SECURITIES

AND EXCHANGE COMMISSION

Washington, D.C. 20549

SCHEDULE

13G

Under

the Securities Exchange Act of 1934

(Amendment No.)*

Peraso

Inc.

(Name

of Issuer)

Common

Stock, par value $0.001 per share

(Title

of Class of Securities)

71360T200

(CUSIP

Number)

February

6, 2024

(Date

of Event which Requires Filing of this Statement)

Check

the appropriate box to designate the rule pursuant to which this Schedule is filed:

☐

Rule 13d-1(b)

☒ Rule 13d-1(c)

☐ Rule 13d-1(d)

*

The remainder of this cover page shall be filled out for a reporting person’s initial filing on this form with respect

to the subject class of securities, and for any subsequent amendment containing information which would alter disclosures provided

in a prior cover page.

The

information required on the remainder of this cover page shall not be deemed to be “filed” for the purpose of Section

18 of the Securities Exchange Act of 1934 (“Act”) or otherwise subject to the liabilities of that section of the Act

but shall be subject to all other provisions of the Act (however, see the Notes).

| CUSIP No. 71360T200 |

|

13G |

|

Page 2 of 10 Pages |

| |

|

| 1. |

NAMES

OF REPORTING PERSONS

I.R.S. IDENTIFICATION NOS. OF ABOVE PERSONS (ENTITIES ONLY)

Ionic Ventures, LLC |

| 2. |

CHECK

THE APPROPRIATE BOX IF A MEMBER OF A GROUP

(see instructions)

(a) ☐

(b) ☒ |

| 3. |

SEC USE

ONLY

|

| 4. |

CITIZENSHIP

OR PLACE OF ORGANIZATION

California, United States |

NUMBER

OF

SHARES

BENEFICIALLY

OWNED BY

EACH

REPORTING

PERSON WITH |

5. |

SOLE

VOTING POWER

0 |

| 6. |

SHARED

VOTING POWER

136,107

(1)

|

| 7. |

SOLE

DISPOSITIVE POWER

0 |

| 8. |

SHARED

DISPOSITIVE POWER

136,107

(1)

|

| 9. |

AGGREGATE

AMOUNT BENEFICIALLY OWNED BY EACH REPORTING PERSON

136,107 (1) |

| 10. |

CHECK

IF THE AGGREGATE AMOUNT IN ROW (9) EXCLUDES CERTAIN SHARES

(see instructions) ☐ |

| 11. |

PERCENT

OF CLASS REPRESENTED BY AMOUNT IN ROW (9)

9.9% (1) |

| 12. |

TYPE

OF REPORTING PERSON (see instructions)

OO |

| |

|

| (1) |

As more fully described

in Item 4 of this Statement on Schedule 13G (this “Statement”), such shares and percentage are

based on 1,346,334 outstanding shares of the issuer’s common stock, par value $0.001 per share (the “Common

Stock”), as disclosed in the issuer’s Current Report on Form 8-K, filed by the issuer with the U.S. Securities

and Exchange Commission (the “SEC”) on February 9, 2024 (the “Form 8-K”), and do not

give full effect to the shares of Common Stock issuable upon full exercise of (i) common stock purchase warrants (the “Warrants”),

(ii) pre-funded common stock purchase warrants (the “Pre-Funded Warrants”), (iii) Series A common stock

purchase warrants (the “Series A Warrants”) and (iv) Series B common stock purchase warrants (the “Series

B Warrants”), which exercise in each case is subject to a 9.99% beneficial ownership blocker (a “Blocker”). |

| CUSIP

No. 71360T200 |

|

13G |

|

Page 3 of 10 Pages |

| |

|

|

|

|

| 1. |

NAMES

OF REPORTING PERSONS

I.R.S. IDENTIFICATION NOS. OF ABOVE PERSONS (ENTITIES ONLY)

Ionic Management, LLC |

| 2. |

CHECK

THE APPROPRIATE BOX IF A MEMBER OF A GROUP

(see instructions)

(a) ☐

(b) ☒ |

| 3. |

SEC

USE ONLY

|

| 4. |

CITIZENSHIP

OR PLACE OF ORGANIZATION

Delaware, United States |

NUMBER

OF

SHARES

BENEFICIALLY

OWNED BY

EACH

REPORTING

PERSON WITH |

5. |

SOLE

VOTING POWER

0 |

| 6. |

SHARED

VOTING POWER

136,107

(1)

|

| 7. |

SOLE

DISPOSITIVE POWER

0 |

| 8. |

SHARED

DISPOSITIVE POWER

136,107

(1)

|

| 9. |

AGGREGATE

AMOUNT BENEFICIALLY OWNED BY EACH REPORTING PERSON

136,107

(1)

|

| 10. |

CHECK

IF THE AGGREGATE AMOUNT IN ROW (9) EXCLUDES CERTAIN SHARES

(see instructions) ☐ |

| 11. |

PERCENT

OF CLASS REPRESENTED BY AMOUNT IN ROW (9)

9.9% (1) |

| 12. |

TYPE

OF REPORTING PERSON (see instructions)

OO |

(1)

As more fully described in Item 4 of this Statement, such shares and percentage are based on 1,346,334 outstanding shares of Common

Stock, as disclosed in the Form 8-K, and do not give full effect to the shares of Common Stock issuable upon full exercise of

(i) the Warrants, (ii) Pre-Funded Warrants, (iii) Series A Warrants and (iv) Series B Warrants, which exercise in each case is

subject to the Blocker.

| CUSIP

No. 71360T200 |

|

13G |

|

Page 4 of 10 Pages |

| |

|

| 1. |

NAMES

OF REPORTING PERSONS

I.R.S. IDENTIFICATION NOS. OF ABOVE PERSONS (ENTITIES ONLY)

Brendan O’Neil |

| 2. |

CHECK

THE APPROPRIATE BOX IF A MEMBER OF A GROUP

(see instructions)

(a) ☐

(b) ☒ |

| 3. |

SEC USE

ONLY

|

| 4. |

CITIZENSHIP

OR PLACE OF ORGANIZATION

United States |

NUMBER

OF

SHARES

BENEFICIALLY

OWNED BY

EACH

REPORTING

PERSON WITH |

5. |

SOLE

VOTING POWER

0 |

| 6. |

SHARED

VOTING POWER

136,107

(1)

|

| 7. |

SOLE

DISPOSITIVE POWER

0 |

| 8. |

SHARED

DISPOSITIVE POWER

136,107

(1)

|

| 9. |

AGGREGATE

AMOUNT BENEFICIALLY OWNED BY EACH REPORTING PERSON

136,107

(1)

|

| 10. |

CHECK

IF THE AGGREGATE AMOUNT IN ROW (9) EXCLUDES CERTAIN SHARES

(see instructions) ☐ |

| 11. |

PERCENT

OF CLASS REPRESENTED BY AMOUNT IN ROW (9)

9.9% (1) |

| 12. |

TYPE

OF REPORTING PERSON (see instructions)

IN |

(1)

As more fully described in Item 4 of this Statement, such shares and percentage are based on 1,346,334 outstanding shares of Common

Stock, as disclosed in the Form 8-K, and do not give full effect to the shares of Common Stock issuable upon full exercise of

(i) the Warrants, (ii) Pre-Funded Warrants, (iii) Series A Warrants and (iv) Series B Warrants, which exercise in each case is

subject to the Blocker.

| CUSIP

No. 71360T200 |

|

13G |

|

Page 5 of 10 Pages |

| |

|

| 1. |

NAMES

OF REPORTING PERSONS

I.R.S. IDENTIFICATION NOS. OF ABOVE PERSONS (ENTITIES ONLY)

Keith Coulston |

| 2. |

CHECK

THE APPROPRIATE BOX IF A MEMBER OF A GROUP

(see instructions)

(a) ☐

(b) ☒ |

| 3. |

SEC USE

ONLY

|

| 4. |

CITIZENSHIP

OR PLACE OF ORGANIZATION

United States |

NUMBER

OF

SHARES

BENEFICIALLY

OWNED BY

EACH

REPORTING

PERSON WITH |

5. |

SOLE

VOTING POWER

0 |

| 6. |

SHARED

VOTING POWER

136,107

(1)

|

| 7. |

SOLE

DISPOSITIVE POWER

0 |

| 8. |

SHARED

DISPOSITIVE POWER

136,107

(1)

|

| 9. |

AGGREGATE

AMOUNT BENEFICIALLY OWNED BY EACH REPORTING PERSON

136,107

(1)

|

| 10. |

CHECK

IF THE AGGREGATE AMOUNT IN ROW (9) EXCLUDES CERTAIN SHARES

(see instructions) ☐ |

| 11. |

PERCENT

OF CLASS REPRESENTED BY AMOUNT IN ROW (9)

9.9% (1) |

| 12. |

TYPE

OF REPORTING PERSON (see instructions)

IN |

(1)

As more fully described in Item 4 of this Statement, such shares and percentage are based on 1,346,334 outstanding shares of Common

Stock, as disclosed in the Form 8-K, and do not give full effect to the shares of Common Stock issuable upon full exercise of

(i) the Warrants, (ii) Pre-Funded Warrants, (iii) Series A Warrants and (iv) Series B Warrants, which exercise in each case is

subject to the Blocker.

| CUSIP

No. 71360T200 |

|

13G |

|

Page 6 of 10 Pages |

Item

1(a). Name of Issuer:

Peraso

Inc. (the “Issuer”).

Item

1(b). Address of Issuer’s Principal Executive Offices:

The

Issuer’s principal executive offices are located at 2309 Bering Drive, San Jose, California 95131.

Item

2(a). Names of Persons Filing:

| (i) |

|

Ionic Ventures LLC, a California

limited liability company (“Ionic”); |

| |

|

| (ii) |

|

Ionic Management, LLC, a Delaware limited liability

company (“Ionic Management”); |

| |

|

| (iii) |

|

Brendan O’Neil (“Mr. O’Neil”);

and |

| |

|

| (iv) |

|

Keith Coulston (“Mr. Coulston”).

|

The

foregoing persons are hereinafter collectively referred to as the “Reporting Persons”. Any disclosures herein

with respect to persons other than the Reporting Persons are made on information and belief after making inquiry to the appropriate

party.

The

Reporting Persons have entered into a Joint Filing Agreement, a copy of which is filed as Exhibit 1 to this Statement on Schedule

13G (this “Statement”), pursuant to which they have agreed to file this Statement and all subsequent amendments

to the Statement jointly in accordance with the provisions of Rule 13d-1(k) of the Act.

The

filing of this Statement should not be construed in and of itself as an admission by any Reporting Person as to beneficial ownership

of the securities reported herein.

Item

2(b). Address of Principal Business Office or, if none, Residence:

The

principal business address of each of the Reporting Persons is 3053 Fillmore St, Suite 256, San Francisco, CA 94123.

Item

2(c). Citizenship:

Ionic

is a limited liability company organized under the laws of the State of California. Ionic Management is a limited liability company

organized under the laws of the State of Delaware. Each of Mr. O’Neil and Mr. Coulston is a citizen of the United States.

Item

2(d). Title of Class of Securities:

The

title of the class of securities to which the Statement relates is the Issuer’s common stock, par value $0.001 per share

(“Common Stock”).

Item

2(e). CUSIP Number: 71360T200

| CUSIP

No. 71360T200 |

|

13G |

|

Page 7 of 10 Pages |

Item

3. If This Statement is Filed Pursuant to §§240.13d-1(b) or 240.13d-2(b) or (c), Check Whether the Person Filing is

a:

Not

applicable.

Item

4. Ownership.

The

information required by this item with respect to each Reporting Person is set forth in Rows 5 through 9 and 11 of the cover page

to this Statement and is incorporated herein by reference for each such Reporting Person. The ownership percentages reported are

based on (i) 1,346,334 outstanding shares of the Common Stock, as disclosed in the issuer’s Current Report on Form 8-K,

filed by the issuer with the U.S. Securities and Exchange Commission (the “SEC”) on February 9, 2024 (the “Form

8-K”), (ii) up to 952,380 shares of Common Stock that are issuable upon full exercise of the Series A common stock purchase

warrants held by Ionic (the “Series A Warrants”), (iii) up to 952,380 shares of Common Stock that are issuable

upon full exercise of Series B common stock purchase warrants held by Ionic (the “Series B Warrants”) and (iv)

up to 356,190 shares of Common Stock that are issuable upon exercise of pre-funded common stock purchase warrants held by Ionic

(the “Pre-Funded Warrants”, and collectively with the Series A Warrants and the Series B Warrants, the “Warrants”),

which further exercise thereof in the case of each of the Series A Warrants, Series B Warrants and Pre-Funded Warrants, is subject

to a 9.99% beneficial ownership blocker (the “Blocker”).

Ionic

holds Warrants exercisable for up to an aggregate of 2,260,950 shares of Common Stock, of which 2,244,843 are not deemed beneficially

owned by Ionic as a result of the triggering of the Blocker in each of the Warrants, which in each case prohibits Ionic from exercising

the Warrants into shares of Common Stock if, as a result of such exercise, the holder thereof, together with its affiliates and

any persons acting as a group together with such holder or any of such affiliates, would beneficially own more than 9.99% of the

total number of shares of Common Stock then issued and outstanding immediately after giving effect to any such exercise.

Ionic

is the beneficial owner of 120,000 shares of Common Stock and an additional 16,107 shares of Common Stock issuable upon full exercise

of the Warrants in any combination (the “Shares”). Ionic has the power to dispose of and the power to vote

the Shares beneficially owned by it, which power may be exercised by its manager, Ionic Management. Each of the managers of Ionic

Management, Mr. O’Neil and Mr. Coulston, has shared power to vote and/or dispose of the Shares beneficially owned by Ionic

and Ionic Management. Neither Mr. O’Neil nor Mr. Coulston directly owns the Shares. By reason of the provisions of Rule

13d-3 of the Act, each of Mr. O’Neil and Mr. Coulston may be deemed to beneficially own the Shares which are beneficially

owned by each of Ionic and Ionic Management, and Ionic Management may be deemed to beneficially own the Shares which are beneficially

owned by Ionic.

Item

5. Ownership of Five Percent or Less of a Class.

Not

applicable.

Item

6. Ownership of More than Five Percent on Behalf of Another Person.

Not

applicable.

| CUSIP

No. 71360T200 |

|

13G |

|

Page 8 of 10 Pages |

Item

7. Identification and Classification of the Subsidiary Which Acquired the Security Being Reported on By the Parent Holding Company.

Not

applicable.

Item

8. Identification and Classification of Members of the Group.

Not

applicable.

Item

9. Notice of Dissolution of Group.

Not

applicable.

Item

10. Certification.

By

signing below the Reporting Persons certify that, to the best of each of their knowledge and belief, the securities referred to

above were not acquired and are not held for the purpose of or with the effect of changing or influencing the control of the issuer

of the securities and were not acquired and are not held in connection with or as a participant in any transaction having that

purpose or effect, other than activities solely in connection with a nomination under § 240.14a-11.

| CUSIP

No. 71360T200 |

|

13G |

|

Page 9 of 10 Pages |

After

reasonable inquiry and to the best of my knowledge and belief, I certify that the information set forth in this statement is true,

complete and correct.

| Date: February 12, 2024 |

IONIC VENTURES, LLC |

| |

|

| |

By: Ionic Management, LLC |

| |

its Manager |

| |

|

| |

By: |

/s/ Keith Coulston |

| |

|

Name: Keith Coulston |

| |

|

Title: Manager |

| |

|

| |

IONIC MANAGEMENT, LLC |

| |

|

| |

By: |

/s/

Keith Coulston |

| |

|

Name: Keith Coulston |

| |

|

Title: Manager |

| |

|

|

| |

/s/ Brendan O’Neil |

| |

Brendan O’Neil |

| |

|

|

| |

/s/ Keith Coulston |

| |

Keith Coulston |

| CUSIP

No. 71360T200 |

|

13G |

|

Page 10 of 10 Pages |

EXHIBIT

1

JOINT

FILING AGREEMENT

PURSUANT

TO RULE 13d-1(k)

The

undersigned acknowledge and agree that the foregoing statement on Schedule 13G is filed on behalf of each of the undersigned and

that all subsequent amendments to this statement on Schedule 13G shall be filed on behalf of each of the undersigned without the

necessity of filing additional joint filing agreements. The undersigned acknowledge that each shall be responsible for the timely

filing of such amendments, and for the completeness and accuracy of the information concerning him or it contained herein and

therein, but shall not be responsible for the completeness and accuracy of the information concerning the others, except to the

extent that he or it knows or has reason to believe that such information is inaccurate. The undersigned hereby further agree

that this Joint Filing Agreement may be executed in any number of counterparts, each of which when so executed shall be deemed

to be an original, but all of which counterparts shall together constitute one and the same instrument.

| Date: February 12, 2024 |

IONIC VENTURES, LLC |

| |

|

| |

By: Ionic Management, LLC, |

| |

its Manager |

| |

|

| |

By: |

/s/ Keith Coulston |

| |

|

Name: Keith Coulston |

| |

|

Title: Manager |

| |

|

| |

IONIC MANAGEMENT, LLC |

| |

|

| |

By: |

/s/

Keith Coulston |

| |

|

Name: Keith Coulston |

| |

|

Title: Manager |

| |

|

|

| |

/s/ Brendan O’Neil |

| |

Brendan O’Neil |

| |

|

|

| |

/s/ Keith Coulston |

| |

Keith Coulston |

| |

|

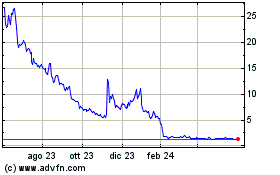

Grafico Azioni Peraso (NASDAQ:PRSO)

Storico

Da Nov 2024 a Dic 2024

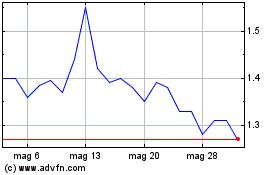

Grafico Azioni Peraso (NASDAQ:PRSO)

Storico

Da Dic 2023 a Dic 2024