Visa’s Growth Corporates Working Capital Index Reveals 300% Increase in Working Capital Efficiency

21 Ottobre 2024 - 2:00AM

Business Wire

Top performing growth corporates surveyed saved

an average of $11 million, with virtual card usage jumping 32%

Visa (NYSE:V), a global leader in digital payments, announced

the findings from its second annual global Growth Corporates

Working Capital Index. The findings revealed an astounding increase

in working capital usage and efficiency, with an 81% adoption rate

of at least one working capital solution in 2024. Beyond increased

adoption, top-performing companies1 saved an average of $11 million

in interest and fees – a YoY efficiency increase of 300%.

The Index surveyed nearly 1,300 CFOs and Treasurers across 8

industry segments and 23 countries, all representing “Growth

Corporates,” organizations that generate between $50 million and $1

billion in annual revenue.

Beyond the increased adoption of working capital solutions,

virtual cards saw a particularly high uptick. These solutions offer

flexible, on-demand working capital solutions that provide access

to funds as corporate needs require. Virtual cards saw a 32% YoY

increase in usage and were intrinsically linked to top-performing

Index scores. Surveyed Growth Corporates who used virtual card

solutions saw higher probability of reduced Days Payable

Outstanding (DPO), strategic utilization of working capital, better

cash flow predictability, more supplier integration into payment

systems and early supplier payment.

The Index notably highlights that CFOs and Treasurers of Growth

Corporate businesses want relationship-based banking and

personalized working capital solutions tailored to their specific

industry, spending habits and business needs. Five out of eight

industries represented by survey respondents cited lengthy approval

processes and uncertainty about approval outcomes as their most

significant obstacles, as respondents expressed the need for

bankers with both the lending experience and working knowledge of

their industry and region to design working capital solutions that

fit their business requirements. And the stakes are high: 90% of

respondents reported negative consequences when working capital

access was denied or took too long.

“Growth Corporates have unique needs and capabilities that often

fall through the cracks between small businesses and enterprises,”

said Lauren Hewings, Visa’s Head of Working Capital Solutioning.

“This valuable segment, which really represents tomorrow’s

enterprises, has historically lacked access to customized,

industry-tailored products and solutions from their financial

institutions; however, increasingly, they are demanding them from

their financial institutions as they seek flexible, on-demand

methods for optimizing cash flow to drive strategic growth.”

Additional key findings include:

- More than half (58%) of top performers surveyed improved their

working capital ratios, as evidenced by 51% shorter cash conversion

cycles and 28% shorter days payable outstanding.

- Strategic use cases drove 62% of working capital use. CFOs and

Treasurers were 35% more likely to use solutions to invest in

company assets and 37% more likely to have invested in organic

growth and expansion, than last year.

- Developing markets and specific industries experienced

remarkable gains: North America’s agriculture sector saw a 17%

Index surge, healthcare in Europe and Asia-Pacific (APAC) led with

16% gains, and retail in Central Europe, Middle East and Africa

(CEMEA) witnessed a dramatic 26% increase in Index scores.

- Top performers surveyed achieved a 21% increase in their net

profit margins and a 14% increase in their working capital

ratios.

- Top-performing CFOs and Treasurers are three times more likely

to use virtual cards next year than bottom performers. Virtual

cards provide access as needed to pay suppliers early, which is

often associated with more favorable pricing from key

suppliers.

For more information about the Growth Corporates Working Capital

Index, please visit:

https://global-corporate.review.visa.com/solutions/commercial-solutions/knowledge-hub/working-capital-index-report.html.

About Visa Inc.

Visa (NYSE: V) is a world leader in digital payments,

facilitating transactions between consumers, merchants, financial

institutions and government entities across more than 200 countries

and territories. Our mission is to connect the world through the

most innovative, convenient, reliable and secure payments network,

enabling individuals, businesses and economies to thrive. We

believe that economies that include everyone everywhere, uplift

everyone everywhere and see access as foundational to the future of

money movement. Learn more at Visa.com.

______________________________ 1 Top performers are

characterized by superior predictability in financing needs, which

enables them to use financing more strategically than less

efficient counterparts. Growth Corporates at the top of the Index

are more likely to be in a stable financial position, either with

the help of external working capital or without and are therefore

the least likely to have needed financing for emergencies.

View source

version on businesswire.com: https://www.businesswire.com/news/home/20241020450871/en/

David Thum dthum@visa.com

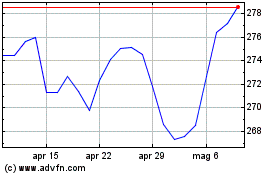

Grafico Azioni Visa (NYSE:V)

Storico

Da Ott 2024 a Nov 2024

Grafico Azioni Visa (NYSE:V)

Storico

Da Nov 2023 a Nov 2024