0000091440false00000914402025-02-062025-02-06

UNITED STATES

SECURITIES AND EXCHANGE COMMISSION

CURRENT REPORT

Pursuant to Section 13 or 15(d) of the

Securities Exchange Act of 1934

Date of Report (Date of earliest event reported): February 6, 2025

Snap-on Incorporated

(Exact name of registrant as specified in its charter) | | | | | | | | | | | | | | |

| Delaware | | 001-07724 | | 39-0622040 |

(State or Other Jurisdiction

of Incorporation) | | (Commission

File Number) | | (IRS Employer

Identification No.) |

| | | | | | | | | | | | | | |

| 2801 80th Street, | Kenosha, | Wisconsin | 53143-5656 |

| (Address of Principal Executive Offices, and Zip Code) |

(262) 656-5200

(Registrant’s telephone number, including area code)

Check the appropriate box below if the Form 8-K filing is intended to simultaneously satisfy the filing obligation of the registrant under any of the following provisions:

☐ Written communication pursuant to Rule 425 under the Securities Act (17 CFR 230.425)

☐ Soliciting material pursuant to Rule 14a-12 under the Exchange Act (17 CFR 240.14a-12)

☐ Pre-commencement communication pursuant to Rule 14d-2(b) under the Exchange Act (17 CFR 240.14d-2(b))

☐ Pre-commencement communication pursuant to Rule 13e-4(c) under the Exchange Act (17 CFR 240.13e-4(c))

Securities registered pursuant to Section 12(b) of the Act: | | | | | | | | |

| Title of each class | Trading Symbol(s) | Name of each exchange on which registered |

| Common Stock, $1.00 par value | SNA | New York Stock Exchange |

Indicate by check mark whether the registrant is an emerging growth company as defined in Rule 405 of the Securities Act of 1933 (17 CFR §230.405 of this chapter) or Rule 12b-2 of the Securities Exchange Act of 1934 (17 CFR §240.12b-2 of this chapter).

Emerging growth company ☐

If an emerging growth company, indicate by check mark if the registrant has elected not to use the extended transition period for complying with any new or revised financial accounting standards provided pursuant to Section 13(a) of the Exchange Act.☐

Item 2.02 Results of Operations and Financial Condition

On February 6, 2025, Snap-on Incorporated (the “Corporation”) issued a press release announcing results for its fourth quarter ended December 28, 2024. The text of the press release is furnished herewith as Exhibit 99 to this Current Report on Form 8-K.

The press release contains cautionary statements identifying important factors that could cause actual results of the Corporation to differ materially from those described in any forward-looking statement of the Corporation.

Item 9.01 Financial Statements and Exhibits (furnished pursuant to Item 2.02)

(d) Exhibits

99 Press Release of Snap-on Incorporated, dated February 6, 2025

SIGNATURES

Pursuant to the requirements of the Securities Exchange Act of 1934, Snap-on Incorporated has duly caused this report to be signed on its behalf by the undersigned hereunto duly authorized.

| | | | | | | | |

| | SNAP-ON INCORPORATED |

| | | |

| | | |

Date: February 6, 2025 | By: | /s/ Aldo J. Pagliari |

| | | Aldo J. Pagliari, Principal Financial Officer, |

| | | Senior Vice President – Finance and

Chief Financial Officer |

Exhibit 99

Snap-on Announces Fourth Quarter and Full Year 2024 Results

Diluted EPS of $4.82 for the quarter compares to $4.75 in Q4 2023;

Operating margin before financial services in Q4 2024 improves 50 basis points to 22.1%;

Sales of $1,198.7 million in the quarter compares to $1,196.6 million last year

KENOSHA, Wis. — February 6, 2025 — Snap-on Incorporated (NYSE: SNA), a leading global innovator, manufacturer and marketer of tools, equipment, diagnostics, repair information and systems solutions for professional users performing critical tasks, today announced 2024 operating results for the fourth quarter and full year.

•Net sales of $1,198.7 million in the fourth quarter of 2024 represented an increase of $2.1 million, or 0.2%, from 2023 levels, reflecting a $2.0 million, or 0.2%, organic gain and $2.1 million of acquisition-related sales, partially offset by $2.0 million of unfavorable foreign currency translation.

•Operating earnings before financial services for the quarter of $265.2 million compared to $257.9 million in 2023. As a percentage of net sales, operating earnings before financial services were 22.1% in the fourth quarter compared to 21.6% last year.

•Financial services revenue in the quarter of $100.5 million compared to $97.2 million in 2023; financial services operating earnings of $66.7 million compared to $67.9 million last year.

•Consolidated operating earnings for the quarter of $331.9 million, or 25.5% of revenues (net sales plus financial services revenue), compared to $325.8 million, or 25.2% of revenues, in 2023.

•The fourth quarter effective income tax rate was 22.5% in 2024 and 21.4% last year.

•Net earnings in the quarter of $258.1 million, or $4.82 per diluted share, compared to net earnings of $255.3 million, or $4.75 per diluted share, a year ago.

•Full year net sales of $4,707.4 million in 2024 represented a decrease of $22.8 million, or 0.5%, from 2023 levels, reflecting a $40.6 million, or 0.9%, organic decline and $5.5 million of unfavorable foreign currency translation, partially offset by $23.3 million of acquisition-related sales. Full year net earnings of $1,043.9 million, or $19.51 per diluted share, compared to $1,011.1 million, or $18.76 per diluted share, in 2023, an increase of $32.8 million or $0.75 per diluted share. In 2024, net earnings included a $17.5 million, or $0.32 per diluted share, after-tax benefit for the final payments associated with a legal matter, which were received in the first six months of 2024.

See “Non-GAAP Measures” below for a definition of, and further explanation about, organic sales.

“We are encouraged by our fourth quarter results as our businesses were again strong, achieving a positive balance and overall progress, with our operations serving critical industries and repair shop owners and managers advancing in both sales and profitability, and with the Snap-on Tools Group continuing to narrow the gap versus prior periods despite the environment of general uncertainty,” said Nick Pinchuk, Snap-on chairman and chief executive officer. “In addition to reconfirming the special resilience of our markets and our enterprise, rooted in essential repair, the quarter demonstrates the considerable capabilities of our team, as is evident in the Tools Group success, pivoting our advantages in product, brand, and people to better match the current preferences of technicians for quick payback items. As we proceed into 2025, we’ll enhance the franchise network by further refocusing our product development, manufacturing, and marketing, meeting the demands of the day, extend to critical industries by sharpening our ability to take full advantage of the growing need for customized solutions, and expand our already prominent position with shop owners and managers by serving the rising complexity of vehicle repair. At the same time, we’ll engage our Snap-on Value Creation Processes, driving improvements across the corporation that when combined with our runways for growth, we believe will author substantial and strategic gain. Finally, I want to thank our franchisees and our associates worldwide for their many contributions, for their steadfast dedication, and for their deep confidence in our prospects as we move forward through this 105th year of our company and significantly beyond.”

Segment Results - Fourth Quarter

Commercial & Industrial Group segment sales of $379.2 million in the quarter compared to $363.9 million last year, reflecting a $14.2 million, or 3.9%, organic gain and $2.1 million of acquisition-related sales, partially offset by $1.0 million of unfavorable foreign currency translation. The organic increase is primarily due to higher sales to customers in critical industries, with particular progress in the specialty torque arena.

Operating earnings of $63.5 million in the period compared to $54.1 million in 2023. The operating margin (operating earnings as a percentage of segment sales) improved 180 basis points to 16.7% from 14.9% last year.

Snap-on Tools Group segment sales of $506.6 million in the quarter compared to $513.3 million last year, reflecting a $7.3 million, or 1.4%, organic sales decrease, partially offset by $0.6 million of favorable foreign currency translation. The organic decline is due to lower activity in the U.S., partially offset by higher sales in the segment’s international operations.

Operating earnings of $106.9 million in the period compared to $111.0 million in 2023. The operating margin of 21.1% compared to 21.6% a year ago.

Repair Systems & Information Group segment sales of $456.6 million in the quarter compared to $450.8 million last year, reflecting a $7.3 million, or 1.6%, organic sales increase, partially offset by $1.5 million of unfavorable foreign currency translation. The organic gain includes higher activity with OEM dealerships and increased sales of diagnostic and repair information products to independent repair shop owners and managers, partially offset by lower volumes of undercar equipment.

Operating earnings of $121.4 million in the period compared to $113.3 million in 2023. The operating margin improved 150 basis points to 26.6% from 25.1% last year.

Financial Services operating earnings of $66.7 million on revenue of $100.5 million in the quarter compared to operating earnings of $67.9 million on revenue of $97.2 million a year ago. Originations of $285.1 million in the fourth quarter represented a decrease of $18.0 million, or 5.9%, from 2023 levels.

Corporate expenses in the fourth quarter of $26.6 million compared to $20.5 million last year.

Outlook

We believe that our markets and our operations possess and have demonstrated continuing and considerable resilience against the uncertainties of the current environment. In 2025, Snap-on expects to make ongoing progress along its decisive runways for coherent growth, leveraging capabilities already proven in the automotive repair arena, developing and expanding its professional customer base, not only in automotive repair, but in adjacent markets, additional geographies and other areas, including extending in critical industries, where the cost and penalties for failure can be high. In pursuit of these initiatives, we project that capital expenditures in 2025 will approximate $100 million.

Snap-on currently anticipates that its full-year 2025 effective income tax rate will be in the range of 22% to 23%.

Conference Call and Webcast on February 6, 2025, at 9:00 a.m. Central Time

A discussion of this release will be webcast on Thursday, February 6, 2025, at 9:00 a.m. Central Time, and a replay will be available for at least 10 days following the call. To access the webcast, visit https://www.snapon.com/EN/Investors/Investor-Events and click on the link to the call. The slide presentation accompanying the call can be accessed under the Downloads tab in the webcast viewer, as well as on the Snap-on website at https://www.snapon.com/EN/Investors/Financial-Information/Quarterly-Earnings.

Non-GAAP Measures

References in this release to “organic sales” refer to sales from continuing operations calculated in accordance with generally accepted accounting principles in the United States (“GAAP”), adjusted to exclude acquisition-related sales and the impact of foreign currency translation. Management evaluates the company’s sales performance based on organic sales growth, which primarily reflects growth from the company’s existing businesses as a result of increased output, expanded customer base, geographic expansion, new product development and pricing changes, and excludes sales contributions from acquired operations the company did not own as of the comparable prior-year reporting period. Organic sales also exclude the effects of foreign currency translation as foreign currency translation is subject to volatility that can obscure underlying business trends. Management believes that the non-GAAP financial measure of organic sales is meaningful to investors as it provides them with useful information to aid in identifying underlying growth trends in the company’s businesses and facilitates comparisons of its sales performance with prior periods.

About Snap-on

Snap-on Incorporated is a leading global innovator, manufacturer, and marketer of tools, equipment, diagnostics, repair information and systems solutions for professional users performing critical tasks including those working in vehicle repair, aerospace, the military, natural resources, and manufacturing. From its founding in 1920, Snap-on has been recognized as the mark of the serious and the outward sign of the pride and dignity working men and women take in their professions. Products and services are sold through the company’s network of widely recognized franchisee vans, as well as through direct and distributor channels, under a variety of notable brands. The company also provides financing programs to facilitate the sales of its products and to support its franchise business. Snap-on, an S&P 500 company, generated sales of $4.7 billion in 2024, and is headquartered in Kenosha, Wisconsin.

Forward-looking Statements

Statements in this news release that are not historical facts, including statements that (i) are in the future tense; (ii) include the words “expects,” “anticipates,” “intends,” “approximates,” or similar words that reference Snap-on or its management; (iii) are specifically identified as forward-looking; or (iv) describe Snap-on’s or management’s future outlook, plans, estimates, objectives or goals, are forward-looking statements within the meaning of the Private Securities Litigation Reform Act of 1995. Snap-on cautions the reader that this news release may contain statements, including earnings projections, that are forward-looking in nature and were developed by management in good faith and, accordingly, are subject to risks and uncertainties regarding Snap-on’s expected results that could cause (and in some cases have caused) actual results to differ materially from those described or contemplated in any forward-looking statement. Factors that may cause the company’s actual results to differ materially from those contained in the forward-looking statements include those found in the company’s reports filed with the Securities and Exchange Commission, including the information under the “Safe Harbor” and “Risk Factors” headings in its Annual Report on Form 10-K for the fiscal year ended December 30, 2023, which are incorporated herein by reference. Snap-on disclaims any responsibility to update any forward-looking statement provided in this news release, except as required by law.

# # #

For additional information, please visit www.snapon.com or contact:

Investors: Media:

Sara Verbsky Samuel Bottum

262/656-4869 262/656-5793

SNAP-ON INCORPORATED

Condensed Consolidated Statements of Earnings

(Amounts in millions, except per share data)

(unaudited)

| | | | | | | | | | | | | | | | | | | | | | | |

| Fourth Quarter | | Full Year |

| 2024 | | 2023 | | 2024 | | 2023 |

| | | | | | | |

| Net sales | $ | 1,198.7 | | | $ | 1,196.6 | | | $ | 4,707.4 | | | $ | 4,730.2 | |

| Cost of goods sold | (602.6) | | | (619.0) | | | (2,329.5) | | | (2,381.1) | |

| Gross profit | 596.1 | | | 577.6 | | | 2,377.9 | | | 2,349.1 | |

| Operating expenses | (330.9) | | | (319.7) | | | (1,309.1) | | | (1,309.2) | |

| Operating earnings before financial services | 265.2 | | | 257.9 | | | 1,068.8 | | | 1,039.9 | |

| | | | | | | |

| Financial services revenue | 100.5 | | | 97.2 | | | 401.0 | | | 378.1 | |

| Financial services expenses | (33.8) | | | (29.3) | | | (124.1) | | | (107.6) | |

| Operating earnings from financial services | 66.7 | | | 67.9 | | | 276.9 | | | 270.5 | |

| | | | | | | |

| Operating earnings | 331.9 | | | 325.8 | | | 1,345.7 | | | 1,310.4 | |

| Interest expense | (12.3) | | | (12.5) | | | (49.6) | | | (49.9) | |

| Other income (expense) – net | 19.6 | | | 17.5 | | | 77.0 | | | 67.5 | |

| Earnings before income taxes | 339.2 | | | 330.8 | | | 1,373.1 | | | 1,328.0 | |

| Income tax expense | (75.0) | | | (69.5) | | | (304.2) | | | (293.4) | |

| | | | | | | |

| | | | | | | |

| Net earnings | 264.2 | | | 261.3 | | | 1,068.9 | | | 1,034.6 | |

| Net earnings attributable to noncontrolling interests | (6.1) | | | (6.0) | | | (25.0) | | | (23.5) | |

| Net earnings attributable to Snap-on Inc. | $ | 258.1 | | | $ | 255.3 | | | $ | 1,043.9 | | | $ | 1,011.1 | |

| | | | | | | |

| | | | | | | |

| Net earnings per share attributable to Snap-on Inc.: | | | | | | | |

| Basic | $ | 4.92 | | | $ | 4.84 | | | $ | 19.85 | | | $ | 19.11 | |

| Diluted | 4.82 | | | 4.75 | | | 19.51 | | | 18.76 | |

| | | | | | | |

| Weighted-average shares outstanding: | | | | | | | |

| Basic | 52.5 | | | 52.7 | | | 52.6 | | | 52.9 | |

| Effect of dilutive securities | 1.0 | | | 1.1 | | | 0.9 | | | 1.0 | |

| Diluted | 53.5 | | | 53.8 | | | 53.5 | | | 53.9 | |

SNAP-ON INCORPORATED

Supplemental Segment Information

(Amounts in millions)

(unaudited)

| | | | | | | | | | | | | | | | | | | | | | | |

| Fourth Quarter | | Full Year |

| 2024 | | 2023 | | 2024 | | 2023 |

| Net sales: | | | | | | | |

| Commercial & Industrial Group | $ | 379.2 | | | $ | 363.9 | | | $ | 1,476.8 | | | $ | 1,458.3 | |

| Snap-on Tools Group | 506.6 | | | 513.3 | | | 1,989.2 | | | 2,088.8 | |

| Repair Systems & Information Group | 456.6 | | | 450.8 | | | 1,797.9 | | | 1,781.2 | |

| Segment net sales | 1,342.4 | | | 1,328.0 | | | 5,263.9 | | | 5,328.3 | |

| Intersegment eliminations | (143.7) | | | (131.4) | | | (556.5) | | | (598.1) | |

| Total net sales | 1,198.7 | | | 1,196.6 | | | 4,707.4 | | | 4,730.2 | |

| Financial Services revenue | 100.5 | | | 97.2 | | | 401.0 | | | 378.1 | |

| Total revenues | $ | 1,299.2 | | | $ | 1,293.8 | | | $ | 5,108.4 | | | $ | 5,108.3 | |

| | | | | | | |

| Operating earnings: | | | | | | | |

| Commercial & Industrial Group | $ | 63.5 | | | $ | 54.1 | | | $ | 242.1 | | | $ | 226.1 | |

| Snap-on Tools Group | 106.9 | | | 111.0 | | | 447.3 | | | 493.8 | |

| Repair Systems & Information Group | 121.4 | | | 113.3 | | | 455.2 | | | 433.2 | |

| Financial Services | 66.7 | | | 67.9 | | | 276.9 | | | 270.5 | |

| Segment operating earnings | 358.5 | | | 346.3 | | | 1,421.5 | | | 1,423.6 | |

| Corporate | (26.6) | | | (20.5) | | | (75.8) | | | (113.2) | |

| Operating earnings | 331.9 | | | 325.8 | | | 1,345.7 | | | 1,310.4 | |

| Interest expense | (12.3) | | | (12.5) | | | (49.6) | | | (49.9) | |

| Other income (expense) – net | 19.6 | | | 17.5 | | | 77.0 | | | 67.5 | |

| Earnings before income taxes | $ | 339.2 | | | $ | 330.8 | | | $ | 1,373.1 | | | $ | 1,328.0 | |

SNAP-ON INCORPORATED

Condensed Consolidated Balance Sheets

(Amounts in millions)

(unaudited)

| | | | | | | | | | | |

| Fiscal Year End |

| 2024 | | 2023 |

| Assets | | | |

| Cash and cash equivalents | $ | 1,360.5 | | | $ | 1,001.5 | |

| Trade and other accounts receivable – net | 815.6 | | | 791.3 | |

| Finance receivables – net | 610.3 | | | 594.1 | |

| Contract receivables – net | 120.0 | | | 120.8 | |

| Inventories – net | 943.4 | | | 1,005.9 | |

| Prepaid expenses and other current assets | 139.6 | | | 138.4 | |

| Total current assets | 3,989.4 | | | 3,652.0 | |

| | | |

| Property and equipment – net | 542.6 | | | 539.3 | |

| Operating lease right-of-use assets | 89.4 | | | 74.7 | |

| Deferred income tax assets | 78.0 | | | 76.0 | |

| Long-term finance receivables – net | 1,312.0 | | | 1,284.2 | |

| Long-term contract receivables – net | 418.3 | | | 407.9 | |

| Goodwill | 1,056.8 | | | 1,097.4 | |

| Other intangible assets – net | 267.6 | | | 268.9 | |

| Pension assets | 125.4 | | | 130.5 | |

| Other long-term assets | 17.3 | | | 14.0 | |

| Total assets | $ | 7,896.8 | | | $ | 7,544.9 | |

| | | |

| Liabilities and Equity | | | |

| Notes payable | $ | 13.7 | | | $ | 15.6 | |

| Accounts payable | 265.9 | | | 238.0 | |

| Accrued benefits | 67.2 | | | 64.4 | |

| Accrued compensation | 86.1 | | | 102.9 | |

| Franchisee deposits | 70.9 | | | 73.3 | |

| Other accrued liabilities | 457.7 | | | 447.4 | |

| Total current liabilities | 961.5 | | | 941.6 | |

| | | |

| Long-term debt | 1,185.5 | | | 1,184.6 | |

| Deferred income tax liabilities | 73.5 | | | 79.2 | |

| Retiree health care benefits | 19.4 | | | 21.8 | |

| Pension liabilities | 78.4 | | | 82.3 | |

| Operating lease liabilities | 68.6 | | | 54.6 | |

| Other long-term liabilities | 92.9 | | | 87.4 | |

| Total liabilities | 2,479.8 | | | 2,451.5 | |

| | | |

| Equity | | | |

| Shareholders' equity attributable to Snap-on Inc. | | | |

| Common stock | 67.5 | | | 67.5 | |

| Additional paid-in capital | 557.7 | | | 545.5 | |

| Retained earnings | 7,584.3 | | | 6,948.5 | |

| Accumulated other comprehensive loss | (575.0) | | | (449.5) | |

| Treasury stock at cost | (2,240.4) | | | (2,040.7) | |

| Total shareholders' equity attributable to Snap-on Inc. | 5,394.1 | | | 5,071.3 | |

| Noncontrolling interests | 22.9 | | | 22.1 | |

| Total equity | 5,417.0 | | | 5,093.4 | |

| Total liabilities and equity | $ | 7,896.8 | | | $ | 7,544.9 | |

| | | |

SNAP-ON INCORPORATED

Condensed Consolidated Statements of Cash Flows

(Amounts in millions)

(unaudited)

| | | | | | | | | | | |

| Fourth Quarter |

| 2024 | | 2023 |

| Operating activities: | | | |

| Net earnings | $ | 264.2 | | | $ | 261.3 | |

| Adjustments to reconcile net earnings to net cash provided (used) by operating activities: | | | |

| Depreciation | 18.0 | | | 18.6 | |

| Amortization of other intangible assets | 6.3 | | | 6.4 | |

| Provision for losses on finance receivables | 20.5 | | | 16.5 | |

| Provision for losses on non-finance receivables | 5.0 | | | 4.2 | |

| Stock-based compensation expense | 7.1 | | | 13.3 | |

| Deferred income tax benefit | (1.0) | | | (2.2) | |

| Gain on sales of assets | (0.1) | | | (0.4) | |

| Changes in operating assets and liabilities, net of effects of acquisitions: | | | |

| Trade and other accounts receivable | (44.8) | | | (6.9) | |

| Contract receivables | (2.0) | | | (6.1) | |

| Inventories | 19.2 | | | 44.3 | |

| Prepaid expenses and other current assets | (0.1) | | | 4.8 | |

| Accounts payable | (4.6) | | | (52.4) | |

| Accrued and other liabilities | 5.8 | | | (4.5) | |

| Net cash provided by operating activities | 293.5 | | | 296.9 | |

| | | |

| Investing activities: | | | |

| Additions to finance receivables | (234.7) | | | (249.2) | |

| Collections of finance receivables | 208.5 | | | 207.0 | |

| Capital expenditures | (18.1) | | | (21.1) | |

| Acquisitions of businesses, net of cash acquired | — | | | (42.6) | |

| Disposals of property and equipment | 1.1 | | | 1.2 | |

| Other | 3.0 | | | 0.1 | |

| Net cash used by investing activities | (40.2) | | | (104.6) | |

| | | |

| Financing activities: | | | |

| Net decrease in other short-term borrowings | (0.4) | | | (1.7) | |

| Cash dividends paid | (112.3) | | | (98.0) | |

| Purchases of treasury stock | (112.5) | | | (60.9) | |

| Proceeds from stock purchase plans and stock option exercises | 30.7 | | | 19.1 | |

| Other | (7.0) | | | (7.5) | |

| Net cash used by financing activities | (201.5) | | | (149.0) | |

| | | |

| Effect of exchange rate changes on cash and cash equivalents | (4.6) | | | (1.1) | |

| Increase in cash and cash equivalents | 47.2 | | | 42.2 | |

| | | |

| Cash and cash equivalents at beginning of period | 1,313.3 | | | 959.3 | |

| Cash and cash equivalents at end of year | $ | 1,360.5 | | | $ | 1,001.5 | |

| | | |

| Supplemental cash flow disclosures: | | | |

| Cash paid for interest | $ | (8.3) | | | $ | (8.4) | |

| Net cash paid for income taxes | (61.8) | | | (76.4) | |

SNAP-ON INCORPORATED

Condensed Consolidated Statements of Cash Flows

(Amounts in millions)

(unaudited)

| | | | | | | | | | | |

| Full Year |

| 2024 | | 2023 |

| Operating activities: | | | |

| Net earnings | $ | 1,068.9 | | | $ | 1,034.6 | |

| Adjustments to reconcile net earnings to net cash provided (used) by operating activities: | | | |

| Depreciation | 72.7 | | | 72.2 | |

| Amortization of other intangible assets | 25.3 | | | 27.1 | |

| Provision for losses on finance receivables | 71.1 | | | 57.2 | |

| Provision for losses on non-finance receivables | 22.8 | | | 19.2 | |

| Stock-based compensation expense | 28.6 | | | 44.7 | |

| Deferred income tax benefit | (8.2) | | | (18.7) | |

| Gain on sales of assets | (0.6) | | | (1.0) | |

| | | |

| Changes in operating assets and liabilities, net of effects of acquisitions: | | | |

| Trade and other accounts receivable | (72.9) | | | (45.2) | |

| Contract receivables | (17.4) | | | (34.0) | |

| Inventories | 27.8 | | | 23.3 | |

| Prepaid expenses and other current assets | 10.4 | | | 35.1 | |

| Accounts payable | 29.0 | | | (48.1) | |

| Accrued and other liabilities | (40.0) | | | (12.2) | |

| Net cash provided by operating activities | 1,217.5 | | | 1,154.2 | |

| | | |

| Investing activities: | | | |

| Additions to finance receivables | (966.0) | | | (1,029.0) | |

| Collections of finance receivables | 837.8 | | | 833.5 | |

| Capital expenditures | (83.5) | | | (95.0) | |

| Acquisitions of businesses, net of cash acquired | — | | | (42.6) | |

| Disposals of property and equipment | 3.1 | | | 2.7 | |

| Other | 4.5 | | | (1.4) | |

| Net cash used by investing activities | (204.1) | | | (331.8) | |

| | | |

| Financing activities: | | | |

| | | |

| | | |

| | | |

| Net decrease in other short-term borrowings | (1.3) | | | (1.7) | |

| Cash dividends paid | (406.4) | | | (355.6) | |

| Purchases of treasury stock | (290.0) | | | (294.7) | |

| Proceeds from stock purchase plans and stock option exercises | 92.3 | | | 113.6 | |

| Other | (44.4) | | | (34.5) | |

| Net cash used by financing activities | (649.8) | | | (572.9) | |

| | | |

| Effect of exchange rate changes on cash and cash equivalents | (4.6) | | | (5.2) | |

| Increase in cash and cash equivalents | 359.0 | | | 244.3 | |

| | | |

| Cash and cash equivalents at beginning of year | 1,001.5 | | | 757.2 | |

| Cash and cash equivalents at end of year | $ | 1,360.5 | | | $ | 1,001.5 | |

| | | |

| Supplemental cash flow disclosures: | | | |

| Cash paid for interest | $ | (44.1) | | | $ | (44.5) | |

| Net cash paid for income taxes | (305.7) | | | (300.9) | |

| | | |

Non-GAAP Supplemental Data

The following non-GAAP supplemental data is presented for informational purposes to provide readers with insight into the information used by management for assessing the operating performance of Snap-on Incorporated's (“Snap-on”) non-financial services (“Operations”) and Financial Services businesses.

The supplemental Operations data reflects the results of operations and financial position of Snap-on's tools, diagnostics, equipment products, software and other non-financial services operations with Financial Services presented on the equity method. The supplemental Financial Services data reflects the results of operations and financial position of Snap-on's U.S. and international financial services operations. The financing needs of Financial Services are met through intersegment borrowings and cash generated from Operations; Financial Services is charged interest expense on intersegment borrowings at market rates. Income taxes are charged to Financial Services on the basis of the specific tax attributes generated by the U.S. and international financial services businesses. Transactions between the Operations and Financial Services businesses are eliminated to arrive at the Condensed Consolidated Financial Statements.

SNAP-ON INCORPORATED

Non-GAAP Supplemental Consolidating Data - Supplemental Condensed Statements of Earnings

(Amounts in millions)

(unaudited)

| | | | | | | | | | | | | | | | | | | | | | | |

| Operations* | | Financial Services |

| Fourth Quarter | | Fourth Quarter |

| 2024 | | 2023 | | 2024 | | 2023 |

| | | | | | | |

| Net sales | $ | 1,198.7 | | | $ | 1,196.6 | | | $ | — | | | $ | — | |

| Cost of goods sold | (602.6) | | | (619.0) | | | — | | | — | |

| Gross profit | 596.1 | | | 577.6 | | | — | | | — | |

| Operating expenses | (330.9) | | | (319.7) | | | — | | | — | |

| Operating earnings before financial services | 265.2 | | | 257.9 | | | — | | | — | |

| | | | | | | |

| Financial services revenue | — | | | — | | | 100.5 | | | 97.2 | |

| Financial services expenses | — | | | — | | | (33.8) | | | (29.3) | |

| Operating earnings from financial services | — | | | — | | | 66.7 | | | 67.9 | |

| | | | | | | |

| Operating earnings | 265.2 | | | 257.9 | | | 66.7 | | | 67.9 | |

| Interest expense | (12.3) | | | (12.5) | | | — | | | — | |

| Intersegment interest income (expense) – net | 16.5 | | | 16.0 | | | (16.5) | | | (16.0) | |

| Other income (expense) – net | 19.5 | | | 17.5 | | | 0.1 | | | — | |

| Earnings before income taxes and equity earnings | 288.9 | | | 278.9 | | | 50.3 | | | 51.9 | |

| Income tax expense | (62.4) | | | (57.8) | | | (12.6) | | | (11.7) | |

| Earnings before equity earnings | 226.5 | | | 221.1 | | | 37.7 | | | 40.2 | |

| Financial services – net earnings attributable to Snap-on | 37.7 | | | 40.2 | | | — | | | — | |

| | | | | | | |

| Net earnings | 264.2 | | | 261.3 | | | 37.7 | | | 40.2 | |

| Net earnings attributable to noncontrolling interests | (6.1) | | | (6.0) | | | — | | | — | |

| Net earnings attributable to Snap-on | $ | 258.1 | | | $ | 255.3 | | | $ | 37.7 | | | $ | 40.2 | |

| | | | | | | |

| * Snap-on with Financial Services presented on the equity method. |

SNAP-ON INCORPORATED

Non-GAAP Supplemental Consolidating Data - Supplemental Condensed Statements of Earnings

(Amounts in millions)

(unaudited)

| | | | | | | | | | | | | | | | | | | | | | | |

| Operations* | | Financial Services |

| | Full Year | | Full Year |

| | 2024 | | 2023 | | 2024 | | 2023 |

| | | | | | | |

| Net sales | $ | 4,707.4 | | | $ | 4,730.2 | | | $ | — | | | $ | — | |

| Cost of goods sold | (2,329.5) | | | (2,381.1) | | | — | | | — | |

| Gross profit | 2,377.9 | | | 2,349.1 | | | — | | | — | |

| Operating expenses | (1,309.1) | | | (1,309.2) | | | — | | | — | |

| Operating earnings before financial services | 1,068.8 | | | 1,039.9 | | | — | | | — | |

| | | | | | | |

| Financial services revenue | — | | | — | | | 401.0 | | | 378.1 | |

| Financial services expenses | — | | | — | | | (124.1) | | | (107.6) | |

| Operating earnings from financial services | — | | | — | | | 276.9 | | | 270.5 | |

| | | | | | | |

| Operating earnings | 1,068.8 | | | 1,039.9 | | | 276.9 | | | 270.5 | |

| Interest expense | (49.6) | | | (49.9) | | | — | | | — | |

| Intersegment interest income (expense) – net | 67.1 | | | 63.9 | | | (67.1) | | | (63.9) | |

| Other income (expense) – net | 76.8 | | | 67.3 | | | 0.2 | | | 0.2 | |

| Earnings before income taxes and equity earnings | 1,163.1 | | | 1,121.2 | | | 210.0 | | | 206.8 | |

| Income tax expense | (251.7) | | | (241.6) | | | (52.5) | | | (51.8) | |

| Earnings before equity earnings | 911.4 | | | 879.6 | | | 157.5 | | | 155.0 | |

| Financial services – net earnings attributable to Snap-on | 157.5 | | | 155.0 | | | — | | | — | |

| | | | | | | |

| Net earnings | 1,068.9 | | | 1,034.6 | | | 157.5 | | | 155.0 | |

| Net earnings attributable to noncontrolling interests | (25.0) | | | (23.5) | | | — | | | — | |

| Net earnings attributable to Snap-on | $ | 1,043.9 | | | $ | 1,011.1 | | | $ | 157.5 | | | $ | 155.0 | |

| | | | | | | |

| * Snap-on with Financial Services presented on the equity method. |

SNAP-ON INCORPORATED

Non-GAAP Supplemental Consolidating Data - Supplemental Condensed Balance Sheets

(Amounts in millions)

(unaudited)

| | | | | | | | | | | | | | | | | | | | | | | |

| | Operations* | | Financial Services |

| | Fiscal Year End | | Fiscal Year End |

| | 2024 | | 2023 | | 2024 | | 2023 |

| Assets | | | | | | | |

| Cash and cash equivalents | $ | 1,360.4 | | | $ | 1,001.3 | | | $ | 0.1 | | | $ | 0.2 | |

| Intersegment receivables | 15.1 | | | 15.7 | | | — | | | — | |

| Trade and other accounts receivable – net | 815.0 | | | 790.6 | | | 0.6 | | | 0.7 | |

| Finance receivables – net | — | | | — | | | 610.3 | | | 594.1 | |

| Contract receivables – net | 4.8 | | | 5.5 | | | 115.2 | | | 115.3 | |

| Inventories – net | 943.4 | | | 1,005.9 | | | — | | | — | |

| Prepaid expenses and other current assets | 143.8 | | | 143.2 | | | 9.4 | | | 7.4 | |

| Total current assets | 3,282.5 | | | 2,962.2 | | | 735.6 | | | 717.7 | |

| | | | | | | |

| Property and equipment – net | 540.2 | | | 536.5 | | | 2.4 | | | 2.8 | |

| Operating lease right-of-use assets | 83.8 | | | 73.8 | | | 5.6 | | | 0.9 | |

| Investment in Financial Services | 403.5 | | | 393.9 | | | — | | | — | |

| Deferred income tax assets | 51.8 | | | 51.3 | | | 26.2 | | | 24.7 | |

| Intersegment long-term notes receivable | 831.8 | | | 785.6 | | | — | | | — | |

| Long-term finance receivables – net | — | | | — | | | 1,312.0 | | | 1,284.2 | |

| Long-term contract receivables – net | 8.4 | | | 8.3 | | | 409.9 | | | 399.6 | |

| Goodwill | 1,056.8 | | | 1,097.4 | | | — | | | — | |

| Other intangible assets – net | 267.6 | | | 268.9 | | | — | | | — | |

| Pension assets | 125.4 | | | 130.5 | | | — | | | — | |

| Other long-term assets | 35.6 | | | 30.2 | | | 0.2 | | | 0.1 | |

| Total assets | $ | 6,687.4 | | | $ | 6,338.6 | | | $ | 2,491.9 | | | $ | 2,430.0 | |

| | | | | | | |

| Liabilities and Equity | | | | | | | |

| Notes payable | $ | 13.7 | | | $ | 15.6 | | | $ | — | | | $ | — | |

| Accounts payable | 265.4 | | | 236.2 | | | 0.5 | | | 1.8 | |

| Intersegment payables | — | | | — | | | 15.1 | | | 15.7 | |

| Accrued benefits | 67.2 | | | 64.4 | | | — | | | — | |

| Accrued compensation | 83.5 | | | 99.9 | | | 2.6 | | | 3.0 | |

| Franchisee deposits | 70.9 | | | 73.3 | | | — | | | — | |

| Other accrued liabilities | 443.6 | | | 432.2 | | | 27.7 | | | 27.4 | |

| Total current liabilities | 944.3 | | | 921.6 | | | 45.9 | | | 47.9 | |

| | | | | | | |

| Long-term debt and intersegment long-term debt | — | | | — | | | 2,017.3 | | | 1,970.2 | |

| Deferred income tax liabilities | 73.5 | | | 79.2 | | | — | | | — | |

| Retiree health care benefits | 19.4 | | | 21.8 | | | — | | | — | |

| Pension liabilities | 78.4 | | | 82.3 | | | — | | | — | |

| Operating lease liabilities | 63.0 | | | 54.0 | | | 5.6 | | | 0.6 | |

| Other long-term liabilities | 91.8 | | | 86.3 | | | 19.6 | | | 17.4 | |

| Total liabilities | 1,270.4 | | | 1,245.2 | | | 2,088.4 | | | 2,036.1 | |

| | | | | | | |

| Total shareholders' equity attributable to Snap-on | 5,394.1 | | | 5,071.3 | | | 403.5 | | | 393.9 | |

| Noncontrolling interests | 22.9 | | | 22.1 | | | — | | | — | |

| Total equity | 5,417.0 | | | 5,093.4 | | | 403.5 | | | 393.9 | |

| Total liabilities and equity | $ | 6,687.4 | | | $ | 6,338.6 | | | $ | 2,491.9 | | | $ | 2,430.0 | |

| | | | | | | |

| * Snap-on with Financial Services presented on the equity method. |

Cover

|

Feb. 06, 2025 |

| Cover [Abstract] |

|

| Document Type |

8-K

|

| Document Period End Date |

Feb. 06, 2025

|

| Entity Registrant Name |

Snap-on Inc

|

| Entity Incorporation, State or Country Code |

DE

|

| Entity File Number |

001-07724

|

| Entity Tax Identification Number |

39-0622040

|

| Entity Address, Address Line One |

2801 80th Street,

|

| Entity Address, City or Town |

Kenosha,

|

| Entity Address, State or Province |

WI

|

| Entity Address, Postal Zip Code |

53143-5656

|

| City Area Code |

262

|

| Local Phone Number |

656-5200

|

| Written Communications |

false

|

| Soliciting Material |

false

|

| Pre-commencement Tender Offer |

false

|

| Pre-commencement Issuer Tender Offer |

false

|

| Title of 12(b) Security |

Common Stock, $1.00 par value

|

| Trading Symbol |

SNA

|

| Security Exchange Name |

NYSE

|

| Entity Emerging Growth Company |

false

|

| Entity Central Index Key |

0000091440

|

| Amendment Flag |

false

|

| X |

- DefinitionBoolean flag that is true when the XBRL content amends previously-filed or accepted submission.

| Name: |

dei_AmendmentFlag |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:booleanItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionFor the EDGAR submission types of Form 8-K: the date of the report, the date of the earliest event reported; for the EDGAR submission types of Form N-1A: the filing date; for all other submission types: the end of the reporting or transition period. The format of the date is YYYY-MM-DD.

| Name: |

dei_DocumentPeriodEndDate |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:dateItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionThe type of document being provided (such as 10-K, 10-Q, 485BPOS, etc). The document type is limited to the same value as the supporting SEC submission type, or the word 'Other'.

| Name: |

dei_DocumentType |

| Namespace Prefix: |

dei_ |

| Data Type: |

dei:submissionTypeItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionAddress Line 1 such as Attn, Building Name, Street Name

| Name: |

dei_EntityAddressAddressLine1 |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:normalizedStringItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- Definition

+ References

+ Details

| Name: |

dei_EntityAddressCityOrTown |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:normalizedStringItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionCode for the postal or zip code

| Name: |

dei_EntityAddressPostalZipCode |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:normalizedStringItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionName of the state or province.

| Name: |

dei_EntityAddressStateOrProvince |

| Namespace Prefix: |

dei_ |

| Data Type: |

dei:stateOrProvinceItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionA unique 10-digit SEC-issued value to identify entities that have filed disclosures with the SEC. It is commonly abbreviated as CIK. Reference 1: http://www.xbrl.org/2003/role/presentationRef

-Publisher SEC

-Name Exchange Act

-Number 240

-Section 12

-Subsection b-2

| Name: |

dei_EntityCentralIndexKey |

| Namespace Prefix: |

dei_ |

| Data Type: |

dei:centralIndexKeyItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionIndicate if registrant meets the emerging growth company criteria. Reference 1: http://www.xbrl.org/2003/role/presentationRef

-Publisher SEC

-Name Exchange Act

-Number 240

-Section 12

-Subsection b-2

| Name: |

dei_EntityEmergingGrowthCompany |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:booleanItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionCommission file number. The field allows up to 17 characters. The prefix may contain 1-3 digits, the sequence number may contain 1-8 digits, the optional suffix may contain 1-4 characters, and the fields are separated with a hyphen.

| Name: |

dei_EntityFileNumber |

| Namespace Prefix: |

dei_ |

| Data Type: |

dei:fileNumberItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionTwo-character EDGAR code representing the state or country of incorporation.

| Name: |

dei_EntityIncorporationStateCountryCode |

| Namespace Prefix: |

dei_ |

| Data Type: |

dei:edgarStateCountryItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionThe exact name of the entity filing the report as specified in its charter, which is required by forms filed with the SEC. Reference 1: http://www.xbrl.org/2003/role/presentationRef

-Publisher SEC

-Name Exchange Act

-Number 240

-Section 12

-Subsection b-2

| Name: |

dei_EntityRegistrantName |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:normalizedStringItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionThe Tax Identification Number (TIN), also known as an Employer Identification Number (EIN), is a unique 9-digit value assigned by the IRS. Reference 1: http://www.xbrl.org/2003/role/presentationRef

-Publisher SEC

-Name Exchange Act

-Number 240

-Section 12

-Subsection b-2

| Name: |

dei_EntityTaxIdentificationNumber |

| Namespace Prefix: |

dei_ |

| Data Type: |

dei:employerIdItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionLocal phone number for entity.

| Name: |

dei_LocalPhoneNumber |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:normalizedStringItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionBoolean flag that is true when the Form 8-K filing is intended to satisfy the filing obligation of the registrant as pre-commencement communications pursuant to Rule 13e-4(c) under the Exchange Act. Reference 1: http://www.xbrl.org/2003/role/presentationRef

-Publisher SEC

-Name Exchange Act

-Number 240

-Section 13e

-Subsection 4c

| Name: |

dei_PreCommencementIssuerTenderOffer |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:booleanItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionBoolean flag that is true when the Form 8-K filing is intended to satisfy the filing obligation of the registrant as pre-commencement communications pursuant to Rule 14d-2(b) under the Exchange Act. Reference 1: http://www.xbrl.org/2003/role/presentationRef

-Publisher SEC

-Name Exchange Act

-Number 240

-Section 14d

-Subsection 2b

| Name: |

dei_PreCommencementTenderOffer |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:booleanItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionTitle of a 12(b) registered security. Reference 1: http://www.xbrl.org/2003/role/presentationRef

-Publisher SEC

-Name Exchange Act

-Number 240

-Section 12

-Subsection b

| Name: |

dei_Security12bTitle |

| Namespace Prefix: |

dei_ |

| Data Type: |

dei:securityTitleItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionName of the Exchange on which a security is registered. Reference 1: http://www.xbrl.org/2003/role/presentationRef

-Publisher SEC

-Name Exchange Act

-Number 240

-Section 12

-Subsection d1-1

| Name: |

dei_SecurityExchangeName |

| Namespace Prefix: |

dei_ |

| Data Type: |

dei:edgarExchangeCodeItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionBoolean flag that is true when the Form 8-K filing is intended to satisfy the filing obligation of the registrant as soliciting material pursuant to Rule 14a-12 under the Exchange Act. Reference 1: http://www.xbrl.org/2003/role/presentationRef

-Publisher SEC

-Name Exchange Act

-Section 14a

-Number 240

-Subsection 12

| Name: |

dei_SolicitingMaterial |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:booleanItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionTrading symbol of an instrument as listed on an exchange.

| Name: |

dei_TradingSymbol |

| Namespace Prefix: |

dei_ |

| Data Type: |

dei:tradingSymbolItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionBoolean flag that is true when the Form 8-K filing is intended to satisfy the filing obligation of the registrant as written communications pursuant to Rule 425 under the Securities Act. Reference 1: http://www.xbrl.org/2003/role/presentationRef

-Publisher SEC

-Name Securities Act

-Number 230

-Section 425

| Name: |

dei_WrittenCommunications |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:booleanItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

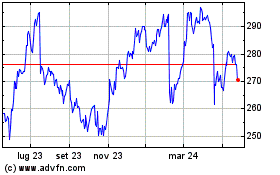

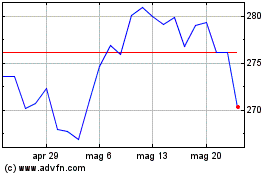

Grafico Azioni Snap on (NYSE:SNA)

Storico

Da Feb 2025 a Mar 2025

Grafico Azioni Snap on (NYSE:SNA)

Storico

Da Mar 2024 a Mar 2025