false000137229900013722992025-03-052025-03-05

UNITED STATES

SECURITIES AND EXCHANGE COMMISSION

Washington, D.C. 20549

___________________________________________________________

FORM 8-K

___________________________________________________________

CURRENT REPORT

Pursuant to Section 13 OR 15 (d)

of The Securities Exchange Act of 1934

Date of Report (Date of Earliest Event Reported): March 5, 2025

___________________________________________________________

OCUGEN, INC.

(Exact Name of Registrant as Specified in its Charter)

___________________________________________________________

| | | | | | | | | | | | | | |

| Delaware | | 001-36751 | | 04-3522315 |

(State or Other Jurisdiction of

Incorporation) | | (Commission

File Number) | | (I.R.S. Employer

Identification Number) |

11 Great Valley Parkway

Malvern, Pennsylvania 19355

(484) 328-4701

(Address, including zip code, and telephone number, including area code, of principal executive office)

N/A

(Former Name or Former Address, if Changed Since Last Report)

Check the appropriate box below if the Form 8–K filing is intended to simultaneously satisfy the filing obligation of the registrant under any of the following provisions (see General Instruction A.2. below):

☐ Written communications pursuant to Rule 425 under the Securities Act (17 CFR 230.425)

☐ Soliciting material pursuant to Rule 14a–12 under the Exchange Act (17 CFR 240.14a–12)

☐ Pre–commencement communications pursuant to Rule 14d–2(b) under the Exchange Act (17 CFR 240.14d–2(b))

☐ Pre–commencement communications pursuant to Rule 13e–4(c) under the Exchange Act (17 CFR 240.13e–4(c))

Securities registered pursuant to Section 12(b) of the Act: | | | | | | | | | | | | | | |

| Title of each class | | Trading Symbol(s) | | Name of each exchange on which registered |

| Common Stock, $0.01 par value per share | | OCGN | | The Nasdaq Stock Market LLC (The Nasdaq Capital Market) |

Indicate by check mark whether the registrant is an emerging growth company as defined in Rule 405 of the Securities Act of 1933 (§230.405 of this chapter) or Rule 12b-2 of the Securities Exchange Act of 1934 (§240.12b-2 of this chapter).

Emerging growth company ☐

If an emerging growth company, indicate by check mark if the registrant has elected not to use the extended transition period for complying with any new or revised financial accounting standards provided pursuant to Section 13(a) of the Exchange Act. ☐

Item 2.02 Results of Operations and Financial Condition.

On March 5, 2025, Ocugen, Inc. (the "Company") issued a press release announcing certain financial results for the fourth quarter and the fiscal year ended December 31, 2024. The Company has scheduled a conference call and webcast for 8:30 a.m. Eastern Time on March 5, 2025, to discuss these financial results and business updates. The Company will use presentation materials in connection with the conference call and webcast, which presentation materials will be posted on the Company's website at www.ocugen.com. Copies of the press release and presentation materials are furnished herewith as Exhibit 99.1 and Exhibit 99.2, respectively, to this Current Report on Form 8-K (this "Report") and incorporated herein by reference.

The information disclosed under Item 2.02 of this Report, including Exhibit 99.1 and Exhibit 99.2, is being furnished and shall not be deemed "filed" for purposes of Section 18 of the Securities Exchange Act of 1934, as amended (the "Exchange Act"), or otherwise subject to the liabilities of that section, and shall not be deemed to be incorporated by reference in any Company filing under the Securities Act of 1933, as amended (the "Securities Act"), or the Exchange Act, except as expressly set forth by specific reference in such filing.

Item 9.01 Financial Statements and Exhibits.

The following exhibits are being furnished herewith:

(d) Exhibits

| | | | | | | | |

| Exhibit No. | | Document |

| 99.1 | | |

| 99.2 | | |

| 104 | | Cover Page Interactive Data File (embedded within the Inline XBRL document). |

SIGNATURE

Pursuant to the requirements of the Securities Exchange Act of 1934, the registrant has duly caused this report to be signed on its behalf by the undersigned hereunto duly authorized.

Date: March 5, 2025

| | | | | | | | |

| OCUGEN, INC. |

| |

| By: | /s/ Shankar Musunuri |

| | Name: Shankar Musunuri |

| | Title: Chairman, Chief Executive Officer, & Co-Founder |

Exhibit 99.1

Ocugen Provides Business Update with Fourth Quarter and Full Year 2024 Financial Results

Conference Call and Webcast Today at 8:30 a.m. ET

•Reached an alignment with FDA on Phase 2/3 pivotal confirmatory clinical trial for OCU410ST for Stargardt disease potentially expediting clinical development by two to three years

•Completed dosing in OCU410 Phase 2 ArMaDa clinical trial (N=51) for geographic atrophy (GA). Data and Safety Monitoring Board (DSMB) recently reviewed interim safety data from Phase 2. All subjects from multiple dose levels in Phase 2 to date demonstrated very favorable safety and tolerability profile.

•Positive 2-year long-term data across multiple mutations of retinitis pigmentosa (RP) from the Phase 1/2 clinical trial of OCU400 demonstrated a durable and statistically significant (p=0.005) improvement in visual function (LLVA) in all evaluable treated subjects at two years when compared to untreated eyes

•OCU400 remains on track to meet 1H 2025 recruitment completion and potential BLA/MAA filings by mid-2026

MALVERN, PA, March 5, 2025 (GLOBE NEWSWIRE) – Ocugen, Inc. (Ocugen or the Company) (NASDAQ: OCGN), a pioneering biotechnology leader in gene therapies for blindness diseases, today reported fourth quarter and full year 2024 financial results along with a general business update.

“Ongoing data from all three clinical programs, along with patient testimonials, continue to support the benefit of one-time treatment from our revolutionary modifier gene therapy platform—as we are seeing consistent stabilization or improvement in treated eyes while maintaining a favorable safety and tolerability profile,” said Dr. Shankar Musunuri, Chairman, CEO and Co-founder of Ocugen. “Throughout 2024, the Company continually advanced its clinical programs in line with enrollment and dosing timelines, and we will continue to drive the product pipeline forward in 2025.”

Recently, the Company announced it will proceed with a Phase 2/3 pivotal confirmatory clinical trial of OCU410ST for Stargardt disease after alignment with the FDA. This accelerated regulatory pathway for OCU410ST is driven by the incredible unmet medical need that exists for 100,000 Stargardt patients in the U.S. and Europe who have no treatment option available. Accelerating the clinical timeline of OCU410ST is expected to save significant costs in addressing disease burden even sooner than anticipated.

The OCU410ST Phase 2/3 clinical trial will randomize 51 subjects, 34 of whom will receive a single, subretinal, 200-μL injection of OCU410ST at a concentration of 1.5 x 1011 vector genomes (vg)/mL in the eye with worse visual acuity, and 17 of whom will serve as untreated controls. One-year data will be utilized for the BLA filing planned for 2027. 6-month data from Phase 1 of the OCU410ST GARDian clinical trial demonstrated considerably slower lesion growth (52%) from baseline in treated eyes versus untreated fellow eyes and clinically meaningful 2-line (10-letter) improvement in visual function (BCVA), which is statistically significant (p=0.02) in treated eyes.

This week, the DSMB for the OCU410 ArMaDa clinical trial for GA convened and reviewed the safety and tolerability profile of an additional 15 subjects from the Phase 2 portion of the study. No serious adverse events related to OCU410 have been reported to date in all 60 subjects, including Phase 1. Unlike currently available treatments for GA, there were no cases of ischemic optic neuropathy, vasculitis, intraocular inflammation, endophthalmitis or choroidal neovascularization, and no adverse events of special interest.

Preliminary 9-month efficacy data of OCU410 in GA patients showed considerably slower lesion growth (44%) from baseline and clinically meaningful 2-line (10-letter) improvement in visual function (LLVA) in treated eyes compared to untreated eyes in the Phase 1 portion of the trial. Furthermore, a single subretinal OCU410 treatment preserves more retinal tissue around GA lesions of treated eyes at 9 months compared to published data on currently available GA therapies. GA, an advanced form of dry age-related macular degeneration, affects 2-3 million people in the U. S. and Europe combined.

Two-year data from the Phase 1/2 OCU400 clinical trial for RP demonstrated a durable and statistically significant (p=0.005) improvement in visual function (LLVA) in all evaluable treated subjects when compared to untreated eyes. 100% (10/10) of treated evaluable subjects showed improvement or preservation in visual function compared to untreated eyes, and OCU400 was observed to have a favorable safety and tolerability profile in all subjects across multiple mutations.

In parallel with clinical milestones, considerable regulatory accomplishments were achieved, including orphan medicinal product designation (OMPD) from the European Medicines Agency (EMA) for OCU410ST for the treatment of ABCA4-associated retinopathies including Stargardt disease, retinitis pigmentosa 19 (RP19), and cone-rod dystrophy 3 (CORD), and a positive opinions from the EMA’s Committee for Advanced Therapies (CAT) for OCU400, OCU410, and OCU410ST Advanced Therapy Medicinal Product (ATMP) classification.

Ocugen’s biologic candidate moved into the clinic and patients are currently being dosed in the OCU200 Phase 1 clinical trial for diabetic macular edema (DME). OCU200 has the potential to change the treatment landscape for DME, diabetic retinopathy, and wet age-related macular degeneration with its unique mechanism of action, binding the active component—tumstatin—to integrin receptors that play a crucial role in disease pathogenesis and holds the promise to benefit all DME patients, including the 30-40% of patients who do not respond to current anti-VEGF therapies.

“I am extremely proud of our team at Ocugen, who are working tirelessly to enroll patients across all four clinical programs in close collaboration with the study centers and investigators, “said Dr. Huma Qamar, Chief Medical Officer at Ocugen. “It is very gratifying to think about the potential unmet medical need that can be addressed through modifier therapy for patients who currently have no options and are facing the prospects of losing their vision altogether.”

Finally, the Investigational New Drug (IND) application for OCU500—the Company’s inhaled mucosal vaccine for COVID-19 was cleared by the FDA. The National Institute of Allergy and Infectious Diseases (NIAID), part of the National Institutes of Health, is expected to sponsor and conduct the Phase 1 trial to assess the safety, tolerability, and immunogenicity of OCU500 administered via two different routes, inhalation into the lungs and intranasally as a spray.

To extend the cash runway into the first quarter of 2026, and support Ocugen’s clinical trials, the Company secured $65 million in equity/debt financings in the second half of 2024. Further supporting Ocugen’s efforts to enable long-term shareholder value, garner significant visibility within the investment community, and broaden the shareholder base, the Company was included in the Russell Index in May 2024.

“Meaningful progress in 2024 and recent success with FDA brought us closer to our goal of three potential BLAs in the years—2026, 2027, 2028, encompassing RP, Stargardt and GA treatments, respectively” said Dr. Musunuri. “While this is an ambitious goal, I am confident that we have the strategic and scientific expertise, and an unrelenting commitment to patients, to deliver on our commitment.”

Business Updates

Novel Modifier Gene Therapy Platform—Potentially Targeting Three BLA Filings in the Next Three Years

•OCU400 — The European Commission (EC) provided a positive opinion from the EMA’s CAT for OCU400 ATMP classification. Actively enrolling patients in the U.S. and Canada in the Phase 3 liMeliGhT clinical trial for the treatment of RP and are on track to complete enrollment in the first half of 2025 and file BLA and MAA submissions in mid-2026.

•OCU410ST — The EMA granted OMPD for OCU410ST for the treatment of ABCA4-associated retinopathies including Stargardt disease, retinitis pigmentosa 19 (RP19), and cone-rod dystrophy 3 (CORD3). The FDA approved a Phase 2/3 pivotal confirmatory clinical trial for BLA filing. Plan to initiate the Phase 2/3 study mid-2025 and targeting BLA submission by 2027. The EC provided a positive opinion from the EMA’s CAT for OCU410ST ATMP classification.

•OCU410 — Completed dosing in Phase 2 of the OCU410 Phase 1/2 ArMaDa clinical trial ahead of schedule. Intend to complete 1-year follow up in the first quarter of 2026 and targeting a BLA filing in 2028. The EC provided a positive opinion from the EMA’s CAT for OCU410 ATMP classification.

Financial Results

•Fourth quarter — Research and development expenses for the three months ended December 31, 2024, were $8.3 million compared to $7.8 million for the three months ended December 31, 2023. General and administrative expenses for the three months ended December 31, 2024, were $6.3 million compared to $5.2 million for the three months ended December 31, 2023. Ocugen reported a $0.05 net loss per common share for the three months ended December 31, 2024, compared to a $0.04 net loss per common share for the three months ended December 31, 2023.

•Full year — Research and development expenses for the year ended December 31, 2024, were $32.1 million compared to $39.6 million for the year ended December 31, 2023. General and administrative expenses for the year ended December 31, 2024, were $26.7 million compared to $32.0 million for the year ended December 31, 2023. Ocugen reported a $0.20 net loss per common share for the year ended December 31, 2024, compared to a $0.26 net loss per common share for the year ended December 31, 2023.

•Ocugen’s cash and restricted cash, totaled $58.8 million as of December 31, 2024, compared to $39.5 million as of December 31, 2023. The Company estimates that its current cash, cash equivalents, and investments will enable it to fund its operations into the first quarter of 2026. The Company had 291.4 million shares of common stock outstanding as of December 31, 2024.

Conference Call and Webcast Details

Ocugen has scheduled a conference call and webcast for 8:30 a.m. ET today to discuss the financial results and recent business highlights. Ocugen’s leadership team will host the call, which will be open to all listeners. There will also be a question-and-answer session following the prepared remarks.

Attendees are invited to participate on the call or webcast using the following details:

Dial-in Numbers: (800) 715-9871 for U.S. callers and (646) 307-1963 for international callers

Conference ID: 5045393

Webcast: Available on the events section of the Ocugen investor site

A replay of the call and archived webcast will be available for approximately 45 days following the event on the Ocugen investor site.

About Ocugen, Inc.

Ocugen, Inc. is a biotechnology company focused on discovering, developing, and commercializing novel gene and cell therapies, biologics, and vaccines that improve health and offer hope for patients across the globe. We are making an impact on patient’s lives through courageous innovation—forging new scientific paths that harness our unique intellectual and human capital. Our breakthrough modifier gene therapy platform has the potential to treat multiple retinal diseases with a single product, and we are advancing research in infectious diseases to support public health and orthopedic diseases to address unmet medical needs. Discover more at www.ocugen.com and follow us on X and LinkedIn.

Cautionary Note on Forward-Looking Statements

This press release contains forward-looking statements within the meaning of The Private Securities Litigation Reform Act of 1995, including, but not limited to, strategy, business plans and objectives for Ocugen’s clinical programs, plans and timelines for the preclinical and clinical development of Ocugen’s product candidates, including the therapeutic potential, clinical benefits and safety and efficacy thereof, expectations regarding timing, success and data announcements of current ongoing preclinical and clinical trials, expected cash runway into the first quarter of 2026, the ability to initiate new clinical programs, statements regarding qualitative assessments of available data, potential benefits, expectations for ongoing and future clinical trials, anticipated regulatory filings and anticipated development timelines, which are subject to risks and uncertainties. We may, in some cases, use terms such as “predicts,” “believes,” “potential,” “proposed,” “continue,” “estimates,” “anticipates,” “expects,” “plans,” “intends,” “may,” “could,” “might,” “will,” “should,” or other words that convey uncertainty of future events or outcomes to identify these forward-looking statements. Such statements are subject to numerous important factors, risks, and uncertainties that may cause actual events or results to differ materially from our current expectations, including, but not limited to, the risks that preliminary, interim and top-line clinical trial results may not be indicative of, and may differ from, final clinical data; that unfavorable new clinical trial data may emerge in ongoing clinical trials or through further analyses of existing clinical trial data; that earlier non-clinical and clinical data and testing of may not be predictive of the results or success of later clinical trials; and that that clinical trial data are subject to differing interpretations and assessments, including by regulatory authorities. These and other risks and uncertainties are more fully described in our annual and periodic filings with the Securities and Exchange Commission (SEC), including the risk factors described in the section entitled “Risk Factors” in the quarterly and annual reports that we file with the SEC. Any forward-looking statements that we make in this press release speak only as of the date of this press release. Except as required by law, we assume no obligation to update forward-looking statements contained in this press release whether as a result of new information, future events, or otherwise, after the date of this press release.

Contact:

Tiffany Hamilton

AVP, Head of Communications

Tiffany.Hamilton@ocugen.com

(Tables to follow)

OCUGEN, INC.

CONSOLIDATED BALANCE SHEETS

(in thousands)

(Unaudited)

| | | | | | | | | | | |

| As of December 31, |

| 2024 | | 2023 |

| Assets | | | |

| Current assets | | | |

| Cash | $ | 58,514 | | | $ | 39,462 | |

| Prepaid expenses and other current assets | 3,168 | | | 3,509 | |

| Total current assets | 61,682 | | | 42,971 | |

| Property and equipment, net | 16,554 | | | 17,290 | |

| Restricted cash | 307 | | | — | |

| Other assets | 3,899 | | | 4,286 | |

| Total assets | $ | 82,442 | | | $ | 64,547 | |

| Liabilities and stockholders' equity | | | |

| Current liabilities | | | |

| Accounts payable | $ | 4,243 | | | $ | 3,172 | |

| Accrued expenses and other current liabilities | 15,500 | | | 13,343 | |

| Operating lease obligations | 519 | | | 574 | |

| Current portion of long term debt | 1,326 | | | — | |

| Total current liabilities | 21,588 | | | 17,089 | |

| Non-current liabilities | | | |

| Operating lease obligations, less current portion | 3,313 | | | 3,567 | |

| Long term debt, net | 27,345 | | | 2,800 | |

| Other non-current liabilities | 564 | | | 527 | |

| Total non-current liabilities | 31,222 | | | 6,894 | |

| Total liabilities | 52,810 | | | 23,983 | |

| Stockholders’ equity | | | |

| Convertible preferred stock | — | | | 1 | |

| Common stock | 2,915 | | | 2,567 | |

| Treasury stock | (48) | | | (48) | |

| Additional paid-in capital | 366,938 | | | 324,191 | |

| Accumulated other comprehensive income | 48 | | | 20 | |

| Accumulated deficit | (340,221) | | | (286,167) | |

| Total stockholders' equity | 29,632 | | | 40,564 | |

| Total liabilities and stockholders' equity | $ | 82,442 | | | $ | 64,547 | |

OCUGEN, INC.

CONSOLIDATED STATEMENTS OF OPERATIONS

(in thousands, except share and per share amounts)

(Unaudited)

| | | | | | | | | | | | | | | | | | | | | | | |

| Three Months Ended

December 31, | | Year Ended December 31, |

| 2024 | | 2023 | | 2024 | | 2023 |

| Collaborative arrangement revenue | $ | 764 | | | $ | 1,409 | | | $ | 4,055 | | | $ | 6,036 | |

| Total revenue | 764 | | | 1,409 | | | 4,055 | | | 6,036 | |

| Operating expenses | | | | | | | |

| Research and development | 8,290 | | | 7,779 | | | 32,126 | | | 39,573 | |

| General and administrative | 6,314 | | | 5,155 | | | 26,686 | | | 31,994 | |

| Total operating expenses | 14,604 | | | 12,934 | | | 58,812 | | | 71,567 | |

| Loss from operations | (13,840) | | | (11,525) | | | (54,757) | | | (65,531) | |

| Other income (expense), net | (40) | | | 555 | | | 703 | | | 2,453 | |

| Net loss | $ | (13,880) | | | $ | (10,970) | | | $ | (54,054) | | | $ | (63,078) | |

| | | | | | | |

| Net loss attributable to common shareholders— basic and diluted | (13,880) | | | (10,970) | | | (54,010) | | | (63,078) | |

| Weighted shares used in calculating net loss per common share — basic and diluted | 290,924,531 | | | 256,506,387 | | | 270,995,121 | | | 244,327,057 | |

| Net loss per share attributable to common shareholders — basic and diluted | $ | (0.05) | | | $ | (0.04) | | | $ | (0.20) | | | $ | (0.26) | |

| | | | | | | |

| Net loss attributable to Series B Convertible Preferred shareholders — basic and diluted | — | | | — | | | (44) | | | — | |

| Weighted shares used in calculating net loss per Series B Convertible Preferred Stock — basic and diluted | — | | | — | | | 54,745 | | | — | |

| Net loss per share attributable to Series B Convertible Preferred shareholders — basic and diluted | $ | — | | | $ | — | | | $ | (0.80) | | | $ | — | |

| | | | | | | |

• • • • •

• • o ± •

× μ • o • •

• • • • • •

* • • ±

• • • • • 6M 0.0 0.2 0.4 0.6 Timeline Treated Eye Untreated Eye 52%

× • • • •

• • • • • • • • •

±

• • 44%

μ μ μ • • •

✓ ✓ ✓ ✓ ✓ ✓ ✓

• • • • • •

20

• • • •

v3.25.0.1

| X |

- DefinitionBoolean flag that is true when the XBRL content amends previously-filed or accepted submission.

| Name: |

dei_AmendmentFlag |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:booleanItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionFor the EDGAR submission types of Form 8-K: the date of the report, the date of the earliest event reported; for the EDGAR submission types of Form N-1A: the filing date; for all other submission types: the end of the reporting or transition period. The format of the date is YYYY-MM-DD.

| Name: |

dei_DocumentPeriodEndDate |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:dateItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionThe type of document being provided (such as 10-K, 10-Q, 485BPOS, etc). The document type is limited to the same value as the supporting SEC submission type, or the word 'Other'.

| Name: |

dei_DocumentType |

| Namespace Prefix: |

dei_ |

| Data Type: |

dei:submissionTypeItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionAddress Line 1 such as Attn, Building Name, Street Name

| Name: |

dei_EntityAddressAddressLine1 |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:normalizedStringItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- Definition

+ References

+ Details

| Name: |

dei_EntityAddressCityOrTown |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:normalizedStringItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionCode for the postal or zip code

| Name: |

dei_EntityAddressPostalZipCode |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:normalizedStringItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionName of the state or province.

| Name: |

dei_EntityAddressStateOrProvince |

| Namespace Prefix: |

dei_ |

| Data Type: |

dei:stateOrProvinceItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionA unique 10-digit SEC-issued value to identify entities that have filed disclosures with the SEC. It is commonly abbreviated as CIK. Reference 1: http://www.xbrl.org/2003/role/presentationRef

-Publisher SEC

-Name Exchange Act

-Number 240

-Section 12

-Subsection b-2

| Name: |

dei_EntityCentralIndexKey |

| Namespace Prefix: |

dei_ |

| Data Type: |

dei:centralIndexKeyItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionIndicate if registrant meets the emerging growth company criteria. Reference 1: http://www.xbrl.org/2003/role/presentationRef

-Publisher SEC

-Name Exchange Act

-Number 240

-Section 12

-Subsection b-2

| Name: |

dei_EntityEmergingGrowthCompany |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:booleanItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionCommission file number. The field allows up to 17 characters. The prefix may contain 1-3 digits, the sequence number may contain 1-8 digits, the optional suffix may contain 1-4 characters, and the fields are separated with a hyphen.

| Name: |

dei_EntityFileNumber |

| Namespace Prefix: |

dei_ |

| Data Type: |

dei:fileNumberItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionTwo-character EDGAR code representing the state or country of incorporation.

| Name: |

dei_EntityIncorporationStateCountryCode |

| Namespace Prefix: |

dei_ |

| Data Type: |

dei:edgarStateCountryItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionThe exact name of the entity filing the report as specified in its charter, which is required by forms filed with the SEC. Reference 1: http://www.xbrl.org/2003/role/presentationRef

-Publisher SEC

-Name Exchange Act

-Number 240

-Section 12

-Subsection b-2

| Name: |

dei_EntityRegistrantName |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:normalizedStringItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionThe Tax Identification Number (TIN), also known as an Employer Identification Number (EIN), is a unique 9-digit value assigned by the IRS. Reference 1: http://www.xbrl.org/2003/role/presentationRef

-Publisher SEC

-Name Exchange Act

-Number 240

-Section 12

-Subsection b-2

| Name: |

dei_EntityTaxIdentificationNumber |

| Namespace Prefix: |

dei_ |

| Data Type: |

dei:employerIdItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionLocal phone number for entity.

| Name: |

dei_LocalPhoneNumber |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:normalizedStringItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionBoolean flag that is true when the Form 8-K filing is intended to satisfy the filing obligation of the registrant as pre-commencement communications pursuant to Rule 13e-4(c) under the Exchange Act. Reference 1: http://www.xbrl.org/2003/role/presentationRef

-Publisher SEC

-Name Exchange Act

-Number 240

-Section 13e

-Subsection 4c

| Name: |

dei_PreCommencementIssuerTenderOffer |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:booleanItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionBoolean flag that is true when the Form 8-K filing is intended to satisfy the filing obligation of the registrant as pre-commencement communications pursuant to Rule 14d-2(b) under the Exchange Act. Reference 1: http://www.xbrl.org/2003/role/presentationRef

-Publisher SEC

-Name Exchange Act

-Number 240

-Section 14d

-Subsection 2b

| Name: |

dei_PreCommencementTenderOffer |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:booleanItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionTitle of a 12(b) registered security. Reference 1: http://www.xbrl.org/2003/role/presentationRef

-Publisher SEC

-Name Exchange Act

-Number 240

-Section 12

-Subsection b

| Name: |

dei_Security12bTitle |

| Namespace Prefix: |

dei_ |

| Data Type: |

dei:securityTitleItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionName of the Exchange on which a security is registered. Reference 1: http://www.xbrl.org/2003/role/presentationRef

-Publisher SEC

-Name Exchange Act

-Number 240

-Section 12

-Subsection d1-1

| Name: |

dei_SecurityExchangeName |

| Namespace Prefix: |

dei_ |

| Data Type: |

dei:edgarExchangeCodeItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionBoolean flag that is true when the Form 8-K filing is intended to satisfy the filing obligation of the registrant as soliciting material pursuant to Rule 14a-12 under the Exchange Act. Reference 1: http://www.xbrl.org/2003/role/presentationRef

-Publisher SEC

-Name Exchange Act

-Number 240

-Section 14a

-Subsection 12

| Name: |

dei_SolicitingMaterial |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:booleanItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionTrading symbol of an instrument as listed on an exchange.

| Name: |

dei_TradingSymbol |

| Namespace Prefix: |

dei_ |

| Data Type: |

dei:tradingSymbolItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionBoolean flag that is true when the Form 8-K filing is intended to satisfy the filing obligation of the registrant as written communications pursuant to Rule 425 under the Securities Act. Reference 1: http://www.xbrl.org/2003/role/presentationRef

-Publisher SEC

-Name Securities Act

-Number 230

-Section 425

| Name: |

dei_WrittenCommunications |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:booleanItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

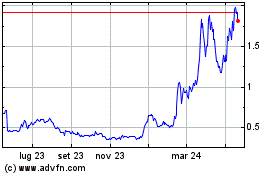

Grafico Azioni Ocugen (NASDAQ:OCGN)

Storico

Da Feb 2025 a Mar 2025

Grafico Azioni Ocugen (NASDAQ:OCGN)

Storico

Da Mar 2024 a Mar 2025