Acquisition Expected to Generate Over $10 Million in Operating

Income Post Integration Completion

Provides Market Leadership in Wisconsin and Expands Retail Store

Presence into Minnesota

Shoe Carnival, Inc. (Nasdaq: SCVL) (the “Company”) announced

today that it has acquired Rogan Shoes, Incorporated (“Rogan’s”), a

53-year-old work and family footwear company with 28 store

locations in Wisconsin, Minnesota, and Illinois, for a purchase

price of $45 million, subject to further adjustments, and funded

entirely with cash on hand.

The acquisition is expected to be immediately accretive to the

Company’s fiscal 2024 earnings and generate approximately $84

million in sales and approximately $10 million in operating income,

excluding transaction and integration costs. The Company has an

18-month integration plan in place and expects to capture an

additional $1.5 million in synergies annually and to realize half

of the profit synergies by fiscal 2025 and the full amount by

fiscal 2026. Strategic and cost synergies will be achieved by

integrating Rogan’s into the Shoe Station growth banner and

leveraging the Company’s existing systems and capabilities.

The Rogan’s acquisition advances the Company’s strategy to be

the nation’s leading family footwear retailer. It immediately

positions the Company as the market leader in Wisconsin, and it

establishes a store base in Minnesota, creating additional

expansion opportunities. Following the integration of the

acquisition into the Company’s Shoe Station growth banner, the

combined banner sales are expected to surpass $200 million by

fiscal 2025. With the acquisition, the Company’s store count

increases to an all-time high of 429, keeping the Company on track

to achieve its target to operate over 500 stores in 2028.

Mark Worden, President & Chief Executive Officer of Shoe

Carnival stated, “Our growth strategy is focused on becoming the

nation’s leading family footwear retailer through a combination of

organic growth initiatives and M&A activity that expands our

geographic footprint and customer base. Over the past five decades

the Rogan family has built a brand that is well known and trusted

throughout the state of Wisconsin. As such, they have established a

clear market leadership position in Wisconsin for work and family

footwear, with a compelling assortment, great customer service, and

a highly committed team of employees.”

“I am excited about the new opportunities for Rogan’s as it

becomes part of the Shoe Carnival family,” said Pat Rogan, Chief

Executive Officer of Rogan’s. “We share a strong focus on customers

and employees and this transaction provides the additional scale

and expertise to drive future growth, create efficiencies and

expand profitability with that shared focus as the foundation,” Mr.

Rogan added.

Fiscal 2023 Preliminary Results

For the fiscal year ended February 3, 2024, the Company achieved

the high end of management’s sales expectations with net sales of

$1.176 billion, driven by strong sales growth during the December

holiday period. Diluted earnings per share are in line with

expectations to be between $2.65 - $2.75, with preliminary results

in the mid-range, excluding any transaction costs related to the

Rogan’s acquisition. The Company’s inventory optimization plan over

delivered annual expectations, reducing inventory levels over $40

million, or over 10 percent, compared to the prior year.

The Company ended fiscal 2023 with over $110 million of cash,

cash equivalents and marketable securities on hand, an increase of

over $45 million versus the prior year. Fiscal year 2023 marks the

19th consecutive year the Company ended the year with no debt,

fully funding operations, new store growth, and store remodels

entirely with cash on hand. Additionally, the Company is funding

the Rogan’s acquisition entirely with cash flow generated in fiscal

2023.

The foregoing expected results are preliminary and remain

subject to the completion of normal quarter and year end accounting

procedures and closing adjustments.

The Company will provide its guidance for fiscal 2024 in March

when it reports final audited financial results for fiscal 2023. On

a preliminary basis, the Company currently expects to grow fiscal

2024 total net sales in the low mid-single digit range, driven by

the newly acquired Rogan’s business, Shoe Station banner growth,

e-commerce growth and continued CRM expansion. Partially offsetting

these growth drivers is the comparison to the 53rd week in fiscal

2023 that will not recur in fiscal 2024 and the expectation of a

challenging economic backdrop continuing in early 2024.

Advisors on the Acquisition

KPMG LLP served as financial and due diligence advisor to Shoe

Carnival and Faegre Drinker Biddle & Reath LLP served as its

legal advisor in connection with the Rogan’s acquisition. TM

Capital served as exclusive financial advisor to Rogan’s.

About Shoe Carnival

Shoe Carnival, Inc. is one of the nation’s largest family

footwear retailers, offering a broad assortment of dress, casual

and athletic footwear for men, women and children with emphasis on

national name brands. As of February 13, 2024, the Company operates

429 stores in 36 states and Puerto Rico under its Shoe Carnival and

Shoe Station banners and offers shopping at www.shoecarnival.com

and www.shoestation.com. Headquartered in Evansville, IN, Shoe

Carnival, Inc. trades on The Nasdaq Stock Market LLC under the

symbol SCVL. Press releases and annual reports are available on the

Company's website at www.shoecarnival.com.

About Rogan’s

Founded in 1971 with its first store in Wisconsin, Rogan’s is

one of the nation’s largest independent shoe retailers, with 28

stores in three midwestern states – Wisconsin, Minnesota and

Illinois. With over 600 employees, Rogan’s carries over 100 name

brands and thousands of styles of footwear for men, women,

children, infants and toddlers.

Cautionary Statement Regarding Forward-Looking

Information

As used herein, “we”, “our” and “us” refer to Shoe Carnival,

Inc. This press release contains forward-looking statements, within

the meaning of the Private Securities Litigation Reform Act of

1995, that involve a number of risks and uncertainties, such as

statements about our preliminary financial results for fiscal 2023,

our preliminary sales expectations for fiscal 2024, the expected

impact of the Rogan’s acquisition on our operations, financial

results, markets and strategies, the integration of the Rogan’s

business, our expected future store count and store growth, our

ability to grow the Rogan’s brand, and our ability to achieve the

strategic objectives, synergies, efficiencies and other benefits

expected to be realized from our acquisition of the Rogan’s

business.

A number of factors could cause our actual results, performance,

achievements or industry results to be materially different from

any future results, performance or achievements expressed or

implied by these forward-looking statements. These factors include,

but are not limited to: our ability to effectively integrate

Rogan’s, retain Rogan’s employees, and achieve the expected

operating results, synergies, efficiencies and other benefits from

the Rogan’s acquisition within the expected time frames, or at all;

risks that the Rogan’s acquisition may disrupt our current plans

and operation or negatively impact our relationship with our

vendors and other suppliers; our ability to control costs and meet

our labor needs in a rising wage, inflationary, and/or supply chain

constrained environment; our ability to maintain current

promotional intensity levels; the effects and duration of economic

downturns and unemployment rates; our ability to achieve expected

operating results, synergies, and other benefits from the Shoe

Station acquisition within expected time frames, or at all; the

potential impact of national and international security concerns,

including those caused by war and terrorism, on the retail

environment; general economic conditions in the areas of the

continental United States and Puerto Rico where our stores are

located; changes in the overall retail environment and more

specifically in the apparel and footwear retail sectors; our

ability to generate increased sales; our ability to successfully

navigate the increasing use of online retailers for fashion

purchases and the impact on traffic and transactions in our

physical stores; the success of the open-air shopping centers where

many of our stores are located and its impact on our ability to

attract customers to our stores; our ability to attract customers

to our e-commerce platform and to successfully grow our omnichannel

sales; the effectiveness of our inventory management, including our

ability to manage key merchandise vendor relationships and

direct-to-consumer initiatives; changes in our relationships with

other key suppliers; changes in the political and economic

environments in, the status of trade relations with, and the impact

of changes in trade policies and tariffs impacting, China and other

countries which are the major manufacturers of footwear; the impact

of competition and pricing; our ability to successfully manage and

execute our marketing initiatives and maintain positive brand

perception and recognition; our ability to successfully manage our

current real estate portfolio and leasing obligations; changes in

weather, including patterns impacted by climate change; changes in

consumer buying trends and our ability to identify and respond to

emerging fashion trends; the impact of disruptions in our

distribution or information technology operations; the impact of

natural disasters, public health and political crises, civil

unrest, and other catastrophic events on our operations and the

operations of our suppliers, as well as on consumer confidence and

purchasing in general; the duration and spread of a public health

crisis, such as COVID-19, and the mitigating efforts deployed,

including the effects of government stimulus on consumer spending;

risks associated with the seasonality of the retail industry; the

impact of unauthorized disclosure or misuse of personal and

confidential information about our customers, vendors and

employees, including as a result of a cybersecurity breach; our

ability to successfully execute our business strategy, including

the availability of desirable store locations at acceptable lease

terms, our ability to identify, consummate or effectively integrate

future acquisitions, our ability to implement and adapt to new

technology and systems, our ability to open new stores in a timely

and profitable manner, including our entry into major new markets,

and the availability of sufficient funds to implement our business

plans; higher than anticipated costs associated with the closing of

underperforming stores; the inability of manufacturers to deliver

products in a timely manner; an increase in the cost, or a

disruption in the flow, of imported goods; the impact of regulatory

changes in the United States, including minimum wage laws and

regulations, and the countries where our manufacturers are located;

the resolution of litigation or regulatory proceedings in which we

are or may become involved; continued volatility and disruption in

the capital and credit markets; future stock repurchases under our

stock repurchase program and future dividend payments.; and other

factors described in the Company’s SEC filings, including the

Company’s latest Annual Report on Form 10-K. In addition, these

forward-looking statements necessarily depend upon assumptions,

estimates and dates that may be incorrect or imprecise and involve

known and unknown risks, uncertainties and other factors.

Accordingly, any forward-looking statements included in this press

release do not purport to be predictions of future events or

circumstances and may not be realized. Forward-looking statements

can be identified by, among other things, the use of

forward-looking terms such as “believes,” “expects,” “aims,” “on

track,” “may,” “will,” “should,” “seeks,” “pro forma,”

“anticipates,” “intends” or the negative of any of these terms, or

comparable terminology, or by discussions of strategy or

intentions. Given these uncertainties, we caution investors not to

place undue reliance on these forward-looking statements, which

speak only as of the date hereof. We disclaim any obligation to

update any of these factors or to publicly announce any revisions

to the forward-looking statements contained in this press release

to reflect future events or developments.

View source

version on businesswire.com: https://www.businesswire.com/news/home/20240213733559/en/

Steve R. Alexander Shoe Carnival – Vice President Investor

Relations (812) 306-6176

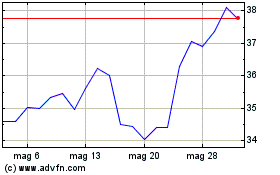

Grafico Azioni Shoe Carnival (NASDAQ:SCVL)

Storico

Da Ott 2024 a Nov 2024

Grafico Azioni Shoe Carnival (NASDAQ:SCVL)

Storico

Da Nov 2023 a Nov 2024