Annaly Capital Management, Inc. (NYSE: NLY) ("Annaly" or the

"Company") today announced its financial results for the quarter

ended June 30, 2023.

Financial Highlights

- GAAP net income of $0.27 per average common share for the

quarter

- Earnings available for distribution ("EAD") of $0.72 per

average common share for the quarter

- Economic return of 2.9% for the second quarter

- Annualized GAAP return on average equity of 5.4% and annualized

EAD return on average equity of 13.2%

- Book value per common share of $20.73

- GAAP leverage of 6.1x, up from 5.9x in the prior quarter;

economic leverage of 5.8x, down from 6.4x in the prior quarter

- Declared quarterly common stock cash dividend of $0.65 per

share

Business Highlights

Investment and Strategy

- Total portfolio of $78.9 billion, including $71.4 billion in

highly liquid Agency portfolio(1)

- Annaly's Agency portfolio declined by 8%, predominantly through

reductions to its TBA position early in the quarter, to proactively

manage leverage ahead of expected volatility events; portfolio

additions focused on increasing exposure to higher coupon specified

pools

- Annaly's Agency portfolio represents 69% of dedicated equity

capital(2), up from 67% in the prior quarter

- Maintained a conservative hedge position amidst elevated

macroeconomic uncertainty and actively managed yield curve exposure

in line with a modest flattening bias throughout the quarter

- Annaly's Mortgage Servicing Rights ("MSR") portfolio grew 19%

quarter-over-quarter to $2.2 billion(3) in assets, representing 15%

of dedicated equity capital(2)

- Annaly's Residential Credit portfolio declined modestly to $4.9

billion(1), representing 16% of dedicated equity capital(2), driven

by robust securitization issuance

- Annaly Residential Credit Group's whole loan correspondent

channel continued to expand market share with the second quarter

representing its highest quarterly loan lock volume since

inception, nearly 20% higher than the prior highest quarter

Financing and Capital

- $6.0 billion of unencumbered assets(4), including cash and

unencumbered Agency MBS of $4.4 billion

- Average GAAP cost of interest bearing liabilities increased 48

basis points to 5.00% and average economic cost of interest bearing

liabilities increased 43 basis points to 2.77%

quarter-over-quarter

- Annaly Residential Credit Group priced eight whole loan

securitizations totaling over $3.0 billion in proceeds since the

beginning of the year(5)

- Annaly remains the largest non-bank issuer and is now the

second largest issuer overall of Prime Jumbo and Expanded Credit

MBS from the beginning of 2022 through the second quarter of

2023(6)

Corporate Responsibility & Governance

- Published fourth ESG Report, titled 25 Years of Purposeful

Housing Finance Leadership, demonstrating Annaly's continued

progress on its environmental, social and governance

initiatives

"We were pleased to generate a 3% economic return in the second

quarter of 2023 driven by our proactive portfolio management and an

improved operating environment," remarked David Finkelstein,

Annaly’s Chief Executive Officer and Chief Investment Officer. "As

we have noted for some time, Annaly is well-prepared for volatility

and strategically managed our leverage position during the quarter

given uncertainties emanating from the regional banking turbulence

and debt ceiling negotiations. These efforts enabled book value to

end the quarter effectively unchanged while our portfolio

out-earned our dividend. Overall, we have generated a 6% economic

return for the first half of the year despite substantial market

volatility – demonstrating the stability and efficacy of our

diversified housing finance model.

"As we begin the second half of the year, our outlook is

optimistic given strong investment returns, declining volatility, a

stable financing environment and a likely end to the Federal

Reserve's rate hiking cycle. We remain overweight Agency MBS given

the relative attractiveness of the sector, though we continue to

actively pursue opportunities across our Residential Credit and MSR

portfolios to enhance risk-adjusted returns."

(1)

Total portfolio represents Annaly’s

investments that are on-balance sheet as well as investments that

are off-balance sheet in which Annaly has economic exposure. Assets

exclude assets transferred or pledged to securitization vehicles of

$11.3 billion, include TBA purchase contracts (market value)

of $3.6 billion, unsettled MSR commitments of $126 million and

$1.2 billion of retained securities that are eliminated in

consolidation and are shown net of participations issued totaling

$0.5 billion. MSR commitments represent the market value of

deals where Annaly has executed a letter of intent. There can be no

assurance whether these deals will close or when they will

close.

(2)

Capital allocation for each of the

investment strategies is calculated as the difference between each

investment strategy’s allocated assets, which include TBA purchase

contracts, and liabilities. Dedicated capital allocations as of

June 30, 2023 exclude commercial real estate assets.

(3)

Includes limited partnership

interests in a MSR fund, which is reported in Other Assets, and

unsettled commitments of $126 million. MSR commitments represent

the market value of deals where Annaly has executed a letter of

intent. There can be no assurance whether these deals close or when

they will close.

(4)

Represents Annaly’s excess liquidity and

defined as assets that have not been pledged or securitized

(generally including cash and cash equivalents, Agency MBS, CRT,

Non-Agency MBS, residential mortgage loans, MSR, reverse repurchase

agreements, other unencumbered financial assets and capital

stock).

(5)

Includes a $401 million residential whole

loan securitization that priced in July 2023.

(6)

Issuer ranking data from Inside

Nonconforming Markets for 2022 through Q2 2023.

Financial Performance

The following table summarizes certain key performance

indicators as of and for the quarters ended June 30, 2023, March

31, 2023 and June 30, 2022:

June 30, 2023

March 31, 2023

June 30, 2022

Book value per common share

$

20.73

$

20.77

$

23.59

GAAP leverage at period-end (1)

6.1:1

5.9:1

5.4:1

GAAP net income (loss) per average common

share (2)

$

0.27

$

(1.79

)

$

2.21

Annualized GAAP return (loss) on average

equity

5.42

%

(28.84

%)

30.60

%

Net interest margin (3)

(0.15

%)

0.09

%

2.64

%

Average yield on interest earning assets

(4)

4.27

%

3.96

%

3.58

%

Average GAAP cost of interest bearing

liabilities (5)

5.00

%

4.52

%

1.12

%

Net interest spread

(0.73

%)

(0.56

%)

2.46

%

Non-GAAP metrics *

Earnings available for distribution per

average common share (2)

$

0.72

$

0.81

$

1.22

Annualized EAD return on average

equity

13.22

%

14.82

%

17.49

%

Economic leverage at period-end (1)

5.8:1

6.4:1

6.6:1

Net interest margin (excluding PAA)

(3)

1.66

%

1.76

%

2.20

%

Average yield on interest earning assets

(excluding PAA) (4)

4.22

%

3.96

%

2.87

%

Average economic cost of interest bearing

liabilities (5)

2.77

%

2.34

%

1.11

%

Net interest spread (excluding PAA)

1.45

%

1.62

%

1.76

%

* Represents a non-GAAP financial measure.

Please refer to the "Non-GAAP Financial Measures" section for

additional information.

(1) GAAP leverage is computed as the sum

of repurchase agreements, other secured financing, debt issued by

securitization vehicles and participations issued divided by total

equity. Economic leverage is computed as the sum of recourse debt,

cost basis of to-be-announced ("TBA") and CMBX derivatives

outstanding, and net forward purchases (sales) of investments

divided by total equity. Recourse debt consists of repurchase

agreements and other secured financing. Debt issued by

securitization vehicles and participations issued are non-recourse

to the Company and are excluded from economic leverage.

(2) Net of dividends on preferred

stock.

(3) Net interest margin represents

interest income less interest expense divided by average Interest

Earning Assets. Net interest margin does not include net interest

component of interest rate swaps. Net interest margin (excluding

PAA) represents the sum of interest income (excluding PAA) plus TBA

dollar roll income and CMBX coupon income less interest expense and

the net interest component of interest rate swaps divided by the

sum of average Interest Earning Assets plus average outstanding TBA

contract and CMBX balances. PAA represents the cumulative impact on

prior periods, but not the current period, of quarter-over-quarter

changes in estimated long-term prepayment speeds related to the

Company’s Agency mortgage-backed securities.

(4) Average yield on interest earning

assets represents annualized interest income divided by average

interest earning assets. Average interest earning assets reflects

the average amortized cost of our investments during the period.

Average yield on interest earning assets (excluding PAA) is

calculated using annualized interest income (excluding PAA).

(5) Average GAAP cost of interest bearing

liabilities represents annualized interest expense divided by

average interest bearing liabilities. Average interest bearing

liabilities reflects the average balances during the period.

Average economic cost of interest bearing liabilities represents

annualized economic interest expense divided by average interest

bearing liabilities. Economic interest expense is comprised of GAAP

interest expense and the net interest component of interest rate

swaps.

Updates to Financial

Disclosures

On September 8, 2022, the Company announced that its Board of

Directors had unanimously approved a reverse stock split of the

Company’s common stock at a ratio of 1-for-4 (the "Reverse Stock

Split"). The Reverse Stock Split was effective following the close

of business on September 23, 2022 (the "Effective Time").

Accordingly, at the Effective Time, every four issued and

outstanding shares of the Company’s common stock were converted

into one share of the Company’s common stock. No fractional shares

were issued in connection with the Reverse Stock Split. Instead,

each stockholder that would have held fractional shares as a result

of the Reverse Stock Split received cash in lieu of such fractional

shares. The par value per share of the Company’s common stock

remained unchanged at $0.01 per share after the Reverse Stock

Split. Accordingly, for all historical periods presented, an amount

equal to the par value of the reduced number of shares resulting

from the Reverse Stock Split was reclassified from Common stock to

Additional paid in capital in the Company’s Consolidated Statements

of Financial Condition. All other references made to share or per

share amounts in the accompanying consolidated financial statements

and disclosures have also been retroactively adjusted, where

applicable, to reflect the effects of the Reverse Stock Split.

Other Information

This news release and our public documents to which we refer

contain or incorporate by reference certain forward-looking

statements which are based on various assumptions (some of which

are beyond our control) and may be identified by reference to a

future period or periods or by the use of forward-looking

terminology, such as "may," "will," "believe," "expect,"

"anticipate," "continue," or similar terms or variations on those

terms or the negative of those terms. Such statements include those

relating to the Company’s future performance, macro outlook, the

interest rate and credit environments, tax reform and future

opportunities. Actual results could differ materially from those

set forth in forward-looking statements due to a variety of

factors, including, but not limited to, changes in interest rates;

changes in the yield curve; changes in prepayment rates; the

availability of mortgage-backed securities ("MBS") and other

securities for purchase; the availability of financing and, if

available, the terms of any financing; changes in the market value

of the Company’s assets; changes in business conditions and the

general economy; the Company’s ability to grow its residential

credit business; the Company's ability to grow its mortgage

servicing rights business; credit risks related to the Company’s

investments in credit risk transfer securities and residential

mortgage-backed securities and related residential mortgage credit

assets; risks related to investments in mortgage servicing rights;

the Company’s ability to consummate any contemplated investment

opportunities; changes in government regulations or policy

affecting the Company’s business; the Company’s ability to maintain

its qualification as a REIT for U.S. federal income tax purposes;

the Company’s ability to maintain its exemption from registration

under the Investment Company Act of 1940; operational risks or risk

management failures by us or critical third parties, including

cybersecurity incidents; and risks and uncertainties related to the

COVID-19 pandemic, including as related to adverse economic

conditions on real estate-related assets and financing conditions.

For a discussion of the risks and uncertainties which could cause

actual results to differ from those contained in the

forward-looking statements, see "Risk Factors" in our most recent

Annual Report on Form 10-K and any subsequent Quarterly Reports on

Form 10-Q. The Company does not undertake, and specifically

disclaims any obligation, to publicly release the result of any

revisions which may be made to any forward-looking statements to

reflect the occurrence of anticipated or unanticipated events or

circumstances after the date of such statements, except as required

by law.

Annaly is a leading diversified capital manager with investment

strategies across mortgage finance. Annaly’s principal business

objective is to generate net income for distribution to its

stockholders and to optimize its returns through prudent management

of its diversified investment strategies. Annaly is internally

managed and has elected to be taxed as a real estate investment

trust, or REIT, for federal income tax purposes. Additional

information on the company can be found at www.annaly.com.

We use our website (www.annaly.com) and LinkedIn account

(www.linkedin.com/company/annaly-capital-management) as channels of

distribution of company information. The information we post

through these channels may be deemed material. Accordingly,

investors should monitor these channels, in addition to following

our press releases, SEC filings and public conference calls and

webcasts. In addition, you may automatically receive email alerts

and other information about Annaly when you enroll your email

address by visiting the "Investors" section of our website, then

clicking on "Investor Resources" and selecting "Email Alerts" to

complete the email notification form. Our website, any alerts and

social media channels are not incorporated by reference into, and

are not a part of, this document.

The Company prepares an investor presentation and supplemental

financial information for the benefit of its shareholders. Please

refer to the investor presentation for definitions of both GAAP and

non-GAAP measures used in this news release. Both the Second

Quarter 2023 Investor Presentation and the Second Quarter 2023

Supplemental Information can be found at the Company’s website

(www.annaly.com) in the Investors section under Investor

Presentations.

Conference Call

The Company will hold the second quarter 2023 earnings

conference call on July 27, 2023 at 9:00 a.m. Eastern Time.

Participants are encouraged to pre-register for the conference call

to receive a unique PIN to gain immediate access to the call and

bypass the live operator. Pre-registration may be completed by

accessing the pre-registration link found on the homepage or

"Investors" section of the Company's website at www.annaly.com, or

by using the following link:

https://dpregister.com/sreg/10180570/f9db28395a. Pre-registration

may be completed at any time, including up to and after the call

start time.

For participants who would like to join the call but have not

pre-registered, access is available by dialing 844-735-3317 within

the U.S., or 412-317-5703 internationally, and requesting the

"Annaly Earnings Call."

There will also be an audio webcast of the call on

www.annaly.com. A replay of the call will be available for one week

following the conference call. The replay number is 877-344-7529

for domestic calls and 412-317-0088 for international calls and the

conference passcode is 4465075. If you would like to be added to

the e-mail distribution list, please visit www.annaly.com, click on

Investors, then select Email Alerts and complete the email

notification form.

Financial Statements

ANNALY CAPITAL MANAGEMENT,

INC. AND SUBSIDIARIES

CONSOLIDATED STATEMENTS OF

FINANCIAL CONDITION

(dollars in thousands, except

per share data)

June 30, 2023

March 31, 2023

December 31, 2022 (1)

September 30,

2022

June 30, 2022

(unaudited)

(unaudited)

(unaudited)

(unaudited)

Assets

Cash and cash equivalents

$

1,236,872

$

1,794,173

$

1,576,714

$

1,466,171

$

853,932

Securities

71,202,461

69,238,185

65,789,907

66,839,353

59,042,734

Loans, net

1,154,320

1,642,822

1,809,832

1,551,707

1,487,133

Mortgage servicing rights

2,018,896

1,790,980

1,748,209

1,705,254

1,421,420

Interests in MSR

—

—

—

—

83,622

Assets transferred or pledged to

securitization vehicles

11,318,419

10,277,588

9,121,912

9,202,014

8,877,247

Assets of disposal group held for sale

—

—

—

11,371

97,414

Derivative assets

457,119

400,139

342,064

1,949,530

748,432

Receivable for unsettled trades

787,442

679,096

575,091

2,153,895

434,227

Principal and interest receivable

944,537

773,722

637,301

262,542

300,028

Intangible assets, net

15,163

15,921

16,679

17,437

18,195

Other assets

195,248

219,391

233,003

247,490

272,865

Total assets

$

89,330,477

$

86,832,017

$

81,850,712

$

85,406,764

$

73,637,249

Liabilities and stockholders’

equity

Liabilities

Repurchase agreements

$

61,637,600

$

60,993,018

$

59,512,597

$

54,160,731

$

51,364,097

Other secured financing

500,000

250,000

250,000

250,000

—

Debt issued by securitization vehicles

9,789,282

8,805,911

7,744,160

7,844,518

7,502,483

Participations issued

492,307

673,431

800,849

745,729

696,944

Liabilities of disposal group held for

sale

—

—

—

1,151

3,608

Derivative liabilities

156,182

473,515

204,172

764,535

379,708

Payable for unsettled trades

4,331,315

3,259,034

1,157,846

9,333,646

1,995,960

Interest payable

140,620

118,395

325,280

30,242

91,962

Dividends payable

321,031

321,023

412,113

411,762

354,027

Other liabilities

74,795

28,657

74,269

912,895

158,560

Total liabilities

77,443,132

74,922,984

70,481,286

74,455,209

62,547,349

Stockholders’ equity

Preferred stock, par value $0.01 per share

(2)

1,536,569

1,536,569

1,536,569

1,536,569

1,536,569

Common stock, par value $0.01 per share

(3)

4,939

4,939

4,683

4,679

4,023

Additional paid-in capital

23,550,346

23,543,091

22,981,320

22,967,665

21,293,146

Accumulated other comprehensive income

(loss)

(2,382,531

)

(2,550,614

)

(3,708,896

)

(5,431,436

)

(4,310,926

)

Accumulated deficit

(10,933,044

)

(10,741,863

)

(9,543,233

)

(8,211,358

)

(7,496,061

)

Total stockholders’ equity

11,776,279

11,792,122

11,270,443

10,866,119

11,026,751

Noncontrolling interests

111,066

116,911

98,983

85,436

63,149

Total equity

11,887,345

11,909,033

11,369,426

10,951,555

11,089,900

Total liabilities and equity

$

89,330,477

$

86,832,017

$

81,850,712

$

85,406,764

$

73,637,249

(1) Derived from the audited consolidated

financial statements at December 31, 2022.

(2) 6.95% Series F Fixed-to-Floating Rate

Cumulative Redeemable Preferred Stock - Includes 28,800,000 shares

authorized, issued and outstanding. 6.50% Series G

Fixed-to-Floating Rate Cumulative Redeemable Preferred Stock -

Includes 17,000,000 shares authorized, issued and outstanding.

6.75% Series I Preferred Stock - Includes 17,700,000 shares

authorized, issued and outstanding.

(3) Includes 1,468,250,000 shares

authorized. Includes 493,893,288 shares issued and outstanding at

June 30, 2023; 493,880,938 shares issued and outstanding at March

31, 2023; 468,309,810 shares issued and outstanding at December 31,

2022; 467,911,144 shares issued and outstanding at September 30,

2022; 402,303,874 shares issued and outstanding at June 30,

2022.

ANNALY CAPITAL MANAGEMENT,

INC. AND SUBSIDIARIES

CONSOLIDATED STATEMENTS OF

COMPREHENSIVE INCOME (LOSS)

(dollars in thousands, except

per share data)

(Unaudited)

For the quarters ended

June 30, 2023

March 31, 2023

December 31,

2022

September 30,

2022

June 30, 2022

Net interest income

Interest income

$

921,494

$

818,250

$

798,934

$

678,488

$

645,615

Interest expense

953,457

798,787

663,847

400,491

170,475

Net interest income

(31,963

)

19,463

135,087

277,997

475,140

Net servicing income

Servicing and related income

83,790

84,273

82,040

74,486

55,685

Servicing and related expense

8,930

7,880

7,659

7,780

5,949

Net servicing income

74,860

76,393

74,381

66,706

49,736

Other income (loss)

Net gains (losses) on investments and

other

(1,308,948

)

1,712

(1,124,924

)

(2,702,512

)

(615,216

)

Net gains (losses) on derivatives

1,475,325

(900,752

)

84,263

2,117,240

1,015,643

Loan loss (provision) reversal

—

219

(7,258

)

1,613

26,913

Business divestiture-related gains

(losses)

—

—

(13,013

)

(2,936

)

(23,955

)

Other, net

9,105

15,498

7,569

1,526

(5,486

)

Total other income (loss)

175,482

(883,323

)

(1,053,363

)

(585,069

)

397,899

General and administrative

expenses

Compensation expense

30,635

29,391

29,714

27,744

22,243

Other general and administrative

expenses

12,280

11,437

13,291

10,178

13,795

Total general and administrative

expenses

42,915

40,828

43,005

37,922

36,038

Income (loss) before income

taxes

175,464

(828,295

)

(886,900

)

(278,288

)

886,737

Income taxes

14,277

11,033

(86

)

(4,311

)

23,420

Net income (loss)

161,187

(839,328

)

(886,814

)

(273,977

)

863,317

Net income (loss) attributable to

noncontrolling interests

(5,846

)

4,928

1,548

1,287

(3,379

)

Net income (loss) attributable to

Annaly

167,033

(844,256

)

(888,362

)

(275,264

)

866,696

Dividends on preferred stock

35,766

31,875

29,974

26,883

26,883

Net income (loss) available (related)

to common stockholders

$

131,267

$

(876,131

)

$

(918,336

)

$

(302,147

)

$

839,813

Net income (loss) per share available

(related) to common stockholders

Basic

$

0.27

$

(1.79

)

$

(1.96

)

$

(0.70

)

$

2.21

Diluted

$

0.27

$

(1.79

)

$

(1.96

)

$

(0.70

)

$

2.20

Weighted average number of common

shares outstanding

Basic

494,165,256

489,688,364

468,250,672

429,858,876

380,609,192

Diluted

494,358,982

489,688,364

468,250,672

429,858,876

380,898,750

Other comprehensive income

(loss)

Net income (loss)

$

161,187

$

(839,328

)

$

(886,814

)

$

(273,977

)

$

863,317

Unrealized gains (losses) on

available-for-sale securities

(294,045

)

675,374

445,896

(2,578,509

)

(2,503,250

)

Reclassification adjustment for net

(gains) losses included in net income (loss)

462,128

482,908

1,276,644

1,457,999

657,806

Other comprehensive income

(loss)

168,083

1,158,282

1,722,540

(1,120,510

)

(1,845,444

)

Comprehensive income (loss)

329,270

318,954

835,726

(1,394,487

)

(982,127

)

Comprehensive income (loss) attributable

to noncontrolling interests

(5,846

)

4,928

1,548

1,287

(3,379

)

Comprehensive income (loss)

attributable to Annaly

335,116

314,026

834,178

(1,395,774

)

(978,748

)

Dividends on preferred stock

35,766

31,875

29,974

26,883

26,883

Comprehensive income (loss)

attributable to common stockholders

$

299,350

$

282,151

$

804,204

$

(1,422,657

)

$

(1,005,631

)

ANNALY CAPITAL MANAGEMENT,

INC. AND SUBSIDIARIES

CONSOLIDATED STATEMENTS OF

COMPREHENSIVE INCOME (LOSS)

(dollars in thousands, except

per share data)

For the six months

ended

June 30, 2023

June 30, 2022

(unaudited)

(unaudited)

Net interest income

Interest income

$

1,739,744

$

1,301,465

Interest expense

1,752,244

245,397

Net interest income

(12,500

)

1,056,068

Net servicing income

Servicing and related income

168,063

90,400

Servicing and related expense

16,810

9,706

Net servicing income

151,253

80,694

Other income (loss)

Net gains (losses) on investments and

other

(1,307,236

)

(775,020

)

Net gains (losses) on derivatives

574,573

2,657,671

Loan loss (provision) reversal

219

26,305

Business divestiture-related gains

(losses)

—

(24,309

)

Other, net

24,603

(2,428

)

Total other income (loss)

(707,841

)

1,882,219

General and administrative

expenses

Compensation expense

60,026

55,245

Other general and administrative

expenses

23,717

26,557

Total general and administrative

expenses

83,743

81,802

Income (loss) before income

taxes

(652,831

)

2,937,179

Income taxes

25,310

49,968

Net income (loss)

(678,141

)

2,887,211

Net income (loss) attributable to

noncontrolling interests

(918

)

(1,740

)

Net income (loss) attributable to

Annaly

(677,223

)

2,888,951

Dividends on preferred stock

67,641

53,766

Net income (loss) available (related)

to common stockholders

$

(744,864

)

$

2,835,185

Net income (loss) per share available

(related) to common stockholders

Basic

$

(1.51

)

$

7.60

Diluted

$

(1.51

)

$

7.59

Weighted average number of common

shares outstanding

Basic

491,939,177

373,017,228

Diluted

491,939,177

373,313,723

Other comprehensive income

(loss)

Net income (loss)

$

(678,141

)

$

2,887,211

Unrealized gains (losses) on

available-for-sale securities

381,329

(6,071,929

)

Reclassification adjustment for net

(gains) losses included in net income (loss)

945,036

802,593

Other comprehensive income

(loss)

1,326,365

(5,269,336

)

Comprehensive income (loss)

648,224

(2,382,125

)

Comprehensive income (loss) attributable

to noncontrolling interests

(918

)

(1,740

)

Comprehensive income (loss)

attributable to Annaly

649,142

(2,380,385

)

Dividends on preferred stock

67,641

53,766

Comprehensive income (loss)

attributable to common stockholders

$

581,501

$

(2,434,151

)

Key Financial Data

The following table presents key metrics of the Company’s

portfolio, liabilities and hedging positions, and performance as of

and for the quarters ended June 30, 2023, March 31, 2023 and June

30, 2022:

June 30, 2023

March 31, 2023

June 30, 2022

Portfolio related metrics

Fixed-rate Residential Securities as a

percentage of total Residential Securities

98

%

98

%

97

%

Adjustable-rate and floating-rate

Residential Securities as a percentage of total Residential

Securities

2

%

2

%

3

%

Weighted average experienced CPR for the

period

7.0

%

5.5

%

14.9

%

Weighted average projected long-term CPR

at period-end

8.6

%

8.4

%

7.7

%

Liabilities and hedging metrics

Weighted average days to maturity on

repurchase agreements outstanding at period-end

44

59

47

Hedge ratio (1)

105

%

106

%

104

%

Weighted average pay rate on interest rate

swaps at period-end (2)

2.50

%

2.13

%

1.16

%

Weighted average receive rate on interest

rate swaps at period-end (2)

5.05

%

4.87

%

1.65

%

Weighted average net rate on interest rate

swaps at period-end (2)

(2.55

%)

(2.74

%)

(0.49

%)

GAAP leverage at period-end (3)

6.1:1

5.9:1

5.4:1

GAAP capital ratio at period-end (4)

13.3

%

13.7

%

15.1

%

Performance related metrics

Book value per common share

$

20.73

$

20.77

$

23.59

GAAP net income (loss) per average common

share (5)

$

0.27

$

(1.79

)

$

2.21

Annualized GAAP return (loss) on average

equity

5.42

%

(28.84

%)

30.60

%

Net interest margin (6)

(0.15

%)

0.09

%

2.64

%

Average yield on interest earning assets

(7)

4.27

%

3.96

%

3.58

%

Average GAAP cost of interest bearing

liabilities (8)

5.00

%

4.52

%

1.12

%

Net interest spread

(0.73

%)

(0.56

%)

2.46

%

Dividend declared per common share

$

0.65

$

0.65

$

0.88

Annualized dividend yield (9)

12.99

%

13.61

%

14.89

%

Non-GAAP metrics *

Earnings available for distribution per

average common share (5)

$

0.72

$

0.81

$

1.22

Annualized EAD return on average equity

(excluding PAA)

13.22

%

14.82

%

17.49

%

Economic leverage at period-end (3)

5.8:1

6.4:1

6.6:1

Economic capital ratio at period end

(4)

14.3

%

13.2

%

13.0

%

Net interest margin (excluding PAA)

(6)

1.66

%

1.76

%

2.20

%

Average yield on interest earning assets

(excluding PAA) (7)

4.22

%

3.96

%

2.87

%

Average economic cost of interest bearing

liabilities (8)

2.77

%

2.34

%

1.11

%

Net interest spread (excluding PAA)

1.45

%

1.62

%

1.76

%

* Represents a non-GAAP financial measure.

Please refer to the "Non-GAAP Financial Measures" section for

additional information.

(1) Measures total notional balances of

interest rate swaps, interest rate swaptions (excluding receiver

swaptions) and futures relative to repurchase agreements, other

secured financing and cost basis of TBA derivatives outstanding and

net forward purchases (sales) of investments; excludes MSR and the

effects of term financing, both of which serve to reduce interest

rate risk. Additionally, the hedge ratio does not take into

consideration differences in duration between assets and

liabilities. Prior to the quarter ended September 30, 2022, the

hedge ratio excluded the impact of net forward purchases (sales) of

investments from the calculation; all prior periods have been

updated to conform to the current presentation resulting in a

reduction of 3% to the hedge ratio for the quarter ended June 30,

2022.

(2) Excludes forward starting swaps.

(3) GAAP leverage is computed as the sum

of repurchase agreements, other secured financing, debt issued by

securitization vehicles and participations issued divided by total

equity. Economic leverage is computed as the sum of recourse debt,

cost basis of to-be-announced ("TBA") and CMBX derivatives

outstanding, and net forward purchases (sales) of investments

divided by total equity. Recourse debt consists of repurchase

agreements and other secured financing. Debt issued by

securitization vehicles and participations issued are non-recourse

to the Company and are excluded from economic leverage.

(4) GAAP capital ratio is computed as

total equity divided by total assets. Economic capital ratio is

computed as total equity divided by total economic assets. Total

economic assets include the implied market value of TBA derivatives

and are net of debt issued by securitization vehicles.

(5) Net of dividends on preferred

stock.

(6) Net interest margin represents

interest income less interest expense divided by average interest

earning assets. Net interest margin does not include net interest

component of interest rate swaps. Net interest margin (excluding

PAA) represents the sum of interest income (excluding PAA) plus TBA

dollar roll income and CMBX coupon income less interest expense and

the net interest component of interest rate swaps divided by the

sum of average interest earning assets plus average TBA contract

and CMBX balances.

(7) Average yield on interest earning

assets represents annualized interest income divided by average

interest earning assets. Average interest earning assets reflects

the average amortized cost of our investments during the period.

Average yield on interest earning assets (excluding PAA) is

calculated using annualized interest income (excluding PAA).

(8) Average GAAP cost of interest bearing

liabilities represents annualized interest expense divided by

average interest bearing liabilities. Average interest bearing

liabilities reflects the average balances during the period.

Average economic cost of interest bearing liabilities represents

annualized economic interest expense divided by average interest

bearing liabilities. Economic interest expense is comprised of GAAP

interest expense and the net interest component of interest rate

swaps.

(9) Based on the closing price of the

Company’s common stock of $20.01, $19.11 and $23.64 at June 30,

2023, March 31, 2023 and June 30, 2022, respectively.

The following table contains additional information on our

investment portfolio as of the dates presented:

For the quarters ended

June 30, 2023

March 31, 2023

June 30, 2022

Agency mortgage-backed securities

$

67,764,264

$

65,623,534

$

55,593,336

Residential credit risk transfer

securities

1,064,401

1,085,384

965,714

Non-agency mortgage-backed securities

2,008,106

2,028,656

2,026,658

Commercial mortgage-backed securities

365,690

500,611

457,026

Total securities

$

71,202,461

$

69,238,185

$

59,042,734

Residential mortgage loans

$

1,154,320

$

1,642,822

$

1,486,811

Residential mortgage loan warehouse

facility

—

—

322

Total loans, net

$

1,154,320

$

1,642,822

$

1,487,133

Mortgage servicing rights

$

2,018,896

$

1,790,980

$

1,421,420

Interests in MSR

$

—

$

—

$

83,622

Agency mortgage-backed securities

transferred or pledged to securitization vehicles

$

—

$

—

$

458,268

Residential mortgage loans transferred or

pledged to securitization vehicles

11,318,419

10,277,588

8,418,979

Assets transferred or pledged to

securitization vehicles

$

11,318,419

$

10,277,588

$

8,877,247

Assets of disposal group held for

sale

$

—

$

—

$

97,414

Total investment portfolio

$

85,694,096

$

82,949,575

$

71,009,570

Non-GAAP Financial

Measures

To supplement its consolidated financial statements, which are

prepared and presented in accordance with U.S. generally accepted

accounting principles ("GAAP"), the Company provides the following

non-GAAP measures:

- earnings available for distribution ("EAD");

- earnings available for distribution attributable to common

stockholders;

- earnings available for distribution per average common

share;

- annualized EAD return on average equity;

- economic leverage;

- economic capital ratio;

- interest income (excluding PAA);

- economic interest expense;

- economic net interest income (excluding PAA);

- average yield on interest earning assets (excluding PAA);

- average economic cost of interest bearing liabilities;

- net interest margin (excluding PAA); and

- net interest spread (excluding PAA).

These measures should not be considered a substitute for, or

superior to, financial measures computed in accordance with GAAP.

While intended to offer a fuller understanding of the Company’s

results and operations, non-GAAP financial measures also have

limitations. For example, the Company may calculate its non-GAAP

metrics, such as earnings available for distribution, or the PAA,

differently than its peers making comparative analysis difficult.

Additionally, in the case of non-GAAP measures that exclude the

PAA, the amount of amortization expense excluding the PAA is not

necessarily representative of the amount of future periodic

amortization nor is it indicative of the term over which the

Company will amortize the remaining unamortized premium. Changes to

actual and estimated prepayments will impact the timing and amount

of premium amortization and, as such, both GAAP and non-GAAP

results.

These non-GAAP measures provide additional detail to enhance

investor understanding of the Company’s period-over-period

operating performance and business trends, as well as for assessing

the Company’s performance versus that of industry peers. Additional

information pertaining to the Company’s use of these non-GAAP

financial measures, including discussion of how each such measure

may be useful to investors, and reconciliations to their most

directly comparable GAAP results are provided below.

Earnings available for distribution, earnings available for

distribution attributable to common stockholders, earnings

available for distribution per average common share and annualized

EAD return on average equity

The Company's principal business objective is to generate net

income for distribution to its stockholders and to preserve capital

through prudent selection of investments and continuous management

of its portfolio. The Company generates net income by earning a net

interest spread on its investment portfolio, which is a function of

interest income from its investment portfolio less financing,

hedging and operating costs. Earnings available for distribution,

which is defined as the sum of (a) economic net interest income,

(b) TBA dollar roll income and CMBX coupon income, (c) net

servicing income less realized amortization of MSR, (d) other

income (loss) (excluding amortization of intangibles, non-EAD

income allocated to equity method investments and other non-EAD

components of other income (loss)), (e) general and administrative

expenses (excluding transaction expenses and non-recurring items),

and (f) income taxes (excluding the income tax effect of non-EAD

income (loss) items) and excludes (g) the premium amortization

adjustment ("PAA") representing the cumulative impact on prior

periods, but not the current period, of quarter-over-quarter

changes in estimated long-term prepayment speeds related to the

Company’s Agency mortgage-backed securities is used by the

Company's management and, the Company believes, used by analysts

and investors to measure its progress in achieving its principal

business objective.

The Company seeks to fulfill this objective through a variety of

factors including portfolio construction, the degree of market risk

exposure and related hedge profile, and the use and forms of

leverage, all while operating within the parameters of the

Company's capital allocation policy and risk governance

framework.

The Company believes these non-GAAP measures provide management

and investors with additional details regarding the Company’s

underlying operating results and investment portfolio trends by (i)

making adjustments to account for the disparate reporting of

changes in fair value where certain instruments are reflected in

GAAP net income (loss) while others are reflected in other

comprehensive income (loss) and (ii) by excluding certain

unrealized, non-cash or episodic components of GAAP net income

(loss) in order to provide additional transparency into the

operating performance of the Company’s portfolio. In addition, EAD

serves as a useful indicator for investors in evaluating the

Company's performance and ability to pay dividends. Annualized EAD

return on average equity, which is calculated by dividing earnings

available for distribution over average stockholders’ equity,

provides investors with additional detail on the earnings available

for distribution generated by the Company’s invested equity

capital.

The following table presents a reconciliation of GAAP financial

results to non-GAAP earnings available for distribution for the

periods presented:

For the quarters ended

June 30, 2023

March 31, 2023

June 30, 2022

(dollars in thousands, except

per share data)

GAAP net income (loss)

$

161,187

$

(839,328

)

$

863,317

Adjustments to exclude reported

realized and unrealized (gains) losses

Net (gains) losses on investments and

other(1)

1,316,837

(1,712

)

615,216

Net (gains) losses on derivatives (2)

(1,050,032

)

1,286,458

(1,014,651

)

Loan loss provision (reversal) (3)

—

(219

)

(29,380

)

Business divestiture-related (gains)

losses

—

—

23,955

Other adjustments

Amortization of intangibles

758

758

1,302

Non-EAD (income) loss allocated to equity

method investments (4)

541

(244

)

(3,270

)

Transaction expenses and non-recurring

items (5)

2,650

1,358

1,751

Income tax effect of non-EAD income (loss)

items

12,364

8,278

28,841

TBA dollar roll income and CMBX coupon

income (6)

1,734

18,183

161,673

MSR amortization (7)

(41,297

)

(43,423

)

(33,810

)

EAD attributable to noncontrolling

interests

(3,344

)

(3,470

)

3,379

Premium amortization adjustment cost

(benefit)

(11,923

)

491

(127,521

)

Earnings available for distribution

*

389,475

427,130

490,802

Dividends on preferred stock

35,766

31,875

26,883

Earnings available for distribution

attributable to common stockholders *

$

353,709

$

395,255

$

463,919

GAAP net income (loss) per average

common share

$

0.27

$

(1.79

)

$

2.21

Earnings available for distribution per

average common share *

$

0.72

$

0.81

$

1.22

Annualized GAAP return (loss) on

average equity

5.42

%

(28.84

%)

30.60

%

Annualized EAD return on average equity

*

13.22

%

14.82

%

17.49

%

* Represents a non-GAAP financial

measure.

(1) Includes a write-down which is

reported in Other, net in the Company's Consolidated Statement of

Comprehensive Income (Loss).

(2) The adjustment to add back Net (gains)

losses on derivatives does not include the net interest component

of interest rate swaps which is reflected in earnings available for

distribution. The net interest component of interest rate swaps

totaled $425.3 million, $385.7 million and $1.0 million for the

quarters ended June 30, 2023, March 31, 2023 and June 30, 2022,

respectively.

(3) Includes $0.0 million, $0.0 million

and ($2.5) million of loss provision (reversal) on the Company’s

unfunded loan commitments for the quarters ended June 30, 2023,

March 31, 2023 and June 30, 2022, respectively, which is reported

in Other, net in the Company’s Consolidated Statements of

Comprehensive Income (Loss).

(4) The Company excludes non-EAD (income)

loss allocated to equity method investments, which represents the

unrealized (gains) losses allocated to equity interests in a

portfolio of MSR, which is a component of Other, net.

(5) Represents costs incurred in

connection with securitizations of residential whole loans.

(6) TBA dollar roll income and CMBX coupon

income each represent a component of Net gains (losses) on

derivatives. CMBX coupon income totaled $0.5 million, $1.1 million

and $1.1 million for the quarters ended June 30, 2023, March 31,

2023 and June 30, 2022, respectively.

(7) MSR amortization utilizes purchase

date cash flow assumptions and actual unpaid principal balances and

is calculated as the difference between projected MSR yield income

and net servicing income for the period.

From time to time, the Company enters into TBA forward contracts

as an alternate means of investing in and financing Agency

mortgage-backed securities. A TBA contract is an agreement to

purchase or sell, for future delivery, an Agency mortgage-backed

security with a specified issuer, term and coupon. A TBA dollar

roll represents a transaction where TBA contracts with the same

terms but different settlement dates are simultaneously bought and

sold. The TBA contract settling in the later month typically prices

at a discount to the earlier month contract with the difference in

price commonly referred to as the "drop". The drop is a reflection

of the expected net interest income from an investment in similar

Agency mortgage-backed securities, net of an implied financing

cost, that would be foregone as a result of settling the contract

in the later month rather than in the earlier month. The drop

between the current settlement month price and the forward

settlement month price occurs because in the TBA dollar roll

market, the party providing the financing is the party that would

retain all principal and interest payments accrued during the

financing period. Accordingly, TBA dollar roll income generally

represents the economic equivalent of the net interest income

earned on the underlying Agency mortgage-backed security less an

implied financing cost.

TBA dollar roll transactions are accounted for under GAAP as a

series of derivatives transactions. The fair value of TBA

derivatives is based on methods similar to those used to value

Agency mortgage-backed securities. The Company records TBA

derivatives at fair value on its Consolidated Statements of

Financial Condition and recognizes periodic changes in fair value

in Net gains (losses) on derivatives in the Consolidated Statements

of Comprehensive Income (Loss), which includes both unrealized and

realized gains and losses on derivatives.

TBA dollar roll income is calculated as the difference in price

between two TBA contracts with the same terms but different

settlement dates multiplied by the notional amount of the TBA

contract. Although accounted for as derivatives, TBA dollar rolls

capture the economic equivalent of net interest income, or carry,

on the underlying Agency mortgage-backed security (interest income

less an implied cost of financing). TBA dollar roll income is

reported as a component of Net gains (losses) on derivatives in the

Consolidated Statements of Comprehensive Income (Loss).

The CMBX index is a synthetic tradable index referencing a

basket of 25 commercial mortgage-backed securities ("CMBS") of a

particular rating and vintage. The CMBX index allows investors to

take a long exposure (referred to as selling protection) or short

exposure (referred to as buying protection) on the respective

basket of CMBS securities and is structured as a "pay-as-you-go"

contract whereby the protection buyer pays to the protection seller

a standardized running coupon on the contracted notional amount.

The Company reports income (expense) on CMBX positions in Net gains

(losses) on derivatives in the Consolidated Statements of

Comprehensive Income (Loss). The coupon payments received or paid

on CMBX positions are equivalent to interest income (expense) and

therefore included in earnings available for distribution.

Premium Amortization Expense

In accordance with GAAP, the Company amortizes or accretes

premiums or discounts into interest income for its Agency

mortgage-backed securities, excluding interest-only securities,

multifamily and reverse mortgages, taking into account estimates of

future principal prepayments in the calculation of the effective

yield. The Company recalculates the effective yield as differences

between anticipated and actual prepayments occur. Using third-party

model and market information to project future cash flows and

expected remaining lives of securities, the effective interest rate

determined for each security is applied as if it had been in place

from the date of the security’s acquisition. The amortized cost of

the security is then adjusted to the amount that would have existed

had the new effective yield been applied since the acquisition

date. The adjustment to amortized cost is offset with a charge or

credit to interest income. Changes in interest rates and other

market factors will impact prepayment speed projections and the

amount of premium amortization recognized in any given period.

The Company’s GAAP metrics include the unadjusted impact of

amortization and accretion associated with this method. Certain of

the Company’s non-GAAP metrics exclude the effect of the PAA, which

quantifies the component of premium amortization representing the

cumulative impact on prior periods, but not the current period, of

quarter-over-quarter changes in estimated long-term CPR.

The following table illustrates the impact of the PAA on premium

amortization expense for the Company’s Residential Securities

portfolio and residential securities transferred or pledged to

securitization vehicles, for the quarters ended June 30, 2023,

March 31, 2023 and June 30, 2022:

For the quarters ended

June 30, 2023

March 31, 2023

June 30, 2022

(dollars in thousands)

Premium amortization expense

(accretion)

$

33,105

$

56,534

$

(4,869

)

Less: PAA cost (benefit)

(11,923

)

491

(127,521

)

Premium amortization expense (excluding

PAA)

$

45,028

$

56,043

$

122,652

Economic leverage and economic capital ratios

The Company uses capital coupled with borrowed funds to invest

primarily in real estate related investments, earning the spread

between the yield on its assets and the cost of its borrowings and

hedging activities. The Company’s capital structure is designed to

offer an efficient complement of funding sources to generate

positive risk-adjusted returns for its stockholders while

maintaining appropriate liquidity to support its business and meet

the Company’s financial obligations under periods of market stress.

To maintain its desired capital profile, the Company utilizes a mix

of debt and equity funding. Debt funding may include the use of

repurchase agreements, loans, securitizations, participations

issued, lines of credit, asset backed lending facilities, corporate

bond issuance, convertible bonds or other liabilities. Equity

capital primarily consists of common and preferred stock.

The Company’s economic leverage ratio is computed as the sum of

recourse debt, cost basis of TBA and CMBX derivatives outstanding,

and net forward purchases (sales) of investments divided by total

equity. Recourse debt consists of repurchase agreements and other

secured financing. Debt issued by securitization vehicles and

participations issued are non-recourse to the Company and are

excluded from economic leverage.

The following table presents a reconciliation of GAAP debt to

economic debt for purposes of calculating the Company’s economic

leverage ratio for the periods presented:

As of

June 30, 2023

March 31, 2023

June 30, 2022

Economic leverage ratio

reconciliation

(dollars in thousands)

Repurchase agreements

$

61,637,600

$

60,993,018

$

51,364,097

Other secured financing

500,000

250,000

—

Debt issued by securitization vehicles

9,789,282

8,805,911

7,502,483

Participations issued

492,307

673,431

696,944

Total GAAP debt

$

72,419,189

$

70,722,360

$

59,563,524

Less Non-Recourse Debt:

Debt issued by securitization vehicles

$

(9,789,282

)

$

(8,805,911

)

$

(7,502,483

)

Participations issued

(492,307

)

(673,431

)

(696,944

)

Total recourse debt

$

62,137,600

$

61,243,018

$

51,364,097

Plus / (Less):

Cost basis of TBA and CMBX derivatives

$

3,625,443

$

12,241,647

$

19,723,326

Payable for unsettled trades

4,331,315

3,259,034

1,995,960

Receivable for unsettled trades

(787,442

)

(679,096

)

(434,227

)

Economic debt *

$

69,306,916

$

76,064,603

$

72,649,156

Total equity

$

11,887,345

$

11,909,033

$

11,089,900

Economic leverage ratio *

5.8:1

6.4:1

6.6:1

* Represents a non-GAAP financial

measure.

The following table presents a reconciliation of GAAP total

assets to economic total assets for purposes of calculating the

Company’s economic capital ratio for the periods presented:

As of

June 30, 2023

March 31, 2023

June 30, 2022

Economic capital ratio

reconciliation

(dollars in thousands)

Total GAAP assets

$

89,330,477

$

86,832,017

$

73,637,249

Less:

Gross unrealized gains on TBA derivatives

(1)

(21,460

)

(167,065

)

(60,661

)

Debt issued by securitization vehicles

(9,789,282

)

(8,805,911

)

(7,502,483

)

Plus:

Implied market value of TBA

derivatives

3,627,716

12,020,810

19,282,979

Total economic assets *

$

83,147,451

$

89,879,851

$

85,357,084

Total equity

$

11,887,345

$

11,909,033

$

11,089,900

Economic capital ratio *

14.3

%

13.2

%

13.0

%

* Represents a non-GAAP financial

measure.

(1) Included in Derivative assets in the

Company’s Consolidated Statements of Financial Condition.

Interest income (excluding PAA), economic interest expense

and economic net interest income (excluding PAA)

Interest income (excluding PAA) represents interest income

excluding the effect of the PAA, and serves as the basis for

deriving average yield on interest earning assets (excluding PAA),

net interest spread (excluding PAA) and net interest margin

(excluding PAA), which are discussed below. The Company believes

this measure provides management and investors with additional

detail to enhance their understanding of the Company’s operating

results and trends by excluding the component of premium

amortization expense representing the cumulative impact on prior

periods, but not the current period, of quarter-over-quarter

changes in estimated long-term prepayment speeds related to the

Company’s Agency mortgage-backed securities (other than

interest-only securities, multifamily and reverse mortgages), which

can obscure underlying trends in the performance of the

portfolio.

Economic interest expense includes GAAP interest expense and the

net interest component of interest rate swaps. The Company uses

interest rate swaps to manage its exposure to changing interest

rates on its repurchase agreements by economically hedging cash

flows associated with these borrowings. Accordingly, adding the net

interest component of interest rate swaps to interest expense, as

computed in accordance with GAAP, reflects the total contractual

interest expense and thus, provides investors with additional

information about the cost of the Company's financing strategy. The

Company may use market agreed coupon ("MAC") interest rate swaps in

which the Company may receive or make a payment at the time of

entering into such interest rate swap to compensate for the

off-market nature of such interest rate swap. In accordance with

GAAP, upfront payments associated with MAC interest rate swaps are

not reflected in the net interest component of interest rate swaps

in the Company's Consolidated Statements of Comprehensive Income

(Loss).

Similarly, economic net interest income (excluding PAA), as

computed below, provides investors with additional information to

enhance their understanding of the net economics of our primary

business operations.

For the quarters ended

June 30, 2023

March 31, 2023

June 30, 2022

Interest income (excluding PAA)

reconciliation

(dollars in thousands)

GAAP interest income

$

921,494

$

818,250

$

645,615

Premium amortization adjustment

(11,923

)

491

(127,521

)

Interest income (excluding PAA)

*

$

909,571

$

818,741

$

518,094

Economic interest expense

reconciliation

GAAP interest expense

$

953,457

$

798,787

$

170,475

Add:

Net interest component of interest rate

swaps

(425,293

)

(385,706

)

(992

)

Economic interest expense *

$

528,164

$

413,081

$

169,483

Economic net interest income (excluding

PAA) reconciliation

Interest income (excluding PAA) *

$

909,571

$

818,741

$

518,094

Less:

Economic interest expense *

528,164

413,081

169,483

Economic net interest income (excluding

PAA) *

$

381,407

$

405,660

$

348,611

* Represents a non-GAAP financial

measure.

Average yield on interest earning assets (excluding PAA), net

interest spread (excluding PAA), net interest margin (excluding

PAA) and average economic cost of interest bearing

liabilities

Net interest spread (excluding PAA), which is the difference

between the average yield on interest earning assets (excluding

PAA) and the average economic cost of interest bearing liabilities,

which represents annualized economic interest expense divided by

average interest bearing liabilities, and net interest margin

(excluding PAA), which is calculated as the sum of interest income

(excluding PAA) plus TBA dollar roll income and CMBX coupon income

less interest expense and the net interest component of interest

rate swaps divided by the sum of average interest earning assets

plus average TBA contract and CMBX balances, provide management

with additional measures of the Company’s profitability that

management relies upon in monitoring the performance of the

business.

Disclosure of these measures, which are presented below,

provides investors with additional detail regarding how management

evaluates the Company’s performance.

For the quarters ended

June 30, 2023

March 31, 2023

June 30, 2022

Economic metrics (excluding

PAA)

(dollars in thousands)

Average interest earning assets

$

86,254,955

$

82,644,998

$

72,123,055

Interest income (excluding PAA) *

$

909,571

$

818,741

$

518,094

Average yield on interest earning assets

(excluding PAA) *

4.22

%

3.96

%

2.87

%

Average interest bearing liabilities

$

75,424,564

$

70,635,632

$

60,446,528

Economic interest expense *

$

528,164

$

413,081

$

169,483

Average economic cost of interest bearing

liabilities *

2.77

%

2.34

%

1.11

%

Economic net interest income (excluding

PAA) *

$

381,407

$

405,660

$

348,611

Net interest spread (excluding PAA) *

1.45

%

1.62

%

1.76

%

Interest income (excluding PAA) *

$

909,571

$

818,741

$

518,094

TBA dollar roll income and CMBX coupon

income

1,734

18,183

161,673

Economic interest expense *

(528,164

)

(413,081

)

(169,483

)

Subtotal

$

383,141

$

423,843

$

510,284

Average interest earnings assets

$

86,254,955

$

82,644,998

$

72,123,055

Average TBA contract and CMBX balances

6,303,202

13,949,884

20,566,553

Subtotal

$

92,558,157

$

96,594,882

$

92,689,608

Net interest margin (excluding PAA)

*

1.66

%

1.76

%

2.20

%

* Represents a non-GAAP financial

measure.

View source

version on businesswire.com: https://www.businesswire.com/news/home/20230725353309/en/

Annaly Capital Management, Inc. Investor Relations 1-888-8Annaly

www.annaly.com

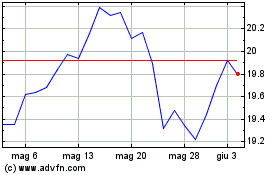

Grafico Azioni Annaly Capital Management (NYSE:NLY)

Storico

Da Gen 2025 a Feb 2025

Grafico Azioni Annaly Capital Management (NYSE:NLY)

Storico

Da Feb 2024 a Feb 2025