Resilient performance in 2023 with 0.9%

like-for-like growth and improved headline margin up 0.2pt

like-for-like. Investing in AI and innovation to deliver improved

growth, margin and cash

WPP (NYSE: WPP) today reported its 2023 Preliminary Results.

Key figures

£m

2023

+/(-) %

reported1

+/(-) %

LFL2

2022

Revenue

14,845

2.9

3.2

14,429

Revenue less pass-through

costs

11,860

0.5

0.9

11,799

Reported:

Operating profit

531

(60.9)

1,358

Profit before tax

346

(70.1)

1,160

Diluted EPS (p)

10.1*

(83.5)

61.2

Dividends per share (p)

39.4

–

39.4

Headline3:

Operating profit

1,750

0.5

1,742

Operating profit margin

14.8%

0.0pt

0.2pt

14.8%

Profit before tax

1,525

(4.8)

1,602

Diluted EPS

93.8

(4.8)

98.5

* includes the impact of accelerated amortisation of previously

indefinite life brands and impairment of leases related to the 2023

property review

Full year and Q4 financial highlights

- FY reported revenue +2.9%, LFL revenue +3.2%

- FY revenue less pass-through costs +0.5%, LFL revenue less

pass-through costs +0.9%

- Q4 LFL revenue less pass-through costs +0.3% with ex-US4 +3.1%

benefiting from strong growth in the UK and India partially offset

by declines in Germany and China. US Q4 LFL decline of 4.5%

primarily due to lower spend by technology, healthcare and retail

clients, partially offset by growth in CPG, telecoms and automotive

sectors

- Global Integrated Agencies FY LFL revenue less pass-through

costs +1.3% (Q4: +0.7%): within which GroupM, our media planning

and buying business, grew +4.9% (Q4: +5.7%), partially offset by a

1.6% decline in other Global Integrated Agencies (Q4: -3.4%)

- Solid new business performance: $4.5bn net new billings5 (2022:

$5.9bn) with Q4 net new billings $1.1bn (Q4 2022: $0.8bn). The

current pipeline of potential new business remains higher

year-on-year

- FY headline operating profit margin in line with original

guidance6 of 15.0% (excluding the impact of FX). Headline operating

profit margin of 14.8% (2022: 14.8%) reflecting a 0.2pt drag from

FX, disciplined cost control and continued investment in our

technology, data and AI offer

- Reported EPS of 10.1p (2022: 61.2p) reflects the impact of

accelerated amortisation of intangible assets as a result of the

creation of VML, and property impairments announced earlier in the

year

- Headline EPS of 93.8p (2022: 98.5p) reflects a zero

contribution from Kantar in income from associates in 2023, which

in 2022 represented 3.3p in headline EPS7

- Adjusted operating cash flow of £1,280m (2022: £669m)

reflecting an improved working capital performance

- Adjusted net debt at 31 December 2023 of £2.5bn, flat

year-on-year

- Final dividend of 24.4p proposed (2022: 24.4p) resulting in a

proposed total dividend of 39.4p (2022: 39.4p) in line with our

payout policy of approximately 40% of headline diluted EPS

Strategic progress and 2024 guidance

- VML launched in January following the merger of VMLY&R and

Wunderman Thompson with senior leadership appointed. GroupM

simplification plan on track. Burson, created from the merger of

Hill & Knowlton and BCW, scheduled to launch in July

- Acquisitions in the year included influencer marketing agencies

Goat and Obviously and are contributing well to growth

- 2020 transformation programme gross annual savings of £475m in

2023 against a 2019 base, ahead of planned £450m, with savings from

our campus programme, procurement initiatives, simpler WPP and

lower travel costs

- 2024 guidance: LFL revenue less pass-through costs growth of

0-1%, with improvement in headline operating profit margin of

20-40bps (excluding the impact of FX)

Innovating to Lead

At our Capital Markets Day in January 2024 we announced the

next phase of our strategy – ‘Innovating to Lead’ – which is built

on four strategic pillars:

- Lead through AI, data and technology, by building on our

leadership position in the application of artificial intelligence

through the acquisition of the AI research firm Satalia in 2021;

organic investment in WPP Open, our AI-driven platform, client

technology and data; and deep partnerships with strategic

technology partners such as Adobe, Google, IBM, Microsoft, Nvidia

and OpenAI. Our plans include annual cash investment of around

£250m in proprietary technology to support our AI and data

strategy

- Unlock the full potential of creative transformation to

drive growth, expanding our client relationships by further

leveraging WPP’s global scale, integrated offer in creative, media,

production and PR, and capabilities in growth areas such as

commerce, influencer marketing and retail media to capture share in

a growing market

- Build world-class, market-leading brands through our six

powerful agency networks – VML, Ogilvy, AKQA, Hogarth, GroupM and

Burson – which now represent close to 90% of WPP’s revenue less

pass-through costs, and in particular reap the benefits of

unrivalled scale from VML as the world’s largest integrated

creative agency, leverage GroupM’s simplified operating model and

scale as the world’s largest media agency and establish Burson as a

leading global strategic communications agency by bringing together

BCW and Hill & Knowlton

- Execute efficiently to drive strong financial returns,

by delivering growth and structural cost savings from the creation

of VML and Burson, and simplification of GroupM, unlocking scale

advantages and further efficiency savings

Our strategy will continue to be underpinned by a disciplined

approach to capital allocation with ongoing organic investment,

a progressive dividend policy and a disciplined approach to

M&A, supported by a strong balance sheet and an investment

grade credit rating.

Mark Read, Chief Executive Officer of WPP, said:

“At our recent Capital Markets Day we detailed our strategy to

capture the opportunities of AI, data and technology, while

harnessing the full power of our offer to clients, building

world-class agency brands, and driving strong financial returns

through efficient execution.

“AI will be fundamental for our business and we are embracing

the opportunities that it presents, putting it at the heart of our

operations and our work for clients. Our AI-powered platform, WPP

Open, is now being used by more than 30,000 people across WPP with

growing adoption by our clients.

“While 2023 was more challenging than we expected due to cuts in

spending by technology clients, we delivered a resilient

performance for the year with 0.9% like-for-like growth and a 0.2

point improvement in our headline operating margin at constant

currency. This was driven by disciplined cost control, while

continuing to invest in AI, data and technology.

“Our net new business of $4.5bn in 2023 included major new

assignments with clients such as Allianz, Krispy Kreme, Mondelēz,

Nestlé, PayPal and Verizon and reflects a stronger year-on-year

performance in the fourth quarter.

“We are optimistic about the strategic opportunities ahead of us

and are confident that we can deliver accelerated and increasingly

profitable growth over the medium term.”

To access WPP's 2023 preliminary results financial tables,

please visit www.wpp.com/investors

Full year overview

Revenue was £14.8bn, up 2.9% from £14.4bn in 2022, and up 3.2%

like-for-like. Revenue less pass-through costs was £11.9bn, up 0.5%

from £11.8bn in 2022, and up 0.9% like-for-like.

Q4 2023

£m

%

reported

%

M&A

%

FX

%

LFL

Revenue

4,116

0.4

1.3

(4.2)

3.3

Revenue less pass-through

costs

3,211

(2.8)

0.9

(4.0)

0.3

2023

£m

%

reported

%

M&A

%

FX

%

LFL

Revenue

14,845

2.9

1.2

(1.5)

3.2

Revenue less pass-through

costs

11,860

0.5

0.9

(1.3)

0.9

Business segment review

Business segments - revenue less pass-through costs

% LFL +/(-)

Global

Integrated

Agencies

Public Relations

Specialist Agencies

Q4 2023

0.7

2.4

(6.8)

2023

1.3

1.4

(3.4)

Global Integrated Agencies: GroupM, our media planning

and buying business, grew well in 2023, benefiting from continued

client investment in media, with like-for-like growth in revenue

less pass-through costs of 4.9% (Q4 +5.7%), partially offset by a

1.6% LFL decline at other Global Integrated Agencies (Q4

-3.4%).

GroupM grew in all major regions with mid-single digit growth in

ex-US markets and low-single digit growth in the US. The digital

billings mix within GroupM increased to 51% (2022: 48%).

Ogilvy’s performance benefited from recent new business wins

including SC Johnson and Verizon, which contributed to mid-single

digit growth.

Hogarth grew well benefiting from increased spend by CPG clients

and growing demand for its technology and AI-driven capabilities as

clients seek to produce more personalised and addressable

content.

Other Global Integrated Agencies: Wunderman Thompson and

VMLY&R (which were merged in January 2024 to become VML) and

AKQA felt the greatest impact from reduced spend across the

technology sector and delays in technology-related projects.

Revenue less pass-through costs in the retail sector was impacted

by 2022 and 2023 client losses and lower spend by some retail

clients in an uncertain macroeconomic environment.

Public Relations: FGS Global continued to grow strongly

in 2023, while Hill & Knowlton delivered modest growth lapping

strong performance in 2022; partially offset by a weaker year for

BCW.

Specialist Agencies: CMI Media Group, our specialist

healthcare media planning and buying agency, grew strongly, offset

by declines at Landor and Design Bridge and Partners. Our smaller

specialist agencies continued to be affected by more cautious

client spending, including delays in project-based spending.

Regional review

Regional segments - revenue less pass-through costs

% LFL +/(-)

North America

United Kingdom

Western

Continental

Europe

Rest of World

Q4 2023

(4.1)

5.1

(0.8)

5.3

2023

(2.7)

5.6

1.8

3.7

North America declined by 2.7% in 2023 reflecting lower revenues

from technology clients and in the retail sector. This was

partially offset by growth in CPG and telecommunications. Lower

revenues from technology clients had a greater adverse impact on

our integrated creative agencies, whilst GroupM grew low-single

digits in the region.

The United Kingdom delivered good growth, building on a strong

prior year performance (2022: +7.6%) with both GroupM and Ogilvy

performing well. CPG and healthcare were the strongest client

sectors.

In Western Continental Europe, Germany, our largest market, had

a challenging end to the year with a more uncertain macro

environment weighing on client spend in the second half. France

returned to growth in Q4 after several quarters of decline as new

clients were onboarded.

The Rest of World saw good growth in 2023 driven by India which

was up 7.7% reflecting strong double-digit growth in the second

half. This was partially offset by China which declined 3.3% with a

consistent level of decline across the first and second half.

Top five markets - revenue less pass-through costs

% LFL +/(-)

USA

UK

Germany

China

India

Q4 2023

(4.5)

5.1

(5.3)

(1.2)

22.0

2023

(2.8)

5.6

0.1

(3.3)

7.7

Client sector review

Client sector - revenue less pass-through costs8

2023

% share, revenue

less pass-

through costs8

% LFL +/(-)

CPG

27.0

14.2

Tech & Digital Services

17.5

(6.9)

Healthcare & Pharma

12.0

0.6

Automotive

10.3

1.3

Retail

9.2

(11.3)

Telecom, Media &

Entertainment

6.4

2.9

Financial Services

6.2

4.3

Other

5.4

(3.4)

Travel & Leisure

3.5

7.1

Government, Public Sector &

Non-profit

2.5

0.2

Strategic progress

Clients: We won $4.5bn of net new business in 2023 (2022:

$5.9bn) including the loss of certain Pfizer creative assignments.

Key assignment wins include Adobe, Allianz, Estée Lauder, Ford,

Hyatt, Krispy Kreme, Lenovo, Lloyds Banking Group, Maruti Suzuki,

Mondelēz, Nestlé, Pernod Ricard, SC Johnson and Verizon.

Creativity and awards: Creativity is applied to

everything that we do at WPP, and we are proud that our world-class

talent has continued to be recognised through prestigious awards.

We had another successful year at the Cannes Lions International

Festival of Creativity, with WPP agencies winning a total of 165

Lions including one Titanium Lion, five Grand Prix, and 24 Gold

awards. Mindshare was named Media Network of the Year.

At the Effies, WPP was awarded the most effective communications

company globally, with Ogilvy ranked the most effective network.

WARC named WPP the top company in all three of their rankings, the

Creative 100, Effective 100 and Media 100 lists. Ogilvy ranked as

the top network of the year in both the Creative 100 and Effective

100 while EssenceMediacom took first place in the Media 100.

WPP was named holding company of the year and VMLY&R network

of the year at the New York Festivals Advertising Awards. Ogilvy

was the most awarded agency at the Global Influencer Marketing

Awards for the fifth year running and was recently named AdWeek’s

2023 Global Agency of the Year. Gain Theory, WPP’s global marketing

effectiveness consultancy, was recognised by Forrester as a Wave

Leader in marketing measurement and optimisation.

Investment for growth: We have invested significantly in

client-facing technology over the last five years and this

continued in 2023, with priorities including WPP Open, our

AI-driven platform; Choreograph, our data products and technology

unit; and other AI tools and services delivered through WPP

Open.

WPP Open brings together all of WPP’s proprietary tools,

technologies, data and services into one operating system, and is

already being deployed across some of our largest global clients,

with broad adoption by over 30,000 of WPP’s people.

We have bolstered our capabilities through acquisitions during

the year, including: influencer marketing agencies Goat, based in

London and Obviously, based in New-York; 3K Communication, a

Frankfurt-based healthcare PR agency; and amp, one of the world’s

leading sonic branding companies. We also made a minority

investment in Majority, a diversity-focused US creative agency.

In July, KKR completed their minority investment to become a 29%

shareholder in FGS Global, after acquiring all of Golden Gate

Capital’s equity and a proportion of the interests of WPP and FGS

Global management. WPP remains the majority owner at 51%. The

transaction valued FGS Global at $1.425bn.

Transformation: At our Capital Markets Day in December

2020 we set out a plan to deliver £600m of annual gross savings by

2025 against the 2019 cost base. At the end of 2023 we had

delivered around £475m of gross savings, which is ahead of the

originally planned £450m.

Savings have come from our operating model, including a simpler

WPP and lower travel costs; from efficiency initiatives driven by

our procurement team and our successful campus strategy; and from

functional effectiveness, focused on IT and finance with savings

from our cloud migration and workforce optimisation.

Our ERP consolidation has taken longer than we originally

expected, but we are realising benefits from the deployment of

Workday at VML (formerly Wunderman Thompson) in North America and

from Maconomy in Asia Pacific and other markets. We anticipate the

bulk of new systems will be rolled out by 2026 with associated

restructuring costs reducing accordingly.

At our Capital Markets Day in January 2024 we outlined an

updated target for headline operating margin of 16-17% over the

medium term underpinned by a plan focused on structural cost

savings and efficiencies which will enable us to deliver more

profitable growth whilst continuing to invest in the business.

This plan builds on the 2020 programme and the structural

changes announced in the last six months with the creation of VML

and Burson and the simplification of GroupM.

Structural cost savings from the creation of VML and Burson and

simplification of GroupM are expected to deliver annualised net

cost savings of c.£125m in 2025, with 40-50% of those savings

expected to be realised in 2024. Restructuring costs associated

with the completion of these programmes in 2024 are expected to be

around £125m.

Targeted efficiency savings across both back office and

commercial delivery represent a further opportunity for annualised

gross savings of around £175m over the next three to five years

which will support delivery of our medium-term margin target and

investment for growth.

Purpose and ESG

WPP’s purpose is to use the power of creativity to build better

futures for our people, planet, clients and communities.

WPP maintained a low-risk rating in the 2023 Sustainalytics risk

rating, which scores the ESG performance of companies. WPP has the

lowest risk rating of its peer group and saw an improvement in its

score from 12.1 in 2022 to 11.0 in 2023.

People: We are committed to building a strong,

purpose-driven culture at WPP where everyone feels valued. WPP

ranked sixth best performer in the 2023 FTSE Women Leaders ranking,

recognising our gender diversity in leadership roles. In addition,

WPP was awarded Leader status for the fifth year running in the

Bloomberg Gender Equality Index. In May, eleven leaders from across

WPP were recognised in the 2023 Empower Role Model Lists, designed

to celebrate leaders who are championing inclusion for people of

colour within global businesses.

Planet: In 2021, we set near-term science-based targets

to reduce our absolute Scope 1 and 2 emissions by at least 84% by

2025 and reduce Scope 3 emissions (including emissions from media

buying - an industry first) by at least 50% by 2030, both from a

2019 base year.

In April, our 2022 Sustainability Report stated that we have

delivered a reduction in Scope 1 and 2 emissions of 71% in absolute

terms since our 2019 baseline. Our 2023 Sustainability Report will

be issued in March 2024.

Clients: Sustainability is a priority for all

stakeholders including our clients. We aim to use our creativity

for good, delivering client work which is inclusive and accessible

and supporting clients on their own sustainability journeys. At the

Ad Net Zero Awards, which recognise the companies and organisations

that are leading the way on sustainability and the move to a net

zero carbon economy, we were proud to win six awards including both

International and UK Grand Prix. The Grand Prix awards were won by

EssenceMediacom for their partnership eBay x Love Island and Grey

Colombia for their Life Extending Stickers innovation for Makro;

both were recognised for their simple, scalable solutions to

shifting consumer behaviour whilst driving material transformation

within their respective industries.

Scrutiny over brands’ environmental claims continues to grow. To

support clients in making effective claims, in 2023 we launched a

client version of our Green Claims Guide and ran targeted training

for employees and clients in high emissions sectors.

Communities: We aim to use the power of our creativity

and voice to support the communities in which we live and work. For

example, during the year we launched the Creative Data School in

partnership with leading non-profit and educational organisations

which has already taught essential technical skills to over 6,000

young people across the UK.

Further detail on how WPP is focused on realising a more

sustainable, equitable future can be read in our 2022

Sustainability Report.

Outlook

Our guidance for 2024 is as follows:

Like-for-like revenue less

pass-through costs growth of 0-1%.

Headline operating margin

improvement of 20-40bps (excluding the impact of FX)

Other 2024 financial indications:

- Mergers and acquisitions will add 0.5-1.0% to revenue less

pass-through costs growth

- FX impact: current rates (at 15 February 2024) imply a c.2%

drag on FY 2024 revenues less pass-through costs, with no

meaningful impact expected on FY 2024 headline operating

margin

- Headline income from associates and non-controlling interests

at similar levels to 2023

- Net finance costs of around £295m

- Effective tax rate (measured as headline tax as a % of headline

profit before tax) of around 28%

- Capex of around £260m

- Cash restructuring costs of around £285m

- Working capital expected to be broadly flat year-on-year

Medium-term targets

In January 2024 we presented updated medium-term financial

framework including the following three targets:

- 3%+ LFL growth in revenue less pass-through costs

- 16-17% headline operating profit margin

- Adjusted operating cash flow conversion of 85%+9

Financial results

Unaudited headline income statement10:

£ million

2023

2022

+/(-) %

reported

+/(-) % LFL

Revenue

14,845

14,429

2.9

3.2

Revenue less pass-through

costs

11,860

11,799

0.5

0.9

Operating profit

1,750

1,742

0.5

Operating profit margin %

14.8%

14.8%

–

0.2pt*

Income from associates

36

74

(51.0)

PBIT

1,786

1,816

(1.6)

Net finance costs

(261)

(214)

(21.8)

Profit before taxation

1,525

1,602

(4.8)

Tax

(412)

(409)

(0.8)

Profit after taxation

1,113

1,193

(6.7)

Non-controlling interests

(87)

(93)

6.4

Profit attributable to

shareholders

1,026

1,100

(6.8)

Diluted EPS

93.8p

98.5p

(4.8)

*margin points

Reconciliation of profit before taxation to headline

operating profit:

£ million

2023

2022

Profit before taxation

346

1,160

Finance and investment income

(127)

(145)

Finance costs

389

359

Revaluation and retranslation of

financial instruments

(7)

(76)

Profit before interest and

taxation

601

1,298

(Earnings)/loss from associates -

after interest and tax

(70)

60

Operating profit

531

1,358

Goodwill impairment

63

38

Amortisation and impairment of

acquired intangible assets

728

62

Investment and other impairment

charges

18

77

(Gains)/losses on disposal of

investments and subsidiaries

(7)

36

Gains on remeasurement of equity

interests arising from a change in scope of ownership

–

(66)

Litigation settlement

(11)

–

Restructuring and transformation

costs

196

219

Property related costs

232

18

Headline operating

profit

1,750

1,742

Business sector11

Revenue analysis

£ million

2023

2022

+/(-) %

reported

+/(-) % LFL

Global Int. Agencies

12,595

12,192

3.3

3.7

Public Relations

1,262

1,232

2.4

2.0

Specialist Agencies

988

1,005

(1.8)

(2.5)

Total Group

14,845

14,429

2.9

3.2

Revenue less pass-through costs analysis

£ million

2023

2022

+/(-) %

reported

+/(-) % LFL

Global Int. Agencies

9,808

9,743

0.7

1.3

Public Relations

1,180

1,161

1.6

1.4

Specialist Agencies

872

895

(2.6)

(3.4)

Total Group

11,860

11,799

0.5

0.9

Headline operating profit analysis

£ million

2023

% margin*

2022

% margin*

Global Int. Agencies

1,474

15.0

1,433

14.7

Public Relations

191

16.2

192

16.5

Specialist Agencies

85

9.7

117

13.0

Total Group

1,750

14.8

1,742

14.8

* Headline operating profit as a percentage of revenue less

pass-through costs

Regional

Revenue analysis

£ million

2023

2022

+/(-) %

reported

+/(-) % LFL

N. America

5,528

5,550

(0.4)

(0.4)

United Kingdom

2,155

2,004

7.6

6.5

W Cont. Europe

3,037

2,876

5.6

3.8

AP, LA, AME, CEE12

4,125

3,999

3.1

6.3

Total Group

14,845

14,429

2.9

3.2

Revenue less pass-through costs analysis

£ million

2023

2022

+/(-) %

reported

+/(-) % LFL

N. America

4,556

4,688

(2.8)

(2.7)

United Kingdom

1,626

1,537

5.8

5.6

W Cont. Europe

2,411

2,319

4.0

1.8

AP, LA, AME, CEE

3,267

3,255

0.3

3.7

Total Group

11,860

11,799

0.5

0.9

Headline operating profit analysis

£ million

2023

% margin*

2022

% margin*

N. America

834

18.3

771

16.4

United Kingdom

215

13.2

187

12.2

W Cont. Europe

258

10.7

301

13.0

AP, LA, AME, CEE

443

13.6

483

14.8

Total Group

1,750

14.8

1,742

14.8

* Headline operating profit as a percentage of revenue less

pass-through costs

Operating profitability

Reported profit before tax was £346m, compared to £1,160m in the

prior period, principally reflecting the accelerated amortisation

of previously indefinite life brands related to the creation of VML

and the impairment taken as a result of the 2023 property

review.

Reported profit after tax was £197m compared to £775m in the

prior period.

Headline EBITDA (including IFRS 16 depreciation) for the year

was down 1.4% to £1,976m. Headline operating profit was up 0.5% to

£1,750m.

Headline operating profit margin was flat year on year at 14.8%

and up 0.2 points year on year on a constant currency basis. Total

operating costs were up 0.5% to £10.1bn. Staff costs, excluding

incentives, were up 0.1% year-on-year at £7.8bn, reflecting wage

inflation offset by lower use of freelancers. Staff costs include

severance costs of £78m (2022: £44m). Incentive costs were down

8.5% year-on-year to £387m, compared to £423m in 2022.

Establishment costs were down 3.8% at £516m reflecting the

progress in our campus programme. IT costs were up 12.6% at £698m,

reflecting investment in enterprise technology and our IT

infrastructure, as well as our global client-facing technology

capabilities including WPP Open, Choreograph and AI

capabilities.

Personal costs rose 9.3% to £223m, reflecting greater

client-related business travel and inflationary pressures. Other

operating expenses were down 0.8% at £535m.

The average number of people in the Group in the year was

114,732 compared to 114,129 in 2022. The total number of people as

at 31 December 2023 was 114,173 compared to 115,473 as at 31

December 2022.

Adjusting items

The Group incurred £1,219m of adjusting items in 2023, mainly

relating to the amortisation of acquired intangible assets,

restructuring and transformation costs, and property and goodwill

impairments. This compares with net adjusting items in 2022 of

£384m.

Goodwill impairment, amortisation and impairment of acquired

intangibles and other impairment charges were £809m (2022: £177m),

mainly related to the accelerated amortisation of indefinite life

brands resulting from the VML merger. This includes accelerated

amortisation charges of £431m and £202m for Wunderman Thompson and

Y&R brands respectively.

Restructuring costs of £196m in 2023 (2022: £219m) mainly relate

to: the Group’s IT transformation; property costs associated with

impairments prior to 2023; and costs related to the continuing

restructuring plan, including the creation of VML and

simplification of GroupM.

Charges associated with property, including the property review

conducted in 2023, were £232m and primarily relate to non-cash

lease impairments in the US.

Interest and taxes

Net finance costs (excluding the revaluation of financial

instruments) were £261m, an increase of £47m year-on-year, due to

higher levels of debt through the year, higher interest rates and

lower investment income partially offset by higher interest earned

on cash.

The headline tax rate (based on headline profit before tax) was

27.0% (2022: 25.5%) and on reported profit before tax was 43.1%

(2022: 33.1%). The increase in the headline tax rate is driven by

lower income from associates and changes in tax rates or tax bases

in the markets in which we operate. Given the Group’s geographic

mix of profits and the changing international tax environment, the

tax rate is expected to increase over the next few years.

Earnings and dividend

Profits attributable to shareholders were £110m, compared to a

profit of £683m in the prior period, principally reflecting the

accelerated amortisation of indefinite life brands and the

impairment taken as a result of the 2023 property review.

Reported diluted earnings per share was 10.1p, compared to 61.2p

in the prior period. Headline diluted earnings per share from

continuing operations decreased by 4.8% to 93.8p.

The Board is proposing a final dividend for 2023 of 24.4 pence

per share, which together with the interim dividend paid in

November 2023 gives a full-year dividend of 39.4 pence per share.

The record date for the final dividend is 7 June 2024, and the

dividend will be payable on 5 July 2024.

Further details of WPP’s financial performance are provided in

Appendix 1.

Cash flow highlights

Twelve months ended (£

million)

31 December 2023

31 December 2022

Headline operating

profit

1,750

1,742

Income from associates

36

74

Depreciation of property, plant

and equipment

165

167

Amortisation of other

intangibles

25

22

Depreciation of right-of-use

assets

257

262

Headline EBITDA

2,233

2,267

Less: income from associates

(36)

(74)

Repayment of lease liabilities

and related interest

(362)

(402)

Non-cash compensation

140

122

Non headline cash costs

(including restructuring cost)

(218)

(174)

Capex

(217)

(223)

Working capital

(260)

(847)

Adjusted operating cash

flow

1,280

669

% conversion of Headline

operating profit

73%

38%

Dividends (to minorities)/ from

associates

(58)

(32)

Earnout payments

(31)

(71)

Net interest

(159)

(121)

Cash tax

(395)

(391)

Adjusted free cash

flow13

637

53

Disposal proceeds

122

51

Net initial acquisition

payments

(280)

(274)

Dividends

(423)

(365)

Share purchases

(54)

(863)

Net cash flow

2

(1,398)

In 2023, net cash inflow was broadly neutral, compared to a

£1.4bn outflow in 2022. The main drivers of the improved cash flow

performance year-on-year were a smaller outflow from investment in

net working capital and lower share purchases.

A working capital outflow of £260m (2022: £847m) includes an

adverse impact of £89m from less favourable FX rates at the end of

the year compared to the prior year. The movement in total working

capital of £260m reflects a favourable movement of £113m in trade

working capital and an outflow of £373m from non-trade working

capital, primarily reflecting year on year movements in bonus,

landlord incentives relating to our campus programme and

prepayments.

A summary of the Group’s unaudited cash flow statement and notes

for the twelve months to 31 December 2023 is provided in Appendix

1.

Balance sheet highlights

As at 31 December 2023 we had cash and cash equivalents of

£1.9bn (2022: £2.0bn) and total liquidity, including undrawn credit

facilities, of £3.8bn. Average adjusted net debt was £3.6bn,

compared to £2.9bn in the prior period, at 2023 exchange rates. As

at 31 December 2023 adjusted net debt was £2.5bn, against £2.5bn as

at 31 December 2022, unchanged on a reported basis and an increase

of £0.1bn at 2023 exchange rates.

We spent £54 million on share purchases during the year to

offset dilution from share-based payments.

Our bond portfolio at 31 December 2023 had an average maturity

of 6.2 years.

In May 2023, we refinanced the November 2023 €750m bond as

planned, issuing a May 2028 €750m bond priced at 4.125%.

The average adjusted net debt to Headline EBITDA ratio in the 12

months to 31 December 2023 is 1.83x, which excludes the impact of

IFRS 16.

A summary of the Group’s unaudited balance sheet and notes as at

31 December 2023 is provided in Appendix 1.

Cautionary statement regarding forward-looking

statements

This document contains statements that are, or may be deemed to

be, “forward-looking statements”. Forward- looking statements give

the Company’s current expectations or forecasts of future events.

An investor can identify these statements by the fact that they do

not relate strictly to historical or current facts.

These forward-looking statements may include, among other

things, plans, objectives, beliefs, intentions, strategies,

projections and anticipated future economic performance based on

assumptions and the like that are subject to risks and

uncertainties. These statements can be identified by the fact that

they do not relate strictly to historical or current facts. They

use words such as ‘aim’, ‘anticipate’, ‘believe’, ‘estimate’,

‘expect’, ‘forecast’, ‘guidance’, ‘intend’, ‘may’, ‘will’,

‘should’, ‘potential’, ‘possible’, ‘predict’, ‘project’, ‘plan’,

‘target’, and other words and similar references to future periods

but are not the exclusive means of identifying such statements. As

such, all forward-looking statements involve risk and uncertainty

because they relate to future events and circumstances that are

beyond the control of the Company. Actual results or outcomes may

differ materially from those discussed or implied in the

forward-looking statements. Therefore, you should not rely on such

forward-looking statements, which speak only as of the date they

are made, as a prediction of actual results or otherwise. Important

factors which may cause actual results to differ include but are

not limited to: the impact of epidemics or pandemics including

restrictions on businesses, social activities and travel; the

unanticipated loss of a material client or key personnel; delays or

reductions in client advertising budgets; shifts in industry rates

of compensation; regulatory compliance costs or litigation; changes

in competitive factors in the industries in which we operate and

demand for our products and services; changes in client

advertising, marketing and corporate communications requirements;

our inability to realise the future anticipated benefits of

acquisitions; failure to realise our assumptions regarding goodwill

and indefinite lived intangible assets; natural disasters or acts

of terrorism; the Company’s ability to attract new clients; the

economic and geopolitical impact of the conflicts in Ukraine and

Gaza; the risk of global economic downturn; slower growth,

increasing interest rates and high and sustained inflation; supply

chain issues affecting the distribution of our clients’ products;

technological changes and risks to the security of IT and

operational infrastructure, systems, data and information resulting

from increased threat of cyber and other attacks; effectively

managing the risks, challenges and efficiencies presented by using

Artificial Intelligence (AI) and Generative AI technologies and

partnerships in our business; the Company’s exposure to changes in

the values of other major currencies (because a substantial portion

of its revenues are derived and costs incurred outside of the UK);

and the overall level of economic activity in the Company’s major

markets (which varies depending on, among other things, regional,

national and international political and economic conditions and

government regulations in the world’s advertising markets). In

addition, you should consider the risks described in Item 3D,

captioned ‘Risk Factors’ in the Group’s Annual Report on Form 20-F

for 2022, which could also cause actual results to differ from

forward-looking information. Neither the Company, nor any of its

directors, officers or employees, provides any representation,

assurance or guarantee that the occurrence of any events

anticipated, expressed or implied in any forward-looking statements

will actually occur. Accordingly, no assurance can be given that

any particular expectation will be met and investors are cautioned

not to place undue reliance on the forward-looking statements.

Other than in accordance with its legal or regulatory

obligations (including under the Market Abuse Regulation, the UK

Listing Rules and the Disclosure and Transparency Rules of the

Financial Conduct Authority), The Company undertakes no obligation

to update or revise any such forward-looking statements, whether as

a result of new information, future events or otherwise.

Any forward looking statements made by or on behalf of the Group

speak only as of the date they are made and are based upon the

knowledge and information available to the Directors at the

time.

______________________________

1

Percentage change in reported

sterling.

2

Like-for-like. LFL comparisons

are calculated as follows: current year, constant currency actual

results (which include acquisitions from the relevant date of

completion) are compared with prior year, constant currency actual

results from continuing operations, adjusted to include the results

of acquisitions and disposals for the commensurate period in the

prior year.

3

In this press release not all of

the figures and ratios used are readily available from the

unaudited interim results included in Appendix 1. Management

believes these non-GAAP measures, including constant currency and

like-for-like growth, revenue less pass-through costs and headline

profit measures, are both useful and necessary to better understand

the Group’s results. Details of how these have been arrived at are

shown in Appendix 2.

4

The aggregate of markets outside

the US.

5

As defined in the glossary on

page 46.

6

Original FY23 guidance given on

23 February 2023.

7

In accordance with IAS 28:

Investments in Associates and Joint Ventures once an investment in

an associate reaches zero carrying value, the Group does not

recognise any further losses, nor income, until the cumulative

share of income returns the carrying value to above zero. At the

end of 2022 WPP’s cumulative reported share of losses in Kantar has

reduced the carrying value of the investment to nil.

8

Proportion of WPP group revenue

less pass-through costs in 2023; table made up of clients

representing 77% of WPP total revenue less pass-through costs.

9

Adjusted operating cash flow

divided by headline operating profit.

10

Non-GAAP measures in this table

are reconciled in Appendix 2.

11

Prior year figures have been

re-presented to reflect the reallocation of a number of

businesses.

12

Asia Pacific, Latin America,

Africa & Middle East and Central & Eastern Europe.

13

Adjusted free cash flow is

reconciled to cash generated by operations in Appendix 2.

View source

version on businesswire.com: https://www.businesswire.com/news/home/20240221470136/en/

Investors and analysts Tom Waldron +44 7788 695864

Anthony Hamilton +44 7464 532903 Caitlin Holt +44 7392 280178

irteam@wpp.com

Media Chris Wade +44 20 7282 4600

Richard Oldworth +44 7710 130 634 Buchanan Communications +44 20

7466 5000

press@wpp.com

wpp.com/investors

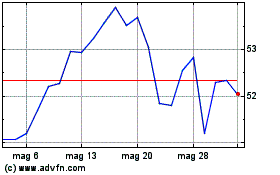

Grafico Azioni WPP (NYSE:WPP)

Storico

Da Gen 2025 a Feb 2025

Grafico Azioni WPP (NYSE:WPP)

Storico

Da Feb 2024 a Feb 2025