Worldscale Adopts ICE’s Benchmark EUA Carbon Pricing for its Tanker Freight Rates

26 Novembre 2024 - 2:30PM

Business Wire

Intercontinental Exchange, Inc. (NYSE:ICE), a leading global

provider of technology and data, today announced that Worldscale

Association Ltd (Worldscale), a leading provider of tanker freight

rate references, has chosen ICE’s European Carbon Allowance (EUA)

futures settlement price as the benchmark carbon price for

calculating tanker freight rates in 2025.

ICE’s EUA futures and options market is the most liquid carbon

market in the world.

Worldscale’s tanker freight flat rates represent the cost of a

standard ship making a round-trip voyage. The rates are comprised

of expenses including bunker prices, port costs and exchange rates.

Under the European Union’s Emission Trading System (EU ETS), for

which ICE’s EUA futures market represents the benchmark price, the

maritime sector now has to account for the carbon emissions of

ships calling in and handling cargoes at EU ports.

“Worldscale needed a transparent price of carbon to be factored

into freight rates and ICE European carbon, as the most liquid

carbon market, is the natural choice,” said Ian McCarthy, Managing

Director of Worldscale.

“Maritime transport is central to the global economy. ICE, as

the leading energy derivatives market, has worked closely with the

industry to provide a solution for how the underlying physical

freight market, as well as related wet freight derivatives used to

hedge freight risk, can comply with the new rules expanding the EU

ETS to maritime,” said Jeff Barbuto, Global Head of Oil Markets at

ICE.

Worldscale will use the average of the daily settlement price

for the period October 1, 2023, to September 30, 2024, of ICE’s EUA

futures December 2024 contract to calculate the carbon cost used in

its 2025 tanker freight flat rates.

ICE offers customers a liquid wet freight futures and options

market to manage the price risk associated with shipping oil. Wet

freight is closely linked to crude and refined product markets,

both of which ICE is a leader in offering derivatives in and are

available to trade as part of ICE’s complex of over 800 oil related

products including ICE Brent, the price barometer for 75% of the

world’s internationally traded crude oil.

ICE’s wet freight futures and options hit a series of open

interest records in November 2024 with record open interest of

181,152 contracts on November 22, 2024.

ICE’s EUA carbon benchmark is part of ICE’s extensive

environmental markets which are the largest and most liquid in the

world for customers to pay for their emissions obligations and

manage the associated price risk. Open interest across ICE’s

environmental markets is up 28% year-over year while ICE’s wider

energy complex is up 20%.

About Intercontinental Exchange

Intercontinental Exchange, Inc. (NYSE: ICE) is a Fortune

500 company that designs, builds and operates digital networks that

connect people to opportunity. We provide financial technology and

data services across major asset classes helping our customers

access mission-critical workflow tools that increase transparency

and efficiency. ICE’s futures, equity, and options exchanges

– including the New York Stock Exchange – and clearing

houses help people invest, raise capital and manage risk. We

offer some of the world’s largest markets to trade and clear energy

and environmental products. Our fixed income, data services

and execution capabilities provide information, analytics and

platforms that help our customers streamline processes and

capitalize on opportunities. At ICE Mortgage Technology, we

are transforming U.S. housing finance, from initial consumer

engagement through loan production, closing, registration and the

long-term servicing relationship. Together, ICE transforms,

streamlines and automates industries to connect our customers to

opportunity.

Trademarks of ICE and/or its affiliates include Intercontinental

Exchange, ICE, ICE block design, NYSE and New York Stock Exchange.

Information regarding additional trademarks and intellectual

property rights of Intercontinental Exchange, Inc. and/or its

affiliates is located here. Key Information Documents for

certain products covered by the EU Packaged Retail and

Insurance-based Investment Products Regulation can be accessed on

the relevant exchange website under the heading “Key Information

Documents (KIDS).”

Safe Harbor Statement under the Private Securities Litigation

Reform Act of 1995 – Statements in this press release regarding

ICE's business that are not historical facts are "forward-looking

statements" that involve risks and uncertainties. For a discussion

of additional risks and uncertainties, which could cause actual

results to differ from those contained in the forward-looking

statements, see ICE's Securities and Exchange Commission (SEC)

filings, including, but not limited to, the risk factors in ICE's

Annual Report on Form 10-K for the year ended December 31, 2023, as

filed with the SEC on February 8, 2024.

Category: EXCHANGES

ICE-CORP

Source: Intercontinental Exchange

View source

version on businesswire.com: https://www.businesswire.com/news/home/20241126988238/en/

ICE Media: Jess Tatham jess.tatham@ice.com +44 7377

947136

ICE Investor: Katia Gonzalez katia.gonzalez@ice.com (678)

981-3882

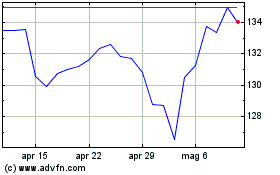

Grafico Azioni Intercontinental Exchange (NYSE:ICE)

Storico

Da Nov 2024 a Dic 2024

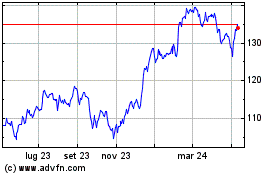

Grafico Azioni Intercontinental Exchange (NYSE:ICE)

Storico

Da Dic 2023 a Dic 2024