- As of the end of Q3 2024, U.S. mortgage holders held $17.2T in

equity, of which $11.2T is ‘tappable,’ meaning it can be borrowed

against with the homeowner maintaining a 20% equity stake in their

home

- The average homeowner with a mortgage now has $319K of equity

in their home, of which $207K is tappable

- Though Q3 withdrawals hit a two-year high – both collectively

and individually among second lien products ($27B) and cash-out

refinances ($21B) – the total represented just 0.42% of available

tappable equity

- Borrowers have been withdrawing equity at less than half the

10-year average 0.92% extraction rate, with second lien products

26% below typical levels and cash-outs 69% below the norm

- The past 10 quarters have seen half the equity extraction to

be expected in a ‘normal’ market, meaning $476B has gone untapped

and not flowed back through the broader economy

- In recent quarters, introductory rates on HELOCs have topped

9.5%, more than doubling the $167 March 2022 monthly interest-only

payment needed for a $50K withdrawal to a high of $413 in January

2024

- Recent Federal Reserve cuts to short-term interest rates –

more directly tied to HELOC than 30-year mortgage offerings – have

already made equity withdrawals modestly more affordable and

attractive

- If both market expectations for an additional ~1.5 pp in

additional Fed cuts and current spreads hold true, we could see

HELOC rate offerings in the low 7% range by the end of 2025

- That would drop the monthly payment needed to withdraw $50K in

equity back down below $300; still notably higher than the

historical average, but more than 25% below recent highs

Intercontinental Exchange, Inc. (NYSE:ICE), a leading global

provider of technology and data, today released its November 2024

ICE Mortgage Monitor Report, based on the company’s robust

mortgage, real estate and public records data sets.

This month’s Mortgage Monitor dives deep into ICE’s latest Q3

2024 homeowner equity data, reporting on both quarterly and annual

growth in mortgage holders’ housing wealth. Though 30-year interest

rates remain volatile, recent and anticipated short-term rate cuts

by the Federal Reserve have the potential to positively impact

equity-based lending. As Andy Walden, ICE Vice President of

Research and Analysis explains, though the cost to borrow against a

homeowner’s equity is notably higher than prior to the Fed’s most

recent tightening cycle, this dynamic is poised to change in the

year ahead.

“While growth in total mortgage holder equity is slowing along

with home prices, Q3’s $17.2T, up 5% from last year, represents

another seasonally adjusted record high,” said Walden. “Of that

total, $11.2T is available to homeowners with mortgages to borrow

against while maintaining a 20% equity stake in their homes. On

average, that works out to roughly $207K in tappable equity per

homeowner. And we did see a bump in equity withdrawals in Q3, with

cash-out refi extractions rising on what had been downwardly

trending 30-year rates and second-lien home equity products getting

a boost from rate cuts late in the quarter.”

In total, U.S. mortgage holders withdrew $48B of home equity in

the third quarter. This was the largest such equity withdrawal

volume in the two years since the Federal reserve first initiated

their latest tightening cycle. Both the $27B equity withdrawn via

second lien products and the $21B withdrawn via cash-out refinances

also marked their own individual two-year highs in Q3. Still,

homeowners remain historically reluctant to borrow against their

home equity. Just 0.42% of available tappable equity was withdrawn

in Q3 2024, well below the 0.92% average extraction rate in the

decade preceding the latest round of Fed increases.

“Despite a two-year high for equity withdrawals in the third

quarter, homeowners are still tapping their housing wealth at less

than half the rate they have historically,” Walden added. “Second

lien withdrawal rates are currently running more than a quarter

below ‘normal’ and cash-out refi withdrawals are still down almost

70%. Over the past 10 quarters homeowners have extracted $476B in

equity, exactly half the extraction we’d expect to see under more

normal circumstances. That equates to nearly a half a trillion

untapped dollars that hasn’t flowed back through the broader

economy.”

Elevated interest rates have been a deterrent to homeowner

equity utilization in recent quarters, as 30-year mortgage rates

climbed at times into the high 7% range, curtailing cash-out

refinance activity, and the average introductory rate on second

lien home equity lines of credit (HELOCs) rose above 9.5%. However,

the Federal Reserve recently began to cut short term interest

rates, to which HELOC rates are closely pegged, with additional

cuts expected on the horizon. As Walden points out, this could make

equity withdrawals both more affordable and more attractive.

“Since the Fed began its latest cycle of rate hikes, the monthly

payment needed to withdraw $50K via a HELOC more than doubled, from

as low as $167 per month back in March 2022 to $413 in January of

this year,” Walden said. “The market’s currently pricing in another

1.5 percentage points of cuts through the end of next year. If that

comes to fruition, and current spreads hold, it’ll have positive

implications for both new equity lending as well as for consumers

with existing HELOCs, with the payment on a $50K withdrawal falling

back down below $300 per month. While still notably above the

20-year average of $210, that represents a more than 25% reduction

from recent highs. Given borrowers’ recent sensitivity to even

slight rate drops, this could serve to entice additional HELOC

utilization, especially with mortgage holders sitting on record

stockpiles of equity and locked into their current homes via low

first lien rates.”

Based on the latest ICE Mortgage Futures as well as industry

consensus forecasts, mortgage rates are not expected to see the

full 1.5pp projected Fed rate decline flow through to 30-year

offerings, which could tighten the spread between 30-year mortgage

and HELOC rates and tip the needle toward equity utilization via

HELOCs for a subset of mortgage holders.

Much more information on these and other topics can be found in

this month’s Mortgage Monitor.

About Mortgage Monitor

ICE manages the nation’s leading repository of loan-level

residential mortgage data and performance information covering the

majority of the overall market, including tens of millions of loans

across the spectrum of credit products and more than 160 million

historical records. The combined insight of the ICE Home Price

Index and ICE Valuation Analytics' home price and real estate data

provides one of the most complete, accurate and timely measures of

home prices available, covering 95% of U.S. residential properties

down to the ZIP-code level. In addition, the company maintains one

of the most robust public property records databases available,

covering 99.9% of the U.S. population and households from more than

3,100 counties.

ICE’s research experts carefully analyze this data to produce a

summary supplemented by dozens of charts and graphs that reflect

trend and point-in-time observations for the monthly Mortgage

Monitor Report. To review the full report, visit:

https://www.icemortgagetechnology.com/resources/data-reports

About Intercontinental Exchange

Intercontinental Exchange, Inc. (NYSE: ICE) is a Fortune 500

company that designs, builds, and operates digital networks that

connect people to opportunity. We provide financial technology and

data services across major asset classes helping our customers

access mission-critical workflow tools that increase transparency

and efficiency. ICE’s futures, equity, and options exchanges --

including the New York Stock Exchange -- and clearing houses help

people invest, raise capital and manage risk. We offer some of the

world’s largest markets to trade and clear energy and environmental

products. Our fixed income, data services and execution

capabilities provide information, analytics and platforms that help

our customers streamline processes and capitalize on opportunities.

At ICE Mortgage Technology, we are transforming U.S. housing

finance, from initial consumer engagement through loan production,

closing, registration and the long-term servicing relationship.

Together, ICE transforms, streamlines, and automates industries to

connect our customers to opportunity.

Trademarks of ICE and/or its affiliates include Intercontinental

Exchange, ICE, ICE block design, NYSE and New York Stock Exchange.

Information regarding additional trademarks and intellectual

property rights of Intercontinental Exchange, Inc. and/or its

affiliates is located here. Key Information Documents for certain

products covered by the EU Packaged Retail and Insurance-based

Investment Products Regulation can be accessed on the relevant

exchange website under the heading “Key Information Documents

(KIDS).”

Safe Harbor Statement under the Private Securities Litigation

Reform Act of 1995 -- Statements in this press release regarding

ICE's business that are not historical facts are "forward-looking

statements" that involve risks and uncertainties. For a discussion

of additional risks and uncertainties, which could cause actual

results to differ from those contained in the forward-looking

statements, see ICE's Securities and Exchange Commission (SEC)

filings, including, but not limited to, the risk factors in ICE's

Annual Report on Form 10-K for the year ended December 31, 2023, as

filed with the SEC on February 8, 2024.

Source: Intercontinental Exchange

Category: Mortgage Technology

ICE-CORP

View source

version on businesswire.com: https://www.businesswire.com/news/home/20241104210130/en/

ICE Media Contact Mitch Cohen mitch.cohen@ice.com +1

(704) 890-8158 ICE Investor Contact: Katia Gonzalez

katia.gonzalez@ice.com +1 (678) 981-3882

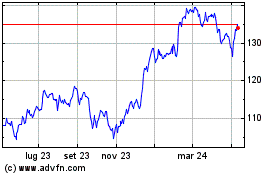

Grafico Azioni Intercontinental Exchange (NYSE:ICE)

Storico

Da Nov 2024 a Dic 2024

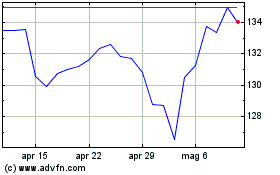

Grafico Azioni Intercontinental Exchange (NYSE:ICE)

Storico

Da Dic 2023 a Dic 2024