- Fourth-quarter revenue of $9.28 billion increased 1%

sequentially and 3% year on year

- Fourth-quarter GAAP EPS of $0.77 decreased 7% sequentially but

was flat year on year

- Fourth-quarter EPS, excluding charges and credits, of $0.92

increased 3% sequentially and 7% year on year

- Fourth-quarter net income attributable to SLB of $1.10 billion

decreased 8% sequentially and 2% year on year

- Fourth-quarter adjusted EBITDA of $2.38 billion increased 2%

sequentially and 5% year on year

- Fourth-quarter cash flow from operations was $2.39 billion and

free cash flow was $1.63 billion

- Board approved a 3.6% increase in quarterly cash dividend to

$0.285 per share

- Full-year revenue of $36.29 billion increased 10% year on

year

- Full-year GAAP EPS of $3.11 increased 7% year on year

- Full-year EPS, excluding charges and credits, of $3.41

increased 14% year on year

- Full-year net income attributable to SLB of $4.46 billion

increased 6% year on year

- Full-year adjusted EBITDA of $9.07 billion increased 12% year

on year

- Full-year cash flow from operations was $6.60 billion and free

cash flow was $3.99 billion

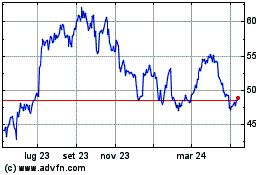

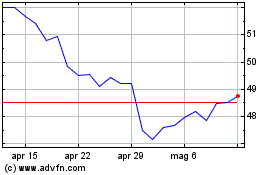

SLB (NYSE: SLB) today announced results for the fourth-quarter

and full-year 2024.

This press release features multimedia. View

the full release here:

https://www.businesswire.com/news/home/20250115789214/en/

The exterior of the SLB headquarters in

Houston, Texas. (Photo: Business Wire)

Fourth-Quarter Results

(Stated in millions, except per share amounts)

Three Months

Ended Change Dec. 31,2024 Sept. 30,2024 Dec.

31,2023

Sequential Year-on-year Revenue

$9,284

$9,158

$8,990

1%

3%

Income before taxes - GAAP basis

$1,387

$1,507

$1,433

-8%

-3%

Income before taxes margin - GAAP basis

14.9%

16.5%

15.9%

-151 bps

-100 bps

Net income attributable to SLB - GAAP basis

$1,095

$1,186

$1,113

-8%

-2%

$0.77

$0.83

$0.77

-7%

-

Adjusted EBITDA*

$2,382

$2,343

$2,277

2%

5%

Adjusted EBITDA margin*

25.7%

25.6%

25.3%

8 bps

33 bps

Pretax segment operating income*

$1,918

$1,902

$1,868

1%

3%

Pretax segment operating margin*

20.7%

20.8%

20.8%

-11 bps

-12 bps

Net income attributable to SLB, excluding charges & credits*

$1,311

$1,271

$1,242

3%

6%

Diluted EPS, excluding charges & credits*

$0.92

$0.89

$0.86

3%

7%

Revenue by Geography

International

$7,483

$7,425

$7,293

1%

3%

North America

1,752

1,687

1,641

4%

7%

Other

49

47

56

n/m

n/m

$9,284

$9,159

$8,990

1%

3%

(Stated in millions)

Three Months Ended Change

Dec. 31,2024 Sept. 30,2024 Dec. 31,2023

Sequential

Year-on-year

Revenue by Division Digital & Integration

$1,156

$1,088

$1,049

6%

10%

Reservoir Performance

1,810

1,823

1,735

-1%

4%

Well Construction

3,267

3,312

3,426

-1%

-5%

Production Systems

3,197

3,103

2,944

3%

9%

Other

(146)

(167)

(164)

n/m

n/m

$9,284

$9,158

$8,990

1%

3%

Pretax Operating Income by Division

Digital & Integration

$442

$386

$356

14%

24%

Reservoir Performance

370

367

371

1%

-

Well Construction

681

714

770

-5%

-12%

Production Systems

506

519

442

-3%

14%

Other

(81)

(84)

(71)

n/m

n/m

$1,918

$1,902

$1,868

1%

3%

Pretax Operating Margin by Division

Digital & Integration

38.3%

35.5%

34.0%

274 bps

430 bps

Reservoir Performance

20.5%

20.1%

21.4%

35 bps

-90 bps

Well Construction

20.8%

21.5%

22.5%

-70 bps

-162 bps

Production Systems

15.8%

16.7%

15.0%

-93 bps

79 bps

Other

n/m

n/m

n/m

n/m

n/m

20.7%

20.8%

20.8%

-11 bps

-12 bps

*These are non-GAAP financial measures. See sections titled

"Charges & Credits", "Divisions" and "Supplementary

Information" for details. n/m = not meaningful

Full-Year Results

(Stated in millions, except per share amounts)

Twelve Months

Ended Dec. 31, 2024 Dec. 31, 2023

Change Revenue

$36,289

$33,135

10%

Income before taxes - GAAP basis

$5,672

$5,282

7%

Income before taxes margin - GAAP basis

15.6%

15.9%

-31 bps

Net income attributable to SLB - GAAP basis

$4,461

$4,203

6%

Diluted EPS - GAAP basis

$3.11

$2.91

7%

Adjusted EBITDA*

$9,070

$8,107

12%

Adjusted EBITDA margin*

25.0%

24.5%

52 bps

Pretax segment operating income*

$7,321

$6,523

12%

Pretax segment operating margin*

20.2%

19.7%

49 bps

Net income attributable to SLB, excluding charges & credits*

$4,888

$4,305

14%

Diluted EPS, excluding charges & credits*

$3.41

$2.98

14%

Revenue by Geography

International

$29,415

$26,188

12%

North America

6,680

6,727

-1%

Other

194

220

n/m

$36,289

$33,135

10%

SLB acquired the Aker subsea business during the fourth quarter of

2023 in connection with the formation of the OneSubsea™ joint

venture. The acquired business generated revenue of $1.93 billion

during the full year of 2024 and $484 million during the fourth

quarter of 2023. Excluding the impact of this acquisition, SLB's

full-year 2024 revenue increased 5% year on year; North America

full-year 2024 revenue decreased 1% year on year; and international

full-year 2024 revenue increased 7% year on year. *These are

non-GAAP financial measures. See sections titled "Charges &

Credits", "Divisions", and "Supplementary Information" for details.

n/m = not meaningful (Stated in millions)

Twelve Months

Ended Dec. 31, 2024 Dec. 31, 2023

Change

Revenue by Division Digital & Integration

$4,247

$3,871

10%

Reservoir Performance

7,177

6,561

9%

Well Construction

13,357

13,478

-1%

Production Systems

12,143

9,831

24%

Other

(635)

(606)

n/m

$36,289

$33,135

10%

Pretax Segment Operating Income

Digital & Integration

$1,408

$1,257

12%

Reservoir Performance

1,452

1,263

15%

Well Construction

2,826

2,932

-4%

Production Systems

1,898

1,245

52%

Other

(263)

(174)

n/m

$7,321

$6,523

12%

Pretax Segment Operating Margin

Digital & Integration

33.1%

32.5%

67 bps

Reservoir Performance

20.2%

19.2%

99 bps

Well Construction

21.2%

21.8%

-59 bps

Production Systems

15.6%

12.7%

297 bps

Other

n/m

n/m

n/m

20.2%

19.7%

49 bps

Adjusted EBITDA

Digital & Integration

$2,074

$1,847

12%

Reservoir Performance

1,841

1,646

12%

Well Construction

3,461

3,514

-1%

Production Systems

2,242

1,569

43%

Other

18

102

n/m

$9,636

$8,678

11%

Corporate & other

(566)

(571)

n/m

$9,070

$8,107

12%

Adjusted EBITDA Margin

Digital & Integration

48.8%

47.7%

111 bps

Reservoir Performance

25.7%

25.1%

57 bps

Well Construction

25.9%

26.1%

-16 bps

Production Systems

18.5%

16.0%

251 bps

Other

n/m

n/m

n/m

26.6%

26.2%

37 bps

Corporate & other

n/m

n/m

n/m

25.0%

24.5%

52 bps

SLB acquired the Aker subsea business during the fourth

quarter of 2023 in connection with the formation of the OneSubsea

joint venture. The acquired business generated revenue of $1.93

billion during the full year of 2024 and $484 million during the

fourth quarter of 2023. Excluding the impact of this acquisition,

SLB's full-year 2024 revenue increased 5% year on year and

Production Systems full-year 2024 revenue increased 9% year on

year. n/m = not meaningful (Stated in millions)

Twelve Months

Ended Dec. 31, 2024 Dec. 31, 2023

Change

Revenue by Geography North America

$6,680

$6,727

-1%

Latin America

6,719

6,645

1%

Europe & Africa*

9,671

8,525

13%

Middle East & Asia

13,026

11,019

18%

Other

193

219

n/m

$36,289

$33,135

10%

International

$29,415

$26,188

12%

North America

6,680

6,727

-1%

Other

194

220

n/m

$36,289

$33,135

10%

Pretax Segment Operating Income

International

$6,291

$5,486

15%

North America

1,134

1,157

-2%

Other

(104)

(120)

n/m

$7,321

$6,523

12%

Pretax Segment Operating Income Margin

International

21.4%

20.9%

44 bps

North America

17.0%

17.2%

-23 bps

Other

n/m

n/m

n/m

20.2%

19.7%

49 bps

Adjusted EBITDA

International

$7,900

$6,988

13%

North America

1,592

1,559

2%

Other

144

131

n/m

$9,636

$8,678

11%

Corporate & other

(566)

(571)

n/m

$9,070

$8,107

12%

Adjusted EBITDA Margin

International

26.9%

26.7%

17 bps

North America

23.8%

23.2%

66 bps

Other

n/m

n/m

n/m

26.6%

26.2%

37 bps

Corporate & other

n/m

n/m

n/m

25.0%

24.5%

52 bps

*Includes Russia and the Caspian region n/m = not meaningful

Consistent Fourth-Quarter and Full-Year Performance Despite

Macro Headwinds

“2024 was a strong year for SLB as we successfully navigated

evolving market conditions to deliver revenue and EBITDA growth,

margin expansion and solid free cash flow,” said SLB Chief

Executive Officer Olivier Le Peuch.

“Year on year, revenue increased by 10% and adjusted EBITDA grew

by 12%, while we generated $3.99 billion in free cash flow,

enabling us to return $3.27 billion to shareholders and reduce net

debt by $571 million. These results demonstrate SLB’s ability to

deliver consistent financial performance despite moderating

upstream investment growth, driven by our global scale, unmatched

digital offerings and ongoing focus on cost optimization.

“Our full-year results were highlighted by 12% international

revenue growth. This performance was led by the Middle East &

Asia and Europe & Africa, which grew 18% and 13%, respectively.

The Middle East & Asia achieved record revenues, while growth

in Europe & Africa was bolstered by the acquired Aker subsea

business. Excluding this acquired business, international revenue

increased 7% year over year, outperforming the rig count over the

same period.

“Sequentially, fourth-quarter revenue grew slightly, driven by

digital sales in North America and higher activity in the Middle

East, Europe and North Africa. On a divisional basis, Digital &

Integration led revenue performance, driven by increased demand for

digital products and solutions, while Production Systems benefited

from strong backlog conversion as customers continued to invest in

maximizing recovery from existing assets,” Le Peuch said.

Production and Recovery Becoming a Pathway to Long-Term

Outperformance

“On a full-year basis, our Core divisions — Reservoir

Performance, Well Construction and Production Systems — delivered

9% revenue growth, led by 24% growth in Production Systems, largely

due to the subsea acquisition. Production Systems grew 9%

organically due to double-digit increases in surface systems,

completions and artificial lift. Reservoir Performance also

delivered 9% growth, underpinned by strong stimulation and

intervention activity in the production space.

“Our fit-for-basin approach, domain expertise and integration

capabilities have established us as the performance partner of

choice for addressing the operating challenges our customers face

throughout the life cycle of their assets. As operators across the

industry increasingly prioritize production and recovery, our

strengths are more critical than ever.

“With the anticipated completion of our announced acquisition of

ChampionX, we are set to further strengthen our production and

recovery capabilities, enabling us to deliver even greater value to

our customers. This strategic acquisition will also enhance the

resilience of the SLB portfolio, providing some stability against

the cycles in the years to come.

Digital Continues to Deliver Highly Accretive Growth with AI

and Autonomous Operations Gaining Traction

“Digital & Integration revenue increased 10% year on year,

driven by 20% growth in digital, which reached $2.44 billion for

the year. Accelerated adoption of our digital technologies marked a

milestone year, highlighted by strategic collaborations with

cross-industry leaders, the launch of the Lumi™ data and AI

platform, new Performance Live™ centers to enable remote

operations, and the achievement of fully autonomous drilling

operations.

“AI is the X factor for our industry, and I am confident that

SLB will continue to be a leader in this area, enabling us to

deliver sustained outperformance for our customers, partners and

shareholders,” Le Peuch said.

Long-Term Fundamentals Will Support Oil and Gas

Investment

“While upstream investment growth will remain subdued in the

short term due to global oversupply, we anticipate the oil supply

imbalance will gradually abate. Global economic growth and a

heightened focus on energy security, coupled with rising energy

demand from AI and data centers will support the investment outlook

for the oil and gas industry throughout the rest of the decade.

“In our Core business, we are making unmatched contributions to

the discovery, development and extraction of oil and gas reserves,

fueling global energy supply. We have the leading offering in

Digital. And we are pursuing a meaningful opportunity in New Energy

and decarbonization, where we have established a differentiated

market position. Together, this is laying a strong foundation for

our business, and SLB is poised to create enduring value for our

customers and shareholders,” Le Peuch said.

Total Return to Shareholders Increasing to $4 Billion in

2025

“SLB remains committed to expanding EBITDA margins, generating

strong cash flows, and increasing returns to shareholders. Given

our confidence in the business outlook and our ability to continue

generating strong cash flows, we are pleased to announce that our

Board of Directors has approved a 3.6% increase to our quarterly

dividend. Additionally, as we believe our stock is undervalued

relative to the strength of our business, we entered into

accelerated share repurchase (ASR) transactions to repurchase $2.3

billion of our company’s common stock. This positions us to

increase total return to shareholders from $3.3 billion in 2024 to

a minimum of $4 billion in 2025," Le Peuch concluded.

Other Events

During the quarter, SLB repurchased 11.8 million shares of its

common stock for a total purchase price of $501 million. For the

full-year 2024, SLB repurchased a total of 38.4 million shares of

its common stock for a total purchase price of $1.74 billion.

On December 20, 2024, SLB entered into ASR transactions to

repurchase $2.3 billion of its common stock. Under the terms of the

ASR agreements, on January 13, 2025, SLB received an initial share

delivery of approximately 80% of the shares to be repurchased,

based on the closing price per share of its common stock on the

preceding day. SLB expects the remainder of the shares to be

delivered no later than the end of May 2025. Under certain

circumstances, SLB may be required to deliver shares or pay cash,

at its option, upon settlement of the ASR agreements. The total

number of shares ultimately purchased under the ASR agreements will

depend upon the final settlement and will be based on

volume-weighted average prices of SLB’s common stock during the

terms of the ASR transactions, less a discount.

On January 16, 2025, SLB’s Board of Directors approved a 3.6%

increase in SLB’s quarterly cash dividend from $0.275 per share of

outstanding common stock to $0.285 per share, beginning with the

dividend payable on April 3, 2025, to stockholders of record on

February 5, 2025.

Fourth-Quarter Revenue by Geographical Area

(Stated in millions)

Three Months Ended Change

Dec. 31,2024 Sept. 30,2024 Dec. 31,2023

Sequential

Year-on-year North America

$1,752

$1,687

$1,641

4%

7%

Latin America

1,634

1,689

1,722

-3%

-5%

Europe & Africa*

2,472

2,434

2,429

2%

2%

Middle East & Asia

3,376

3,302

3,141

2%

7%

Eliminations & other

49

47

56

n/m

n/m

$9,284

$9,159

$8,990

1%

3%

International

$7,483

$7,425

$7,293

1%

3%

North America

$1,752

$1,687

$1,641

4%

7%

*Includes Russia and the Caspian region n/m = not meaningful

International

Revenue in Latin America of $1.63 billion declined 3%

sequentially, driven primarily by reduced drilling activity in

Mexico. This decline was partially offset by increased production

system sales in Brazil. Year on year, revenue decreased 5%,

reflecting reduced drilling in Mexico, partially offset by robust

activity in Argentina and higher production system sales in

Brazil.

Europe & Africa revenue of $2.47 billion rose 2%

sequentially, supported by increased activity in Europe and North

Africa, despite lower subsea production system sales in

Scandinavia. Year on year, revenue also grew 2%, with stronger

performances in North Africa and Europe offsetting weaker results

in West Africa.

Revenue in the Middle East & Asia of $3.38 billion

increased 2% sequentially, driven by strong activity in the United

Arab Emirates, higher drilling in Egypt, and increased stimulation,

intervention and evaluation activity in Qatar. These gains offset

weaker performance in Saudi Arabia and Australia. Year on year,

revenue grew 7%, reflecting robust activity in the United Arab

Emirates, Iraq, Kuwait, East Asia, China and Indonesia, partially

offset by reduced drilling in India.

North America

North America revenue of $1.75 billion increased 4%

sequentially due to higher digital sales and increased sales of

production systems in the U.S. Gulf of Mexico, as well as higher

digital sales and increased drilling activity in U.S. land and

Canada. Year on year, revenue rose 7%, driven by growth in offshore

activity in the U.S. Gulf of Mexico and higher Asset Performance

Solutions (APS) revenue in Canada, despite lower drilling activity

in U.S. land.

Fourth-Quarter Results by Division

Digital & Integration

(Stated in millions)

Three Months Ended Change

Dec. 31,2024 Sept. 30,2024 Dec. 31,2023

Sequential

Year-on-year Revenue International

$824

$830

$790

-1%

4%

North America

331

258

257

28%

29%

Other

1

-

2

n/m

n/m

$1,156

$1,088

$1,049

6%

10%

Pretax operating income

$442

$386

$356

14%

24%

Pretax operating margin

38.3%

35.5%

34.0%

274 bps

430 bps

n/m = not meaningful

Digital & Integration revenue of $1.16 billion increased 6%

sequentially driven by 10% growth in digital revenue, supported by

greater adoption of digital technologies and higher sales of

exploration data, particularly in the U.S. Gulf of Mexico. APS

revenue was flat sequentially. Year on year, revenue grew 10%, with

digital revenue up 21%, offsetting a 2% decline in APS revenue.

Digital & Integration pretax operating margin of 38%

expanded 274 bps sequentially, reflecting improved profitability in

digital from higher sales and cost efficiencies. Year on year,

margin expanded 430 bps due to stronger digital performance,

partially offset by lower APS profitability stemming from higher

amortization expenses and lower gas prices.

Reservoir Performance

(Stated in millions)

Three Months Ended Change

Dec. 31,2024 Sept. 30,2024 Dec. 31,2023

Sequential

Year-on-year Revenue International

$1,669

$1,676

$1,611

-

4%

North America

139

145

123

-4%

13%

Other

2

2

1

n/m

n/m

$1,810

$1,823

$1,735

-1%

4%

Pretax operating income

$370

$367

$371

1%

-

Pretax operating margin

20.5%

20.1%

21.4%

35 bps

-90 bps

n/m = not meaningful

Reservoir Performance revenue of $1.81 billion declined 1%

sequentially driven by reduced intervention and stimulation

activity, partially offset by stronger evaluation activity. Revenue

was impacted by lower stimulation and intervention work in Saudi

Arabia, which was offset by increased activity in the rest of the

Middle East & Asia and North America. Year on year, revenue

increased 4% due to higher intervention and stimulation activity,

despite lower evaluation revenue.

Reservoir Performance pretax operating margin of 20% expanded 35

bps sequentially, reflecting improved profitability in evaluation

services, partially offset by weaker performance in intervention.

Year on year, the margin decreased 90 bps due to an unfavorable

technology mix.

Well Construction

(Stated in millions)

Three Months Ended Change

Dec. 31,2024 Sept. 30,2024 Dec. 31,2023

Sequential

Year-on-year Revenue International

$2,625

$2,675

$2,748

-2%

-4%

North America

583

581

614

-

-5%

Other

59

56

64

n/m

n/m

$3,267

$3,312

$3,426

-1%

-5%

Pretax operating income

$681

$714

$770

-5%

-12%

Pretax operating margin

20.8%

21.5%

22.5%

-70 bps

-162 bps

n/m = not meaningful

Well Construction revenue of $3.27 billion declined 1%

sequentially due to reduced drilling activity in Mexico and Saudi

Arabia, partially mitigated by higher activity across the rest of

the Middle East & Asia. Year on year, revenue declined 5%,

reflecting lower drilling activity in Mexico, Saudi Arabia and U.S.

land, partially offset by improved performance in the rest of the

Middle East & Asia.

Well Construction pretax operating margin of 21% declined 70 bps

sequentially and 162 bps year on year due to reduced activity

across North America and international markets.

Production Systems

(Stated in millions)

Three Months Ended Change

Dec. 31,2024 Sept. 30,2024 Dec. 31,2023

Sequential

Year-on-year Revenue International

$2,471

$2,373

$2,276

4%

9%

North America

716

723

666

-1%

7%

Other

10

7

2

n/m

n/m

$3,197

$3,103

$2,944

3%

9%

Pretax operating income

$506

$519

$442

-3%

14%

Pretax operating margin

15.8%

16.7%

15.0%

-93 bps

79 bps

n/m = not meaningful

Production Systems revenue of $3.20 billion increased 3%

sequentially with growth led by higher international sales of

artificial lift, midstream production systems and completions,

partially offset by reduced sales of subsea production systems.

Year on year, revenue grew 9%, mainly due to strong sales both in

North America and internationally across most of the portfolio.

Production Systems pretax operating margin of 16% decreased 93

bps sequentially due to lower profitability in subsea production

systems, partially offset by improved profitability in artificial

lift and midstream production systems. Year on year, pretax

operating margin expanded 79 bps due to improved profitability

across a majority of the business lines.

Quarterly Highlights

CORE

Contract Awards

SLB continues to win new contract awards that align with SLB’s

strengths in the Core, particularly in the international and

offshore basins. Notable highlights include the following:

- SLB has been awarded a series of major drilling contracts by

Shell to support capital-efficient energy development across its

deep- and ultradeepwater assets in the UK North Sea, Trinidad and

Tobago, the Gulf of Mexico and others. The projects, which will be

delivered over a three-year time frame, will combine SLB’s

AI-enabled digital drilling capabilities with its expertise in

ultradeepwater environments. The scope of the contracts will

include digital directional drilling services and hardware, logging

while drilling (LWD), surface logging, cementing, drilling and

completions fluids, completions, and wireline services. Each

project will be managed through SLB’s Performance Live

centers.

- SLB OneSubsea, alongside Subsea Integration Alliance partner

Subsea7, has signed a global frame agreement with bp, forming a

platform to combine subsea expertise more effectively across a

portfolio of future projects. This collaboration combines

capabilities throughout all project stages — from initial concept

development to full-field life cycle — enabling enhanced subsea

project performance. Through early engagement and new ways of

working, SLB OneSubsea and its alliance partners will support bp in

achieving accelerated project delivery, standardization,

simplification and reduced total cost of ownership, ultimately

improving subsea project economics while embedding quality and

driving sustainable outcomes in subsea field operations.

- SLB has been awarded, after a competitive tender, a new

contract by Petrobras for integrated services across all offshore

fields operated by Petrobras in Brazil. SLB will oversee the

construction of more than 100 deepwater wells, utilizing advanced

drilling, cementing and drilling fluid technologies on up to nine

ultradeepwater rigs.

- Offshore Brazil, SLB OneSubsea was awarded multiple contracts

by Petrobras. Following a competitive tender, SLB OneSubsea was

awarded a contract to provide two subsea production manifolds, one

electrohydraulic distribution unit and additional related services

for the Roncador project. Additionally, SLB OneSubsea was awarded a

contract for two subsea raw seawater injection (RWI) systems to

increase recovery from the Búzios field. Under the contract, SLB

OneSubsea will provide two complete subsea RWI systems to support

Petrobras’ FPSOs P-74 and P-75, and they will each consist of a

subsea seawater injection pump, umbilical system and topside

variable speed drive.

- In Italy, TotalEnergies awarded SLB a four-year contract for

the provision of completions and artificial lift equipment and

services in Tempa Rossa Field, one of the largest land fields in

Europe with an estimated volume of 200 million barrels and a target

production of over 50,000 barrels per day. The field presents

several technical challenges which require custom-designed

technologies to maximize production and recovery. SLB was selected

for its ability to deliver fit-for-basin solutions using its global

reach and the expertise of the local team.

- In Oman, Petroleum Development Oman has awarded SLB a five-year

contract for well placement services throughout its Block 6

concession. SLB will provide multiple key technologies, including

PowerDrive Orbit™ system and the PeriScope HD™ service, across a

variety of gas and oil fields, for both development and exploration

wells.

- Also in Oman, Daleel Petroleum LLC awarded SLB a five-year

contract for advanced measurements-while-drilling (MWD) and

directional drilling services in its Block 5 concession, with an

expected delivery of more than 250 wells. SLB was able to secure

this award through market-leading fit-for-basin MWD, LWD and rotary

steerable system technologies, which have improved well delivery

efficiencies and service quality reliability.

Technology and Innovation

Notable technology introductions and deployment in the quarter

include the following:

- SLB introduced Neuro™ autonomous geosteering, which dynamically

responds to subsurface complexities to drill more efficient,

higher-performing wells, while reducing the carbon footprint of the

drilling operations. Using AI, Neuro autonomous geosteering

integrates and interprets complex real-time subsurface information

to autonomously guide the drill bit through the most productive

layer or “sweet spot” of the reservoir.

- SLB launched Stream™ high-speed intelligent telemetry that

increases drilling confidence and performance for complex wells.

Designed to overcome the bottlenecks and limitations of

conventional mud pulse, Stream telemetry combines proprietary AI

algorithms with SLB’s TruLink™ definitive dynamic

survey-while-drilling service. This provides uninterrupted,

high-speed, high-fidelity real-time subsurface measurements with no

data limitations, regardless of depth, in even the most challenging

conditions. Stream telemetry has already been deployed in 14

countries, with more than 370 runs and more than 1.5 million feet

drilled.

- Offshore United States, SLB helped Chevron access resources in

a high-pressure deepwater area of the Gulf of Mexico. New

technologies deployed included 20,000-psi-rated trees, manifolds,

connections, controls, and an advanced boosting system, presenting

new opportunities for resource extraction in high-pressure

environments.

- In Kuwait, SLB and Kuwait Oil Company tackled significant

challenges in the mature Bahrah Field by using an advanced openhole

multistage completion design and OpenPath Flex™ acid stimulation

service. The project achieved Kuwait's longest lateral at 13,800

feet, incorporating 29 treatment stages with up to three acid

fracturing stages daily. Kinetix™ software enhanced fault

isolation, while DataFRAC™ services provided comprehensive

exploratory area assessments, improving the geomechanical earth

model. These innovative methods, including the use of a frac tree

for isolation, eliminated HSE risks associated with isolation tools

and set a new benchmark for operational efficiency and safety in

acid fracturing operations.

- In Malaysia, SLB and Hibiscus Oil and Gas Malaysia Limited

integrated a directional drilling solution using SLB Smith Bits and

PowerDrive X6™ rotary steerable system in the Bunga Orkid project

that resulted in the longest extended-reach drilling well in

Malaysia at a depth of 6,970 meters. SLB provided drilling,

measurements, geoservices, and drilling fluid, as well as proactive

real-time monitoring and intervention during drilling and tripping

using our K&M Technology Group. Bottomhole assembly

optimization and proven techniques were implemented based on a

similar offset well.

- Also in Malaysia, SLB and PETRONAS Carigali Sdn. Bhd.

successfully implemented a matrix stimulation treatment using the

OneSTEP EF™ efficient, low-risk sandstone stimulation solution in

two oil-producing layers in the Dulang oil field. This innovative

approach improved operational efficiency, increasing oil production

by 400% without increasing the water cut. This success underscores

the outstanding collaboration between PETRONAS Carigali and SLB in

identifying the issues and developing fit-for-basin solutions.

- In Western Australia, SLB deployed drilling services for Strike

Energy to successfully drill the easternmost and deepest well to

date in the Kingia-High Cliff Sandstones of Perth Basin, enabling

the discovery of two significant gas resources. With a record total

depth of 5,225 meters, it is the deepest onshore well in

Australia.

DIGITAL

SLB is deploying digital technology at scale, partnering with

customers to migrate their technology and workflows into the cloud,

to embrace new AI-enabled capabilities, and to leverage insights to

elevate their performance. Notable highlights include the

following:

- In the United States, SLB, Equinor and Sensia collaborated to

enhance Equinor’s subsurface and surface modeling workflows for one

of Equinor’s non-operated assets in the Gulf of Mexico. The

improved model links geology, geophysics and engineering, replacing

a manual process with automated live updates. This was achieved by

connecting Petrel™ subsurface software, Intersect™ high-resolution

reservoir simulator and Pipesim™ steady-state multiphase flow

simulator. A link to the production database in OFM™ well and

reservoir analysis software enabled production history updates to

the dynamic reservoir model. In tests, the subsurface model updates

were improved from months to weeks and days, and simulation

runtimes were reduced from nine hours to 36 minutes.

- In Suriname, Staatsolie Maatschappij Suriname N.V. has awarded

SLB a four-year contract for the Delfi™ digital platform to

increase the efficiency of its offshore teams. The Delfi platform

will bring both data and applications into the cloud to foster

collaboration and derive further insights. Coupled with a previous

contract award to SLB for the country’s National Data Repository,

this platform will be the digital foundation for Suriname’s Center

of Excellence, which was formed to maximize the value of the

country’s hydrocarbon resources.

- In Egypt, Khalda Petroleum Company awarded SLB a multiyear

digital contract for Petrel subsurface software technology in

addition to a long-term contract for seismic imaging and processing

over the West Kalabsha and Shushan concessions. The full integrity

processing scope spans from deblending to full-waveform inversion

(FWI). Deblending separates overlapping seismic signals from

simultaneous sources, producing clean data ready for further

analysis. FWI then iteratively refines the subsurface velocity

model using full-waveform data, resulting in highly accurate,

high-resolution images of complex geological structures. This

reservoir characterization will enable Khalda Petroleum Company to

better understand subsurface features, identify potential

hydrocarbon zones, and make informed decisions about exploration,

drilling and production.

- In Malaysia, PETRONAS through Malaysia Petroleum Management

(MPM) has signed a memorandum of understanding with SLB to enhance

technical capabilities in AI, machine learning and generative AI

technologies. This collaboration aims to leverage cutting-edge

AI-driven solutions for MPM's data platform, revolutionizing the

management and interpretation of subsurface data.

- In Australia, Arrow Energy awarded SLB a contract to deploy

enterprise-scale advanced digital solutions by migrating its

subsurface applications from third-party cloud hosts to SLB’s Delfi

platform. By incorporating this collaborative exploration and

production platform into its digital strategy, Arrow Energy can

quickly deploy scalable advanced workflows, reducing the total cost

of ownership and enhancing efficiency.

NEW ENERGY

SLB continues to participate in the global transition to

low-carbon energy systems through innovative technology and

strategic partnerships, including the following:

- SLB entered into an agreement with Aramco and Linde that paves

the way for the development of a carbon capture and storage (CCS)

hub in Jubail, Saudi Arabia, that is expected to become one of the

largest globally. The first phase of the project is expected to

capture and store up to nine million metric tons of CO2 annually,

with construction completed by the end of 2027. Later phases are

expected to further expand its capacity.

- SLB Capturi™ reached a significant milestone, achieving

mechanical completion of the carbon capture plant at Heidelberg

Materials’ cement facility in Brevik, Norway. The carbon capture

plant is designed to capture up to 400,000 metric tons of CO2

annually from the cement facility. When operational, this

world-first commercial-scale carbon capture plant at a cement

facility will enable production of net-zero cement, without

compromising the product strength or quality.

- In Norway, SLB Capturi completed a test campaign at WACKER's

silicon production site to capture CO2 emissions generated from the

production of metallurgical-grade silicon — an essential raw

material for microchips, solar modules and silicones. During the

test campaign, a mobile test unit was installed adjacent to

WACKER's production facilities, effectively replicating the CO2

capture process on a smaller scale. The pilot study concluded

successfully in late July and achieved capture rates of over 95%.

Additionally, WACKER and SLB Capturi conducted an engineering

feasibility study to design a plant that would capture 180,000

metric tons of CO2 annually.

- In Taiwan, CPC Corporation, Taiwan (CPC), has awarded SLB a

three-year contract for subsurface site characterization; storage

development planning; and measurement, monitoring, and verification

planning for a strategic shoreline CCS project. The objective of

the project is to improve the performance and reduce the

operational risks of CCS, which will help CPC’s ambition to

commence commercial CCS operations in 2030.

FINANCIAL TABLES

Condensed Consolidated Statement of Income

(Stated in millions, except per

share amounts)

Fourth Quarter Twelve Months Periods Ended December 31,

2024

2023

2024

2023

Revenue

$9,284

$8,990

$36,289

$33,135

Interest & other income (1)

115

95

380

342

Expenses Cost of revenue (1)

7,322

7,194

28,829

26,572

Research & engineering

192

187

749

711

General & administrative

81

96

385

364

Merger & integration (1)

63

45

123

45

Restructuring

& other (1)

223

-

399

-

Interest

131

130

512

503

Income before taxes (1)

$1,387

$1,433

$5,672

$5,282

Tax expense (1)

269

284

1,093

1,007

Net income (1)

$1,118

$1,149

$4,579

$4,275

Net income attributable to noncontrolling interests (1)

23

36

118

72

Net income attributable to SLB (1)

$1,095

$1,113

$4,461

$4,203

Diluted earnings per share of SLB (1)

$0.77

$0.77

$3.11

$2.91

Average shares outstanding

1,406

1,429

1,421

1,425

Average shares outstanding assuming dilution

1,420

1,446

1,436

1,443

Depreciation & amortization included in expenses (2)

$648

$609

$2,519

$2,312

(1)

See section entitled “Charges & Credits” for details.

(2)

Includes depreciation of fixed assets and amortization of

intangible assets, exploration data costs and APS investments.

Condensed Consolidated Balance Sheet

(Stated in millions)

Dec. 31, Dec. 31, Assets

2024

2023

Current Assets Cash and short-term investments

$4,669

$3,989

Receivables

8,011

7,812

Inventories

4,375

4,387

Other current assets

1,515

1,530

18,570

17,718

Investment in affiliated companies

1,635

1,624

Fixed assets

7,359

7,240

Goodwill

14,593

14,084

Intangible assets

3,012

3,239

Other assets

3,766

4,052

$48,935

$47,957

Liabilities and Equity Current Liabilities Accounts payable

and accrued liabilities

$10,375

$10,904

Estimated liability for taxes on income

982

994

Short-term borrowings and current portion of long-term debt

1,051

1,123

Dividends payable

403

374

12,811

13,395

Long-term debt

11,023

10,842

Other liabilities

2,751

2,361

26,585

26,598

Equity

22,350

21,359

$48,935

$47,957

Liquidity

(Stated in millions) Components of Liquidity Dec. 31,2024 Sept.

30,2024 Dec. 31,2023 Cash and short-term investments

$4,669

$4,462

$3,989

Short-term borrowings and current portion of long-term debt

(1,051)

(1,059)

(1,123)

Long-term debt

(11,023)

(11,864)

(10,842)

Net Debt (1)

$(7,405)

$(8,461)

$(7,976)

Details of changes in liquidity follow:

Twelve

Fourth Twelve

Months Quarter Months Periods

Ended December 31,

2024

2024

2023

Net income

$4,579

$1,118

$4,275

Charges and credits, net of tax (2)

454

223

110

5,033

1,341

4,385

Depreciation and amortization (3)

2,519

648

2,312

Stock-based compensation expense

316

72

293

Change in working capital

(1,379)

352

(215)

US Federal tax refund

-

-

85

Other

113

(23)

(223)

Cash flow from operations

6,602

2,390

6,637

Capital expenditures

(1,931)

(609)

(1,939)

APS investments

(483)

(93)

(507)

Exploration data capitalized

(198)

(57)

(153)

Free cash flow (4)

3,990

1,631

4,038

Dividends paid

(1,533)

(389)

(1,317)

Stock repurchase program

(1,737)

(501)

(694)

Proceeds from employee stock plans

248

4

281

Business acquisitions and investments, net of cash acquired

(553)

(1)

(330)

Purchases of Blue Chip Swap securities

(207)

(71)

(185)

Proceeds from sale of Blue Chip Swap securities

152

60

97

Proceeds from sale of Liberty shares

-

-

137

Taxes paid on net settled stock-based compensation awards

(90)

(4)

(169)

Other

53

26

(195)

Decrease in net debt before impact of changes in foreign

exchange rates

323

755

1,663

Impact of changes in foreign exchange rates on net debt

248

301

(307)

Decrease in Net Debt

571

1,056

1,356

Net Debt, beginning of period

(7,976)

(8,461)

(9,332)

Net Debt, end of period

$(7,405)

$(7,405)

$(7,976)

(1)

“Net Debt” represents gross debt less cash

and short-term investments. Management believes that Net Debt

provides useful information to investors and management regarding

the level of SLB’s indebtedness by reflecting cash and investments

that could be used to repay debt. Net Debt is a non-GAAP financial

measure that should be considered in addition to, not as a

substitute for or superior to, total debt.

(2)

See section entitled “Charges &

Credits” for details.

(3)

Includes depreciation of fixed assets and

amortization of intangible assets, exploration data costs, and APS

investments.

(4)

“Free cash flow” represents cash flow from

operations less capital expenditures, APS investments and

exploration data costs capitalized. Management believes that free

cash flow is an important liquidity measure for the company and

that it is useful to investors and management as a measure of SLB’s

ability to generate cash. Once business needs and obligations are

met, this cash can be used to reinvest in the company for future

growth or to return to shareholders through dividend payments or

share repurchases. Free cash flow does not represent the residual

cash flow available for discretionary expenditures. Free cash flow

is a non-GAAP financial measure that should be considered in

addition to, not as a substitute for or superior to, cash flow from

operations.

Charges & Credits

In addition to financial results determined in accordance with

U.S. generally accepted accounting principles (GAAP), this

fourth-quarter 2024 earnings release also includes non-GAAP

financial measures (as defined under the SEC’s Regulation G). In

addition to the non-GAAP financial measures discussed under

“Liquidity”, SLB net income, excluding charges & credits, as

well as measures derived from it (including diluted EPS, excluding

charges & credits; effective tax rate, excluding charges &

credits; adjusted EBITDA and adjusted EBITDA margin) are non-GAAP

financial measures. Management believes that the exclusion of

charges & credits from these financial measures provides useful

perspective on SLB’s underlying business results and operating

trends, and a means to evaluate SLB’s operations period over

period. These measures are also used by management as performance

measures in determining certain incentive compensation. The

foregoing non-GAAP financial measures should be considered in

addition to, not as a substitute for or superior to, other measures

of financial performance prepared in accordance with GAAP. The

following is a reconciliation of certain of these non-GAAP measures

to the comparable GAAP measures. For a reconciliation of adjusted

EBITDA to the comparable GAAP measure, please refer to the section

titled “Supplementary Information” (Question 11).

(Stated in millions, except per

share amounts)

Fourth Quarter 2024 Pretax Tax Noncont.Interests Net

DilutedEPS * SLB net income (GAAP basis)

$1,387

$269

$23

$1,095

$0.77

Asset impairments (1)

162

23

-

139

0.10

Merger & integration

63

6

7

50

0.04

Restructuring (1)

61

10

-

51

0.04

Gain on sale of investment (2)

(24)

-

-

(24)

(0.02)

SLB net income, excluding charges & credits

$1,649

$308

$30

$1,311

$0.92

Third Quarter 2024

Pretax Tax Noncont.Interests Net

Diluted EPS

SLB net income (GAAP basis)

$1,507

$289

$32

$1,186

$0.83

Restructuring (1)

65

10

-

55

0.04

Merger & integration (3)

47

10

7

30

0.02

SLB net income, excluding charges & credits

$1,619

$309

$39

$1,271

$0.89

Fourth Quarter 2023

Pretax Tax Noncont.Interests Net

Diluted EPS

SLB net income (GAAP basis)

$1,433

$284

$36

$1,113

$0.77

Merger & integration (3)

56

8

8

40

0.03

Argentina devaluation (4)

90

-

-

90

0.06

SLB net income, excluding charges & credits

$1,579

$292

$44

$1,243

$0.86

* Does not add due to rounding.

(Stated in millions, except per

share amounts)

Twelve Months 2024 Pretax Tax Noncont.Interests Net

DilutedEPS SLB net income (GAAP basis)

$5,672

$1,093

$118

$4,461

$3.11

Workforce reductions (1)

237

37

-

200

0.14

Merger & integration (5)

166

27

27

112

0.08

Asset impairments (1)

162

23

-

139

0.10

Gain on sale of investment (2)

(24)

-

-

(24)

(0.02)

SLB net income, excluding charges & credits

$6,213

$1,180

$145

$4,888

$3.41

Twelve Months 2023

Pretax Tax Noncont.Interests Net

Diluted EPS

SLB net income (GAAP basis)

$5,282

$1,007

$72

$4,203

$2.91

Argentina devaluation (4)

90

-

-

90

0.06

Merger & integration (6)

56

8

8

40

0.03

Gain on sale of Liberty shares (2)

(36)

(8)

-

(28)

(0.02)

SLB net income, excluding charges & credits

$5,392

$1,007

$80

$4,305

$2.98

(1)

Classified in Restructuring & other in

the Condensed Consolidated Statement of Income.

(2)

Classified in Interest & other income

in the Condensed Consolidated Statement of Income.

(3)

During the third quarter of 2024, $14

million of these charges were classified in Cost of revenue in the

Condensed Consolidation Statement of Income with the remaining $33

million classified in Merger & integration. During the fourth

quarter of 2023, $11 million of these charges were classified in

Cost of revenue with the remaining $45 million classified in Merger

& integration.

(4)

Classified in Cost of revenue in the

Condensed Consolidated Statement of Income.

(5)

During the full year 2024, $43 million of

these charges were classified in Cost of revenue in the Condensed

Consolidation Statement of Income with the remaining $123 million

classified in Merger & integration.

(6)

During the full year 2023, $11 million of

these charges were classified in Cost of revenue in the Condensed

Consolidated Statement of Income with the remaining $45 million

classified in Merger & integration.

Divisions

(Stated in millions)

Three Months Ended Dec. 31, 2024

Sept. 30, 2024 Dec. 31, 2023

Revenue

IncomeBeforeTaxes Revenue IncomeBeforeTaxes Revenue

IncomeBeforeTaxes Digital & Integration

$1,156

$442

$1,088

$386

$1,049

$356

Reservoir Performance

1,810

370

1,823

367

1,735

371

Well Construction

3,267

681

3,312

714

3,426

770

Production Systems

3,197

506

3,103

519

2,944

442

Eliminations & other

(146)

(81)

(167)

(84)

(164)

(71)

Pretax segment operating income

1,918

1,902

1,868

Corporate & other

(177)

(187)

(193)

Interest income(1)

36

36

30

Interest expense(1)

(128)

(132)

(126)

Charges & credits(2)

(262)

(112)

(146)

$9,284

$1,387

$9,159

$1,507

$8,990

$1,433

(Stated in millions)

Full Year 2024 Revenue IncomeBefore Taxes

Depreciation andAmortization (3) Net

InterestExpense(Income) (4) AdjustedEBITDA (5)

CapitalInvestments (6) Digital & Integration

$4,247

$1,408

$654

$12

$2,074

$682

Reservoir Performance

7,177

1,452

403

(14)

1,841

624

Well Construction

13,357

2,826

649

(14)

3,461

745

Production Systems

12,143

1,898

348

(4)

2,242

418

Eliminations & other

(635)

(263)

287

(6)

18

143

7,321

2,341

(26)

9,636

2,612

Corporate & other

(744)

178

(566)

Interest income (1)

134

Interest expense (1)

(498)

Charges & credits (2)

(541)

$36,289

$5,672

$2,519

$(26)

$9,070

$2,612

(Stated in millions)

Full Year 2023 Revenue Income BeforeTaxes Depreciation

andAmortization (3) Net InterestExpense(Income) (4) AdjustedEBITDA

(5) CapitalInvestments (6) Digital & Integration

$3,871

$1,257

$578

$12

$1,847

$660

Reservoir Performance

6,561

1,263

387

(4)

1,646

514

Well Construction

13,478

2,932

587

(5)

3,514

908

Production Systems

9,831

1,245

325

(1)

1,569

384

Eliminations & other

(606)

(174)

277

(1)

102

133

6,523

2,154

1

8,678

2,599

Corporate & other

(729)

158

(571)

Interest income (1)

87

Interest expense (1)

(489)

Charges & credits (2)

(110)

$33,135

$5,282

$2,312

$1

$8,107

$2,599

(1)

Excludes amounts which are included in the

segments’ results.

(2)

See section entitled “Charges &

Credits” for details.

(3)

Includes depreciation of fixed assets and

amortization of intangible assets, APS and exploration data

costs.

(4)

Excludes interest income and interest

expense recorded at the corporate level.

(5)

Adjusted EBITDA represents income before

taxes excluding depreciation and amortization, interest income,

interest expense and charges & credits.

(6)

Capital investment includes capital

expenditures, APS investments and exploration data costs

capitalized.

Geographical

(Stated in millions)

Full Year 2024 Revenue IncomeBefore Taxes

Depreciation andAmortization (3) Net

InterestExpense(Income) (4) AdjustedEBITDA (5)

International

$29,415

$6,291

$1,648

($39)

$7,900

North America

6,680

1,134

445

13

1,592

Eliminations & other

194

(104)

248

-

144

7,321

2,341

(26)

9,636

Corporate & other

(744)

178

(566)

Interest income (1)

134

Interest expense (1)

(498)

Charges & credits (2)

(541)

$36,289

$5,672

$2,519

$(26)

$9,070

(Stated in millions)

Full Year 2023 Revenue Income BeforeTaxes Depreciation

andAmortization (3) Net InterestExpense(Income) (4) AdjustedEBITDA

(5) International

$26,188

$5,486

$1,513

($11)

$6,988

North America

6,727

1,157

389

13

1,559

Eliminations & other

220

(120)

252

(1)

131

6,523

2,154

1

8,678

Corporate & other

(729)

158

(571)

Interest income (1)

87

Interest expense (1)

(489)

Charges & credits (2)

(110)

$33,135

$5,282

$2,312

$1

$8,107

(1)

Excludes amounts which are included in the

segments’ results.

(2)

See section entitled “Charges &

Credits” for details.

(3)

Includes depreciation of fixed assets and

amortization of intangible assets, APS and exploration data

costs.

(4)

Excludes interest income and interest

expense recorded at the corporate level.

(5)

Adjusted EBITDA represents income before

taxes excluding depreciation and amortization, interest income,

interest expense and charges & credits.

Supplementary Information

Frequently Asked Questions

1)

What is the capital investment guidance for the full-year

2025?

Capital investment (consisting of capex,

exploration data costs and APS investments) for the full-year 2025

is expected to be approximately $2.3 billion. This amount is

excluding any impact from the anticipated closure of the announced

acquisition of ChampionX. Capital investment for the full-year 2024

was $2.6 billion.

2)

What were cash flow from

operations and free cash flow for the fourth quarter of

2024?

Cash flow from operations for the

fourth quarter of 2024 was $2.39 billion and free cash flow was

$1.63 billion.

3)

What were cash flow from

operations and free cash flow for the full year of 2024?

Cash flow from operations for the

full year of 2024 was $6.60 billion and free cash flow was $3.99

billion.

4)

What was included in “Interest

& other income” for the fourth quarter of 2024?

“Interest & other income” for

the fourth quarter of 2024 was $115 million. This consisted of the

following:

(Stated in millions) Gain on sale of investment

$24

Interest income

46

Earnings of equity method investments

45

$115

5)

How did interest income and interest expense change during

the fourth quarter of 2024?

Interest income of $46 million for the

fourth quarter of 2024 decreased $6 million sequentially. Interest

expense of $131 million decreased $5 million sequentially.

6)

What is the difference between

SLB’s consolidated income before taxes and pretax segment operating

income?

The difference consists of

corporate items, charges and credits, and interest income and

interest expense not allocated to the segments, as well as

stock-based compensation expense, amortization expense associated

with certain intangible assets, certain centrally managed

initiatives, and other nonoperating items.

7)

What was the effective tax

rate (ETR) for the fourth quarter of 2024?

The ETR for the fourth quarter of

2024, calculated in accordance with GAAP, was 19.4% as compared to

19.2% for the third quarter of 2024. Excluding charges and credits,

the ETR for the fourth quarter of 2024 was 18.7% as compared to

19.1% for the third quarter of 2024.

8)

What was the effective tax

rate (ETR) for the full year of 2024?

The ETR for the full year of

2024, calculated in accordance with GAAP, was 19.3% as compared to

19.1% for the full year of 2023. Excluding charges and credits, the

ETR for the full year of 2024 was 19.0% as compared to 18.7% for

the full year of 2023.

9)

How many shares of common

stock were outstanding as of December 31, 2024, and how did this

change from the end of the previous quarter?

There were 1.401 billion shares

of common stock outstanding as of December 31, 2024, and 1.412

billion shares outstanding as of September 30, 2024.

(Stated in millions)

Shares outstanding at September 30, 2024

1,412

Shares issued under employee stock purchase plan

-

Shares issued to optionees, less shares exchanged

-

Vesting of restricted stock

1

Stock repurchase program

(12)

Shares outstanding at December 31, 2024

1,401

10)

What was the weighted average number of

shares outstanding during the fourth quarter of 2024 and third

quarter of 2024? How does this reconcile to the average number of

shares outstanding, assuming dilution, used in the

calculation of diluted earnings per share?

The weighted average number of shares

outstanding was 1.406 billion during the fourth quarter of 2024 and

1.417 billion during the third quarter of 2024. The following is a

reconciliation of the weighted average shares outstanding to the

average number of shares outstanding, assuming dilution, used in

the calculation of diluted earnings per share.

(Stated in millions)

Fourth Quarter2024 Third Quarter2024

Weighted average shares outstanding

1,406

1,417

Unvested restricted stock

13

14

Assumed exercise of stock options

1

1

Average shares outstanding, assuming dilution

1,420

1,432

11)

What was SLB’s adjusted EBITDA in the fourth quarter of 2024,

the third quarter of 2024, the fourth quarter of 2023, the full

year of 2024, and the full year of 2023? What was SLB’s adjusted

EBITDA margin for those periods?

SLB’s adjusted EBITDA was $2.382 billion

in the fourth quarter of 2024, $2.343 billion in the third quarter

of 2024, and $2.277 billion in the fourth quarter of 2023.

SLB’s adjusted EBITDA margin was 25.7% in

the fourth quarter of 2024, 25.6% in the third quarter of 2024, and

25.3% in the fourth quarter of 2023.

(Stated in millions)

Fourth Quarter2024 Third Quarter2024

Fourth Quarter2023 Net income attributable to SLB

$1,095

$1,186

$1,113

Net income attributable to noncontrolling interests

23

32

36

Tax expense

269

289

284

Income before taxes

$1,387

$1,507

$1,433

Charges & credits

262

112

146

Depreciation and amortization

648

640

609

Interest expense

131

136

130

Interest income

(46)

(52)

(41)

Adjusted EBITDA

$2,382

$2,343

$2,277

Revenue

$9,284

$9,159

$8,990

Adjusted EBITDA margin

25.7%

25.6%

25.3%

SLB’s adjusted EBITDA was $9.070 billion

for the full year of 2024, and $8.107 billion for the full year of

2023.

SLB’s adjusted EBITDA margin was 25.0% for

the full year of 2024, and 24.5% for the full year of 2023.

(Stated in millions)

2024

2023

Change

Net income attributable to SLB

$4,461

$4,203

Net income attributable to noncontrolling interests

118

72

Tax expense

1,093

1,007

Income before taxes

$5,672

$5,282

Charges & credits

541

110

Depreciation and amortization

2,519

2,312

Interest expense

512

503

Interest income

(174)

(100)

Adjusted EBITDA

$9,070

$8,107

12%

Revenue

$36,289

$33,135

10%

Adjusted EBITDA margin

25.0%

24.5%

53 bps Adjusted EBITDA represents income before taxes, excluding

charges & credits, depreciation and amortization, interest

expense, and interest income. Management believes that adjusted

EBITDA is an important profitability measure for SLB and that it

provides useful perspective on SLB’s underlying business results

and operating trends, and a means to evaluate SLB’s operations

period over period. Adjusted EBITDA is also used by management as a

performance measure in determining certain incentive compensation.

Adjusted EBITDA should be considered in addition to, not as a

substitute for or superior to, other measures of financial

performance prepared in accordance with GAAP.

12)

What were the components of

depreciation and amortization expense for the fourth quarter of

2024, the third quarter of 2024, and the fourth quarter of 2023,

the full year of 2024, and the full year of 2023?

The components of depreciation

and amortization expense for the fourth quarter of 2024, the third

quarter of 2024, and the fourth quarter of 2023 were as

follows:

(Stated in millions)

Fourth Quarter2024 Third Quarter2024

Fourth Quarter2023 Depreciation of fixed assets

$396

$394

$380

Amortization of intangible assets

84

87

83

Amortization of APS investments

126

124

111

Amortization of exploration data costs capitalized

42

35

35

$648

$640

$609

The components of depreciation and

amortization expense for the full years of 2024 and 2023 were as

follows:

(Stated in millions)

2024

2023

Depreciation of fixed assets

$1,551

$1,445

Amortization of intangible assets

334

314

Amortization of APS investments

481

410

Amortization of exploration data costs capitalized

153

143

$2,519

$2,312

13)

What Divisions comprise SLB’s Core business and what were

their revenue and pretax operating income for the fourth quarter of

2024, the third quarter of 2024, the fourth quarter of 2023, the

full year of 2024, and the full year of 2023?

SLB’s Core business comprises the

Reservoir Performance, Well Construction, and Production Systems

Divisions. SLB’s Core business revenue and pretax operating income

for the fourth quarter of 2024, third quarter of 2024, and the

fourth quarter of 2023 are calculated as follows:

(Stated in millions)

Three Months Ended Change

Dec. 31,2024 Sept. 30,2024 Dec. 31,2023

Sequential Year-on-year

Revenue Reservoir

Performance

$1,810

$1,823

$1,735

Well Construction

3,267

3,312

3,426

Production Systems

3,197

3,103

2,944

$8,274

$8,238

$8,105

-

2%

Pretax Operating Income

Reservoir Performance

$370

$367

$371

Well Construction

681

714

770

Production Systems

506

519

442

$1,557

$1,600

$1,583

-3%

-2%

Pretax Operating Margin

Reservoir Performance

20.5%

20.1%

21.4%

Well Construction

20.8%

21.5%

22.5%

Production Systems

15.8%

16.7%

15.0%

18.8%

19.4%

19.5%

-60 bps

-71 bps

SLB’s Core business revenue and pretax

operating income for the full year of 2024 and the full year of

2023 are calculated as follows:

(Stated in millions)

Twelve Months Ended

Dec. 31,2024 Dec. 31,2023 Change

Revenue

Reservoir Performance

$7,177

$6,561

Well Construction

13,357

13,478

Production Systems

12,143

9,831

$32,677

$29,871

9%

Pretax Operating Income

Reservoir Performance

$1,452

$1,263

Well Construction

2,826

2,932

Production Systems

1,898

1,245

$6,176

$5,440

14%

Pretax Operating Margin

Reservoir Performance

20.2%

19.2%

Well Construction

21.2%

21.8%

Production Systems

15.6%

12.7%

18.9%

18.2%

69 bps

About SLB

SLB (NYSE: SLB) is a global technology company driving energy

innovation for a balanced planet. With a global presence in more

than 100 countries and employees representing almost twice as many

nationalities, we work each day on innovating oil and gas,

delivering digital at scale, decarbonizing industries, and

developing and scaling new energy systems that accelerate the

energy transition. Find out more at slb.com.

Conference Call Information

SLB will hold a conference call to discuss the earnings press

release and business outlook on Friday, January 17, 2025. The call

is scheduled to begin at 9:30 a.m. U.S. Eastern time. To access the

call, which is open to the public, please contact the conference

call operator at +1 (833) 470-1428 within North America, or +1

(404) 975-4839 outside of North America, approximately 10 minutes

prior to the call’s scheduled start time, and provide the access

code 491926. At the conclusion of the conference call, an audio

replay will be available until January 24, 2025, by dialling +1

(866) 813-9403 within North America, or +1 (929) 458-6194 outside

of North America, and providing the access code 808014. The

conference call will be webcasted simultaneously at

https://events.q4inc.com/attendee/800374382 on a listen-only basis.

A replay of the webcast will also be available at the same website

until January 24, 2025.

Forward-Looking Statements

This fourth-quarter and full-year 2024 earnings press release,

as well as other statements we make, contain “forward-looking

statements” within the meaning of the federal securities laws,

which include any statements that are not historical facts. Such

statements often contain words such as “expect,” “may,” “can,”

“believe,” “predict,” “plan,” “potential,” “projected,”

“projections,” “precursor,” “forecast,” “outlook,” “expectations,”

“estimate,” “intend,” “anticipate,” “ambition,” “goal,” “target,”

“scheduled,” “think,” “should,” “could,” “would,” “will,” “see,”

“likely,” and other similar words. Forward-looking statements

address matters that are, to varying degrees, uncertain, such as

statements about our financial and performance targets and other

forecasts or expectations regarding, or dependent on, our business

outlook; growth for SLB as a whole and for each of its Divisions

(and for specified business lines, geographic areas, or

technologies within each Division); oil and natural gas demand and

production growth; oil and natural gas prices; forecasts or

expectations regarding energy transition and global climate change;

improvements in operating procedures and technology; capital

expenditures by SLB and the oil and gas industry; our business

strategies, including digital and “fit for basin,” as well as the

strategies of our customers; our capital allocation plans,

including dividend plans and share repurchase programs; our APS

projects, joint ventures, and other alliances; the impact of the

ongoing conflict in Ukraine on global energy supply; access to raw

materials; future global economic and geopolitical conditions;

future liquidity, including free cash flow; and future results of

operations, such as margin levels. These statements are subject to

risks and uncertainties, including, but not limited to, changing

global economic and geopolitical conditions; changes in exploration

and production spending by our customers, and changes in the level

of oil and natural gas exploration and development; the results of

operations and financial condition of our customers and suppliers;

the inability to achieve our financial and performance targets and

other forecasts and expectations; the inability to achieve our

net-zero carbon emissions goals or interim emissions reduction

goals; general economic, geopolitical, and business conditions in

key regions of the world; the ongoing conflict in Ukraine; foreign

currency risk; inflation; changes in monetary policy by

governments; pricing pressure; weather and seasonal factors;

unfavorable effects of health pandemics; availability and cost of

raw materials; operational modifications, delays, or cancellations;

challenges in our supply chain; production declines; the extent of

future charges; the inability to recognize efficiencies and other

intended benefits from our business strategies and initiatives,

such as digital or new energy, as well as our cost reduction

strategies; changes in government regulations and regulatory

requirements, including those related to offshore oil and gas

exploration, radioactive sources, explosives, chemicals, and

climate-related initiatives; the inability of technology to meet

new challenges in exploration; the competitiveness of alternative

energy sources or product substitutes; and other risks and

uncertainties detailed in this press release and our most recent

Forms 10-K, 10-Q, and 8-K filed with or furnished to the Securities

and Exchange Commission (the “SEC”).

This press release also includes forward-looking statements

relating to the proposed transaction between SLB and ChampionX,

including statements regarding the benefits of the transaction and

the anticipated timing of the transaction. Factors and risks that

may impact future results and performance include, but are not

limited to, and in each case as a possible result of the proposed

transaction on each of SLB and ChampionX: the ultimate outcome of

the proposed transaction between SLB and ChampionX; the effect of

the announcement of the proposed transaction; the ability to

operate the SLB and ChampionX respective businesses, including

business disruptions; difficulties in retaining and hiring key

personnel and employees; the ability to maintain favorable business

relationships with customers, suppliers, and other business

partners; the terms and timing of the proposed transaction; the

occurrence of any event, change, or other circumstance that could

give rise to the termination of the proposed transaction; the

anticipated or actual tax treatment of the proposed transaction;

the ability to satisfy closing conditions to the completion of the

proposed transaction; other risks related to the completion of the

proposed transaction and actions related thereto; the ability of

SLB and ChampionX to integrate the business successfully and to

achieve anticipated synergies and value creation from the proposed

transaction; the ability to secure government regulatory approvals

on the terms expected, at all or in a timely manner; litigation and

regulatory proceedings, including any proceedings that may be

instituted against SLB or ChampionX related to the proposed

transaction, as well as the risk factors discussed in SLB’s and

ChampionX’s most recent Forms 10-K, 10-Q, and 8-K filed with or

furnished to the SEC.

If one or more of these or other risks or uncertainties

materialize (or the consequences of any such development changes),

or should our underlying assumptions prove incorrect, actual

results or outcomes may vary materially from those reflected in our