U.S. Bank Expands Alliance Strategy, Announces Edwards Jones Partnership

21 Agosto 2024 - 3:00PM

Business Wire

Edward Jones clients will have access to

checking, credit card products powered by U.S. Bank

U.S. Bank has entered into a strategic partnership to serve

Edward Jones’ clients banking needs with leading U.S. Bank deposit

and credit card solutions. Through the alliance, Edward Jones

financial advisors will have the unique opportunity and tools to

introduce co-branded U.S. Bank deposit and credit card products to

the firm’s U.S. clients beginning in late 2025.

The launch will include expanded banking products powered by

U.S. Bank that will be made available to Edward Jones U.S. clients

through the firm’s more than 19,000 financial advisors, serving 8

million clients with $2 trillion client assets under care across

North America.

“U.S. Bank and Edward Jones share a mission to improve the

financial lives of our clients. Working together, we look forward

to helping more clients achieve their financial goals with simple

and easy to use banking solutions,” said Arijit Roy, head of

consumer and business banking products at U.S. Bank.

U.S. Bank has had an Edward Jones card-issuing relationship

through its Elan division since 2012. This expanded alliance will

feature new co-branded Edward Jones and U.S. Bank credit card

products with enhanced rewards for consumer and small business

clients.

This is the latest step in the U.S. Bank alliance strategy to

extend the company’s geographic reach and serve more clients. In

2020, U.S. Bank entered into an alliance with State Farm to assume

the insurance provider’s deposit and credit card account products.

The relationship now includes business banking, deposit and credit

card products available through State Farm’s 19,400 agents located

across 48 states.

Alliances are one way U.S. Bank has continued to focus on

meeting consumers where they are and offering a simplified

experience around core deposit products. Other recent examples

include the launch of Bank Smartly Checking and Smart Rewards, new

capabilities to make it faster and easier than ever before to

switch your paycheck direct deposit when opening a new account and

the ability for clients and non-clients to open certificates of

deposit (CDs) in all 50 states. U.S. Bank also recently launched a

partnership with Greenlight to provide complimentary access to the

Greenlight debit card and money app for families with kids and

teens.

About U.S. Bank

U.S. Bancorp, with more than 70,000 employees and $680 billion

in assets as of June 30, 2024, is the parent company of U.S. Bank

National Association. Headquartered in Minneapolis, the company

serves millions of customers locally, nationally and globally

through a diversified mix of businesses including consumer banking,

business banking, commercial banking, institutional banking,

payments and wealth management. U.S. Bancorp has been recognized

for its approach to digital innovation, community partnerships and

customer service, including being named one of the 2024 World’s

Most Ethical Companies and Fortune’s most admired superregional

bank. Learn more at usbank.com/about.

Disclosures: Deposit products are offered by U.S. Bank National

Association. Member FDIC. The creditor and issuer of this card is

U.S. Bank National Association, pursuant to a license from Visa

U.S.A. Inc., and the card is available to United States residents

only.

View source

version on businesswire.com: https://www.businesswire.com/news/home/20240821260441/en/

Tessa Bajema, U.S. Bank Public Affairs & Communications

tessa.bajema@usbank.com| 415.774.2394

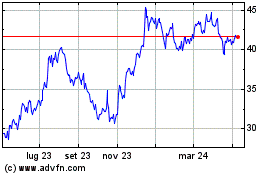

Grafico Azioni US Bancorp (NYSE:USB)

Storico

Da Gen 2025 a Feb 2025

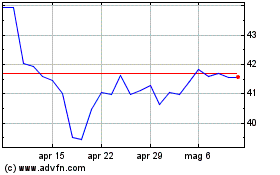

Grafico Azioni US Bancorp (NYSE:USB)

Storico

Da Feb 2024 a Feb 2025