Current Report Filing (8-k)

26 Maggio 2023 - 10:44PM

Edgar (US Regulatory)

0001173514false00011735142023-05-252023-05-25

UNITED STATES

SECURITIES AND EXCHANGE COMMISSION

WASHINGTON, DC 20549

_______________________________________________________________________________________________________________________________________________________________________________________________________

FORM 8-K | | |

| CURRENT REPORT |

| Pursuant to Section 13 OR 15(d) of The Securities Exchange Act of 1934 |

|

| | | | | | | | |

| Date of Report (Date of earliest event reported): | May 25, 2023 |

| | |

| HYSTER-YALE MATERIALS HANDLING, INC. |

| (Exact name of registrant as specified in its charter) |

| | |

| Delaware | 000-54799 | 31-1637659 |

| (State or other jurisdiction of incorporation) | (Commission File Number) | (IRS Employer Identification No.) |

| | |

| 5875 Landerbrook Drive, Suite 300 | | |

| Cleveland | (440) | |

| OH | 449-9600 | 44124-4069 |

| (Address of principal executive offices) | (Registrant's telephone number, including area code) | (Zip code) |

| N/A | |

| (Former name or former address, if changed since last report) |

Check the appropriate box below if the Form 8-K filing is intended to simultaneously satisfy the filing obligation of the registrant under any of the following provisions:

☐ Written communications pursuant to Rule 425 under the Securities Act (17 CFR 230.425)

☐ Soliciting material pursuant to Rule 14a-12 under the Exchange Act (17 CFR 240.14a-12)

☐ Pre-commencement communications pursuant to Rule 14d-2(b) under the Exchange Act (17 CFR 240.14d-2(b))

☐ Pre-commencement communications pursuant to Rule 13e-4(c) under the Exchange Act (17 CFR 240.13e-4(c))

Securities registered pursuant to Section 12(b) of the Act: | | | | | | | | |

| Title of each class | Trading Symbol(s) | Name of each exchange on which registered |

| Class A Common Stock, $0.01 par value per share | HY | New York Stock Exchange |

Indicate by check mark whether the registrant is an emerging growth company as defined in Rule 405 of the Securities Act of 1933 (§230.405 of this chapter) or Rule 12b-2 of the Securities Exchange Act of 1934 (§240.12b-2 of this chapter).

Emerging growth company ☐

If an emerging growth company, indicate by check mark if the registrant has elected not to use the extended transition period for complying with any new or revised financial accounting standards provided pursuant to Section 13(a) of the Exchange Act. ☐

Item 1.01. Entry Into a Material Definitive Agreement.

The information set forth under Item 2.03 of this Current Report on Form 8-K is incorporated by reference in this Item 1.01.

Item 2.03. Creation of a Direct Financial Obligation or an Obligation under an Off-Balance Sheet Arrangement

On May 25, 2023 (the “Amendment Closing Date”), Hyster-Yale Materials Handling, Inc. (“Hyster-Yale”), its wholly owned subsidiaries, Bolzoni Auramo, Inc, Hyster-Yale Group, Inc., Hyster-Yale Nederland B.V. and Hyster-Yale UK Limited (collectively, the “Borrowers”), and certain subsidiaries of Hyster-Yale, each acting as guarantors (collectively, the “Company”), entered into a First Amendment to the Second Amended and Restated Loan, Security and Guaranty Agreement (the “Amendment”) with certain financial institutions as lenders and Bank of America, N.A., as administrative agent and security trustee, for its revolving credit facility (the “Facility”). As a result of the Amendment, among other items, (i) a new tranche of revolving loans with aggregate commitments of $25.0 million (the “FILO Commitments”) was established under the Facility and (ii) the benchmark interest rate for U.S. dollar-denominated borrowings under the Facility changed from LIBOR to Term SOFR, each as defined in the Facility.

The FILO Commitments will terminate on May 1, 2024 unless otherwise terminated prior to such date by the Company in accordance with the terms of the Facility. Commencing December 1, 2023, the FILO Commitments will amortize on a monthly basis in the amount of $4,166,667 per month. Loans under the FILO Commitments (“FILO Loans”) will bear interest at a floating rate, which can be a base rate or Term SOFR, plus an applicable margin. The applicable margins for FILO Loans are 2.25% for base rate loans and 3.25% for Term SOFR loans. On the Amendment Closing Date, existing U.S. Loans (as defined in the Facility) were reallocated to the FILO Commitment. As a result of such reallocation, the FILO Commitment was fully utilized as of the Amendment Closing Date.

After giving effect to the Amendment, the Facility consists of a domestic revolving credit facility in the amount of $210.0 million, a foreign revolving credit facility in the amount of $90.0 million and the FILO Commitments in the amount of $25.0 million.

Certain of the banks and financial institutions that are parties to the Facility and their respective affiliates have in the past provided, are currently providing and in the future may continue to provide investment banking, commercial banking and other financial services to Hyster-Yale and its subsidiaries in the ordinary course of business for which they have received and will receive customary compensation. In the ordinary course of business, such banks and financial institutions and their respective affiliates may participate in loans and actively trade the equity securities of Hyster-Yale for their own account or for the accounts of customers and, accordingly, such banks and financial institutions and their respective affiliates may at any time hold long or short positions in such securities.

SIGNATURES

Pursuant to the requirements of the Securities Exchange Act of 1934, the registrant has duly caused this report to be signed on its behalf by the undersigned hereunto duly authorized.

| | | | | | | | | | | |

| | | |

| Date: | May 26, 2023 | | HYSTER-YALE MATERIALS HANDLING, INC. |

| | | |

| | By: | /s/ Suzanne Schulze Taylor |

| | | Name: Suzanne Schulze Taylor |

| | | Title: Senior Vice President, General Counsel and Secretary |

| | | |

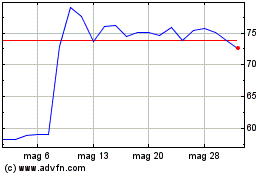

Grafico Azioni Hyster Yale Materials Ha... (NYSE:HY)

Storico

Da Apr 2024 a Mag 2024

Grafico Azioni Hyster Yale Materials Ha... (NYSE:HY)

Storico

Da Mag 2023 a Mag 2024