false

0001507605

0001507605

2024-08-12

2024-08-12

iso4217:USD

xbrli:shares

iso4217:USD

xbrli:shares

UNITED

STATES

SECURITIES

AND EXCHANGE COMMISSION

WASHINGTON,

D.C. 20549

FORM

8-K

CURRENT

REPORT

Pursuant

to Section 13 or 15(d)

of

the Securities Exchange Act of 1934

Date

of Report (Date of earliest event reported): August 12, 2024

MARATHON

DIGITAL HOLDINGS, INC.

(Exact

name of Registrant as Specified in Its Charter)

| Nevada |

|

001-36555 |

|

01-0949984 |

(State

or Other Jurisdiction

of

Incorporation) |

|

(Commission

File

Number) |

|

(IRS

Employer

Identification

No.) |

101

NE Third Avenue, Suite 1200

Fort Lauderdale, FL 33301

(Address of principal executive offices and zip code)

(800)

804-1690

(Registrant’s telephone number, including area code)

Not

Applicable

(Former Name or Former Address, if Changed Since Last Report)

Check

the appropriate box below if the Form 8-K filing is intended to simultaneously satisfy the filing obligation of the registrant under

any of the following provisions:

| ☐ |

Written communications pursuant to Rule 425 under the Securities

Act (17 CFR 230.425) |

| |

|

| ☐ |

Soliciting material pursuant to Rule 14a-12 under the Exchange

Act (17 CFR 240.14a-12) |

| |

|

| ☐ |

Pre-commencement communications pursuant to Rule 14d-2(b) under

the Exchange Act (17 CFR 240.14d-2(b)) |

| |

|

| ☐ |

Pre-commencement communications pursuant to Rule 13e-4(c) under

the Exchange Act (17 CFR 240.13e-4(c)) |

Securities

registered pursuant to Section 12(b) of the Act:

| Title of each class |

|

Trading

Symbol(s) |

|

Name of each exchange

on which registered |

| Common Stock |

|

MARA |

|

The Nasdaq Capital Market |

Indicate

by check mark whether the registrant is an emerging growth company as defined in Rule 405 of the Securities Act of 1933 (§230.405

of this chapter) or Rule 12b-2 of the Securities Exchange Act of 1934 (§240.12b-2 of this chapter).

Emerging

growth company ☐

If

an emerging growth company, indicate by check mark if the registrant has elected not to use the extended transition period for complying

with any new or revised financial accounting standards provided pursuant to Section 13(a) of the Exchange Act. ☐

Item 8.01

Other Events.

Convertible

Notes Offering

On

August 12, 2024, Marathon Digital Holdings, Inc. (the “Company”) issued a press release announcing its intention to offer,

subject to market conditions and other factors, $250.0 million aggregate principal amount of convertible senior notes due 2031 in a private

offering to persons reasonably believed to be qualified institutional buyers in reliance on Rule 144A under the Securities Act of 1933,

as amended (the “Securities Act”), and to grant to the initial purchasers of the notes an option to purchase, within a 13-day

period beginning on, and including, the date on which the notes are first issued, up to an additional $37.5 million aggregate principal

amount of the notes. A copy of the press release announcing the offering is filed as Exhibit 99.1 to this Current Report on Form 8-K

and is incorporated herein by reference.

On

August 12, 2024, the Company issued a press release announcing that it has priced a private offering of $250.0 million aggregate principal

amount of its convertible senior notes due 2031. The notes will only be sold to persons reasonably believed to be qualified institutional

buyers pursuant to Rule 144A under the Securities Act. The Company also granted to the initial purchasers of the notes an option to purchase,

within a 13-day period beginning on, and including, the date on which the notes are first issued, up to an additional $50.0 million

aggregate principal amount of the notes. The offering is expected to close on August 14, 2024, subject to satisfaction of customary closing

conditions.

The

Company estimates that the net proceeds of the offering will be approximately $243.8 million (or approximately $292.5 million

if the initial purchasers exercise in full their option to purchase additional notes), after deducting the initial purchasers’

discounts and commissions but before estimated offering expenses payable by the Company. The Company intends to use the net proceeds

from the sale of the notes to acquire additional bitcoin and for general corporate purposes, which may include working capital, strategic

acquisitions, expansion of existing assets, and repayment of debt and other outstanding obligations.

A

copy of the press release announcing the pricing of the offering is filed as Exhibit 99.2 to this Current Report on Form 8-K and is incorporated

herein by reference.

The

information included in this Current Report on Form 8-K is neither an offer to sell nor a solicitation of an offer to buy any securities.

Cautionary

Note Regarding Forward-Looking Statements

Statements

in this Current Report on Form 8-K and the exhibits attached hereto about future expectations, plans, and prospects, as well as any other

statements regarding matters that are not historical facts, may constitute “forward-looking statements” within the meaning

of The Private Securities Litigation Reform Act of 1995. These statements include, but are not limited to, statements relating to the

estimated net proceeds of the offering, the anticipated use of such net proceeds, and the completion of the offering. The words

“anticipate,” “believe,” “continue,” “could,” “estimate,” “expect,”

“intend,” “may,” “plan,” “potential,” “predict,” “project,” “should,”

“target,” “will,” “would,” and similar expressions are intended to identify forward-looking statements,

although not all forward-looking statements contain these identifying words. Actual results may differ materially from those indicated

by such forward-looking statements as a result of various important factors, including uncertainties related to market conditions and

the completion of the offering on the anticipated terms or at all, the other factors discussed in the “Risk Factors” section

of the Company’s Annual Report on Form 10-K filed with the U.S. Securities and Exchange Commission (the “SEC”) on February

28, 2024, as amended on May 24, 2024, the “Risk Factors” section of the Company’s Quarterly Report on Form 10-Q filed

with the SEC on August 1, 2024 and the risks described in other filings that the Company may make from time to time with the SEC. Any

forward-looking statements contained in this Current Report on Form 8-K speak only as of the date hereof, and the Company specifically

disclaims any obligation to update any forward-looking statement, whether as a result of new information, future events, or otherwise,

except as required by law.

Item 9.01.

Financial Statements and Exhibits.

(d)

Exhibits

SIGNATURES

Pursuant

to the requirements of the Securities Exchange Act of 1934, the registrant has duly caused this report to be signed on its behalf by

the undersigned hereunto duly authorized.

| Date:

August 13, 2024 |

MARATHON DIGITAL HOLDINGS, INC. |

| |

|

|

| |

By: |

/s/

Zabi Nowaid |

| |

Name: |

Zabi

Nowaid |

| |

Title: |

General

Counsel and Corporate Secretary |

Exhibit 99.1

Marathon

Digital Holdings, Inc. Announces Proposed Private Offering of

$250

Million of Convertible Senior Notes

Proceeds

to be used primarily to acquire bitcoin and for general corporate purposes

Fort

Lauderdale, FL, August 12, 2024 (GLOBE NEWSWIRE)—Marathon Digital Holdings, Inc. (NASDAQ: MARA) (“MARA” or the

“Company”), a global leader in leveraging digital asset compute to support the energy transformation, today announced that

it intends to offer, subject to market conditions and other factors, $250 million aggregate principal amount of convertible senior notes

due 2031 (the “notes”) in a private offering to persons reasonably believed to be qualified institutional buyers in reliance

on Rule 144A under the Securities Act of 1933, as amended (the “Securities Act”). MARA also expects to grant to the initial

purchasers of the notes an option to purchase, within a 13-day period beginning on, and including, the date on which the notes are first

issued, up to an additional $37.5 million aggregate principal amount of the notes. The offering is subject to market and other conditions,

and there can be no assurance as to whether, when or on what terms the offering may be completed.

The

notes will be unsecured, senior obligations of MARA and will bear interest payable semi-annually in arrears on March 1 and September

1 of each year, beginning on March 1, 2025. The notes will mature on September 1, 2031, unless earlier repurchased, redeemed or converted

in accordance with their terms. Subject to certain conditions, on or after September 6, 2028, MARA may redeem for cash all or any portion

of the notes. If MARA redeems fewer than all the outstanding notes, at least $75 million aggregate principal amount of notes must be

outstanding and not subject to redemption as of the relevant redemption notice date. Holders of the notes will have the right to require

MARA to repurchase for cash all or any portion of their notes on March 1, 2029. The notes will be convertible into cash, shares of MARA’s

common stock, or a combination of cash and shares of MARA’s common stock, at MARA’s election. Prior to March 1, 2031, the

notes will be convertible only upon the occurrence of certain events and during certain periods, and thereafter, at any time until the

close of business on the second scheduled trading day immediately preceding the maturity date. The interest rate, initial conversion

rate, and other terms of the notes will be determined at the time of pricing of the offering.

MARA

intends to use the net proceeds from the sale of the notes to acquire additional bitcoin and for general corporate purposes, which may

include working capital, strategic acquisitions, expansion of existing assets, and repayment of debt and other outstanding obligations.

The

notes will be offered and sold to persons reasonably believed to be qualified institutional buyers pursuant to Rule 144A under the Securities

Act. The offer and sale of the notes and the shares of MARA’s common stock issuable upon conversion of the notes, if any, have

not been and will not be registered under the Securities Act or the securities laws of any other jurisdiction, and the notes and any

such shares may not be offered or sold in the United States absent registration or an applicable exemption from such registration requirements.

Any offer of the notes will be made only by means of a private offering memorandum.

This

press release shall not constitute an offer to sell, or a solicitation of an offer to buy, the notes, nor shall there be any sale of

the notes in any state or jurisdiction in which such offer, solicitation or sale would be unlawful under the securities laws of any such

state or jurisdiction.

About

MARA

MARA

(NASDAQ:MARA) is a global leader in digital asset compute that develops and deploys innovative technologies to build a more sustainable

and inclusive future. MARA secures the world’s preeminent blockchain ledger and supports the energy transformation by converting

clean, stranded, or otherwise underutilized energy into economic value.

Forward-Looking

Statements

Statements

in this press release about future expectations, plans, and prospects, as well as any other statements regarding matters that are not

historical facts, may constitute “forward-looking statements” within the meaning of The Private Securities Litigation Reform

Act of 1995. These statements include, but are not limited to, statements relating to the completion, size and timing of the offering,

the anticipated use of any proceeds from the offering, and the terms of the notes. The words “anticipate,” “believe,”

“continue,” “could,” “estimate,” “expect,” “intend,” “may,” “plan,”

“potential,” “predict,” “project,” “should,” “target,” “will,”

“would,” and similar expressions are intended to identify forward-looking statements, although not all forward-looking statements

contain these identifying words. Actual results may differ materially from those indicated by such forward-looking statements as a result

of various important factors, including uncertainties related to market conditions and the completion of the offering on the anticipated

terms or at all, the other factors discussed in the “Risk Factors” section of MARA’s Annual Report on Form 10-K filed

with the U.S. Securities and Exchange Commission (the “SEC”) on February 28, 2024, as amended on May 24, 2024, the “Risk

Factors” section of MARA’s Quarterly Report on Form 10-Q filed with the SEC on August 1, 2024 and the risks described in

other filings that MARA may make from time to time with the SEC. Any forward-looking statements contained in this press release speak

only as of the date hereof, and MARA specifically disclaims any obligation to update any forward-looking statement, whether as a result

of new information, future events, or otherwise, except to the extent required by applicable law.

MARA

Company Contact:

Telephone:

800-804-1690

Email:

ir@mara.com

Exhibit 99.2

Marathon

Digital Holdings, Inc. Announces Pricing of Oversubscribed Offering of Convertible Senior Notes

Proceeds

to be used primarily to acquire bitcoin and for general corporate purposes

Fort

Lauderdale, FL, August 12, 2024 (GLOBE NEWSWIRE) — Marathon Digital Holdings, Inc. (NASDAQ: MARA) (“MARA” or the “Company”),

a global leader in leveraging digital asset compute to support the energy transformation, today announced the pricing of its offering

of $250 million aggregate principal amount of 2.125% convertible senior notes due 2031 (the “notes”). The notes will

be sold in a private offering to persons reasonably believed to be qualified institutional buyers in reliance on Rule 144A under the

Securities Act of 1933, as amended (the “Securities Act”). MARA also granted to the initial purchasers of the notes an option

to purchase, within a 13-day period beginning on, and including, the date on which the notes are first issued, up to an additional $50

million aggregate principal amount of the notes. The option to purchase additional notes was upsized from the previously announced option

to purchase $37.5 million aggregate principal amount of notes. The offering is expected to close on August 14, 2024, subject

to satisfaction of customary closing conditions.

The

notes will be unsecured, senior obligations of MARA and will bear interest at a rate of 2.125% per annum, payable semi-annually

in arrears on March 1 and September 1 of each year, beginning on March 1, 2025. The notes will mature on September 1, 2031, unless earlier

repurchased, redeemed or converted in accordance with their terms. Subject to certain conditions, on or after September 6, 2028, MARA

may redeem for cash all or any portion of the notes at a redemption price equal to 100% of the principal amount of the notes to be redeemed,

plus accrued and unpaid interest, if any, to, but excluding, the redemption date, if the last reported sale price of MARA common stock

has been at least 130% of the conversion price then in effect for a specified period of time ending on, and including, the trading day

immediately before the date MARA provides the notice of redemption. If MARA redeems fewer than all the outstanding notes, at least $75

million aggregate principal amount of notes must be outstanding and not subject to redemption as of the relevant redemption notice date.

Holders

of notes may require MARA to repurchase for cash all or any portion of their notes on March 1, 2029 or upon the occurrence of certain

events that constitute a fundamental change under the indenture governing the notes at a repurchase price equal to 100% of the principal

amount of the notes to be repurchased, plus any accrued and unpaid interest to, but excluding, the date of repurchase. In connection

with certain corporate events or if MARA calls any note for redemption, it will, under certain circumstances, be required to increase

the conversion rate for holders who elect to convert their notes in connection with such corporate event or notice of redemption.

The

notes will be convertible into cash, shares of MARA’s common stock, or a combination of cash and shares of MARA’s common

stock, at MARA’s election. Prior to March 1, 2031, the notes will be convertible only upon the occurrence of certain events and

during certain periods, and thereafter, at any time until the close of business on the second scheduled trading day immediately preceding

the maturity date.

The

conversion rate for the notes will initially be 52.9451 shares of MARA common stock per $1,000 principal amount of notes, which

is equivalent to an initial conversion price of approximately $18.89 per share. The conversion rate will be subject to adjustment

upon the occurrence of certain events.

MARA

estimates that the net proceeds from the sale of the notes will be approximately $243.8 million (or approximately $292.5

million if the initial purchasers exercise in full their option to purchase additional notes), after deducting the initial purchasers’

discounts and commissions but before estimated offering expenses payable by MARA.

MARA

intends to use the net proceeds from the sale of the notes to acquire additional bitcoin and for general corporate purposes, which may

include working capital, strategic acquisitions, expansion of existing assets, and repayment of debt and other outstanding obligations.

The

notes are being offered and sold to persons reasonably believed to be qualified institutional buyers pursuant to Rule 144A under the

Securities Act. The offer and sale of the notes and the shares of MARA’s common stock issuable upon conversion of the notes, if

any, have not been and will not be registered under the Securities Act or the securities laws of any other jurisdiction, and the notes

and any such shares may not be offered or sold in the United States absent registration or an applicable exemption from such registration

requirements. The offering of the notes is being made only by means of a private offering memorandum.

This

press release shall not constitute an offer to sell, or a solicitation of an offer to buy, the notes, nor shall there be any sale of

the notes in any state or jurisdiction in which such offer, solicitation or sale would be unlawful under the securities laws of any such

state or jurisdiction.

About

MARA

MARA

(NASDAQ:MARA) is a global leader in digital asset compute that develops and deploys innovative technologies to build a more sustainable

and inclusive future. MARA secures the world’s preeminent blockchain ledger and supports the energy transformation by converting

clean, stranded, or otherwise underutilized energy into economic value.

Forward-Looking

Statements

Statements

in this press release about future expectations, plans, and prospects, as well as any other statements regarding matters that are not

historical facts, may constitute “forward-looking statements” within the meaning of The Private Securities Litigation Reform

Act of 1995. These statements include, but are not limited to, statements relating to the estimated net proceeds of the offering, the

anticipated use of such net proceeds, and the anticipated closing of the offering. The words “anticipate,” “believe,”

“continue,” “could,” “estimate,” “expect,” “intend,” “may,” “plan,”

“potential,” “predict,” “project,” “should,” “target,” “will,”

“would,” and similar expressions are intended to identify forward-looking statements, although not all forward-looking statements

contain these identifying words. Actual results may differ materially from those indicated by such forward-looking statements as a result

of various important factors, including uncertainties related to market conditions and the completion of the offering, uncertainties

related to the satisfaction of closing conditions for the sale of the notes, the other factors discussed in the “Risk Factors”

section of MARA’s Annual Report on Form 10-K filed with the U.S. Securities and Exchange Commission (the “SEC”) on

February 28, 2024, as amended on May 24, 2024, the “Risk Factors” section of MARA’s Quarterly Report on Form 10-Q filed

with the SEC on August 1, 2024 and the risks described in other filings that MARA may make from time to time with the SEC. Any forward-looking

statements contained in this press release speak only as of the date hereof, and MARA specifically disclaims any obligation to update

any forward-looking statement, whether as a result of new information, future events, or otherwise, except to the extent required by

applicable law.

MARA

Company Contact:

Telephone:

800-804-1690

Email:

ir@mara.com

v3.24.2.u1

| X |

- DefinitionBoolean flag that is true when the XBRL content amends previously-filed or accepted submission.

| Name: |

dei_AmendmentFlag |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:booleanItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionFor the EDGAR submission types of Form 8-K: the date of the report, the date of the earliest event reported; for the EDGAR submission types of Form N-1A: the filing date; for all other submission types: the end of the reporting or transition period. The format of the date is YYYY-MM-DD.

| Name: |

dei_DocumentPeriodEndDate |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:dateItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionThe type of document being provided (such as 10-K, 10-Q, 485BPOS, etc). The document type is limited to the same value as the supporting SEC submission type, or the word 'Other'.

| Name: |

dei_DocumentType |

| Namespace Prefix: |

dei_ |

| Data Type: |

dei:submissionTypeItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionAddress Line 1 such as Attn, Building Name, Street Name

| Name: |

dei_EntityAddressAddressLine1 |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:normalizedStringItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionAddress Line 2 such as Street or Suite number

| Name: |

dei_EntityAddressAddressLine2 |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:normalizedStringItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- Definition

+ References

+ Details

| Name: |

dei_EntityAddressCityOrTown |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:normalizedStringItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionCode for the postal or zip code

| Name: |

dei_EntityAddressPostalZipCode |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:normalizedStringItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionName of the state or province.

| Name: |

dei_EntityAddressStateOrProvince |

| Namespace Prefix: |

dei_ |

| Data Type: |

dei:stateOrProvinceItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionA unique 10-digit SEC-issued value to identify entities that have filed disclosures with the SEC. It is commonly abbreviated as CIK. Reference 1: http://www.xbrl.org/2003/role/presentationRef

-Publisher SEC

-Name Exchange Act

-Number 240

-Section 12

-Subsection b-2

| Name: |

dei_EntityCentralIndexKey |

| Namespace Prefix: |

dei_ |

| Data Type: |

dei:centralIndexKeyItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionIndicate if registrant meets the emerging growth company criteria. Reference 1: http://www.xbrl.org/2003/role/presentationRef

-Publisher SEC

-Name Exchange Act

-Number 240

-Section 12

-Subsection b-2

| Name: |

dei_EntityEmergingGrowthCompany |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:booleanItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionCommission file number. The field allows up to 17 characters. The prefix may contain 1-3 digits, the sequence number may contain 1-8 digits, the optional suffix may contain 1-4 characters, and the fields are separated with a hyphen.

| Name: |

dei_EntityFileNumber |

| Namespace Prefix: |

dei_ |

| Data Type: |

dei:fileNumberItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionTwo-character EDGAR code representing the state or country of incorporation.

| Name: |

dei_EntityIncorporationStateCountryCode |

| Namespace Prefix: |

dei_ |

| Data Type: |

dei:edgarStateCountryItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionThe exact name of the entity filing the report as specified in its charter, which is required by forms filed with the SEC. Reference 1: http://www.xbrl.org/2003/role/presentationRef

-Publisher SEC

-Name Exchange Act

-Number 240

-Section 12

-Subsection b-2

| Name: |

dei_EntityRegistrantName |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:normalizedStringItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionThe Tax Identification Number (TIN), also known as an Employer Identification Number (EIN), is a unique 9-digit value assigned by the IRS. Reference 1: http://www.xbrl.org/2003/role/presentationRef

-Publisher SEC

-Name Exchange Act

-Number 240

-Section 12

-Subsection b-2

| Name: |

dei_EntityTaxIdentificationNumber |

| Namespace Prefix: |

dei_ |

| Data Type: |

dei:employerIdItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionLocal phone number for entity.

| Name: |

dei_LocalPhoneNumber |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:normalizedStringItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionBoolean flag that is true when the Form 8-K filing is intended to satisfy the filing obligation of the registrant as pre-commencement communications pursuant to Rule 13e-4(c) under the Exchange Act. Reference 1: http://www.xbrl.org/2003/role/presentationRef

-Publisher SEC

-Name Exchange Act

-Number 240

-Section 13e

-Subsection 4c

| Name: |

dei_PreCommencementIssuerTenderOffer |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:booleanItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionBoolean flag that is true when the Form 8-K filing is intended to satisfy the filing obligation of the registrant as pre-commencement communications pursuant to Rule 14d-2(b) under the Exchange Act. Reference 1: http://www.xbrl.org/2003/role/presentationRef

-Publisher SEC

-Name Exchange Act

-Number 240

-Section 14d

-Subsection 2b

| Name: |

dei_PreCommencementTenderOffer |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:booleanItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionTitle of a 12(b) registered security. Reference 1: http://www.xbrl.org/2003/role/presentationRef

-Publisher SEC

-Name Exchange Act

-Number 240

-Section 12

-Subsection b

| Name: |

dei_Security12bTitle |

| Namespace Prefix: |

dei_ |

| Data Type: |

dei:securityTitleItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionName of the Exchange on which a security is registered. Reference 1: http://www.xbrl.org/2003/role/presentationRef

-Publisher SEC

-Name Exchange Act

-Number 240

-Section 12

-Subsection d1-1

| Name: |

dei_SecurityExchangeName |

| Namespace Prefix: |

dei_ |

| Data Type: |

dei:edgarExchangeCodeItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionBoolean flag that is true when the Form 8-K filing is intended to satisfy the filing obligation of the registrant as soliciting material pursuant to Rule 14a-12 under the Exchange Act. Reference 1: http://www.xbrl.org/2003/role/presentationRef

-Publisher SEC

-Name Exchange Act

-Number 240

-Section 14a

-Subsection 12

| Name: |

dei_SolicitingMaterial |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:booleanItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionTrading symbol of an instrument as listed on an exchange.

| Name: |

dei_TradingSymbol |

| Namespace Prefix: |

dei_ |

| Data Type: |

dei:tradingSymbolItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionBoolean flag that is true when the Form 8-K filing is intended to satisfy the filing obligation of the registrant as written communications pursuant to Rule 425 under the Securities Act. Reference 1: http://www.xbrl.org/2003/role/presentationRef

-Publisher SEC

-Name Securities Act

-Number 230

-Section 425

| Name: |

dei_WrittenCommunications |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:booleanItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

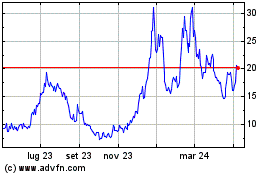

Grafico Azioni MARA (NASDAQ:MARA)

Storico

Da Ott 2024 a Nov 2024

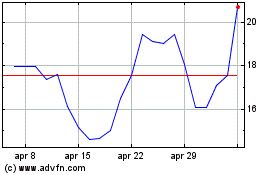

Grafico Azioni MARA (NASDAQ:MARA)

Storico

Da Nov 2023 a Nov 2024