0001331875false00013318752024-11-062024-11-06

United States

SECURITIES AND EXCHANGE COMMISSION

Washington, D.C. 20549

FORM 8-K

Current Report

Pursuant to Section 13 or 15(d) of the Securities Exchange Act of 1934

Date of Report (date of earliest event reported):

November 6, 2024

Fidelity National Financial, Inc.

(Exact name of Registrant as Specified in its Charter)

001-32630

(Commission File Number) | | | | | | | | |

| Delaware | | 16-1725106 |

(State or Other Jurisdiction of

Incorporation or Organization) | |

(IRS Employer Identification Number) |

601 Riverside Avenue

Jacksonville, Florida 32204

(Addresses of Principal Executive Offices)

(904) 854-8100

(Registrant's Telephone Number, Including Area Code)

(Former Name or Former Address, if Changed Since Last Report)

Check the appropriate box below if the Form 8-K filing is intended to simultaneously satisfy the filing obligation of the registrant under any of the following provisions: | | | | | | | | |

| ☐ | | Written communications pursuant to Rule 425 under the Securities Act (17 CFR 230.425) |

| ☐ | | Soliciting material pursuant to Rule 14a-12 under the Exchange Act (17 CFR 240.14a-12) |

| ☐ | | Pre-commencement communications pursuant to Rule 14d-2(b) under the Exchange Act (17 CFR 240.14d-2(b)) |

| ☐ | | Pre-commencement communications pursuant to Rule 13e-4(c) under the Exchange Act (17 CFR 240.13e-4(c)) |

Securities registered pursuant to Section 12(b) of the Act: | | | | | | | | | | | | | | |

| Title of Each Class | | Trading Symbol | | Name of Each Exchange on Which Registered |

| FNF Common Stock, $0.0001 par value | | FNF | | New York Stock Exchange |

Indicate by check mark whether the registrant is an emerging growth company as defined in Rule 405 of the Securities Act of 1933 (§230.405 of this chapter) or Rule 12b-2 of the Securities Exchange Act of 1934 (§240.12b-2 of this chapter).

Emerging growth company ☐

If an emerging growth company, indicate by check mark if the registrant has elected not to use the extended transition period for complying with any new or revised financial accounting standards provided pursuant to Section 13(a) of the Exchange Act. ☐

| | | | | | | | |

| Item 2.02. | | Results of Operations and Financial Condition |

On November 6, 2024, Fidelity National Financial, Inc. (the "Company", "FNF") issued an earnings release announcing its financial results for the Third Quarter of 2024. A copy of the FNF earnings release is attached as Exhibit 99.1 to this Current Report on Form 8-K.

The following information, including the Exhibits referenced in this Item 2.02, is being furnished pursuant to this Item 2.02 and shall not be deemed “filed” for purposes of Section 18 of the Securities Exchange Act of 1934, as amended or otherwise subject to the liabilities of that Section, nor shall it be deemed incorporated by reference into any registration statement or other document pursuant to the Securities Act of 1933, as amended, except as shall be expressly set forth by specific reference in such filing.

| | | | | | | | |

| Item 9.01. | | Financial Statements and Exhibits |

(d) Exhibits

| | | | | | | | | | | | | | |

| | | | | |

| Exhibit | | Description |

| 99.1 | | | | |

| 101 | | | | Cover Page Interactive Data File - the cover page XBRL tags are embedded within the Inline XBRL document. |

SIGNATURE

Pursuant to the requirements of the Securities Exchange Act of 1934, the registrant has duly caused this report to be signed on its behalf by the undersigned thereunto duly authorized. | | | | | | | | | | | | | | | | | |

| | | | | |

| | Fidelity National Financial, Inc. | |

| Date: | November 6, 2024 | By: | /s/ Anthony J. Park | |

| | | Name: | Anthony J. Park | |

| | | Title: | Chief Financial Officer | |

FNF Reports Third Quarter 2024 Financial Results

Jacksonville, Fla. – (November 6, 2024) - Fidelity National Financial, Inc. (NYSE:FNF) (“FNF” or the “Company”), a leading provider of title insurance and transaction services to the real estate and mortgage industries and a leading provider of insurance solutions serving retail annuity and life customers and institutional clients through its majority-owned, publicly traded subsidiary F&G Annuities & Life, Inc. (NYSE:FG) (“F&G”), today reported financial results for the third quarter ended September 30, 2024.

Net earnings attributable to common shareholders for the third quarter were $266 million, or $0.97 per diluted share (per share), compared to $426 million, or $1.57 per share, for the third quarter of 2023. Net earnings attributable to common shareholders include mark-to-market effects and non-recurring items; all of which are excluded from adjusted net earnings attributable to common shareholders.

Adjusted net earnings attributable to common shareholders (adjusted net earnings) for the third quarter were $356 million, or $1.30 per share, compared to $333 million, or $1.23 per share, for the third quarter of 2023.

•The Title Segment contributed $244 million, in line with $245 million for the third quarter of 2023

•The F&G Segment contributed $135 million, compared to $102 million for the third quarter of 2023, including alternative investment returns below our long-term expectations of $35 million and net significant income items of $16 million. Please see “Segment Financial Results” for F&G under “Non-GAAP Measures and Other Information” for further explanation

•The Corporate Segment had adjusted net earnings of $3 million before eliminating $26 million of dividend income from F&G in the consolidated financial statements, compared to $8 million for the third quarter of 2023 before eliminating $22 million of dividend income from F&G in the consolidated financial statements

Company Highlights

•Strong Title Segment revenue and margin; continue to successfully navigate current market: For the Title Segment, total revenue of $2.1 billion for the quarter, a 12% increase over $1.9 billion in the third quarter of 2023. Total revenue, excluding recognized gains and losses, of $2.0 billion for the third quarter, a 6% increase over $1.9 billion in the third quarter of 2023. Adjusted pre-tax title margin was 15.9% for the quarter, compared to 16.2% in the third quarter of 2023

•F&G Segment robust sales growth across multi-channel platform drove record assets under management: For the F&G Segment, gross sales of $3.9 billion for the third quarter increased 39% over the third quarter of 2023. F&G achieved record assets under management before flow reinsurance of $62.9 billion at the end of the third quarter, an increase of 20% over the third quarter of 2023

•Sustainable common dividend backed by strong balance sheet: FNF paid common dividends of $0.48 per share for $130 million and ended the third quarter with $822 million in cash and short-term liquid investments at the holding company

William P. Foley, II, Chairman, commented, “Our Title business continues to outperform in the current market and delivered an industry leading adjusted pre-tax title margin of 15.9% for the third quarter. We are well positioned for a rebound in transactional levels and we continue to build and expand the business for the long-term. F&G continues to benefit as consumers want to secure the relatively higher interest rates, guaranteed tax deferred growth and principal protection that annuities provide. As a result, F&G has profitably grown assets under management before flow reinsurance to a record $62.9 billion at the end of the third quarter, driven by gross sales of $3.9 billion, an increase of 39% over the third quarter of 2023 with a record level of retail sales. The F&G Segment’s earnings contribution to FNF was 39% for the first nine months of 2024, providing an important complement to our Title business. Taken together, our business is performing at a high level reflecting both our momentum and successful execution to deliver strong results.”

Summary Financial Results

| | | | | | | | | | | | | | | | | | | | |

| | | | | | |

| (In millions, except per share data) | Three Months Ended | Year to Date |

| September 30, 2024 | | September 30, 2023 | 2024 | | 2023 |

| Total revenue | $ | 3,603 | | | $ | 2,778 | | $ | 10,060 | | | $ | 8,320 | |

| F&G total gross sales1 | $ | 3,878 | | | $ | 2,781 | | $ | 11,793 | | | $ | 9,070 | |

F&G assets under management (AUM)1 | $ | 52,464 | | | $ | 47,103 | | $ | 52,464 | | | $ | 47,103 | |

F&G AUM before flow reinsurance1 | $ | 62,875 | | | $ | 52,577 | | $ | 62,875 | | | $ | 52,577 | |

| Total assets | $ | 94,672 | | | $ | 74,002 | | $ | 94,672 | | | $ | 74,002 | |

| Adjusted pre-tax title margin | 15.9 | % | | 16.2 | % | 14.5 | % | | 14.3 | % |

| Net earnings attributable to common shareholders | $ | 266 | | | $ | 426 | | $ | 820 | | | $ | 586 | |

| Net earnings per share attributable to common shareholders | $ | 0.97 | | | $ | 1.57 | | $ | 3.00 | | | $ | 2.16 | |

Adjusted net earnings1 | $ | 356 | | | $ | 333 | | $ | 900 | | | $ | 758 | |

Adjusted net earnings per share1 | $ | 1.30 | | | $ | 1.23 | | $ | 3.30 | | | $ | 2.80 | |

| Weighted average common diluted shares | 273 | | | 271 | | 273 | | | 271 | |

| Total common shares outstanding | 274 | | | 272 | | 274 | | | 272 | |

1 See definition of non-GAAP measures below

Segment Financial Results

Title Segment

This segment consists of the operations of the Company’s title insurance underwriters and related businesses, which provide core title insurance and escrow and other title-related services including loan sub-servicing, valuations, default services, and home warranty.

Mike Nolan, Chief Executive Officer, said, “We continue to successfully navigate the low transactional environment, and delivered adjusted pre-tax earnings in Title of $323 million and an industry leading adjusted pre-tax title margin of 15.9% for the third quarter. While we saw limited impact in the third quarter from lower mortgage rates, we are poised to capture the upside when mortgage rates trend lower given the scale and efficiencies of our diversified national footprint. We have continued to invest in our business despite the challenging real estate market -- actively recruiting talent to drive revenue, making strategic acquisitions and investing in technology, all while maintaining industry leading margins. We firmly believe in the long term value of the title insurance business, regardless of the cyclical nature of the real estate market.”

Third Quarter 2024 Highlights

•Total revenue of $2.1 billion, compared with $1.9 billion in the third quarter of 2023

•Total revenue, excluding recognized gains and losses, of $2.0 billion, a 6% increase over the third quarter of 2023

◦Direct title premiums of $571 million, a 9% increase over third quarter of 2023

◦Agency title premiums of $789 million, an 8% increase over third quarter of 2023

◦Commercial revenue of $290 million, a 10% increase over third quarter of 2023

•Purchase orders opened increased 1% on a daily basis over the third quarter of 2023, and purchase orders closed decreased 2% on a daily basis from the third quarter of 2023

•Refinance orders opened increased 46% on a daily basis and refinance orders closed increased 17% on a daily basis over the third quarter of 2023

•Commercial orders opened increased 3% and commercial orders closed increased 1% over the third quarter of 2023

•Total fee per file of $3,708 for the third quarter, a 2% increase over the third quarter of 2023

Third Quarter 2024 Financial Results

•Pre-tax title margin of 17.7% and industry leading adjusted pre-tax title margin of 15.9% for the third quarter of 2024, compared to 13.2% and 16.2%, respectively, for the third quarter of 2023

•Pre-tax earnings from continuing operations in Title for the third quarter of $372 million, compared with $248 million for the third quarter of 2023

•Adjusted pre-tax earnings in Title for the third quarter of $323 million compared with $311 million for the third quarter of 2023

F&G Segment

This segment consists of operations of FNF’s majority-owned subsidiary F&G, a leading provider of insurance solutions serving retail annuity and life customers and funding agreement and pension risk transfer institutional clients.

Chris Blunt, Chief Executive Officer, commented, "We have profitably grown assets under management before flow reinsurance to a record $62.9 billion at the end of the third quarter. Gross sales of $3.9 billion increased 39% over the third quarter of 2023, boosted by record retail sales of $3.5 billion, nearly double the prior year quarter. Our retail sales continue to surge driven by favorable market conditions and a strong demand for retirement savings products, and we are seeing a healthy PRT pipeline with some significant early wins in the fourth quarter. I am confident in our ability to expand our margin, even in a lower rate environment, and we will continue to benefit from our accretive flow reinsurance and owned distribution strategies, setting F&G apart. Our great results through the first nine months of the year have positioned us well for the remainder of the year and we continue to make strong progress toward our Investor Day targets.”

Third Quarter 2024

•Robust profitable gross sales: Gross sales of $3.9 billion for the third quarter, an increase of 39% over the third quarter of 2023, primarily driven by record retail sales

•Record Retail channel sales of $3.5 billion for the third quarter, an increase of 84% over the third quarter of 2023, driven by favorable market conditions and strong demand for retirement savings products

•Institutional market sales of nearly $0.4 billion of pension risk transfer for the third quarter, compared to $0.9 billion of pension risk transfer and funding agreements for third quarter of 2023; institutional sales are opportunistic and volumes vary quarter to quarter

•Net sales of $2.4 billion for the third quarter, an increase of 4% over the third quarter of 2023

•Record AUM before flow reinsurance of $62.9 billion at the end of the third quarter increased 20% over the third quarter of 2023. This included record AUM of $52.5 billion, an increase of 11% from the third quarter of 2023, driven by retained new business flows and net debt and equity proceeds over the past twelve months

•Net loss attributable to common shareholders for F&G Segment of $5 million for the third quarter due to unfavorable mark-to-market movement, compared to net earnings of $259 million for the third quarter of 2023 which included favorable mark-to-market movement

•Adjusted net earnings attributable to common shareholders for F&G Segment of $135 million for the third quarter, compared to $102 million for the third quarter of 2023

◦F&G’s adjusted net earnings reflect alternatives investment portfolio short-term mark-to-market movement that differs from long-term return expectation. The third quarter of 2024 includes short term investment income from alternative investments and $16 million of net significant income items, whereas the third quarter of 2023 included short term investment income from alternative investments and no significant income or expense items

◦As compared to the prior year quarter, adjusted net earnings reflect asset growth, margin diversification from accretive flow reinsurance fees and owned distribution margin, disciplined expense management and higher interest expense due to planned capital market activity

◦Please see “Segment Financial Results” for F&G under “Non-GAAP Measures and Other Information” for further explanation

Conference Call

We will host a call with investors and analysts to discuss FNF’s third quarter 2024 results on Thursday, November 7, 2024, beginning at 11:00 a.m. Eastern Time. A live webcast of the conference call will be available on the Events and Multimedia page of the FNF Investor Relations website at fnf.com. The conference call replay will be available via webcast through the FNF Investor Relations website at fnf.com.

About Fidelity National Financial, Inc.

Fidelity National Financial, Inc. (NYSE: FNF) is a leading provider of title insurance and transaction services to the real estate and mortgage industries. FNF is the nation’s largest title insurance company through its title insurance underwriters - Fidelity National Title, Chicago Title, Commonwealth Land Title, Alamo Title and National Title of New York - that collectively issue more title insurance policies than any other title company in the United States. More information about FNF can be found at fnf.com.

About F&G

F&G is part of the FNF family of companies. F&G is committed to helping Americans turn their aspirations into reality. F&G is a leading provider of insurance solutions serving retail annuity and life customers and institutional clients and is headquartered in Des Moines, Iowa. For more information, please visit fglife.com.

Use of Non-GAAP Financial Information

Generally Accepted Accounting Principles (GAAP) is the term used to refer to the standard framework of guidelines for financial accounting. GAAP includes the standards, conventions, and rules accountants follow in recording and summarizing transactions and in the preparation of financial statements. In addition to reporting financial results in accordance with GAAP, this earnings release includes non-GAAP financial measures, which the Company believes are useful to help investors better understand its financial performance, competitive position and prospects for the future. These non-GAAP measures include adjusted net earnings per share, adjusted pre-tax title earnings, adjusted pre-tax title earnings as a percentage of adjusted title revenue (adjusted pre-tax title margin), adjusted net earnings attributable to common shareholders (adjusted net earnings), assets under management (AUM), average assets under management (AAUM) and sales.

Management believes these non-GAAP financial measures may be useful in certain instances to provide additional meaningful comparisons between current results and results in prior operating periods. Our non-GAAP measures may not be comparable to similarly titled measures of other organizations because other organizations may not calculate such non-GAAP measures in the same manner as we do.

The presentation of this financial information is not intended to be considered in isolation of or as a substitute for, or superior to, the financial information prepared and presented in accordance with GAAP. By disclosing these non-GAAP financial measures, FNF believes it offers investors a greater understanding of, and an enhanced level of transparency into, the means by which the Company’s management operates the Company.

Any non-GAAP measures should be considered in context with the GAAP financial presentation and should not be considered in isolation or as a substitute for GAAP net earnings, net earnings attributable to common shareholders, net earnings per share, or any other measures derived in accordance with GAAP as measures of operating performance or liquidity. Further, FNF's non-GAAP measures may be calculated differently from similarly titled measures of other companies. Reconciliations of these non-GAAP financial measures to the most directly comparable GAAP measures are provided below.

Forward-Looking Statements and Risk Factors

This press release contains forward-looking statements that involve a number of risks and uncertainties. Statements that are not historical facts, including statements regarding our expectations, hopes, intentions or strategies regarding the future are forward-looking statements. Forward-looking statements are based on management's beliefs, as well as assumptions made by, and information currently available to, management. Because such statements are based on expectations as to future financial and operating results and are not statements of fact, actual results may differ materially from those projected. We undertake no obligation to update any forward-looking statements, whether as a result of new information, future events or otherwise. The risks and uncertainties which forward-looking statements are subject to include, but are not limited to: changes in general economic, business, political crisis, war and pandemic conditions, including ongoing geopolitical conflicts; weakness or adverse changes in the level of real estate activity, which may be caused by, among other things, high or increasing interest rates, a limited supply of mortgage funding or a weak U.S. economy; our potential inability to find suitable acquisition candidates; our dependence on distributions from our title insurance underwriters as a main source of cash flow; significant competition that F&G and our operating subsidiaries face; compliance with extensive government regulation of our

operating subsidiaries, including regulation of title insurance and services and privacy and data protection laws; systems damage, failures, interruptions, cyberattacks and intrusions, or unauthorized data disclosures; and other risks detailed in the "Statement Regarding Forward-Looking Information," "Risk Factors" and other sections of FNF's Form 10-K and other filings with the Securities and Exchange Commission.

FNF-E

SOURCE: Fidelity National Financial, Inc.; F&G Annuities & Life, Inc.

CONTACT:

Lisa Foxworthy-Parker

SVP of Investor & External Relations

Investors@fnf.com

515.330.3307

FIDELITY NATIONAL FINANCIAL, INC.

THIRD QUARTER SEGMENT INFORMATION

(In millions, except per share data)

(Unaudited) | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | |

| | Consolidated | | Title | | F&G | | Corporate and Other | | Elimination |

| Three Months Ended | | | | | |

| September 30, 2024 | | | | | |

| Direct title premiums | | $ | 571 | | | $ | 571 | | | $ | — | | | $ | — | | | $ | — | |

| Agency title premiums | | 789 | | | 789 | | | — | | | — | | | — | |

| Escrow, title related and other fees | | 1,159 | | | 581 | | | 526 | | | 52 | | | — | |

| Total title and escrow | | 2,519 | | | 1,941 | | | 526 | | | 52 | | | — | |

| | | | | | | | | | |

| Interest and investment income | | 815 | | | 92 | | | 712 | | | 37 | | | (26) | |

| Recognized gains and losses, net | | 269 | | | 63 | | | 206 | | | — | | | — | |

| Total revenue | | 3,603 | | | 2,096 | | | 1,444 | | | 89 | | | (26) | |

| | | | | | | | | | |

| Personnel costs | | 810 | | | 688 | | | 80 | | | 42 | | | — | |

| Agent commissions | | 612 | | | 612 | | | — | | | — | | | — | |

| Other operating expenses | | 396 | | | 328 | | | 45 | | | 23 | | | — | |

| Benefits & other policy reserve changes | | 1,095 | | | — | | | 1,095 | | | — | | | — | |

| Market risk benefit (gains) losses | | 71 | | | — | | | 71 | | | — | | | — | |

| Depreciation and amortization | | 189 | | | 35 | | | 147 | | | 7 | | | — | |

| Provision for title claim losses | | 61 | | | 61 | | | — | | | — | | | — | |

| Interest expense | | 56 | | | — | | | 36 | | | 20 | | | — | |

| Total expenses | | 3,290 | | | 1,724 | | | 1,474 | | | 92 | | | — | |

| | | | | | | | | | |

| Pre-tax earnings (loss) | | $ | 313 | | | $ | 372 | | | $ | (30) | | | $ | (3) | | | $ | (26) | |

| | | | | | | | | | |

| | | | | | | | | | |

| | | | | | | | | | |

| | | | | | | | | | |

| | | | | | | | | | |

| | | | | | | | | | |

| | | | | | | | | | |

| | | | | | | | | | |

| | | | | | | | | | |

| | | | | | | | | | |

| | | | | | | | | | |

| Income tax expense (benefit) | | 44 | | | 73 | | | (25) | | | (4) | | | — | |

| Earnings (loss) from equity investments | | 2 | | | 2 | | | — | | | — | | | — | |

| | | | | | | | | | |

| Non-controlling interests | | 5 | | | 5 | | | — | | | — | | | — | |

| | | | | | | | | | |

| Net earnings (loss) attributable to common shareholders | | $ | 266 | | | $ | 296 | | | $ | (5) | | | $ | 1 | | | $ | (26) | |

| | | | | | | | | | |

| | | | | | | | | | |

| | | | | | | | | | |

| EPS attributable to common shareholders - basic | | $ | 0.98 | | | | | | | | | |

| | | | | | | | | | |

| | | | | | | | | | |

| | | | | | | | | | |

| EPS attributable to common shareholders - diluted | | $ | 0.97 | | | | | | | | | |

| | | | | | | | | | |

| Weighted average shares - basic | | 272 | | | | | | | | | |

| Weighted average shares - diluted | | 273 | | | | | | | | | |

FIDELITY NATIONAL FINANCIAL, INC.

THIRD QUARTER SEGMENT INFORMATION

(In millions, except per share data)

(Unaudited) | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | |

| | Consolidated | | Title | | F&G | | Corporate and Other | | Elimination |

| Three Months Ended | | | | | |

| September 30, 2024 | | | | | |

| Net earnings (loss) attributable to common shareholders | | $ | 266 | | | $ | 296 | | | $ | (5) | | | $ | 1 | | | $ | (26) | |

| | | | | | | | | | |

| | | | | | | | | | |

| | | | | | | | | | |

| | | | | | | | | | |

| | | | | | | | | | |

| Pre-tax earnings (loss) | | $ | 313 | | | $ | 372 | | | $ | (30) | | | $ | (3) | | | $ | (26) | |

| | | | | | | | | | |

| Non-GAAP Adjustments | | | | | | | | | | |

| Recognized (gains) and losses, net | | (17) | | | (63) | | | 46 | | | — | | | — | |

| Market related liability adjustments | | 145 | | | — | | | 145 | | | — | | | — | |

| | | | | | | | | | |

| | | | | | | | | | |

| | | | | | | | | | |

| Purchase price amortization | | 39 | | | 14 | | | 22 | | | 3 | | | — | |

| | | | | | | | | | |

| | | | | | | | | | |

| | | | | | | | | | |

| | | | | | | | | | |

| | | | | | | | | | |

| | | | | | | | | | |

| Adjusted pre-tax earnings (loss) | | $ | 480 | | | $ | 323 | | | $ | 183 | | | $ | — | | | $ | (26) | |

| | | | | | | | | | |

| Total non-GAAP, pre-tax adjustments | | $ | 167 | | | $ | (49) | | | $ | 213 | | | $ | 3 | | | $ | — | |

| Income taxes on non-GAAP adjustments | | (33) | | | 12 | | | (44) | | | (1) | | | — | |

| Non-controlling interest on non-GAAP adjustments | | (29) | | | — | | | (29) | | | — | | | — | |

| | | | | | | | | | |

| Deferred tax asset valuation allowance | | (15) | | | (15) | | | — | | | — | | | — | |

| Total non-GAAP adjustments | | $ | 90 | | | $ | (52) | | | $ | 140 | | | $ | 2 | | | $ | — | |

| | | | | | | | | | |

| Adjusted net earnings (loss) attributable to common shareholders | | $ | 356 | | | $ | 244 | | | $ | 135 | | | $ | 3 | | | $ | (26) | |

| | | | | | | | | | |

| Adjusted EPS attributable to common shareholders - diluted | | $ | 1.30 | | | | | | | | | |

| | | | | | | | | | |

| | | | | | | | | | |

| | | | | | | | | | |

| | | | | | | | | | |

| | | | | | | | | | |

| | | | | | | | | | |

| | | | | | | | | | |

FIDELITY NATIONAL FINANCIAL, INC.

THIRD QUARTER SEGMENT INFORMATION

(In millions, except per share data)

(Unaudited)

| | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | |

| | Consolidated | | Title | | F&G | | Corporate and Other | | Elimination |

| Three Months Ended | | | | | |

| September 30, 2023 | | | | | |

| Direct title premiums | | $ | 524 | | | $ | 524 | | | $ | — | | | $ | — | | | $ | — | |

| Agency title premiums | | 728 | | | 728 | | | — | | | — | | | — | |

| Escrow, title related and other fees | | 1,196 | | | 577 | | | 582 | | | 37 | | | — | |

| Total title and escrow | | 2,448 | | | 1,829 | | | 582 | | | 37 | | | — | |

| | | | | | | | | | |

| Interest and investment income | | 686 | | | 92 | | | 578 | | | 38 | | | (22) | |

| Recognized gains and losses, net | | (356) | | | (46) | | | (309) | | | (1) | | | — | |

| Total revenue | | 2,778 | | | 1,875 | | | 851 | | | 74 | | | (22) | |

| | | | | | | | | | |

| Personnel costs | | 734 | | | 654 | | | 58 | | | 22 | | | — | |

| Agent commissions | | 564 | | | 564 | | | — | | | — | | | — | |

| Other operating expenses | | 380 | | | 313 | | | 38 | | | 29 | | | — | |

| Benefits & other policy reserve changes | | 292 | | | — | | | 292 | | | — | | | — | |

| Market risk benefit (gains) losses | | (49) | | | — | | | (49) | | | — | | | — | |

| Depreciation and amortization | | 153 | | | 39 | | | 108 | | | 6 | | | — | |

| Provision for title claim losses | | 57 | | | 57 | | | — | | | — | | | — | |

| Interest expense | | 44 | | | — | | | 24 | | | 20 | | | — | |

| Total expenses | | 2,175 | | | 1,627 | | | 471 | | | 77 | | | — | |

| | | | | | | | | | |

| Pre-tax earnings (loss) | | $ | 603 | | | $ | 248 | | | $ | 380 | | | $ | (3) | | | $ | (22) | |

| | | | | | | | | | |

| | | | | | | | | | |

| | | | | | | | | | |

| | | | | | | | | | |

| | | | | | | | | | |

| | | | | | | | | | |

| | | | | | | | | | |

| | | | | | | | | | |

| | | | | | | | | | |

| | | | | | | | | | |

| | | | | | | | | | |

| | | | | | | | | | |

| Income tax expense (benefit) | | 141 | | | 73 | | | 74 | | | (6) | | | — | |

| Earnings from equity investments | | 15 | | | 15 | | | — | | | — | | | — | |

| | | | | | | | | | |

| Non-controlling interests | | 51 | | | 5 | | | 47 | | | (1) | | | — | |

| | | | | | | | | | |

| Net earnings (loss) attributable to common shareholders | | $ | 426 | | | $ | 185 | | | $ | 259 | | | $ | 4 | | | $ | (22) | |

| | | | | | | | | | |

| | | | | | | | | | |

| | | | | | | | | | |

| EPS attributable to common shareholders - basic | | $ | 1.58 | | | | | | | | | |

| | | | | | | | | | |

| | | | | | | | | | |

| | | | | | | | | | |

| EPS attributable to common shareholders - diluted | | $ | 1.57 | | | | | | | | | |

| | | | | | | | | | |

| Weighted average shares - basic | | 270 | | | | | | | | | |

| Weighted average shares - diluted | | 271 | | | | | | | | | |

FIDELITY NATIONAL FINANCIAL, INC.

THIRD QUARTER SEGMENT INFORMATION

(In millions, except per share data)

(Unaudited)

| | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | |

| | Consolidated | | Title | | F&G | | Corporate and Other | | Elimination |

| Three Months Ended | | | | | |

| September 30, 2023 | | | | | |

| Net earnings (loss) attributable to common shareholders | | $ | 426 | | | $ | 185 | | | $ | 259 | | | $ | 4 | | | $ | (22) | |

| | | | | | | | | | |

| | | | | | | | | | |

| | | | | | | | | | |

| | | | | | | | | | |

| | | | | | | | | | |

| Pre-tax earnings (loss) | | $ | 603 | | | $ | 248 | | | $ | 380 | | | $ | (3) | | | $ | (22) | |

| | | | | | | | | | |

| Non-GAAP Adjustments | | | | | | | | | | |

| Recognized (gains) and losses, net | | 43 | | | 46 | | | (4) | | | 1 | | | — | |

| Market related liability adjustments | | (237) | | | — | | | (237) | | | — | | | — | |

| | | | | | | | | | |

| | | | | | | | | | |

| Purchase price amortization | | 26 | | | 17 | | | 5 | | 4 | | | — | |

| Transaction costs | | 1 | | | — | | | 1 | | | — | | | — | |

| | | | | | | | | | |

| | | | | | | | | | |

| | | | | | | | | | |

| | | | | | | | | | |

| Adjusted pre-tax earnings (loss) | | $ | 436 | | | $ | 311 | | | $ | 145 | | | $ | 2 | | | $ | (22) | |

| | | | | | | | | | |

| Total non-GAAP, pre-tax adjustments | | $ | (167) | | | $ | 63 | | | $ | (235) | | | $ | 5 | | | $ | — | |

| Income taxes on non-GAAP adjustments | | 33 | | | (15) | | | 49 | | | (1) | | | — | |

| Non-controlling interest on non-GAAP adjustments | | 29 | | | — | | | 29 | | | — | | | — | |

| Deferred tax asset valuation allowance | | 12 | | | 12 | | | — | | | — | | | — | |

| Total non-GAAP adjustments | | $ | (93) | | | $ | 60 | | | $ | (157) | | | $ | 4 | | | $ | — | |

| | | | | | | | | | |

| Adjusted net earnings (loss) attributable to common shareholders | | $ | 333 | | | $ | 245 | | | $ | 102 | | | $ | 8 | | | $ | (22) | |

| | | | | | | | | | |

| Adjusted EPS attributable to common shareholders - diluted | | $ | 1.23 | | | | | | | | | |

| | | | | | | | | | |

| | | | | | | | | | |

| | | | | | | | | | |

| | | | | | | | | | |

| | | | | | | | | | |

| | | | | | | | | | |

| | | | | | | | | | |

| | | | | | | | | | |

| | | | | | | | | | |

| | | | | | | | | | |

| | | | | | | | | | |

| | | | | | | | | | |

| | | | | | | | | | |

| | | | | | | | | | |

| | | | | | | | | | |

| | | | | | | | | | |

| | | | | | | | | | |

| | | | | | | | | | |

| | | | | | | | | | |

FIDELITY NATIONAL FINANCIAL, INC.

YTD SEGMENT INFORMATION

(In millions, except per share data)

(Unaudited) | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | |

| | | | | | | | | | |

| | Consolidated | | Title | | F&G | | Corporate and Other | | Elimination |

| Nine Months Ended | | | | | |

| September 30, 2024 | | | | | |

| Direct title premiums | | $ | 1,575 | | | $ | 1,575 | | | $ | — | | | $ | — | | | $ | — | |

| Agency title premiums | | 2,166 | | | 2,166 | | | — | | | — | | | — | |

| Escrow, title related and other fees | | 3,555 | | | 1,636 | | | 1,772 | | | 147 | | | — | |

| Total title and escrow | | 7,296 | | | 5,377 | | | 1,772 | | | 147 | | | — | |

| | | | | | | | | | |

| Interest and investment income | | 2,308 | | | 262 | | | 2,012 | | | 114 | | | (80) | |

| Recognized gains and losses, net | | 456 | | | 51 | | | 401 | | | 4 | | | — | |

| Total revenue | | 10,060 | | | 5,690 | | | 4,185 | | | 265 | | | (80) | |

| | | | | | | | | | |

| Personnel costs | | 2,316 | | | 1,986 | | | 215 | | | 115 | | | — | |

| Agent commissions | | 1,681 | | | 1,681 | | | — | | | — | | | — | |

| Other operating expenses | | 1,152 | | | 924 | | | 149 | | | 79 | | | — | |

| Benefits & other policy reserve changes | | 2,864 | | | — | | | 2,864 | | | — | | | — | |

| Market risk benefit (gains) losses | | 80 | | | — | | | 80 | | | — | | | — | |

| Depreciation and amortization | | 545 | | | 106 | | | 417 | | | 22 | | | — | |

| Provision for title claim losses | | 168 | | | 168 | | | — | | | — | | | — | |

| Interest expense | | 152 | | | — | | | 94 | | | 58 | | | — | |

| Total expenses | | 8,958 | | | 4,865 | | | 3,819 | | | 274 | | | — | |

| | | | | | | | | | |

| | | | | | | | | | |

| | | | | | | | | | |

| | | | | | | | | | |

| | | | | | | | | | |

| | | | | | | | | | |

| | | | | | | | | | |

| | | | | | | | | | |

| | | | | | | | | | |

| | | | | | | | | | |

| | | | | | | | | | |

| | | | | | | | | | |

| | | | | | | | | | |

| | | | | | | | | | |

| Pre-tax earnings (loss) from continuing operations | | $ | 1,102 | | | $ | 825 | | | $ | 366 | | | $ | (9) | | | $ | (80) | |

| | | | | | | | | | |

| Income tax expense (benefit) | | 223 | | | 190 | | | 51 | | | (18) | | | — | |

| Earnings (loss) from equity investments | | 4 | | | 4 | | | — | | | — | | | — | |

| | | | | | | | | | |

| Non-controlling interests | | 63 | | | 12 | | | 51 | | | — | | | — | |

| | | | | | | | | | |

| Net earnings (loss) attributable to common shareholders | | $ | 820 | | | $ | 627 | | | $ | 264 | | | $ | 9 | | | $ | (80) | |

| | | | | | | | | | |

| | | | | | | | | | |

| | | | | | | | | | |

| EPS attributable to common shareholders - basic | | $ | 3.03 | | | | | | | | | |

| | | | | | | | | | |

| | | | | | | | | | |

| | | | | | | | | | |

| EPS attributable to common shareholders - diluted | | $ | 3.00 | | | | | | | | | |

| | | | | | | | | | |

| Weighted average shares - basic | | 271 | | | | | | | | | |

| Weighted average shares - diluted | | 273 | | | | | | | | | |

FIDELITY NATIONAL FINANCIAL, INC.

YTD SEGMENT INFORMATION

(In millions, except per share data)

(Unaudited) | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | |

| | | | | | | | | | |

| | Consolidated | | Title | | F&G | | Corporate and Other | | Elimination |

| Nine Months Ended | | | | | |

| September 30, 2024 | | | | | |

| Net earnings (loss) attributable to common shareholders | | $ | 820 | | | $ | 627 | | | $ | 264 | | | $ | 9 | | | $ | (80) | |

| | | | | | | | | | |

| | | | | | | | | | |

| | | | | | | | | | |

| | | | | | | | | | |

| | | | | | | | | | |

| | | | | | | | | | |

| Pre-tax earnings (loss) | | $ | 1,102 | | | $ | 825 | | | $ | 366 | | | $ | (9) | | | $ | (80) | |

| | | | | | | | | | |

| Non-GAAP Adjustments | | | | | | | | | | |

| Recognized (gains) and losses, net | | 5 | | | (51) | | | 60 | | | (4) | | | — | |

| Market related liability adjustments | | 19 | | | — | | | 19 | | | — | | | — | |

| | | | | | | | | | |

| | | | | | | | | | |

| Purchase price amortization | | 115 | | | 44 | | | 63 | | | 8 | | | — | |

| | | | | | | | | | |

| | | | | | | | | | |

| Transaction costs | | (2) | | | — | | | (3) | | | 1 | | | — | |

| | | | | | | | | | |

| | | | | | | | | | |

| | | | | | | | | | |

| | | | | | | | | | |

| Adjusted pre-tax earnings (loss) | | $ | 1,239 | | | $ | 818 | | | $ | 505 | | | $ | (4) | | | $ | (80) | |

| | | | | | | | | | |

| Total non-GAAP, pre-tax adjustments | | $ | 137 | | | $ | (7) | | | $ | 139 | | | $ | 5 | | | $ | — | |

| Income taxes on non-GAAP adjustments | | (26) | | | 2 | | | (27) | | | (1) | | | — | |

| Deferred tax asset valuation allowance | | (7) | | | (7) | | | — | | | — | | | — | |

| Non-controlling interest on non-GAAP adjustments | | (24) | | | — | | | (24) | | | — | | | — | |

| | | | | | | | | | |

| | | | | | | | | | |

| Total non-GAAP adjustments | | $ | 80 | | | $ | (12) | | | $ | 88 | | | $ | 4 | | | $ | — | |

| | | | | | | | | | |

| Adjusted net earnings (loss) attributable to common shareholders | | $ | 900 | | | $ | 615 | | | $ | 352 | | | $ | 13 | | | $ | (80) | |

| | | | | | | | | | |

| Adjusted EPS attributable to common shareholders - diluted | | $ | 3.30 | | | | | | | | | |

| | | | | | | | | | |

| | | | | | | | | | |

| | | | | | | | | | |

| | | | | | | | | | |

| | | | | | | | | | |

| | | | | | | | | | |

| | | | | | | | | | |

FIDELITY NATIONAL FINANCIAL, INC.

YTD SEGMENT INFORMATION

(In millions, except per share data)

(Unaudited) | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | |

| | | | | | F&G | | | | |

| Nine Months Ended | | Consolidated | | Title | | | Corporate and Other | | Elimination |

| September 30, 2023 | | | | | |

| Direct title premiums | | $ | 1,493 | | | $ | 1,493 | | | $ | — | | | $ | — | | | $ | — | |

| Agency title premiums | | 1,991 | | | 1,991 | | | — | | | — | | | — | |

| Escrow, title related and other fees | | 3,288 | | | 1,629 | | | 1,523 | | | 136 | | | — | |

| Total title and escrow | | 6,772 | | | 5,113 | | | 1,523 | | | 136 | | | — | |

| | | | | | | | | | |

| Interest and investment income | | 1,915 | | | 252 | | | 1,622 | | | 84 | | | (43) | |

| Recognized gains and losses, net | | (367) | | | (74) | | | (257) | | | (36) | | | — | |

| Total revenue | | 8,320 | | | 5,291 | | | 2,888 | | | 184 | | | (43) | |

| | | | | | | | | | |

| Personnel costs | | 2,166 | | | 1,908 | | | 167 | | | 91 | | | — | |

| Agent commissions | | 1,534 | | | 1,534 | | | — | | | — | | | — | |

| Other operating expenses | | 1,134 | | | 939 | | | 107 | | | 88 | | | — | |

| Benefits & other policy reserve changes | | 1,921 | | | — | | | 1,921 | | | — | | | — | |

| Market risk benefit (gains) losses | | (20) | | | — | | | (20) | | | — | | | — | |

| Depreciation and amortization | | 438 | | | 115 | | | 302 | | | 21 | | | — | |

| Provision for title claim losses | | 157 | | | 157 | | | — | | | — | | | — | |

| Interest expense | | 129 | | | — | | | 71 | | | 58 | | | — | |

| Total expenses | | 7,459 | | | 4,653 | | | 2,548 | | | 258 | | | — | |

| | | | | | | | | | |

| | | | | | | | | | |

| | | | | | | | | | |

| | | | | | | | | | |

| | | | | | | | | | |

| | | | | | | | | | |

| | | | | | | | | | |

| | | | | | | | | | |

| | | | | | | | | | |

| | | | | | | | | | |

| | | | | | | | | | |

| | | | | | | | | | |

| | | | | | | | | | |

| | | | | | | | | | |

| Pre-tax earnings (loss) | | $ | 861 | | | $ | 638 | | | $ | 340 | | | $ | (74) | | | $ | (43) | |

| | | | | | | | | | |

| Income tax expense (benefit) | | 245 | | | 165 | | | 99 | | | (19) | | | — | |

| Earnings from equity investments | | 16 | | | 16 | | | — | | | — | | | — | |

| | | | | | | | | | |

| Non-controlling interests | | 46 | | | 11 | | | 36 | | | (1) | | | — | |

| | | | | | | | | | |

| Net earnings (loss) attributable to common shareholders | | $ | 586 | | | $ | 478 | | | $ | 205 | | | $ | (54) | | | $ | (43) | |

| | | | | | | | | | |

| | | | | | | | | | |

| | | | | | | | | | |

| EPS attributable to common shareholders - basic | | $ | 2.17 | | | | | | | | | |

| | | | | | | | | | |

| | | | | | | | | | |

| EPS attributable to common shareholders - diluted | | $ | 2.16 | | | | | | | | | |

| | | | | | | | | | |

| Weighted average shares - basic | | 270 | | | | | | | | | |

| Weighted average shares - diluted | | 271 | | | | | | | | | |

FIDELITY NATIONAL FINANCIAL, INC.

YTD SEGMENT INFORMATION

(In millions, except per share data)

(Unaudited)

| | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | |

| | Consolidated | | Title | | F&G | | Corporate and Other | | Elimination |

| Nine Months Ended | | | | | |

| September 30, 2023 | | | | | |

| Net earnings (loss) attributable to common shareholders | | $ | 586 | | | $ | 478 | | | $ | 205 | | | $ | (54) | | | $ | (43) | |

| | | | | | | | | | |

| | | | | | | | | | |

| | | | | | | | | | |

| | | | | | | | | | |

| | | | | | | | | | |

| Pre-tax earnings (loss) | | $ | 861 | | | $ | 638 | | | $ | 340 | | | $ | (74) | | | $ | (43) | |

| | | | | | | | | | |

| Non-GAAP Adjustments | | | | | | | | | | |

| Recognized (gains) and losses, net | | 210 | | | 74 | | | 100 | | | 36 | | | — | |

| Market related liability adjustments | | (95) | | | — | | | (95) | | | — | | | — | |

| | | | | | | | | | |

| | | | | | | | | | |

| Purchase price amortization | | 81 | | | 54 | | | 16 | | 11 | | | — | |

| Transaction costs | | 8 | | | — | | | 3 | | 5 | | | — | |

| | | | | | | | | | |

| | | | | | | | | | |

| | | | | | | | | | |

| | | | | | | | | | |

| Adjusted pre-tax earnings (loss) | | $ | 1,065 | | | $ | 766 | | | $ | 364 | | | $ | (22) | | | $ | (43) | |

| | | | | | | | | | |

| Total non-GAAP, pre-tax adjustments | | $ | 204 | | | $ | 128 | | | $ | 24 | | | $ | 52 | | | $ | — | |

| Income taxes on non-GAAP adjustments | | (48) | | | (31) | | | (5) | | | (12) | | | — | |

| Deferred tax asset valuation allowance | | 19 | | | 11 | | | — | | | 8 | | | — | |

| Non-controlling interest on non-GAAP adjustments | | (3) | | | — | | | (3) | | | — | | | — | |

| | | | | | | | | | |

| | | | | | | | | | |

| Total non-GAAP adjustments | | $ | 172 | | | $ | 108 | | | $ | 16 | | | $ | 48 | | | $ | — | |

| | | | | | | | | | |

| Adjusted net earnings (loss) attributable to common shareholders | | $ | 758 | | | $ | 586 | | | $ | 221 | | | $ | (6) | | | $ | (43) | |

| | | | | | | | | | |

| Adjusted EPS attributable to common shareholders - diluted | | $ | 2.80 | | | | | | | | | |

| | | | | | | | | | |

| | | | | | | | | | |

| | | | | | | | | | |

| | | | | | | | | | |

| | | | | | | | | | |

| | | | | | | | | | |

| | | | | | | | | | |

FIDELITY NATIONAL FINANCIAL, INC.

SUMMARY BALANCE SHEET INFORMATION

(In millions) | | | | | | | | | | | | | | | | | | | | |

| | | September 30,

2024 | | December 31,

2023 |

| | | (Unaudited) | | (Unaudited) |

| Cash and investment portfolio | | | $ | 67,957 | | | | $ | 58,816 | |

| Goodwill | | | 5,272 | | | | 4,830 | |

| Title plant | | | 422 | | | | 418 | |

| Total assets | | | 94,672 | | | | 80,614 | |

| Notes payable | | | 4,186 | | | | 3,887 | |

| Reserve for title claim losses | | | 1,720 | | | | 1,770 | |

| Secured trust deposits | | | 766 | | | | 731 | |

| Accumulated other comprehensive (loss) earnings | | | (1,423) | | | | (2,119) | |

| Non-controlling interests | | | 820 | | | | 552 | |

| Total equity and non-controlling interests | | | 8,902 | | | | 7,460 | |

| Total equity attributable to common shareholders | | | 8,082 | | | | 6,908 | |

Non-GAAP Measures and Other Information

Title Segment

The table below reconciles pre-tax title earnings to adjusted pre-tax title earnings.

| | | | | | | | | | | | | | | | | | | | | | | | |

| Three Months Ended | | | Nine Months Ended | | | |

| (Dollars in millions) | September 30, 2024 | September 30, 2023 | | | September 30, 2024 | September 30, 2023 | | | | |

Pre-tax earnings | $ | 372 | | $ | 248 | | | | $ | 825 | | $ | 638 | | | | | |

Non-GAAP adjustments before taxes | | | | | | | | | | |

Recognized (gains) and losses, net | (63) | | 46 | | | | (51) | | 74 | | | | | |

Purchase price amortization | 14 | | 17 | | | | 44 | | 54 | | | | | |

| | | | | | | | | | |

Total non-GAAP adjustments | (49) | | 63 | | | | (7) | | 128 | | | | | |

Adjusted pre-tax earnings | $ | 323 | | $ | 311 | | | | $ | 818 | | $ | 766 | | | | | |

Adjusted pre-tax margin | 15.9 | % | 16.2 | % | | | 14.5 | % | 14.3 | % | | | | |

FIDELITY NATIONAL FINANCIAL, INC.

QUARTERLY OPERATING STATISTICS

(Unaudited)

| | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | |

| | Q3 2024 | | Q2 2024 | | Q1 2024 | | Q4 2023 | | Q3 2023 | | Q2 2023 | | Q1 2023 | | Q4 2022 |

| Quarterly Opened Orders ('000's except % data) |

| Total opened orders* | | 352 | | | 344 | | | 315 | | | 257 | | | 318 | | | 347 | | | 308 | | | 266 | |

| Total opened orders per day* | | 5.5 | | | 5.5 | | | 5.1 | | | 4.1 | | | 5.0 | | | 5.4 | | | 5.0 | | | 4.3 | |

| Purchase % of opened orders | | 73 | % | | 80 | % | | 79 | % | | 78 | % | | 80 | % | | 79 | % | | 78 | % | | 76 | % |

| Refinance % of opened orders | | 27 | % | | 20 | % | | 21 | % | | 22 | % | | 20 | % | | 21 | % | | 22 | % | | 24 | % |

| Total closed orders* | | 232 | | | 229 | | | 186 | | | 192 | | | 224 | | | 233 | | | 188 | | | 216 | |

| Total closed orders per day* | | 3.6 | | | 3.6 | | | 3.0 | | | 3.1 | | | 3.6 | | | 3.6 | | | 3.0 | | | 3.5 | |

| Purchase % of closed orders | | 77 | % | | 81 | % | | 79 | % | | 80 | % | | 80 | % | | 81 | % | | 78 | % | | 76 | % |

| Refinance % of closed orders | | 23 | % | | 19 | % | | 21 | % | | 20 | % | | 20 | % | | 19 | % | | 22 | % | | 24 | % |

| | | | | | | | | | | | | | | | |

| Commercial (millions, except orders in '000's) |

| Total commercial revenue | | $ | 290 | | | $ | 273 | | | $ | 238 | | | $ | 294 | | | $ | 263 | | | $ | 263 | | | $ | 241 | | | $ | 344 | |

| Total commercial opened orders | | 50.8 | | | 50.7 | | | 48.7 | | | 43.7 | | | 49.1 | | | 50.2 | | | 48.5 | | | 44.9 | |

| Total commercial closed orders | | 25.9 | | | 25.7 | | | 24.3 | | | 26.3 | | | 25.6 | | | 27.7 | | | 24.7 | | | 30.5 | |

| | | | | | | | | | | | | | | | |

| National commercial revenue | | $ | 151 | | | $ | 145 | | | $ | 123 | | | $ | 164 | | | $ | 131 | | | $ | 132 | | | $ | 123 | | | $ | 177 | |

| National commercial opened orders | | 21.9 | | | 21.4 | | | 19.4 | | | 18.2 | | | 19.2 | | | 19.5 | | | 18.8 | | | 17.8 | |

| National commercial closed orders | | 10.4 | | | 9.8 | | | 9.2 | | | 10.1 | | | 9.4 | | | 10.1 | | | 8.7 | | | 11.9 | |

| | | | | | | | | | | | | | | | |

| Total Fee Per File |

| Fee per file | | $ | 3,708 | | | $ | 3,759 | | | $ | 3,555 | | | $ | 3,806 | | | $ | 3,618 | | | $ | 3,598 | | | $ | 3,446 | | | $ | 3,649 | |

| | | | | | | | | | | | | | | | |

| Residential fee per file | | $ | 2,881 | | | $ | 2,995 | | | $ | 2,746 | | | $ | 2,889 | | | $ | 2,861 | | | $ | 2,897 | | | $ | 2,601 | | | $ | 2,542 | |

| Total commercial fee per file | | $ | 11,200 | | | $ | 10,600 | | | $ | 9,800 | | | $ | 11,200 | | | $ | 10,300 | | | $ | 9,500 | | | $ | 9,800 | | | $ | 11,300 | |

| National commercial fee per file | | $ | 14,500 | | | $ | 14,800 | | | $ | 13,400 | | | $ | 16,300 | | | $ | 14,000 | | | $ | 13,000 | | | $ | 14,100 | | | $ | 14,900 | |

| | | | | | | | | | | | | | | | |

| Total Staffing |

| Total field operations employees | | 10,400 | | | 10,300 | | | 10,000 | | | 9,900 | | | 10,400 | | | 10,600 | | | 10,400 | | | 10,700 | |

| | | | | | | | | | | | | | | | |

| Actual title claims paid ($ millions) | | $ | 64 | | | $ | 70 | | | $ | 70 | | | $ | 64 | | | $ | 69 | | | $ | 67 | | | $ | 62 | | | $ | 79 | |

| | | | | | | | | | | | | | | | |

Title Segment (continued)

FIDELITY NATIONAL FINANCIAL, INC.

MONTHLY TITLE ORDER STATISTICS

| | | | | | | | | | | | | | | | | | | | | | | | | | |

| | | Direct Orders Opened * | | | Direct Orders Closed * |

| Month | | / (% Purchase) | | / (% Purchase) |

| July 2024 | | | 115,000 | 78% | | | 79,000 | 80% |

| August 2024 | | | 117,000 | 73% | | | 79,000 | 78% |

| September 2024 | | | 120,000 | 68% | | | 74,000 | 74% |

| | | | | | | |

| Third Quarter 2024 | | | 352,000 | 73% | | | 232,000 | 77% |

| | | | | | | | | | | | | | | | | | | | | | | | | | |

| | | Direct Orders Opened * | | | Direct Orders Closed * |

| Month | | / (% Purchase) | | | / (% Purchase) |

| July 2023 | | | 107,000 | 80% | | | 74,000 | 81% |

| August 2023 | | | 114,000 | 79% | | | 80,000 | 80% |

| September 2023 | | | 97,000 | 79% | | | 70,000 | 80% |

| | | | | | | |

| Third Quarter 2023 | | | 318,000 | 80% | | | 224,000 | 80% |

| * Includes an immaterial number of non-purchase and non-refinance orders |

F&G Segment

The table below reconciles net earnings (loss) attributable to common shareholders to adjusted net earnings attributable to common shareholders. The F&G Segment is reported net of noncontrolling minority interest.

| | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | |

| Three Months Ended | | | | | | | | | | | | | Nine Months Ended |

| (Dollars in millions) | September 30, 2024 | | September 30, 2023 | | | | | | | | | | | | | September 30, 2024 | | September 30, 2023 | |

| | | | | | | | | | | | | | | | | | | |

| Net earnings attributable to common shareholders | $ | (5) | | | $ | 259 | | | | | | | | | | | | | | $ | 264 | | | $ | 205 | | |

| | | | | | | | | | | | | | | | | | | |

| | | | | | | | | | | | | | | | | | | |

Non-GAAP adjustments(1): | | | | | | | | | | | | | | | | | | | |

| Recognized (gains) losses, net | 46 | | | (4) | | | | | | | | | | | | | | 60 | | | 100 | | |

| Market related liability adjustments | 145 | | | (237) | | | | | | | | | | | | | | 19 | | | (95) | | |

| Purchase price amortization | 22 | | | 5 | | | | | | | | | | | | | | 63 | | | 16 | | |

| Transaction costs | — | | | 1 | | | | | | | | | | | | | | (3) | | | 3 | | |

| | | | | | | | | | | | | | | | | | | |

| | | | | | | | | | | | | | | | | | | |

| Income taxes on non-GAAP adjustments | (44) | | | 49 | | | | | | | | | | | | | | (27) | | | (5) | | |

| Non-controlling interest on non-GAAP adjustments | (29) | | | 29 | | | | | | | | | | | | | | (24) | | | (3) | | |

Adjusted net earnings (loss) attributable to common shareholders(1) | $ | 135 | | | $ | 102 | | | | | | | | | | | | | | $ | 352 | | | $ | 221 | | |

•Adjusted net earnings of $135 million for the third quarter of 2024 include $111 million, or $0.40 per share, of investment income from alternative investments, $18 million, or $0.07 per share, of CLO redemption gains and bond prepay income, and $12 million, or $0.04 per share, of tax valuation allowance benefit; partially offset by $14 million, or $0.05 per share, of net expense from actuarial assumption updates. Alternative investments investment income based on management’s long-term expected return of approximately 10% was $146 million, or $0.53 per share.

•Adjusted net earnings of $102 million for the third quarter of 2023 included $97 million, or $0.36 per share, of investment income from alternative investments. Alternative investments investment income based on management’s long-term expected return of approximately 10% was $121 million, or $0.45 per share.

•Adjusted net earnings of $352 million for the nine months ended September 30, 2024 include $317 million, or $1.16 per share, of investment income from alternative investments, $26 million or $0.10 per share of CLO redemption gains and bond prepay income, and $12 million, or $0.04 per share of tax valuation allowance benefit; partially offset by $27 million, or $0.10 per share, of net expense from actuarial assumption and model updates. Alternative investments investment income based on management’s long-term expected return of approximately 10% was $413 million, or $1.51 per share.

•Adjusted net earnings of $221 million for the nine months ended September 30, 2023 included $249 million, or $0.92 per share, of investment income from alternative investments and $4 million, or $0.01 per share, of bond prepay income, partially offset by $31 million, or $0.11 per share, tax valuation allowance expense. Alternative investments investment income based on management’s long-term expected return of approximately 10% was $348 million, or $1.28 per share.

Footnotes:

1.Non-GAAP financial measure. See the Non-GAAP Measures section below for additional information.

The table below provides a summary of sales highlights.

| | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | |

| | | | Three Months Ended | | | Nine Months Ended | | | | | | | | | | | | |

| (In millions) | | | | September 30, 2024 | | September 30, 2023 | | | September 30, 2024 | | September 30, 2023 | | | | | | | | | | | | | | |

| Total annuity sales | | | | $ | 3,502 | | | $ | 1,858 | | | | $ | 9,389 | | | $ | 6,870 | | | | | | | | | | | | | | | |

| Indexed universal life sales | | | | 39 | | | 38 | | | | 125 | | | 117 | | | | | | | | | | | |

| Funding agreements (FABN/FHLB) | | | | — | | | 415 | | | | 1,020 | | | 871 | | | | | | | | | | | | | | | |

| Pension risk transfer | | | | 337 | | | 470 | | | | 1,259 | | | 1,212 | | | | | | | | | | | | | | | |

Gross sales(1) | | | | $ | 3,878 | | | $ | 2,781 | | | | $ | 11,793 | | | $ | 9,070 | | | | | | | | | | | | | | | |

| Sales attributable to flow reinsurance to third parties | | | | (1,492) | | | (513) | | | | (3,660) | | | (2,381) | | | | | | | | | | | | | | | |

Net Sales(1) | | | | $ | 2,386 | | | $ | 2,268 | | | | $ | 8,133 | | | $ | 6,689 | | | | | | | | | | | | | | | |

Footnotes:

1.Non-GAAP financial measure. See the Non-GAAP Measures section below for additional information.

DEFINITIONS

The following represents the definitions of non-GAAP measures used by the Company.

Adjusted Net Earnings attributable to common shareholders

Adjusted net earnings attributable to common shareholders is a non-GAAP economic measure we use to evaluate financial performance each period. Adjusted net earnings attributable to common shareholders is calculated by adjusting net earnings (loss) attributable to common shareholders to eliminate:

i.Recognized (gains) and losses, net: the impact of net investment gains/losses, including changes in allowance for expected credit losses and other than temporary impairment (“OTTI”) losses, recognized in operations; and the effects of changes in fair value of the reinsurance related embedded derivative and other derivatives, including interest rate swaps and forwards;

ii.Market related liability adjustments: the impacts related to changes in the fair value, including both realized and unrealized gains and losses, of index product related derivatives and embedded derivatives, net of hedging cost; the impact of initial pension risk transfer deferred profit liability losses, including amortization from previously deferred pension risk transfer deferred profit liability losses; and the changes in the fair value of market risk benefits by deferring current period changes and amortizing that amount over the life of the market risk benefit;

iii.Purchase price amortization: the impacts related to the amortization of certain intangibles (internally developed software, trademarks and value of distribution asset and the change in fair value of liabilities recognized as a result of acquisition activities);

iv.Transaction costs: the impacts related to acquisition, integration and merger related items;

v.Certain income tax adjustments: the impacts related to unusual tax items that do not reflect our core operating performance such as the establishment or reversal of significant deferred tax asset valuation allowances in our Title and Corporate and Other segments;

vi.Other “non-recurring,” “infrequent” or “unusual items”: Management excludes certain items determined to be “non-recurring,” “infrequent” or “unusual” from adjusted net earnings when incurred if it is determined these expenses are not a reflection of the core business and when the nature of the item is such that it is not reasonably likely to recur within two years and/or there was not a similar item in the preceding two years;

vii.Non-controlling interest on non-GAAP adjustments: the portion of the non-GAAP adjustments attributable to the equity interest of entities that FNF does not wholly own; and

viii.Income taxes: the income tax impact related to the above-mentioned adjustments is measured using an effective tax rate, as appropriate by tax jurisdiction

While these adjustments are an integral part of the overall performance of F&G, market conditions and/or the non-operating nature of these items can overshadow the underlying performance of the core business. Accordingly, management considers this to be a useful measure internally and to investors and analysts in analyzing the trends of our operations. Adjusted net earnings should not be used as a substitute for net earnings (loss). However, we believe the adjustments made to net earnings (loss) in order to derive adjusted net earnings provide an understanding of our overall results of operations.

Assets Under Management (AUM)

AUM is comprised of the following components and is reported net of reinsurance assets ceded in accordance with GAAP:

i. total invested assets at amortized cost, excluding investments in unconsolidated affiliates, owned distribution and derivatives;

ii.investments in unconsolidated affiliates at carrying value;

iii.related party loans and investments;

iv.accrued investment income;

v.the net payable/receivable for the purchase/sale of investments; and

vi.cash and cash equivalents excluding derivative collateral at the end of the period.

Management considers this non-GAAP financial measure to be useful internally and to investors and analysts when assessing the size of our investment portfolio that is retained.

AUM before Flow Reinsurance

AUM before Flow Reinsurance is comprised of components consistent with AUM, but also includes flow reinsured assets.

Management considers this non-GAAP financial measure to be useful internally and to investors and analysts when assessing the size of our investment portfolio including reinsured assets.

Average Assets Under Management (AAUM)

AAUM is calculated as AUM at the beginning of the period and the end of each month in the period, divided by the total number of months in the period plus one.

Management considers this non-GAAP financial measure to be useful internally and to investors and analysts when assessing the rate of return on retained assets.

Sales

Annuity, IUL, funding agreement and non-life contingent PRT sales are not derived from any specific GAAP income statement accounts or line items and should not be viewed as a substitute for any financial measure determined in accordance with GAAP. Sales from these products are recorded as deposit liabilities (i.e., contractholder funds) within the Company's consolidated financial statements in accordance with GAAP. Life contingent PRT sales are recorded as premiums in revenues within the consolidated financial statements. Management believes that presentation of sales, as measured for management purposes, enhances the understanding of our business and helps depict longer term trends that may not be apparent in the results of operations due to the timing of sales and revenue recognition.

v3.24.3

| X |

- DefinitionBoolean flag that is true when the XBRL content amends previously-filed or accepted submission.

| Name: |

dei_AmendmentFlag |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:booleanItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionFor the EDGAR submission types of Form 8-K: the date of the report, the date of the earliest event reported; for the EDGAR submission types of Form N-1A: the filing date; for all other submission types: the end of the reporting or transition period. The format of the date is YYYY-MM-DD.

| Name: |

dei_DocumentPeriodEndDate |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:dateItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionThe type of document being provided (such as 10-K, 10-Q, 485BPOS, etc). The document type is limited to the same value as the supporting SEC submission type, or the word 'Other'.

| Name: |

dei_DocumentType |

| Namespace Prefix: |

dei_ |

| Data Type: |

dei:submissionTypeItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionAddress Line 1 such as Attn, Building Name, Street Name

| Name: |

dei_EntityAddressAddressLine1 |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:normalizedStringItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- Definition

+ References

+ Details

| Name: |

dei_EntityAddressCityOrTown |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:normalizedStringItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionCode for the postal or zip code

| Name: |

dei_EntityAddressPostalZipCode |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:normalizedStringItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionName of the state or province.

| Name: |

dei_EntityAddressStateOrProvince |

| Namespace Prefix: |

dei_ |

| Data Type: |

dei:stateOrProvinceItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionA unique 10-digit SEC-issued value to identify entities that have filed disclosures with the SEC. It is commonly abbreviated as CIK. Reference 1: http://www.xbrl.org/2003/role/presentationRef

-Publisher SEC

-Name Exchange Act

-Number 240

-Section 12

-Subsection b-2

| Name: |

dei_EntityCentralIndexKey |

| Namespace Prefix: |

dei_ |

| Data Type: |

dei:centralIndexKeyItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionIndicate if registrant meets the emerging growth company criteria. Reference 1: http://www.xbrl.org/2003/role/presentationRef

-Publisher SEC

-Name Exchange Act

-Number 240

-Section 12

-Subsection b-2

| Name: |

dei_EntityEmergingGrowthCompany |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:booleanItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionCommission file number. The field allows up to 17 characters. The prefix may contain 1-3 digits, the sequence number may contain 1-8 digits, the optional suffix may contain 1-4 characters, and the fields are separated with a hyphen.

| Name: |

dei_EntityFileNumber |

| Namespace Prefix: |

dei_ |

| Data Type: |

dei:fileNumberItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionTwo-character EDGAR code representing the state or country of incorporation.

| Name: |

dei_EntityIncorporationStateCountryCode |

| Namespace Prefix: |

dei_ |

| Data Type: |

dei:edgarStateCountryItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionThe exact name of the entity filing the report as specified in its charter, which is required by forms filed with the SEC. Reference 1: http://www.xbrl.org/2003/role/presentationRef

-Publisher SEC

-Name Exchange Act

-Number 240

-Section 12

-Subsection b-2

| Name: |

dei_EntityRegistrantName |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:normalizedStringItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionThe Tax Identification Number (TIN), also known as an Employer Identification Number (EIN), is a unique 9-digit value assigned by the IRS. Reference 1: http://www.xbrl.org/2003/role/presentationRef

-Publisher SEC

-Name Exchange Act

-Number 240

-Section 12

-Subsection b-2

| Name: |

dei_EntityTaxIdentificationNumber |

| Namespace Prefix: |

dei_ |

| Data Type: |

dei:employerIdItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionLocal phone number for entity.

| Name: |

dei_LocalPhoneNumber |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:normalizedStringItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionBoolean flag that is true when the Form 8-K filing is intended to satisfy the filing obligation of the registrant as pre-commencement communications pursuant to Rule 13e-4(c) under the Exchange Act. Reference 1: http://www.xbrl.org/2003/role/presentationRef

-Publisher SEC

-Name Exchange Act

-Number 240

-Section 13e

-Subsection 4c

| Name: |

dei_PreCommencementIssuerTenderOffer |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:booleanItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionBoolean flag that is true when the Form 8-K filing is intended to satisfy the filing obligation of the registrant as pre-commencement communications pursuant to Rule 14d-2(b) under the Exchange Act. Reference 1: http://www.xbrl.org/2003/role/presentationRef

-Publisher SEC

-Name Exchange Act

-Number 240

-Section 14d

-Subsection 2b

| Name: |

dei_PreCommencementTenderOffer |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:booleanItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionTitle of a 12(b) registered security. Reference 1: http://www.xbrl.org/2003/role/presentationRef

-Publisher SEC

-Name Exchange Act

-Number 240

-Section 12

-Subsection b

| Name: |

dei_Security12bTitle |

| Namespace Prefix: |

dei_ |

| Data Type: |

dei:securityTitleItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionName of the Exchange on which a security is registered. Reference 1: http://www.xbrl.org/2003/role/presentationRef

-Publisher SEC

-Name Exchange Act

-Number 240

-Section 12

-Subsection d1-1

| Name: |

dei_SecurityExchangeName |

| Namespace Prefix: |

dei_ |

| Data Type: |

dei:edgarExchangeCodeItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionBoolean flag that is true when the Form 8-K filing is intended to satisfy the filing obligation of the registrant as soliciting material pursuant to Rule 14a-12 under the Exchange Act. Reference 1: http://www.xbrl.org/2003/role/presentationRef

-Publisher SEC

-Name Exchange Act

-Number 240

-Section 14a

-Subsection 12

| Name: |

dei_SolicitingMaterial |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:booleanItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionTrading symbol of an instrument as listed on an exchange.

| Name: |

dei_TradingSymbol |

| Namespace Prefix: |

dei_ |

| Data Type: |

dei:tradingSymbolItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionBoolean flag that is true when the Form 8-K filing is intended to satisfy the filing obligation of the registrant as written communications pursuant to Rule 425 under the Securities Act. Reference 1: http://www.xbrl.org/2003/role/presentationRef

-Publisher SEC

-Name Securities Act

-Number 230

-Section 425

| Name: |

dei_WrittenCommunications |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:booleanItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

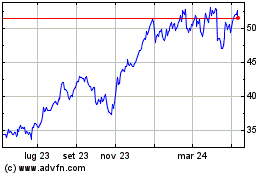

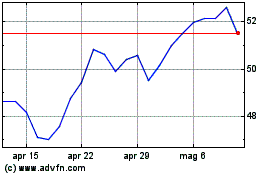

Grafico Azioni Fidelity National Financ... (NYSE:FNF)

Storico

Da Nov 2024 a Dic 2024

Grafico Azioni Fidelity National Financ... (NYSE:FNF)

Storico

Da Dic 2023 a Dic 2024