false

0001090009

0001090009

2024-01-18

2024-01-18

0001090009

dei:FormerAddressMember

2024-01-18

2024-01-18

iso4217:USD

xbrli:shares

iso4217:USD

xbrli:shares

UNITED STATES

SECURITIES AND EXCHANGE COMMISSION

WASHINGTON, DC 20549

FORM 8-K

CURRENT REPORT PURSUANT

TO SECTION 13 OR 15(D) OF THE

SECURITIES EXCHANGE ACT OF 1934

Date of report (Date of earliest event reported)

January 18, 2024

| |

Southern First Bancshares, Inc. |

|

| |

(Exact name of registrant as specified in its charter) |

|

| |

South Carolina |

|

| |

(State or other jurisdiction of incorporation) |

|

| 000-27719 |

58-2459561 |

| (Commission File Number) |

(IRS Employer Identification No.) |

| |

| 6 Verdae Boulevard, Greenville, SC |

29607 |

| (Address of principal executive offices) |

(Zip Code) |

| |

(864) 679-9000 |

|

| |

(Registrant's telephone number, including area code) |

|

| |

|

|

| |

100 Verdae Boulevard, Suite 100, Greenville, SC |

|

| |

(Former name or former address, if changed since last report) |

|

Check the appropriate

box below if the Form 8-K filing is intended to simultaneously satisfy the filing obligation of

the registrant under any of the

following provisions (see General Instruction A.2. below):

| ☐ | Written

communications pursuant to Rule 425 under the Securities Act (17 CFR 230.425) |

| ☐ | Soliciting

material pursuant to Rule 14a-12 under the Exchange Act (17 CFR 240.14a-12) |

| ☐ | Pre-commencement

communications pursuant to Rule 14d-2(b) under the Exchange Act (17CFR 240.14d-2(b)) |

| ☐ | Pre-commencement

communications pursuant to Rule 13e-4(c) under the Exchange Act (17 CFR 240.13e-4(c)) |

Securities registered pursuant to Section 12(b) of the Act:

| Title of each class |

Trading Symbol(s) |

Name of each exchange on which registered |

| Common Stock |

SFST |

The Nasdaq Global Market |

Indicate by check mark whether the registrant is an emerging growth company

as defined in Rule 405 of the Securities Act of 1933 (§230.405 of this chapter) or Rule 12b-2 of the Securities Exchange Act of 1934

(§240.12b-2 of this chapter).

Emerging growth

company ¨

If

an emerging growth company, indicate by check mark if the registrant has elected not to use the extended transition period for complying

with any new or revised financial accounting standards provided pursuant to Section 13(a) of the Exchange Act. ¨

ITEM 2.02. Results of Operations and Financial

Condition.

On January 18, 2024, Southern First Bancshares, Inc.,

holding company for Southern First Bank, issued a press release announcing its financial results for the period ended December 31, 2023.

The press release is furnished as Exhibit 99.1 to this Current Report on Form 8-K.

ITEM 7.01 Regulation FD Disclosure.

A copy of a slide presentation

also highlighting Southern First Bancshares, Inc. financial results for the period ended December 31, 2023 is furnished as Exhibit 99.2

to this Current Report on Form 8-K. The slide presentation also will be available on our website, www.southernfirst.com, under

the “Investor Relations” section.

ITEM 9.01. Financial Statements and Exhibits.

| (d) Exhibits |

The following exhibit index lists the exhibits that are either filed or furnished with the Current Report on Form 8-K. |

EXHIBIT INDEX

SIGNATURES

Pursuant to the requirements of the Securities Exchange Act of 1934, the

Registrant has duly caused this report to be signed on its behalf by the undersigned hereunto duly authorized.

| |

|

SOUTHERN FIRST BANCSHARES, INC. |

| |

|

|

| |

|

By: |

/s/ D.

Andrew Borrmann |

| |

|

Name: |

D. Andrew Borrmann |

| |

|

Title: |

Chief Financial Officer |

January 18, 2024

Exhibit 99.1

Southern First Reports Results for 2023

Greenville, South Carolina, January 18, 2024

– Southern First Bancshares, Inc. (NASDAQ: SFST), holding company for Southern First Bank, today announced its financial

results for the three and twelve months ended December 31, 2023.

“We are pleased with our fourth quarter results

as we saw further growth in book value, stability in net interest margin and strong credit quality,” stated Art Seaver, the Company’s

Chief Executive Officer. “We are beginning 2024 with excellent momentum and a proven ability to grow organic and high quality client

relationships in every market we serve.”

2023 Fourth Quarter

Highlights

| · | Net

income was $4.2 million and diluted earnings per common share were $0.51 for Q4 2023 |

| · | Book

value per common share increased to $38.63 at Q4 2023, or 5%, over Q4 2022 |

| · | Total

loans increased 5% (annualized) to $3.6 billion at Q4 2023, compared to Q3 2023 and increased

10%, from $3.3 billion at Q4 2022 |

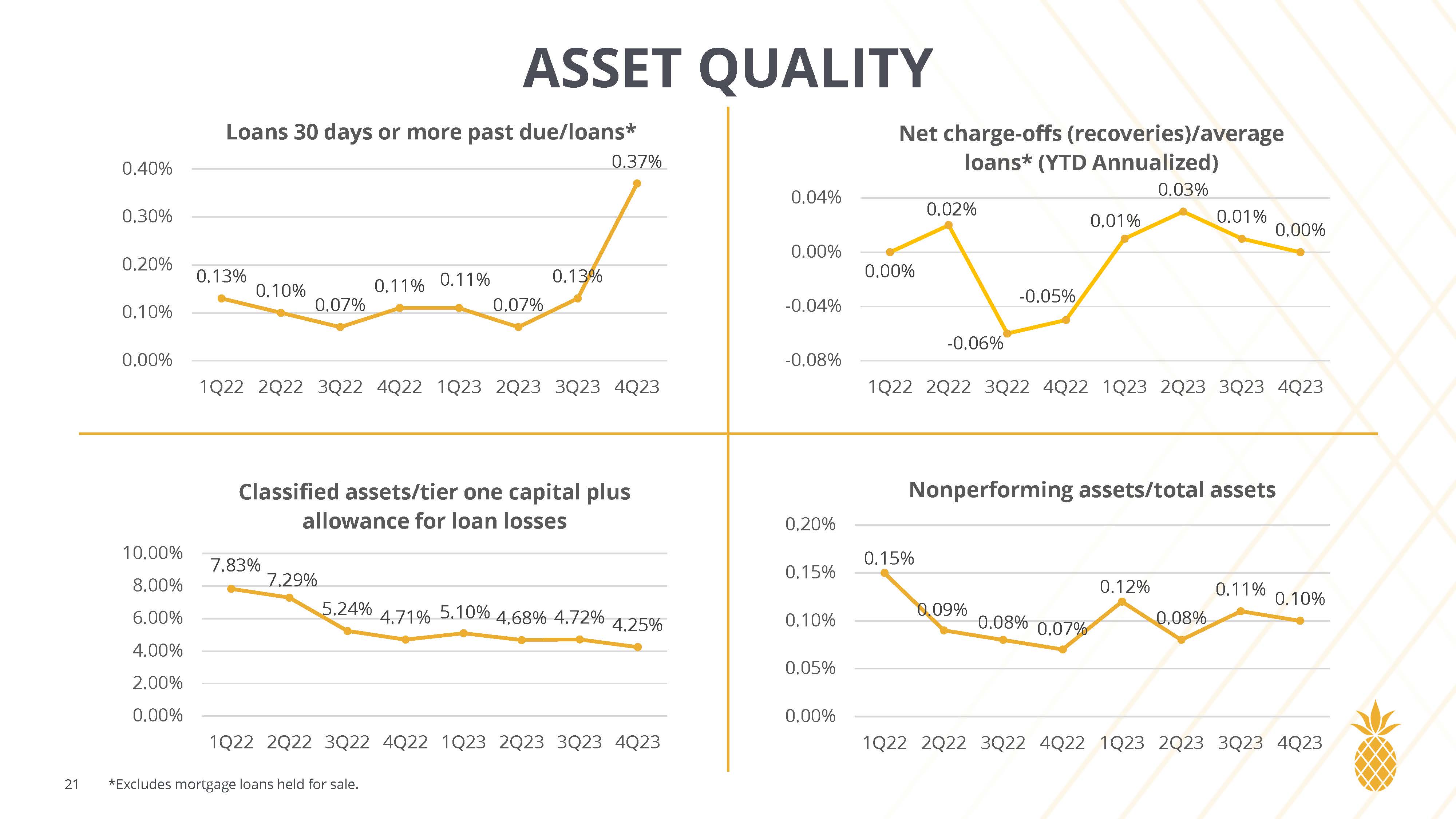

| · | Credit

quality remains strong with nonperforming assets to total assets of 0.10% and past due loans

to total loans of 0.37% at Q4 2023 |

| · | Total

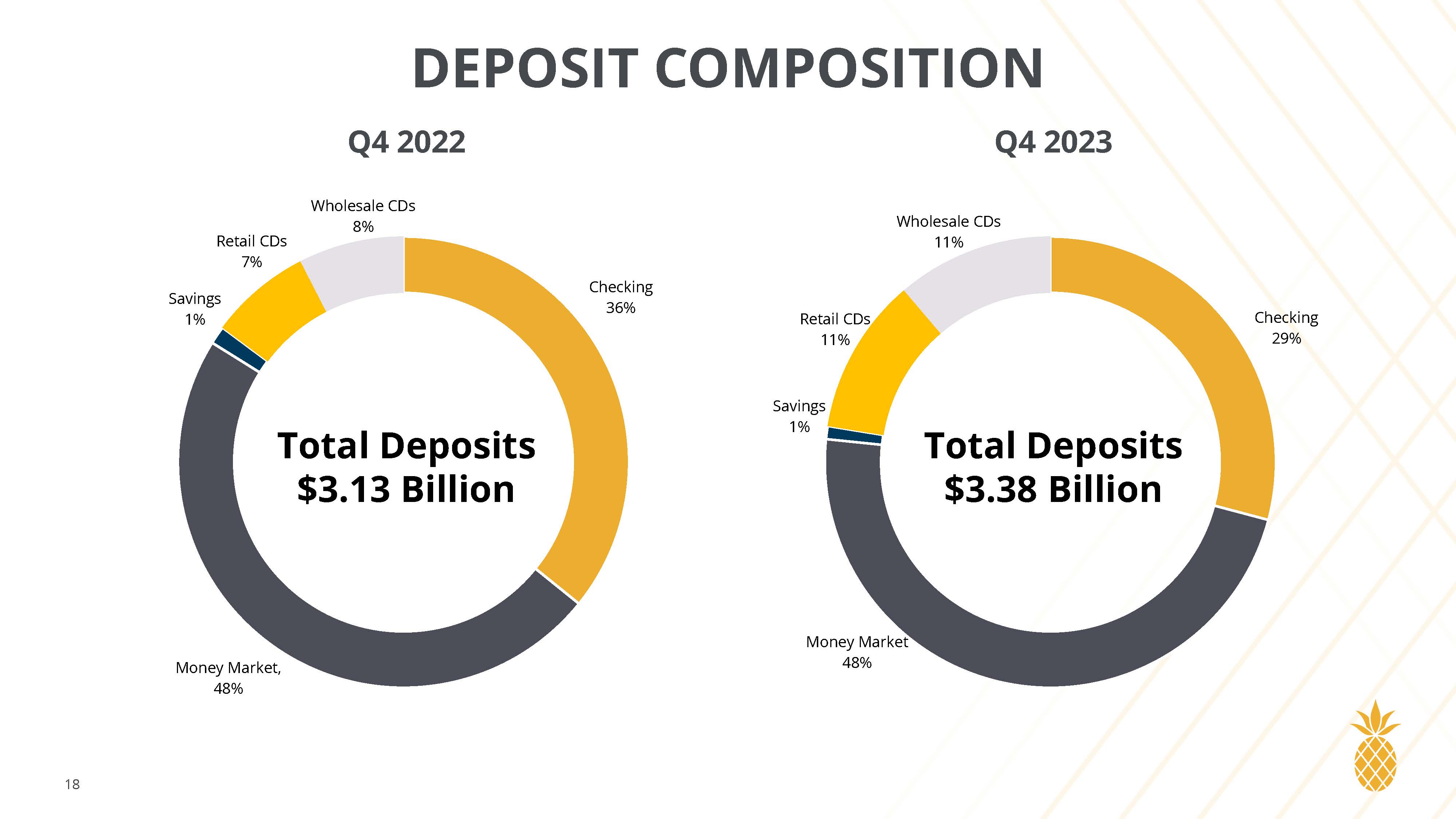

deposits increased to $3.4 billion at Q4 2023, compared to $3.3 billion at Q3 2023 and increased

8% from Q4 2022 |

| · | Net

interest margin was 1.92% for Q4 2023, compared to 1.97% for Q3 2023 and 2.88% for Q4 2022 |

| |

|

Quarter Ended |

| |

|

December 31 |

September 30 |

June 30 |

March 31 |

December 31 |

| |

|

2023 |

2023 |

2023 |

2023 |

2022 |

| Earnings ($ in thousands, except per share data): |

|

|

|

|

|

|

| Net income available to common shareholders |

$ |

4,167 |

4,098 |

2,458 |

2,703 |

5,492 |

| Earnings per common share, diluted |

|

0.51 |

0.51 |

0.31 |

0.33 |

0.68 |

| Total revenue(1) |

|

21,390 |

22,094 |

21,561 |

22,468 |

25,826 |

| Net interest margin (tax-equivalent)(2) |

|

1.92% |

1.97% |

2.05% |

2.36% |

2.88% |

| Return on average assets(3) |

|

0.40% |

0.40% |

0.26% |

0.30% |

0.63% |

| Return on average equity(3) |

|

5.39% |

5.35% |

3.27% |

3.67% |

7.44% |

| Efficiency ratio(4) |

|

79.61% |

78.31% |

80.67% |

76.12% |

63.55% |

| Noninterest expense to average assets (3) |

|

1.64% |

1.69% |

1.82% |

1.89% |

1.87% |

| Balance Sheet ($ in thousands): |

|

|

|

|

|

|

| Total loans(5) |

$ |

3,602,627 |

3,553,632 |

3,537,616 |

3,417,945 |

3,273,363 |

| Total deposits |

|

3,379,564 |

3,347,771 |

3,433,018 |

3,426,774 |

3,133,864 |

| Core deposits(6) |

|

2,811,499 |

2,866,574 |

2,880,507 |

2,946,567 |

2,759,112 |

| Total assets |

|

4,055,789 |

4,019,957 |

4,002,107 |

3,938,140 |

3,691,981 |

| Book value per common share |

|

38.63 |

37.57 |

37.42 |

37.16 |

36.76 |

| Loans to deposits |

|

106.60% |

106.15% |

103.05% |

99.74% |

104.45% |

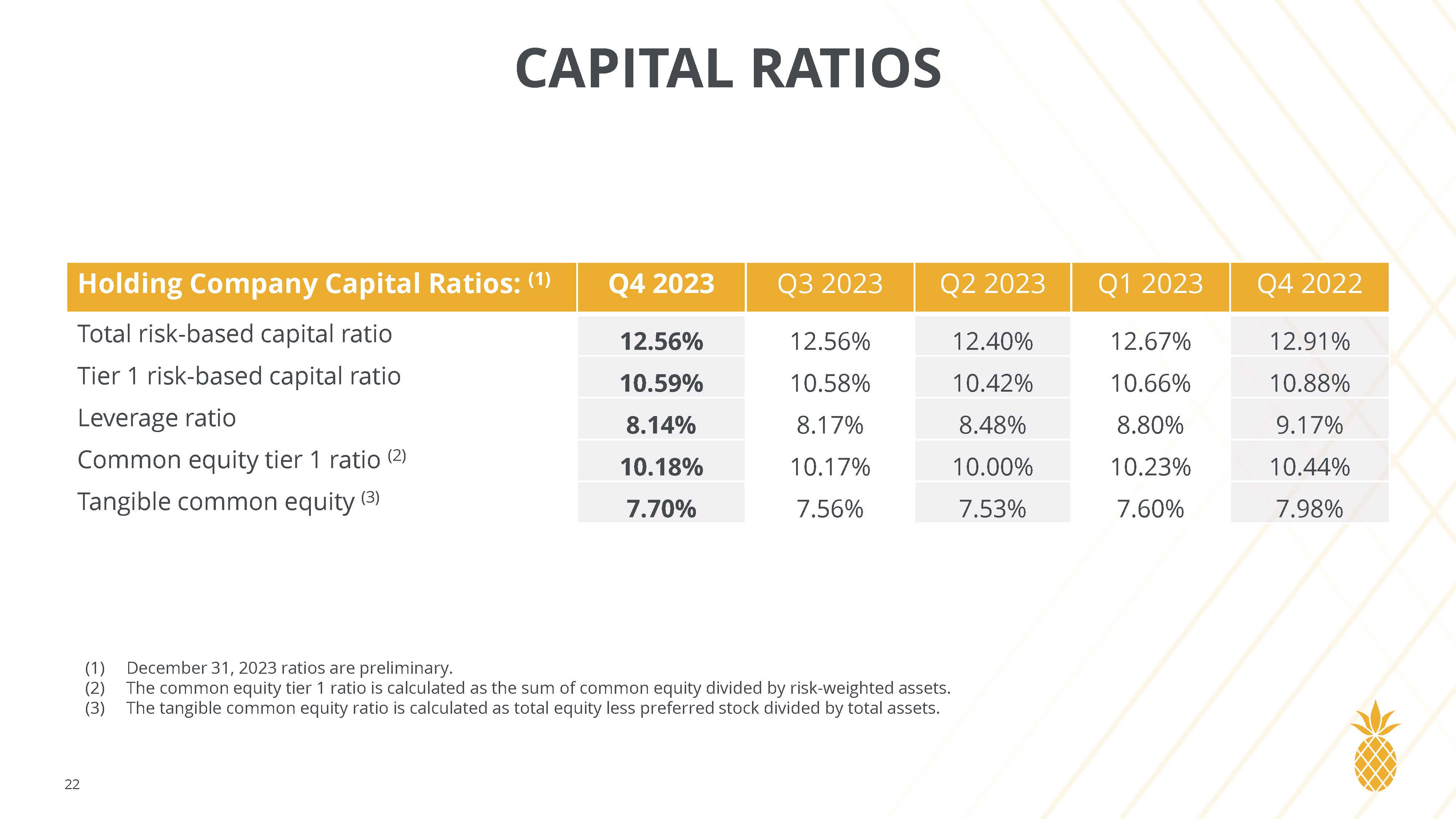

| Holding Company Capital Ratios(7): |

|

|

|

|

|

|

| Total risk-based capital ratio |

|

12.56% |

12.56% |

12.40% |

12.67% |

12.91% |

| Tier 1 risk-based capital ratio |

|

10.59% |

10.58% |

10.42% |

10.66% |

10.88% |

| Leverage ratio |

|

8.14% |

8.17% |

8.48% |

8.80% |

9.17% |

| Common equity tier 1 ratio(8) |

|

10.18% |

10.17% |

10.00% |

10.23% |

10.44% |

| Tangible common equity(9) |

|

7.70% |

7.56% |

7.53% |

7.60% |

7.98% |

| Asset Quality Ratios: |

|

|

|

|

|

|

| Nonperforming assets/ total assets |

|

0.10% |

0.11% |

0.08% |

0.12% |

0.07% |

| Classified assets/tier one capital plus allowance for credit losses |

|

4.25% |

4.72% |

4.68% |

5.10% |

4.71% |

| Loans 30 days or more past due/ loans(5) |

|

0.37% |

0.13% |

0.07% |

0.11% |

0.11% |

| Net charge-offs (recoveries)/average loans(5) (YTD annualized) |

|

0.00% |

0.01% |

0.03% |

0.01% |

(0.05%) |

| Allowance for credit losses/loans(5) |

|

1.13% |

1.16% |

1.16% |

1.18% |

1.18% |

| Allowance for credit losses/nonaccrual loans |

|

1,026.58% |

953.25% |

1,363.11% |

854.33% |

1,470.74% |

[Footnotes to table located on page 6]

income statements

– Unaudited

| |

|

|

|

|

| |

|

Quarter Ended |

|

Twelve Months Ended |

| |

|

Dec 31 |

Sept 30 |

Jun 30 |

Mar 31 |

Dec 31 |

|

December 31 |

| (in thousands, except per share data) |

|

2023 |

2023 |

2023 |

2023 |

2022 |

|

2023 |

2022 |

| Interest income |

|

|

|

|

|

|

|

|

|

| Loans |

$ |

44,758 |

43,542 |

41,089 |

36,748 |

33,939 |

|

166,137 |

114,233 |

| Investment securities |

|

1,674 |

1,470 |

706 |

613 |

562 |

|

4,463 |

1,990 |

| Federal funds sold |

|

2,703 |

2,435 |

891 |

969 |

525 |

|

6,998 |

1,439 |

| Total interest income |

|

49,135 |

47,447 |

42,686 |

38,330 |

35,026 |

|

177,598 |

117,662 |

| Interest expense |

|

|

|

|

|

|

|

|

|

| Deposits |

|

27,127 |

25,130 |

25,937 |

17,179 |

10,329 |

|

91,373 |

18,102 |

| Borrowings |

|

2,948 |

2,972 |

1,924 |

727 |

578 |

|

8,571 |

1,939 |

| Total interest expense |

|

30,075 |

28,102 |

23,861 |

17,906 |

10,907 |

|

99,944 |

20,041 |

| Net interest income |

|

19,060 |

19,345 |

18,825 |

20,424 |

24,119 |

|

77,654 |

97,621 |

| Provision (reversal) for credit losses |

|

(975) |

(500) |

910 |

1,825 |

2,325 |

|

1,260 |

6,155 |

| Net interest income after provision for credit losses |

|

20,035 |

19,845 |

17,915 |

18,599 |

21,794 |

|

76,394 |

91,466 |

| Noninterest income |

|

|

|

|

|

|

|

|

|

| Mortgage banking income |

|

868 |

1,208 |

1,337 |

622 |

291 |

|

4,036 |

4,198 |

| Service fees on deposit accounts |

|

371 |

356 |

331 |

325 |

187 |

|

1,382 |

782 |

| ATM and debit card income |

|

565 |

588 |

536 |

555 |

575 |

|

2,245 |

2,225 |

| Income from bank owned life insurance |

|

361 |

349 |

338 |

332 |

344 |

|

1,379 |

1,289 |

| Loss on disposal of fixed assets |

|

- |

- |

- |

- |

- |

|

- |

(394) |

| Other income |

|

165 |

248 |

194 |

210 |

310 |

|

818 |

1,480 |

| Total noninterest income |

|

2,330 |

2,749 |

2,736 |

2,044 |

1,707 |

|

9,860 |

9,580 |

| Noninterest expense |

|

|

|

|

|

|

|

|

|

| Compensation and benefits |

|

9,401 |

10,231 |

10,287 |

10,356 |

9,576 |

|

40,275 |

38,790 |

| Occupancy |

|

2,718 |

2,562 |

2,518 |

2,457 |

2,666 |

|

10,255 |

9,105 |

| Other real estate owned expenses |

|

- |

- |

- |

- |

- |

|

- |

- |

| Outside service and data processing costs |

|

2,000 |

1,744 |

1,705 |

1,629 |

1,521 |

|

7,078 |

6,112 |

| Insurance |

|

937 |

1,243 |

897 |

689 |

551 |

|

3,766 |

1,686 |

| Professional fees |

|

581 |

504 |

751 |

660 |

788 |

|

2,496 |

2,635 |

| Marketing |

|

364 |

293 |

335 |

366 |

282 |

|

1,357 |

1,216 |

| Other |

|

1,027 |

725 |

900 |

947 |

1,029 |

|

3,600 |

3,389 |

| Total noninterest expenses |

|

17,028 |

17,302 |

17,393 |

17,104 |

16,413 |

|

68,827 |

62,933 |

| Income before provision for income taxes |

|

5,337 |

5,293 |

3,258 |

3,539 |

7,088 |

|

17,427 |

38,113 |

| Income tax expense |

|

1,170 |

1,195 |

800 |

836 |

1,596 |

|

4,001 |

8,998 |

| Net income available to common shareholders |

$ |

4,167 |

4,098 |

2,458 |

2,703 |

5,492 |

|

13,426 |

29,115 |

| |

|

|

|

|

|

|

|

|

|

| Earnings per common share – Basic |

$ |

0.51 |

0.51 |

0.31 |

0.34 |

0.69 |

|

1.67 |

3.66 |

| Earnings per common share – Diluted |

|

0.51 |

0.51 |

0.31 |

0.33 |

0.68 |

|

1.66 |

3.61 |

| Basic weighted average common shares |

|

8,056 |

8,053 |

8,051 |

8,026 |

7,971 |

|

8,047 |

7,958 |

| Diluted weighted average common shares |

|

8,080 |

8,072 |

8,069 |

8,092 |

8,071 |

|

8,078 |

8,072 |

[Footnotes to table located on page 6]

Net income for the fourth quarter of 2023 was $4.2 million,

or $0.51 per diluted share, a $69 thousand increase from the third quarter of 2023 and a $1.3 million decrease from the fourth quarter

of 2022. Net interest income decreased $285 thousand during the fourth quarter of 2023, compared to the third quarter of 2023, and decreased

$5.1 million, compared to the fourth quarter of 2022. The decrease in net interest income from the prior quarter and prior year was primarily

driven by an increase in interest expense on deposit accounts as deposit costs continued to reprice in relation to the Federal Reserve’s

525-basis point interest rate hikes over the past two years.

There was a reversal of the provision for credit losses

of $975 thousand for the fourth quarter of 2023, compared to a reversal of $500 thousand during the third quarter of 2023 and a provision

of $2.3 million during the fourth quarter of 2022. The provision reversal during the fourth quarter of 2023 includes a $640 thousand reversal

of the provision for credit losses and a $335 thousand reversal of the reserve for unfunded commitments. The reversal of the provision

for credit losses was driven by lower expected loss rates, while the reversal of the reserve for unfunded commitments was driven by a

decrease in the balance of unfunded commitments at December 31, 2023, compared to the previous quarter and year.

Noninterest income was $2.3 million for the fourth quarter

of 2023, compared to $2.7 million for the third quarter of 2023, and $1.7 million for the fourth quarter of 2022. Mortgage banking income

continues to be the largest component of our noninterest income at $868 thousand for the fourth quarter of 2023, $1.2 million for the

third quarter of 2023, and $291 thousand for the fourth quarter of 2022.

Noninterest expense for the fourth quarter of 2023 was

$17.0 million, a $274 thousand decrease from the third quarter of 2023, and a $615 thousand increase from the fourth quarter of 2022.

The decrease in noninterest expense from the previous quarter was driven by a decrease in compensation and benefits expense, while the

increase from the prior year related primarily to increases in outside service and data processing costs and insurance expenses. The decrease

in compensation and benefits expenses during the current quarter was due primarily to lower bonus and commissions expenses, combined with

a decrease in various benefit-related expenses. In addition, the increase in outside service and data processing costs from the prior

quarter and prior year was driven by an increase in software licensing and maintenance costs, while insurance costs increased over the

prior year due to higher FDIC insurance premiums.

Our effective tax rate was 21.9% for the fourth quarter

of 2023, 22.6% for the third quarter of 2023, and 22.5% for the fourth quarter of 2022. The lower tax rate in the fourth quarter of 2023

as compared to the prior quarter and prior year relates primarily to the effect of equity compensation transactions and return to provision

differences on our tax rate during the quarter.

Net interest income and margin

- Unaudited

| |

|

|

| |

|

For

the Three Months Ended |

| |

December

31, 2023 |

September

30, 2023 |

December

31,2022 |

| (dollars

in thousands) |

Average

Balance |

Income/

Expense |

Yield/

Rate(3) |

Average

Balance |

Income/

Expense |

Yield/

Rate(3) |

Average

Balance |

Income/

Expense |

Yield/

Rate(3) |

| Interest-earning

assets |

|

|

|

|

|

|

|

|

|

| Federal

funds sold and interest-bearing deposits |

$ |

197,482 |

$ |

2,703 |

5.43% |

$ |

181,784 |

$ |

2,435 |

5.31% |

$ |

60,176 |

$ |

525 |

3.46% |

| Investment

securities, taxable |

151,969 |

1,632 |

4.26% |

148,239 |

1,429 |

3.82% |

86,594 |

515 |

2.36% |

| Investment

securities, nontaxable(2) |

7,831 |

55 |

2.76% |

7,799 |

55 |

2.77% |

9,987 |

61 |

2.42% |

| Loans(10) |

3,586,863 |

44,758 |

4.95% |

3,554,478 |

43,542 |

4.86% |

3,165,061 |

33,939 |

4.25% |

| Total

interest-earning assets |

3,944,145 |

49,148 |

4.94% |

3,892,300 |

47,461 |

4.84% |

3,321,818 |

35,040 |

4.18% |

| Noninterest-earning

assets |

174,717 |

|

|

159,103 |

|

|

162,924 |

|

|

| Total

assets |

$ |

4,118,862 |

|

|

$ |

4,051,403 |

|

|

$ |

3,484,742 |

|

|

| Interest-bearing

liabilities |

|

|

|

|

|

|

|

|

|

| NOW

accounts |

$ |

301,424 |

656 |

0.86% |

$ |

297,028 |

620 |

0.83% |

$ |

343,541 |

379 |

0.44% |

| Savings

& money market |

1,697,144 |

17,042 |

3.98% |

1,748,638 |

16,908 |

3.84% |

1,529,532 |

7,657 |

1.99% |

| Time

deposits |

759,839 |

9,429 |

4.92% |

648,949 |

7,602 |

4.65% |

405,907 |

2,293 |

2.24% |

| Total

interest-bearing deposits |

2,758,407 |

27,127 |

3.90% |

2,694,615 |

25,130 |

3.70% |

2,278,980 |

10,329 |

1.80% |

| FHLB

advances and other borrowings |

257,880 |

2,387 |

3.67% |

264,141 |

2,414 |

3.63% |

7,594 |

81 |

4.23% |

| Subordinated

debentures |

36,305 |

561 |

6.13% |

36,278 |

558 |

6.10% |

36,197 |

497 |

5.45% |

| Total

interest-bearing liabilities |

3,052,592 |

30,075 |

3.91% |

2,995,034 |

28,102 |

3.72% |

2,322,771 |

10,907 |

1.86% |

| Noninterest-bearing

liabilities |

759,413 |

|

|

752,433 |

|

|

869,314 |

|

|

| Shareholders’

equity |

306,857 |

|

|

303,936 |

|

|

292,657 |

|

|

| Total

liabilities and shareholders’ equity |

$ |

4,118,862 |

|

|

$ |

4,051,403 |

|

|

$ |

3,484,742 |

|

|

| Net

interest spread |

|

|

1.04% |

|

|

1.12% |

|

|

2.32% |

| Net

interest income (tax equivalent) / margin |

|

$ |

19,073 |

1.92% |

|

$ |

19,359 |

1.97% |

|

$ |

24,133 |

2.88% |

| Less:tax-equivalent

adjustment(2) |

|

13 |

|

|

14 |

|

|

14 |

|

| Net

interest income |

|

$ |

19,060 |

|

|

$ |

19,345 |

|

|

$ |

24,119 |

|

[Footnotes to table located on page 6]

Net interest income was $19.1 million for the fourth

quarter of 2023, a $285 thousand decrease from the third quarter of 2023, driven by a $2.0 million increase in interest expense, partially

offset by a $1.7 million increase in interest income, on a tax-equivalent basis. The increase in interest expense was driven by a $57.6

million increase in average interest-bearing liabilities at an average cost of 3.91%, a 19-basis points increase over the previous quarter,

partially offset by a $51.8 million increase in average interest-earning assets at an average rate of 4.94%, an increase of 10-basis points

from the third quarter of 2023. In comparison to the fourth quarter of 2022, net interest income decreased $5.1 million, resulting primarily

from a $729.8 million

increase in average interest-bearing liabilities during

the 12 months ended December 31, 2023, combined with a 205-basis point increase in the average cost. Our net interest margin, on a tax-equivalent

basis, was 1.92% for the fourth quarter of 2023, a 5-basis point decrease from 1.97% for the third quarter of 2023 and a 96-basis point

decrease from 2.88% for the fourth quarter of 2022. As a result of the significant increase in the federal funds rate over the past two

years, the rates on our non-maturity deposits have increased and continue to increase more quickly than the yield on our interest-earning

assets, resulting in the lower net interest margin during the fourth quarter of 2023.

Balance sheets - Unaudited

| |

|

|

|

| |

|

Ending Balance |

| |

|

December 31 |

September 30 |

June 30 |

March 31 |

December 31 |

| (in thousands, except per share data) |

|

2023 |

2023 |

2023 |

2023 |

2022 |

| Assets |

|

|

|

|

|

|

| Cash and cash equivalents: |

|

|

|

|

|

|

| Cash and due from banks |

$ |

28,020 |

17,395 |

24,742 |

22,213 |

18,788 |

| Federal funds sold |

|

119,349 |

127,714 |

170,145 |

242,642 |

101,277 |

| Interest-bearing deposits with banks |

|

8,801 |

7,283 |

10,183 |

7,350 |

50,809 |

| Total cash and cash equivalents |

|

156,170 |

152,392 |

205,070 |

272,205 |

170,874 |

| Investment securities: |

|

|

|

|

|

|

| Investment securities available for sale |

|

134,702 |

144,035 |

91,548 |

94,036 |

93,347 |

| Other investments |

|

19,939 |

19,600 |

12,550 |

10,097 |

10,833 |

| Total investment securities |

|

154,641 |

163,635 |

104,098 |

104,133 |

104,180 |

| Mortgage loans held for sale |

|

7,194 |

7,117 |

15,781 |

6,979 |

3,917 |

| Loans (5) |

|

3,602,627 |

3,553,632 |

3,537,616 |

3,417,945 |

3,273,363 |

| Less allowance for credit losses |

|

(40,682) |

(41,131) |

(41,105) |

(40,435) |

(38,639) |

| Loans, net |

|

3,561,945 |

3,512,501 |

3,496,511 |

3,377,510 |

3,234,724 |

| Bank owned life insurance |

|

52,501 |

52,140 |

51,791 |

51,453 |

51,122 |

| Property and equipment, net |

|

94,301 |

95,743 |

96,964 |

97,806 |

99,183 |

| Deferred income taxes |

|

12,200 |

13,078 |

12,356 |

12,087 |

12,522 |

| Other assets |

|

16,837 |

23,351 |

19,536 |

15,967 |

15,459 |

| Total assets |

$ |

4,055,789 |

4,019,957 |

4,002,107 |

3,938,140 |

3,691,981 |

| Liabilities |

|

|

|

|

|

|

| Deposits |

$ |

3,379,564 |

3,347,771 |

3,433,018 |

3,426,774 |

3,133,864 |

| FHLB Advances |

|

275,000 |

275,000 |

180,000 |

125,000 |

175,000 |

| Subordinated debentures |

|

36,322 |

36,295 |

36,268 |

36,241 |

36,214 |

| Other liabilities |

|

52,436 |

56,993 |

51,307 |

50,775 |

52,391 |

| Total liabilities |

|

3,743,322 |

3,716,059 |

3,700,593 |

3,638,790 |

3,397,469 |

| Shareholders’ equity |

|

|

|

|

|

|

| Preferred stock - $.01 par value; 10,000,000 shares authorized |

|

- |

- |

- |

- |

- |

| Common Stock - $.01 par value; 10,000,000 shares authorized |

|

81 |

81 |

81 |

80 |

80 |

| Nonvested restricted stock |

|

(3,596) |

(4,065) |

(4,051) |

(4,462) |

(3,306) |

| Additional paid-in capital |

|

121,777 |

121,757 |

120,912 |

120,683 |

119,027 |

| Accumulated other comprehensive loss |

|

(11,342) |

(15,255) |

(12,710) |

(11,775) |

(13,410) |

| Retained earnings |

|

205,547 |

201,380 |

197,282 |

194,824 |

192,121 |

| Total shareholders’ equity |

|

312,467 |

303,898 |

301,514 |

299,350 |

294,512 |

| Total liabilities and shareholders’ equity |

$ |

4,055,789 |

4,019,957 |

4,002,107 |

3,938,140 |

3,691,981 |

| Common Stock |

|

|

|

|

|

|

| Book value per common share |

$ |

38.63 |

37.57 |

37.42 |

37.16 |

36.76 |

| Stock price: |

|

|

|

|

|

|

| High |

|

37.15 |

30.18 |

31.34 |

45.05 |

49.50 |

| Low |

|

25.16 |

24.22 |

21.33 |

30.70 |

41.46 |

| Period end |

|

37.10 |

26.94 |

24.75 |

30.70 |

45.75 |

| Common shares outstanding |

|

8,088 |

8,089 |

8,058 |

8,048 |

8,011 |

[Footnotes to table located on page 6]

Asset quality

measures - Unaudited

| |

|

Quarter Ended |

| |

|

December 31 |

September 30 |

June 30 |

March 31 |

December 31 |

| (dollars in thousands) |

|

2023 |

2023 |

2023 |

2023 |

2022 |

| Nonperforming Assets |

|

|

|

|

|

|

| Commercial |

|

|

|

|

|

|

| Non-owner occupied RE |

$ |

1,423 |

1,615 |

754 |

1,384 |

247 |

| Commercial business |

|

319 |

404 |

137 |

1,196 |

182 |

| Consumer |

|

|

|

|

|

|

| Real estate |

|

985 |

1,228 |

1,053 |

1,075 |

1,099 |

| Home equity |

|

1,236 |

1,068 |

1,072 |

1,078 |

1,099 |

| Total nonaccrual loans |

|

3,963 |

4,315 |

3,016 |

4,733 |

2,627 |

| Other real estate owned |

|

- |

- |

- |

- |

- |

| Total nonperforming assets |

$ |

3,963 |

4,315 |

3,016 |

4,733 |

2,627 |

| Nonperforming assets as a percentage of: |

|

|

|

|

|

|

| Total assets |

|

0.10% |

0.11% |

0.08% |

0.12% |

0.07% |

| Total loans |

|

0.11% |

0.12% |

0.09% |

0.14% |

0.08% |

| Classified assets/tier 1 capital plus allowance for credit losses |

|

4.25% |

4.72% |

4.68% |

5.10% |

4.71% |

| |

|

Quarter Ended |

| |

|

December 31 |

September 30 |

June 30 |

March 31 |

December 31 |

| (dollars in thousands) |

|

2023 |

2023 |

2023 |

2023 |

2022 |

| Allowance for Credit Losses |

|

|

|

|

|

|

| Balance, beginning of period |

$ |

41,131 |

41,105 |

40,435 |

38,639 |

36,317 |

| Loans charged-off |

|

(119) |

(42) |

(440) |

(161) |

- |

| Recoveries of loans previously charged-off |

|

310 |

168 |

15 |

102 |

22 |

| Net loans (charged-off) recovered |

|

191 |

126 |

(425) |

(59) |

22 |

| Provision for (reversal of) credit losses |

|

(640) |

(100) |

1,095 |

1,855 |

2,300 |

| Balance, end of period |

$ |

40,682 |

41,131 |

41,105 |

40,435 |

38,639 |

| Allowance for credit losses to gross loans |

|

1.13% |

1.16% |

1.16% |

1.18% |

1.18% |

| Allowance for credit losses to nonaccrual loans |

|

1,026.58% |

953.25% |

1,363.11% |

854.33% |

1,470.74% |

| Net charge-offs (recoveries) to average loans QTD (annualized) |

|

(0.02%) |

(0.01%) |

0.05% |

0.01% |

0.00% |

Total nonperforming assets decreased by $352 thousand

during the fourth quarter of 2023, and represented 0.10% of total assets, a decrease compared to 0.11% for the third quarter of 2023 and

an increase compared to 0.07% for the fourth quarter of 2022. While we added two new relationships to nonaccrual during the fourth quarter

of 2023, there were also three relationships either returned to accrual status or paid off during the quarter. In addition, our classified

asset ratio decreased to 4.25% for the fourth quarter of 2023 from 4.72% in the third quarter of 2023 and from 4.71% in the fourth quarter

of 2022.

At December 31, 2023, the allowance for credit losses

was $40.7 million, or 1.13% of total loans, compared to $41.1 million, or 1.16% of total loans at September 30, 2023, and $38.6 million,

or 1.18% of total loans, at December 31, 2022. We had net recoveries of $191 thousand, or 0.02% annualized, for the fourth quarter of

2023, compared to net recoveries of $126 thousand for the third quarter of 2023 and net recoveries of $22 thousand for the fourth quarter

of 2022. There was a reversal of the provision for credit losses of $640 thousand for the fourth quarter of 2023, compared to a reversal

of $100 thousand for the third quarter of 2023 and a provision of $2.3 million for the fourth quarter of 2022. The provision reversal

was driven by lower expected loss rates resulting from low charge-offs during the quarter and year, combined with a lower specific reserve

for individually assessed loans during the current quarter as several loans were paid off or returned to accruing status.

LOAN COMPOSITION - Unaudited

| |

| |

|

Quarter Ended |

| |

|

December 31 |

September 30 |

June 30 |

March 31 |

December 31 |

| (dollars in thousands) |

|

2023 |

2023 |

2023 |

2023 |

2022 |

| Commercial |

|

|

|

|

|

|

| Owner occupied RE |

$ |

631,657 |

637,038 |

613,874 |

615,094 |

612,901 |

| Non-owner occupied RE |

|

942,529 |

937,749 |

951,536 |

928,059 |

862,579 |

| Construction |

|

150,680 |

119,629 |

115,798 |

94,641 |

109,726 |

| Business |

|

500,161 |

500,253 |

511,719 |

495,161 |

468,112 |

| Total commercial loans |

|

2,225,027 |

2,194,669 |

2,192,927 |

2,132,955 |

2,053,318 |

| Consumer |

|

|

|

|

|

|

| Real estate |

|

1,082,429 |

1,074,679 |

1,047,904 |

993,258 |

931,278 |

| Home equity |

|

183,004 |

180,856 |

185,584 |

180,974 |

179,300 |

| Construction |

|

63,348 |

54,210 |

61,044 |

71,137 |

80,415 |

| Other |

|

48,819 |

49,218 |

50,157 |

39,621 |

29,052 |

| Total consumer loans |

|

1,377,600 |

1,358,963 |

1,344,689 |

1,284,990 |

1,220,045 |

| Total gross loans, net of deferred fees |

|

3,602,627 |

3,553,632 |

3,537,616 |

3,417,945 |

3,273,363 |

| Less—allowance for credit losses |

|

(40,682) |

(41,131) |

(41,105) |

(40,435) |

(38,639) |

| Total loans, net |

$ |

3,561,945 |

3,512,501 |

3,496,511 |

3,377,510 |

3,234,724 |

DEPOSIT COMPOSITION - Unaudited

| |

| |

|

Quarter Ended |

| |

|

December 31 |

September 30 |

June 30 |

March 31 |

December 31 |

| (dollars in thousands) |

|

2023 |

2023 |

2023 |

2023 |

2022 |

| Non-interest bearing |

$ |

674,167 |

675,409 |

698,084 |

740,534 |

804,115 |

| Interest bearing: |

|

|

|

|

|

|

| NOW accounts |

|

310,218 |

306,667 |

308,762 |

303,743 |

318,030 |

| Money market accounts |

|

1,605,278 |

1,685,736 |

1,692,900 |

1,748,562 |

1,506,418 |

| Savings |

|

31,669 |

34,737 |

36,243 |

39,706 |

40,673 |

| Time, less than $250,000 |

|

190,167 |

125,506 |

114,691 |

106,679 |

89,877 |

| Time and out-of-market deposits, $250,000 and over |

|

568,065 |

519,716 |

582,338 |

487,550 |

374,751 |

| Total deposits |

$ |

3,379,564 |

3,347,771 |

3,433,018 |

3,426,774 |

3,133,864 |

Footnotes to tables:

(1) Total revenue is the sum of net interest income and noninterest income.

(2) The tax-equivalent adjustment to net interest income adjusts the yield

for assets earning tax-exempt income to a comparable yield on a taxable basis.

(3) Annualized for the respective three-month period.

(4) Noninterest expense divided by the sum of net interest income and noninterest

income.

(5) Excludes mortgage loans held for sale.

(6) Excludes out of market deposits and time deposits greater than $250,000

totaling $568,065,000.

(7) December 31, 2023 ratios are preliminary.

(8) The common equity tier 1 ratio is calculated as the sum of common equity

divided by risk-weighted assets.

(9) The tangible common equity ratio is calculated as total equity less preferred

stock divided by total assets.

(10) Includes mortgage loans held for sale.

About Southern First Bancshares

Southern

First Bancshares, Inc., Greenville, South Carolina is a registered bank holding company incorporated under the laws of South

Carolina. The company’s wholly owned subsidiary, Southern First Bank, is the second largest bank headquartered in South

Carolina. Southern First Bank has been providing financial services since 1999 and now operates in 12 locations in the Greenville,

Columbia, and Charleston markets of South Carolina as well as the Charlotte, Triangle and Triad regions of North Carolina and

Atlanta, Georgia. Southern First Bancshares has consolidated assets of approximately $4.1 billion and its common stock is traded on

The NASDAQ Global Market under the symbol “SFST.” More information can be found at www.southernfirst.com.

FORWARD-LOOKING STATEMENTS

Certain

statements in this news release contain “forward-looking statements" within the meaning of the Private Securities

Litigation Reform Act of 1995, such as statements relating to future plans and expectations, and are thus

prospective. Such forward-looking statements are identified by words such as “believe,” “expect,”

“anticipate,” “estimate,” “preliminary”, “intend,” “plan,”

“target,” “continue,” “lasting,” and “project,” as well as similar expressions. Such

statements are subject to risks, uncertainties, and other factors which could cause actual results to differ materially from future

results expressed or implied by such forward-looking statements. Although we believe that the assumptions underlying the

forward-looking statements are reasonable, any of the assumptions could prove to be inaccurate. Therefore, we can give no assurance

that the results contemplated in the forward-looking statements will be realized. The inclusion of this forward-looking information

should not

be construed as a representation by our company or any

person that the future events, plans, or expectations contemplated by our company will be achieved.

The following factors, among others, could cause actual

results to differ materially from the anticipated results or other expectations expressed in the forward-looking statements: (1) competitive

pressures among depository and other financial institutions may increase significantly and have an effect on pricing, spending, third-party

relationships and revenues; (2) the strength of the United States economy in general and the strength of the local economies in which

the company conducts operations may be different than expected; (3) the rate of delinquencies and amounts of charge-offs, the level of

allowance for credit loss, the rates of loan and deposit growth as well as pricing of each product, or adverse changes in asset quality

in our loan portfolio, which may result in increased credit risk-related losses and expenses; (4) changes in legislation, regulation,

policies, or administrative practices, whether by judicial, governmental, or legislative action, including, but not limited to, changes

affecting oversight of the financial services industry or consumer protection; (5) the impact of changes to Congress on the regulatory

landscape and capital markets; (6) adverse conditions in the stock market, the public debt market and other capital markets (including

changes in interest rate conditions) could continue to have a negative impact on the company; (7) changes in interest rates, which may

continue to affect the company’s net income, interest expense, prepayment penalty income, mortgage banking income, and other future

cash flows, or the market value of the company’s assets, including its investment securities; (8) elevated inflation which may cause

adverse risk to the overall economy, and could indirectly pose challenges to our clients and to our business; (9) any increase in FDIC

assessments which have increased and may continue to increase our cost of doing business; and (10) changes in accounting principles, policies,

practices, or guidelines. Additional factors that could cause our results to differ materially from those described in the

forward-looking statements can be found in our reports (such as Annual Reports on Form 10-K, Quarterly Reports on Form 10-Q and Current

Reports on Form 8-K) filed with the SEC and available at the SEC’s Internet site (http://www.sec.gov). All subsequent

written and oral forward-looking statements concerning the company or any person acting on its behalf is expressly qualified in its entirety

by the cautionary statements above. We do not undertake any obligation to update any forward-looking statement to reflect circumstances

or events that occur after the date the forward-looking statements are made, except as required by law.

FINANCIAL & MEDIA CONTACT:

ART SEAVER 864-679-9010

WEB SITE: www.southernfirst.com

Exhibit

99.2

v3.23.4

Cover

|

Jan. 18, 2024 |

| Entity Addresses [Line Items] |

|

| Document Type |

8-K

|

| Amendment Flag |

false

|

| Document Period End Date |

Jan. 18, 2024

|

| Entity File Number |

000-27719

|

| Entity Registrant Name |

Southern First Bancshares, Inc.

|

| Entity Central Index Key |

0001090009

|

| Entity Tax Identification Number |

58-2459561

|

| Entity Incorporation, State or Country Code |

SC

|

| Entity Address, Address Line One |

6 Verdae Boulevard

|

| Entity Address, City or Town |

Greenville

|

| Entity Address, State or Province |

SC

|

| Entity Address, Postal Zip Code |

29607

|

| City Area Code |

864

|

| Local Phone Number |

679-9000

|

| Written Communications |

false

|

| Soliciting Material |

false

|

| Pre-commencement Tender Offer |

false

|

| Pre-commencement Issuer Tender Offer |

false

|

| Title of 12(b) Security |

Common Stock

|

| Trading Symbol |

SFST

|

| Security Exchange Name |

NASDAQ

|

| Entity Emerging Growth Company |

false

|

| Former Address [Member] |

|

| Entity Addresses [Line Items] |

|

| Entity Address, Address Line One |

100 Verdae Boulevard

|

| Entity Address, Address Line Two |

Suite 100

|

| Entity Address, City or Town |

Greenville

|

| Entity Address, State or Province |

SC

|

| X |

- DefinitionBoolean flag that is true when the XBRL content amends previously-filed or accepted submission.

| Name: |

dei_AmendmentFlag |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:booleanItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionFor the EDGAR submission types of Form 8-K: the date of the report, the date of the earliest event reported; for the EDGAR submission types of Form N-1A: the filing date; for all other submission types: the end of the reporting or transition period. The format of the date is YYYY-MM-DD.

| Name: |

dei_DocumentPeriodEndDate |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:dateItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionThe type of document being provided (such as 10-K, 10-Q, 485BPOS, etc). The document type is limited to the same value as the supporting SEC submission type, or the word 'Other'.

| Name: |

dei_DocumentType |

| Namespace Prefix: |

dei_ |

| Data Type: |

dei:submissionTypeItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionAddress Line 1 such as Attn, Building Name, Street Name

| Name: |

dei_EntityAddressAddressLine1 |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:normalizedStringItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionAddress Line 2 such as Street or Suite number

| Name: |

dei_EntityAddressAddressLine2 |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:normalizedStringItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- Definition

+ References

+ Details

| Name: |

dei_EntityAddressCityOrTown |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:normalizedStringItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionCode for the postal or zip code

| Name: |

dei_EntityAddressPostalZipCode |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:normalizedStringItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionName of the state or province.

| Name: |

dei_EntityAddressStateOrProvince |

| Namespace Prefix: |

dei_ |

| Data Type: |

dei:stateOrProvinceItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionLine items represent financial concepts included in a table. These concepts are used to disclose reportable information associated with domain members defined in one or many axes to the table.

| Name: |

dei_EntityAddressesLineItems |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:stringItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionA unique 10-digit SEC-issued value to identify entities that have filed disclosures with the SEC. It is commonly abbreviated as CIK. Reference 1: http://www.xbrl.org/2003/role/presentationRef

-Publisher SEC

-Name Exchange Act

-Number 240

-Section 12

-Subsection b-2

| Name: |

dei_EntityCentralIndexKey |

| Namespace Prefix: |

dei_ |

| Data Type: |

dei:centralIndexKeyItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionIndicate if registrant meets the emerging growth company criteria. Reference 1: http://www.xbrl.org/2003/role/presentationRef

-Publisher SEC

-Name Exchange Act

-Number 240

-Section 12

-Subsection b-2

| Name: |

dei_EntityEmergingGrowthCompany |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:booleanItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionCommission file number. The field allows up to 17 characters. The prefix may contain 1-3 digits, the sequence number may contain 1-8 digits, the optional suffix may contain 1-4 characters, and the fields are separated with a hyphen.

| Name: |

dei_EntityFileNumber |

| Namespace Prefix: |

dei_ |

| Data Type: |

dei:fileNumberItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionTwo-character EDGAR code representing the state or country of incorporation.

| Name: |

dei_EntityIncorporationStateCountryCode |

| Namespace Prefix: |

dei_ |

| Data Type: |

dei:edgarStateCountryItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionThe exact name of the entity filing the report as specified in its charter, which is required by forms filed with the SEC. Reference 1: http://www.xbrl.org/2003/role/presentationRef

-Publisher SEC

-Name Exchange Act

-Number 240

-Section 12

-Subsection b-2

| Name: |

dei_EntityRegistrantName |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:normalizedStringItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionThe Tax Identification Number (TIN), also known as an Employer Identification Number (EIN), is a unique 9-digit value assigned by the IRS. Reference 1: http://www.xbrl.org/2003/role/presentationRef

-Publisher SEC

-Name Exchange Act

-Number 240

-Section 12

-Subsection b-2

| Name: |

dei_EntityTaxIdentificationNumber |

| Namespace Prefix: |

dei_ |

| Data Type: |

dei:employerIdItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionLocal phone number for entity.

| Name: |

dei_LocalPhoneNumber |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:normalizedStringItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionBoolean flag that is true when the Form 8-K filing is intended to satisfy the filing obligation of the registrant as pre-commencement communications pursuant to Rule 13e-4(c) under the Exchange Act. Reference 1: http://www.xbrl.org/2003/role/presentationRef

-Publisher SEC

-Name Exchange Act

-Number 240

-Section 13e

-Subsection 4c

| Name: |

dei_PreCommencementIssuerTenderOffer |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:booleanItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionBoolean flag that is true when the Form 8-K filing is intended to satisfy the filing obligation of the registrant as pre-commencement communications pursuant to Rule 14d-2(b) under the Exchange Act. Reference 1: http://www.xbrl.org/2003/role/presentationRef

-Publisher SEC

-Name Exchange Act

-Number 240

-Section 14d

-Subsection 2b

| Name: |

dei_PreCommencementTenderOffer |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:booleanItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionTitle of a 12(b) registered security. Reference 1: http://www.xbrl.org/2003/role/presentationRef

-Publisher SEC

-Name Exchange Act

-Number 240

-Section 12

-Subsection b

| Name: |

dei_Security12bTitle |

| Namespace Prefix: |

dei_ |

| Data Type: |

dei:securityTitleItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionName of the Exchange on which a security is registered. Reference 1: http://www.xbrl.org/2003/role/presentationRef

-Publisher SEC

-Name Exchange Act

-Number 240

-Section 12

-Subsection d1-1

| Name: |

dei_SecurityExchangeName |

| Namespace Prefix: |

dei_ |

| Data Type: |

dei:edgarExchangeCodeItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionBoolean flag that is true when the Form 8-K filing is intended to satisfy the filing obligation of the registrant as soliciting material pursuant to Rule 14a-12 under the Exchange Act. Reference 1: http://www.xbrl.org/2003/role/presentationRef

-Publisher SEC

-Name Exchange Act

-Section 14a

-Number 240

-Subsection 12

| Name: |

dei_SolicitingMaterial |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:booleanItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionTrading symbol of an instrument as listed on an exchange.

| Name: |

dei_TradingSymbol |

| Namespace Prefix: |

dei_ |

| Data Type: |

dei:tradingSymbolItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionBoolean flag that is true when the Form 8-K filing is intended to satisfy the filing obligation of the registrant as written communications pursuant to Rule 425 under the Securities Act. Reference 1: http://www.xbrl.org/2003/role/presentationRef

-Publisher SEC

-Name Securities Act

-Number 230

-Section 425

| Name: |

dei_WrittenCommunications |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:booleanItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

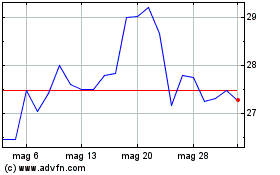

Grafico Azioni Southern First Bancshares (NASDAQ:SFST)

Storico

Da Nov 2024 a Dic 2024

Grafico Azioni Southern First Bancshares (NASDAQ:SFST)

Storico

Da Dic 2023 a Dic 2024