ICE Expands Intraday Pricing and Analytics Offering for Canadian Fixed Income Markets with CanDeal DNA

10 Febbraio 2025 - 3:00PM

Business Wire

Intercontinental Exchange, Inc. (NYSE: ICE), a leading global

provider of technology and data, today announced the launch of

intraday price updates and bond analytics data for Canadian fixed

income securities through an agreement with CanDeal DNA, a premier

source for Canadian fixed income and OTC derivatives pricing and

analytics data.

This new offering enhances ICE’s existing suite of pricing and

reference data for fixed income asset classes, including Canadian

fixed income securities. ICE can now provide pricing, spreads and

standard analytics fields updating at hourly intervals from 8AM to

5PM (ET).

“By working with CanDeal, we’re able to enhance our offering

with hourly updates for Canadian fixed income markets, a major

value-add for our clients,” said Chris Edmonds, President, Fixed

Income & Data Services, at ICE. “Not only are we investing in

quality data, but we’re also building upon our robust coverage to

help enable our clients to make more informed investment decisions

and better manage risk, with access to comprehensive and timely

market data.”

Through this collaboration, ICE can now offer both intraday and

end-of-day reference prices for over 80,000 Canadian fixed income

securities via the CanDeal DNA Reference Pricing Service. This

expanded frequency can provide ICE’s customers with a

high-resolution view into intraday price volatility and relevant

decision-making insights.

“This integration allows us to offer market participants more

timely price discovery and insights by security and sector to

support their strategies in Canadian fixed income,” said Robin

Hanlon, Head of Strategic Partnerships at CanDeal DNA. “We’re

excited to continue our relationship with ICE, providing their

clients with quality prices and analytics for CAD-denominated fixed

income securities.”

This latest expansion is a key addition to ICE’s suite of

pricing and analytics products, designed to support intraday,

real-time decision making and help provide clients with greater

flexibility and precision in their day-to-day processes.

For more information about ICE’s pricing and analytics offering,

visit: https://www.ice.com/market-data/pricing-and-analytics

About Intercontinental Exchange

Intercontinental Exchange, Inc. (NYSE: ICE) is a Fortune 500

company that designs, builds and operates digital networks that

connect people to opportunity. We provide financial technology and

data services across major asset classes helping our customers

access mission-critical workflow tools that increase transparency

and efficiency. ICE’s futures, equity, and options exchanges –

including the New York Stock Exchange – and clearing houses help

people invest, raise capital and manage risk. We offer some of the

world’s largest markets to trade and clear energy and environmental

products. Our fixed income, data services and execution

capabilities provide information, analytics and platforms that help

our customers streamline processes and capitalize on opportunities.

At ICE Mortgage Technology, we are transforming U.S. housing

finance, from initial consumer engagement through loan production,

closing, registration and the long-term servicing relationship.

Together, ICE transforms, streamlines and automates industries to

connect our customers to opportunity.

Safe Harbor Statement under the Private Securities Litigation

Reform Act of 1995 – Statements in this press release regarding

ICE's business that are not historical facts are "forward-looking

statements" that involve risks and uncertainties. For a discussion

of additional risks and uncertainties, which could cause actual

results to differ from those contained in the forward-looking

statements, see ICE's Securities and Exchange Commission (SEC)

filings, including, but not limited to, the risk factors in ICE's

Annual Report on Form 10-K for the year ended December 31, 2024, as

filed with the SEC on February 6, 2025.

Category: Fixed Income and Data Services

SOURCE: Intercontinental Exchange

ICE-CORP

About CanDeal Group

CanDeal Group is a leading provider of an electronic marketplace

and data services for Canadian dollar debt securities and

derivatives. CanDeal Markets provides access to a deep pool of

liquidity for Canadian government, agency, provincial and corporate

bonds, as well as money market instruments and interest rate swaps.

CanDeal DNA (Data & Analytics) division delivers the most

comprehensive and accurate dealer-sourced OTC content for pricing,

analytics and reference data to industry market participants,

vendor channels and solution providers. CanDeal Benchmark

Administration Services is an independent business unit that

administers Term CORRA, Canada’s benchmark rate. CanDeal Solutions

delivers mutualized services, including the development of a

centralized KYC utility for the Canadian market.

CanDeal’s stakeholders include BMO Nesbitt Burns Inc., CIBC

World Markets Inc., National Bank Financial Inc., RBC Dominion

Securities Inc., Scotia Capital Inc., TD Securities Inc. and TSX

Inc. Visit www.candeal.com.

View source

version on businesswire.com: https://www.businesswire.com/news/home/20250210166098/en/

ICE Media Isabella Bezzone +1 212 748 3948

isabella.bezzone@ice.com

media@theice.com

ICE Investor Relations Katia Gonzalez +1 678 981 3882

katia.gonzalez@ice.com

investors@ice.com CanDeal Group

candealdna@paragonpr.com

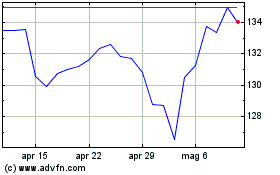

Grafico Azioni Intercontinental Exchange (NYSE:ICE)

Storico

Da Gen 2025 a Feb 2025

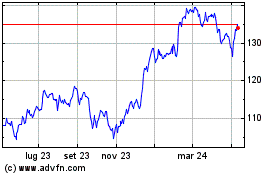

Grafico Azioni Intercontinental Exchange (NYSE:ICE)

Storico

Da Feb 2024 a Feb 2025