VirTra, Inc. (Nasdaq: VTSI)

(“VirTra”), a global provider of judgmental use of force

training simulators, firearms training simulators for the law

enforcement and military markets, reported results for the fourth

quarter and full year ended December 31, 2023. The financial

statements are available on VirTra’s website and here.

Fourth Quarter 2023 Financial Summary:

- Total revenue increased 17%

year-over-year to $10.1 million

- Gross profit increased 58%

year-over-year to $8.4 million, or 83% of total revenue

- Net income increased by $1.4 million

year-over-year to $2.8 million

- Adjusted EBITDA totaled $2.2

million

- Cash and cash equivalents of $18.9

million at December 31, 2023

Full Year 2023 Financial Summary:

- Total revenue increased 34% to $38.0

million

- Gross profit increased 64% to $26.7

million, or 70% of total revenue

- Net income increased by $6.4 million

to $8.4 million

- Adjusted EBITDA totaled $11.6

million

Fourth Quarter and Full Year 2023 Financial

Highlights:

| |

For the Three Months Ended |

|

For the Twelve Months Ended |

|

All figures in millions, except per share data |

December 31, 2023 |

December 31, 2022 |

% Δ |

|

December 31, 2023 |

December 31, 2022 |

% Δ |

|

Total Revenue |

$10.1 |

$8.6 |

17% |

|

$38.0 |

$28.3 |

34% |

| |

|

|

|

|

|

|

|

|

Gross Profit |

$8.4 |

$5.3 |

58% |

|

$26.7 |

$16.3 |

64% |

|

Gross Margin |

83% |

61% |

N/A |

|

70% |

57% |

N/A |

| |

|

|

|

|

|

|

|

| Net

Income (Loss) |

$2.8 |

$1.4 |

N/A |

|

$8.4 |

$2.0 |

N/A |

|

Diluted EPS |

$0.25 |

$0.13 |

N/A |

|

$0.77 |

$0.18 |

N/A |

|

Adjusted EBITDA |

$2.2 |

$1.9 |

N/A |

|

$11.6 |

$4.0 |

N/A |

| |

|

|

|

|

|

|

|

Management Commentary

“2023 was a year of substantial transformation,

which culminated in a strong fourth quarter with revenue of $10.1

million – our third double-digit million revenue quarter in 2023.

This performance led to record-breaking annual revenue of $38.0

million, representing a 34% increase from 2022,” said VirTra CEO

John Givens. “Our success has been the result of strategic changes

we’ve implemented across our business, particularly in enhancing

our internal operations. Last year, we successfully upgraded our

machine shop and consolidated production into a single facility,

implemented a new ERP system, and revised our processes for

scalability, just to name a few of the operational strides we took.

These actions have increased our throughput significantly and

improved our book-to-ship ratio, all while reducing production

costs and maintaining excellent product quality. We are now

shipping orders that we receive within days instead of years, and

we have set a solid foundation for future success as demand for our

solutions continues to rise.”

“This strategic overhaul was instrumental in

effectively working through the substantial backlog we faced

entering 2023. With that backlog down to $19.4 million entering

2024, growing bookings and our pipeline will be critical to our

growth trajectory going forward. To align more closely with future

growth opportunities, we also restructured our sales team,

introducing new methodologies, adopting a territory-based approach,

and revising our compensation structure. We expect these

adjustments to enhance our sales productivity and bolster our

customer success functions.

“As our newly implemented sales strategies begin

to take root, we expect that the technological innovations we made

in 2023 will drive further interest from the core law enforcement

market and the military sector. The introduction of V-XR®, our

extended reality training platform, has been met with great

interest, with a very positive market reception setting us up for

strong delivery volume starting in the next few months. V-XR’s

emphasis on training soft skills, such as managing mental health

crises, is set to broaden our reach within our core target markets

but also in wider settings, such as in hospitals and educational

institutions. Additionally, to better serve military customers, we

integrated VBS, a premier military software that facilitates the

creation of real-time, geo-specific training into our simulators.

Despite the typically longer sales cycles in the military market,

our foothold is expanding ahead of schedule.

“Building on our operating momentum, we are

moving into the second quarter with high confidence in our

trajectory for continued growth for 2024.”

Fourth Quarter 2023 Financial Results

Total revenue increased 16% to $10.1 million

from $8.7 million in the fourth quarter of 2022. The increase in

revenue was driven by continued demand for training solutions with

government customers, both domestically and internationally.

Gross profit increased 58% to $8.4 million from

$5.3 million in the fourth quarter of 2022. Gross profit margin was

83%, an increase compared to 61% in the fourth quarter of 2022.

Net operating expense was $5.8 million, compared

to $3.4 million in the fourth quarter of 2022. The increase in net

operating expense was associated with additional staffing and the

opening of the Company’s Orlando facility.

Operating income increased by $0.7 million to

$2.6 million from $1.9 million in the fourth quarter of 2022.

Net income was $2.8 million, or $0.25 per

diluted share (based on 11.0 million weighted average diluted

shares outstanding), an improvement compared to net income of $1.4

million, or $0.13 per diluted share (based on 10.9 million weighted

average diluted shares outstanding), in the fourth quarter of

2022.

Adjusted EBITDA, a non-GAAP metric, was $2.2

million, compared to $1.9 million in the fourth quarter of

2022.

Full Year 2023 Financial Results

Total revenue increased 34% to $38.0 million

from $28.3 million in 2022. The increase in revenue was primarily

the result of increases in simulator and accessory sales, STEP

sales, and design and prototyping revenue.

Gross profit increased 64% to $26.7 million from

$16.3 million in 2022. Gross profit margin was 70%, an increase

compared to 57% in 2022. The increase in gross profit margin was

primarily due to the aforementioned increase in revenue while

maintaining cost of sales in line with 2022 levels. Also

contributing to this increase was an unusual event of the Company’s

receiving a $3 million kickoff milestone payment in connection with

a contract for custom work, for which no significant costs were

associated.

Net operating expense was $17.0 million in 2023,

compared to $13.7 million in 2022. The increase in net operating

expense was primarily driven by an increase in salaries and

benefits resulting from the addition of new staff, expenses for the

new Orlando office, as well as an increase in R&D spend, and

the implementation expense related to the launch of the Company’s

new ERP system.

Operating income jumped to $9.6 million in 2023,

a $7.0 million increase from $2.6 million in the prior year

period.

Net income was $8.4 million, or $0.77 per

diluted share (based on 11.0 million weighted average diluted

shares outstanding), an improvement compared to net income of $2.0

million, or $0.18 per diluted share (based on 10.9 million weighted

average diluted shares outstanding), in 2022.

Adjusted EBITDA, a non-GAAP metric, increased to

$11.1 million from $3.6 million in 2022.

Financial Commentary

“In the fourth quarter we continued to grow our

revenue while making improvements to our profitability metrics,”

said VirTra CFO Alanna Boudreau. “The changes we’ve made internally

to our operations have also had a significant effect on the margin

growth we had in the fourth quarter and throughout the year. Based

on our recent performance, we are expecting that our backlog will

remain lower than past levels historically as we focus on

continuing to improve our book-to-ship ratio moving forward. We

anticipate continued revenue and profitability expansion as we move

into additional markets outside of law enforcement in 2024.”

Conference CallVirTra’s

management will hold a conference call today (April 1, 2024) at

4:30 p.m. Eastern time (1:30 p.m. Pacific time) to discuss these

results. VirTra’s Chief Executive Officer John Givens and Chief

Financial Officer Alanna Boudreau will host the call, followed by a

question-and-answer period.

U.S. dial-in number: 1-877-407-9208International

number: 1-201-493-6784Conference ID: 13743893

Please call the conference telephone number 5-10

minutes prior to the start time. An operator will register your

name and organization. If you have any difficulty connecting with

the conference call, please contact Gateway Investor Relations at

949-574-3860.

The conference call will be broadcast live and

available for replay here and via the investor relations section of

the Company’s website.

A replay of the call will be available after

7:30 p.m. Eastern time on the same day through November 28,

2023.

Toll-free replay number:

1-844-512-2921International replay number: 1-412-317-6671Replay ID:

13743893

About VirTra, Inc.VirTra

(Nasdaq: VTSI) is a global provider of judgmental use of force

training simulators, firearms training simulators for the law

enforcement, military, educational and commercial markets. The

company’s patented technologies, software, and scenarios provide

intense training for de-escalation, judgmental use-of-force,

marksmanship, and related training that mimics real-world

situations. VirTra’s mission is to save and improve lives worldwide

through practical and highly effective virtual reality and

simulator technology. Learn more about the company

at www.VirTra.com.

About the Presentation of Adjusted

EBITDAAdjusted earnings before interest, income taxes,

depreciation, and amortization and before other non-operating costs

and income (“Adjusted EBITDA”) is a non-GAAP financial measure.

Adjusted EBITDA also includes non-cash stock option expense and

other than temporary impairment loss on investments. Other

companies may calculate Adjusted EBITDA differently. VirTra

calculates its Adjusted EBITDA to eliminate the impact of certain

items it does not consider to be indicative of its performance and

its ongoing operations. Adjusted EBITDA is presented herein because

management believes the presentation of Adjusted EBITDA provides

useful information to VirTra’s investors regarding VirTra’s

financial condition and results of operations and because Adjusted

EBITDA is frequently used by securities analysts, investors, and

other interested parties in the evaluation of companies in VirTra’s

industry, several of which present a form of Adjusted EBITDA when

reporting their results. Adjusted EBITDA has limitations as an

analytical tool and should not be considered in isolation or as a

substitute for analysis of VirTra’s results as reported under

accounting principles generally accepted in the United States of

America (“GAAP”). Adjusted EBITDA should not be considered as an

alternative for net income, cash flows from operating activities

and other consolidated income or cash flows statement data prepared

in accordance with GAAP or as a measure of profitability or

liquidity. A reconciliation of net income to Adjusted EBITDA is

provided in the following tables:

| |

For the Years Ended |

|

| |

December 31, |

|

|

December 31, |

|

|

Increase |

|

|

% |

|

| |

2023 |

|

|

2022 |

|

|

(Decrease) |

|

|

Change |

|

| |

|

|

|

|

|

|

|

|

|

|

|

|

Net Income |

$ |

8,402,858 |

|

|

$ |

1,955,898 |

|

|

$ |

6,446,960 |

|

|

330 |

% |

|

Adjustments: |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

Provision for income taxes |

|

1,818,812 |

|

|

|

571,642 |

|

|

|

1,247,170 |

|

|

218 |

% |

|

Depreciation and amortization |

|

928,545 |

|

|

|

887,118 |

|

|

|

41,427 |

|

|

5 |

% |

|

Interest (net) |

|

(20,440 |

) |

|

|

190,772 |

|

|

|

(211,212 |

) |

|

(111 |

)% |

| EBITDA |

$ |

11,129,775 |

|

|

$ |

3,605,430 |

|

|

$ |

7,524,345 |

|

|

209 |

% |

|

Right of use amortization |

|

496,127 |

|

|

|

412,335 |

|

|

|

83,792 |

|

|

20 |

% |

| |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

| Adjusted EBITDA |

$ |

11,625,902 |

|

|

$ |

4,017,765 |

|

|

$ |

7,608,137 |

|

|

189 |

% |

| |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

Forward-Looking StatementsThe

information in this discussion contains forward-looking statements

and information within the meaning of Section 27A of the Securities

Act of 1933, as amended, and Section 21E of the Securities Exchange

Act of 1934, as amended, which are subject to the “safe harbor”

created by those sections. The words “anticipates,” “believes,”

“estimates,” “expects,” “intends,” “may,” “plans,” “projects,”

“will,” “should,” “could,” “predicts,” “potential,” “continue,”

“would” and similar expressions are intended to identify

forward-looking statements, although not all forward-looking

statements contain these identifying words. We may not actually

achieve the plans, intentions or expectations disclosed in our

forward-looking statements and you should not place undue reliance

on our forward-looking statements. Actual results or events could

differ materially from the plans, intentions and expectations

disclosed in the forward-looking statements that we make. The

forward-looking statements are applicable only as of the date on

which they are made, and we do not assume any obligation to update

any forward-looking statements. All forward-looking statements in

this document are made based on our current expectations,

forecasts, estimates and assumptions, and involve risks,

uncertainties and other factors that could cause results or events

to differ materially from those expressed in the forward-looking

statements. In evaluating these statements, you should specifically

consider various factors, uncertainties and risks that could affect

our future results or operations. These factors, uncertainties and

risks may cause our actual results to differ materially from any

forward-looking statement set forth in the reports we file with or

furnish to the Securities and Exchange Commission (the “SEC”). You

should carefully consider these risks and uncertainties described

and other information contained in the reports we file with or

furnish to the SEC before making any investment decision with

respect to our securities. All forward-looking statements

attributable to us or persons acting on our behalf are expressly

qualified in their entirety by this cautionary statement.

Investor Relations Contact:

Matt Glover and Alec WilsonGateway Group, Inc.

VTSI@gateway-grp.com949-574-3860

|

- Financial Tables to Follow - |

|

|

|

VIRTRA, INC. |

|

CONDENSED BALANCE SHEETS |

|

|

|

|

December 31, |

|

|

December 31, |

|

|

|

2023 |

|

|

2022 |

|

|

ASSETS |

|

|

|

|

|

|

|

| Current

assets: |

|

|

|

|

|

|

|

|

Cash and cash equivalents |

$ |

18,849,842 |

|

|

$ |

13,483,597 |

|

|

Accounts receivable, net |

|

15,724,147 |

|

|

|

3,002,887 |

|

|

Inventory, net |

|

12,404,880 |

|

|

|

9,592,328 |

|

|

Unbilled revenue |

|

1,109,616 |

|

|

|

7,485,990 |

|

|

Prepaid expenses and other current assets |

|

906,803 |

|

|

|

531,051 |

|

| |

|

|

|

|

|

|

|

|

Total current assets |

|

48,995,288 |

|

|

|

34,095,853 |

|

| |

|

|

|

|

|

|

|

| Long-term

assets: |

|

|

|

|

|

|

|

|

Property and equipment, net |

|

15,487,012 |

|

|

|

15,267,133 |

|

|

Operating lease right-of-use asset, net |

|

716,687 |

|

|

|

1,212,814 |

|

|

Intangible assets, net |

|

567,540 |

|

|

|

587,777 |

|

|

Security deposits, long-term |

|

35,691 |

|

|

|

35,691 |

|

|

Other assets, long-term |

|

201,670 |

|

|

|

376,461 |

|

|

Deferred tax asset, net |

|

3,630,154 |

|

|

|

2,238,762 |

|

| |

|

|

|

|

|

|

|

|

Total long-term assets |

|

20,638,754 |

|

|

|

19,718,638 |

|

| |

|

|

|

|

|

|

|

| Total

assets |

$ |

69,634,042 |

|

|

$ |

53,814,491 |

|

| |

|

|

|

|

|

|

|

|

LIABILITIES AND STOCKHOLDERS’ EQUITY |

|

|

|

|

|

|

|

| |

|

|

|

|

|

|

|

| Current

liabilities: |

|

|

|

|

|

|

|

|

Accounts payable |

$ |

2,282,427 |

|

|

$ |

1,251,240 |

|

|

Accrued compensation and related costs |

|

2,221,416 |

|

|

|

1,494,890 |

|

|

Accrued expenses and other current liabilities |

|

3,970,559 |

|

|

|

1,917,922 |

|

|

Note payable, current |

|

226,355 |

|

|

|

232,537 |

|

|

Operating lease liability, short-term |

|

317,840 |

|

|

|

557,683 |

|

|

Deferred revenue, short-term |

|

6,736,175 |

|

|

|

4,302,492 |

|

| |

|

|

|

|

|

|

|

|

Total current liabilities |

|

15,754,772 |

|

|

|

9,756,764 |

|

| |

|

|

|

|

|

|

|

| Long-term

liabilities: |

|

|

|

|

|

|

|

|

Deferred revenue, long-term |

|

3,012,206 |

|

|

|

1,605,969 |

|

|

Note payable, long-term |

|

7,813,021 |

|

|

|

8,050,116 |

|

|

Operating lease liability, long-term |

|

432,176 |

|

|

|

720,023 |

|

| |

|

|

|

|

|

|

|

|

Total long-term liabilities |

|

11,257,403 |

|

|

|

10,376,108 |

|

| |

|

|

|

|

|

|

|

| Total

liabilities |

|

27,012,175 |

|

|

|

20,132,872 |

|

| |

|

|

|

|

|

|

|

| Commitments and contingencies

(See Note 11) |

|

|

|

|

|

|

|

| |

|

|

|

|

|

|

|

| Stockholders’

equity: |

|

|

|

|

|

|

|

| Preferred stock $0.0001 par

value; 2,500,000 authorized; no shares issued or outstanding |

|

|

|

|

|

|

|

| Common stock $0.0001 par

value; 50,000,000 shares authorized; 11,107,230 shares and

10,900,759 shares issued and outstanding as of December 31, 2023

and 2022, respectively |

|

1,109 |

|

|

|

1,089 |

|

| Class A common stock $0.0001

par value; 2,500,000 shares authorized; no shares issued or

outstanding |

|

|

|

|

|

|

|

| Class B common stock $0.0001

par value; 7,500,000 shares authorized; no shares issued or

outstanding |

|

|

|

|

|

|

|

| Additional paid-in

capital |

|

31,957,765 |

|

|

|

31,420,395 |

|

| Retained earnings |

|

10,662,993 |

|

|

|

2,260,135 |

|

| |

|

|

|

|

|

|

|

| Total stockholders’

equity |

|

42,621,867 |

|

|

|

33,681,619 |

|

| |

|

|

|

|

|

|

|

| Total liabilities and

stockholders’ equity |

$ |

69,634,042 |

|

|

$ |

53,814,491 |

|

| |

|

|

|

|

|

|

|

| VIRTRA,

INC. |

| CONDENSED

STATEMENTS OF OPERATIONS |

|

(UNAUDITED) |

|

|

|

|

For the years ended |

|

|

|

December 31, 2023 |

|

|

December 31, 2022 |

|

| |

|

|

|

|

|

|

Revenues: |

|

|

|

|

|

|

|

|

Net sales |

$ |

38,043,360 |

|

|

$ |

28,302,244 |

|

|

Total revenue |

|

38,043,360 |

|

|

|

28,302,244 |

|

| |

|

|

|

|

|

|

|

|

Cost of sales |

|

11,378,264 |

|

|

|

12,047,366 |

|

| |

|

|

|

|

|

|

|

|

Gross profit |

|

26,665,096 |

|

|

|

16,254,878 |

|

| |

|

|

|

|

|

|

|

| Operating expenses: |

|

|

|

|

|

|

|

|

General and administrative |

|

14,235,194 |

|

|

|

11,054,333 |

|

|

Research and development |

|

2,794,314 |

|

|

|

2,606,840 |

|

| |

|

|

|

|

|

|

|

|

Net operating expense |

|

17,029,508 |

|

|

|

13,661,173 |

|

| |

|

|

|

|

|

|

|

|

Income from operations |

|

9,635,588 |

|

|

|

2,593,705 |

|

| |

|

|

|

|

|

|

|

| Other income (expense): |

|

|

|

|

|

|

|

|

Other income |

|

888,464 |

|

|

|

194,523 |

|

|

Other (expense) income |

|

(302,382 |

) |

|

|

(260,688 |

) |

| |

|

|

|

|

|

|

|

|

Net other income (expense) |

|

586,082 |

|

|

|

(66,165 |

) |

| |

|

|

|

|

|

|

|

|

Income before provision for income taxes |

|

10,221,670 |

|

|

|

2,527,540 |

|

| |

|

|

|

|

|

|

|

|

Provision (Benefit) for income taxes |

|

1,818,812 |

|

|

|

571,642 |

|

| |

|

|

|

|

|

|

|

| Net income |

$ |

8,402,858 |

|

|

$ |

1,955,898 |

|

| |

|

|

|

|

|

|

|

| Net income per common

share: |

|

|

|

|

|

|

|

|

Basic |

$ |

0.77 |

|

|

$ |

0.18 |

|

|

Diluted |

$ |

0.77 |

|

|

$ |

0.18 |

|

| |

|

|

|

|

|

|

|

| Weighted average shares

outstanding: |

|

|

|

|

|

|

|

|

Basic |

|

10,958,448 |

|

|

|

10,863,680 |

|

|

Diluted |

|

10,963,477 |

|

|

|

10,873,606 |

|

| |

|

|

|

|

|

|

|

|

VIRTRA, INC. |

|

CONDENSED STATEMENTS OF CASH FLOWS |

|

(Unaudited) |

| |

|

|

|

|

|

| |

For the Years Ended December 31, |

|

| |

2023 |

|

|

2022 |

|

| |

|

|

|

|

|

|

Cash flows from operating activities: |

|

|

|

|

|

|

|

|

Net income |

$ |

8,402,858 |

|

|

$ |

1,955,898 |

|

|

Adjustments to reconcile net income to net cash (used in) provided

by operating activities: |

|

|

|

|

|

|

|

|

Depreciation and amortization |

|

928,545 |

|

|

|

887,118 |

|

|

Right of use amortization |

|

496,127 |

|

|

|

412,335 |

|

|

Bad debt expense |

|

308,657 |

|

|

|

- |

|

|

Employee stock compensation |

|

482,490 |

|

|

|

456,167 |

|

|

Changes in operating assets and liabilities: |

|

|

|

|

|

|

|

|

Accounts receivable, net |

|

(13,029,917 |

) |

|

|

893,852 |

|

|

Inventory, net |

|

(2,812,552 |

) |

|

|

(4,577,404 |

) |

|

Deferred taxes |

|

(1,391,392 |

) |

|

|

(564,528 |

) |

|

Unbilled revenue |

|

6,376,374 |

|

|

|

(3,539,544 |

) |

|

Prepaid expenses and other current assets |

|

(375,752 |

) |

|

|

409,836 |

|

|

Other assets |

|

174,791 |

|

|

|

(186,727 |

) |

|

Operating lease right of use liability |

|

(527,690 |

) |

|

|

(416,292 |

) |

|

Security deposits, long-term |

|

- |

|

|

|

(15,979 |

) |

|

Accounts payable and other accrued expenses |

|

3,810,157 |

|

|

|

1,811,646 |

|

|

Payments on operating lease liability |

|

- |

|

|

|

- |

|

|

Deferred revenue |

|

3,839,920 |

|

|

|

(219,729 |

) |

| |

|

|

|

|

|

|

|

| Net cash provided by (used in)

operating activities |

|

6,682,616 |

|

|

|

(2,693,351 |

) |

| |

|

|

|

|

|

|

|

| Cash flows from investing

activities: |

|

|

|

|

|

|

|

| |

|

|

|

|

|

|

|

|

Purchase of intangible assets |

|

- |

|

|

|

(120,016 |

) |

|

Purchase of property and equipment |

|

(1,128,187 |

) |

|

|

(3,221,182 |

) |

| Net cash (used in) investing

activities |

|

(1,128,187 |

) |

|

|

(3,341,198 |

) |

| |

|

|

|

|

|

|

|

| Cash flows from financing

activities: |

|

|

|

|

|

|

|

|

Principal payments of debt |

|

(243,084 |

) |

|

|

(231,264 |

) |

|

Stock issued for options exercised |

|

54,900 |

|

|

|

40,845 |

|

| Net cash (used in) financing

activities |

|

(188,184 |

) |

|

|

(190,419 |

) |

| |

|

|

|

|

|

|

|

| Net increase (decrease) in

cash and restricted cash |

|

5,366,245 |

|

|

|

(6,224,968 |

) |

| Cash and restricted cash,

beginning of period |

|

13,483,597 |

|

|

|

19,708,565 |

|

| Cash and restricted cash, end

of period |

$ |

18,849,842 |

|

|

$ |

13,483,597 |

|

| |

|

|

|

|

|

|

|

| Supplemental disclosure of

cash flow information: |

|

|

|

|

|

|

|

|

Cash (refunded) paid: |

|

|

|

|

|

|

|

|

Income taxes paid (refunded) |

$ |

- |

|

|

$ |

108,777 |

|

|

Interest paid |

$ |

248,653 |

|

|

|

128,507 |

|

| |

|

|

|

|

|

|

|

| Supplemental disclosure of

non-cash investing and financing activities: |

|

|

|

|

|

|

|

|

Addition of new lease and corresponding ROU asset and lease

liability |

$ |

- |

|

|

$ |

294,016 |

|

|

Conversion of inventory to property and equipment |

$ |

- |

|

|

$ |

840,843 |

|

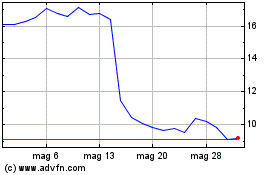

Grafico Azioni Virtra (NASDAQ:VTSI)

Storico

Da Gen 2025 a Feb 2025

Grafico Azioni Virtra (NASDAQ:VTSI)

Storico

Da Feb 2024 a Feb 2025