UNITED

STATES

SECURITIES AND EXCHANGE COMMISSION

Washington, DC

20549

Form

6-K

Report

of Foreign Private Issuer

Pursuant

to Rule 13a-16 or 15d-16 of

the

Securities Exchange Act of 1934

| For

the month of: December, 2024 |

Commission

File Number: 002-09048 |

THE BANK OF NOVA SCOTIA

(Name

of registrant)

40

Temperance Street, Toronto, Ontario, M5H 0B4

Attention:

Secretary's Department (Tel.: (416) 866-3672)

(Address

of Principal Executive Offices)

Indicate

by check mark whether the registrant files or will file annual reports under cover of Form 20-F or Form 40-F:

Form

20-F Form

40-F X

SIGNATURES

Pursuant

to the requirements of the Securities Exchange Act of 1934, the registrant has duly caused this report to be signed on its behalf

by the undersigned, thereunto duly authorized.

| |

|

THE BANK OF NOVA SCOTIA |

| |

|

|

| Date: December 13, 2024 |

By: |

/s/

Meigan

Terry

|

| |

|

Name: Meigan Terry |

| |

|

Title: SVP, Global Communications |

EXHIBIT

INDEX

Exhibit 99.1

Scotiabank Receives Regulatory Approval for Additional

Investment in KeyCorp

TORONTO, Dec. 13, 2024 /CNW/ - Scotiabank announced

today that it has received regulatory approval from the Board of Governors of the Federal Reserve System for its approximately 10% additional

investment (the "Additional Investment") in KeyCorp. Scotiabank and KeyCorp expect to close the Additional Investment in 2024.

Scotiabank previously announced on August 12, 2024

that it had entered into an agreement to acquire an approximate 14.9% pro-forma ownership stake in KeyCorp in two stages - an initial

investment of 4.9% (the "Initial Investment") and the Additional Investment of approximately 10%. The Initial Investment was

completed on August 30, 2024.

About Scotiabank

Scotiabank's vision is to be our clients' most trusted financial partner and deliver sustainable, profitable growth. Guided by our

purpose: "for every future," we help our clients, their families and their communities achieve success through a broad range

of advice, products and services, including personal and commercial banking, wealth management and private banking, corporate and investment

banking, and capital markets. With assets of approximately $1.4 trillion (as at October 31, 2024), Scotiabank is one of

the largest banks in North America by assets, and trades on the Toronto Stock Exchange (TSX: BNS) and New York Stock Exchange

(NYSE: BNS). For more information, please visit www.scotiabank.com and follow us on X @Scotiabank.

Forward-looking statements

From time to time, our public communications include oral or written forward-looking statements. Statements of this type are included

in this document, and may be included in other filings with Canadian securities regulators or the U.S. Securities and Exchange Commission

(SEC), or in other communications. In addition, representatives of the Bank may include forward-looking statements orally to analysts,

investors, the media and others. All such statements are made pursuant to the "safe harbor" provisions of the U.S. Private Securities

Litigation Reform Act of 1995 and any applicable Canadian securities legislation. Forward-looking statements may include, but are not

limited to, statements made in this document, the Management's Discussion and Analysis in the Bank's 2024 Annual Report under the headings

"Outlook" and in other statements regarding the Bank's objectives, strategies to achieve those objectives, the regulatory environment

in which the Bank operates, anticipated financial results, and the outlook for the Bank's businesses and for the Canadian, U.S. and global

economies. Such statements are typically identified by words or phrases such as "believe," "expect," "aim,"

"achieve," "foresee," "forecast," "anticipate," "intend," "estimate," "outlook,"

"seek," "schedule," "plan," "goal," "strive," "target," "project,"

"commit," "objective," and similar expressions of future or conditional verbs, such as "will," "may,"

"should," "would," "might," "can" and "could" and positive and negative variations thereof.

By their very nature, forward-looking statements require

us to make assumptions and are subject to inherent risks and uncertainties, which give rise to the possibility that our predictions, forecasts,

projections, expectations or conclusions will not prove to be accurate, that our assumptions may not be correct and that our financial

performance objectives, vision and strategic goals will not be achieved.

We caution readers not to place undue reliance on

these statements as a number of risk factors, many of which are beyond our control and effects of which can be difficult to predict, could

cause our actual results to differ materially from the expectations, targets, estimates or intentions expressed in such forward-looking

statements.

The future outcomes that relate to forward-looking

statements may be influenced by many factors, including but not limited to: general economic and market conditions in the countries in

which we operate and globally; changes in currency and interest rates; increased funding costs and market volatility due to market illiquidity

and competition for funding; the failure of third parties to comply with their obligations to the Bank and its affiliates, including relating

to the care and control of information, and other risks arising from the Bank's use of third parties; changes in monetary, fiscal, or

economic policy and tax legislation and interpretation; changes in laws and regulations or in supervisory expectations or requirements,

including capital, interest rate and liquidity requirements and guidance, and the effect of such changes on funding costs; geopolitical

risk; changes to our credit ratings; the possible effects on our business and the global economy of war, conflicts or terrorist actions

and unforeseen consequences arising from such actions; technological changes, including the use of data and artificial intelligence in

our business, and technology resiliency; operational and infrastructure risks; reputational risks; the accuracy and completeness of information

the Bank receives on customers and counterparties; the timely development and introduction of new products and services, and the extent

to which products or services previously sold by the Bank require the Bank to incur liabilities or absorb losses not contemplated at their

origination; our ability to execute our strategic plans, including the successful completion of acquisitions and dispositions, including

obtaining regulatory approvals; critical accounting estimates and the effect of changes to accounting standards, rules and interpretations

on these estimates; global capital markets activity; the Bank's ability to attract, develop and retain key executives; the evolution of

various types of fraud or other criminal behaviour to which the Bank is exposed; anti-money laundering; disruptions or attacks (including

cyberattacks) on the Bank's information technology, internet connectivity, network accessibility, or other voice or data communications

systems or services, which may result in data breaches, unauthorized access to sensitive information, denial of service and potential

incidents of identity theft; increased competition in the geographic and in business areas in which we operate, including through internet

and mobile banking and non-traditional competitors; exposure related to significant litigation and regulatory matters; environmental,

social and governance risks, including climate change, our ability to implement various sustainability-related initiatives (both internally

and with our clients and other stakeholders) under expected time frames, and our ability to scale our sustainable-finance products and

services; the occurrence of natural and unnatural catastrophic events and claims resulting from such events, including disruptions to

public infrastructure, such as transportation, communications, power or water supply; inflationary pressures; global supply-chain disruptions;

Canadian housing and household indebtedness; the emergence or continuation of widespread health emergencies or pandemics, including their

impact on the global economy, financial market conditions and the Bank's business, results of operations, financial condition and prospects;

and the Bank's anticipation of and success in managing the risks implied by the foregoing. A substantial amount of the Bank's business

involves making loans or otherwise committing resources to specific companies, industries or countries. Unforeseen events affecting such

borrowers, industries or countries could have a material adverse effect on the Bank's financial results, businesses, financial condition

or liquidity. These and other factors may cause the Bank's actual performance to differ materially from that contemplated by forward-looking

statements. The Bank cautions that the preceding list is not exhaustive of all possible risk factors and other factors could also adversely

affect the Bank's results, for more information, please see the "Risk Management" section of the Bank's 2024 Annual Report,

as may be updated by quarterly reports.

Material economic assumptions underlying the forward-looking

statements contained in this document are set out in the 2024 Annual Report under the headings "Outlook", as updated by quarterly

reports. The "Outlook" and "2025 Priorities" sections are based on the Bank's views and the actual outcome is uncertain.

Readers should consider the above-noted factors when reviewing these sections. When relying on forward-looking statements to make decisions

with respect to the Bank and its securities, investors and others should carefully consider the preceding factors, other uncertainties

and potential events.

Any forward-looking statements contained in this document

represent the views of management only as of the date hereof and are presented for the purpose of assisting the Bank's shareholders and

analysts in understanding the Bank's financial position, objectives and priorities, and anticipated financial performance as at and for

the periods ended on the dates presented, and may not be appropriate for other purposes. Except as required by law, the Bank does not

undertake to update any forward-looking statements, whether written or oral, that may be made from time to time by or on its behalf.

Additional information relating to the Bank, including

the Bank's Annual Information Form, can be located on the SEDAR+ website at www.sedarplus.ca and on the EDGAR section of the SEC's website

at www.sec.gov.

SOURCE Scotiabank

View original content to download multimedia: http://www.newswire.ca/en/releases/archive/December2024/13/c8142.html

%CIK: 0000009631

For further information: For investor inquiries only: John McCartney,

Investor Relations, Scotiabank, john.mccartney@scotiabank.com; For media inquiries only: Clancy Zeifman, Global Communications, Scotiabank,

clancy.zeifman@scotiabank.com

CO: Scotiabank

CNW 06:00e 13-DEC-24

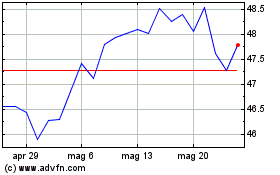

Grafico Azioni Bank Nova Scotia Halifax (NYSE:BNS)

Storico

Da Feb 2025 a Mar 2025

Grafico Azioni Bank Nova Scotia Halifax (NYSE:BNS)

Storico

Da Mar 2024 a Mar 2025