Q1 performance in line with expectations.

2024 guidance reiterated. Strong progress on strategic initiatives

across Burson, GroupM and VML

WPP (NYSE: WPP) today reported its 2024 First Quarter Trading

Update.

Key figures

First Quarter

£ million

‘+/(-) % reported1

‘+/(-) % LFL2

Revenue

3,412

(1.4)

2.1

Revenue less pass-through costs

2,687

(5.0)

(1.6)

- Q1 revenue -1.4%; LFL revenue +2.1%

- Q1 LFL revenue less pass-through costs -1.6% (Q1 2023: +2.9%)

with growth in the UK and Western Continental Europe offset by

declines in North America and Asia Pacific, which saw strong growth

in India offset by a decline in China

- Global Integrated Agencies revenue less pass-through costs

declined 0.7%, with 2.4% growth in GroupM offset by a 3.3% decline

at integrated creative agencies with the loss of assignments at a

healthcare client and reduced spend at technology companies

- New client assignment wins from AstraZeneca, Canon, Molson

Coors, Daiichi Sankyo, Nestlé, Perfetti, Perrigo, Rightmove and

Telefónica. Q1 net new billings of $0.8bn (Q1 2023: $1.5bn)

- Strong progress on the strategic initiatives laid out at our

CMD in January. Burson, GroupM and VML on track to deliver targeted

in-year savings and well-placed to benefit from a strong

pipeline

- Continued strategic progress on AI initiatives. WPP Open

adopted by over 50,000 of our people and at the heart of Nestlé

Oceania, ASEAN and Nestlé Health Science US wins. Collaboration

with Google to integrate Gemini 1.5 Pro in WPP Open announced in

April. WPP named NVIDIA Industry Innovation Partner of the Year in

EMEA

- 2024 guidance reiterated: LFL revenue less pass-through costs

growth expected to be 0-1%; with headline operating margin

improvement of 20-40bps (excluding the impact of FX)

Mark Read, Chief Executive Officer of WPP, said:

“The first quarter of 2024 was very much in line with our

expectations with performance reflecting the toughest comparator of

the year.

“Strategically, we have progressed well on the priorities set

out at our Capital Markets Day at the end of January. We’ve rolled

out multiple AI tools through our intelligent marketing operating

system WPP Open, including the latest foundation models from Bria,

Google and OpenAI, and at Google Cloud Next we launched our

Performance Brain to predict the best-performing content ahead of

campaigns going live. These products are being deployed at scale,

together with investment in training for our people. WPP Open was

also at the heart of our most recent new business successes,

including major media wins with Nestlé.

“Structurally, VML is now well established and is on track to

deliver savings. GroupM is progressing well with its simplification

and Burson will be operational in July. I’m very pleased with the

progress we are making and we are already seeing the benefits of a

simpler and more agile structure for our clients.

“Our outlook for the full year is reiterated. We remain on track

to return to growth in the balance of the year, supported by an

encouraging new business pipeline and the strength of our business

creatively and in media, both powered by new AI capabilities, while

our simpler structure will drive organisational flexibility and

stronger cash conversion.”

Overview

Revenue in the first quarter was £3.4bn, down 1.4% from £3.5bn

in Q1 2023, and up 2.1% like-for-like. Revenue less pass-through

costs was £2.7bn, down 5.0% from £2.8bn in Q1 2023, and down 1.6%

like-for-like.

£ million

Q1 2024

% reported

% FX

% M&A

% LFL

Revenue

3,412

(1.4)

(4.2)

0.7

2.1

Revenue less pass-through costs

2,687

(5.0)

(3.9)

0.5

(1.6)

Business segment review3 - revenue less pass-through

costs

£ million

Q1 2024

Q1 2023

+/(-) % reported

+/(-) % LFL

Global Integrated Agencies

2,202

2,305

(4.5)

(0.7)

Public Relations

276

292

(5.5)

(3.3)

Specialist Agencies

209

232

(9.9)

(7.6)

Total Group

2,687

2,829

(5.0)

(1.6)

Global Integrated Agencies: GroupM, our media planning

and buying business, saw growth in revenue less pass-through costs

of 2.4% in Q1 (Q1 2023: +6.1%), with continued growth in client

investment in media, partially offset by the impact of US client

assignment losses from prior years and lower spending by technology

clients.

Other Global Integrated Agencies declined 3.3% (Q1 2023: +0.7%),

also impacted by lower year-on-year spending by technology clients

and the first full quarter impact of the loss of Pfizer creative

assignments. Against that backdrop, VML and AKQA declined in the

quarter, with continued growth at Hogarth and Ogilvy, supported by

recent client wins.

Public Relations: BCW and Hill & Knowlton, which

together will merge to form Burson in July, saw a combined decline

due to the loss of Pfizer assignments and the impact of

macroeconomic uncertainty on client spending. FGS Global grew

against a tough comparison.

Specialist Agencies: Landor, Design Bridge and Partners,

and a number of our smaller specialist agencies continued to be

affected by delays in project-based spending. CMI Media Group, our

specialist healthcare media planning and buying agency, continued

to grow well, building on strong prior year performance.

Regional review - revenue less pass-through costs

£ million

Q1 2024

Q1 2023

+/(-) % reported

+/(-) % LFL

N. America

1,055

1,150

(8.3)

(5.2)

United Kingdom

383

377

1.6

0.3

W Cont. Europe

556

558

(0.4)

3.3

AP, LA, AME, CEE

693

744

(6.9)

(0.6)

Total Group

2,687

2,829

(5.0)

(1.6)

North America had a challenging quarter as expected,

declining 5.2% due to a year-on-year reduction in spend from

technology clients, the loss of Pfizer at our creative agencies,

and client assignment losses at GroupM. We continue to expect our

strategic actions to drive improved performance in the region

across the balance of 2024.

The United Kingdom grew 0.3% against a tough comparison

(Q1 2023: +7.4%) with growth in CPG offsetting declines in

technology client spend. Western Continental Europe saw

strength in France and Spain offset by a decline in Germany.

Rest of World declined 0.6% primarily due to a decline in

Asia Pacific of 3.2%. Growth in India of 6.6%, reflecting last

year’s strong new business momentum, was offset by a 15.4% decline

in China, due to a challenging macro and client environment.

There was continued growth in Latin America (+2.3%) and Middle

East & Africa (+7.8%). Central & Eastern Europe was flat

(-0.1%).

Top five markets - revenue less pass-through costs

% LFL +/(-)

USA

UK

Germany

China

India

Q1 2024

(5.4)

0.3

(1.9)

(15.4)

6.6

Client sector review

Client sector - revenue less pass-through costs

Q1 2024

% share, revenue less pass-

through costs4

% LFL +/(-)

CPG

28.0

9.5

Tech & Digital Services

17.1

(9.0)

Healthcare & Pharma

11.6

(8.2)

Automotive

10.6

(0.7)

Retail

8.9

(9.1)

Telecom, Media & Entertainment

6.8

6.8

Financial Services

6.2

(0.9)

Other

4.7

(14.8)

Travel & Leisure

3.7

4.0

Government, Public Sector &

Non-profit

2.4

(6.6)

Operating and strategic progress

Lead through AI, data and technology

At the Capital Markets Day in January, WPP set out its strategy

to leverage its first-mover advantage in applying AI to marketing.

During the quarter we continued to invest in WPP Open, our

intelligent marketing operating system powered by AI, as part of

our annual investment of £250m in AI, data and tech. WPP Open is

already used by more than 50,000 of our people and adopted by key

clients, including The Coca-Cola Company and L’Oréal. Most

recently, WPP Open was leveraged in a bespoke agency model,

OpenMind, to win media assignments at Nestlé Oceania, ASEAN and

Nestlé Health Science US.

In April, WPP announced a collaboration with Google Cloud to

integrate Google’s Gemini 1.5 Pro models with WPP Open, with a

range of Gemini powered applications demoed during the keynote

session of the annual Google Cloud Next conference, including WPP

Open Creative Studio and an upgraded AI Performance BrainTM.

WPP was proud to be recognised by the NVIDIA Partner Network as

the Industry Innovation Partner of the Year in EMEA.

Accelerate growth through the power of creative

transformation

Creativity is what sets WPP apart, and when combined with AI,

technology, data and the largest global media platform, we have an

unparalleled offer to clients.

During the quarter, WPP topped the WARC Media 100 for the

seventh year running and topped the WARC Creative 100 for the

second consecutive year. All three of WARC’s top creative directors

work at WPP agencies. WPP also topped The Drum’s World Creative

Rankings 2024 for the third year in a row.

Ogilvy was named the 2024 Global Agency Network of the Year by

Ad Age and also topped both the WARC Effective 100 and Creative 100

rankings. VML was third in the WARC Creative 100. Mindshare New

York was named the number one media agency in the WARC Effective

100 rankings.

VML’s ‘Waiting to Live’ campaign with NHS Blood and Transplant

won two Gold Clio awards.

At this year’s Super Bowl, WPP integrated creative agencies were

responsible for 12 of the 57 advertising spots shown during

coverage of the game. GroupM secured the media for 19 spots.

Build world-class, market-leading brands

Good progress has been made on each of our strategic initiatives

with integration and cost actions relating to VML expected to be

broadly complete in early Q2. The GroupM simplification and Burson

merger also remain on track.

Across all three agencies, we have a strong pipeline of new

business and we are encouraged by conversion in Q1. VML won a

global assignment for Perrigo and a US assignment from Daiichi

Sankyo and AstraZeneca for their medicine Enhertu in breast cancer.

GroupM won Nestlé Oceania, ASEAN and Health Sciences in the US and

Burson won Kellanova.

GroupM agency Wavemaker was named the number one global media

agency network in the COMvergence Final 2023 Global New Business

Barometer with a total new business value of $2.4bn including

retentions.

Execute efficiently to drive financial returns through margin

and cash

As well as the initiatives above we are making good progress

against our enterprise IT roadmap and workforce optimisation across

finance and IT.

In the UK, Workday HCM access was rolled out across more than

10,000 employees. In the US, VML and GroupM ERP deployment plans

are tracking in line with our plans. Several smaller markets in

EMEA are preparing for the rollout of Maconomy in the second

quarter.

Our cloud migration continues at pace with over 50% of legacy

on-premise workloads migrated to the cloud by the end of Q1, with

three more data centres closed in Germany, North America and Brazil

during the period.

No new campuses were opened in the quarter, but several new

campus openings are planned for the second half of 2024.

Purpose and ESG

WPP’s purpose is to use the power of creativity to build better

futures for our people, planet, clients and communities. Read more

on the ways WPP is working to deliver against its purpose in our

2023 Sustainability Report.

Balance sheet highlights

Average adjusted net debt in the first three months of 2024 was

£3.5bn, compared to £3.4bn reported in the first quarter of 2023,

with no material impact from FX.

Adjusted net debt at 31 March 2024 was £4.0bn, against £3.9bn as

at 31 March 2023.

In March, WPP issued two bonds as part of a planned refinancing

of two upcoming debt maturities, issuing a €600m 3.625% bond due

2029 and a €650m 4.0% bond due 2033.

Outlook

We are reaffirming our guidance for 2024 as follows:

Like-for-like revenue less

pass-through costs growth of 0-1%. Headline operating margin

improvement of 20-40bps (excluding the impact of FX)

Other 2024 financial indications:

- Mergers and acquisitions will add 0.5-1.0% to revenue less

pass-through costs growth

- FX impact: current rates (at 19 April 2024) imply a c.1.1% drag

on FY 2024 revenue less pass-through costs, with no meaningful

impact expected on FY 2024 headline operating margin

- Headline income from associates and non-controlling interests

at similar levels to 2023

- Net finance costs of around £295m

- Effective tax rate (measured as headline tax as a % of headline

profit before tax) of around 28%

- Capex of around £260m

- Cash restructuring costs of around £285m

- Working capital expected to be broadly flat year-on-year

Medium-term targets

In January 2024, we presented an updated medium-term financial

framework including the following three targets:

- 3%+ LFL growth in revenue less pass-through costs

- 16-17% headline operating profit margin

- Adjusted operating cash flow conversion of 85%+5

Cautionary statement regarding forward-looking

statements

This document contains statements that are, or may be deemed to

be, “forward-looking statements”. Forward-looking statements give

the Company’s current expectations or forecasts of future events.

An investor can identify these statements by the fact that they do

not relate strictly to historical or current facts.

These forward-looking statements may include, among other

things, plans, objectives, beliefs, intentions, strategies,

projections and anticipated future economic performance based on

assumptions and the like that are subject to risks and

uncertainties. These statements can be identified by the fact that

they do not relate strictly to historical or current facts. They

use words such as ‘aim’, ‘anticipate’, ‘believe’, ‘estimate’,

‘expect’, ‘forecast’, ‘guidance’, ‘intend’, 'may', ‘will’,

‘should’, ‘potential’, ‘possible’, ‘predict’, ‘project’, ‘plan’,

‘target’, and other words and similar references to future periods

but are not the exclusive means of identifying such statements. As

such, all forward-looking statements involve risk and uncertainty

because they relate to future events and circumstances that are

beyond the control of the Company. Actual results or outcomes may

differ materially from those discussed or implied in the

forward-looking statements. Therefore, you should not rely on such

forward-looking statements, which speak only as of the date they

are made, as a prediction of actual results or otherwise. Important

factors which may cause actual results to differ include but are

not limited to: the impact of epidemics or pandemics including

restrictions on businesses, social activities and travel; the

unanticipated loss of a material client or key personnel; delays or

reductions in client advertising budgets; shifts in industry rates

of compensation; regulatory compliance costs or litigation; changes

in competitive factors in the industries in which we operate and

demand for our products and services; changes in client

advertising, marketing and corporate communications requirements;

our inability to realise the future anticipated benefits of

acquisitions; failure to realise our assumptions regarding goodwill

and indefinite lived intangible assets; natural disasters or acts

of terrorism; the Company’s ability to attract new clients; the

economic and geopolitical impact of the conflicts in Ukraine and

Gaza; the risk of global economic downturn; slower growth,

increasing interest rates and high and sustained inflation; supply

chain issues affecting the distribution of our clients' products;

technological changes and risks to the security of IT and

operational infrastructure, systems, data and information resulting

from increased threat of cyber and other attacks; effectively

managing the risks, challenges and efficiencies presented by using

Artificial Intelligence (AI) and Generative AI technologies and

partnerships in our business; risks related to our environmental,

social and governance goals and initiatives, including impacts from

regulators and other stakeholders, and the impact of factors

outside of our control on such goals and initiatives; the Company’s

exposure to changes in the values of other major currencies

(because a substantial portion of its revenues are derived and

costs incurred outside of the UK); and the overall level of

economic activity in the Company’s major markets (which varies

depending on, among other things, regional, national and

international political and economic conditions and government

regulations in the world’s advertising markets). They use words

such as ‘aim’, ‘anticipate’, ‘believe’, ‘estimate’, ‘expect’,

‘forecast’, ‘guidance’, ‘intend’, 'may', ‘will’, ‘should’,

‘potential’, ‘possible’, ‘predict’, ‘project’, ‘plan’, ‘target’,

and other words and similar references to future periods but are

not the exclusive means of identifying such statements. Neither the

Company, nor any of its directors, officers or employees, provides

any representation, assurance or guarantee that the occurrence of

any events anticipated, expressed or implied in any forward-looking

statements will actually occur. Accordingly, no assurance can be

given that any particular expectation will be met and investors are

cautioned not to place undue reliance on the forward-looking

statements.

Other than in accordance with its legal or regulatory

obligations (including under the Market Abuse Regulation, the UK

Listing Rules and the Disclosure and Transparency Rules of the

Financial Conduct Authority), the Company undertakes no obligation

to update or revise any such forward-looking statements, whether as

a result of new information, future events or otherwise.

Any forward-looking statements made by or on behalf of the Group

speak only as of the date they are made and are based upon the

knowledge and information available to the Directors on the date of

this document.

___________________

1. Percentage change in reported

sterling.

2. Like-for-like. LFL comparisons are

calculated as follows: current year, constant currency actual

results (which include acquisitions from the relevant date of

completion) are compared with prior year, constant currency actual

results from continuing operations, adjusted to include the results

of acquisitions and disposals for the commensurate period in the

prior year. Throughout the commentary in this release growth rates

are LFL unless stated otherwise.

3. Prior year figures have been

re-presented to reflect the reallocation of a number of businesses

between Global Integrated Agencies and Specialist Agencies.

4. Proportion of WPP revenue less

pass-through costs in Q1 2024; table made up of clients

representing 77% of WPP total revenue less pass-through costs.

5. Adjusted operating cash flow divided by

headline operating profit.

View source

version on businesswire.com: https://www.businesswire.com/news/home/20240424517529/en/

Investors and analysts Tom Waldron +44 7788 695864

Anthony Hamilton +44 7464 532903 Caitlin Holt +44 7392 280178

irteam@wpp.com

Media Chris Wade +44 20 7282 4600

Richard Oldworth +44 7710 130 634 Buchanan Communications +44 20

7466 5000 press@wpp.com

wpp.com/investors

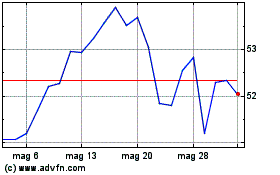

Grafico Azioni WPP (NYSE:WPP)

Storico

Da Gen 2025 a Feb 2025

Grafico Azioni WPP (NYSE:WPP)

Storico

Da Feb 2024 a Feb 2025