TABLE OF CONTENTS

UNITED STATES

SECURITIES AND EXCHANGE COMMISSION

Washington, D.C. 20549

SCHEDULE 14D-9

SOLICITATION/RECOMMENDATION STATEMENT

UNDER SECTION 14(d)(4) OF THE SECURITIES EXCHANGE ACT OF 1934

(Amendment No. 1)

Squarespace, Inc.

(Name of Subject Company)

Squarespace, Inc.

(Name of Person(s) Filing Statement)

Class A Common Stock, $0.0001 par value per share

Class B Common Stock, $0.0001 par value per share

Class C Common Stock, $0.0001 par value per share

(Title of Class of Securities)

Class A Common Stock: 85225A107

(CUSIP Number of Class of Securities)

Anthony Casalena

Chief Executive Officer

225 Varick Street,

12th Floor

New York,

New York 10014

Tel: (646) 580-3456

(Name, Address and Telephone Number of Person Authorized to Receive Notices and Communications

on Behalf of the Person(s) Filing Statement)

With copies to:

| | | |

Allison Schneirov

Christopher Barlow

Daniel Luks

Skadden, Arps, Slate, Meagher &

Flom LLP

One Manhattan West

New York, NY 10001

Tel: (212) 735-3000 | | | Srinivas Raju

Nathaniel Stuhlmiller

Richards, Layton & Finger, P.A.

920 North King Street

Wilmington, Delaware 19801

Tel: (302) 651-7700 |

| | | |

☐

| Check the box if the filing relates solely to preliminary communications made before the commencement of a tender offer. |

TABLE OF CONTENTS

Explanatory Note

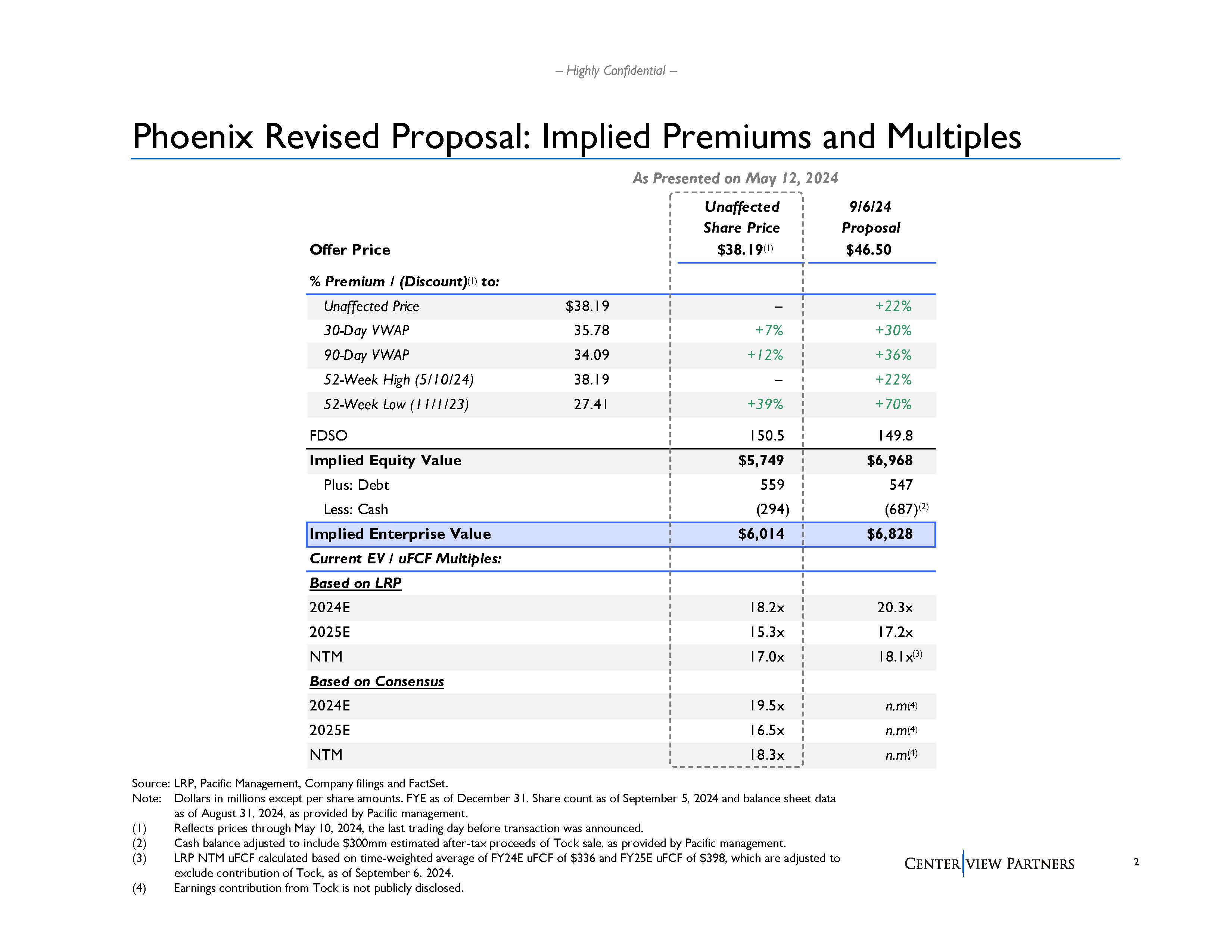

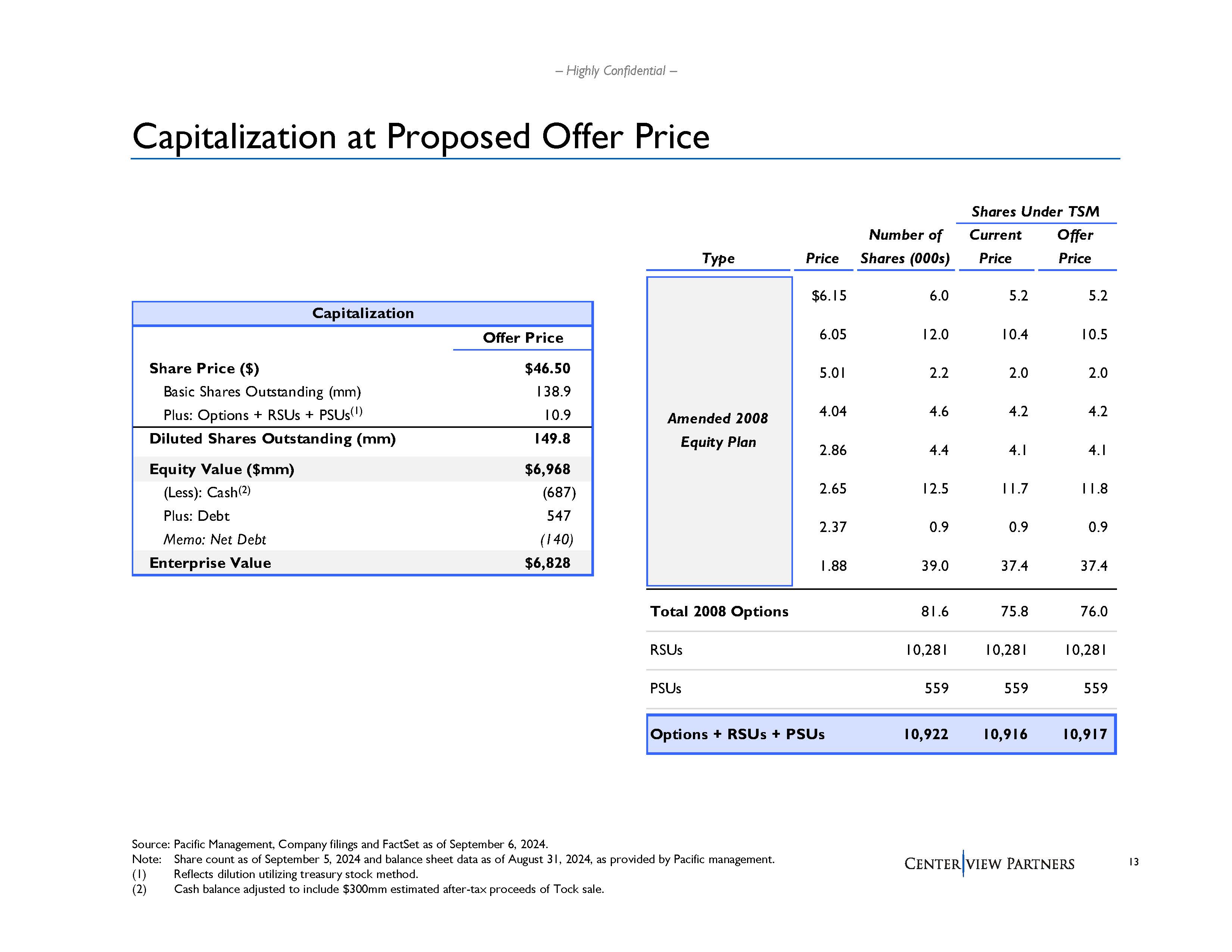

This Amendment No. 1 (which we refer to as this “Amendment No. 1”) amends and supplements the Solicitation/Recommendation Statement on Schedule 14D-9 filed with the U.S. Securities and Exchange Commission (which we refer to as the “SEC”) on September 16, 2024, by Squarespace, Inc., a Delaware corporation (which we refer to as “Squarespace”). We refer to the Schedule 14D-9, together with the exhibits thereto and as it may be amended or supplemented from time to time, as the “Schedule 14D-9.” The Schedule 14D-9 relates to the cash tender offer (which we refer to as the “Offer”) by Spaceship Group MergerCo, Inc., a Delaware corporation (which we refer to as “Purchaser”) and a wholly owned subsidiary of Spaceship Purchaser, Inc., a Delaware corporation (which we refer to as “Parent”), to purchase all of the outstanding Shares at an offer price of $46.50 per Share (which we refer to as the “Offer Price”).

The Offer is disclosed in the Tender Offer Statement on Schedule TO, as amended or supplemented from time to time, filed by Parent and Purchaser with the SEC on September 16, 2021, and is made upon the terms and subject to the conditions set forth in the related offer to purchase (which we refer to, as it may be amended or supplemented from time to time, as the “Offer to Purchase”) and the related letter of transmittal (which we refer to, as it may be amended or supplemented from time to time, as the “Letter of Transmittal”). The Offer to Purchase and the Letter of Transmittal were filed as Exhibits (a)(1)(A) and (a)(1)(B) to the Schedule 14D-9, respectively. Unless the context otherwise indicates, we use the terms “us,” “we” and “our” to refer to Squarespace.

Capitalized terms used but not otherwise defined in this Amendment No. 1 have the meanings given to them in the Schedule 14D-9. The information in the Schedule 14D-9 is incorporated by reference into this Amendment No. 1, except that such information is amended and supplemented to the extent specifically provided in this Amendment No. 1.

TABLE OF CONTENTS

| Subject Company Information |

Name and Address

The name of the subject company to which this Solicitation/Recommendation Statement on Schedule 14D-9 (together with any exhibits and annexes attached hereto, this “Schedule 14D-9”) relates is Squarespace, Inc., a Delaware corporation (“Squarespace”). Unless the context indicates otherwise, we use the terms “us,” “we” and “our” to refer to Squarespace. The address of Squarespace’s principal executive office is 225 Varick Street, 12th Floor, New York, New York 10014. The telephone number of Squarespace’s principal executive office is (646) 580-3456.

Securities

The title of the class of equity securities to which this Schedule 14D-9 relates is the Class A common stock, par value $0.0001 per share, of Squarespace (which we refer to as “Class A Shares”), the Class B common stock, par value $0.0001 per share, of Squarespace (which we refer to as “Class B Shares”) and the Class C common stock, par value $0.0001 per share, of Squarespace (which we refer to as “Class C Shares,” collectively with Class A Shares and Class B Shares, the “Shares” or the “Squarespace Common Stock”).

As of September 1, 2024, there were (1) 91,086,529 Class A Shares issued and outstanding; (2) 47,844,755 Class B Shares issued and outstanding; and (3) no Class C Shares issued and outstanding.

Also as of September 1, there were (1) an aggregate of 10,297,794 shares of Squarespace Common Stock underlying outstanding restricted stock units (RSUs), 37,182 of which were held by our current non-employee directors and 623,700 of which were held by our current executive officers and (2) an aggregate of 559,382 shares of Squarespace Common Stock underlying outstanding performance restricted stock units (PSUs) (assuming achievement of target level performance and excluding Mr. Casalena’s Squarespace PSUs which will be automatically forfeited in connection with the Transactions without the payment of any consideration), none of which were held by our current non-employee directors and 256,410 of which were held by our current executive officers.

TABLE OF CONTENTS

| Identity and Background of Filing Person |

Name and Address

Squarespace, the subject company, is the person filing this Schedule 14D-9. The name, business address and business telephone number of Squarespace are set forth in the section of this Schedule 14D-9 captioned “Item 1. Subject Company Information—Name and Address.”

Tender Offer

This Schedule 14D-9 relates to the cash tender offer (which we refer to as the “Offer”) by Spaceship Group MergerCo, Inc., a Delaware corporation (which we refer to as “Purchaser”) and a wholly owned subsidiary of Spaceship Purchaser, Inc., a Delaware corporation (which we refer to as “Parent”), to purchase all of the outstanding Shares at an offer price of $46.50 per Share (which we refer to as the “Offer Price”).

The Offer is being made upon the terms and subject to the conditions set forth in the Offer to Purchase, dated September 16, 2024 (as it may be amended or supplemented from time to time, and which we refer to as the “Offer to Purchase”), and the related form of Letter of Transmittal (as it may be amended or supplemented from time to time, and which we refer to as the “Letter of Transmittal”), pursuant to the Amended and Restated Agreement and Plan of Merger (as it may be amended from time to time, and which we refer to as the “A&R Merger Agreement”), dated September 9, 2024, by and among Parent, Purchaser (together, the “Buyer Parties”) and Squarespace. The A&R Merger Agreement amends and restates and supersedes the Agreement and Plan of Merger, dated May 13, 2024 (which we refer to as the “Original Merger Agreement”), by and among the Buyer Parties and Squarespace. A more complete description of the A&R Merger Agreement can be found in Section 10 of the Offer to Purchase. A copy of the A&R Merger Agreement is filed as Exhibit (e)(1) to this Schedule 14D-9 and is incorporated in this Schedule 14D-9 by reference. The Offer is described in a Tender Offer Statement on Schedule TO (as it may be amended or supplemented from time to time, which we refer to as the “Schedule TO”) filed by Purchaser and Parent with the Securities and Exchange Commission (which we refer to as the “SEC”) on September 16, 2024. Copies of The Offer to Purchase and form of Letter of Transmittal are filed as Exhibits (a)(1)(A) and (a)(1)(B) hereto, respectively, and are incorporated herein by reference. The Offer to Purchase and form of Letter of Transmittal are being mailed to Squarespace’s stockholders together with this Schedule 14D-9.

Pursuant to the A&R Merger Agreement, upon the terms and subject to the conditions thereof, Purchaser will (and Parent will cause Purchaser to) (1) promptly after the Expiration Date (as defined below), accept for payment all Shares tendered (and not validly withdrawn) pursuant to the Offer (we refer to the time of such acceptance as the “Offer Acceptance Time”); and (2) as promptly as practicable after the Offer Acceptance Time, pay for such Shares by delivery of funds to the depositary for the Offer. Parent shall provide or cause to be provided to Purchaser the consideration necessary for Purchaser to comply with such obligations to accept for payment and pay for such Shares.

As promptly as practicable following (but in any event on the same day as) the consummation of the Offer, the subsequent direct or indirect contribution by the Rollover Stockholders of a portion of the Shares to an entity that indirectly owns 100% of the equity interest of Parent (the “Rollover”), the subsequent sale (substantially concurrent with the Accel Share Sale and the GA Share Sale) by the Anthony Casalena 2019 Family Trust, the Anthony Casalena Revocable Trust and the Casalena Foundation of a portion of the Shares to an entity that indirectly owns 100% of the equity interest of Parent (the “Casalena Share Sale”), the subsequent sale (substantially concurrent with the GA Share Sale and the Casalena Share Sale) by Accel Growth Fund L.P., Accel Growth Fund Strategic Partners L.P. and Accel Growth Fund Investors 2010 L.L.C. (collectively, the “Accel Share Sellers”) of all of the Shares held by the Accel Share Sellers at the Offer Price to an entity that indirectly owns 100% of the equity interest of Parent (the “Accel Share Sale”), the subsequent sale (substantially concurrent with the Accel Share Sale and the Casalena Share Sale) by General Atlantic (SQRS II), L.P. of a portion of the Shares at the Offer Price to an entity that indirectly owns 100% of the equity interest of Parent (the “GA Share Sale” and together with the Accel Share Sale and the Casalena Share Sale, the “Share Sales” and each, a “Share Sale”), or at such other time as Parent and the Company mutually agree in writing, the A&R Merger Agreement provides that Purchaser will be merged with and into Squarespace (which we refer to as the “Merger”) with Squarespace continuing as the surviving corporation in the Merger (which we refer to as the “Surviving Corporation”), except if the conditions (other than those conditions that by their terms are to be satisfied at the Closing, but subject to the satisfaction or waiver by the Party entitled to waive (to the extent permitted thereunder) of such conditions at the Closing) are not be satisfied or waived by such date, in which case no later than the third (3rd) Business Day after the date on which such conditions are satisfied or waived. The A&R

TABLE OF CONTENTS

Merger Agreement contemplates that the Merger will be effected pursuant to Section 251(h) of the Delaware General Corporation Law (which we refer to as the “DGCL”), which permits completion of the Merger without a vote of Squarespace stockholders. Under the terms of the A&R Merger Agreement, Squarespace and the Buyer Parties must consummate the Merger on the Closing Date (as defined in the A&R Merger Agreement) pursuant to the DGCL by filing a certificate of merger with the Secretary of State of the State of Delaware in accordance with the applicable provisions of the DGCL (the time of such filing with the Secretary of State of the State of Delaware, or such other time as may be agreed in writing by Parent, Purchaser and Squarespace and specified in the Certificate of Merger, being referred to herein as the “Effective Time”). At the Effective Time, each Share outstanding as of immediately prior to the Effective Time, other than (i) Owned Company Shares (as defined below) and (ii) all Shares that are issued and outstanding as of immediately prior to the effective time of the Merger and held by Squarespace stockholders who have properly and validly exercised their statutory rights of appraisal in respect of such Shares in accordance with Section 262 of the DGCL (“Dissenting Company Shares”) and have not properly and validly withdrawn their demand for appraisal rights in respect of such Shares in accordance with Section 262 of the DGCL, as applicable, will be cancelled and extinguished and automatically converted into the right to receive cash in an amount equal to the Offer Price, without interest thereon and subject to any applicable withholding Taxes (or in the case of a lost, stolen or destroyed certificate, upon delivery of an affidavit (and bond, if required) in accordance with the A&R Merger Agreement). In addition, at the Effective Time, each Owned Company Share will automatically be cancelled and extinguished without any conversion thereof or consideration paid therefor.

Furthermore certain of Squarespace’s existing stockholders including, (1) the Anthony Casalena 2019 Family Trust, the Anthony Casalena Revocable Trust, the Casalena Foundation (collectively, “Casalena”), (2) Accel Leaders 3 L.P. (for itself and as nominee for Accel Leaders 3 L.P., Accel Leaders 3 Entrepreneurs L.P. and Accel Leaders 3 Investors (2020) L.P.) (collectively, the “Accel Rollover Stockholders”, and, together with the Accel Share Sellers “Accel”) and (3) General Atlantic (SQRS II), L.P. (“GA SQRS II”) ((1)-(3), together with any Management Rollover Stockholders (as defined below), if any, collectively the “Rollover Stockholders”) have agreed to contribute or otherwise sell, as applicable, the Owned Company Shares held by such Rollover Stockholders (which we collectively refer to as the “Rollover or Sale Shares”) to an entity that indirectly owns 100% of the equity interest of Parent pursuant to those certain Tender and Support Agreements entered into in connection with the Transactions, by certain of Squarespace’s existing stockholders, including certain affiliates of (i) Casalena, (ii) GA SQRS II and (iii) Accel (as amended, restated, supplemented or otherwise modified from time to time, the “Tender and Support Agreements”). Subject to the prior waiver by Squarespace of the applicable restrictions under the A&R Merger Agreement, following the date hereof, the Buyer Parties may engage in discussions with certain of Squarespace’s members of senior management regarding such senior management electing to participate in the rollover transactions described herein. To the extent any such members of senior management would have been deemed to be Unaffiliated Company Stockholders, but, subject to the approval of Squarespace and the Buyer Parties, elect to participate in the rollover transactions, such members of senior management (the “Management Rollover Stockholders”) will no longer be deemed to be Unaffiliated Company Stockholders, including, but not limited to, for purposes of clause (ii) of the Minimum Condition and such shares which participate in the Rollover shall be included in the Rollover or Sale Shares.

Rollover or Sale Shares are not entitled to receive the Per Share Price (as defined in the A&R Merger Agreement) and will, immediately prior to the Closing, be contributed or otherwise sold, directly or indirectly, to Parent (or any direct or indirect parent entity thereof designated by Parent) pursuant to the terms of the applicable Tender and Support Agreement.

Purchaser commenced (within the meaning of Rule 14d-2 promulgated under the Securities Exchange Act of 1934 (which we refer to as the “Exchange Act”)) the Offer on September 16, 2024. Subject to the terms and conditions of the A&R Merger Agreement and the Offer, the Offer is initially scheduled to expire as of one minute after 11:59 p.m., New York City time (which we refer to as the “Expiration Time”) at the end of October 11, 2024 (which we refer to as the “Initial Expiration Date,” and such date or such subsequent date to which the Initial Expiration Date is extended in accordance with the terms of the A&R Merger Agreement, as the “Expiration Date”). Acceptance for the payment of Shares validly tendered and not validly withdrawn pursuant to and subject to the conditions to the Offer (as more fully described in Section “The Tender Offer – Section 2” in the Offer to Purchase) is expected to occur promptly after the Expiration Date.

“Owned Company Shares” means collectively, (1) the shares of Squarespace Common Stock held by Squarespace and its subsidiaries, (2) the shares of Squarespace Common Stock owned by Parent or Purchaser, (3) the shares of

TABLE OF CONTENTS

Squarespace Common Stock owned by the Rollover Stockholders that such Rollover Stockholders have agreed to contribute or otherwise sell to an entity that indirectly owns 100% of the equity interest of Parent pursuant to those certain Tender and Support Agreements entered into in connection with the Transactions, including the Offer and the Merger, (4) the shares of Squarespace Common Stock owned by any direct or indirect wholly owned subsidiary of Parent or Purchaser as of immediately prior to the Transactions, and (5) the shares of Squarespace Common Stock irrevocably accepted for purchase by Purchaser in the Offer.

The Offer is conditioned upon the satisfaction of the following conditions at the Expiration Time, or waiver by Purchaser (or by Parent on behalf of Purchaser) (except that the Minimum Condition defined below may not be waived by Purchaser (or by Parent on behalf of Purchaser) without Squarespace’s prior written consent):

• | (i) the number of Shares validly tendered (within the meaning of Section 251(h) of the DGCL) and not validly withdrawn, together with any Owned Company Shares, equals at least one vote more than 50% of the aggregate voting power of all issued and outstanding Shares, (ii) the number of Shares beneficially owned, directly or indirectly, by the Unaffiliated Company Stockholders (as defined below) and validly tendered (within the meaning of Section 251(h) of the DGCL) and not validly withdrawn, equals at least one vote more than 50% of the aggregate voting power of all issued and outstanding Shares beneficially owned, directly or indirectly, by the Unaffiliated Company Stockholders, (iii) the number of Class B Shares validly tendered (within the meaning of Section 251(h) of the DGCL) and not validly withdrawn, together with any Class B Shares constituting Owned Company Shares, equals at least one vote more than 50% of the aggregate voting power of all issued and outstanding Class B Shares, and (iv) the number of Class A Shares validly tendered (within the meaning of Section 251(h) of the DGCL) and not validly withdrawn, together with any Class A Shares constituting Owned Company Shares, equals at least one vote more than 50% of the aggregate voting power of all issued and outstanding Class A Shares, in each case as of the Expiration Time, but excluding any Shares held in treasury by Squarespace as of the expiration of the Offer or any other Shares acquired by Squarespace prior to the expiration of the Offer (including any Shares acquired in connection with tax withholding or payment of the exercise price for the exercise of Squarespace Options, Squarespace PSUs or Squarespace RSUs) (collectively, the “Minimum Condition”); |

• | certain representations and warranties made by Squarespace in the A&R Merger Agreement will be true and correct, subject to the materiality and other qualifications set forth in the A&R Merger Agreement as further described in the Offer to Purchase; |

• | Squarespace will have performed and complied in all material respects with certain covenants and obligations as further described in the Offer to Purchase; |

• | no material adverse effect on Squarespace has occurred since September 9, 2024 that is continuing; |

• | the Buyer Parties will have received a certificate of Squarespace, validly executed for and on behalf of Squarespace and in the name of Squarespace by a duly authorized executive officer thereof, certifying that the conditions set forth in the second, third, and fourth bullets above have been satisfied; and |

• | the A&R Merger Agreement will not have been terminated in accordance with its terms. |

“Unaffiliated Company Stockholders” means the holders of Squarespace Common Stock, excluding (i) General Atlantic L.P. (“General Atlantic”), its investment fund affiliates and its portfolio companies majority owned by such investment fund affiliates, (ii) Accel Management Co. Inc., its investment fund affiliates and its portfolio companies majority owned by such investment fund affiliates, (iii) Permira Advisers LLC, its investment fund affiliates and its portfolio companies majority owned by such investment fund affiliates, (iv) the members of the Squarespace Board of Directors (the “Board”), (v) any person that Squarespace has determined to be an “officer” of Squarespace within the meaning of Rule 16a-1(f) of the Exchange Act and (vi) Anthony Casalena and his controlled affiliates.

The foregoing summary of the Offer, the Transactions and the other transactions contemplated by the A&R Merger Agreement (all of which we refer to as the “Transactions”) is qualified in its entirety by the descriptions contained in the Offer to Purchase, and the terms of the A&R Merger Agreement and the Letter of Transmittal. Copies of the Offer to Purchase, the A&R Merger Agreement and the Letter of Transmittal are filed as Exhibits (a)(1)(A), (e)(1), and (a)(1)(B), respectively, to this Schedule 14D-9 and are incorporated in this Schedule 14D-9 by reference.

TABLE OF CONTENTS

As set forth in the Schedule TO, the Buyer Parties’ principal executive offices are located at c/o Permira Advisers LLC, 320 Park Avenue, 23rd Floor, New York, NY 10022. The telephone number of the Buyer Parties is (212) 386-7480.

Information relating to the Offer, including the Offer to Purchase, the Letter of Transmittal and related documents and this Schedule 14D-9, can be found on the SEC’s website at www.sec.gov, or under the “SEC Filings” section of Squarespace’s website at www.investors.squarespace.com.

TABLE OF CONTENTS

| Past Contacts, Transactions, Negotiations and Agreements |

Except as described below in “Item 4. The Solicitation or Recommendation—Background of the Offer and Merger”, “Item 7. Purposes of the Transaction and Plans or Proposals—Subject Company Negotiations” and “Item 7. Purposes of the Transaction and Plans or Proposals—Transactions and Other Matters,” and other than the A&R Merger Agreement and agreements entered into in connection therewith, including the Tender and Support Agreements (as discussed in the sections of this Schedule 14D-9 captioned “Item 2. Identity and Background of Filing Person—The Tender Offer” and “—Arrangements between Squarespace and Buyer Parties—Tender and Support Agreements”), and certain activity related to Squarespace’s equity compensation awards discussed elsewhere in this Schedule 14D-9, during the past two years: (1) there were no negotiations, transactions or material contacts between Squarespace and its affiliates, on the one hand, and any of the Purchaser or Parent Filing Parties (in their capacity as such), on the other hand, concerning any merger, consolidation, acquisition, tender offer for or other acquisition of any class of Squarespace’s securities, election of Squarespace’s directors or sale or other transfer of a material amount of assets of Squarespace, (2) Squarespace and its affiliates did not enter into any other transaction with an aggregate value exceeding one percent of Squarespace’s consolidated revenues with any Purchaser or Parent Filing Party, and (3) none of Squarespace’s executive officers, directors or affiliates that is a natural person entered into any transaction during the past two years with an aggregate value (in respect of such transaction or series of similar transactions with that person) exceeding $60,000 with any of the Purchaser or Parent Filing Parties.

Arrangements between Squarespace and Buyer Parties

A&R Merger Agreement

Summaries of the material terms of the A&R Merger Agreement are included in Section 10 of the Offer to Purchase and are incorporated in this Schedule 14D-9 by reference. The A&R Merger Agreement governs the contractual rights among Squarespace, Parent and Purchaser in relation to the Offer and the Merger. The A&R Merger Agreement is not intended to provide any other factual information about Squarespace, Parent or Purchaser. The A&R Merger Agreement has been provided solely to inform investors of its terms.

The representations, warranties, covenants and agreements included in the A&R Merger Agreement (1) were made only for purposes of the A&R Merger Agreement and as of specific dates; (2) were made solely for the benefit of the parties to the A&R Merger Agreement; and (3) may be subject to important qualifications, limitations and supplemental information agreed to by Squarespace and the Buyer Parties in connection with negotiating the terms of the A&R Merger Agreement. In addition, the representations and warranties may have been included in the A&R Merger Agreement for the purpose of allocating contractual risk between Squarespace and the Buyer Parties rather than to establish matters as facts, and may be subject to standards of materiality applicable to such parties that differ from those applicable to investors. Other than the indemnification provisions of the A&R Merger Agreement (which are discussed under the section of this Schedule 14D-9 captioned “—Indemnification and Insurance” below), the rights of Squarespace’s stockholders to receive the Offer Price, the rights of holders of certain equity awards to receive the consideration described in the A&R Merger Agreement, the rights of Squarespace (on behalf of Squarespace stockholders) to pursue certain equitable remedies and the rights of certain financing sources of the Buyer Parties as set forth in the A&R Merger Agreement, nothing in the A&R Merger Agreement confers any rights or remedies upon any person other than the parties to the A&R Merger Agreement. Squarespace’s stockholders and other investors are not entitled to, and should not, rely on the representations, warranties and covenants or any descriptions thereof as characterizations of the actual state of facts or conditions of Squarespace and the Buyer Parties or any of their respective subsidiaries or affiliates.

The summaries in the Offer to Purchase may not contain all of the information about the A&R Merger Agreement that is important to Squarespace stockholders, and Squarespace stockholders are encouraged to read the A&R Merger Agreement carefully in its entirety. The legal rights and obligations of the parties are governed by the specific language of the A&R Merger Agreement and not by the summaries included in Section 10 of the Offer to Purchase captioned “The Merger Agreement; Other Agreements.”

TABLE OF CONTENTS

Confidentiality Agreement

Squarespace and Permira Advisers LLC executed a confidentiality agreement, dated March 29, 2024 (which we refer to as the “Confidentiality Agreement”), pursuant to which, among other things, both parties agreed, subject to certain exceptions, to keep confidential certain non-public information disclosed to the other party. The termination of the A&R Merger Agreement does not affect the obligations of the parties contained in the Confidentiality Agreement, all of which obligations survive the termination of the A&R Merger Agreement in accordance with its terms.

The foregoing summary of the Confidentiality Agreement is qualified in its entirety by reference to the full text of the Confidentiality Agreement, which is filed as Exhibit (e)(3) to this Schedule 14D-9 and is incorporated in this Schedule 14D-9 by reference.

Fee Funding Agreement

Concurrently with the execution of the A&R Merger Agreement, Parent has delivered an amendment to that certain fee funding agreement from Permira VIII - 1 SCSp, Permira VIII - 2 SCSp, Permira VIII AIV LP1 L.P., Permira VIII AIV LP2 L.P., Permira VIII CIS SCSp, Permira VIII CIS 2 SCSp, PILI 1 Portfolio SCSp, PILI 2 Portfolio SCSp, PILI 4 Portfolio SCSp, Permira Investment Capital LP, Permira Investment Capital II LP and Permira Investment Capital III LP (collectively, the “FFA Investors”) (which we refer to as the “Fee Funding Agreement”) in favor of Squarespace and pursuant to which, on the terms and subject to the conditions contained therein, the FFA Investors are guaranteeing certain obligations of the Buyer Parties in connection with the A&R Merger Agreement.

Pursuant to the Fee Funding Agreement, subject to the terms and conditions contained therein, each FFA Investor has agreed to pay a portion of the payment of: (a) the aggregate amount of the Parent Termination Fee (as defined in the A&R Merger Agreement) solely if and when payable by Parent pursuant to the A&R Merger Agreement; (b) certain enforcement and interest expenses solely if and when payable by Parent in connection with certain legal proceedings and defaults under the A&R Merger Agreement; and (c) certain reimbursement obligations solely if and when payable by Parent pursuant to the indemnification obligations to Squarespace and its representatives in connection with the Debt Financing. The obligations of the FFA Investors under the Fee Funding Agreement are subject to an aggregate cap equal to $266,575,303.45.

• | Subject to specified exceptions, the Fee Funding Agreement will terminate upon the earliest of: |

• | the termination of the A&R Merger Agreement by mutual written consent of Squarespace, Parent and Merger Sub; |

• | the Closing pursuant to the A&R Merger Agreement; |

• | the date that is 60 days following the valid termination of the A&R Merger Agreement, unless, prior to the expiration of such 60 day period, Squarespace has delivered a written notice with respect to the obligations payable alleging that the FFA Investors, Parent or Merger Sub is liable for any such obligations; and |

• | Squarespace or any of its affiliates asserts certain litigation or legal proceedings under the A&R Merger Agreement or the Equity Commitment Letters. |

The foregoing summary of the Fee Funding Agreement is qualified in its entirety by reference to the full text of the Fee Funding Agreement, which are filed as Exhibit (e)(15) and (e)(16) to this Schedule 14D-9 and are incorporated in this Schedule 14D-9 by reference.

Equity Commitment Letters

Concurrently with the execution of the A&R Merger Agreement, Parent entered into (i) an amendment to that certain equity commitment letter executed by Permira VIII - 1 SCSp, Permira VIII - 2 SCSp, Permira VIII AIV LP1 L.P., Permira VIII AIV LP2 L.P., Permira VIII CIS SCSp, Permira VIII CIS 2 SCSp, PILI 1 Portfolio SCSp, PILI 2 Portfolio SCSp, PILI 4 Portfolio SCSp, Permira Investment Capital LP, Permira Investment Capital II LP, Permira Investment Capital III LP and accepted and agreed to by Squarespace, Inc., Spaceship Purchaser, Inc., Spaceship Parent, LP, Spaceship HoldCo, LLC and Spaceship Intermediate 2, Inc. (the “Permira Equity Investors”) and (ii) an amendment to that certain equity commitment letter executed by Accel Leaders 4 L.P., for itself and as nominee for, Accel Leaders 4 L.P., Accel Leaders 4 Entrepreneurs L.P., and Accel Leaders 4 Investors (2022) L.P. and Accel Leaders 3 L.P., for itself and as nominee for Accel Leaders 3 L.P., Accel Leaders 3 Entrepreneurs L.P. and Accel

TABLE OF CONTENTS

Leaders 3 Investors (2020) L.P. and accepted and agreed to by Spaceship Purchaser, Inc., Spaceship Parent, LP, Spaceship HoldCo, LLC and Spaceship Intermediate, Inc. (the “Accel Equity Investors,” and together with the Permira Equity Investors, the “Equity Investors”) (which we refer to as the “Equity Commitment Letters”) pursuant to which the Equity Investors have committed, subject to the terms and conditions contained therein, to invest in Parent, directly or indirectly, the cash amounts set forth therein. The proceeds of the Equity Commitment Letters, together with the proceeds of that certain debt commitment letter previously delivered to Squarespace (the “Debt Commitment Letter”), are intended to fund the full amount of the aggregate consideration payable in the Transactions, on the terms and subject to the conditions set forth therein. Squarespace is an express limited third party beneficiary of certain rights in the Equity Commitment Letters, on the terms and subject to the conditions set forth therein.

Pursuant to the Equity Commitment Letters, subject to the terms and conditions therein, including (A) the debt financing pursuant to the Debt Commitment Letter (or any alternative debt financing) having been funded in full or being (as affirmed in writing by the agent therefor) funded in full subject only to the satisfaction of those conditions that by their nature are to be satisfied at the Closing (provided, that those conditions are satisfied at the Closing), and substantially simultaneously with the funding of the equity financing pursuant to the Equity Commitment Letters, (B) the prior or substantially concurrent funding in full by each of the Equity Investors under their respective Equity Commitment Letter and (C) the prior or substantially concurrent contribution by each of the Rollover Stockholders that has entered into a Tender and Support Agreement of all of such Rollover Stockholder’s Rollover Shares to a direct or indirect parent entity of Parent, in each case, as specified in such Rollover Stockholder’s Tender and Support Agreement, (i) the Permira Equity Investors will provide Parent with an equity commitment of up to $2,426,000,000.00 in cash in the aggregate, in accordance with the respective commitment percentages of the Permira Equity Investors set forth therein, and (ii) the Accel Equity Investors will provide Parent with an equity commitment of up to $413,185,502.26 in cash in the aggregate, in accordance with the respective commitment percentages of the Accel Equity Investors set forth therein, in each case, which may be reduced in accordance with the terms set forth in the applicable Equity Commitment Letter of the Permira Equity Investors and Accel Equity Investors.

Squarespace is an express third-party beneficiary of the Equity Commitment Letters solely with respect to enforcing Parent’s right to cause the commitments under the Equity Commitment Letters by the Equity Investors to be funded to Parent in accordance with the Equity Commitment Letters, and to cause Parent to enforce its rights against each of the Equity Investors to perform their respective funding obligations under the Permira Equity Investors’ Equity Commitment Letter or the Accel Equity Investors’ Equity Commitment Letter, as applicable, in each case subject to (1) the satisfaction, or written waiver (to the extent permitted) by Parent of all conditions to the obligation of the Buyer Parties to consummate the Merger and the transactions contemplated by the A&R Merger Agreement that are to occur on the Closing Date as set forth in section 7.1 of the A&R Merger Agreement (other than those conditions that by their terms are to be satisfied at the closing of the Merger, but subject to the satisfaction or written waiver by the Buyer Parties (to the extent permitted thereunder) of such conditions), (2) the contemporaneous funding of the debt financing pursuant to the Debt Commitment Letter at the closing of the Merger and the contemporaneous consummation of the reinvestments pursuant to the Tender and Support Agreements and (3) the contemporaneous consummation of the Merger at the Effective Time.

The foregoing summary of the Equity Commitment Letters is qualified in its entirety by reference to the full text of the Equity Commitment Letters, which are filed as Exhibit (e)(4), (e)(5), (e)(6), (e)(7), (e)(8) and (e)(9), respectively, to this Schedule 14D-9 and are incorporated in this Schedule 14D-9 by reference.

Tender and Support Agreements

In connection with the execution of the A&R Merger Agreement, each of (i) Anthony Casalena and Casalena (collectively, the “Casalena Parties”), (ii) GA SQRS II and (iii) Accel and certain other affiliates of Accel (collectively, the “Accel Parties”) entered into a Tender and Support Agreement with Parent and Squarespace. The Tender and Support Agreements amend and restate and supersede the applicable Support Agreements, each dated May 13, 2024 and as amended, as applicable, by and among Squarespace, Parent and each of the foregoing (i)–(iii) and, in the case of GA SQRS II and the Accel Parties, were further amended and restated on September 16, 2024, to provide for the direct sale of shares of Squarespace Common Stock to an entity that indirectly owns 100% of the equity interest of Parent.

Pursuant to the Tender and Support Agreements, each of GA SQRS II, the Accel Parties and the Casalena Parties has agreed, among other things, to vote its shares of Squarespace Common Stock against any other action, agreement or

TABLE OF CONTENTS

proposal which would reasonably be expected to prevent, materially impair or materially delay the consummation of the Transactions or any of the other transactions contemplated by the A&R Merger Agreement. The Tender and Support Agreements also include certain restrictions on transfer of shares of Squarespace Common Stock by the stockholders. Notwithstanding anything to the contrary in the Tender and Support Agreements, each of GA SQRS II, Accel and Casalena may elect prior to the Offer Acceptance Time (as defined in the A&R Merger Agreement) to replace all or a portion of its Rollover or Sale Shares with an equity investment indirectly in Parent.

Under the Tender and Support Agreements, immediately prior to the Effective Time, each of GA SQRS II, Accel and Casalena will contribute, sell or otherwise transfer to a direct or indirect parent company of Parent a portion of its holdings of Squarespace Common Stock in exchange for equity interests in such a direct or indirect parent company of Parent, such that, based on equity and rollover commitments, Casalena, GA SQRS II and Accel will indirectly own approximately 33.3%, approximately 8.4% and approximately 9.0% of Squarespace, respectively, following consummation of the Transactions. As a result of the Transactions, the shares of Squarespace Common Stock contributed or sold to such parent company of Parent by Casalena, GA SQRS II and Accel (together, as applicable, with their respective affiliates) will be cancelled and extinguished without any conversion thereof or consideration paid therefor along with the other Owned Company Shares.

The foregoing summary of the Tender and Support Agreements is qualified in its entirety by reference to the full text of the Tender and Support Agreements, which are filed as Exhibit (e)(10), (e)(11), (e)(12), (e)(13) and (e)(14), respectively, to this Schedule 14D-9 and are incorporated in this Schedule 14D-9 by reference.

Arrangements between Squarespace and its Executive Officers, Directors and Affiliates

Squarespace’s directors and executive officers may have interests in the Transactions that are different from, or in addition to, the interests of Squarespace’s stockholders more generally. These interests may include, among others:

• | Certain members of the Squarespace Board received and are entitled to receive compensation for their service on the Special Committee. In particular, Squarespace paid compensation of $20,000 per month to Special Committee members and $25,000 per month to the Special Committee Chair, payable from the formation of the Special Committee on February 22, 2024 until the Original Merger Agreement was executed on May 13, 2024. In addition, Squarespace will pay to Michael Fleisher, as Special Committee Chair, a monthly fee equal to $10,000 for each full or partial month from and including May 14, 2024 through the month in which the Closing occurs. Squarespace will pay the other members of the Special Committee a monthly fee equal to $7,500 for each full or partial month from and including May 14, 2024 through the month in which the Closing occurs. Such fees are in addition to the regular compensation received as a member of the Squarespace Board; |

• | Squarespace’s directors and officers are entitled to continued indemnification and insurance coverage under the A&R Merger Agreement and indemnification agreements between such individuals and Squarespace; |

• | Anthony Casalena, Squarespace’s Chief Executive Officer, (i) will be the Chief Executive Officer of the Surviving Corporation as of the consummation of the Merger and (ii) together with the Casalena Rollover Stockholders, entered into a Tender and Support Agreement with Squarespace and Parent, pursuant to which the Casalena Rollover Stockholders agreed, among other things, to contribute, sell or otherwise transfer a portion of the shares of Squarespace Common Stock owned by them to a direct or indirect parent company of Parent in exchange for equity interests in such direct or indirect parent company of Parent, which contribution and exchange will happen immediately prior to the Closing and, solely as a result of such contribution and exchange, Mr. Casalena (together, as applicable, with his affiliates) will own approximately 33.3% of such direct or indirect parent company following the consummation of such contribution and exchange and will have certain governance rights with respect to such direct or indirect parent company following the consummation of the Merger; |

• | Each of Squarespace’s executive officers (other than Anthony Casalena, Squarespace’s Chief Executive Officer) is party to an employment agreement with Squarespace that provides for severance payments and benefits in the event of an involuntary termination (as defined in the section of this Schedule 14D-9 captioned “—Change in Control and Severance Benefits under Existing Agreements—Executive Employment Agreements” below); |

TABLE OF CONTENTS

• | Squarespace RSUs (as defined in the section of this Schedule 14D-9 captioned “Effect of the Offer and the Merger on Shares and Squarespace Equity Awards—Consideration for Squarespace Options, Squarespace RSUs, and Squarespace PSUs—Generally” below) granted to non-employee directors in 2024 are subject to prorated vesting in connection with the Merger; |

• | Mr. Levy is a member of the Squarespace Board and an employee of an entity affiliated with General Atlantic and Mr. Braccia is a member of the Squarespace Board and an employee of an entity affiliated with the Accel Rollover Stockholders, and, each of GA SQRS II (the “General Atlantic Rollover Stockholder”) and the Accel Rollover Stockholders entered into a Tender and Support Agreement with Squarespace and Parent, pursuant to which each such Rollover Stockholder agreed, among other things, to contribute, sell or otherwise transfer a portion of the Shares it owns to a direct or indirect parent company of Parent in exchange for equity interests in such direct or indirect parent company of Parent, which contribution and exchange will happen immediately prior to the Closing and, solely as a result of such contribution and exchange, each of the General Atlantic Rollover Stockholder and the Accel Rollover Stockholders (together, as applicable, with their respective affiliates) will own approximately 8.4% and 0.5%, respectively, of such direct or indirect parent company, following the consummation of such contribution and exchange (with respect to the Accel Rollover Stockholders this does not reflect the equity commitment by the Accel Equity Investors pursuant to its equity commitment letter). |

These interests may create potential conflicts of interest. The Squarespace Board was aware of these interests and considered them, among other matters, in recommending the Offer and approving the A&R Merger Agreement, as more fully discussed in the section of this Schedule 14D-9 captioned “Item 4. The Solicitation or Recommendation—Squarespace’s Reasons for the Offer and the Merger.”

Potential for Future Arrangements

To Squarespace’s knowledge, except for certain agreements described in this Schedule 14D-9 (or in the documents incorporated herein by reference) between Squarespace and its executive officers and directors, no employment, equity contribution or other agreement, arrangement or understanding between any executive officer or director of Squarespace, on the one hand, and Parent, or any of its affiliates or Squarespace, on the other hand, existed as of the date of this Schedule 14D-9, and neither the Offer nor the Merger is conditioned upon any executive officer or director of Squarespace entering into any such agreement, arrangement or understanding.

It is possible that continuing employees, including executive officers, of Squarespace will enter into new compensation arrangements with the Surviving Corporation. Such arrangements may include agreements regarding future terms of employment, the right to receive equity or equity-based awards of the Surviving Corporation, and/or retention. Any such arrangements are currently expected to be entered into after the completion of the Offer and will not become effective until after the Merger is completed. There can be no assurance that the applicable parties will reach an agreement on any terms, or at all, and neither the Offer nor the Merger is conditioned upon any executive officer or director of Squarespace entering into any such agreement, arrangement or understanding. Subject to the prior waiver by Squarespace of the applicable restrictions under the A&R Merger Agreement, following the date hereof, the Buyer Parties may engage in discussions with certain of Squarespace’s members of senior management regarding such senior management electing to participate in the rollover transactions described herein. To the extent any such members of senior management would have been deemed to be Unaffiliated Company Stockholders, but, subject to the approval of Squarespace and the Buyer Parties, elect to participate in the rollover transactions, such members of senior management will no longer be deemed to be Unaffiliated Company Stockholders, including, but not limited to, for purposes of clause (ii) of the Minimum Condition and such shares which participate in the Rollover shall be included in the Rollover or Sale Shares.

TABLE OF CONTENTS

Change in Control and Severance Benefits Under Existing Agreements

Executive Employment Agreements

Squarespace has entered into employment agreements with each of Nathan Gooden (Squarespace’s Chief Financial Officer), Paul Gubbay (Squarespace’s Chief Product Officer) and Courtenay O’Connor (Squarespace’s General Counsel), which provide that if the applicable executive officer is terminated by Squarespace without “cause” or by the applicable executive officer for “good reason” (in each case, an “involuntary termination”), whether or not in connection with a change in control, the applicable executive officer will be entitled to the following severance benefits:

• | Base salary continuation for a certain number of months (12 months for Mr. Gooden, and six months for Mr. Gubbay and Ms. O’Connor); |

• | Squarespace will pay the executive’s COBRA premiums for a certain number of months (12 months for Mr. Gooden, and six months for Mr. Gubbay and Ms. O’Connor); and |

• | if such involuntary termination occurs within three months prior to or within 12 months following a change in control, 100% acceleration of all Squarespace Equity Awards (as defined in the section of this Schedule 14D-9 captioned “Effect of the Offer and the Merger on Shares and Squarespace Equity Awards—Consideration for Squarespace Options, Squarespace RSUs, and Squarespace PSUs—Generally” below). |

The severance benefits are conditioned on the applicable executive officer executing and not revoking a general release of claims in favor of Squarespace.

For an estimate of the value of the payments and benefits described above that would be payable to Squarespace’s named executive officers upon an involuntary termination in connection with the Merger, which we have assumed constitutes a change of control under the Squarespace Equity Plans (as defined in the section of this Schedule 14D-9 captioned “Effect of the Offer and the Merger on Shares and Squarespace Equity Awards—Consideration for Squarespace Options, Squarespace RSUs, and Squarespace PSUs—Generally” below) and the employment agreements for our named executive officers, see “—Golden Parachute Compensation” below.

Anthony Casalena (Squarespace’s Chief Executive Officer) has also entered into an employment agreement with Squarespace. However, Mr. Casalena’s employment agreement does not provide for any severance payments or benefits upon his termination of employment.

For a description of the employment agreements for Messrs. Casalena, Gooden and Gubbay and Ms. O’Connor, reference is made to pages 33-34 of Squarespace’s Definitive Proxy Statement on Schedule 14A, filed with the SEC on August 22, 2024 (which we refer to as the “Proxy Statement”) (under the heading “Potential Payments Upon Termination or Change in Control”).

Equity Award Arrangements with Directors and Executive Officers

Squarespace’s non-employee director compensation policy, dated as of August 1, 2023, provides that upon a change in control, all outstanding Squarespace RSUs held by each non-employee director will vest in full, subject to the director’s continued service with Squarespace until immediately prior to the change in control. Notwithstanding anything in Squarespace’s non-employee director compensation policy to the contrary, the Squarespace RSUs granted to non-employee directors in 2024, which are the only outstanding Squarespace Equity Awards held by non-employee directors as of the date of this Schedule 14D-9, are subject to prorated vesting in connection with the Merger. Any portion of the Squarespace RSUs granted in 2024 that do not vest pro rata in connection with the Merger will be forfeited without the payment of any consideration.

Squarespace has granted Squarespace PSUs (as defined in the section of this Schedule 14D-9 captioned “Effect of the Offer and the Merger on Shares and Squarespace Equity Awards—Consideration for Squarespace Options, Squarespace RSUs, and Squarespace PSUs—Generally” below) to certain executive officers under our 2021 Equity Incentive Plan. Pursuant to the terms of the award agreements with respect to such Squarespace PSUs, upon a change in control, any earned Squarespace PSUs will remain subject to the executive’s continuous service with us through the applicable vesting dates and will become immediately vested upon an involuntary termination occurring within three months prior to or within 12 months following a change in control. Our 2021 Equity Incentive Plan and 2008 Equity Incentive Plan also provide that if any payments or benefits provided for under an agreement with any participant (including our executive officers) or otherwise payable to the participant would constitute “excess

TABLE OF CONTENTS

parachute payments” within the meaning of Section 280G of the Internal Revenue Code of 1986, as amended (which we refer to as the “Code”) and could be subject to the related excise tax, the participant will receive either full payment of such payments and benefits or such lesser amount that would result in no portion of the payments and benefits being subject to the excise tax, whichever results in the greater amount of after-tax benefits to the applicable participant. Squarespace is not required to provide any tax gross-up payments to any executive officer.

Pursuant to the award agreement governing Mr. Casalena’s Squarespace PSUs and the A&R Merger Agreement, his Squarespace PSUs will be automatically forfeited in connection with the Merger without the payment of any consideration.

For an estimate of the value of the payments and benefits described above that could be payable to Squarespace’s named executive officers upon consummation of the Merger, which we have assumed constitutes a change of control under the Squarespace Equity Plans and the employment agreements for our named executive officers, see “—Golden Parachute Compensation” below.

Effect of the Offer and the Merger on Shares and Squarespace Equity Awards

Consideration for Shares in the Offer and the Merger

If Squarespace’s executive officers and directors who own Shares tender their Shares for purchase pursuant to the Offer, they will receive the same consideration on the same terms and conditions as the other Squarespace stockholders. If such executive officers and directors do not tender their Shares pursuant to the Offer but the conditions of the Offer are otherwise satisfied or waived in accordance with the terms of the A&R Merger Agreement and the Merger is consummated, then such executive officers and directors will also receive the same consideration on the same terms and conditions as the other Squarespace stockholders. For information on the number of Shares and the consideration that would be payable in connection with the Offer and the Merger in respect of those Shares, please see the section in this Schedule 14D-9 captioned “—Equity Interests of Squarespace’s Executive Officers and Directors.”

Consideration for Squarespace Options, Squarespace RSUs, and Squarespace PSUs —Generally

Squarespace from time to time has granted awards under the Squarespace, Inc. 2021 Equity Incentive Plan, the Squarespace, Inc. 2017 Equity Incentive Plan and the Squarespace, Inc. Amended and Restated 2008 Equity Incentive Plan (which we refer to as the “Squarespace Equity Plans”), consisting of options to purchase Shares (which we refer to as a “Squarespace Option”), restricted stock units covering Shares, other than Squarespace PSUs (which we refer to as a “Squarespace RSU”), and restricted stock units covering Shares whose vesting is conditioned in full or in part based on the achievement of performance goals or metrics (which we refer to as a “Squarespace PSU” and together with Squarespace Options and Squarespace RSUs, “Squarespace Equity Awards”).

As of September 1, 2024, none of Squarespace’s current non-employee directors and executive officers held any outstanding Squarespace Options. Also as of September 1, there were outstanding (1) Squarespace RSUs covering an aggregate of 10,297,794 of Shares, 37,182 of which were held by Squarespace’s current non-employee directors and 623,700 of which were held by Squarespace’s current executive officers and (2) Squarespace PSUs covering an aggregate of 559,382 shares of Shares (assuming achievement of target level performance and excluding Mr. Casalena’s Squarespace PSUs which will be automatically forfeited in connection with the Merger without the payment of any consideration), none of which were held by Squarespace’s current non-employee directors and 256,410 of which were held by Squarespace’s current executive officers.

At the Effective Time, each outstanding Squarespace Option (other than any Squarespace Option with a per Share exercise price at or above the Offer Price (which we refer to as an “Out-of-the-Money Option”)) that is vested by its terms as of the Effective Time will be cancelled and converted into the right to receive a lump sum cash payment, without interest, equal to the product of the excess of the Offer Price over the applicable exercise price per Share subject to such Squarespace Option multiplied by the number of Shares subject to such Squarespace Option. Any outstanding Out-of-the-Money Options, whether vested or unvested, will be cancelled at the Effective Time for no consideration.

At the Effective Time, each outstanding Squarespace Option (other than any Out-of-the-Money Option) that is not vested as of the Effective Time will be converted into a contractual right to receive a payment in an amount of cash equal to the product of the excess of the Offer Price over the applicable exercise per Share subject to such Squarespace Option multiplied by the number of Shares subject to such Squarespace Option (which we refer to as a “Converted Option Award”), and any unvested Out-of-the Money Option will be cancelled at the Effective Time for no consideration. Each Converted Option Award will remain subject to the same vesting terms and conditions that applied to the associated Squarespace Option immediately prior to the Effective Time.

TABLE OF CONTENTS

At the Effective Time, each outstanding Squarespace RSU (other than Squarespace RSUs held by non-employee directors) and Squarespace PSU (other than each outstanding Squarespace PSU that is scheduled to automatically forfeit as of the Effective Time pursuant to its terms and the A&R Merger Agreement will be forfeited as of the Effective Time for no consideration, which we refer to as a “Forfeited Squarespace PSU”) that is not vested by its terms as of the Effective Time will be converted into a contractual right to receive a payment in an amount of cash equal to the product of the Offer Price multiplied by the number of Shares subject to the applicable Squarespace RSU or Squarespace PSU (which we refer to as a “Converted Full Value Award”) (with the number of shares of Shares subject to Squarespace PSUs determined in accordance with the applicable award agreement prior to the closing). Each Converted Full Value Award will remain subject to the same vesting terms and conditions that applied to the associated Squarespace RSU or Squarespace PSU, as applicable, immediately prior to the Effective Time.

At the Effective Time, each Forfeited Squarespace PSU will be forfeited as of the Effective Time for no consideration.

At the Effective Time, each outstanding Squarespace RSU that is held by a non-employee director of Squarespace will be converted into the right to receive a lump sum cash payment, without interest, equal to the product of the Offer Price multiplied by the number of Shares subject to the Squarespace RSU (subject to prorated vesting). This amount (less any required withholding and other taxes) will be paid to the applicable holder no later than the second regularly scheduled payroll date following the date on which the closing occurs (the “Closing Date”).

Equity Interests of Squarespace’s Executive Officers and Directors

The following table sets forth the number of Shares held by each of Squarespace’s executive officers and directors that are outstanding as of September 1, 2024. As of September 1, 2024, the executive officers and directors of Squarespace beneficially owned, in the aggregate, 17,025,514 shares of Class A Common Stock and 42,886,410 shares of Class B Common Stock. In computing the number of shares beneficially owned by a person, shares of Squarespace Common Stock subject to options, or other rights held by such person that are currently exercisable or will become exercisable within 60 days of September 1, 2024 are considered outstanding. The table also sets forth the values of these Shares, determined as the number of applicable Shares multiplied by the Offer Price. No additional Shares were granted to any executive officer or director in contemplation of the Offer and the Merger.

| | | | | | |

Anthony Casalena(1) | | | 1,953,786 | | | 42,886,410 | | | 44,840,196 | | | $1,996,171,851.00 |

Nathan Gooden(2) | | | 77,212 | | | | | | 77,212 | | | $3,590,358.00 |

Paul Gubbay(3) | | | 48,769 | | | | | | 48,769 | | | $2,267,758.50 |

Courtenay O’Connor(4) | | | 57,296 | | | | | | 57,296 | | | $2,664,264.00 |

Andrew Braccia(5) | | | 14,572,025 | | | | | | 14,572,025 | | | $677,599,162.50 |

Michael Fleisher(6) | | | 75,493 | | | | | | 75,493 | | | $3,510,424.50 |

Jonathan Klein(7) | | | 168,072 | | | | | | 168,072 | | | $7,815,348.00 |

Liza Landsman(8) | | | 29,173 | | | | | | 29,173 | | | $1,356,544.50 |

Anton Levy(9) | | | 25,390 | | | | | | 25,390 | | | $1,180,635.00 |

Neela Montgomery(10) | | | 18,298 | | | | | | 18,298 | | | $850,857.00 |

All executive officers and directors as a group (10 persons)(11) | | | 17,025,514 | | | 42,886,410 | | | 59,911,924 | | | $2,785,904,466.00 |

| | | | | | | | | | | | |

(1)

| Consists of (a) 387,500 shares of Class A common stock and 2,050,838 shares of Class B common stock held directly by Anthony Casalena 2019 Family Trust, for which Mr. Casalena is the trustee, and (b) 1,566,286 shares of Class A common stock and 40,835,572 of Class B common stock held directly by Anthony Casalena Revocable Trust, for which Mr. Casalena is the trustee. Each share of Class B common stock is convertible at the option of Mr. Casalena into one share of Class A common stock. Mr. Casalena may be deemed to have voting power and dispositive power over the shares held by the Anthony Casalena 2019 Family Trust and the Anthony Casalena Revocable Trust. |

(2)

| Consists of 77,212 shares of Class A common stock. |

(3)

| Consists of 48,769 shares of Class A common stock. |

(4)

| Consists of 57,296 shares of Class A common stock. |

(5)

| Consists of (a) 25,390 shares of Class A common stock held directly by Andrew Braccia, (b) 32,439 shares of Class A common stock held by AKB Living Trust, of which Andrew Braccia is a trustee and (c) shares held by the entities affiliated with Accel, consisting of (a) 530,953 shares of Class A common stock held of record by Accel Leaders 3 L.P., (b) 21,982 shares of Class A common stock held of record by Accel Leaders |

TABLE OF CONTENTS

3 Entrepreneurs L.P., (c) 31,686 shares of our Class A common stock held of record by Accel Leaders 3 Investors (2020) L.P., (d) 12,808,246 shares of Class A common stock held of record by Accel Growth Fund L.P., (e) 250,729 shares of Class A common stock held of record by Accel Growth Fund Strategic Partners L.P. (f) 870,600 shares of Class A common stock held of record by Accel Growth Fund Investors 2010 L.L.C., and (g) 49,190 shares of Class A common stock held by Andrew Braccia. Accel Leaders 3 GP Associates L.L.C. (“AL3A”) is the general partner of the general partner of both Accel Leaders 3 L.P. and Accel Leaders 3 Entrepreneurs L.P., and the general partner of Accel Leaders 3 Investors (2020) L.P., and has the sole voting and investment power. Andrew Braccia, Sameer Gandhi, Ping Li, Ryan Sweeney, and Richard Wong are the directors of AL3A and share such powers. Accel Growth Fund Associates L.L.C. (“AGFA”) is the general partner of both Accel Growth Fund L.P. and Accel Growth Fund Strategic Partners L.P. and has the sole voting and investment power. Andrew Braccia, Kevin Efrusy, Sameer Gandhi, Ping Li, and Richard Wong are the managing members of AGFA and share such powers. Andrew Braccia, Kevin Efrusy, Sameer Gandhi, Ping Li, and Richard Wong are the managing members of Accel Growth Fund Investors 2010 L.L.C. and share the voting and investment powers. The address of the foregoing Accel entities is 500 University Avenue, Palo Alto, California, 94301..

(6)

| Consists of 75,493 shares of Class A common stock. |

(7)

| Consists of 168,072 shares of Class A common stock. |

(8)

| Consists of 29,173 shares of Class A common stock. |

(9)

| Consists of 25,390 shares of Class A common stock held by Mr. Levy solely for the benefit of General Atlantic Service Company, L.P. Mr. Levy disclaims beneficial ownership of the restricted stock units and the shares of Class A common stock. |

(10)

| Consists of 18,298 shares of Class A common stock. |

(11)

| Consists of 17,025,514 shares of Class A common stock, (b) 42,886,410 shares of Class B common stock. |

Consideration for Squarespace RSUs and Squarespace PSUs Held by Directors and Executive Officers in the Merger

The following table sets forth for each of Squarespace’s executive officers and directors the number of Shares subject to his or her Squarespace RSUs and Squarespace PSUs, in each case expected to be held on the Closing Date of the Merger. As of September 1, 2024, our current non-employee directors and executive officers do not hold any outstanding Squarespace Options.

| | | | | | |

Non-Employee Directors

| | | | | | | | | | | | | | | |

Andrew Braccia | | | 6,197 | | | 288,161 | | | — | | | — | | | 288,161 |

Michael Fleisher | | | 6,197 | | | 288,161 | | | — | | | — | | | 288,161 |

Jonathan Klein | | | 6,197 | | | 288,161 | | | — | | | — | | | 288,161 |

Liza Landsman | | | 6,197 | | | 288,161 | | | — | | | — | | | 288,161 |

Anton Levy | | | 6,197 | | | 288,161 | | | — | | | — | | | 288,161 |

Neela Montgomery | | | 6,197 | | | 288,161 | | | — | | | — | | | 288,161 |

Executive Officers

| | | | | | | | | | | | | | | |

Anthony Casalena | | | — | | | — | | | —(4) | | | —(4) | | | —(4) |

Nathan Gooden | | | 404,557 | | | 18,811,901 | | | 134,837 | | | 6,269,921 | | | 25,081,822 |

Paul Gubbay | | | 110,954 | | | 5,159,361 | | | 59,718 | | | 2,776,887 | | | 7,936,248 |

Courtenay O’Connor | | | 108,189 | | | 5,030,789 | | | 61,855 | | | 2,876,258 | | | 7,907,047 |

| | | | | | | | | | | | | | | |

(1)

| Represents Shares subject to Squarespace RSUs outstanding as of September 1, 2024. The values shown with respect to Squarespace RSUs are determined as the product of the Per Share Price multiplied by the total number of Shares subject to Squarespace RSUs. With respect to Squarespace RSUs held by non-employee directors, the number of Shares subject to such Squarespace RSUs does not reflect any prorated vesting in connection with the Merger. |

(2)

| Represents Shares subject to Squarespace PSUs outstanding as of September 1, 2024 (without regard to any change in control-related accelerated vesting, except as noted below), and includes Squarespace PSUs that have been earned but are subject to the satisfaction of service-based vesting conditions. The values shown with respect to Squarespace PSUs are determined as the product of the Per Share Price multiplied by the total number of Shares subject to Squarespace PSUs (assuming achievement of target performance levels). Achievement of maximum performance levels would result in 200% of such amounts. |

(3)

| Each of the Squarespace executive officers (other than Anthony Casalena) is eligible for vesting acceleration of his or her equity awards in connection with certain qualifying terminations of employment under their respective employment agreements. |

(4)

| Mr. Casalena’s Squarespace PSUs, which cover, at maximum performance, 2,750,000 Shares, will be automatically forfeited in connection with the Merger without the payment of any consideration. |

TABLE OF CONTENTS

Employment and Other Arrangements Following the Transactions

As of the date of this Schedule 14D-9, none of Squarespace’s senior management (other than Mr. Casalena as described in the following sentence) has (1) reached an understanding on potential employment or other retention terms with the Surviving Corporation or with Parent or Purchaser (or any of their respective affiliates), or (2) entered into any definitive agreements or arrangements regarding employment or other retention with Squarespace or with Parent or Purchaser (or any of their respective affiliates) to be effective following the consummation of the Merger. Mr. Casalena will be the Chief Executive Officer of Squarespace as of the consummation of the Merger and will have certain governance rights with respect to the Squarespace. Subject to the prior waiver by Squarespace of the applicable restrictions under the A&R Merger Agreement, following the date hereof, the Buyer Parties may engage in discussions with certain of Squarespace’s members of senior management regarding such senior management electing to participate in the rollover transactions described herein. To the extent any such members of senior management would have been deemed to be Unaffiliated Company Stockholders, but, subject to the approval of Squarespace and the Buyer Parties, elect to participate in the rollover transactions, such members of senior management will no longer be deemed to be Unaffiliated Company Stockholders, including, but not limited to, for purposes of clause (ii) of the Minimum Condition and such shares which participate in the Rollover shall be included in the Rollover or Sale Shares. Subject to the prior waiver by Squarespace of the applicable restrictions under the A&R Merger Agreement, Parent or Purchaser (or their respective affiliates) may have discussions with certain of Squarespace’s employees (including certain of its senior management) regarding employment or other retention terms and may enter into definitive agreements regarding employment or retention. Any such agreements will not increase or decrease the Offer Price paid to Squarespace’s stockholders in the Offer.

Golden Parachute Compensation

The information set forth in the tables below is intended to comply with Item 402(t) of Regulation S-K, which requires disclosure of information about certain compensation for each of Squarespace’s named executive officers (“NEOs”) that is based on or otherwise relates to the Merger and assumes, among other things, that the Merger constitutes a change in control under the Squarespace Equity Plans and each NEO’s employment agreement, the Merger is consummated and that the NEOs will incur a severance-qualifying termination of employment immediately following consummation of the Merger. The NEOs for Squarespace’s fiscal year ended December 31, 2023 consisted of Anthony Casalena, Nathan Gooden, Paul Gubbay and Courtenay O’Connor. As noted above, Mr. Casalena is not entitled to any severance payments or benefits upon his termination of employment.

The amounts indicated below are estimates based on multiple assumptions that may or may not actually occur or be accurate on the relevant date, including assumptions described below, and do not reflect certain compensation actions that may occur before the consummation of the Merger. For purposes of calculating such amounts, on a pre-tax basis, Squarespace has assumed:

• | the Merger constitutes a change in control under the Squarespace Equity Plans and each NEO’s employment agreement; |

• | September 1, 2024, which is the latest practicable date prior to this filing, as the date of the closing of the Merger; |

• | each NEO experiences an involuntary termination on September 1, 2024, based on the terms of his or her respective agreement(s); |

• | the NEO’s base salary rates remain unchanged from those in effect as of September 1, 2024; |

• | Squarespace RSUs and Squarespace PSUs are valued based upon the Offer Price, and do not forecast any vesting, deferrals or forfeitures of equity-based awards following September 1, 2024 (except for Mr. Casalena’s Squarespace PSUs, which will be automatically forfeited in connection with the Merger pursuant to their terms without the payment of any consideration); and |

• | Squarespace PSUs held by each NEO (other than Mr. Casalena) will be deemed earned based on the achievement of target level of performance. |

TABLE OF CONTENTS

In accordance with the terms of Squarespace’s 2021 Equity Incentive Plan and 2008 Equity Incentive Plan, if the payments or benefits to an NEO under his or her respective agreement(s) would be subject to excise taxes under Section 280G and 4999 of the Code, such payments will be reduced if and to the extent such reduction would result in a better result to the NEO taking into account applicable taxes.

| | | | | | | | | | | | |

Anthony Casalena | | | — | | | — | | | — | | | — |

Nathan Gooden | | | 750,000 | | | 25,081,822 | | | 32,000 | | | 25,863,822 |

Paul Gubbay | | | 325,000 | | | 7,936,248 | | | 13,600 | | | 8,274,848 |

Courtenay O’Connor | | | 275,000 | | | 7,907,047 | | | 12,800 | | | 8,194,847 |

| | | | | | | | | | | | |

1)

| The estimated amount for each NEO (other than Mr. Casalena who is not entitled to any severance payments or benefits) represents the cash severance payments to which the NEO may become entitled under his or her existing employment agreement. As discussed above, under their existing employment agreements, upon an involuntary termination (whether or not in connection with a change in control), the NEOs will be entitled to base salary continuation for a certain number of months (12 months for Mr. Gooden, and six months for Mr. Gubbay and Ms. O’Connor). The cash severance is contingent upon an involuntary termination and subject to the NEO’s execution and non-revocation of a release of claims. These amounts are payments that would be payable upon an involuntary termination of employment, whether or not there is also a change in control. |

2)

| As noted above, each NEO (other than Mr. Casalena) is eligible for “double-trigger” acceleration in full of his or her Squarespace Equity Awards in the event he or she experiences an involuntary termination within three months prior to or within 12 months following a change in control. Set forth below are the values of each unvested Squarespace Equity Award held by the NEOs that would become vested upon an involuntary termination immediately following the consummation of a change-in-control. Mr. Casalena’s Squarespace PSUs, which cover, at maximum performance, 2,750,000 Shares, will be automatically forfeited in connection with the Merger without the payment of any consideration. |

| | | | | | |

Anthony Casalena | | | — | | | — |

Nathan Gooden | | | 18,811,901 | | | 6,269,921 |

Paul Gubbay | | | 5,159,361 | | | 2,776,887 |

Courtenay O’Connor | | | 5,030,789 | | | 2,876,258 |

| | | | | | |

(i)

| Includes Squarespace PSUs that have been earned but are subject to the satisfaction of service-based vesting conditions. |

3)

| The estimated amount for each NEO (other than Mr. Casalena who is not entitled to any severance payments or benefits) represents continuation of medical benefits to which the NEO may become entitled under his or her existing employment agreement. As discussed above, under their existing employment agreements, upon an involuntary termination (whether or not in connection with a change in control), Squarespace will pay such NEOs COBRA premiums for a certain number of months (12 months for Mr. Gooden, and six months for Mr. Gubbay and Ms. O’Connor). These amounts are contingent upon an involuntary termination and are subject to the NEO’s execution and non-revocation of a release of claims. These amounts are payments that would be payable upon an involuntary termination of employment, whether or not there is also a change in control. |

Rule 14d-10(d) Matters

Prior to the scheduled expiration of the Offer, Squarespace, shall take all such steps as may be required to cause each agreement, arrangement or understanding entered into by Squarespace or any of its subsidiaries (including any employee agreement) on or after May 13, 2024 with any of its officers, directors or employees pursuant to which consideration is paid to such officer, director or employee to be approved as an “employment compensation, severance or other employee benefit arrangement” within the meaning of Rule 14d-10(d) under the Exchange Act and to satisfy the requirements of the non-exclusive safe harbor set forth in Rule 14d-10(d) under the Exchange Act.

Indemnification and Insurance

The A&R Merger Agreement provides that, from and after the Effective Time for six years thereafter, the Surviving Corporation and its subsidiaries will honor and fulfill, in all respects, the obligations of Squarespace and its subsidiaries pursuant to any indemnification agreements between Squarespace or any of its subsidiaries and any of their current or former directors, officers or managers (and any person who becomes a director, officer or manager of Squarespace or any of its subsidiaries prior to the Effective Time) (the “Indemnified Persons”), respectively, for any acts or omissions by the Indemnified Persons occurring prior to the Effective Time. In addition, during the period commencing at the Effective Time and ending on the sixth anniversary of the Effective Time, the Surviving

TABLE OF CONTENTS

Corporation and its subsidiaries will maintain the provisions with respect to indemnification, advancement of expenses and exculpation from liability as set forth in the certificates of incorporation, bylaws and other organizational documents of Squarespace and its subsidiaries as of May 13, 2024. During such six-year period, such provisions may not be amended, repealed or otherwise modified in any adverse manner except as required by applicable law.

In addition, the A&R Merger Agreement provides that, during the six-year period commencing at the Effective Time, the Surviving Corporation will (and Parent will cause the Surviving Corporation to) indemnify and hold harmless each Indemnified Persons to the fullest extent permitted by applicable law, from and against any costs, fees and expenses (including attorneys’ fees and investigation expenses), judgments, fines, losses, claims, damages, liabilities and amounts paid in settlement or compromise in connection with any actual or threatened legal proceeding or other matter, whether civil, criminal, administrative or investigative, to the extent that such actual or threatened legal proceeding or other matter is based on, arising out of or relating to the fact that such person is or was a director, officer, member, manager or employee of Squarespace or its subsidiaries or such person is or was serving at the request of or with the knowledge and consent of Squarespace and its subsidiaries as a director, officer, member, manager or fiduciary of another person and based on, arising out of or relating to any act, omission, fact, circumstance or other matter occurring or existing on or prior the Effective Time. Parent shall cause the Surviving Corporation and its subsidiaries to, and the Surviving Corporation and its subsidiaries shall, advance such costs, fees and expenses incurred by or on behalf of the Indemnified Persons on a current basis (but no later than thirty days after the submission of invoices) to the fullest extent permitted by applicable law to repay such advances if it is determined in a final and non-appealable adjudication of a court of competent jurisdiction that such indemnified person is not entitled to indemnification.