Marathon Digital Holdings, Inc. (NASDAQ: MARA) (“MARA” or the

“Company”), a global leader in leveraging digital asset compute to

support the energy transformation, today announced the closing of

its offering of 2.125% convertible senior notes due 2031 (the

“notes”). The aggregate principal amount of the notes sold in the

offering was $300 million, which includes $50 million aggregate

principal amount of notes issued pursuant to an option to purchase,

within a 13-day period beginning on, and including, the date on

which the notes were first issued, granted to the initial

purchasers under the purchase agreement, which the initial

purchasers exercised in full on August 13, 2024 and which

additional purchase was completed on August 14, 2024. The notes

were sold in a private offering to persons reasonably believed to

be qualified institutional buyers in reliance on Rule 144A under

the Securities Act of 1933, as amended (the “Securities Act”).

The net proceeds from the sale of the notes were

approximately $292.5 million, after deducting the initial

purchasers’ discounts and commissions but before estimated offering

expenses payable by MARA. On August 14, 2024, MARA also announced

that, during the period between August 12, 2024 and August 14,

2024, MARA acquired approximately 4,144 bitcoin for approximately

$249 million in cash, using proceeds from the sale of the notes, at

an average price of approximately $59,500 per bitcoin, inclusive of

fees and expenses. MARA intends to use the remaining net proceeds

from the sale of the notes to acquire additional bitcoin and for

general corporate purposes, which may include working capital,

strategic acquisitions, expansion of existing assets, and repayment

of debt and other outstanding obligations.

The notes are unsecured, senior obligations of

MARA and bear interest at a rate of 2.125% per annum, payable

semi-annually in arrears on March 1 and September 1 of each year,

beginning on March 1, 2025. The notes will mature on September 1,

2031, unless earlier repurchased, redeemed or converted in

accordance with their terms. Subject to certain conditions, on or

after September 6, 2028, MARA may redeem for cash all or any

portion of the notes at a redemption price equal to 100% of the

principal amount of the notes to be redeemed, plus accrued and

unpaid interest, if any, to, but excluding, the redemption date, if

the last reported sale price of MARA’s common stock has been at

least 130% of the conversion price then in effect for a specified

period of time ending on, and including, the trading day

immediately before the date MARA provides the notice of redemption.

If MARA redeems fewer than all the outstanding notes, at least $75

million aggregate principal amount of notes must be outstanding and

not subject to redemption as of the relevant redemption notice

date.

Holders of notes may require MARA to repurchase

for cash all or any portion of their notes on March 1, 2029 or upon

the occurrence of certain events that constitute a fundamental

change under the indenture governing the notes at a repurchase

price equal to 100% of the principal amount of the notes to be

repurchased, plus any accrued and unpaid interest to, but

excluding, the date of repurchase. In connection with certain

corporate events or if MARA calls any note for redemption, it will,

under certain circumstances, be required to increase the conversion

rate for holders who elect to convert their notes in connection

with such corporate event or notice of redemption.

The notes are convertible into cash, shares of

MARA’s common stock, or a combination of cash and shares of MARA’s

common stock, at MARA’s election. Prior to March 1, 2031, the notes

are convertible only upon the occurrence of certain events and

during certain periods, and thereafter, at any time until the close

of business on the second scheduled trading day immediately

preceding the maturity date.

The conversion rate for the notes is initially

52.9451 shares of MARA’s common stock per $1,000 principal amount

of notes, which is equivalent to an initial conversion price of

approximately $18.89 per share. The conversion rate is subject to

adjustment upon the occurrence of certain events.

The notes were sold to persons reasonably

believed to be qualified institutional buyers pursuant to Rule 144A

under the Securities Act. The offer and sale of the notes and the

shares of MARA’s common stock issuable upon conversion of the

notes, if any, have not been and will not be registered under the

Securities Act or the securities laws of any other jurisdiction,

and the notes and any such shares may not be offered or sold in the

United States absent registration or an applicable exemption from

such registration requirements. The offering of the notes was made

only by means of a private offering memorandum.

This press release shall not constitute an offer

to sell, or a solicitation of an offer to buy, the notes, nor shall

there be any sale of the notes in any state or jurisdiction in

which such offer, solicitation or sale would be unlawful under the

securities laws of any such state or jurisdiction.

About MARA

MARA (NASDAQ:MARA) is a global leader in digital

asset compute that develops and deploys innovative technologies to

build a more sustainable and inclusive future. MARA secures the

world’s preeminent blockchain ledger and supports the energy

transformation by converting clean, stranded, or otherwise

underutilized energy into economic value.

Forward-Looking Statements

Statements in this press release about future

expectations, plans, and prospects, as well as any other statements

regarding matters that are not historical facts, may constitute

“forward-looking statements” within the meaning of The Private

Securities Litigation Reform Act of 1995. These statements include,

but are not limited to, statements relating to MARA’s use of the

net proceeds of the offering. The words “anticipate,” “believe,”

“continue,” “could,” “estimate,” “expect,” “intend,” “may,” “plan,”

“potential,” “predict,” “project,” “should,” “target,” “will,”

“would,” and similar expressions are intended to identify

forward-looking statements, although not all forward-looking

statements contain these identifying words. Actual results may

differ materially from those indicated by such forward-looking

statements as a result of various important factors, including the

factors discussed in the “Risk Factors” section of MARA’s Annual

Report on Form 10-K filed with the U.S. Securities and Exchange

Commission (the “SEC”) on February 28, 2024, as amended on May 24,

2024, the “Risk Factors” section of MARA’s Quarterly Report on Form

10-Q filed with the SEC on August 1, 2024 and the risks described

in other filings that MARA may make from time to time with the SEC.

Any forward-looking statements contained in this press release

speak only as of the date hereof, and MARA specifically disclaims

any obligation to update any forward-looking statement, whether as

a result of new information, future events, or otherwise, except to

the extent required by applicable law.

MARA Company Contact:Telephone: 800-804-1690Email:

ir@mara.com

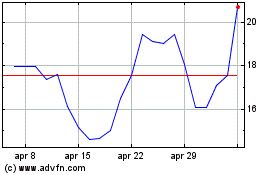

Grafico Azioni MARA (NASDAQ:MARA)

Storico

Da Dic 2024 a Gen 2025

Grafico Azioni MARA (NASDAQ:MARA)

Storico

Da Gen 2024 a Gen 2025