Albany International Corp. (NYSE:AIN) today reported operating

results for its second quarter of 2024, which ended June 30,

2024.

"Overall, we had another good quarter as our businesses

delivered strong results and are responding well to their industry

challenges," said President and CEO, Gunnar Kleveland. "Revenue of

$332 million was up $58 million or 21.1% over prior year due to the

inclusion of Heimbach and sales growth in Engineered

Composites.

"In Machine Clothing, revenues at $194 million grew

year-over-year, driven by our Heimbach acquisition, slightly offset

by lower organic demand, primarily in Europe and North America. Our

global order backlog remains stable. We continue to make progress

with the integration at Heimbach.

"In Engineered Composites, we delivered 20% year-over-year top

line growth as our current programs ramp up. We see growth in our

commercial markets, especially in space and other emerging

platforms. Our defense business is also growing, primarily the

CH-53K and JASSM platforms, partially offset by the Joint Strike

Fighter program," concluded Kleveland.

For the second quarter ended June 30,

2024:

- Net revenues were $332.0 million, up 21.1%, or 21.6% after

adjusting for currency translation, when compared to the prior

year. MC's net revenues increased 21.6%, driven by Heimbach net

revenues, which was partially offset by lower net revenues in the

rest of the segment, due to decreased sales in pulp, packaging and

publication grades, net of increased sales in tissue grades and

engineered fabrics. AEC's net revenues increased 20.5%, primarily

driven by growth on CH-53K and other commercial and space

programs.

- Gross profit of $112.4 million was 9.4% higher than the $102.7

million reported for the same period of 2023; overall gross margin

declined by more than 350 basis points, driven by lower Heimbach

margins at MC and driven by changes in the estimated profitability

of long-term contracts at AEC.

- Selling, General, and Administrative (SG&A) expenses were

$55.5 million, compared to $46.8 million in the same period of

2023; the increase was driven primarily by the inclusion of

Heimbach, in addition to acquisition and integration expenses.

- Operating income was $42.9 million, compared to $45.5 million

in the prior year. Despite higher gross profit, increases in

SG&A and Restructuring expenses drove a decrease in operating

income compared to the prior year.

- Effective tax rate for the quarter was 27.9%, compared to 42.8%

for the second quarter of 2023. The 2023 rate was higher primarily

due to unfavorable discrete tax adjustments.

- Net income attributable to the Company was $24.6 million ($0.79

per share), compared to $26.7 million ($0.85 per share) in the

second quarter of 2023; Adjusted diluted earnings per share (or

Adjusted diluted EPS, a non-GAAP measure) was $0.89 per share in

both the second quarter of 2024 and 2023.

- Adjusted EBITDA (a non-GAAP measure) was $63.1 million,

compared to $65.0 million in the second quarter of 2023, a decrease

of 3.0%.

Please see the tables below for a reconciliation of non-GAAP

measures to their comparable GAAP measures.

Outlook for Full-Year 2024

The company is reaffirming its guidance for the full year of

2024 as follows:

- Total company revenue between $1.26 and $1.33 billion

- Effective income tax rate between 29% and 31%

- Capital expenditures in the range of $90 to $95 million

- Adjusted diluted earnings per share between $3.55 and

$4.05

- Total company Adjusted EBITDA between $260 to $290 million

- Machine Clothing revenue between $760 to $790 million

- Machine Clothing Adjusted EBITDA between $230 and $250

million

- Albany Engineered Composites revenue between $500 to $540

million, and

- Albany Engineered Composites Adjusted EBITDA between $97 to

$107 million.

ALBANY INTERNATIONAL CORP.

CONSOLIDATED STATEMENTS OF

INCOME

(in thousands, except per share

amounts)

(unaudited)

Three Months Ended June

30,

Six Months Ended June

30,

2024

2023

2024

2023

Net revenues

$

331,994

$

274,123

$

645,324

$

543,219

Cost of goods sold

219,611

171,419

424,255

341,197

Gross profit

112,383

102,704

221,069

202,022

Selling, general, and administrative

expenses

55,515

46,760

110,350

95,239

Technical and research expenses

11,860

10,318

24,525

20,595

Restructuring expenses, net

2,103

125

4,312

145

Operating income

42,905

45,501

81,882

86,043

Interest expense/(income), net

2,950

3,106

6,269

6,396

Other (income)/expense, net

5,657

(4,511

)

2,675

(4,966

)

Income before income taxes

34,298

46,906

72,938

84,613

Income tax expense

9,578

20,080

20,849

30,701

Net income

24,720

26,826

52,089

53,912

Net income attributable to the

noncontrolling interest

96

154

174

351

Net income attributable to the Company

$

24,624

$

26,672

$

51,915

$

53,561

Earnings per share attributable to Company

shareholders - Basic

$

0.79

$

0.86

$

1.66

$

1.72

Earnings per share attributable to Company

shareholders - Diluted

$

0.79

$

0.85

$

1.66

$

1.71

Shares of the Company used in computing

earnings per share:

Basic

31,242

31,174

31,225

31,152

Diluted

31,342

31,269

31,316

31,243

Dividends declared per Class A share

$

0.26

$

0.25

$

0.52

$

0.50

ALBANY INTERNATIONAL CORP.

CONSOLIDATED BALANCE SHEETS

(in thousands, except share

data)

(unaudited)

June 30, 2024

December 31, 2023

Assets

Cash and cash equivalents

$

116,439

$

173,420

Accounts receivable, net

280,008

287,781

Contract assets, net

189,242

182,281

Inventories

161,626

169,567

Income taxes prepaid and receivable

9,993

11,043

Prepaid expenses and other current

assets

49,143

53,872

Total current assets

$

806,451

$

877,964

Property, plant and equipment, net

582,167

601,989

Intangibles, net

41,505

44,646

Goodwill

178,236

180,181

Deferred income taxes

27,203

22,941

Noncurrent receivables, net

—

4,392

Other assets

116,259

102,901

Total assets

$

1,751,821

$

1,835,014

Liabilities and Shareholders' Equity

Accounts payable

$

84,628

$

87,104

Accrued liabilities

129,511

142,988

Current maturities of long-term debt

2,732

4,218

Income taxes payable

7,765

14,369

Total current liabilities

224,636

248,679

Long-term debt

374,325

452,667

Other noncurrent liabilities

151,892

139,385

Deferred taxes and other liabilities

27,620

26,963

Total liabilities

778,473

867,694

Commitments and Contingencies

Shareholders' Equity:

Preferred stock, par value $5.00 per

share; authorized 2,000,000 shares; none issued

—

—

Class A Common Stock, par value $0.001 per

share; authorized 100,000,000 shares; 40,908,380 issued in 2024 and

40,856,910 in 2023

41

41

Additional paid in capital

452,461

448,218

Retained earnings

1,046,612

1,010,942

Accumulated items of other comprehensive

income:

Translation adjustments

(154,304

)

(124,901

)

Pension and postretirement liability

adjustments

(16,718

)

(17,346

)

Derivative valuation adjustment

4,115

9,079

Treasury stock (Class A), at cost;

9,661,845 shares in 2024 and 2023

(364,665

)

(364,665

)

Total shareholders' equity

967,542

961,368

Noncontrolling interest

5,806

5,952

Total equity

973,348

967,320

Total liabilities and shareholders'

equity

$

1,751,821

$

1,835,014

ALBANY INTERNATIONAL CORP.

CONSOLIDATED STATEMENTS OF CASH

FLOWS

(in thousands)

(unaudited)

Six Months Ended June

30,

2024

2023

Cash flows from operating activities:

Net income

$

52,089

$

53,912

Adjustments to reconcile net income to net

cash provided by operating activities:

Depreciation

41,247

32,299

Amortization

3,446

3,018

Change in deferred taxes and other

liabilities

(2,391

)

1,787

Impairment of property, plant and

equipment

120

532

Non-cash interest expense

513

565

Compensation and benefits paid or payable

in Class A Common Stock

4,243

2,274

Provision/(recovery) for credit losses

from uncollected receivables and contract assets

(174

)

493

Foreign currency remeasurement gain on

intercompany loans

(2,580

)

(3,198

)

Fair value adjustment on foreign currency

contracts

3,109

(123

)

Gain on sale of assets

(512

)

—

Changes in operating assets and

liabilities that provided/(used) cash:

Accounts receivable

4,929

(40,131

)

Contract assets

(8,435

)

4,606

Inventories

3,062

(9,174

)

Prepaid expenses and other current

assets

(2,454

)

(2,700

)

Income taxes prepaid and receivable

873

(381

)

Accounts payable

17,679

(5,255

)

Accrued liabilities

(15,367

)

(21,570

)

Income taxes payable

(5,599

)

(4,943

)

Noncurrent receivables

(379

)

1,705

Other noncurrent liabilities

(924

)

(1,922

)

Other, net

494

2,881

Net cash provided by operating

activities

92,989

14,675

Cash flows from investing activities:

Purchases of property, plant and

equipment

(46,616

)

(34,899

)

Purchased software

(40

)

(72

)

Proceeds received from sale of assets

1,029

—

Net cash used in investing activities

(45,627

)

(34,971

)

Cash flows from financing activities:

Proceeds from borrowings

43,282

61,000

Principal payments on debt

(122,828

)

(13,000

)

Taxes paid in lieu of share issuance

(2,446

)

(3,136

)

Dividends paid

(16,233

)

(15,570

)

Net cash (used in)/provided by financing

activities

(98,225

)

29,294

Effect of exchange rate changes on cash

and cash equivalents

(6,118

)

142

(Decrease)/increase in cash and cash

equivalents

(56,981

)

9,140

Cash and cash equivalents at beginning of

period

173,420

291,776

Cash and cash equivalents at end of

period

$

116,439

$

300,916

The following table presents the reconciliation of Net revenues

to net revenues excluding the effect of changes in currency

translation rates, a non-GAAP measure:

(in thousands, except

percentages)

Net revenues as reported, Q2

2024

(Decrease)/ increase due to

changes in currency translation rates

Q2 2024 revenues on same basis

as Q2 2023 currency translation rates

Net revenues as reported, Q2

2023

% Change compared to Q2 2023,

excluding currency rate effects

Machine Clothing

$

193,578

$

(1,128

)

$

194,706

$

159,217

22.3

%

Albany Engineered Composites

138,416

(219

)

138,635

114,906

20.7

%

Consolidated total

$

331,994

$

(1,347

)

$

333,341

$

274,123

21.6

%

(in thousands, except

percentages)

Net revenues as reported, YTD

2024

(Decrease)/ increase due to

changes in currency translation rates

YTD 2024 revenues on same

basis as 2023 currency translation rates

Net revenues as reported, YTD

2023

% Change compared to 2023,

excluding currency rate effects

Machine Clothing

$

378,795

$

(1,726

)

$

380,521

$

312,439

21.8

%

Albany Engineered Composites

266,529

2

266,527

230,780

15.5

%

Consolidated total

$

645,324

$

(1,724

)

$

647,048

$

543,219

19.1

%

The following table presents Gross profit and Gross profit

margin:

(in thousands, except

percentages)

Gross profit,

Q2 2024

Gross profit margin, Q2

2024

Gross profit,

Q2 2023

Gross profit margin, Q2

2023

Machine Clothing

$

88,873

45.9

%

$

80,919

50.8

%

Albany Engineered Composites

23,510

17.0

%

21,785

19.0

%

Consolidated total

$

112,383

33.9

%

$

102,704

37.5

%

(in thousands, except

percentages)

Gross profit,

YTD 2024

Gross profit margin, YTD

2024

Gross profit,

YTD 2023

Gross profit margin, YTD

2023

Machine Clothing

$

173,528

45.8

%

$

158,774

50.8

%

Albany Engineered Composites

47,541

17.8

%

43,248

18.7

%

Consolidated total

$

221,069

34.3

%

$

202,022

37.2

%

A reconciliation from Net income/(loss) (GAAP) to Adjusted

EBITDA (non-GAAP) for the current-year and comparable prior-year

periods has been calculated as follows:

Three months ended June 30,

2024

(in thousands)

Machine Clothing

Albany Engineered

Composites

Corporate expenses

and other

Total Company

Net income/(loss) (GAAP)

$

53,685

$

9,434

$

(38,399

)

$

24,720

Interest expense/(income), net

—

—

2,950

2,950

Income tax expense

—

—

9,578

9,578

Depreciation and amortization expense

8,081

13,161

1,147

22,389

EBITDA (non-GAAP)

61,766

22,595

(24,724

)

59,637

Restructuring costs

1,584

922

115

2,621

Foreign currency revaluation

(gains)/losses (a)

(1,272

)

(42

)

139

(1,175

)

Other transition expenses

—

—

1,368

1,368

Acquisition/integration costs

345

—

424

769

Pre-tax (income) attributable to

noncontrolling interest

(58

)

(80

)

—

(138

)

Adjusted EBITDA (non-GAAP)

$

62,365

$

23,395

$

(22,678

)

$

63,082

Adjusted EBITDA margin (Adjusted EBITDA

divided by Net revenues) (non-GAAP)

32.2

%

16.9

%

—

19.0

%

Three months ended June 30,

2023

(in thousands)

Machine Clothing

Albany Engineered

Composites

Corporate expenses

and other

Total Company

Net income/(loss) (GAAP)

$

53,726

$

8,668

$

(35,568

)

$

26,826

Interest expense/(income), net

—

—

3,106

3,106

Income tax expense

—

—

20,080

20,080

Depreciation and amortization expense

4,931

12,072

947

17,950

EBITDA (non-GAAP)

58,657

20,740

(11,435

)

67,962

Restructuring costs

125

—

—

125

Foreign currency revaluation

(gains)/losses (a)

566

133

(4,185

)

(3,486

)

Acquisition/integration costs

—

271

363

634

Pre-tax (income) attributable to

noncontrolling interest

—

(212

)

—

(212

)

Adjusted EBITDA (non-GAAP)

$

59,348

$

20,932

$

(15,257

)

$

65,023

Adjusted EBITDA margin (Adjusted EBITDA

divided by Net revenues) (non-GAAP)

37.3

%

18.2

%

—

23.7

%

Six months ended June 30, 2024

(in thousands)

Machine Clothing

Albany Engineered

Composites

Corporate expenses

and other

Total Company

Net income/(loss) (GAAP)

$

101,795

$

18,622

$

(68,328

)

$

52,089

Interest expense/(income), net

—

—

6,269

6,269

Income tax expense

—

—

20,849

20,849

Depreciation and amortization expense

16,182

26,220

2,291

44,693

EBITDA (non-GAAP)

117,977

44,842

(38,919

)

123,900

Restructuring costs

1,605

3,110

115

4,830

Foreign currency revaluation

(gains)/losses (a)

(2,682

)

238

(1,157

)

(3,601

)

Other transition expenses

—

—

1,493

1,493

Acquisition/integration costs

1,058

182

850

2,090

Pre-tax (income) attributable to

noncontrolling interest

(69

)

(185

)

—

(254

)

Adjusted EBITDA (non-GAAP)

$

117,889

$

48,187

$

(37,618

)

$

128,458

Adjusted EBITDA margin (Adjusted EBITDA

divided by Net revenues-non-GAAP)

31.1

%

18.1

%

—

19.9

%

Six months ended June 30, 2023

(in thousands)

Machine Clothing

Albany Engineered

Composites

Corporate expenses

and other

Total Company

Net income/(loss) (GAAP)

$

102,690

$

18,086

$

(66,864

)

$

53,912

Interest expense/(income), net

—

—

6,396

6,396

Income tax expense

—

—

30,701

30,701

Depreciation and amortization expense

9,706

23,736

1,875

35,317

EBITDA (non-GAAP)

112,396

41,822

(27,892

)

126,326

Restructuring costs

145

—

—

145

Foreign currency revaluation

(gains)/losses (a)

2,526

—

(4,125

)

(1,599

)

Acquisition/integration costs

—

540

363

903

Pre-tax (income) attributable to

noncontrolling interest

—

(401

)

—

(401

)

Adjusted EBITDA (non-GAAP)

$

115,067

$

41,961

$

(31,654

)

$

125,374

Adjusted EBITDA margin (Adjusted EBITDA

divided by Net revenues-non-GAAP)

36.8

%

18.2

%

—

23.1

%

Per share impact of the adjustments to earnings per share are as

follows:

Three months ended June 30,

2024

(in thousands, except per share

amounts)

Pre tax

Amounts

Tax

Effect

After tax

Effect

Per share

Effect

Restructuring costs

$

2,621

$

583

$

2,038

$

0.07

Foreign currency revaluation

(gains)/losses (a)

(1,175

)

(377

)

(798

)

(0.03

)

Other transition expenses

1,368

267

1,101

0.04

Acquisition/integration costs

769

188

581

0.02

Three months ended June 30,

2023

(in thousands, except per share

amounts)

Pre tax

Amounts

Tax

Effect

After tax

Effect

Per share

Effect

Restructuring costs

$

125

$

31

$

94

$

0.00

Foreign currency revaluation

(gains)/losses (a)

(3,486

)

(1,034

)

(2,452

)

(0.08

)

Withholding tax related to internal

restructuring

—

(3,026

)

3,026

0.10

Acquisition/integration costs

634

158

476

0.02

Six months ended June 30, 2024

(in thousands, except per share

amounts)

Pre tax

Amounts

Tax

Effect

After tax

Effect

Per share

Effect

Restructuring costs

$

4,830

$

1,168

$

3,662

$

0.12

Foreign currency revaluation

(gains)/losses (a)

(3,601

)

(1,143

)

(2,458

)

(0.08

)

Other transition expenses

1,493

298

1,195

0.04

Acquisition/integration costs

2,090

575

1,515

0.05

Six months ended June 30, 2023

(in thousands, except per share

amounts)

Pre tax

Amounts

Tax

Effect

After tax

Effect

Per share

Effect

Restructuring costs

$

145

$

35

$

110

$

0.00

Foreign currency revaluation

(gains)/losses (a)

(1,599

)

(481

)

(1,118

)

(0.04

)

Withholding tax related to internal

restructuring

—

(3,026

)

3,026

0.10

Acquisition/integration costs

903

235

668

0.02

The following table provides a reconciliation of Diluted

Earnings per share to Adjusted Diluted Earnings per share:

Three months ended June

30,

Six months ended June

30,

Per share amounts (Diluted)

2024

2023

2024

2023

Earnings per share attributable to Company

shareholders - Basic (GAAP)

$

0.79

$

0.86

$

1.66

$

1.72

Effect of dilutive stock-based

compensation plans

—

(0.01

)

—

(0.01

)

Earnings per share attributable to Company

shareholders - Diluted (GAAP)

$

0.79

$

0.85

$

1.66

$

1.71

Adjustments, after tax:

Restructuring costs

0.07

—

0.12

—

Foreign currency revaluation

(gains)/losses (a)

(0.03

)

(0.08

)

(0.08

)

(0.04

)

Other transition expenses

0.04

—

0.04

—

Withholding tax related to internal

restructuring

—

0.10

—

0.10

Acquisition/integration costs

0.02

0.02

0.05

0.02

Adjusted Diluted Earnings per share

(non-GAAP)

$

0.89

$

0.89

$

1.79

$

1.79

The calculations of net debt are as follows:

(in thousands)

June 30, 2024

December 31, 2023

June 30, 2023

Current maturities of long-term debt

$

2,732

$

4,218

$

—

Long-term debt

374,325

452,667

487,000

Total debt

377,057

456,885

487,000

Cash and cash equivalents

116,439

173,420

300,916

Net debt (non-GAAP)

$

260,618

$

283,465

$

186,084

The calculation of net leverage ratio as of June 30, 2024 is as

follows:

Total Company

Twelve months ended

Six months ended

Trailing twelve

months ended

(in thousands)

December 31,

2023

June 30,

2023

June 30,

2024

June 30, 2024

(non-GAAP) (b)

Net income/(loss) (GAAP)

$

111,610

$

53,912

$

52,089

$

109,787

Interest expense/(income), net

13,601

6,396

6,269

13,474

Income tax expense

48,846

30,701

20,849

38,994

Depreciation and amortization expense

76,733

35,317

44,693

86,109

EBITDA (non-GAAP)

250,790

126,326

123,900

248,364

Restructuring costs

282

145

4,830

4,967

Foreign currency revaluation

(gains)/losses (a)

1,296

(1,599

)

(3,601

)

(706

)

CEO and other transition expenses

2,719

—

1,493

4,212

Inventory step-up impacting Cost of goods

sold

5,480

—

—

5,480

Acquisition/integration costs

5,194

903

2,090

6,381

Pre-tax (income) attributable to

noncontrolling interest

(665

)

(401

)

(254

)

(518

)

Adjusted EBITDA (non-GAAP)

$

265,096

$

125,374

$

128,458

$

268,180

(in thousands, except for net leverage

ratio)

June 30, 2024

Net debt (non-GAAP)

$

260,618

Trailing twelve months Adjusted EBITDA

(non-GAAP)

268,180

Net leverage ratio (non-GAAP)

0.97

(a) Foreign currency revaluation

(gains)/losses represent unrealized gains and losses arising from

the remeasurement of monetary assets and liabilities denominated in

non-functional currencies on the balance sheet date.

(b) Calculated as amounts incurred during

the twelve months ended December 31, 2023, less those incurred

during the six months ended June 30, 2023, plus those incurred

during the six months June 30, 2024.

The tables below provide a reconciliation of forecasted

full-year 2024 Adjusted EBITDA and Adjusted Diluted EPS (non-GAAP

measures) to the comparable GAAP measures.

Forecast of Full Year 2024 Adjusted

EBITDA

Machine Clothing

Engineered Composites

(in millions)

Low

High

Low

High

Net income attributable to the Company

(GAAP) (c)

$

200

$

215

$

44

$

49

Income attributable to the noncontrolling

interest

—

—

(1

)

(1

)

Interest expense/(income), net

—

—

—

—

Income tax expense

—

—

—

—

Depreciation and amortization

30

35

50

55

EBITDA (non-GAAP)

230

250

93

103

Restructuring costs (d)

2

2

3

3

Foreign currency revaluation

(gains)/losses (d)

(3

)

(3

)

—

—

Acquisition/integration costs (d)

1

1

—

—

Pre-tax (income)/loss attributable to

non-controlling interest

—

—

1

1

Adjusted EBITDA (non-GAAP)

$

230

$

250

$

97

$

107

(c) Interest, Other income/expense and

Income taxes are not allocated to the business segments

Forecast of Full Year 2024 Adjusted

EBITDA

Total Company

(in millions)

Low

High

Net income attributable to the Company

(GAAP)

$

107

$

122

Income attributable to the noncontrolling

interest

(1

)

(1

)

Interest expense/(income), net

17

18

Income tax expense

47

51

Depreciation and amortization

85

95

EBITDA (non-GAAP)

255

285

Restructuring costs (d)

5

5

Foreign currency revaluation

(gains)/losses (d)

(4

)

(4

)

Acquisition/integration costs (d)

2

2

Other transition expenses (d)

1

1

Pre-tax (income)/loss attributable to

non-controlling interest

1

1

Adjusted EBITDA (non-GAAP)

$

260

$

290

Total Company

Forecast of Full Year 2024 Earnings per

share (diluted) (e)

Low

High

Net income attributable to the Company

(GAAP)

$

3.42

$

3.92

Restructuring costs (d)

0.12

0.12

Foreign currency revaluation

(gains)/losses (d)

(0.08

)

(0.08

)

Other transition expenses (d)

0.04

0.04

Acquisition/integration costs (d)

0.05

0.05

Adjusted Diluted Earnings per share

(non-GAAP)

$

3.55

$

4.05

(d) Due to the uncertainty of these items,

we are unable to forecast these items for 2024

(e) Calculations based on weighted average

shares outstanding estimate of approximately 31.2 million

About Albany International Corp.

Albany International is a leading developer and manufacturer of

engineered components, using advanced materials processing and

automation capabilities, with two core businesses. Machine Clothing

is the world’s leading producer of custom-designed, consumable

belts essential for the manufacture of paper, paperboard, tissue

and towel, pulp, non-wovens and a variety of other industrial

applications. Albany Engineered Composites is a growing designer

and manufacturer of advanced materials-based engineered components

for demanding aerospace applications, supporting both commercial

and military platforms. Albany International is headquartered in

Rochester, New Hampshire, operates 32 facilities in 14 countries,

employs approximately 6,000 people worldwide, and is listed on the

New York Stock Exchange (Symbol AIN). Additional information about

the Company and its products and services can be found at

www.albint.com.

Non-GAAP Measures

This release, including the conference call commentary

associated with this release, contains certain non-GAAP measures,

that should not be considered in isolation or as a substitute for

the related GAAP measures. Such non-GAAP measures include net

revenues and percent change in net revenues, excluding the impact

of currency translation effects; EBITDA, Adjusted EBITDA, and

Adjusted EBITDA margin; Net debt; Net leverage ratio; and Adjusted

diluted earnings per share (or Adjusted Diluted EPS). Management

believes that these non-GAAP measures provide additional useful

information to investors regarding the Company’s operational

performance.

Presenting Net revenues and change in Net revenues, after

currency effects are excluded, provides management and investors

insight into underlying revenues trends. Net revenues, or percent

changes in net revenues, excluding currency rate effects, are

calculated by converting amounts reported in local currencies into

U.S. dollars at the exchange rate of a prior period. These amounts

are then compared to the U.S. dollar amount as reported in the

current period.

EBITDA (calculated as net income excluding interest, income

taxes, depreciation and amortization), Adjusted EBITDA, and

Adjusted Diluted EPS are performance measures that relate to the

Company’s continuing operations. The Company defines Adjusted

EBITDA as EBITDA excluding costs or benefits that are not

reflective of the Company’s ongoing or expected future operational

performance. Such excluded costs or benefits do not consist of

normal, recurring cash items necessary to generate revenues or

operate our business. Adjusted EBITDA margin represents Adjusted

EBITDA expressed as a percentage of net revenues.

The Company defines Adjusted Diluted EPS as diluted earnings per

share (GAAP), adjusted by the after tax per share amount of costs

or benefits not reflective of the Company’s ongoing or expected

future operational performance. The income tax effects are

calculated using the applicable statutory income tax rate of the

jurisdictions where such costs or benefits were incurred or the

effective tax rate applicable to total company results.

The Company’s Adjusted EBITDA, Adjusted EBITDA margin, and

Adjusted Diluted EPS may not be comparable to similarly titled

measures of other companies.

Net debt aids investors in understanding the Company’s debt

position if all available cash were applied to pay down

indebtedness.

Net leverage ratio informs the investors of the Company's

financial leverage at the end of the reporting period, providing an

indicator of the Company's ability to repay its debt.

We encourage investors to review our financial statements and

publicly-filed reports in their entirety and not to rely on any

single financial measure.

Forward-Looking Statements

This press release may contain statements, estimates, guidance

or projections that constitute “forward-looking statements” as

defined under U.S. federal securities laws. Generally, the words

“believe,” “expect,” “intend,” “estimate,” “anticipate,” “project,”

“will,” “should,” “look for,” “guidance,” “guide,” and similar

expressions identify forward-looking statements, which generally

are not historical in nature. Because forward-looking statements

are subject to certain risks and uncertainties (including, without

limitation, those set forth in the Company’s most recent Annual

Report on Form 10-K or Quarterly Report on Form 10-Q), actual

results may differ materially from those expressed or implied by

such forward-looking statements.

Forward-looking statements in this release or in the webcast

include, without limitation, statements about macroeconomic

conditions, including inflationary cost pressures, as well as

global events, which include but are not limited to geopolitical

events; paper-industry trends and conditions during the current

year and in future years; expectations in the current period and in

future periods of revenues, EBITDA, Adjusted EBITDA (both in

dollars and as a percentage of net revenues), Adjusted Diluted EPS,

income, gross profit, gross margin, cash flows and other financial

items in each of the Company’s businesses, and for the Company as a

whole; the timing and impact of production and development programs

in the Company’s AEC business segment and the revenues growth

potential of key AEC programs, as well as AEC as a whole; the

amount and timing of capital expenditures, future tax rates and

cash paid for taxes, depreciation and amortization; future debt and

net debt levels and debt covenant ratios; and changes in currency

rates and their impact on future revaluation gains and losses.

Furthermore, a change in any one or more of the foregoing factors

could have a material effect on the Company’s financial results in

any period. Such statements are based on current expectations, and

the Company undertakes no obligation to publicly update or revise

any forward-looking statements.

Statements expressing management’s assessments of the growth

potential of its businesses, or referring to earlier assessments of

such potential, are not intended as forecasts of actual future

growth, and should not be relied on as such. While management

believes such assessments to have a reasonable basis, such

assessments are, by their nature, inherently uncertain. This

release and earlier releases set forth a number of assumptions

regarding these assessments, including historical results,

independent forecasts regarding the markets in which these

businesses operate, and the timing and magnitude of orders for our

customers’ products. Historical growth rates are no guarantee of

future growth, and such independent forecasts and assumptions could

prove materially incorrect in some cases.

View source

version on businesswire.com: https://www.businesswire.com/news/home/20240806960688/en/

Investor / Media Contact: JC Chetnani VP-Investor

Relations and Treasurer +1 (603) 330-5851

jc.chetnani@albint.com

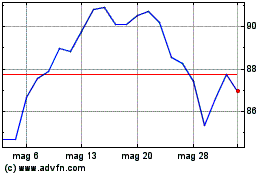

Grafico Azioni Albany (NYSE:AIN)

Storico

Da Nov 2024 a Dic 2024

Grafico Azioni Albany (NYSE:AIN)

Storico

Da Dic 2023 a Dic 2024