Form FWP - Filing under Securities Act Rules 163/433 of free writing prospectuses

11 Dicembre 2024 - 10:47PM

Edgar (US Regulatory)

Filed Pursuant to Rule 433

Registration Statement No. 333-282565

|

|

|

Market-Linked Step Up Notes

|

|

|

|

|

|

Market-Linked Step Up Notes Linked to the STOXX® Global Select Dividend 100 Index

|

The graph above and the table below reflect the hypothetical return on the notes, based on the terms contained in the table to the left (using the mid-point for any range(s)). The graph and table have been prepared for purposes of illustration only and do not take into account any tax consequences from investing in the notes.

Hypothetical Percentage Change from the Starting Value to the Ending Value

Hypothetical Redemption Amount per Unit

Hypothetical Total Rate of Return on the Notes

(1)This hypothetical percentage change corresponds to the Threshold Value.

(2)This amount represents the sum of the principal amount and the hypothetical Step Up Payment of $2.50.

(3)This hypothetical percentage change corresponds to the Step Up Value.

|

|

Issuer

|

The Bank of Nova Scotia (“BNS”)

|

|

Principal Amount

|

$10.00 per unit

|

|

Term

|

Approximately two years

|

|

Market Measure

|

The STOXX® Global Select Dividend 100 Index (Bloomberg symbol: “SDGP”)

|

|

Payout Profile at Maturity

|

●If the Market Measure is flat or increases up to the Step Up Value, a return equal to the Step Up Payment

●If the Market Measure increases above the Step Up Value, a return equal to the percentage increase in the Market Measure

●1-to-1 downside exposure to decreases in the Market Measure, with up to 100.00% of your principal at risk

|

|

Step Up Value

|

[122.00% to 128.00%] of the Starting Value, to be determined on the pricing date

|

|

Step Up Payment

|

[$2.20 to $2.80] per unit, a return of [22.00% to 28.00%] over the principal amount, to be determined on the pricing date

|

|

Threshold Value

|

100.00% of the Starting Value

|

|

Investment Considerations

|

This investment is designed for investors who anticipate that the Market Measure will increase over the term of the notes and are willing to take full downside risk and forgo interim interest payments.

|

|

Preliminary Offering Documents

|

http://www.sec.gov/Archives/edgar/data/9631/000183988224044779/bns_fwp-25769.htm

|

|

Exchange Listing

|

No

|

|

You should read the relevant Preliminary Offering Documents before you invest. Click on the Preliminary Offering Documents hyperlink above or call your Financial Advisor for a hard copy.

Risk Factors

Please see the Preliminary Offering Documents for a description of certain risks related to this investment, including, but not limited to, the following:

●Depending on the performance of the Market Measure as measured shortly before the maturity date, your investment may result in a loss; there is no guaranteed return of principal.

●Payments on the notes are subject to the credit risk of BNS, and actual or perceived changes in the creditworthiness of BNS are expected to affect the value of the notes. If BNS becomes insolvent or is unable to pay its obligations, you may lose your entire investment.

●The initial estimated value of the notes on the pricing date will be less than their public offering price.

●If you attempt to sell the notes prior to maturity, their market value may be lower than both the public offering price and the initial estimated value of the notes on the pricing date.

●You will have no rights of a holder of the securities represented by the Market Measure, and you will not be entitled to receive securities or dividends or other distributions by the issuers of those securities.

●The value of, and your return on, the notes may be affected by factors affecting the international securities markets, specifically changes in the countries represented by the Market Measure. In addition, you will not obtain the benefit of any increase in the value of the currencies in which the securities in the Index trade against the U.S. dollar which you would have received if you had owned the securities in the Market Measure during the term of your notes, although the level of the Market Measure may be adversely affected by general exchange rate movements in the market.

Final terms will be set on the pricing date within the given range for the specified Market-Linked Investment. Please see the Preliminary Offering Documents for complete product disclosure, including related risks and tax disclosure.

|

The Bank of Nova Scotia ("BNS") has filed a registration statement (which includes a prospectus) with the U.S. Securities and Exchange Commission (SEC) for the notes that are described in this Guidebook. Before you invest, you should carefully read the prospectus in that registration statement and other documents that BNS has filed with the SEC for more complete information about BNS and any offering described in this Guidebook. You may obtain these documents without cost by visiting EDGAR on the SEC Website at www.sec.gov. BNS's Central Index Key, or CIK, on the SEC website is 9631. Alternatively, Merrill Lynch will arrange to send you the prospectus and other documents relating to any offering described in this document if you so request by calling toll-free 1-800-294-1322. BNS faces risks that are specific to its business, and we encourage you to carefully consider these risks before making an investment in its securities.

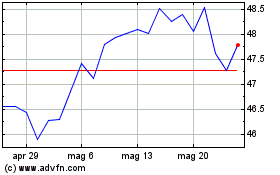

Grafico Azioni Bank Nova Scotia Halifax (NYSE:BNS)

Storico

Da Nov 2024 a Dic 2024

Grafico Azioni Bank Nova Scotia Halifax (NYSE:BNS)

Storico

Da Dic 2023 a Dic 2024