Criminals Reverting to Old-School Tactics with New Twists, Visa’s State of Scams Report Shows

23 Ottobre 2024 - 2:00PM

Business Wire

Latest Visa Biannual Threats Report highlights emerging scams

targeting consumers, merchants and financial institutions.

Ahead of Money20/20 US, Visa, a global leader in digital

payments, today published the State of Scams: Fall 2024 Biannual

Threats Report. The latest edition of the report brings

to light several emerging threats and scams targeting banks and

consumers, including a surprising resurgence of small-scale

physical crime.

This press release features multimedia. View

the full release here:

https://www.businesswire.com/news/home/20241023398641/en/

“Visa invested $11 billion dollars in technology and

infrastructure in the past five years, and our network is more

secure than ever,” said Paul Fabara, Chief Risk and Client Services

Officer at Visa. “As payments become safer, fraudsters are

reverting to tried-and-true tactics that target the weakest link in

the ecosystem: consumers. Visa is committed to removing risks

across a transaction, regardless of how you’re paying, but that

doesn’t mean consumers should let their guard down.”

Key themes highlighted in the report include:

- The resurgence of physical theft: Scammers are going

back to basics with an increase of physical theft over the past six

months, capitalizing on the window between the theft and the

victim’s awareness. After a theft, the most common ways the

criminals are capitalizing on their theft by purchasing gift cards

or physical goods to resell, or even using the card number online

for money transfers. Similarly, in March of 2023, Visa identified

an emerging threat dubbed “digital pickpocketing,” where

cybercriminals use a mobile point-of-sale device to tap against

unsuspecting consumers’ wallets and initiate a payment, often in

crowded areas.

- Government impersonation scams: Consumers are falling

victim to scams where fraudsters pose as representatives from the

government, including agencies like the USPS, the FBI and the IRS.

In the first three months of 2024, the average government

impersonation scam victim in the U.S. lost $14,000 in cash,

totaling more than US$20 million. Additionally, between 2022 and

2023, there was 90% increase in losses from cash payments due to

government impersonation scams1. As government impersonation scams

move towards cash, Visa predicts that banks will see an increase in

large cash withdrawals by customers at ATMs.

- The rise of authentication bypass scams: Looking for a

way to get around two-factor authentication, fraudsters are

doubling down on one-time-password phishing scams, which allow

criminals access to full account funds and information via

increasingly convincing texts, emails or phone calls. These scams

have grown more convincing in part due to the prevalence of Gen

AI.

While many of the scams highlighted in the report target

consumers, the research contains key takeaways for financial

institutions and merchants as well.

- Gas station fraud: After a successful small

authorization, fraudsters are making large fuel purchases at gas

stations using accounts that do not have enough money to cover the

total. In the past six months, activity has significantly shifted

from targeting issuers in the U.S., Latin America and Caribbean to

issuers in Central Europe, Middle East and Africa, showing how

these scams spread globally.

- Enumeration: Merchants continue to be targeted by

cybercriminals who test payment data with scale and speed, leading

them to access consumer account information. Enumeration, or

automatic testing of common payment data to guess account numbers,

remains a top threat to the payment ecosystem, with significant

fraud occurring in the year after a successful enumeration attack.

Industries most impacted over the past year include restaurants,

government services, and charitable and social service

organizations.

- Token provisioning fraud: Tokenization remains one of

the safest ways to pay, but as the technology gains momentum,

scammers have taken to obtaining tokens illegitimately—and cashing

out under the radar of financial institutions. Recently, Visa has

noted a marked delay in when cybercriminals choose to cashout

compromised accounts, hoping to evade detection after initial

provisioning fraud.

- Ransomware: More sophisticated ransomware attacks are

affecting more companies and individuals. Although there was an

overall decrease of 12.3% in attempted ransomware attacks seen

during the period of this report, there was a 24% increase in

targeting of third-party providers like cloud or web hosting

services, creating the opportunity for more fraud per attack. Just

one attack to a third-party provider affected an estimated 2,620

organizations along with 77.2 million individuals, making these

third-party providers a prime target for criminals2.

This report also marks the first edition published under the

newly expanded Payment Fraud Disruption team, now part of the

Payment Ecosystem Risk and Control (PERC) team, which works to

protect the Global Payment Ecosystem against threats and abuse by

transforming risk controls, leveraging intelligence-driven

solutions, and upholding Visa’s Rules and Standards.

The full report can be found HERE. To find out more about how

Visa works to prevent fraud and protect the payments ecosystem,

visit visa.com/security.

About Visa

Visa (NYSE: V) is a world leader in digital payments,

facilitating transactions between consumers, merchants, financial

institutions and government entities across more than 200 countries

and territories. Our mission is to connect the world through the

most innovative, convenient, reliable and secure payments network,

enabling individuals, businesses and economies to thrive. We

believe that economies that include everyone everywhere, uplift

everyone everywhere and see access as foundational to the future of

money movement. Learn more at Visa.com.

____________________

1 Visa Biannual Threats Report Fall 2024 2 Visa Biannual Threats

Report Fall 2024

View source

version on businesswire.com: https://www.businesswire.com/news/home/20241023398641/en/

Media Contact Meg Omecene momecene@visa.com

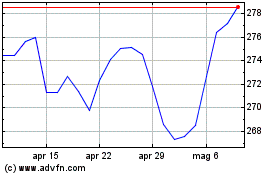

Grafico Azioni Visa (NYSE:V)

Storico

Da Nov 2024 a Dic 2024

Grafico Azioni Visa (NYSE:V)

Storico

Da Dic 2023 a Dic 2024