OHA is Administrative Agent & Lead Left Arranger for Private Refinancing of MedVet

25 Giugno 2024 - 9:37PM

Oak Hill Advisors (“OHA”) served as Administrative Agent and Lead

Left Arranger for a private unitranche facility to support a

recapitalization of MedVet. MedVet is a founder and veterinarian

owned platform that operates a leading network of specialty and

emergency veterinary hospitals across the U.S. OHA was the sole

lender of the private unitranche facility, consisting of a term

loan and delayed draw term loan.

OHA’s reputation and experience investing in the

veterinary care space for nearly a decade positioned it to source

and diligence this opportunity. OHA made its first investment in a

veterinary services platform in 2014 and currently has over $1

billion invested in animal health and pet care businesses, ranging

from private unitranche to junior capital financings. This

non-sponsored transaction also demonstrates OHA’s expertise working

directly with management teams and their advisors to deliver

tailored solutions.

“OHA is a true partner in this important

transaction for our organization,” said MedVet CFO Dain Bussewitz,

“OHA’s knowledge of our profession, ability to commit to the entire

unitranche facility and structuring insight enabled streamlined

execution of our refinancing while providing capacity to support

the next phase of our growth.”

###

About OHA: Oak Hill Advisors (OHA) is a

leading global credit-focused alternative asset manager with over

30 years of investment experience. OHA works with institutions and

individuals and seeks to deliver a consistent track record of

attractive risk-adjusted returns. The firm manages approximately

$64 billion of capital across credit strategies, including private

credit, high yield bonds, leveraged loans, stressed and distressed

debt and collateralized loan obligations as of March 31, 2024.

OHA’s emphasis on long-term partnerships with companies, sponsors

and other partners provides access to a proprietary opportunity

set, allowing for customized credit solutions across market

cycles.

With over 400 experienced professionals across

six global offices, OHA brings a collaborative approach to offering

investors a single platform to meet their diverse credit needs. OHA

is the private markets platform of T. Rowe Price Group, Inc.

(NASDAQ – GS: TROW). For more information, please visit

oakhilladvisors.com.

About MedVet: MedVet is the largest

independent veterinarian owned and led network of specialty and

emergency hospitals dedicated to delivering exceptional care and a

deeply supportive experience to pets and their loving families,

referring veterinarians, and their caregivers. For nearly 40 years,

the organization’s empathetic, insightful, and driven team of

expert caregivers has helped MedVet become the preferred choice for

high-quality, compassionate care; proudly providing more than

500,000 patient visits each year in communities throughout the

United States. You can learn more about MedVet by visiting

medvet.com.

Natalie Harvard, Head of Investor Relations & Partner

Oak Hill Advisors, L.P.

212-326-1505

nharvard@oakhilladvisors.com

Kristin Celestino, Public Relations

Oak Hill Advisors, L.P.

817-215-2934

kcelestino@oakhilladvisors.com

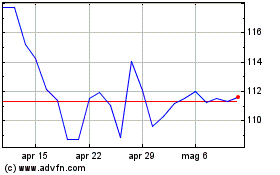

Grafico Azioni T Rowe Price (NASDAQ:TROW)

Storico

Da Gen 2025 a Feb 2025

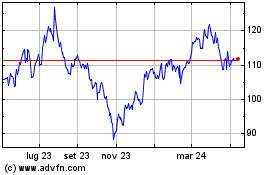

Grafico Azioni T Rowe Price (NASDAQ:TROW)

Storico

Da Feb 2024 a Feb 2025