Form 6-K - Report of foreign issuer [Rules 13a-16 and 15d-16]

30 Gennaio 2024 - 4:59PM

Edgar (US Regulatory)

UNITED STATES SECURITIES AND EXCHANGE

COMMISSION

WASHINGTON,

D.C. 20549

FORM 6-K

REPORT OF

FOREIGN ISSUER PURSUANT TO RULE 13a-16 OR 15d-16

UNDER THE SECURITIES EXCHANGE ACT OF 1934

For the month of January, 2024

Commission file number: 1-10110

BANCO BILBAO VIZCAYA ARGENTARIA, S.A.

(Exact name of Registrant as specified in its charter)

BANK BILBAO VIZCAYA ARGENTARIA, S.A.

(Translation of Registrant’s name into English)

Calle Azul 4,

28050 Madrid

Spain

(Address of

principal executive offices)

Indicate by check mark whether the registrant files or will file annual reports under cover of Form

20-F or Form 40-F:

Form

20-F X Form 40-F

Indicate by check mark if the registrant is submitting the Form 6-K in paper as permitted by

Regulation S-T Rule 101(b)(1):

Yes No X

Indicate by check mark if the registrant is submitting the Form 6-K in paper as permitted by

Regulation S-T Rule 101(b)(7):

Yes No X

|

|

|

|

|

Press Release |

|

|

01.30.2024 |

BBVA surpasses

€8 billion in annual profit for the first time

In 2023 the BBVA Group added 11.1 million new customers and increased lending nearly 8 percent yoy. The bank also channeled

€70 billion in sustainable business, exceeding the €200-billion mark since 2018. BBVA posted a record net attributable profit of €8.02 billion in 2023, up 22 percent yoy

(+35 percent in constant euros)1. Recurrent earnings per share rose even more, 27 percent, driven by share buybacks executed in 2023. BBVA will pay a cash dividend €0.55 per share against 2023 earnings2, 28 percent more than in 2022, and will launch a new share buyback

program for €781 million3. In total, BBVA will distribute more than €4 billion to its shareholders.

1 Recurrent net attributable profit growth, excluding from the comparison the net impact of the purchase of offices

from Merlin in Spain in 2022 (€-201 million).

2 Of this amount €0.16 per share was paid in October as an interim dividend against 2023 earnings. The additional payment of €0.39 per share is subject to the approval of the governing bodies.

3 Pending approval from the governing bodies and subject to mandatory regulatory approval.

|

|

|

|

|

|

|

|

01.30.2024 |

In 2023, the Group generated significant organic growth thanks to its strategy based on innovation, digitization and

sustainability. The bank added more than 11 million new customers, 65 percent of them through digital channels. Digital sales, in units, now account for 79 percent of the total.

Furthermore, between January and December 2023, BBVA channeled €70 billion

in sustainable business, up 39 percent from a year earlier. Since 2018, the Group has channeled €206 billion, exceeding the pace required to meet the goal set for 2025.

Greater banking activity, with lending increasing nearly 8 percent in 2023, had a positive impact on society throughout our footprint. Thanks to financing provided

by the bank, 140,000 families purchased their home, 550,000 SMEs and self-employed increased their business, and 70,000 larger companies had access to financing to invest in growth. Likewise, BBVA channeled

€15 billion in inclusive growth projects,

such as the construction of hospitals and schools.

Except where otherwise stated, the evolution of each of the main headings, and changes in the income statement described below refer

to constant exchange rates. In other words, they do not take currency fluctuations into account.

At the top of the P&L account, lending growth in all business

areas -with the exception of Spain, where it saw a slight drop- and improved customer spreads pushed net interest income (NII) to €23.09 billion, up 29 percent. The good

performance of Spain, Mexico and South America stood out.

Greater activity also reflected positively in net fees and commissions, reaching €6.29 billion in 2023, up 21 percent vs a year earlier. The contribution from Turkey and Mexico is particularly relevant in this heading. In total, NII and net fees and commissions, the

bank’s core revenues, saw a 27 percent increase yoy, to

|

|

|

|

|

|

|

|

01.30.2024 |

€29.38 billion. Moreover, NTI grew 32 percent vs 2022, to €2.18 billion,

while the line for ‘other operating income and expenses’ posted a result of €-2.02 billion.

As a result of all the above, gross income reached €29.54 billion, up 30 percent yoy.

Operating expenses in 2023 were affected by high inflation rates in the Group’s footprint. This heading stood at

€12.31 billion, up 20 percent yoy. Nevertheless, the strength of gross income secured positive jaws and an improvement in the efficiency ratio of 370 bps in 2023, to

41.7 percent, which is significantly better than the average figure for comparable European peers.

The good business performance in 2023 prompted operating

income to record levels, with an increase yoy of 39 percent, to €17.23 billion.

Amid a context

of higher interest rates and growth in the most profitable segments, the provisions for impairments on financial assets rose 34 percent, to €4.43 billion, mainly due to higher

provisioning needs in Mexico and South America. As a result, the accumulated cost of risk increased to 1.15 percent, in line with expectations. The NPL ratio remained stable at 3.4 percent, while the coverage ratio slipped to

77 percent.

The BBVA Group posted a net attributable profit of €8.02 billion in 2023, up

40 percent yoy (+26 percent including the impact of exchange rates). In the fourth quarter alone, net attributable profit topped €2.06 billion. The bank expects net attributable

profit to continue to grow in 2024.

The annual profit increased by 35 percent when excluding the non-recurring impact

of the acquisition of offices from Merlin in 2022 for

€-201 million. In current euros, the increase was 22 percent, while earnings per share grew even

more, about 27 percent, thanks to the share buyback programs executed throughout the year.

On the back of these results, profitability indicators improved significantly: ROTE stood at 17 percent, with ROE at

16.2 percent, prompting BBVA to remain among the most profitable banks in Europe. Furthermore, in 2023 the Group continued to create value for its shareholders. The tangible book value per share plus dividends rose 20 percent yoy.

BBVA is to distribute more than €4 billion against 2023 earnings to shareholders, equivalent to a

50 percent payout. The bank is proposing to increase the annual gross cash dividend to €0.55 per share (compared to €0.43 in 2022,

28 percent more). Of this figure, a dividend of €0.16 per share was paid in October as an interim dividend. The final dividend of €0.39

per share will be submitted to the Annual General Meeting for approval, and is expected to be paid in April. Furthermore, the bank will launch a new share buyback program of €781 million³.

|

|

|

|

|

|

|

|

01.30.2024 |

The fully-loaded CET 1 capital ratio ended the year at 12.67 percent, well above the bank’s target range of 11.5

to 12 percent.

Business areas

In

Spain, lending growth in the most profitable segments offset the drop in mortgages and large corporations. Customer resources improved 2 percent thanks to off-balance sheet funds and time deposits.

The area posted a record net attributable profit of €2.76 billion in 2023 (+65 percent yoy4), driven by NII performance (+49

percent). The increase of gross income (+29 percent vs 2022) offset the rise of operating expenses (+8 percent). The efficiency ratio improved to 39.9 percent (-760 bps in the past 12 months).

Regarding risk indicators, as of Dec 31, 2023, the NPL ratio stood at 4.1 percent, with coverage ratio at 55 percent. The cost of risk was 0.37 percent, in line with expectations.

The strong lending activity stood out in Mexico, posting a yoy increase of 11 percent with growth in all business segments. Customer resources also showed a

solid performance, with a 13 percent increase thanks to deposits and mutual funds. Net attributable profit reached a record €5.34 billion, up 17 percent from a year earlier, driven

mostly by NII growth (+20 percent), which was boosted by greater activity and improved customer spreads. Double-digit growth prevailed in all income statement figures. As for asset quality indicators, the accumulated cost of risk stood at

2.96 percent, in line with expectations. The NPL ratio ended the year at 2.6 percent, with coverage ratio standing at 123 percent.

In Turkey, lending increased mostly due to growth in loans in Turkish lira (+55 percent, below the inflation

rate). Customer deposits also grew, backed by time deposits in local currency (+122 percent yoy). Turkey posted a net attributable profit of €528 million in 2023, up 5 percent from

a year earlier (in current euros). This result was driven by growth in net fees and commissions and NTI, which helped offset the pressure on NII, as well as lower provisions. Both the cost of risk and the NPL ratio showed a favorable evolution,

standing at 0.25 percent and 3.8 percent, respectively. The coverage ratio stood at high levels (97 percent).

In South America, lending activity

increased by 8.1 percent through December 2023, boosted by the retail portfolio, which was favored by the positive performance of consumer loans and credit cards. As for customer resources, growth in time deposits stood out in Colombia and

Peru, as well as demand deposits, and to a lesser extent, mutual funds in Argentina. The net attributable profit stood at €613 million. Despite the increase in lending in Colombia, the

attributable profit was impacted by higher costs of customer resources and impairments in retail portfolios. In Peru, growth in provisions, as a result of the macroeconomic environment, was offset by the positive evolution of core revenues.

Argentina, despite a strong depreciation of its currency, contributed €132 million to the Group’s results. The NPL ratio ended the year at 4.8 percent, with coverage ratio standing

at 88 percent. The cost of risk was 2.51 percent.

|

|

|

|

|

BBVA Corporate Communications

Tel. +34 699 337 924

comunicacion.corporativa@bbva.com

For more financial information about BBVA visit: https://shareholdersandinvestors.bbva.com/

For more news about BBVA visit: https://www.bbva.com

|

4 The comparison includes the net impact of the acquisition of offices from Merlin in Spain in 2022 (€-201

million).

|

|

|

|

|

|

|

|

01.30.2024 |

|

|

|

|

|

|

|

|

|

|

|

|

|

| |

|

|

|

|

Change

2023/2022 |

|

|

|

|

|

| BBVA Group (€M) |

|

2023 |

|

|

% constant |

|

|

% |

|

|

|

|

|

| Net Interest Income |

|

|

23,089 |

|

|

|

29 |

|

|

|

21 |

|

|

|

|

|

| Net Fees and Commissions |

|

|

6,288 |

|

|

|

21 |

|

|

|

17 |

|

|

|

|

|

| Net Trading Income |

|

|

2,183 |

|

|

|

32 |

|

|

|

13 |

|

|

|

|

|

| Other Income & Expenses1 |

|

|

-2,018 |

|

|

|

-5 |

|

|

|

19 |

|

|

|

|

|

| Gross Income |

|

|

29,542 |

|

|

|

30 |

|

|

|

19 |

|

|

|

|

|

| Operating Expenses |

|

|

-12,308 |

|

|

|

20 |

|

|

|

15 |

|

|

|

|

|

| Operating Income |

|

|

17,233 |

|

|

|

39 |

|

|

|

23 |

|

|

|

|

|

| Impairment on Financial Assets |

|

|

-4,428 |

|

|

|

34 |

|

|

|

31 |

|

|

|

|

|

| Provisions and Other Gains and Losses |

|

|

-386 |

|

|

|

85 |

|

|

|

48 |

|

|

|

|

|

| Income Before Tax |

|

|

12,419 |

|

|

|

40 |

|

|

|

19 |

|

|

|

|

|

| Income Tax |

|

|

-4,003 |

|

|

|

33 |

|

|

|

16 |

|

|

|

|

|

| Non-controlling Interest |

|

|

-397 |

|

|

|

n.s. |

|

|

|

n.s. |

|

|

|

|

|

| Net

Attributable Profit (ex non-recurring impacts)2 |

|

|

8,019 |

|

|

|

35 |

|

|

|

22 |

|

|

|

|

|

| Net

Attributable Profit (reported) |

|

|

8,019 |

|

|

|

40 |

|

|

|

26 |

|

(1) Extraordinary banking tax in Spain (-215

€M) is registered under Other Income & Expenses. (2) Non-recurring results include the negative impact of 201€M due to the agreement reached with Merlin for the purchase of 662 branches in Spain in 2Q22

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

| |

|

|

|

|

Change

4Q23/4Q22 |

|

|

Change

4Q23/3Q23 |

|

|

|

|

|

|

|

| BBVA Group (€M) |

|

4Q23 |

|

|

% constant |

|

|

% |

|

|

% constant |

|

|

% |

|

|

|

|

|

|

|

| Net Interest Income |

|

|

5,246 |

|

|

|

19 |

|

|

|

-2 |

|

|

|

0 |

|

|

|

-18 |

|

|

|

|

|

|

|

| Net Fees and Commissions |

|

|

1,694 |

|

|

|

36 |

|

|

|

28 |

|

|

|

11 |

|

|

|

1 |

|

|

|

|

|

|

|

| Net Trading Income |

|

|

753 |

|

|

|

231 |

|

|

|

180 |

|

|

|

45 |

|

|

|

14 |

|

|

|

|

|

|

|

| Other Income & Expenses |

|

|

-255 |

|

|

|

-40 |

|

|

|

-42 |

|

|

|

-71 |

|

|

|

-69 |

|

|

|

|

|

|

|

| Gross Income |

|

|

7,438 |

|

|

|

35 |

|

|

|

15 |

|

|

|

14 |

|

|

|

-7 |

|

|

|

|

|

|

|

| Operating Expenses |

|

|

-3,068 |

|

|

|

19 |

|

|

|

7 |

|

|

|

6 |

|

|

|

-7 |

|

|

|

|

|

|

|

| Operating Income |

|

|

4,370 |

|

|

|

48 |

|

|

|

21 |

|

|

|

19 |

|

|

|

-6 |

|

|

|

|

|

|

|

| Impairment on Financial Assets |

|

|

-1,225 |

|

|

|

33 |

|

|

|

23 |

|

|

|

8 |

|

|

|

1 |

|

|

|

|

|

|

|

| Provisions and Other Gains and Losses |

|

|

-213 |

|

|

|

571 |

|

|

|

276 |

|

|

|

187 |

|

|

|

169 |

|

|

|

|

|

|

|

| Income Before Tax |

|

|

2,932 |

|

|

|

47 |

|

|

|

15 |

|

|

|

19 |

|

|

|

-13 |

|

|

|

|

|

|

|

| Income Tax |

|

|

-799 |

|

|

|

25 |

|

|

|

-6 |

|

|

|

-8 |

|

|

|

-35 |

|

|

|

|

|

|

|

| Non-controlling Interest |

|

|

-75 |

|

|

|

n.s. |

|

|

|

n.s. |

|

|

|

n.s. |

|

|

|

n.s. |

|

|

|

|

|

|

|

| Net Attributable Profit

(reported) |

|

|

2,058 |

|

|

|

57 |

|

|

|

32 |

|

|

|

26 |

|

|

|

-1 |

|

|

|

|

|

|

|

|

|

01.30.2024 |

About BBVA

BBVA is a global financial services group founded in 1857. The bank is present in more than 25 countries, has a

strong leadership position in the Spanish market, is the largest financial institution in Mexico and it has leading franchises in South America and Turkey.

BBVA contributes with its activity to the progress and welfare of all its stakeholders: shareholders, clients, employees, providers and society in general. In this regard, BBVA supports families, entrepreneurs and companies in their

plans, and helps them to take advantage of the opportunities provided by innovation and technology. Likewise, BBVA offers its customers a unique value proposition, leveraged on technology and data, helping them improve their financial health with

personalized information on financial decision-making.

SIGNATURE

Pursuant to the requirements of the Securities Exchange Act of 1934, the registrant has duly caused this report to be signed on its behalf by

the undersigned, thereunto duly authorized.

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

Banco Bilbao Vizcaya Argentaria, S.A. |

|

|

| Date: January 30, 2024 |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

By: /s/ María Ángeles Peláez Morón |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

Name: María Ángeles Peláez Morón |

|

|

|

|

|

|

|

|

|

|

|

|

|

Title: Authorized representative |

|

|

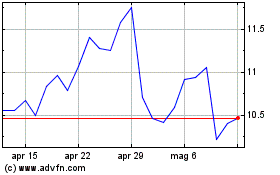

Grafico Azioni BBVA Bilbao Vizcaya Arge... (NYSE:BBVA)

Storico

Da Ott 2024 a Nov 2024

Grafico Azioni BBVA Bilbao Vizcaya Arge... (NYSE:BBVA)

Storico

Da Nov 2023 a Nov 2024