STRONG FOUNDATION. STRONGER FUTURE. Simpson Manufacturing Co., Inc. 2023 Off-Season Engagement Exhibit 99.1

This presentation contains forward-looking statements within the meaning of the Private Securities Litigation Reform Act of 1995, Section 27A of the Securities Act of 1933, as amended, and Section 21E of the Securities Exchange Act of 1934, as amended. Forward-looking statements generally can be identified by words such as "anticipate," "believe," "estimate," "expect," "intend," "plan," "outlook," "target," "continue," "predict," "project," "change," "result," "future," "will," "could," "can," "may," "likely," "potentially," or similar expressions. Forward-looking statements are all statements other than those of historical fact and include, but are not limited to, statements about future financial and operating results, our plans, objectives, business outlook, priorities, expectations and intentions, expectations for sales and market growth, comparable sales, earnings and performance, stockholder value, capital expenditures, cash flows, the housing market, the home improvement industry, demand for services, share repurchases, our ongoing integration of ETANCO, our strategic initiatives, including the impact of these initiatives on our strategic and operational plans and financial results, and any statement of an assumption underlying any of the foregoing. Forward-looking statements are subject to inherent uncertainties, risks and other factors that are difficult to predict and could cause our actual results to vary in material respects from what we have expressed or implied by these forward-looking statements. Important factors that could cause our actual results and financial condition to differ materially from those expressed in or implied by our forward-looking statements include the effect of global pandemics such as the COVID-19 pandemic and other widespread public health crisis and their effects on the global economy, the effects of inflation and labor and supply shortages, on our operations, the operations of our customers, suppliers and business partners, and our ongoing integration of ETANCO, as well as those discussed in the "Risk Factors" and " Management's Discussion and Analysis of Financial Condition and Results of Operations" sections of our most recent Annual Report on Form 10-K, subsequent Quarterly Reports on Form 10-Q and other reports we file with the SEC. We caution that you should not place undue reliance on these forward-looking statements, which speak only as of the date of this press release. We undertake no obligation to publicly update any forward-looking statement, whether as a result of new information, future developments or otherwise, except as may be required by law. Readers are urged to carefully review and consider the various disclosures made in our reports filed with the SEC that advise of the risks and factors that may affect our business, results of operations and financial condition. 2 Safe Harbor

3(1) Above market top-line growth relative to U.S. housing starts. (2) Time frame represents January 1, 2019 to June 30, 2023. Investment Highlights Industry leader with unique business model, above market top-line growth(1), strong brand recognition and trusted reputation Diversified product offerings and geographies mitigate exposure to cyclical U.S. housing market Leadership position in structural connections for wood with significant opportunities in all addressable markets Industry-leading gross profit and operating margins have improved over time Strong balance sheet enables financial flexibility ~43% of free cash flow returned to stockholders since 2019(2)

4 Diverse portfolio of solutions An increasingly diverse portfolio of products and software, and a commitment to developing complete solutions for the markets we serve. Unparalleled availability & delivery Industry-leading product availability and delivery standards on our vast product offering across multiple distribution channels, with typical delivery within 24- 48 hours. Longstanding relationships Our long-standing reputation, relationships and engagement with builders and distributors, engineers, building officials, and contractors to design safer, stronger structures and improve construction practices. Unyielding innovation A dedication to innovation, extensive product engineering, and research and testing in our state-of-the-art labs. Immersive service Best-in-class field support, technical expertise, digital tools, and training to make it easy to select, specify, install and purchase our products. Impactful industry outreach A strong commitment to trades education and partnering with organizations that provide training and career opportunities to attract more people to the industry and alleviate labor shortages. Why Simpson? Our Customer-Centric Approach GROWTH OPPORTUNITIES WITHIN 5 KEY END USE MARKETS IN NORTH AMERICA FOCUSED ON: COMMERCIAL BUILDING TECHNOLOGY OEM NATIONAL RETAIL We are focused on becoming the leader in engineered load-rated construction fastening solutions in OEM, R&R / DIY and Mass Timber which supports our long-term goal of establishing ourselves as the leader in building technology across all of our markets Our Business Model and Commitment to Growth RESIDENTIAL

5 Mike Olosky brings a proven track record of leadership and implementation of Simpson's growth strategy • Joined Simpson in November 2020 as Chief Operating Officer, and promoted to President and Chief Operating Officer in January 2022 • Instrumental in developing the Company’s ambitions and leading the Company through its next phase of growth • Prior to joining Simpson, spent 22+ years in numerous leadership positions at Henkel, including as President and Head of the Electronics and Industrial Division • New leadership team has significant experience with Simpson prior to taking on new roles The Board underwent a deliberate, multi-year succession planning process, culminating in the appointment of Simpson’s COO, Mike Olosky, to serve as CEO effective January 2023 Worldclass Leadership Team Brian Magstadt CFO and Treasurer Michael Andersen Executive VP, Europe Phillip Burton Executive VP, North America Roger Dankel Executive VP, North American Sales Jeremy Gilstrap Executive VP, Innovation Jennifer Lutz Executive VP, Human Resources As a part of the succession planning process, a new executive leadership team was instated: Cassandra Payton Executive VP, General Counsel

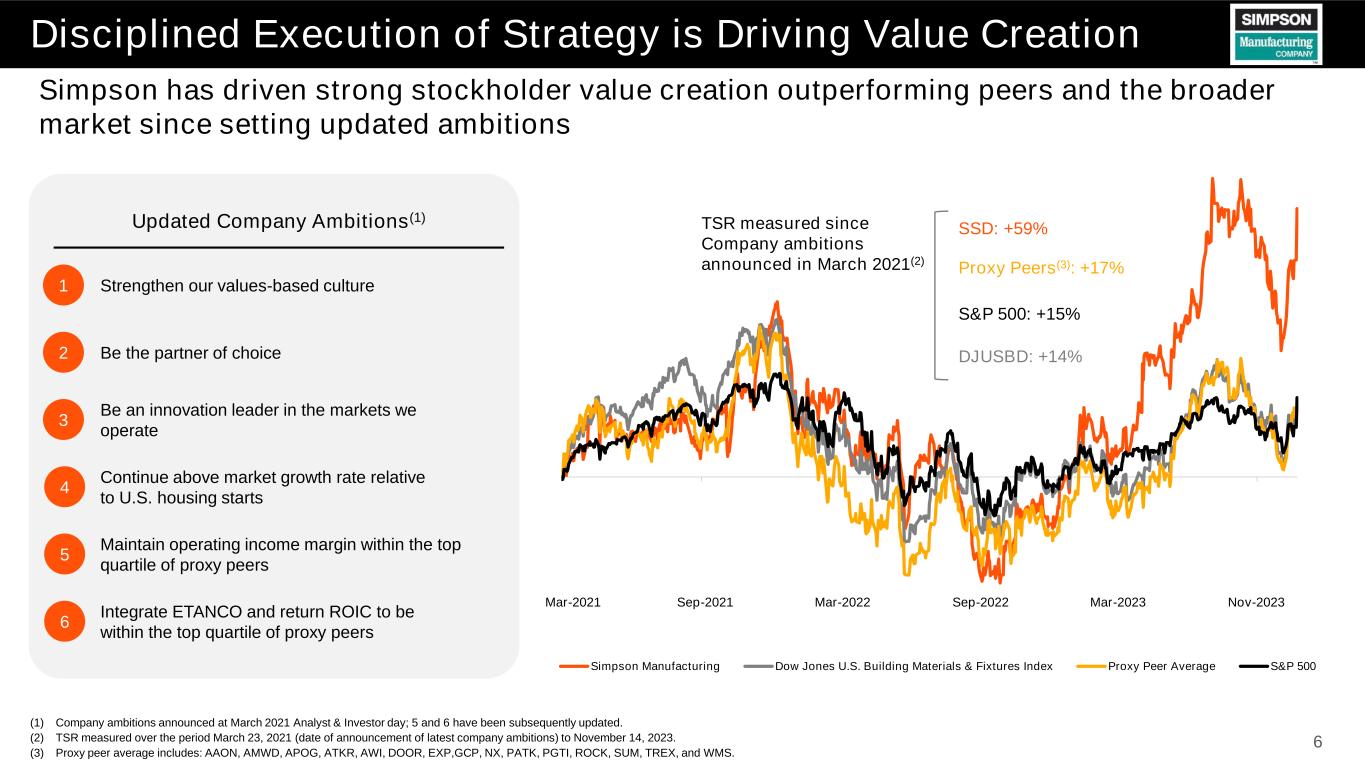

6 Simpson has driven strong stockholder value creation outperforming peers and the broader market since setting updated ambitions (1) Company ambitions announced at March 2021 Analyst & Investor day; 5 and 6 have been subsequently updated. (2) TSR measured over the period March 23, 2021 (date of announcement of latest company ambitions) to November 14, 2023. (3) Proxy peer average includes: AAON, AMWD, APOG, ATKR, AWI, DOOR, EXP,GCP, NX, PATK, PGTI, ROCK, SUM, TREX, and WMS. Disciplined Execution of Strategy is Driving Value Creation Updated Company Ambitions(1) 1 Strengthen our values-based culture 2 Be the partner of choice 3 Be an innovation leader in the markets we operate 4 Continue above market growth rate relative to U.S. housing starts 5 Maintain operating income margin within the top quartile of proxy peers 6 Integrate ETANCO and return ROIC to be within the top quartile of proxy peers Simpson Manufacturing Dow Jones U.S. Building Materials & Fixtures Index Proxy Peer Average S&P 500 Proxy Peers(3): +17% DJUSBD: +14% SSD: +59% S&P 500: +15% TSR measured since Company ambitions announced in March 2021(2) Nov-2023Mar-2021 Mar-2023Sep-2022Mar-2022Sep-2021

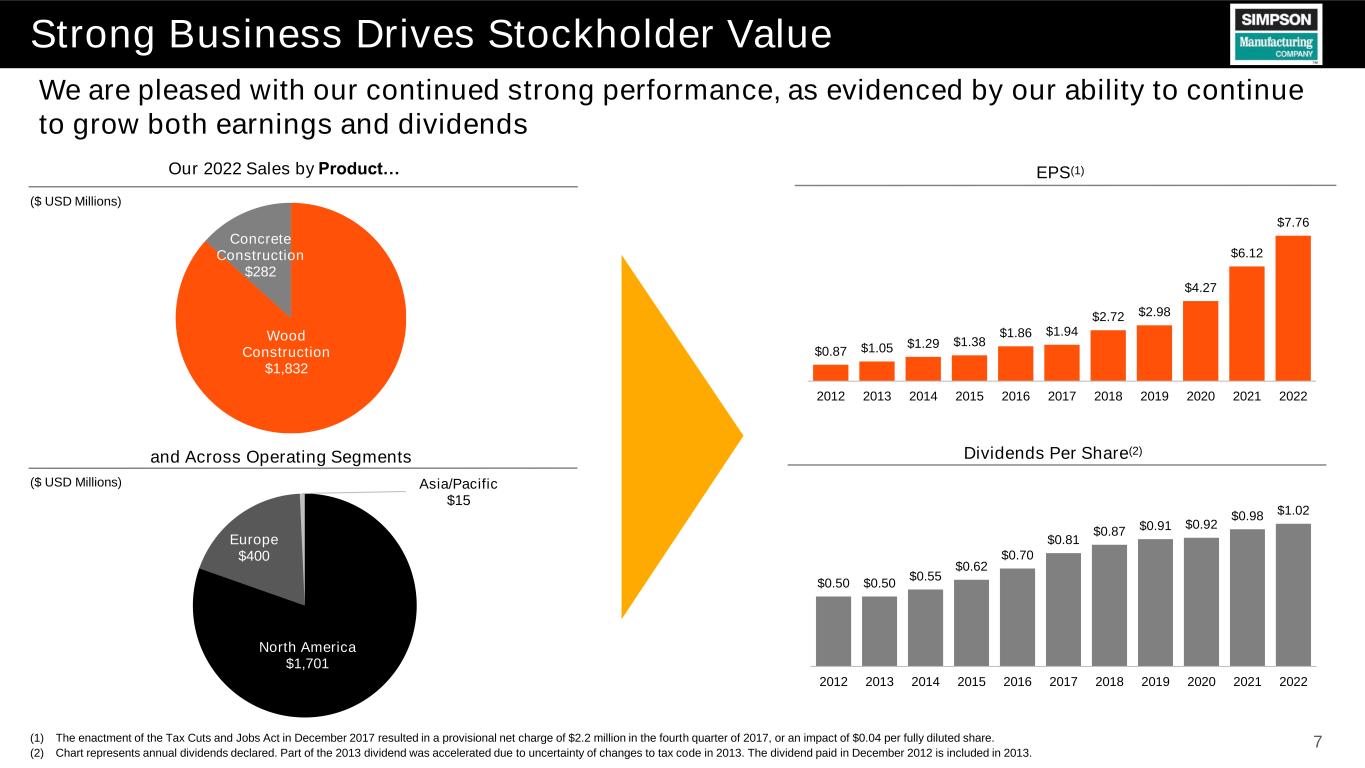

Our 2022 Sales by Product… ($ USD Millions) Wood Construction $1,832 Concrete Construction $282 North America $1,701 Europe $400 Asia/Pacific $15 and Across Operating Segments ($ USD Millions) EPS(1) $0.87 $1.05 $1.29 $1.38 $1.86 $1.94 $2.72 $2.98 $4.27 $6.12 $7.76 2012 2013 2014 2015 2016 2017 2018 2019 2020 2021 2022 Dividends Per Share(2) $0.50 $0.50 $0.55 $0.62 $0.70 $0.81 $0.87 $0.91 $0.92 $0.98 $1.02 2012 2013 2014 2015 2016 2017 2018 2019 2020 2021 2022 7 We are pleased with our continued strong performance, as evidenced by our ability to continue to grow both earnings and dividends (1) The enactment of the Tax Cuts and Jobs Act in December 2017 resulted in a provisional net charge of $2.2 million in the fourth quarter of 2017, or an impact of $0.04 per fully diluted share. (2) Chart represents annual dividends declared. Part of the 2013 dividend was accelerated due to uncertainty of changes to tax code in 2013. The dividend paid in December 2012 is included in 2013. Strong Business Drives Stockholder Value

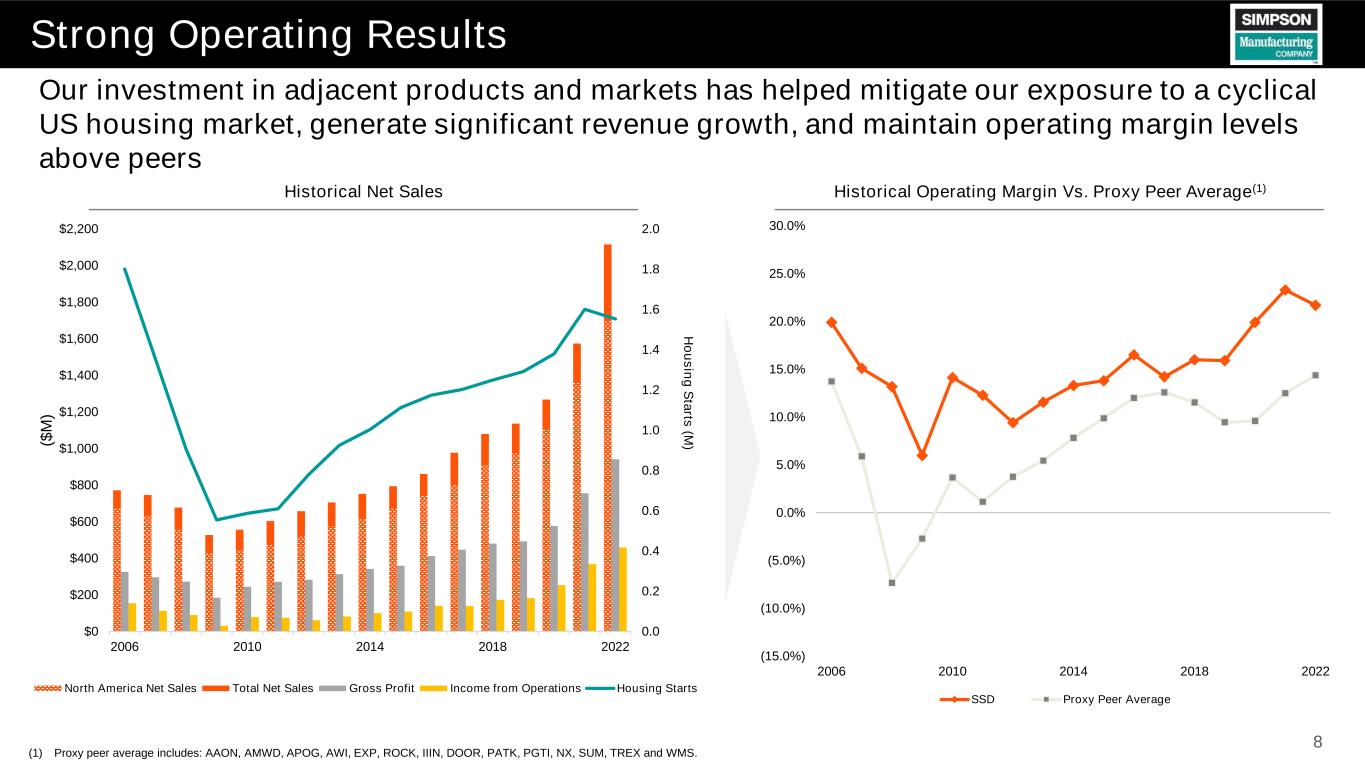

8 (1) Proxy peer average includes: AAON, AMWD, APOG, AWI, EXP, ROCK, IIIN, DOOR, PATK, PGTI, NX, SUM, TREX and WMS. Our investment in adjacent products and markets has helped mitigate our exposure to a cyclical US housing market, generate significant revenue growth, and maintain operating margin levels above peers 2006 2010 2014 2018 2022 0.0 0.2 0.4 0.6 0.8 1.0 1.2 1.4 1.6 1.8 2.0 $0 $200 $400 $600 $800 $1,000 $1,200 $1,400 $1,600 $1,800 $2,000 $2,200 H o u s in g S ta rts (M )($ M ) North America Net Sales Total Net Sales Gross Profit Income from Operations Housing Starts Strong Operating Results (15.0%) (10.0%) (5.0%) 0.0% 5.0% 10.0% 15.0% 20.0% 25.0% 30.0% 2006 2010 2014 2018 2022 SSD Proxy Peer Average Historical Net Sales Historical Operating Margin Vs. Proxy Peer Average(1)

4 2 4 Tenure >10 Years 4-10 Years <4 Years 9 CLD; N&ESG* Jennifer Chatman Paul J. Cortese Professor of Mgmt. Haas School of Business, UC Berkeley Deep understanding of organizational structures, leadership and compensation along with human resources expertise and academic knowledge Philip Donaldson Executive Vice President & CFO, Andersen Corporation AF*; CSA Extensive industry, operational and financial management experience brings a strong focus on driving stockholder value James Andrasick Chairman Former Chairman & CEO, Matson Navigation AF; CLD; CSA; N&ESG Extensive international business, capital allocation, and management expertise as a former executive Gary Cusumano Deep understanding of real estate development, business acumen and industry knowledge from a management and board member perspective Retired Chairman, The Newhall Land and Farming Company CLD*; CSA Kenneth Knight President & CEO, Invitae Corporation AF; N&ESG Extensive background in industrial manufacturing and knowledge in M&A and innovative growth AF; CSA* Proven record of leadership and entrepreneurship, and deep knowledge of cyber, technology and software Celeste Volz Ford Founder & Former CEO, Stellar Solutions CLD; N&ESG Robin Greenway MacGillivray Former Senior Vice President, One AT&T Integration, AT&T Significant experience with M&A and deep understanding of corporate culture, governance and leadership development Felica Coney Joined Board June 2023 Vice President, Global Server Operations, Google, Inc. AF; CSA Extensive experience in operations, supply chain and environmental, health and safety across public companies Chau Banks Joined Board June 2023 Senior VP and Chief Information & Data Officer, The Clorox Company AF; CLD Significant experience in information technology including cyber, data transformations, and customer facing-digital technology Michael Olosky President and CEO, Simpson Manufacturing CSA Industry, international operations, and leadership experience with deep knowledge of Simpson’s daily operations and growth initiatives 43 5 Women 3 Racially Diverse 5 Men Diversity 12 Diverse Board with Balance of Tenures(1) Committee Key: AF= Audit and Finance Committee; CLD = Compensation and Leadership Development Committee; CSA = Corporate Strategy and Acquisitions Committee; N&ESG = Nominating and ESG Committee; * = Committee Chair Recent refreshment of directors enriches the Board’s comprehensive skillset and core strengths which align with Simpson’s strategy and growth-oriented culture (1) Tenure statistics reflect board composition as of January 1, 2024. Independent Board Committed to Strong Oversight

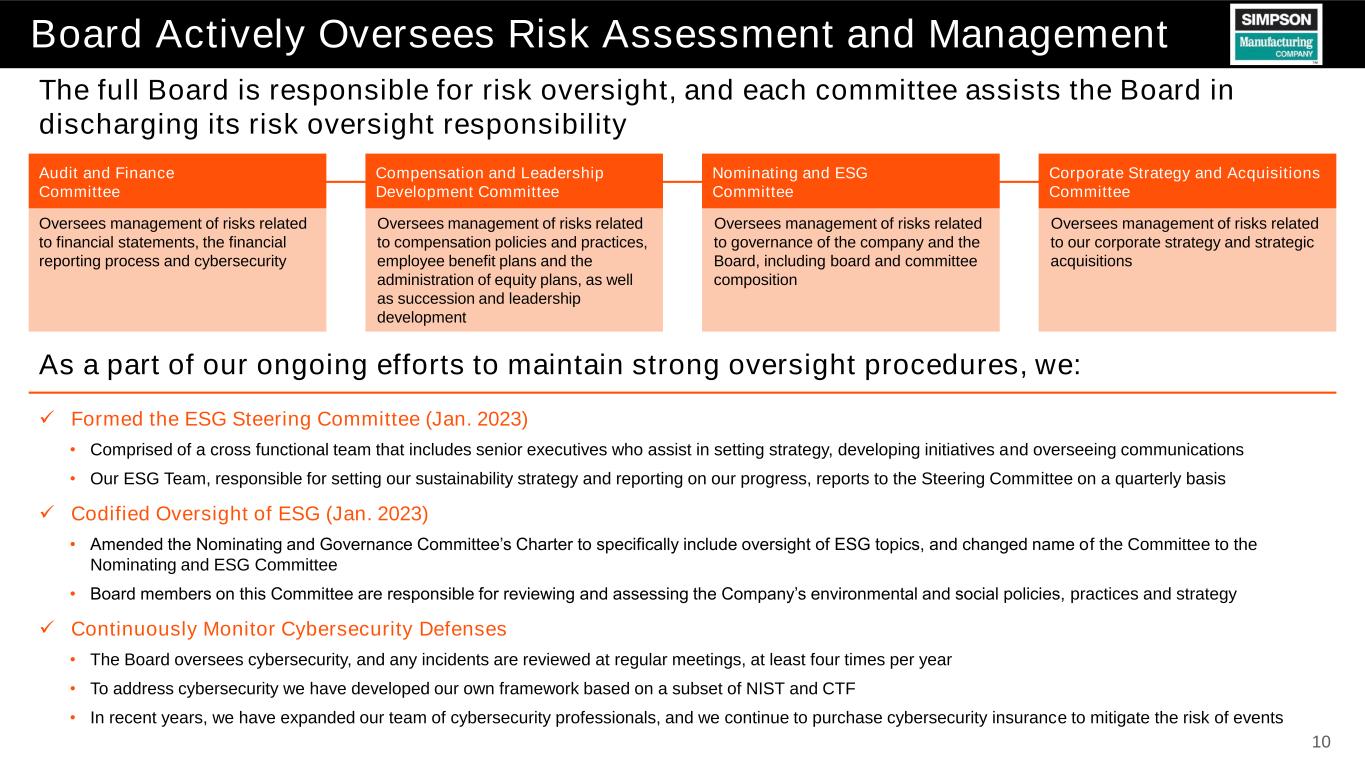

The full Board is responsible for risk oversight, and each committee assists the Board in discharging its risk oversight responsibility Board Actively Oversees Risk Assessment and Management Audit and Finance Committee Oversees management of risks related to financial statements, the financial reporting process and cybersecurity Compensation and Leadership Development Committee Oversees management of risks related to compensation policies and practices, employee benefit plans and the administration of equity plans, as well as succession and leadership development Nominating and ESG Committee Oversees management of risks related to governance of the company and the Board, including board and committee composition Corporate Strategy and Acquisitions Committee Oversees management of risks related to our corporate strategy and strategic acquisitions ✓ Formed the ESG Steering Committee (Jan. 2023) • Comprised of a cross functional team that includes senior executives who assist in setting strategy, developing initiatives and overseeing communications • Our ESG Team, responsible for setting our sustainability strategy and reporting on our progress, reports to the Steering Committee on a quarterly basis ✓ Codified Oversight of ESG (Jan. 2023) • Amended the Nominating and Governance Committee’s Charter to specifically include oversight of ESG topics, and changed name of the Committee to the Nominating and ESG Committee • Board members on this Committee are responsible for reviewing and assessing the Company’s environmental and social policies, practices and strategy ✓ Continuously Monitor Cybersecurity Defenses • The Board oversees cybersecurity, and any incidents are reviewed at regular meetings, at least four times per year • To address cybersecurity we have developed our own framework based on a subset of NIST and CTF • In recent years, we have expanded our team of cybersecurity professionals, and we continue to purchase cybersecurity insurance to mitigate the risk of events As a part of our ongoing efforts to maintain strong oversight procedures, we: 10

Social Responsibility Diversity, Equity and Inclusion Leadership & Development Human Capital Management Health and Safety Striving to ensure everyone at our Company feels included and empowered, and equipping our employees with the tools and confidence to nurture themselves and their careers • GOAL: Foster diversity in our workforce and maintain representation of differing genders, ages, races, ethnicities, and abilities ✓ Partnering with DiversityJobs to promote our job postings, and recently established a promotion guide to ensure a fair and consistent approach • GOAL: Ensure all employees have access to opportunities to grow and thrive in their careers with the Company ✓ In 2022, began offering leadership developmental programs for high- potential sales leaders, and in 2023 will initiate sales rotation program • GOAL: Strengthen our values-based leadership and culture based on our Company value that Everybody Matters ✓ Periodically conducts employee surveys to inform and support the behaviors, expectations and experiences of employees • GOAL: Provide the highest standard of safety and create a healthy working environment ✓ In 2022, improved the global Total Recordable Incident Rate to1.57, below the gold standard of recognized international experts 11 We operate in an environmentally responsible manner to protect our employees, customers and communities while prioritizing an inclusive, equitable and diverse company Sustainability, Environmental and Social Responsibility Environmental Manufacturing Facilities Energy Conservation Waste Reduction and Recycling Sustainable Building Practices Committed to continuously improving the efficiency of our resource use to lessen our impact, and designing and manufacturing products with environmental conservation in mind • GOAL: Minimize amount of total waste generated by manufacturing processes through companywide lean practices ✓ In 2022, introduced a centralized formal process to understand and address our footprint • GOAL: Improve energy efficiencies at facilities globally to ensure eco- friendly, cost-effective operations ✓ In 2022, conducted an energy audit and identified multiple opportunities to conserve energy • GOAL: Support the Circular Economy by minimizing our largest recognized waste stream and sending unused steel back upstream ✓ In 2022, contracted a waste consultant to evaluate operations and make recommendations about waste reduction • GOAL: Support sustainable business practices through use of green building technology and non-toxic materials ✓ In 2022, we bolstered our green use product offering through ETANCO’s technology

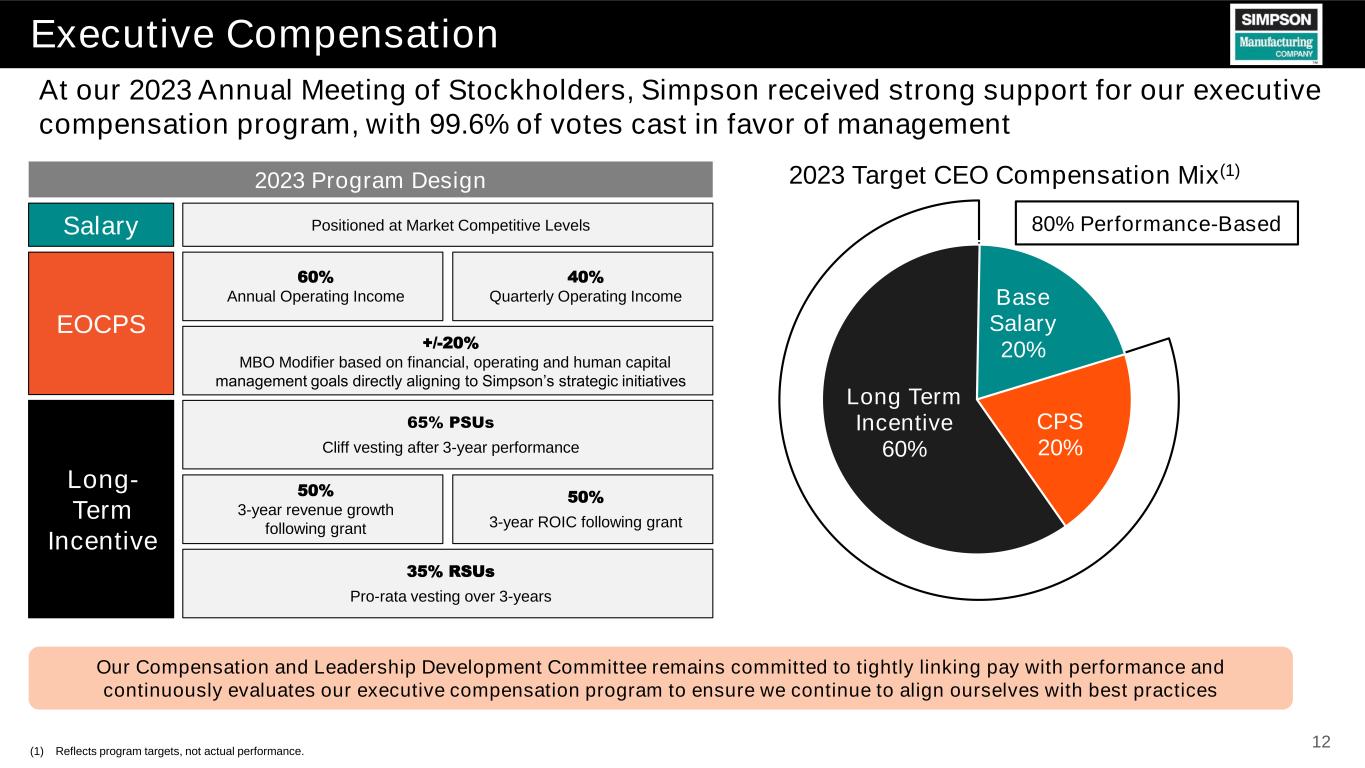

(1) Reflects program targets, not actual performance. 12 2023 Target CEO Compensation Mix(1) Long Term Incentive 60% Long Term Incentive 60% Base Salary 20% CPS 20% 80% Performance-Based Our Compensation and Leadership Development Committee remains committed to tightly linking pay with performance and continuously evaluates our executive compensation program to ensure we continue to align ourselves with best practices Long- Term Incentive EOCPS 60% Annual Operating Income 2023 Program Design Salary Positioned at Market Competitive Levels 35% RSUs Pro-rata vesting over 3-years 65% PSUs Cliff vesting after 3-year performance 50% 3-year revenue growth following grant 50% 3-year ROIC following grant 40% Quarterly Operating Income +/-20% MBO Modifier based on financial, operating and human capital management goals directly aligning to Simpson’s strategic initiatives At our 2023 Annual Meeting of Stockholders, Simpson received strong support for our executive compensation program, with 99.6% of votes cast in favor of management Executive Compensation

13 Enhancements to our practices and policies and efforts taken to-date Governance Sustainability, Environmental and Social Responsibility • Separate Chair of the Board and CEO • Board comprised of majority independent directors • Commitment to Board refreshment (added two directors in 2023) • Conducts annual Board and Committee self-evaluations and reviews of director qualifications • Continued commitment to social responsibility and environmentally sustainable business practices, as highlighted in our 2022 ESG Report published in June 2023 • ESG developments in our 2022 report include: ‒ Formed ESG Steering Committee to oversee our companywide ESG strategy and performance ‒ Our Nominating and ESG Committee – formerly our Nominating and Governance Committee – will provide Board-level oversight of our ESG performance ‒ Conducted a pay equity analysis, supporting our commitment to achieving and maintain internal pay equity across gender, race and ethnicity ‒ Assessed our alignment with the UN Sustainable Development Goals ‒ Reported Scope 1 and 2 emissions Compensation • Disclose specific targets of the compensation program and how they tie to our strategy • Maintaining longer performance-based equity award performance periods • Double-trigger vesting of equity awards upon a change in control • Rigorous approach to establishing performance goals under the incentive plans Our Board remains committed to constructive engagement with our stockholders and regularly reviews and incorporates stockholder perspectives into our key practices Commitment to Strong Governance Practices To inform our practices, Simpson maintains a strong stockholder engagement program led by the Board and senior management In late 2022 and early 2023, we reached out to stockholders holding 71% O/S and conducted engagement with 33% O/S(1) (1) Outreach and engagement statistics based on shares outstanding as of January 20, 2023, reflecting 13F filings from CapIQ.

14 Appendix

Return on Invested Capital (“ROIC”) Definition 15 When referred to in this presentation, return on invested capital (“ROIC”) for a fiscal year is calculated based on (i) the net income of that year as presented in the Company’s consolidated statements of operations prepared pursuant to generally accepted accounting principles in the U.S. (“GAAP”), as divided by (ii) the average of the sum of total stockholders’ equity and total long-term debt, at the beginning of and at the end of such year, as presented in the Company’s consolidated balance sheets prepared pursuant to GAAP for that applicable year. As such, the Company’s ROIC, a ratio or statistical measure, is calculated using exclusively GAAP financial measures.