- Regular Monthly Tax-Exempt and Taxable Fund Distributions

- Eight Funds Declare Monthly Level Distributions

- Three Funds Declare Monthly Managed Distributions

- Seven Funds Declare Quarterly Managed Distributions

As previously announced, the Board of Trustees of Nuveen

Intermediate Duration Municipal Term Fund (NYSE: NID) has approved

the liquidation of the fund upon the fund’s originally scheduled

termination date. NID intends to liquidate on or before March 31,

2023. The fund will not declare its regular monthly income

distribution in March 2023 and expects to include any remaining

undistributed net investment income with the fund’s final

liquidating distribution. The fund anticipates making its final

liquidating distribution on or about March 31, 2023. In connection

with the liquidation, the fund anticipates providing an estimate of

the amount of tax-exempt income included as part of the fund’s

liquidating distribution. The final tax character of all

distributions paid in 2023 will be reported to shareholders on Form

1099-DIV, which will be sent out in early 2024. Nuveen does not

provide tax advice; investors should consult a professional tax

advisor regarding their specific tax situation.

Several Nuveen closed-end funds have declared distributions.

These funds represent investment strategies for investors seeking

diversified sources of cash flow to prepare for and sustain their

retirement income needs. For further information regarding fund

distributions, including earnings, undistributed net investment

income, and notices, please visit www.nuveen.com/cef.

Shareholders can expect regular distribution information to be

posted on www.nuveen.com on the first business day of each month.

To ensure that our shareholders have access to the latest

information, timely distribution and fund updates can be subscribed

to at www.nuveen.com/subscriptions, under the closed-end funds tab

of the Product Documents section. You can also follow updates by

navigating to the Closed-End Fund section of our Resource Center,

located at www.nuveen.com/resource-center.

The following dates apply to today's monthly distribution

declarations for the following tax-exempt and taxable closed-end

funds:

Record Date

March 15, 2023

Ex-Dividend Date

March 14, 2023

Payable Date

April 3, 2023

Monthly Distribution Per

Share

Change From

Ticker

Exchange

Fund

Name

Amount

Previous Month

NXP

NYSE

Nuveen Select Tax-Free Income

Portfolio

$0.0485

-

NUV

NYSE

Nuveen Municipal Value Fund, Inc.

$0.0280

-

NUW

NYSE

Nuveen AMT-Free Municipal Value Fund

$0.0390

-

NMI

NYSE

Nuveen Municipal Income Fund, Inc.

$0.0300

-

NIM

NYSE

Nuveen Select Maturities Municipal

Fund

$0.0245

-

NZF

NYSE

Nuveen Municipal Credit Income Fund

$0.0430

-

NMZ

NYSE

Nuveen Municipal High Income Opportunity

Fund

$0.0455

-

NIQ

NYSE

Nuveen Intermediate Duration Quality

Municipal Term Fund

$0.0295

-

NAD

NYSE

Nuveen Quality Municipal Income Fund

$0.0395

-

NEA

NYSE

Nuveen AMT-Free Quality Municipal Income

Fund

$0.0350

-

NVG

NYSE

Nuveen AMT-Free Municipal Credit Income

Fund

$0.0425

-

NMCO

NYSE

Nuveen Municipal Credit Opportunities

Fund

$0.0525

-

California

NAC

NYSE

Nuveen California Quality Municipal Income

Fund

$0.0360

-

NKX

NYSE

Nuveen California AMT-Free Quality

Municipal Income Fund

$0.0415

-

NCA

NYSE

Nuveen California Municipal Value Fund

$0.0290

-

NXC

NYSE

Nuveen California Select Tax-Free Income

Portfolio

$0.0435

-

New

York

NRK

NYSE

Nuveen New York AMT-Free Quality Municipal

Income Fund

$0.0345

-

NAN

NYSE

Nuveen New York Quality Municipal Income

Fund

$0.0375

-

NXN

NYSE

Nuveen New York Select Tax-Free Income

Portfolio

$0.0385

-

NNY

NYSE

Nuveen New York Municipal Value Fund

$0.0260

-

Other State

Funds

NAZ

NYSE

Nuveen Arizona Quality Municipal Income

Fund

$0.0325

-

NKG

NYSE

Nuveen Georgia Quality Municipal Income

Fund

$0.0270

-

NMT

NYSE

Nuveen Massachusetts Quality Municipal

Income Fund

$0.0260

-

NMS

NYSE

Nuveen Minnesota Quality Municipal Income

Fund

$0.0360

-

NOM

NYSE

Nuveen Missouri Quality Municipal Income

Fund

$0.0255

-

NXJ

NYSE

Nuveen New Jersey Quality Municipal Income

Fund

$0.0325

-

NUO

NYSE

Nuveen Ohio Quality Municipal Income

Fund

$0.0275

-

NQP

NYSE

Nuveen Pennsylvania Quality Municipal

Income Fund

$0.0290

-

NPV

NYSE

Nuveen Virginia Quality Municipal Income

Fund

$0.0360

-

Monthly Distribution Per

Share

Change From

Ticker

Exchange

Fund

Name

Amount

Previous Month

Preferred and

Income Securities

JPC

NYSE

Nuveen Preferred & Income

Opportunities Fund

$0.0470

-

JPI

NYSE

Nuveen Preferred and Income Term Fund

$0.1150

-

JPS

NYSE

Nuveen Preferred & Income Securities

Fund

$0.0405

-

JPT

NYSE

Nuveen Preferred and Income Fund

$0.1070

-

NPFD

NYSE

Nuveen Variable Rate Preferred &

Income Fund

$0.0960

-

Taxable

Municipals

NBB

NYSE

Nuveen Taxable Municipal Income Fund

$0.0720

-

Corporate High

Yield Debt

JHAA

NYSE

Nuveen Corporate Income 2023 Target Term

Fund

$0.0185

-$0.0065

Monthly Level Distributions

The goal of each fund’s level distribution program is to provide

shareholders with stable, but not guaranteed, cash flow,

independent of the amount or timing of income earned or capital

gains realized by the funds. Each fund intends to distribute all or

substantially all of its net investment income through its regular

monthly distribution and to distribute realized capital gains at

least annually. In any monthly period, in order to maintain its

level distribution amount, each fund may pay out more or less than

its net investment income during the period. As a result, regular

distributions throughout the year are expected to include net

investment income and potentially a return of capital and/or

capital gains for tax purposes. If a distribution includes anything

other than net investment income, the fund provides a notice of the

best estimate of its distribution sources at the time of the

distribution which may be viewed at

www.nuveen.com/CEFdistributions. These estimates may not match the

final tax characterization (for the full year’s distributions)

contained in shareholders’ 1099-DIV forms after the end of the

year.

You should not draw any conclusions about the Fund’s investment

performance from the amount of the distribution. A return of

capital is a non-taxable distribution of a portion of a Fund’s

capital. A distribution including return of capital does not

necessarily reflect a Fund’s investment performance and should not

be confused with “yield” or “income.”

Record Date

March 15, 2023

Ex-Dividend Date

March 14, 2023

Payable Date

April 3, 2023

Monthly Distribution Per

Share

Change From

Ticker

Exchange

Fund

Name

Amount

Previous Month

Floating

Rate

NSL

NYSE

Nuveen Senior Income Fund

$0.0435

-

JFR

NYSE

Nuveen Floating Rate Income Fund

$0.0745

-

JRO

NYSE

Nuveen Floating Rate Income Opportunity

Fund

$0.0740

-

JSD

NYSE

Nuveen Short Duration Credit Opportunities

Fund

$0.1110

-

JQC

NYSE

Nuveen Credit Strategies Income Fund

$0.0475

-

Mortgage-Backed

Securities

JMM

NYSE

Nuveen Multi-Market Income Fund

$0.0275

-

JLS

NYSE

Nuveen Mortgage and Income Fund

$0.1160

-

Global High Yield

Debt

JGH

NYSE

Nuveen Global High Income Fund

$0.1035

-

Monthly Managed Distributions

The goal of each fund’s managed distribution program is to

provide shareholders relatively consistent and predictable cash

flow by systematically converting expected long-term return

potential into regular distributions. Historical distribution

sources have included net investment income, realized gains and

return of capital. If a distribution includes anything other than

net investment income, the fund provides a notice of the best

estimate of its distribution sources at that time which may be

viewed at www.nuveen.com/CEFdistributions. These estimates may not

match the final tax characterization contained in shareholders’

1099-DIV forms after the end of the year.

Under a Managed Distribution policy, Nuveen closed-end funds

seek to maintain a stable regular distribution amount that, over

the long term, matches the fund’s total distributions paid to its

total return. Investors should not draw any conclusions about a

fund’s past or future investment performance from its current

distribution rate or from the terms of its Managed Distribution

Policy.

- Actual returns likely will differ from projected long-term

returns, (and therefore a fund’s distribution rate, also), at least

over shorter time periods. Over a specific timeframe, a fund’s net

asset value will increase (if returns exceed distributions), or

decrease (if distributions exceed returns), by the difference

between actual returns and total distributions.

- A return of capital is a non-taxable distribution of a portion

of the fund’s capital. When a fund’s returns exceed distributions,

return of capital may represent portfolio gains earned, but not

realized as a taxable capital gain. In periods when a fund’s

returns fall short of distributions, it will represent a portion of

the investors’ original principal unless the shortfall is offset

during other time periods over the life of the investment (previous

or subsequent) when the fund’s total return exceeds

distributions.

- For additional information about managed distributions, please

see Understanding Managed Distributions.

The following dates apply to today's declarations:

Record Date

March 15, 2023

Ex-Dividend Date

March 14, 2023

Payable Date

April 3, 2023

Monthly Distribution Per

Share

Change From

Ticker

Exchange

Fund

Name

Amount

Previous Month

Real

Assets

JRI

NYSE

Nuveen Real Asset Income and Growth

Fund

$0.0870

-$0.0095

National

Municipal

NDMO

NYSE

Nuveen Dynamic Municipal Opportunities

Fund

$0.0620

-$0.0145

Taxable Fixed

Income-Multi-Sector

NPCT

NYSE

Nuveen Core Plus Impact Fund

$0.0830

-$0.0200

Information regarding each fund’s last 19(a) Distribution Notice

(as of January 31, 2023) is also included below. This informational

notice provides further details on the sources of fund

distributions. The full text of this notice is also available on

the Nuveen website via Distribution Source Estimates.

The following tables provide estimates of each fund’s

distribution sources, reflecting year-to-date cumulative experience

through the month-end prior to the latest distribution. The funds

attribute these estimates equally to each regular distribution

throughout the year. Consequently, the estimated information as of

the specified month-end shown below is for the current

distribution, and also represents an updated estimate for all prior

months in the year. For all funds, it is estimated that the funds

have distributed more than their income and net realized capital

gains; therefore, a portion of their distributions may be (and is

shown below as being estimated to be) a return of capital. A return

of capital may occur, for example, when some or all of the money

that you invested in the Fund is paid back to you. A return of

capital distribution does not necessarily reflect the Fund’s

investment performance and should not be confused with “yield” or

“income.”

The amounts and sources of distributions reported in this

19(a) Notice are only estimates and are not being provided for tax

reporting purposes. The actual amounts and sources of the amounts

for tax reporting purposes will depend upon each Fund’s investment

experience during the remainder of the fiscal year and may be

subject to changes based on tax regulations. Each Fund will send

you a Form 1099-DIV for the calendar year that will tell you how to

report distributions for federal income tax purposes. More details

about each Fund’s distributions and the basis for these estimates

are available on www.nuveen.com/cef.

Data as of 1/31/2023

Current Month

Fiscal YTD

Estimated Sources of

Distribution

Estimated Sources of

Distribution

Estimated Percentages of

Distribution 1

Per Share

LT

ST

Return of

Per Share

LT

ST

Return of

LT

ST

Return of

Distribution

NII

Gains

Gains

Capital

Distribution

NII

Gains

Gains

Capital

NII

Gains

Gains

Capital

NDMO (FYE 10/31)

.0765

0.0370

0.0000

0.0000

0.0395

0.2295

0.1110

0.0000

0.0000

0.1185

48.4%

0.0%

0.0%

51.6%

JRI (FYE 12/31)

.0965

0.0266

0.0000

0.0000

0.0699

0.0965

0.0266

0.0000

0.0000

0.0699

27.6%

0.0%

0.0%

72.4%

NPCT (FYE 12/31)

.1030

0.0387

0.0000

0.0000

0.0643

0.1030

0.0387

0.0000

0.0000

0.0643

37.6%

0.0%

0.0%

62.4%

1 Net investment income (NII) and capital

gain amounts are as of the stated month-end date above.

The following tables provides information regarding each fund’s

distributions and total return performance over various time

periods. This information is intended to help you better understand

whether returns for the specified time periods were sufficient to

meet distributions.

Data as of 1/31/2023

Annualized

Cumulative

Inception Date

Monthly

Distribution

Fiscal YTD

Distribution

NAV

5-Year Return on

NAV2

Fiscal YTD Distribution

Rate on NAV1

Fiscal YTD Return on

NAV

Fiscal YTD Distribution

Rate on NAV1

NDMO (FYE 10/31)

Aug-2020

.0765

.2295

11.33

-5.05%

8.10%

11.75%

2.03%

JRI (FYE 12/31)

Apr-2012

.0965

.0965

14.63

1.56%

7.92%

8.52%

0.66%

NPCT (FYE 12/31)

Apr-2021

.1030

.1030

13.21

-14.85%

9.36%

8.50%

0.78%

1As a percentage of 1/31/2023 NAV.

2 NPCT and NDMO 5 year return figure

reflects the annualized since inception return on NAV

Quarterly Managed Distributions

The goal of each fund’s managed distribution program is to

provide shareholders relatively consistent and predictable cash

flow by systematically converting expected long-term return

potential into regular distributions. Historical distribution

sources have included net investment income, realized gains and

return of capital. If a distribution includes anything other than

net investment income, the fund provides a notice of the best

estimate of its distribution sources at that time which may be

viewed at www.nuveen.com/CEFdistributions. These estimates may not

match the final tax characterization contained in shareholders’

1099-DIV forms after the end of the year.

Under a Managed Distribution policy, Nuveen closed-end funds

seek to maintain a stable regular distribution amount that, over

the long term, matches the fund’s total distributions paid to its

total return. Investors should not draw any conclusions about a

fund’s past or future investment performance from its current

distribution rate or from the terms of its Managed Distribution

Policy.

- Actual returns likely will differ from projected long-term

returns, (and therefore a fund’s distribution rate, also), at least

over shorter time periods. Over a specific timeframe, a fund’s net

asset value will increase (if returns exceed distributions), or

decrease (if distributions exceed returns), by the difference

between actual returns and total distributions.

- A return of capital is a non-taxable distribution of a portion

of the fund’s capital. When a fund’s returns exceed distributions,

return of capital may represent portfolio gains earned, but not

realized as a taxable capital gain. In periods when a fund’s

returns fall short of distributions, it will represent a portion of

the investors’ original principal unless the shortfall is offset

during other time periods over the life of the investment (previous

or subsequent) when the fund’s total return exceeds

distributions.

- For additional information about managed distributions, please

see Understanding Managed Distributions.

The following dates apply to today's declarations:

Record Date

March 15, 2023

Ex-Dividend Date

March 14, 2023

Payable Date

April 3, 2023

Quarterly Distribution Per

Share

Change From

Ticker

Exchange

Fund

Name

Amount

Previous Quarter

Domestic

Equity

JCE

NYSE

Nuveen Core Equity Alpha Fund

$0.3200

-$0.0752

Covered

Call

DIAX

NYSE

Nuveen Dow 30SM Dynamic Overwrite Fund

$0.2867

-

BXMX

NYSE

Nuveen S&P 500 Buy-Write Income

Fund

$0.2365

-

QQQX

NASDAQ

Nuveen NASDAQ 100 Dynamic Overwrite

Fund

$0.4200

-$0.0734

SPXX

NYSE

Nuveen S&P 500 Dynamic Overwrite

Fund

$0.2940

-

Real

Assets

JRS

NYSE

Nuveen Real Estate Income Fund

$0.1700

-$0.0390

Multi-Asset

NMAI

NYSE

Nuveen Multi-Asset Income Fund

$0.3000

-$0.0500

Information regarding each fund’s last 19(a) Distribution Notice

(as of November 30, 2022) is also included below. This

informational notice provides further details on the sources of

fund distributions. The full text of this notice is also available

on the Nuveen website via Distribution Source Estimates.

The following table provides estimates of the Funds’

distribution sources, reflecting year-to-date cumulative experience

through the month-end prior to the latest distribution. The Funds

attribute these estimates equally to each regular distribution

throughout the year. Consequently, the estimated information as of

the specified month-end shown below is for the current

distribution, and also represents an updated estimate for all prior

months in the year. It is estimated that JRS, QQQX, SPX, DIAX, JCE

and NMAI have distributed more than their income and net realized

capital gains; therefore, a portion of the distributions may be

(and is shown below as being estimated to be) a return of capital.

A return of capital may occur, for example, when some or all of the

money that you invested in the Fund is paid back to you. A return

of capital distribution does not necessarily reflect the Fund’s

investment performance and should not be confused with “yield” or

“income.”

The amounts and sources of distributions reported in this

19(a) Notice are only estimates and are not being provided for tax

reporting purposes. The actual amounts and sources of the amounts

for tax reporting purposes will depend upon each Fund’s investment

experience during the remainder of the fiscal year and may be

subject to changes based on tax regulations. Each Fund will send

you a Form 1099-DIV for the calendar year that will tell you how to

report distributions for federal income tax purposes. More details

about each Fund’s distributions and the basis for these estimates

are available on www.nuveen.com/cef.

Data as of 11/30/2022

Current Quarter

Fiscal YTD

Estimated Percentages

Estimated Sources of

Distribution

Estimated Sources of

Distribution

of Distribution 1

Per Share

LT

ST

Return of

Per Share

LT

ST

Return of

LT

ST

Return of

Distribution

NII

Gains

Gains

Capital

Distribution

NII

Gains

Gains

Capital

NII

Gains

Gains

Capital

JRS (FYE 12/31)

.2090

0.0370

0.0000

0.0753

0.0967

0.8360

0.1479

0.0000

0.3014

0.3867

17.7%

0.0%

36.0%

46.3%

QQQX (FYE 12/31)

.4934

0.0029

0.1721

0.2932

0.0252

1.9736

0.0116

0.6883

1.1728

0.1009

0.6%

34.9%

59.4%

5.1%

SPXX (FYE 12/31)

.2940

0.0316

0.2407

0.0000

0.0217

1.1760

0.1263

0.9629

0.0000

0.0868

10.7%

81.9%

0.0%

7.4%

BXMX (FYE 12/31)

.2365

0.0239

0.0224

0.1902

0.0000

0.9460

0.0956

0.0897

0.7608

0.0000

10.1%

9.5%

80.4%

0.0%

DIAX (FYE 12/31)

.2867

0.0537

0.0405

0.0752

0.1173

1.1468

0.2148

0.1619

0.3008

0.4693

18.7%

14.1%

26.2%

40.9%

JCE (FYE 12/31)

.3952

0.0235

0.0000

0.2963

0.0753

1.5808

0.0942

0.0000

1.1854

0.3013

6.0%

0.0%

75.0%

19.1%

NMAI (FYE 12/31)

.3500

0.1218

0.0202

0.0000

0.2080

1.4000

0.4872

0.0806

0.0000

0.8321

34.8%

5.8%

0.0%

59.4%

1 Net investment income (NII) is a

projection through the end of the current calendar quarter using

actual data through the stated month-end date above. Capital gain

amounts are as of the stated date above. JRS owns REIT securities

which attribute their distributions to various sources including

NII, gains, and return of capital. The estimated per share sources

above include an allocation of the NII based on prior year

attributions which can be expected to differ from the actual final

attributions for the current year.

The following table provides information regarding distributions

and total return performance over various time periods. This

information is intended to help you better understand whether

returns for the specified time periods were sufficient to meet

distributions.

Data as of 11/30/2022

Annualized

Cumulative

Inception Date

Quarterly

Distribution

Fiscal

YTD

Distribution

NAV

5-Year

Return on NAV2

Fiscal YTD

Distribution Rate on

NAV1

Fiscal YTD

Return on NAV

Fiscal YTD

Distribution Rate on

NAV1

JRS (FYE 12/31)

Nov-2001

.2090

.8360

8.85

2.43%

9.45%

-28.74%

9.45%

QQQX (FYE 12/31)

Jan-2007

.4934

1.9736

21.46

5.75%

9.20%

-22.80%

9.20%

SPXX (FYE 12/31)

Nov-2005

.2940

1.1760

15.63

5.69%

7.52%

-11.68%

7.52%

BXMX (FYE 12/31)

Oct-2004

.2365

.9460

13.19

5.01%

7.17%

-8.99%

7.17%

DIAX (FYE 12/31)

Apr-2005

.2867

1.1468

16.80

4.33%

6.83%

-2.04%

6.83%

JCE (FYE 12/31)

Mar-2007

.3952

1.5808

13.05

6.93%

12.11%

-13.21%

12.11%

NMAI (FYE 12/31)

Nov-2021

.3500

1.4000

14.22

-17.38%

9.85%

-19.30%

9.85%

1As a percentage of 11/30/2022 NAV.

2 NMAI 5 year return figure reflects the

annualized since inception return on NAV

Nuveen is a leading sponsor of closed-end funds (CEFs) with $54

billion of assets under management across 55 CEFs as of 31 Dec

2022. The funds offer exposure to a broad range of asset classes

and are designed for income-focused investors seeking regular

distributions. Nuveen has more than 35 years of experience managing

CEFs. For more information, please visit Nuveen’s CEF homepage

www.nuveen.com/closed-end-funds or contact:

About Nuveen

Nuveen, the investment manager of TIAA, offers a comprehensive

range of outcome-focused investment solutions designed to secure

the long-term financial goals of institutional and individual

investors. Nuveen has $1.1 trillion in assets under management as

of 31 Dec 2022 and operations in 27 countries. Its investment

specialists offer deep expertise across a comprehensive range of

traditional and alternative investments through a wide array of

vehicles and customized strategies. For more information, please

visit www.nuveen.com.

Nuveen Securities, LLC, member FINRA and SIPC.

The information contained on the Nuveen website is not a part of

this press release.

EPS-2762984PR-E0323W

View source

version on businesswire.com: https://www.businesswire.com/news/home/20230301006003/en/

Financial Professionals: 800-752-8700

Investors: 800-257-8787

Media: media-inquiries@nuveen.com

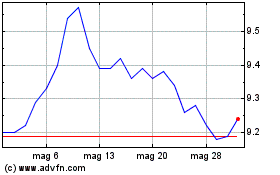

Grafico Azioni Nuveen Muni Income (NYSE:NMI)

Storico

Da Ott 2024 a Nov 2024

Grafico Azioni Nuveen Muni Income (NYSE:NMI)

Storico

Da Nov 2023 a Nov 2024