Essex Property Trust Prices $400 Million of Senior Notes

06 Febbraio 2025 - 11:08PM

Business Wire

Essex Property Trust, Inc. (NYSE:ESS) (“Essex”) announced today

that its operating partnership, Essex Portfolio, L.P. (the

“Issuer”), priced an underwritten public offering of $400 million

aggregate principal amount of 5.375% senior notes due 2035 (the

“Notes”). The Notes were priced at 99.604% of par value with a

yield to maturity of 5.425%. Interest is payable semiannually at an

interest rate per annum of 5.375% on April 1 and October 1 of each

year with the first interest payment due October 1, 2025. The Notes

mature on April 1, 2035. The Notes will be the senior unsecured

obligations of the Issuer and will be fully and unconditionally

guaranteed by Essex. The Notes offering is expected to close on

February 18, 2025, subject to the satisfaction of certain closing

conditions.

The Issuer intends to use the net proceeds of this offering to

repay upcoming debt maturities, including to fund a portion of the

repayment of the Issuer’s $500.0 million aggregate principal amount

outstanding of 3.500% senior notes due April 2025, and for other

general corporate and working capital purposes, which may include

the funding of potential acquisition opportunities. Pending

application of the net proceeds from the offering for the foregoing

purposes, such proceeds initially may be used to repay borrowings

outstanding under the Issuer’s unsecured credit facilities and/or

invested in short-term securities.

J.P. Morgan Securities LLC, U.S. Bancorp Investments, Inc.,

Wells Fargo Securities, LLC, BMO Capital Markets Corp., PNC Capital

Markets LLC and Truist Securities, Inc. served as joint

book-running managers, BofA Securities, Inc., Scotia Capital (USA)

Inc. and TD Securities (USA) LLC served as senior co-managers and

Mizuho Securities USA LLC, Regions Securities LLC and Samuel A.

Ramirez & Company, Inc. served as co-managers for the

offering.

The Issuer and Essex have jointly filed a registration statement

(including a preliminary prospectus supplement and a prospectus)

with the U.S. Securities and Exchange Commission (“SEC”) for the

offering to which this communication relates. You may get these

documents for free by searching the SEC online database on the SEC

website at http://www.sec.gov. Alternatively, the Issuer, Essex,

any underwriter or any dealer participating in the offering will

arrange to send you the prospectus supplement and prospectus if you

request it from (i) J.P. Morgan Securities LLC, c/o Broadridge

Financial Solutions, 1155 Long Island Avenue, Edgewood, NY 11717 or

by email at prospectus-eq_fi@jpmchase.com and

postsalemanualrequests@broadridge.com, (ii) U.S. Bancorp

Investments, Inc. toll free at 1-877-558-2607 or (iii) Wells Fargo

Securities, LLC toll free at 1-800-645-3751.

This press release shall not constitute an offer to sell or the

solicitation of an offer to buy any securities nor will there be

any sale of these securities in any jurisdiction in which, or to

any person to whom, such offer, solicitation or sale would be

unlawful.

About Essex Property Trust,

Inc.

Essex Property Trust, Inc., an S&P 500 company, is a fully

integrated real estate investment trust (“REIT”) that acquires,

develops, redevelops, and manages multifamily residential

properties in selected West Coast markets. Essex currently has

ownership interests in 256 apartment communities comprising over

62,000 apartment homes with an additional property in active

development. Additional information about the Company can be found

on the Company’s website at www.essex.com.

Safe Harbor Statement

This press release includes “forward-looking statements” within

the meaning of Section 27A of the Securities Act of 1933, as

amended, and Section 21E of the Securities Exchange Act of 1934, as

amended. Forward-looking statements are statements which are not

historical facts, including statements regarding our expectations,

estimates, assumptions, hopes, intentions, beliefs and strategies

regarding the future. Words such as “expects,” “assumes,”

“anticipates,” “may,” “will,” “intends,” “plans,” “projects,”

“believes,” “seeks,” “future,” “estimates,” and variations of such

words and similar expressions are intended to identify such

forward-looking statements. Such forward-looking statements

include, among other things, statements related to the Notes

offering, including the terms, timing and completion of the

offering and the expected use of the net proceeds therefrom. We

cannot assure the future results or outcome of the matters

described in these statements; rather, these statements merely

reflect our current expectations of the approximate outcomes of the

matters discussed. Factors that might cause our actual results,

performance or achievements to differ materially from those

expressed or implied by these forward-looking statements include,

but are not limited to, those associated with market risks and

uncertainties and the satisfaction of customary closing conditions

for an offering of the Notes, as well as the risks referenced in

our annual report on Form 10-K for the year ended December 31,

2023, our quarterly reports on Form 10-Q for the quarters ended

March 31, 2024, June 30, 2024, and September 30, 2024, and any

subsequent current reports on Form 8-K filed (and not furnished) by

us with the SEC, and the prospectus supplement and related

prospectus for this offering, as well as those risk factors and

special considerations set forth in our other filings with the SEC

that are incorporated by reference in such prospectus supplement

and accompanying prospectus which may cause our actual results,

performance or achievements to be materially different from any

future results, performance or achievements expressed or implied by

such forward-looking statements. All forward-looking statements are

made as of the date hereof, we assume no obligation to update or

supplement this information for any reason, and therefore, they may

not represent our estimates and assumptions after the date of this

press release.

View source

version on businesswire.com: https://www.businesswire.com/news/home/20250206072367/en/

Loren Rainey Director, Investor Relations (650) 655-7800

lrainey@essex.com

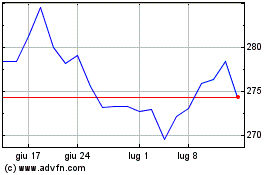

Grafico Azioni Essex Property (NYSE:ESS)

Storico

Da Feb 2025 a Mar 2025

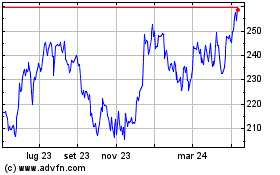

Grafico Azioni Essex Property (NYSE:ESS)

Storico

Da Mar 2024 a Mar 2025