WNS (Holdings) Limited (“WNS” or “the Company”) (NYSE: WNS), a

leading provider of global digital-led Business Process Management

(BPM) solutions today released a supplementary financial

information package (the “Supplemental Financial Information”)

containing its unaudited quarterly financial results for each of

the quarters in fiscal 2024 and for full year fiscal 2024 and 2023

prepared in accordance with United States Generally Accepted

Accounting Principles (“US GAAP”). The Company transitioned from

reporting on the forms available to foreign private issuers (FPIs)

and filing financial statements with the SEC under the

International Financial Reporting Standards (“IFRS”) to voluntarily

filing on US domestic issuer forms and filing its financial

statements under US GAAP.

Our first set of unaudited financial statements prepared in

accordance with US GAAP will be for the first quarter ended June

30, 2024, which will include certain comparative financial

information for fiscal 2024. Until the adoption of US GAAP, the

financial statements included in our annual reports on Form 20-F

and reports on Form 6-K were prepared in accordance with the IFRS,

as issued by the International Accounting Standards Board

(“IASB”).

The Supplemental Financial Information is contained in an

exhibit to a report on Form 8-K submitted to the US Securities and

Exchange Commission on July 09, 2024. The Supplemental Financial

Information sets forth the key impact on our quarterly financial

statements for each of the quarters in fiscal 2024 and for full

year fiscal 2024 and 2023 as a result of our transition to US GAAP.

We provide the Supplemental Financial Information to help users of

our financial statements better understand such impact of the

transition to US GAAP on the Company’s financial statements that

will be included as the comparative information in the Company’s

consolidated interim financial statements for the quarterly periods

during fiscal 2025 and for full year fiscal 2025 that will be

prepared in accordance with US GAAP.

The consolidated financial information included in this report

for the full year fiscal 2024 and 2023 under IFRS have been derived

from our audited consolidated financial statements included in our

annual report for the year ended March 31, 2024 on Form 20-F.

Impact of US GAAP on net income

The following table provides a summary of the significant

differences between US GAAP and IFRS on our net income for the four

quarters of fiscal 2024 and the years ended March 31, 2024 and

2023.

Three months ended

Year ended

June 30,

September 30,

December 31,

March 31,

March 31,

March 31,

(US$ thousands)

2023

2023

2023

2024

2024

2023

Net income as per IFRS

$

30,136

$

57,813

$

39,636

$

12,563

$

140,148

$

137,308

Net impact of US GAAP adjustment

1,828

1,629

1,901

1,971

7,329

1,114

Net income as per US GAAP

$

31,964

$

59,442

$

41,537

$

14,534

$

147,477

$

138,422

The primary impact as a result of conversion to US GAAP on net

income for fiscal 2024 and 2023 is outlined below under “US GAAP

adjustments to net income and shareholders’ equity”.

US GAAP adjustments to net income and shareholders’

equity

An explanation of how the transition from IFRS to US GAAP has

affected the Company’s net income for the four quarters of fiscal

2024 and the years ended March 31, 2024 and 2023 and shareholders’

equity as of March 31, 2022, March 31, 2023, June 30, 2023,

September 30, 2023, December 31, 2023 and March 31, 2024 is set out

in the following tables and the notes outlined below under “Notes

to reconciliation of net income and shareholders’ equity”:

Reconciliation of net income

Three months ended

Year ended

June 30,

September 30,

December 31,

March 31,

March 31,

March 31,

(US$ thousands)

Notes

2023

2023

2023

2024

2024

2023

Net income as per IFRS

$

30,136

$

57,813

$

39,636

$

12,563

$

140,148

$

137,308

Lease

1

569

384

483

(4

)

1,432

875

Employee benefits

2

(3

)

(4

)

(3

)

(20

)

(30

)

85

Income tax expense

3

1,262

1,249

1,421

1,995

5,927

154

Total US GAAP adjustments

$

1,828

$

1,629

$

1,901

$

1,971

$

7,329

$

1,114

Net income as per US GAAP

$

31,964

$

59,442

$

41,537

$

14,534

$

147,477

$

138,422

Reconciliation of shareholders’ equity:

March 31,

March 31,

June 30,

September 30,

December 31,

March 31,

(US$ thousands)

Notes

2022

2023

2023

2023

2023

2024

Shareholders’ equity under IFRS

$

754,003

$

801,136

$

760,578

$

816,326

$

821,983

$

765,728

Lease

1

20,280

19,714

20,216

20,195

20,965

20,847

Employee benefits

2

—

—

—

—

—

—

Net total impact

20,280

19,714

20,216

20,195

20,965

20,847

Income tax expense impact on above

transactions

3(a)

(3,045

)

(3,744

)

(3,844

)

(3,924

)

(4,027

)

(4,191

)

Income tax expense impact on share based

compensation expense

3(b)

(3,153

)

(5,049

)

(1,003

)

583

2,356

4,924

Total US GAAP adjustments

14,082

10,921

15,369

16,854

19,294

21,580

Shareholders’ equity under US

GAAP

$

768,085

$

812,057

$

775,947

$

833,180

$

841,277

$

787,308

Notes to reconciliation of net income and shareholders’

equity

1. Lease

a. Under IFRS, the Company, as lessee, applied the single lease

model that is similar to the accounting for a finance lease under

US GAAP. The expense recognition presented a higher portion of the

total expense earlier in the lease term as a combination of

straight-line depreciation of the Operating lease right-of-use

(‘ROU’) asset and the effective interest rate method applied to the

lease liability results in a decreasing rate of interest expense

recognition throughout the lease term.

Under US GAAP, there is dual classification lease accounting

model for lessees: finance leases and operating leases. The

Company, as a lessee, has classified all its leases as operating

leases and recognized a single lease expense, including both a ROU

asset depreciation component and an interest expense component, on

a straight-line basis throughout the lease term.

b. ROU asset measurement as at April 1, 2019, the date of

transition to IFRS 16 -“Leases” and ASC 842 – “Classification and

accounting treatment of Lease”:

Under IFRS, the Company elected to measure ROU assets related to

certain lease contracts as if IFRS 16 -“Leases” had always been

applied (but using the incremental borrowing rate at the date of

initial application). Under US GAAP, upon transition to ASC 842,

Leases, the Company measures ROU asset at an amount equal to the

lease liability.

c. Under IFRS, the Company is required to impute interest on

refundable security deposit with lessor. Imputed interest is

considered as part of ROU assets. Under US GAAP, the Company is not

required to impute interest on refundable security deposit with the

lessor.

2. Employee benefits

a. Actuarial gains and losses: Under IFRS, the Company

recognized actuarial gains and losses in other comprehensive income

and does not reclassify actuarial gains and losses to the statement

of income. Under US GAAP, the Company recognizes actuarial gains

and losses in other comprehensive income and amortizes it to net

periodic benefit cost over the expected remaining period of service

of the covered employees using the corridor method.

b. Past service cost: Under IFRS, the Company recognizes past

service costs associated with a plan amendment in the statement of

income immediately when the plan amendment occurs. Under US GAAP,

past service cost associated with plan amendment is initially

recognized in full in other comprehensive income in the reporting

period in which the amendment occurs and subsequently amortizes

into employee benefit cost over the expected remaining period of

service of the covered employees.

3. Income tax expense

The difference in deferred tax as compared to IFRS is primarily

on account of:

a. Tax impact of above US GAAP adjustments.

b. Treatment of share-based compensation expense, as below:-

Under IFRS, income tax effects of share-based awards is measured

based on an estimate of the future tax deduction, if any, for the

award measured at the end of each reporting period. When the

expected tax benefits from equity awards exceed the recorded

cumulative recognized expense multiplied by the tax rate, the tax

benefit up to the amount of the tax effect of the cumulative book

compensation expense is recorded in the income statement; the

excess is recorded in equity. When the expected tax benefit is less

than the tax effect of the cumulative amount of recognized expense,

the entire tax benefit is recorded in the income statement.

Under US GAAP, deferred taxes are recorded as share-based

compensation expense is recognized, as long as that particular type

of instrument ordinarily would result in a future tax deduction.

The measurement of the deferred tax asset is based on the amount of

compensation cost recognized for book purposes. Changes in the

stock price do not impact the deferred tax asset or result in any

adjustments prior to settlement or expiration. Upon settlement or

expiration, excess tax benefits and tax deficiencies (the

difference between the recorded deferred tax asset and the tax

benefit of the actual tax deduction) are recognized within income

tax expense in the consolidated statement of income.

US GAAP impact on earnings per ordinary share, basic and

diluted

The following table provides the impact of US GAAP adjustments

on basic earnings per ordinary share in fiscal 2024 and 2023:

Three months ended

Year ended

June 30,

September 30,

December 31,

March 31,

March 31,

March 31,

(US$)

2023

2023

2023

2024

2024

2023

Basic earnings per ordinary share under

IFRS

$

0.63

$

1.22

$

0.84

$

0.27

$

2.97

$

2.85

Net impact of US GAAP adjustments

0.04

0.03

0.04

0.04

0.15

0.02

Basic earnings per ordinary share under

US GAAP

$

0.67

$

1.25

$

0.88

$

0.31

$

3.12

$

2.87

The following table provides the impact of US GAAP adjustments

on diluted earnings per ordinary share in fiscal 2024 and 2023:

Three months ended

Year ended

June 30,

September 30,

December 31,

March 31,

March 31,

March 31,

(US$)

2023

2023

2023

2024

2024

2023

Diluted earnings per ordinary share

under IFRS

$

0.60

$

1.16

$

0.81

$

0.26

$

2.83

$

2.70

Net impact of US GAAP adjustments

0.04

0.04

0.04

0.04

0.16

0.04

Diluted earnings per ordinary share

under US GAAP

$

0.64

$

1.20

$

0.85

$

0.30

$

2.99

$

2.74

The following table provides the impact of US GAAP adjustments

on diluted weighted average number of equity shares in fiscal 2024

and 2023:

Three months ended

Year ended

June 30,

September 30,

December 31,

March 31,

March 31,

March 31,

(US$)

2023

2023

2023

2024

2024

2023

Diluted weighted average ordinary

shares outstanding

50,259,257

49,650,152

49,083,704

48,252,531

49,570,081

50,877,769

Net impact of US GAAP adjustments*

—

—

—

—

(258,307

)

(353,825

)

Diluted weighted average number of

equity shares under US GAAP

50,259,257

49,650,152

49,083,704

48,252,531

49,311,774

50,523,944

* Under IFRS, dilutive potential ordinary shares are determined

independently for each period presented. The number of dilutive

potential ordinary shares included in the annual (or year-to-date)

period is not equal to a weighted average of the dilutive potential

ordinary shares included in each interim computation. Under US

GAAP, the calculation of diluted EPS for year-to-date (including

annual) periods is based on the weighted average number of the

shares included in each interim period for that year-to-date

period.

The following table provides the impact of US GAAP adjustments

on diluted weighted average number of equity shares in fiscal

2024:

For the period from April 1,

2023 to

June 30,

September 30,

December 31,

March 31,

(US$)

2023

2023

2023

2024

Diluted weighted average ordinary

shares outstanding

50,259,257

50,009,844

49,755,508

49,570,082

Net impact of US GAAP adjustments*

—

(56,736

)

(92,903

)

(258,308

)

Diluted weighted average number of

equity shares under US GAAP

50,259,257

49,953,108

49,662,605

49,311,774

*Under IFRS, dilutive potential ordinary shares are determined

independently for each period presented. The number of dilutive

potential ordinary shares included in the annual (or year-to-date)

period is not equal to a weighted average of the dilutive potential

ordinary shares included in each interim computation. Under US

GAAP, the calculation of diluted EPS for year-to-date (including

annual) periods is based on the weighted average number of the

shares included in each interim period for that year-to-date

period.

About WNS

WNS (Holdings) Limited (NYSE: WNS) is a leading Business Process

Management (BPM) company. WNS combines deep industry knowledge with

technology, analytics, and process expertise to co-create

innovative, digitally led transformational solutions with over 600

clients across various industries. WNS delivers an entire spectrum

of BPM solutions including industry-specific offerings, customer

experience services, finance and accounting, human resources,

procurement, and research and analytics to re-imagine the digital

future of businesses. As of March 31, 2024, WNS had 60,125

professionals across 65 delivery centers worldwide including

facilities in Canada, China, Costa Rica, India, Malaysia, the

Philippines, Poland, Romania, South Africa, Sri Lanka, Turkey, the

United Kingdom, and the United States. For more information, visit

www.wns.com.

Safe Harbor Statement

This release contains forward-looking statements, as defined in

the safe harbor provisions of the US Private Securities Litigation

Reform Act of 1995. These forward-looking statements are based on

our current expectations and assumptions about our Company and our

industry. Generally, these forward-looking statements may be

identified by the use of terminology such as “anticipate,”

“believe,” “estimate,” “expect,” “intend,” “will,” “seek,” “should”

and similar expressions. These statements include, among other

things, expressed or implied forward-looking statements relating to

discussions of our strategic initiatives and the expected resulting

benefits, our growth opportunities, industry environment, our

expectations concerning our future financial performance and growth

potential, including our fiscal 2025 guidance, estimated capital

expenditures, expected foreign currency exchange rates, and

reporting change discussed above and the expected resulting

benefits. Forward-looking statements inherently involve risks and

uncertainties that could cause actual results to differ materially

from those expressed or implied by such statements. Such risks and

uncertainties include but are not limited to worldwide economic and

business conditions, our dependence on a limited number of clients

in a limited number of industries; the impact of the recurrence of

the COVID-19 pandemic on our and our clients’ business, financial

condition, results of operations and cash flows; currency

fluctuations; political or economic instability in the

jurisdictions where we have operations; regulatory, legislative and

judicial developments; increasing competition in the BPM industry;

technological innovation; our liability arising from fraud or

unauthorized disclosure of sensitive or confidential client and

customer data; telecommunications or technology disruptions; our

ability to attract and retain clients; negative public reaction in

the US or the UK to offshore outsourcing; our ability to collect

our receivables from, or bill our unbilled services to our clients;

our ability to expand our business or effectively manage growth;

our ability to hire and retain enough sufficiently trained

employees to support our operations; the effects of our different

pricing strategies or those of our competitors; our ability to

successfully consummate, integrate and achieve accretive benefits

from our strategic acquisitions (including Vuram, OptiBuy, and The

Smart Cube), and to successfully grow our revenue and expand our

service offerings and market share; future regulatory actions and

conditions in our operating areas; and our ability to manage the

impact of climate change on our business. These and other factors

are more fully discussed in our most recent annual report on Form

20-F and subsequent reports on Form 6-K filed with or furnished to

the US Securities and Exchange Commission (SEC) which are available

at www.sec.gov. We caution you not to place undue reliance on any

forward-looking statements. Except as required by law, we do not

undertake to update any forward-looking statements to reflect

future events or circumstances. References to “$” and “USD” refer

to the United States dollars, the legal currency of the United

States.

View source

version on businesswire.com: https://www.businesswire.com/news/home/20240709311667/en/

Investors: David

Mackey EVP – Finance & Head of Investor Relations WNS

(Holdings) Limited +1 (646) 908-2615 david.mackey@wns.com

Media: Archana

Raghuram EVP & Global Head – Marketing & Communications

WNS (Holdings) Limited +91 (22) 4095 2397 archana.raghuram@wns.com;

pr@wns.com

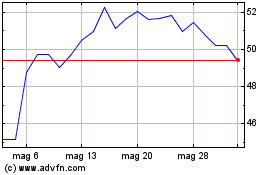

Grafico Azioni WNS (NYSE:WNS)

Storico

Da Dic 2024 a Gen 2025

Grafico Azioni WNS (NYSE:WNS)

Storico

Da Gen 2024 a Gen 2025