0000818479false00008184792024-07-292024-07-29

UNITED STATES

SECURITIES AND EXCHANGE COMMISSION

WASHINGTON, D.C. 20549

FORM 8-K

CURRENT REPORT

Pursuant to Section 13 OR 15(d) of The Securities Exchange Act of 1934

July 29, 2024

Date of Report (date of earliest event reported)

DENTSPLY SIRONA Inc.

(Exact name of registrant as specified in its charter) | | | | | | | | | | | | | | |

Delaware | 0-16211 | 39-1434669 | |

(State or other jurisdiction of incorporation or organization) | (Commission File Number) | (I.R.S. Employer Identification No.) | |

| |

13320 Ballantyne Corporate Place, | Charlotte | North Carolina | 28277-3607 | |

(Address of Principal Executive Offices) | (Zip Code) | |

(844) 848-0137

Registrant’s telephone number, including area code

Check the appropriate box below if the Form 8-K filing is intended to simultaneously satisfy the filing obligation of the registrant under any of the following provisions (see General Instruction A.2. below):

☐ Written communications pursuant to Rule 425 under the Securities Act (17 CFR 230.425)

☐ Soliciting material pursuant to Rule 14a-12 under the Exchange Act (17 CFR 240.14a-12)

☐ Pre-commencement communications pursuant to Rule 14d-2(b) under the Exchange Act (17 CFR 240.14d-2(b))

☐ Pre-commencement communications pursuant to Rule 13e-4(c) under the Exchange Act (17 CFR 240.13e-4(c))

Securities registered pursuant to Section 12(b) of the Act: | | | | | | | | |

| Title of each class | Trading Symbol(s) | Name of each exchange on which registered |

| Common Stock, par value $0.01 per share | XRAY | The Nasdaq Stock Market LLC |

Indicate by check mark whether the registrant is an emerging growth company as defined in Rule 405 of the Securities Act of 1933 (§230.405 of this chapter) or Rule 12b-2 of the Securities Exchange Act of 1934 (§240.12b-2 of this chapter).

Emerging growth company ☐

If an emerging growth company, indicate by check mark if the registrant has elected not to use the extended transition period for complying with any new or revised financial accounting standards provided pursuant to Section 13(a) of the Exchange Act.

o

Item 2.02 Results of Operations and Financial Condition

On July 31, 2024, DENTSPLY SIRONA Inc. (the “Company”) issued a press release regarding the Company’s financial results for its second fiscal quarter ended June 30, 2024. A copy of the Company’s press release is furnished as Exhibit 99.1.

Item 2.05 Costs Associated with Exit or Disposal Activities

On July 29, 2024, the Board of Directors of the Company approved a plan to restructure the Company’s business to improve operational performance and drive shareholder value creation. The restructuring plan anticipates a net reduction in the Company’s global workforce of approximately 2% to 4%. The proposed changes are subject to co-determination processes with employee representative groups in countries where required. The Company expects to incur between $40 million and $50 million in non-recurring restructuring charges under the plan, primarily related to employee transition, severance payments and employee benefits, which are expected to be expensed and paid in cash in 2024 and 2025.

Actions taken under the restructuring plan will seek to further streamline the Company’s operations and global footprint, as well as improve alignment of the Company’s cost structure with its strategic growth objectives. The Company anticipates that the restructuring plan will be substantially completed by the end of 2025 and result in $80 to $100 million in annual cost savings.

The estimates of the charges and expenditures that the Company expects to incur in connection with the restructuring plan, and the timing thereof, are subject to several assumptions, including local law requirements in various jurisdictions, co-determination aspects in countries where required, and actual amounts may differ materially from estimates. In addition, the Company may incur additional charges or cash expenditures not currently contemplated due to unanticipated events that may occur, including in connection with the implementation of the restructuring plan.

Item 5.02 Departure of Directors or Certain Officers; Election of Directors; Appointment of Certain Officers; Compensatory Arrangements of Certain Officers

On July 31, 2024, as part of the restructuring plan described in Item 2.05 herein, the Company eliminated the position of Executive Vice President, Chief Business Officer which is currently held by Mr. Andreas G. Frank, effective October 1, 2024, or such other date as mutually agreed to between the parties (the “Termination Date”). On the Termination Date, Mr. Frank will be eligible to receive severance in the amounts to which he is entitled under the Company’s Key Employee Severance Benefit Plan, as amended.

Additionally, on July 25, 2024, Richard M. Wagner informed the Company of his decision to resign as Vice President, Chief Accounting Officer of the Company effective August 16, 2024, to pursue another opportunity. Mr. Wagner’s resignation was not because of any disagreement with the Company on any matter relating to the Company’s financial statements, internal controls, operations, policies, or practices, including accounting principles and practices. Mr. Wagner will remain with the Company through August 16, 2024 to help facilitate the transition of his responsibilities.

In connection with Mr. Wagner’s resignation, Glenn G. Coleman, Executive Vice President, Chief Financial Officer, will assume the responsibilities of principal accounting officer on an interim basis, effective August 16, 2024. Mr. Coleman’s biographical information is set forth in the Company’s Proxy Statement filed with the U.S. Securities and Exchange Commission on April 10, 2024, and such information is incorporated herein by reference. No new compensatory arrangements will be entered into with Mr. Coleman in connection with his assuming the responsibilities as the Company’s interim principal accounting officer.

Item 7.01 Regulation FD Disclosure

On July 31, 2024, the Company issued a press release announcing the restructuring plan described above. A copy of the press release is attached hereto as Exhibit 99.1 and is incorporated by reference herein.

The information furnished pursuant to Items 2.02 and 7.01, including Exhibit 99.1, shall not be deemed “filed” for purposes of Section 18 of the Securities Exchange Act of 1934, as amended (the “Exchange Act”), or otherwise subject to the liabilities of that section, nor shall it be deemed incorporated by reference into any filing made by the Company under the Securities Act of 1933, as amended, or the Exchange Act, except as shall be expressly set forth by specific reference in any such filing.

Item 9.01 Financial Statements and Exhibits

(d) Exhibits

| | | | | | | | |

| Exhibit No. | | Description |

| | |

| | DENTSPLY SIRONA Inc. Press release issued July 31, 2024, as referenced in Items 2.02 and 7.01 |

| | |

| 104 | | Cover Page Interactive Data File (embedded within the Inline XBRL Document) |

| | |

Forward Looking Statements

This Current Report on Form 8-K contains statements that do not directly and exclusively relate to historical facts which constitute forward-looking statements, including, statements and projections concerning, among other things, the expected timing, benefits and costs associated with the Company’s restructuring plan described in this Current Report on Form 8-K. The Company’s forward-looking statements represent current expectations and beliefs and involve risks and uncertainties. Actual results may differ significantly from those projected or suggested in any forward-looking statements and no assurance can be given that the results described in such forward-looking statements will be achieved. Investors are cautioned not to place undue reliance on such forward-looking statements which speak only as of the date they are made. The forward-looking statements are subject to numerous assumptions, risks and uncertainties and other factors that could cause actual results to differ materially from those described in such statements, many of which are outside of our control. The Company does not undertake any obligation to release publicly any revisions to such forward-looking statements to reflect events or circumstances occurring after the date hereof or to reflect the occurrence of unanticipated events. Any number of factors could cause the Company’s actual results to differ materially from those contemplated by any forward-looking statements, including, but not limited to, the risks associated with the following: the Company’s ability to remain profitable in a very competitive marketplace, which depends upon the Company’s ability to differentiate its products and services from those of competitors; the Company’s failure to realize assumptions and projections which may result in the need to record additional impairment charges; the effect of changes to the Company’s distribution channels for its products and the failure of significant distributors of the Company to effectively manage their inventories; the Company’s ability to control costs and failure to realize expected benefits of cost reduction and restructuring efforts and the Company’s failure to anticipate and appropriately adapt to changes or trends within the rapidly changing dental industry. Furthermore, many of these risks and uncertainties are currently amplified by and may continue to be amplified by or may, in the future, be amplified by, macroeconomic conditions, such as recession risks, continued elevated levels of inflation and higher interest rates that affect our customers, employees, vendors and the economies and communities where they operate. Investors should carefully consider these and other relevant factors, including those risk factors in Part I, Item 1A, (“Risk Factors”) in the Company’s most recent Form 10-K, including any amendments thereto, and any updating information which may be contained in the Company’s other filings with the Securities and Exchange Commission (“SEC”), when reviewing any forward-looking statement. The Company notes these factors for investors as permitted under the Private Securities Litigation Reform Act of 1995. Investors should understand it is impossible to predict or identify all such factors or risks. As such, you should not consider either the foregoing lists, or the risks identified in the Company’s SEC filings, to be a complete discussion of all potential risks or uncertainties.

SIGNATURE

Pursuant to the requirements of the Securities Exchange Act of 1934, the Company has duly caused this report to be signed on its behalf by the undersigned hereunto duly authorized.

DENTSPLY SIRONA Inc.

| | | | | | | | |

| By: | | /s/ Richard C. Rosenzweig |

| | Richard C. Rosenzweig |

| | Executive Vice President, Corporate Development, |

| | General Counsel and Secretary |

Date: July 31, 2024

Dentsply Sirona Reports Second Quarter 2024 Results and Announces Second Phase of Transformation

•Net sales of $984 million decreased (4.2%), organic sales decreased (2.3%)

•GAAP gross margin of 51.9%, GAAP net loss of ($4) million or loss per share of ($0.02)

•Adjusted EBITDA margin of 17.5%, adjusted EPS of $0.49

•Revised FY24 outlook: organic sales down (1%) to flat (previously flat to up 1.5%); adjusted EPS of $1.96 to $2.02 (previously $2.00 to $2.10)

•Company repurchased $150 million of its common stock in Q2 2024; expects to repurchase $100 million of its common stock in Q3 2024

•Second phase of transformation includes an expected reduction in annualized operating expenses of $80 to $100 million over approximately 12 to 18 months

Charlotte, N.C., July 31, 2024 - DENTSPLY SIRONA Inc. (“Dentsply Sirona” or the "Company") (Nasdaq: XRAY) today announced its financial results for the second quarter of 2024.

Second quarter net sales of $984 million decreased (4.2%) (organic sales decreased (2.3%)) compared to the second quarter of 2023. Net loss was ($4) million, or ($0.02) per share, compared to net income of $86 million, or $0.40 per share in the second quarter of 2023. Adjusted earnings per diluted share were $0.49, compared to $0.51 in the second quarter of 2023. A reconciliation of Non-GAAP measures (including organic sales, adjusted EBITDA and margin, adjusted EPS, adjusted free cash flow conversion, and segment adjusted operating income) to GAAP measures is provided below.

“Our second quarter results were unfavorably impacted by lower demand in our Connected Technology Solutions segment due to continued macroeconomic and competitive pressures. Despite this, we were pleased to deliver growth in three of our four segments. We are revising our full year outlook to reflect lower expected sales and adjusted EPS,” said Simon Campion, President and Chief Executive Officer. “The second phase of our transformation allows us to both fund reinvestment in our business to better position us to drive profitable growth and contribute to our 2026 adjusted EPS target. As part of this second phase, Andreas Frank, Executive Vice President and Chief Business Officer, will be leaving Dentsply Sirona in October. Andreas has been an important member of our leadership team and we thank him for his many valued contributions to our Company and transformation. We wish him and his family much success in their next phase.”

Q2 24 Summary Results (GAAP) | | | | | | | | | | | | | | | | | | | | | | | | | | |

| (in millions, except per share amount and percentages) | | | | | | | | Q2 24 | | Q2 23 | | YoY |

| | | | | | | | | | | | |

| Net Sales | | | | | | | | $984 | | $1,028 | | (4.2%) |

| Gross Profit | | | | | | | | $511 | | $550 | | (7.1%) |

| Gross Margin | | | | | | | | 51.9% | | 53.5% | | |

| Net (Loss) Income Attributable to Dentsply Sirona | | | | | | | | ($4) | | $86 | | NM |

| | | | | | | | | | | | |

| | | | | | | | | | | | |

| Diluted (Loss) Earnings Per Share | | | | | | | | ($0.02) | | $0.40 | | NM |

NM - not meaningful

Percentages are based on actual values and may not reconcile due to rounding.

Q2 24 Summary Results (Non-GAAP)[1] | | | | | | | | | | | | | | | | | | | | | | | | | | |

| (in millions, except per share amount and percentages) | | | | | | | | Q2 24 | | Q2 23 | | YoY |

| | | | | | | | | | | | |

| Net Sales | | | | | | | | $984 | | $1,028 | | (4.2%) |

| Organic Sales Growth % | | | | | | | | | | | | (2.3%) |

| Adjusted EBITDA | | | | | | | | $173 | | $185 | | (5.9%) |

| Adjusted EBITDA Margin | | | | | | | | 17.5% | | 17.8% | | |

| | | | | | | | | | | | |

| Adjusted EPS | | | | | | | | $0.49 | | $0.51 | | (4.0%) |

[1] Organic sales growth, adjusted EBITDA, and adjusted EPS are Non-GAAP financial measures which exclude certain items. Please refer to "Non-GAAP Financial Measures" below for a description of these measures and to the tables at the end of this release for a reconciliation between GAAP and Non-GAAP measures.

Percentages are based on actual values and may not reconcile due to rounding.

Q2 24 Segment Results

| | | | | | | | | | | | | | | | |

| | Net Sales Growth % | | Organic Sales Growth % |

| | | | | | |

| | | | | | |

| Connected Technology Solutions | | (18.2%) | | | (16.2%) | |

| Essential Dental Solutions | | (0.4%) | | | 1.5% | |

| Orthodontic and Implant Solutions | | 2.6% | | | 4.6% | |

| Wellspect Healthcare | | 9.7% | | | 11.7% | |

| Total | | (4.2%) | | | (2.3%) | |

Q2 24 Geographic Results

| | | | | | | | | | | | | | | | |

| | Net Sales Growth % | | Organic Sales Growth % |

| | | | | | |

| | | | | | |

| United States | | (0.7%) | | | (0.6%) | |

| Europe | | (4.0%) | | | (2.6%) | |

| Rest of World | | (9.4%) | | | (4.3%) | |

| Total | | (4.2%) | | | (2.3%) | |

Cash Flow and Liquidity

Operating cash flow in the second quarter of 2024 was $208 million, compared to $104 million in the prior year, primarily as a result of the favorable timing of cash collections and receipt of a foreign tax refund. In the second quarter of 2024, the Company paid $33 million in dividends and executed share repurchases of $150 million, resulting in a total of $212 million returned to shareholders through dividends and share repurchases in the first six months of 2024. The Company had $279 million of cash and cash equivalents as of June 30, 2024.

2024 Outlook

Based on the Company's results during the first half of 2024 and its latest view of the macroeconomic environment, foreign exchange, and market dynamics, the Company is revising its 2024 outlook. The revised outlook includes expected net sales in the range of $3.86 billion to $3.90 billion, down (1%) to flat on an organic basis. Adjusted EPS is expected to be in the range of $1.96 to $2.02, up 7% to 10% year-over-year.

Other 2024 outlook assumptions are included in the second quarter 2024 earnings presentation posted on the Investors section of the Dentsply Sirona website at https://investor.dentsplysirona.com. The Company does not provide forward-looking estimates on a GAAP basis as certain information, which may include, but is not limited to, restructuring charges, transformation related costs, impairment charges, certain tax adjustments, and other significant items, is not available without unreasonable effort and cannot be reasonably estimated. The exact amounts of these charges or credits are not currently determinable but may be significant.

Restructuring Plan

On July 29, 2024, the Company’s Board of Directors approved a restructuring plan that initiates the second phase of the Company's transformation efforts. In connection with this plan, the Company expects to incur $40 million to $50 million in non-recurring charges, which will be expensed and paid in cash in 2024 and 2025. The plan is anticipated to result in $80 million to $100 million in annualized cost savings over the next 12 to 18 months.

Quarterly Cash Dividend

On July 29, 2024, the Company's Board of Directors declared a quarterly cash dividend of $0.16 per share of common stock, an indicated annual rate of $0.64 per share. The dividend is payable on October 11, 2024, to holders of record as of September 27, 2024.

Conference Call/Webcast Information

Dentsply Sirona’s management team will host an investor conference call and live webcast on July 31, 2024, at 8:30 am ET. A live webcast of the investor conference call and a presentation related to the call will be available on the Investors section of the Company’s website at https://investor.dentsplysirona.com.

For those planning to participate on the call, please register at https://register.vevent.com/register/BIe9e2b2889a35416ba5fb19bf5137a867. A webcast replay of the conference call will be available on the Investors section of the Company’s website following the call.

About Dentsply Sirona

Dentsply Sirona is the world’s largest manufacturer of professional dental products and technologies, with over a century of innovation and service to the dental industry and patients worldwide. Dentsply Sirona develops, manufactures, and markets a comprehensive solutions offering including dental and oral health products as well as other consumable medical devices under a strong portfolio of world-class brands. Dentsply Sirona’s products provide innovative, high-quality and effective solutions to advance patient care and deliver better and safer dental care. Dentsply Sirona’s headquarters is located in Charlotte, North Carolina. The Company’s shares are listed in the United States on Nasdaq under the symbol XRAY. Visit www.dentsplysirona.com for more information about Dentsply Sirona and its products.

Contact Information:

Investors:

Andrea Daley

Vice President, Investor Relations

+1-704-591-8631

InvestorRelations@dentsplysirona.com

Press:

Marion Par-Weixlberger

Vice President, Public Relations & Corporate Communications

+43 676 848414588

marion.par-weixlberger@dentsplysirona.com

Forward-Looking Statements and Associated Risks

All statements in this Press Release that do not directly and exclusively relate to historical facts constitute “forward-looking statements.” Such statements are subject to numerous assumptions, risks, uncertainties and other factors that could cause actual results to differ materially from those described in such statements, many of which are outside of our control, including those described in Part I, Item 1A, “Risk Factors” of the Company's Annual Report on Form 10-K for the fiscal year ended December 31, 2023 (the "2023 Form 10-K"), and other factors which may be described in the Company’s other filings with the Securities and Exchange Commission (the “SEC”). No assurance can be given that any expectation, belief, goal or plan set forth in any forward-looking statement can or will be achieved, and readers are cautioned not to place undue reliance on such statements which speak only as of the date they are made. We do not undertake any obligation to update or release any revisions to any forward-looking statement or to report any events or circumstances after the date of this Press Release or to reflect the occurrence of unanticipated events. Investors should understand it is not possible to predict or identify all such factors or risks. As such, you should not consider the risks identified in the Company’s SEC filings to be a complete discussion of all potential risks or uncertainties associated with an investment in the Company.

DENTSPLY SIRONA INC. AND SUBSIDIARIES

CONSOLIDATED STATEMENTS OF OPERATIONS

(in millions, except per share amounts)

(unaudited) | | | | | | | | | | | | | | | | | | | | | | | | | | |

| Three Months Ended June 30, | | | Six Months Ended June 30, |

| 2024 | | 2023 | | | | | 2024 | | 2023 |

| | | | | | | | | | |

| Net sales | $ | 984 | | | $ | 1,028 | | | | | | $ | 1,937 | | | $ | 2,006 | |

| Cost of products sold | 473 | | | 478 | | | | | | 920 | | | 937 | |

| | | | | | | | | | |

| Gross profit | 511 | | | 550 | | | | | | 1,017 | | | 1,069 | |

| | | | | | | | | | |

| Selling, general, and administrative expenses | 399 | | | 416 | | | | | | 814 | | | 832 | |

| Research and development expenses | 41 | | 49 | | | | | 83 | | 95 | |

| Intangible asset impairments | — | | | — | | | | | | 6 | | | — | |

| Restructuring and other costs | 21 | | | 5 | | | | | | 22 | | | 64 | |

| | | | | | | | | | |

| Operating income | 50 | | | 80 | | | | | | 92 | | | 78 | |

| | | | | | | | | | |

| Other income and expenses: | | | | | | | | | | |

| Interest expense, net | 17 | | | 22 | | | | | | 35 | | | 42 | |

| | | | | | | | | | |

| Other (income) expense, net | (1) | | | 12 | | | | | | (8) | | | 18 | |

| | | | | | | | | | |

| Income before income taxes | 34 | | | 46 | | | | | | 65 | | | 18 | |

| Provision (benefit) for income taxes | 38 | | | (39) | | | | | | 52 | | | (44) | |

| | | | | | | | | | |

| | | | | | | | | | |

| Net (loss) income | (4) | | | 85 | | | | | | 13 | | | 62 | |

| | | | | | | | | | |

| Less: Net loss attributable to noncontrolling interest | — | | | (1) | | | | | | (1) | | | (5) | |

| | | | | | | | | | |

| Net (loss) income attributable to Dentsply Sirona | $ | (4) | | | $ | 86 | | | | | | $ | 14 | | | $ | 67 | |

| | | | | | | | | | |

| (Loss) earnings per common share attributable to Dentsply Sirona: | | | | | | | | | | |

| Basic | $ | (0.02) | | | $ | 0.41 | | | | | | $ | 0.07 | | | $ | 0.31 | |

| Diluted | $ | (0.02) | | | $ | 0.40 | | | | | | $ | 0.07 | | | $ | 0.31 | |

| | | | | | | | | | |

| Weighted average common shares outstanding: | | | | | | | | | | |

| Basic | 205.6 | | | 211.9 | | | | | | 206.5 | | | 213.2 | |

| Diluted | 205.6 | | | 213.1 | | | | | | 207.3 | | | 214.4 | |

DENTSPLY SIRONA INC. AND SUBSIDIARIES

CONDENSED CONSOLIDATED BALANCE SHEETS

(in millions)

(unaudited)

| | | | | | | | | | | |

| June 30, 2024 | | December 31, 2023 |

| | | |

| Assets | | | |

| Current Assets: | | | |

| Cash and cash equivalents | $ | 279 | | | $ | 334 | |

| Accounts and notes receivable-trade, net | 591 | | | 695 | |

| Inventories, net | 608 | | | 624 | |

| Prepaid expenses and other current assets | 280 | | | 320 | |

| Total Current Assets | 1,758 | | | 1,973 | |

| | | |

| Property, plant, and equipment, net | 789 | | | 800 | |

| Operating lease right-of-use assets, net | 162 | | | 178 | |

| Identifiable intangible assets, net | 1,559 | | | 1,705 | |

| Goodwill | 2,389 | | | 2,438 | |

| Other noncurrent assets | 240 | | | 276 | |

| Total Assets | $ | 6,897 | | | $ | 7,370 | |

| | | |

| Liabilities and Equity | | | |

| Current Liabilities: | | | |

| Accounts payable | $ | 287 | | | $ | 305 | |

| Accrued liabilities | 650 | | | 749 | |

| Income taxes payable | 24 | | | 49 | |

| Notes payable and current portion of long-term debt | 362 | | | 322 | |

| Total Current Liabilities | 1,323 | | | 1,425 | |

| | | |

| Long-term debt | 1,737 | | | 1,796 | |

| Operating lease liabilities | 113 | | | 125 | |

| Deferred income taxes | 194 | | | 228 | |

| Other noncurrent liabilities | 466 | | | 502 | |

| Total Liabilities | 3,833 | | | 4,076 | |

| | | |

| Total Equity | 3,064 | | | 3,294 | |

| | | |

| Total Liabilities and Equity | $ | 6,897 | | | $ | 7,370 | |

| | | |

DENTSPLY SIRONA INC. AND SUBSIDIARIES

CONSOLIDATED STATEMENTS OF CASH FLOWS

(in millions)

(unaudited)

| | | | | | | | | | | |

| Six Months Ended June 30, |

| 2024 | | 2023 |

| | | |

| Cash flows from operating activities: | | | |

| Net income | $ | 13 | | | $ | 62 | |

| | | |

| Adjustments to reconcile net income to net cash provided by operating activities: | | | |

| Depreciation | 64 | | | 64 | |

| Amortization of intangible assets | 108 | | | 106 | |

| | | |

| | | |

| | | |

| | | |

| Indefinite-lived intangible asset impairment | 6 | | | — | |

| Deferred income taxes | (11) | | | (83) | |

| Stock based compensation expense | 23 | | | 31 | |

| | | |

| | | |

| | | |

| | | |

| | | |

| Other non-cash expense | 38 | | | 36 | |

| | | |

| | | |

| | | |

| | | |

| Changes in operating assets and liabilities, net of acquisitions: | | | |

| Accounts and notes receivable-trade, net | 86 | | | (38) | |

| Inventories, net | (7) | | | (32) | |

| Prepaid expenses and other current assets | 29 | | | (40) | |

| Other noncurrent assets | (6) | | | (1) | |

| Accounts payable | (11) | | | (15) | |

| Accrued liabilities | (78) | | | (2) | |

| Income taxes | (9) | | | (34) | |

| Other noncurrent liabilities | (12) | | | 29 | |

| Net cash provided by operating activities | 233 | | | 83 | |

| | | |

| Cash flows from investing activities: | | | |

| Capital expenditures | (86) | | | (72) | |

| | | |

| | | |

| | | |

| | | |

| | | |

| | | |

| | | |

| Cash received on derivative contracts | 1 | | | 4 | |

| Cash paid on derivative contracts | (9) | | | — | |

| | | |

| | | |

| | | |

| Other investing activities | 1 | | | 1 | |

| Net cash used in investing activities | (93) | | | (67) | |

| | | |

| Cash flows from financing activities: | | | |

| Cash paid for treasury stock | (150) | | | (150) | |

| Proceeds on short-term borrowings | 43 | | | 143 | |

| | | |

| Cash dividends paid | (62) | | | (57) | |

| | | |

| | | |

| | | |

| Repayments on long-term borrowings | (6) | | | (1) | |

| | | |

| | | |

| | | |

| | | |

| | | |

| | | |

| Other financing activities, net | (10) | | | (5) | |

| Net cash used in financing activities | (185) | | | (70) | |

| Effect of exchange rate changes on cash and cash equivalents | (10) | | | (16) | |

| Net decrease in cash and cash equivalents | (55) | | | (70) | |

| Cash and cash equivalents at beginning of period | 334 | | | 365 | |

| Cash and cash equivalents at end of period | $ | 279 | | | $ | 295 | |

| | | |

| | | |

| | | |

Non-GAAP Financial Measures

In addition to results determined in accordance with U.S. generally accepted accounting principles (“US GAAP”), the Company provides certain measures in this press release, described below, which are not calculated in accordance with US GAAP and therefore represent Non-GAAP measures. These Non-GAAP measures may differ from those used by other companies and should not be considered in isolation from, or as a substitute for, measures of financial performance prepared in accordance with US GAAP. These Non-GAAP measures are used by the Company to measure its performance and may differ from those used by other companies.

Management believes that these Non-GAAP measures are helpful as they provide a measure of the results of operations, and are frequently used by investors and analysts to evaluate the Company’s performance exclusive of certain items that impact the comparability of results from period to period, and which may not be indicative of past or future performance of the Company.

Organic Sales

The Company defines "organic sales" as the reported net sales adjusted for: (1) net sales from acquired businesses recorded prior to the first anniversary of the acquisition; (2) net sales attributable to disposed businesses or discontinued product lines in both the current and prior year periods; and (3) the impact of foreign currency changes, which is calculated by translating current period net sales using the comparable prior period's foreign currency exchange rates.

Adjusted Operating Income and Margin

Adjusted operating income is computed by excluding the following items from operating income (loss) as reported in accordance with US GAAP:

(1) Business combination related costs and fair value adjustments. These adjustments include costs related to consummating and integrating acquired businesses, as well as net gains and losses related to disposed businesses. In addition, this category includes the post-acquisition roll-off of fair value adjustments recorded related to business combinations, except for amortization expense of purchased intangible assets noted below. Although the Company is regularly engaged in activities to find and act on opportunities for strategic growth and enhancement of product offerings, the costs associated with these activities may vary significantly between periods based on the timing, size and complexity of acquisitions and as such may not be indicative of past and future performance of the Company.

(2) Restructuring related charges and other costs. These adjustments include costs related to the implementation of restructuring initiatives, including but not limited to, severance costs, facility closure costs, and lease and contract termination costs, as well as related professional service costs associated with these restructuring initiatives and global transformation activity. The Company is continually seeking to take actions that could enhance its efficiency; consequently, restructuring charges may recur but are subject to significant fluctuations from period to period due to the varying levels of restructuring activity, and as such may not be indicative of past and future performance of the Company. Other costs include gains and losses on the sale of property, charges related to legal settlements, executive separation costs, write-offs of inventory as a result of product rationalization, and changes in accounting principles recorded within the period. This category also includes costs related to investigations, related ongoing legal matters and associated remediation activities which primarily include legal, accounting and other professional service fees, as well as turnover and other employee-related costs.

(3) Goodwill and intangible asset impairments. These adjustments include charges related to goodwill and intangible asset impairments.

(4) Amortization of purchased intangible assets. This adjustment excludes the periodic amortization expense related to purchased intangible assets, which are recorded at fair value. Although these costs contribute to revenue generation and will recur in future periods, their amounts are significantly impacted by the timing and size of acquisitions, and as such may not be indicative of the future performance of the Company.

(5) Fair value and credit risk adjustments. These adjustments include the non-cash mark-to-market changes in fair value associated with pension assets and obligations, and equity-method investments. Although these adjustments are recurring in nature, they are subject to significant fluctuations from period to period due to changes in the underlying assumptions and market conditions. The non-service component of pension expense is a recurring item, however it is subject to significant fluctuations from period to period due to changes in actuarial assumptions, interest rates, plan changes, settlements, curtailments, and other changes in facts and circumstances. As such, these items may not be indicative of past and future performance of the Company.

Adjusted operating income margin is calculated by dividing adjusted operating income by net sales.

Adjusted Gross Profit

Adjusted gross profit is computed by excluding from gross profit the impact of any of the above adjustments on either sales or cost of sales.

Adjusted Net Income (Loss)

Adjusted net income (loss) consists of net income (loss) as reported in accordance with US GAAP, adjusted to exclude the items identified above, as well as the related income tax impacts of those items. Additionally, net income is adjusted for other tax-related adjustments such as: discrete adjustments to valuation allowances and other uncertain tax positions, final settlement of income tax audits, discrete tax items resulting from the implementation of restructuring initiatives and the windfall or shortfall relating to exercise of employee share-based compensation, any difference between the interim and annual effective tax rate, and adjustments relating to prior periods.

These adjustments are irregular in timing, and the variability in amounts may not be indicative of past and future performance of the Company and therefore are excluded for comparability purposes.

Adjusted EBITDA and Margin

In addition to the adjustments described above in arriving at adjusted net income, adjusted EBITDA is computed by further excluding any remaining interest expense, net, income tax expense, depreciation and amortization.

Adjusted EBITDA margin is calculated by dividing adjusted EBITDA by net sales.

Adjusted Earnings (Loss) Per Diluted Share

Adjusted earnings (loss) per diluted share (adjusted EPS) is computed by dividing adjusted earnings (loss) attributable to Dentsply Sirona shareholders by the diluted weighted average number of common shares outstanding.

Adjusted Free Cash Flow and Conversion

The Company defines adjusted free cash flow as net cash provided by operating activities minus capital expenditures during the same period, and adjusted free cash flow conversion is defined as adjusted free cash flow divided by adjusted net income (loss). Management believes this Non-GAAP measure is important for use in evaluating the Company’s financial performance as it measures our ability to efficiently generate cash from our business operations relative to earnings. It should be considered in addition to, rather than as a substitute for, net income (loss) as a measure of our performance or net cash provided by operating activities as a measure of our liquidity.

DENTSPLY SIRONA INC. AND SUBSIDIARIES

(In millions, except percentages)

(unaudited)

A reconciliation of reported net sales to organic sales by geographic region is as follows:

| | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | |

| | Three Months Ended June 30, 2024 | | Q2 2024 Change | | Three Months Ended June 30, 2023 |

| (in millions, except percentages) | | U.S. | Europe | ROW | Total | | U.S. | Europe | ROW | Total | | U.S. | Europe | ROW | Total |

| | | | | | | | | | | | | | | |

| Net sales | | $ | 360 | | $ | 387 | | $ | 237 | | $ | 984 | | | (0.7 | %) | (4.0 | %) | (9.4 | %) | (4.2 | %) | | $ | 362 | | $ | 403 | | $ | 263 | | $ | 1,028 | |

| Foreign exchange impact | | | | | | | (0.1 | %) | (1.4 | %) | (5.1 | %) | (1.9 | %) | | | | | |

| | | | | | | | | | | | | | | |

| | | | | | | | | | | | | | | |

| Organic sales | | | | | | | (0.6 | %) | (2.6 | %) | (4.3 | %) | (2.3 | %) | | | | | |

Percentages are based on actual values and may not reconcile due to rounding.

A reconciliation of reported net sales to organic sales by segment is as follows:

| | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | |

| | Three Months Ended June 30, 2024 | | Q2 2024 Change | | Three Months Ended June 30, 2023 |

| (in millions, except percentages) | | Connected Technology Solutions | Essential Dental Solutions | Orthodontic and Implant Solutions | Wellspect Healthcare | Total | | Connected Technology Solutions | Essential Dental Solutions | Orthodontic and Implant Solutions | Wellspect Healthcare | Total | | Connected Technology Solutions | Essential Dental Solutions | Orthodontic and Implant Solutions | Wellspect Healthcare | Total |

| | | | | | | | | | | | | | | | | | |

| Net sales | | $ | 253 | | $ | 375 | | $ | 276 | | $ | 80 | | $ | 984 | | | (18.2 | %) | (0.4 | %) | 2.6 | % | 9.7 | % | (4.2 | %) | | $ | 309 | | $ | 377 | | $ | 270 | | $ | 72 | | $ | 1,028 | |

| Foreign exchange impact | | | | | | | | (2.0 | %) | (1.9 | %) | (2.0 | %) | (2.0 | %) | (1.9 | %) | | | | | | |

| | | | | | | | | | | | | | | | | | |

| | | | | | | | | | | | | | | | | | |

| Organic sales | | | | | | | | (16.2 | %) | 1.5 | % | 4.6 | % | 11.7 | % | (2.3 | %) | | | | | | |

Percentages are based on actual values and may not reconcile due to rounding.

DENTSPLY SIRONA INC. AND SUBSIDIARIES

(In millions, except percentages)

(unaudited)

The Company’s segment adjusted operating income for the three and six months ended June 30, 2024 and 2023 was as follows:

| | | | | | | | | | | | | | | | | | | | | | | | | | |

| | Three Months Ended June 30, | | Six Months Ended June 30, |

| (in millions) | | 2024 | | 2023 | | 2024 | | 2023 |

| | | | | | | | |

| Connected Technology Solutions | | $ | 3 | | | $ | 26 | | | $ | 5 | | | $ | 32 | |

| Essential Dental Solutions | | 125 | | | 125 | | | 240 | | | 250 | |

| Orthodontic and Implant Solutions | | 42 | | | 49 | | | 84 | | | 98 | |

| Wellspect Healthcare | | 24 | | | 21 | | | 47 | | | 39 | |

| Segment adjusted operating income | | 194 | | | 221 | | | 376 | | | 419 | |

| | | | | | | | |

| Reconciling items expense (income): | | | | | | | | |

All other (a) | | 69 | | | 83 | | | 148 | | | 171 | |

| Intangible asset impairments | | — | | | — | | | 6 | | | — | |

| Restructuring and other costs | | 21 | | | 5 | | | 22 | | | 64 | |

| Interest expense, net | | 17 | | | 22 | | | 35 | | | 42 | |

| | | | | | | | |

| Other (income) expense, net | | (1) | | | 12 | | | (8) | | | 18 | |

| Amortization of intangible assets | | 54 | | | 53 | | | 108 | | | 106 | |

| | | | | | | | |

| Income before income taxes | | $ | 34 | | | $ | 46 | | | $ | 65 | | | $ | 18 | |

(a) Includes unassigned corporate headquarters costs.

DENTSPLY SIRONA INC. AND SUBSIDIARIES

(In millions, except percentages)

(unaudited)

For the three months ended June 30, 2024, a reconciliation of selected items as reported in the Condensed Consolidated Statements of Operations to adjusted Non-GAAP items is as follows:

| | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | |

| (in millions, except percentages and per share data) | | | | | | | | Gross Profit | | | | Operating Income | | Net (Loss) Income Attributable to Dentsply Sirona (a) | | Diluted EPS |

| GAAP | | | | | | | | $ | 511 | | | | | $ | 50 | | | $ | (4) | | | $ | (0.02) | |

| Non-GAAP Adjustments: | | | | | | | | | | | | | | | | |

| Amortization of Purchased Intangible Assets | | | | | | | | 30 | | | | | 54 | | | 40 | | | 0.19 | |

| Restructuring Related Charges and Other Costs | | | | | | | | 3 | | | | | 35 | | | 28 | | | 0.14 | |

| | | | | | | | | | | | | | | | |

| | | | | | | | | | | | | | | | |

| Fair Value and Credit Risk Adjustments | | | | | | | | — | | | | | — | | | 1 | | | — | |

| Income Tax Related Adjustments | | | | | | | | — | | | | | — | | | 36 | | | 0.18 | |

| Adjusted Non-GAAP | | | | | | | | $ | 544 | | | | | $ | 139 | | | $ | 101 | | | $ | 0.49 | |

| GAAP Margin | | | | | | | | | | | | 5.1 | % | | | | |

| Adjusted Non-GAAP Margin | | | | | | | | | | | | 14.2 | % | | | | |

| | | | | | | | | | | | | | | | |

| Weighted average common shares outstanding used in calculating diluted GAAP net loss per common share | | 205.6 | |

| Weighted average common shares outstanding used in calculating diluted Non-GAAP net income per common share | | 206.1 | |

(a) The total tax expense associated with the Non-GAAP adjustments above was $15 million. | | |

Percentages are based on actual values and may not reconcile due to rounding.

DENTSPLY SIRONA INC. AND SUBSIDIARIES

(In millions, except percentages)

(unaudited)

For the three months ended June 30, 2023, a reconciliation of selected items as reported in the Condensed Consolidated Statements of Operations to adjusted Non-GAAP items is as follows:

| | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | |

| (in millions, except percentages and per share data) | | | | | | | | Gross Profit | | | | Operating Income | | Net Income Attributable to Dentsply Sirona (a) | | Diluted EPS |

| GAAP | | | | | | | | $ | 550 | | | | | $ | 80 | | | $ | 86 | | | $ | 0.40 | |

| Non-GAAP Adjustments: | | | | | | | | | | | | | | | | |

| Amortization of Purchased Intangible Assets | | | | | | | | 30 | | | | | 53 | | | 39 | | | 0.18 | |

| Restructuring Related Charges and Other Costs | | | | | | | | 3 | | | | | 20 | | | 3 | | | 0.02 | |

| | | | | | | | | | | | | | | | |

| Business Combination Related Costs and Fair Value Adjustments | | | | | | | | 1 | | | | | 7 | | | 10 | | | 0.04 | |

| | | | | | | | | | | | | | | | |

| Income Tax Related Adjustments | | | | | | | | — | | | | | — | | | (29) | | | (0.13) | |

| Adjusted Non-GAAP | | | | | | | | $ | 584 | | | | | $ | 160 | | | $ | 109 | | | $ | 0.51 | |

| GAAP Margin | | | | | | | | | | | | 7.8 | % | | | | |

| Adjusted Non-GAAP Margin | | | | | | | | | | | | 15.6 | % | | | | |

| | | | | | | | | | | | | | | | |

| Weighted average common shares outstanding used in calculating diluted GAAP net loss per common share | | 213.1 | |

| Weighted average common shares outstanding used in calculating diluted Non-GAAP net income per common share | | 213.1 | |

(a) The total tax expense associated with the Non-GAAP adjustments above was $60 million. | | |

Percentages are based on actual values and may not reconcile due to rounding.

DENTSPLY SIRONA INC. AND SUBSIDIARIES

(In millions, except percentages)

(unaudited)

A reconciliation of reported net (loss) income attributable to Dentsply Sirona to adjusted EBITDA and margin for the three months ended June 30, 2024 and 2023 is as follows:

| | | | | | | | | | | | | | |

| | Three Months Ended June 30, |

| (in millions, except percentages) | | 2024 | | 2023 |

| | | | |

| Net (loss) income attributable to Dentsply Sirona | | $ | (4) | | | $ | 86 | |

| Interest expense, net | | 17 | | | 22 | |

| Income tax expense (benefit) | | 38 | | | (39) | |

Depreciation(1) | | 32 | | | 33 | |

| Amortization of purchased intangible assets | | 54 | | | 53 | |

| Restructuring related charges and other costs | | 35 | | | 20 | |

| | | | |

| Business combination related costs and fair value adjustments | | — | | | 10 | |

| Fair value and credit risk adjustments | | 1 | | | — | |

Adjusted EBITDA(2) | | $ | 173 | | | $ | 185 | |

| | | | |

| Net sales | | $ | 984 | | | $ | 1,028 | |

| Adjusted EBITDA margin | | 17.5 | % | | 17.8 | % |

(1) Excludes those depreciation related amounts which were included as part of the business combination related adjustments.

(2) Adjusted EBITDA for 2023 has been updated to reflect the reclassification of $1 million in certain gains from hedging instruments from Interest expense to Other expense (income) in order to conform with current year presentation.

Percentages are based on actual values and may not reconcile due to rounding.

A reconciliation of adjusted free cash flow conversion for the three months ended June 30, 2024 and 2023 is as follows:

| | | | | | | | | | | | | | |

| | Three Months Ended June 30, |

| (in millions, except percentages) | | 2024 | | 2023 |

| | | | |

| Net cash provided by operating activities | | $ | 208 | | | $ | 104 | |

| Capital expenditures | | (52) | | | (33) | |

| Adjusted free cash flow | | $ | 156 | | | $ | 71 | |

| | | | |

| Adjusted net income | | $ | 101 | | | $ | 109 | |

| Adjusted free cash flow conversion | | 155 | % | | 65 | % |

Percentages are based on actual values and may not reconcile due to rounding.

v3.24.2

| X |

- DefinitionBoolean flag that is true when the XBRL content amends previously-filed or accepted submission.

| Name: |

dei_AmendmentFlag |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:booleanItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionFor the EDGAR submission types of Form 8-K: the date of the report, the date of the earliest event reported; for the EDGAR submission types of Form N-1A: the filing date; for all other submission types: the end of the reporting or transition period. The format of the date is YYYY-MM-DD.

| Name: |

dei_DocumentPeriodEndDate |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:dateItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionThe type of document being provided (such as 10-K, 10-Q, 485BPOS, etc). The document type is limited to the same value as the supporting SEC submission type, or the word 'Other'.

| Name: |

dei_DocumentType |

| Namespace Prefix: |

dei_ |

| Data Type: |

dei:submissionTypeItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionAddress Line 1 such as Attn, Building Name, Street Name

| Name: |

dei_EntityAddressAddressLine1 |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:normalizedStringItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- Definition

+ References

+ Details

| Name: |

dei_EntityAddressCityOrTown |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:normalizedStringItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionCode for the postal or zip code

| Name: |

dei_EntityAddressPostalZipCode |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:normalizedStringItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionName of the state or province.

| Name: |

dei_EntityAddressStateOrProvince |

| Namespace Prefix: |

dei_ |

| Data Type: |

dei:stateOrProvinceItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionA unique 10-digit SEC-issued value to identify entities that have filed disclosures with the SEC. It is commonly abbreviated as CIK. Reference 1: http://www.xbrl.org/2003/role/presentationRef

-Publisher SEC

-Name Exchange Act

-Number 240

-Section 12

-Subsection b-2

| Name: |

dei_EntityCentralIndexKey |

| Namespace Prefix: |

dei_ |

| Data Type: |

dei:centralIndexKeyItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionIndicate if registrant meets the emerging growth company criteria. Reference 1: http://www.xbrl.org/2003/role/presentationRef

-Publisher SEC

-Name Exchange Act

-Number 240

-Section 12

-Subsection b-2

| Name: |

dei_EntityEmergingGrowthCompany |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:booleanItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionCommission file number. The field allows up to 17 characters. The prefix may contain 1-3 digits, the sequence number may contain 1-8 digits, the optional suffix may contain 1-4 characters, and the fields are separated with a hyphen.

| Name: |

dei_EntityFileNumber |

| Namespace Prefix: |

dei_ |

| Data Type: |

dei:fileNumberItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionTwo-character EDGAR code representing the state or country of incorporation.

| Name: |

dei_EntityIncorporationStateCountryCode |

| Namespace Prefix: |

dei_ |

| Data Type: |

dei:edgarStateCountryItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionThe exact name of the entity filing the report as specified in its charter, which is required by forms filed with the SEC. Reference 1: http://www.xbrl.org/2003/role/presentationRef

-Publisher SEC

-Name Exchange Act

-Number 240

-Section 12

-Subsection b-2

| Name: |

dei_EntityRegistrantName |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:normalizedStringItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionThe Tax Identification Number (TIN), also known as an Employer Identification Number (EIN), is a unique 9-digit value assigned by the IRS. Reference 1: http://www.xbrl.org/2003/role/presentationRef

-Publisher SEC

-Name Exchange Act

-Number 240

-Section 12

-Subsection b-2

| Name: |

dei_EntityTaxIdentificationNumber |

| Namespace Prefix: |

dei_ |

| Data Type: |

dei:employerIdItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionLocal phone number for entity.

| Name: |

dei_LocalPhoneNumber |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:normalizedStringItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionBoolean flag that is true when the Form 8-K filing is intended to satisfy the filing obligation of the registrant as pre-commencement communications pursuant to Rule 13e-4(c) under the Exchange Act. Reference 1: http://www.xbrl.org/2003/role/presentationRef

-Publisher SEC

-Name Exchange Act

-Number 240

-Section 13e

-Subsection 4c

| Name: |

dei_PreCommencementIssuerTenderOffer |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:booleanItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionBoolean flag that is true when the Form 8-K filing is intended to satisfy the filing obligation of the registrant as pre-commencement communications pursuant to Rule 14d-2(b) under the Exchange Act. Reference 1: http://www.xbrl.org/2003/role/presentationRef

-Publisher SEC

-Name Exchange Act

-Number 240

-Section 14d

-Subsection 2b

| Name: |

dei_PreCommencementTenderOffer |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:booleanItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionTitle of a 12(b) registered security. Reference 1: http://www.xbrl.org/2003/role/presentationRef

-Publisher SEC

-Name Exchange Act

-Number 240

-Section 12

-Subsection b

| Name: |

dei_Security12bTitle |

| Namespace Prefix: |

dei_ |

| Data Type: |

dei:securityTitleItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionName of the Exchange on which a security is registered. Reference 1: http://www.xbrl.org/2003/role/presentationRef

-Publisher SEC

-Name Exchange Act

-Number 240

-Section 12

-Subsection d1-1

| Name: |

dei_SecurityExchangeName |

| Namespace Prefix: |

dei_ |

| Data Type: |

dei:edgarExchangeCodeItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionBoolean flag that is true when the Form 8-K filing is intended to satisfy the filing obligation of the registrant as soliciting material pursuant to Rule 14a-12 under the Exchange Act. Reference 1: http://www.xbrl.org/2003/role/presentationRef

-Publisher SEC

-Name Exchange Act

-Section 14a

-Number 240

-Subsection 12

| Name: |

dei_SolicitingMaterial |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:booleanItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionTrading symbol of an instrument as listed on an exchange.

| Name: |

dei_TradingSymbol |

| Namespace Prefix: |

dei_ |

| Data Type: |

dei:tradingSymbolItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionBoolean flag that is true when the Form 8-K filing is intended to satisfy the filing obligation of the registrant as written communications pursuant to Rule 425 under the Securities Act. Reference 1: http://www.xbrl.org/2003/role/presentationRef

-Publisher SEC

-Name Securities Act

-Number 230

-Section 425

| Name: |

dei_WrittenCommunications |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:booleanItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

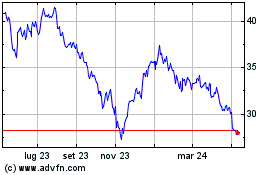

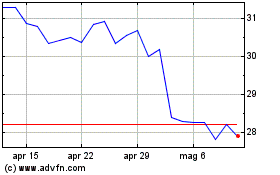

Grafico Azioni DENTSPLY SIRONA (NASDAQ:XRAY)

Storico

Da Ott 2024 a Nov 2024

Grafico Azioni DENTSPLY SIRONA (NASDAQ:XRAY)

Storico

Da Nov 2023 a Nov 2024