments, whether contractual or otherwise, that are inconsistent with his obligations under this Agreement.

The Executive represents and warrants that he will not use or disclose, in connection with his employment by the Company, any trade

secrets or proprietary information or intellectual property in which any other person or entity has any right, title or interest

and that his employment by the Company as contemplated by this Agreement will not infringe or violate the rights of any other person.

Compensation and Benefits.

a) Base

Salary. In consideration for his work under the terms of this Agreement, the Executive shall earn a base salary in the

gross amount of $300,000 (Three Hundred Thousand Dollars) per year (“Base Salary”). Executive’s Base Salary

shall be paid in equal semi-monthly installments, in accordance with the regular payroll practices of the Company.

b) Annual

Bonus. For the calendar year 2023, the Company may, in its sole discretion, grant Executive an annual incentive bonus.

Beginning in calendar year 2024, Executive shall be eligible for an annual incentive bonus based upon targets set by the Board

of Directors and its Compensation Committee in their sole and absolute discretion in an executive bonus plan, by January 30, 2024,

and January 30 of each succeeding year. Beginning in 2024, and thereafter, Executive’s bonus target shall be up to 40% (forty

percent) of Executive’s Base Salary.

c) Option

Grants. On the Effective Date, the Company shall grant Executive an option, valued by the Company’s Black-Scholes

analysis at $335,000.00 (Three Hundred Thirty-Five Thousand Dollars) to purchase common shares of the Company (the “Option”).

The Option shall vest over four years. One-quarter of the Option shall vest on the first anniversary of the grant date and afterward

shall vest monthly at the rate of 1/36 per month until fully vested. The Option and its vesting shall be subject to, and governed

by, the terms and conditions of the Company’s 2020 Stock and Incentive Compensation Plan as amended from time to time (the

“Incentive Plan”), and the award agreement issued by the Incentive Plan.

d) Clawback

Rules. Notwithstanding any other provisions in this Agreement to the contrary, any incentive-based compensation, including

any annual incentive bonus and the Option, paid to the Executive under this Agreement, the Incentive Plan, or any other agreement

or arrangement with the Company, which is subject to recovery under any law, government rule or regulation, or stock exchange listing

requirement (“Clawback Rules”), will be subject to such deductions and clawback as may be required to be made

pursuant to such Clawback Rules or any policy adopted by the Company pursuant to any such Clawback Rules. The Company shall decide,

in its sole and absolute discretion, what policies it must adopt in order to comply with such Clawback Rules.

e) Benefits

and Perquisites. Executive shall be eligible for any fringe benefits offered by the Company on the same terms and conditions

as other executives. Such benefits may include group health benefits and a 401k retirement plan. The Company reserves the right,

in its sole discretion, to amend or terminate any employee benefit plan in accordance with applicable law.

f) Paid

Time Off. Executive will be entitled to 20 (twenty) paid vacation days per calendar year, pro-rated for partial years.

Vacation days shall accrue at the rate of 1/24 per pay period. Executive shall be entitled to an additional vacation day each succeeding

year up to a maximum accrual rate of 30 vacation days per year. The maximum vacation accrual shall be 1.75 times Executive’s

annual vacation allotment, at which point Executive shall not accrue any additional vacation days until Executive’s accrual

balance is reduced below that amount. Executive shall also be entitled to five paid sick days and those paid holidays recognized

by the Company. All paid time off shall be governed by the Company’s policies which the Company may, in its sole and absolute

discretion, change from time to time.

g) Taxes-Withholdings.

All compensation paid or provided under this Agreement shall be subject to such deductions and withholdings for taxes and such

other amounts as are required by law or elected by the Executive.

Business Expenses. The Company

will reimburse or advance all reasonable business expenses that Executive incurs in connection with the performance of his duties

under this Agreement, including travel expenses, in accordance with the Company’s policies as established from time to time.

Termination of Employment. The

Executive’s employment hereunder may be terminated by either the Company or the Executive at any time and for any reason.

On termination of the Executive’s employment, the Executive shall be entitled to the compensation and benefits described

in this Section 5 and shall have no further rights to any compensation or any other benefits from the Company or any of its affiliates.

For

Cause, or Without Good Reason. The Executive’s employment hereunder may be terminated by the Company for Cause,

or by the Executive without Good Reason. If the Executive’s employment is terminated by the Company for Cause, or by the

Executive without Good Reason, the Executive shall be entitled to receive:

any accrued but

unpaid Base Salary which shall be paid on the pay date immediately following the Termination Date (as defined below) in accordance

with the Company’s customary payroll procedures;

reimbursement for

unreimbursed business expenses properly incurred by the Executive, which shall be subject to and paid in accordance with the Company’s

expense reimbursement policy; and

such employee benefits

(including equity compensation), if any, to which the Executive may be entitled under the Company’s employee benefit plans

as of the Termination Date; provided that, in no event shall the Executive be entitled to any payments in the nature of

severance or termination payments except as specifically provided herein.

Items 5.1(a)(i) through 5.1(a)(iii)

are referred to herein collectively as the “Accrued Amounts.”

such employee benefits

(including equity compensation), if any, to which the Executive may be entitled under the Company’s employee benefit plans

as of the Termination Date; provided that, in no event shall the Executive be entitled to any payments in the nature of

severance or termination payments except as specifically provided herein.

Items 5.1(a)(i) through 5.1(a)(iii)

are referred to herein collectively as the “Accrued Amounts.”

Cause. For purposes of this Agreement,

but not for purposes of the Incentive Plan, “Cause” shall mean the Executive:

| i) | intentionally or negligently fails

to perform his duties under this Agreement; |

| | | |

| ii) | refuses to comply with a lawful order of the Board; |

| | | |

| iii) | materially breaches a material term of this Agreement; |

| | | |

| iv) | willfully and materially violates a written Company policy; |

| | | |

| | v) | is indicted for, convicted of, or pleads guilty or no contest to, a

felony or crime involving moral turpitude; |

| | | |

| | vi) | engages in conduct that constitutes gross negligence or willful misconduct

in carrying out his duties; |

| | | |

| | vii) | materially violates a federal or state law that the Board reasonably

determines has had, or is reasonably likely to have, a material detrimental effect on the Company’s

reputation or business; or |

| | | |

| viii) | commits an act of fraud or dishonesty in the performance of his job duties; |

provided, however, that in the case of (i) - (iv),

if curable, the Executive shall have fifteen (15) days from the delivery of written notice by the Company within which to cure

any acts or omissions constituting Cause.

c) Good

Reason. For purposes of this Agreement, “Good Reason” shall mean the occurrence of any of the

following, in each case during the Term without the Executive’s written consent:

i) a reduction in the Executive’s

Base Salary, other than a general reduction in Base Salary of no more than ten percent (10%) that affects all similarly situated

executives in substantially the same proportions;

ii) a relocation of the Executive’s

principal place of employment by more than 50 (fifty) miles;

iii) any material breach

by the Company of any material provision of this Agreement, including failure to provide any material payment or benefit required

to be provided to Executive under this Agreement;

iv) a material, adverse change

in the Executive’s authority, duties, or responsibilities (other than temporarily while the Executive is physically or mentally

incapacitated or as required by applicable law);

Executive cannot terminate employment

for Good Reason unless Executive has provided written notice to the Company of the existence of the circumstances providing grounds

for termination for Good Reason within thirty (30) days after the initial existence of such grounds and the Company has had thirty

(30) days from the date on which such notice is provided to cure such circumstances. If Executive does not terminate his employment

for Good Reason within sixty-five (65) days after Executive learns of the first occurrence of the applicable grounds, then Executive

will be deemed to have waived the right to terminate for Good Reason with respect to such grounds.

d) Termination

Without Cause or Resignation for Good Reason. If Executive’s employment is terminated by the Company without Cause,

or by the Executive for Good Reason, the Executive shall be entitled to receive:

i) The Accrued Amounts;

ii) Severance

pay in an amount equal to two months of Executive’s then-applicable Base Salary (the “Severance Pay”).

On the first anniversary of the Effective Date, Executive’s Severance Pay amount will increase to six months of Executive’s

then-applicable Base Salary. The Severance Pay will be paid to Executive in a lump sum within fourteen (14) days after the Release

(defined below) becomes effective; and

iii) Whatever

rights with respect to any option or equity grants that are afforded to Executive under the Incentive Plan, including the Incentive

Plan’s definition of “Cause” for termination of employment.

e) Release.

The Company’s obligation to pay Severance Pay, is expressly conditioned upon Executive’s execution of and delivery

to the Company (and non-revocation) of a release (as drafted by the Company at the time of Executive’s termination of employment)

which will include an unconditional release of all rights to any claims, charges, complaints, grievances, arising from or relating

to Executive’s employment or its termination plus any other potential claims, known or unknown to Executive, against the

Company, its affiliates or assigns, or any of their officers, directors, employees and agents, through to the date of Executive’s

termination from employment (the “Release”). The Release shall not be mutual but may contain mutual confidentiality

and non-disparagement provisions and requirements that certain features of this Agreement remain in effect. The Release shall not

require Executive to waive or release any rights to vested or earned compensation of any kind or to waive any rights as a shareholder,

option holder, unitholder, or as a participant in the Company’s Incentive Plan.

k) Notice of Termination.

Any termination of the Executive’s employment hereunder by the Company or by Executive during the Term (other than termination

on account of Executive’s death) shall be communicated by written notice of termination (“Notice of Termination”)

to the other party hereto. The Notice of Termination shall specify:

(1) The termination

provision of this Agreement relied upon;

(2) To the extent

applicable, the facts and circumstances claimed to provide a basis for termination of the Executive’s employment under the

provision so indicated; and

| (3) | The applicable Termination Date. |

l) Termination

Date. The Executive’s “Termination Date” shall be:

(iv) (i)

If Executive’s employment hereunder terminates on account of Executive’s death, the date of the Executive’s

death;

(v) (ii) If

the Company terminates Executive’s employment hereunder for any reason, the date the Notice of Termination is delivered to

the Executive;

(vi) (iii) If Executive terminates his employment hereunder with or without Good Reason, the date specified in the Executive’s Notice

of Termination.

Confidentiality.

Confidential Information.

The Executive acknowledges that the Executive will occupy a position of trust and confidence. The Company, from time to time,

may disclose to the Executive, and the Executive will require access to and may generate confidential and proprietary information

(no matter how created or stored) concerning the business practices, products, services, and operations of the Company which is

not known to its competitors or within its industry generally and which is of great competitive value to it, including, but not

limited to: (i) Trade Secrets (as defined herein), inventions, mask works, ideas, concepts, drawings, materials, documentation,

procedures, diagrams, specifications, models, processes, formulae, source and object codes, data, software, programs, other works

of authorship, know-how, improvements, discoveries, developments, designs and techniques; (ii) information regarding research,

development, products, marketing plans, market research and forecasts, bids, proposals, quotes, business plans, budgets, financial

information and projections, overhead costs, profit margins, pricing policies and practices, accounts, processes, planned collaborations

or alliances, licenses, suppliers and customers; (iii) operational information including deployment plans, means and methods of

performing services, operational needs information, and operational policies and practices; and (iv) any information obtained by

the Company from any third party that the Company treats or agrees to treat as confidential or proprietary information of the third

party (collectively, “Confidential Information”). The Executive acknowledges and agrees that Confidential Information

includes Confidential Information disclosed to the Executive prior to entering into this Agreement.

Trade Secrets.

“Trade Secrets” means any information, including any data, plan, drawing, specification, pattern, procedure,

method, computer data, system, program or design, device, list, tool, or compilation, that relates to the present or planned business

of the Company and which: (i) derives economic value, actual or potential, from not being generally known to, and not readily ascertainable

by proper means to, other persons who can obtain economic value from their disclosure or use; and (ii) is the subject of efforts

that are reasonable under the circumstances to maintain their secrecy. To the extent that the foregoing definition is inconsistent

with a definition of “trade secret” under applicable law, the latter definition shall control.

Restrictions On Use

and Disclosure of Confidential Information. The Executive agrees during his employment and after his employment ends, the

Executive will hold the Confidential Information in strict confidence and will neither use the information nor disclose it to anyone,

except to the extent necessary to carry out the Executive’s responsibilities as an employee of the Company or as specifically

authorized in writing by a duly authorized officer of the Company. Nothing in this Agreement shall be deemed to prohibit the Executive

from disclosing any concerns about suspected unlawful conduct to any proper government authority subject to proper jurisdiction.

This provision shall survive the termination of the Executive’s employment for so long as the Company maintains the secrecy

of the Confidential Information and the Confidential Information has competitive value; and to the extent such information is otherwise

protected by statute for a longer period, for example and not by way of limitation, the Defend Trade Secrets Act of 2016 (“DTSA”),

then until such information ceases to have statutory protection.

Defend Trade Secrets

Act. Misappropriation of a Trade Secret of the Company in breach of this Agreement may subject the Executive to liability

under the DTSA, entitle the Company to injunctive relief, and require the Executive to pay compensatory damages, double damages,

and attorneys’ fees to the Company. Notwithstanding any other provision of this Agreement, Executive hereby is notified in

accordance with the DTSA that Executive will not be held criminally or civilly liable under a federal or state law for the disclosure

of a trade secret that is made in confidence to a federal, state or local government official, either directly or indirectly, or

to an attorney, and solely for the purpose of reporting or investigating a suspected violation of law; or is made in a complaint

or other document filed in a lawsuit or other proceeding, if such filing is made under seal. If the Executive files a lawsuit for

retaliation by the Company for reporting a suspected violation of law, the Executive may disclose the trade secret to the Executive’s

attorney and use the trade secret information in the court proceeding, provided that the Executive must file any document containing

the trade secret under seal, and must not disclose the trade secret, except pursuant to court order.

Inventions and Proprietary Information.

Definitions.

I) “Intellectual

Property Rights” means all rights in and to United States and foreign (A) patents, patent disclosures, and inventions

(whether patentable or not), (B) trademarks, service marks, trade dress, trade names, logos, corporate names, and domain names,

and other similar designations of source or origin, together with the goodwill symbolized by any of the foregoing, (C) copyrights

and works of authorship (whether copyrightable or not), including computer programs, mask works, and rights in data and databases,

(D) trade secrets, know-how, and other confidential information, (E) all other intellectual property rights, in each case whether

registered or unregistered, and including all rights of priority in and all rights to apply to register for such rights, all registrations

and applications for, and renewals or extensions of, such rights, and all similar or equivalent rights or forms of protection in

any part of the world, (F) any and all royalties, fees, income, payments, and other proceeds with respect to any and all of the

foregoing, and (G) any and all claims and causes of action with respect to any of the foregoing, including all rights to recover

for infringement, misappropriation, or dilution of the foregoing, and all rights corresponding thereto throughout the world.

(i) “Work

Product” means, without limitation, any and all ideas, concepts, information, materials, processes, methods, data, programs,

know-how, technology, improvements, discoveries, developments, works of authorship, designs, artwork, formulae, other copyrightable

works, and techniques and all Intellectual Property Rights that presently exist or may come to exist in the future in any of the

items listed above.

Work Product.

(ix) All

right, title, and interest in and to all Work Product as well as any and all Intellectual Property Rights therein and all improvements

thereto shall be the sole and exclusive property of the Company.

(x) The

Company shall have the unrestricted right (but not any obligation), in its sole and absolute discretion, to (A) use, commercialize,

or otherwise exploit any Work Product or (B) file an application for patent, copyright registration, or registration of any other

Intellectual Property Rights, and prosecute or abandon such application prior to issuance or registration. No royalty or other

consideration shall be due or owing to the Executive now or in the future as a result of such activities.

(xi) The

Work Product is and shall at all times remain the Confidential Information of the Company.

Work Made for Hire; Assignment; Limitations.

(xii) The

Executive acknowledges that, by reason of being employed by the Company at the relevant times, to the extent permitted by law,

all Work Product consisting of copyrightable subject matter is “work made for hire” as defined in the Copyright Act

of 1976 (17 U.S.C. § 101), and such copyrights are therefore owned by the Company. To the extent that the foregoing does not

apply, the Executive hereby irrevocably assigns to the Company, and its successors and assigns, for no additional consideration,

the Executive’s entire right, title, and interest, in and to all Work Product and Intellectual Property Rights therein, including

without limitation the right to sue, counterclaim, and recover for all past, present, and future infringement, misappropriation,

or dilution thereof, and all rights corresponding thereto throughout the world. Nothing contained in this Agreement shall be construed

to reduce or limit the Company’s right, title, or interest in any Work Product or Intellectual Property Rights so as to be

less in any respect than the Company would have had in the absence of this Agreement.

(xiii) To

the extent that the Executive has not separately assigned any Prior Inventions, the Executive hereby irrevocably assigns to the